Deducting Your Property Taxes

If you’re a homeowner, you almost certainly have to pay property taxes. These are local taxes based upon the assessed value of your home. The more your home is worth, the more you’ll have to pay. Fortunately, property taxes are deductible from your federal income taxes. However, the Tax Cuts and Jobs Act imposed new limitations on this deduction.

How To Claim Your Real Estate Tax Deduction

If you decide to claim the standard deduction, you can’t also itemize to deduct your property taxes. If your standard deduction would be higher than any savings you could gain by itemizing your taxes, it makes more sense to claim that standard deduction. If you’d save more by itemizing and claiming your property tax deduction, you should itemize and not claim the standard deduction.

If you plan on itemizing your taxes, here are the steps to follow to claim your property tax deduction.

How Does The Property Tax Deduction Work

The most important rule to remember is that you can only claim the property tax deduction if you choose to itemize your taxes. If you claim the standard deduction, youre not eligible to also claim your property taxes.

Its up to you to figure out which decision makes the most financial sense. Depending on your personal situation, the standard deduction could be higher than what you would save by itemizing, so be sure to do the math and choose wisely.

Also Check: How Much Can You Inherit Without Paying Taxes In 2020

Tax Credits For Electric Vehicles

Buyers of all-electric or plug-in hybrid vehicles may be eligible for a federal income tax credit up to $7,500 thats in addition to possible state or local incentives. Keep in mind that federal credits are based upon manufacturer production Teslas sold after Dec. 31, 2019, for example, are no longer eligible, but a Toyota RAV4 Prime is . Look up a vehicle youre interested in here.

LIMITATIONS: As we mentioned earlier, the IRS limits the total amount of credit per vehicle to $7,500. If you owe less than that to Uncle Sam, the difference disappears. For example, if your tax credit is $7,500 but you owe $6,000 when you file taxes, you dont get a check for the difference $1,500 nor does it apply to your taxes for next year.

This Is One Of The Most Significant Tax Benefits You Obtain When You Own A Home

For decades, one of the most significant tax benefits you obtain when you own your home has been the ability to deduct your real estate taxes. These taxes are still deductible by homeowners who itemize their personal deduction on Form 1040 Schedule A, but the deduction has been capped by the Tax Cuts and Jobs Act.

Read Also: What Is The Difference Between Payroll And Income Taxes

State And Local Personal Property Taxes

Deductible personal property taxes are those based only on the value of personal property such as a boat or car. The tax must be charged to you on a yearly basis, even if it’s collected more than once a year or less than once a year.

Some taxes and fees you can’t deduct on Schedule A include federal income taxes, social security taxes, transfer taxes on the sale of property, homeowner’s association fees, estate and inheritance taxes, and service charges for water, sewer, or trash collection. Refer to the Instructions for Schedule A and Publication 17 for more taxes you can’t deduct.

You Can Deduct Mortgage Points From Your Taxes Too

You can buy mortgage points, also called “discount points,” when buying a house to decrease the interest on the mortgage. Each 1% of the mortgage amount that home buyers pay on top of their down payment generally reduces their interest rate by 0.25%, though the exact amount will depend on the lender and the loan.

Discount points can save you big money on a 30-year mortgage by lowering the total interest you’ll have to pay across decades, but they can also save you money on your taxes when you buy them. The IRS considers mortgage points to be prepaid interest, so you can add the amount paid for points to your total mortgage interest that’s entered on Line 8 of 1040 Schedule A.

Don’t Miss: How To Avoid Paying Taxes On Divorce Settlement

Can You Get A Property Tax Deduction On A Second Or Third Property

You can claim a tax deduction for a second or third property as long as you live there for at least 14 days out of the year and it is not rented out longer than that. However, the total amount of deductions for state, local and property taxes still cannot exceed $10,000, including the tax on your primary residence. The second property must also meet all the qualifications of being considered a second residence.

How Much Can Be Deducted

The total amount you can deduct is dependent on the changes to the Tax Cuts and Jobs Act, which was passed at the end of 2017. This affects both itemized and standard deductions.

Lets unpack that a little bit.

Itemized Property Tax Deduction

The Tax Cuts and Jobs Act capped the deduction for state and local taxes, including property taxes, at $10,000 . This means that if the amount of taxes youve paid out over the course of the year exceeds those amounts, youre not able to claim the full amount of your property taxes.

Plus, this cap is on a combination of taxes not just your home. In addition to property taxes, the cap includes state and local income and sales taxes , so youll likely exceed that capped amount quickly.

Standard Deduction

While the Tax Cuts and Jobs Act capped the deduction for property taxes, it also nearly doubled the amount of the standard deduction. It should be noted that standard deduction amounts are indexed annually for inflation, so theyre further on the rise.

Standard deduction amounts for 2020 and 2021

|

Filing Status |

|

$18,800 |

Also Check: What Can I Write Off On My Taxes For Instacart

Did Property Taxes Go Up In 2020

Property taxes are based on the assessed value of the property as of Jan. 1. The property prices were high in January 2020 because the coronavirus pandemic hadn’t started yet. If you expect your property taxes to decline based on the appraised value, you might be disappointed. The property tax varies significantly from one state to another. If you don’t agree with the assessed value of your property, you can request a reassessment.

What Property Taxes Are Eligible

The tax code defines the personal property tax pretty simply. It’s imposed annually on certain items of property. U.S. Treasury regulations spell out three criteria for being able to deduct a personal property tax:

- The tax must be an ad valorem tax based on the value of the property.

- It must be imposed annually.

- It must be imposed on personal property.

The IRS defines personal property as “movable” property, as compared to real estate. Examples include planes, boats, RVs, and motorcycles.

Also Check: Where Do I Send My Tax Return From Florida

Deducting Property Tax As A Business Expense

The IRS says you can deduct property taxes, but they put some limitations and restrictions on what portion of your property tax is deductible as a business expense:

You can deduct the portion of your property tax that is levied based on the assessed value.

You cannot deduct any portion of your property tax that is levied on “local benefit.” According to the IRS, this includes taxes charged for “local benefits and improvements that tend to increase the value of your property. These include assessments for streets, sidewalks, water mains, sewer lines, and public parking facilities. You should increase the basis of your property by the amount of the assessment.”

Just to confuse the matter, even more, the IRS says you CAN deduct the portion of local benefit taxes if they are for maintenance, repairs, or interest charges. You’ll have to look closely at your real estate tax bill and separate it out into the taxable and non-taxable portions.

Check with your local taxing authority for more information on real estate taxes on your business property. Since property taxes are specific to each state, you might also go to your search engine and type in “property taxes ” for more information.

Are Property Taxes Part Of The Standard Deduction

If you decide to take the standard deduction, are property taxes included? There are two parts to address here. The first is residential property taxes, and the second is rental property taxes.

For a residence, if your total deductions, including property taxes, dont exceed the standard deduction, then you should probably take the standard deduction.

As an example, lets say someone itemizes their deductions, which include:

- Medical deductible expenses

The person is filing married and has deductions of $16,000. That is less than the $25,900 standard deduction. In this case, the standard deduction makes more sense.

To answer the question, are property taxes part of the standard deduction no. Property taxes are just another deduction that can be used if you are itemizing deductions.

Things are a little different for a rental property. For a rental property, you can use property sales taxes along with other related expenses to offset rental income. This really has nothing to do with the standard deduction. Rental property owners are familiar with the practice of offsetting income through expenses and deductions.

Next, the rental property owner will add up their deductions to see if they are more than the standard deduction. If not, the property owner will use the standard deduction. In this way, you can still take the standard deduction while getting the benefit of property taxes .

Learn Ways to Help Reduce or Defer Real Estate Taxes

You May Like: What Is The Sales Tax Rate In Florida

There’s Also A Mortgage

Homeowners who have received a Mortgage Credit Certificate from a state or local government — usually acquired via a mortgage lender — can get a percentage of their mortgage interest payments back as a tax credit. Mortgage certificate credit rates vary based on states and go as low as 10% in Virginia to as high as 30% in Florida, per Bankrate.

For example, if you paid $12,000 in yearly mortgage interest in Florida with an MCC, you’d get a $3,600 tax credit. That money is nonrefundable, however — it can only be used against taxes you owe. If you don’t owe federal taxes, it won’t give you money back.

This homeowner tax tip is most effective if you are a first-time homeowner, which is generously defined as not living in a home that you’ve owned for the past three years. If you’re buying your first home, be sure to ask your lender or mortgage broker to see if you qualify for an MCC.

To file for your mortgage-interest tax credit, use IRS Form 8396. Remember, you don’t need to itemize deductions to claim tax credits.

Could You Lose Money If You Deduct Property Taxes

The Balance / Nusha Ashjaee

It may seem like one taxing authority or another wants a share from you. The Internal Revenue Service allows you to get some of your money back in the form of a property tax deduction for the cost of taxes that you must pay to local taxing authorities.

While the passage of the Tax Cuts and Jobs Act in 2018 imposed a cap on the amount you can deduct, the local property tax deduction is still available to homeowners.

Also Check: How Far Back Can I File Taxes

No Matter How You File Block Has Your Back

If You Bought Or Sold Your House This Year

-

If you owned taxable property for part of the year before selling it, you can usually deduct the taxes attributable to the time you owned the property. So, if you sold your house in July, you would deduct the first half of the years property taxes on the house, and the buyer would deduct the second half.

-

Renters might qualify for a property tax deduction on their state taxes.

Learn more ways to capitalize on your home

-

Our home affordability calculator will show how much house you can afford to buy.

Don’t Miss: How To File Taxes At H& r Block

Be Sure Youre Itemizing Your Deductions

Yes, its the age-old question: Should you itemize or take the standard deduction? If taking the standard deduction will result in a lower tax bill, dont waste your time itemizing and claiming property taxes. For 2021, the standard deduction is $25,100 if youre married filing jointly. It takes a bunch of deductions to exceed the standard deduction, and thats why 87% of taxpayers use the standard deduction instead of itemizing.3

Property For Personal Use

If you use the property as a second homenot as a rentalyou can deduct mortgage interest, mortgage discount points, and PMI just as you would for a second home in the U.S.

For 2022, you can deduct the interest that you pay on the first $750,000 of qualified mortgage debt on your first and second homes . Note that if you bought your properties before Dec. 16, 2017, you receive the previous deduction limit of $1 million of qualified mortgage debt. Check with a tax expert to be sure where you fit in.

Under the Tax Cuts and Jobs Act , you can deduct interest on the first $750,000 of mortgage debt on a first or second home. The current limitation will revert to the previous $1 million limit after 2025.

As with a primary residence, you cant write off expenses such as utilities, maintenance, or insurance unless youre able to claim the home office deduction .

While the mortgage interest deduction is the same whether the home is in the U.S. or abroad, property taxes work differently. Under the Tax Cuts and Jobs Act , foreign property taxes arent deductible for tax years 2018 through 2025.

Also Check: How Much Is Maryland Sales Tax

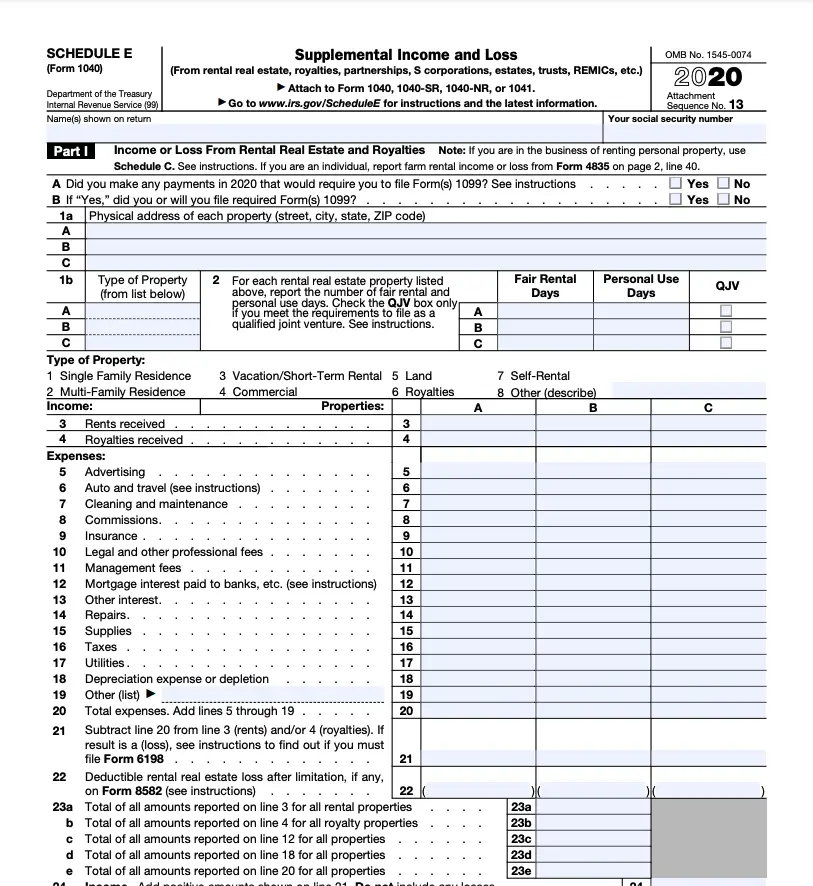

What Deductions Can I Take As An Owner Of Rental Property

If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on your tax return. These expenses may include mortgage interest, property tax, operating expenses, depreciation, and repairs.

You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. Ordinary expenses are those that are common and generally accepted in the business. Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance.

You can deduct the costs of certain materials, supplies, repairs, and maintenance that you make to your rental property to keep your property in good operating condition.

You can deduct the expenses paid by the tenant if they are deductible rental expenses. When you include the fair market value of the property or services in your rental income, you can deduct that same amount as a rental expense.

You may not deduct the cost of improvements. A rental property is improved only if the amounts paid are for a betterment or restoration or adaptation to a new or different use. See the Tangible Property Regulations – Frequently Asked Questions for more information about improvements. The cost of improvements is recovered through depreciation.

What Types Of Property Taxes Are Deductible

The only property taxes that are eligible for a deduction are from property used by the owner for personal use. The properties owned could include a primary home, a co-op apartment, land, vacation homes, boats, foreign property, and cars.

The taxes paid on rental or commercial properties aren’t tax-deductible. Also, if you pay taxes on properties that you don’t own, the taxes aren’t deductible. The payment for services like water or trash isn’t deductible. Property taxes that you owe but havent paid yet also aren’t allowed as deductions.

Read Also: How Long Can You Go Without Filing Your Taxes

How To Claim Rental Property Tax Deductions

In general, you should file rental property tax deductions the same year you pay the expenses using a Schedule E form. The process will be much more manageable if you keep detailed records of all income and costs related to the property as they occur. Plus, if youre ever audited, youll have to provide proof for every deduction you claim.

While weve reviewed several rental property tax deductions above, the filing process gets more complicated if you use the rental property as your primary residence at any point in a given tax year. Each years Schedule E form denotes the number of days that you can personally use your home and the percentage of days that the property can be rented out at fair market value before anything changes. In most cases, you wont be able to deduct expenses or losses for personal use on Schedule E. You may be able to file them using a Schedule A form if you choose to itemize your deductions.