What Are The Benefits Of Each Type Of Tax

The benefits of each type of tax are similar. They both allow the government to assess the value of your property and collect taxes based on that value. They also provide a way for the government to finance public services, such as schools and roads.

The main difference between the two is that real estate tax is assessed on the value of your real estate, while property tax is set on the value of your property.

Tax Rates Penalties & Fees

How much is it?

The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. For the 2022 tax year, the rates are:

0.6317% + 0.7681% = 1.3998%

The amount of Real Estate Tax you owe is determined by the value of your property, as assessed by the Office of Property Assessment . If you disagree with your property assessment, you can file an appeal with the Board of Revision of Taxes . Appeals must be filed by the first Monday in October of the year prior to the tax year you are appealing.

What happens if you don’t pay on time?

If you fail to pay your Real Estate Taxes by March 31, increased charges which include interest will be added to the principal amount of the tax. Collectively called additions, these charges accrue at the rate of 1.5% per month, beginning April 1 until January 1 of the following year.

If the taxes remain unpaid on January 1 of the following year:

- A 15% maximum addition is added to the principal balance

- The taxes are registered delinquent and

- Liens are filed in the amount of the total delinquency, including additions.

- The City can begin the process of selling your home at a sheriff sale.

How Are Property Taxes Determined

Personal property taxes are calculated based on the depreciated value of the asset. Typically, the local tax assessor creates a baseline value based on the amount paid for the personal property. The assessed value usually declines each year due to expected wear and tear.

Each state treats personal property taxes differently. For vehicles, most owners pay the taxes when they renew their tags. When you pay these annual vehicle registration or license fees, the portion that is based on the value of the vehicle is the personal property tax.

Don’t Miss: Can I Track My Unemployment Tax Refund

What Does The Government Do With This Money

That’s a good question. Since you pay those taxes, you have the right to know where the money’s going. Most of the time it goes back into city resources you use every day.

Like roads, traffic lights, and even street cleaners. If you live somewhere where it snows, your real estate taxes help pay for the snow plows that make life that much easier.

Your home taxes may even be helping pay your child’s teachers’ salary. Public schools profit from the real estate tax umbrella as well.

If your local government is working on building any sort of public use structure, your money could go there too. Basically, if you drive around your city, you’ll see your money at work everywhere.

Real Estate Taxes Vs Property Taxes

When it comes to real estate taxes vs. property taxes, whats the difference? In short, there is none. The IRS uses the term real estate taxes, but most people use property taxes to mean the same thing. Both of these terms refer to money paid to state or local governments because of levies on immovable land.

The only important distinction to make is that personal property taxes are different from real estate taxes and property taxes. Personal property taxes refer to movable properties, like the car you drive to work. These items are taxed differently from real estate.

Keep reading to learn more about how these taxes work and put an end to any confusion surrounding these real estate terms.

Read Also: How To Look Up My Taxes

Real Estate Tax & Assessments

Property Tax Deadlines

The first half property* tax due date is June 25 and the second half tax due date is December 5.

Note: when a tax due date falls on a weekend, it automatically extends to the next business day.

This year , the second half tax due date is December 5

*Includes real estate, tangible personal property, machinery and tools, mobile homes, and public service.

To avoid mail delays, access your tax bills and make payments online via the button above.

The County of Albemarle appraises real estate every year based on 100% Fair Market Value as required by the Code of Virginia. The Real Estate tax is a tax assessed on all real property in the County unless a legal exemption exists.

Real property taxation generates the largest local revenue source in many states. Real estate tax bills are mailed in the Spring and Fall to the property owner with payment due to the County by June 25th and December 5th.

The Board of Supervisors holds an annual public hearing on the Tax Rate Changes prior to the issuance of Real Estate tax bills.

The 2022 Real Estate Tax Rate is $.854 per hundred of assessed value.

The information below is used to determine the assessment of a property.

- Information gathered on site visits

- Specific parcel information and any improvements

You can view real estate assessment information using the County’s GIS Maps.

How Do You Calculate Philippine Real Property Tax

Use the following example as a guide for calculating your real property tax:

A residential property in Metro Manila is said to have a market price of Php5,000,0000. This includes a parcel of land valued at Php3,000,000 and the house that sits upon this land is valued at Php2,000,000.

The real property tax to be paid by the property owner is Php28,000. Getting to this result may seem like a heavy task at first, but when you do it regularly, you would be able to calculate real property taxes with ease in no time.

Read Also: Do My Taxes Myself Online

Real Property Tax Rates

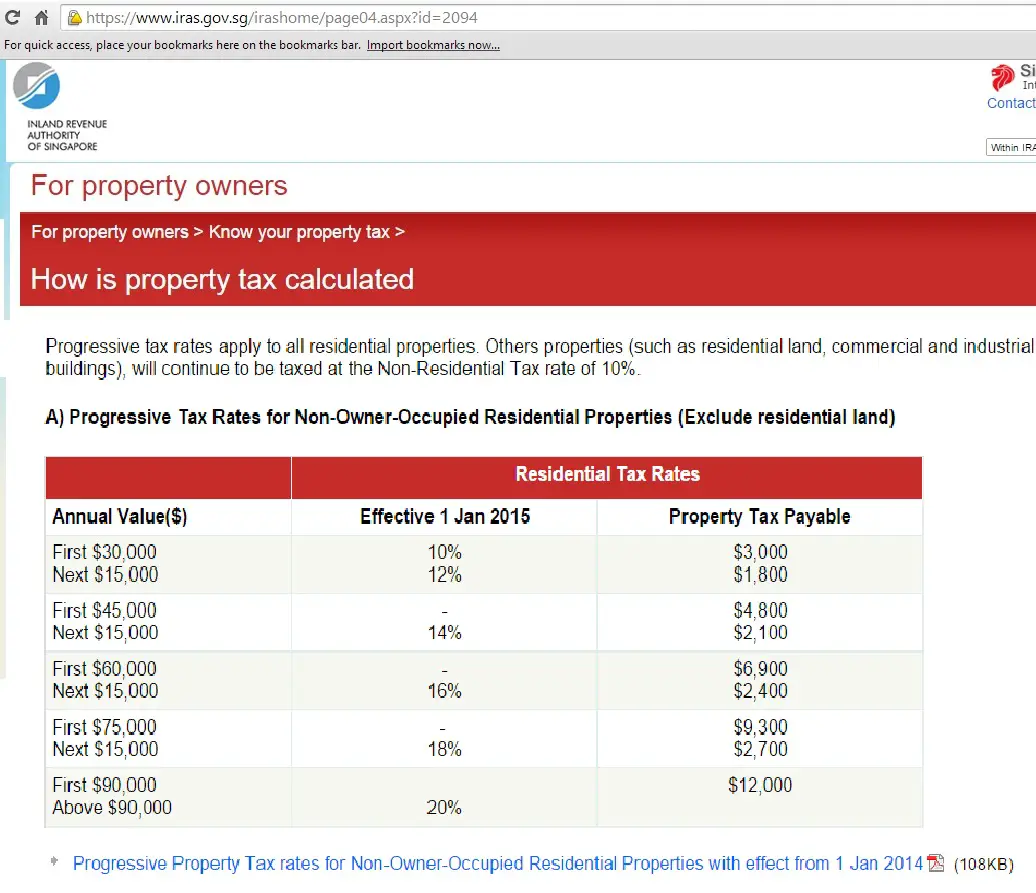

Real property is taxed based on its classification. Classification is the grouping of properties based on similar use. Properties in different classes are taxed at different rates.

A tax rate is the amount of tax on each $100 of the assessed value of the property. The rates are established by the Council of the District of Columbia and may change from year to year.

Difference Between Real Estate Taxes And Property Taxes

Categorized under Business,Investment,Legal | Difference Between Real Estate Taxes and Property Taxes

The acquisition of real estate itself and property whether for investment, personal use or business use has its own tax consequences. Despite the fact that the cost of real estate and property is a capital expenditure that produces no immediate tax benefit or liability, the acquisition puts a lot of tax provisions that the owner will have to adhere to at every step of the propertys life cycle.

The terms real estate and property are often used to mean the same thing. While this is not the case, they can be easily confused for the other as they refer to almost the same thing. For an item to be classified as having real estate tax or property tax obligations, the following is put into consideration.

- Whether the property can be moved

- Whether the property is designed to remain permanently in place

- The damage that will be sustained when the property is moved

- How the property is affixed to land

- The size and costs required to move the components

- The type and quantity of equipment required for a move

Recommended Reading: When Will We Get Our Tax Return

Which Type Of Tax Is Right For You

Both real estate taxes and property taxes have their pros and cons. Real estate taxes are generally considered more stable because they are based on the propertys value, which is not as susceptible to fluctuations in the market.

Property taxes, on the other hand, are generally considered fairer because they are based on the actual use and occupancy of the property.

So, which type of tax is right for you? To make sure, property tax consulting can help you to make a better choice.

Defining Real Estate Vs Property Taxes

Though they may seem similar, real estate taxes and property taxes are two distinct types of taxes.

Real estate taxes vs property taxes the main difference is who pays them. Real estate taxes are typically paid by the land owner, while the property owner pays property taxes.

Thanks for reading our article! Want to learn more about how to manage your real estate investments? Check out our other guides today!

Don’t Miss: Do You Have To Pay Taxes On Unemployment In California

Real Estate Vs Property Taxes

It may be confusing to keep these two types of taxes separate, partially due to how often the terms real estate taxes and property taxes are used interchangeably. However there is a way to keep these two straight:

- Real estate taxes are paid on immovable assets

- Personal property taxes are paid on movable property assets

Another way to think about this is to understand that real estate tax is based on just that real estate. Personal property taxes are then based on personal property property you own that is not real estate.

They Pay For Local Government Services

Real estate taxes pay for a variety of local services. School districts and cities have large property tax bases, and local governments, including special districts, rely on them heavily. The average school district collected $212 billion in 2017 from property taxes, accounting for more than 80 percent of their own source of general revenue. However, school districts receive significant intergovernmental transfers as well, making property taxes an insignificant part of their total general revenue.

The relationship between property tax revenues and land development is common across the United States. Generally, the more land is developed, the more government services are needed. In California, some cities and counties provide all the public services residents expect, but many rely on special districts for those services. In fact, 557 special districts provide services, including fire protection and park and recreation. But the relationship between property tax revenue and development isnt always so clear.

Property taxes can be difficult to calculate, but there are ways to estimate the amount of money a property owner is responsible for paying. Some counties take market value as their basis, while others use appraised values. This results in an assessment ratio, which is the percentage of a homes value that is taxable. Different municipalities have different assessment ratios, but in general, these rates can be in the range of 25 percent or less.

Also Check: How To Organize Tax Documents For Accountant

How Do You Pay Real Property Tax In The Philippines

There are two ways to pay real property tax in the Philippines: online and in person.

Online Payment

You can either use the Moneygment app or check out your local government unit if they have an online payment system in place. This makes it possible for property owners to settle their real property taxes without having to do it in person and risk getting infected with COVID-19.

For owners of properties in Metro Manila, Calabarzon, Central Luzon, and Cebu, you can use a mobile application called Moneygment.

How To Pay Philippine Real Property Tax with Moneygment

In-Person Payment

Can You Deduct Property Taxes

Property taxes are deductible, but the Tax Cuts and Jobs Act of 2017 put a cap on how much you can deduct. You may wonder how the new administration may change property taxes, but nothing has changed for now. According to QuickenLoans.com, you can deduct up to $10,000 if youre married filing jointly, or up to $5,000 if youre filing separately or youre single. Its always best to consult a tax professional.

Also Check: How Much Is Tax In Los Angeles

Mobile Homes And Exemptions

Mobile homes that are a primary or secondary residences fall into a murky category. If they are on rented land, they’re considered personal property and must be licensed and taxed just like a car. If the mobile home sits on land that you own it’s considered real estate and subject to real estate taxes. Most municipalities that impose real estate and personal property taxes also offer various exemptions. For instance, exemptions typically apply for widows, disabled persons and families of combat military personnel.

References

Revisiting The Inheritance Exclusion

It has been decades since Californians voted to create the inherited property exclusion. Since then, this decision has had significant consequences, yet little attention has been paid to reviewing it. Moreover, indications are that use of the exclusion will grow in the future. In light of this, the Legislature may want to revisit the inheritance exclusion. As a starting point, the Legislature would want to consider what goal it wishes to achieve by having an inheritance exclusion. Is the goal to ensure that a family continues to occupy a particular property? Or to maintain ownership of a particular property within a family? Or to promote property inheritance in and of itself?

Different goals suggest different policies. If the goal is to unconditionally promote property inheritance, maintaining the existing inheritance exclusion makes sense. If, however, the goal is more narrowsuch as making sure a family continues to occupy a particular homethe scope of the existing inheritance exclusion is far too broad.

Reasons the Existing Policy May Be Too Broad

Potential Alternatives

Limit to Homes Used as a Primary Residence. One option is to limit the exclusion to homes that are occupied by the family member following inheritance. Inherited homes used as rentals or second homes would be subject to reassessment. Such a change could possibly cut in half the property tax losses resulting from the existing exclusion.

Read Also: When Are Tax Returns 2021

What Is Personal Property Tax

Personal property tax is not the same thing as property tax. Personal property taxes are paid on movable items you own like boats, vehicles, RVs or planes. The portion of your annual vehicle registration thats based on the vehicles value is one form of personal property tax.

This tax is paid on the local or state levels. Some areas do not require you to pay personal property tax at all. Those that do generally require it be paid annually when you file tax returns. Personal property taxes usually fund public works projects, like schools and roads.

What Happens If You Fail To Pay Real Property Taxes On Time

There will be consequences for not being able to pay your real property taxes on time. First, the penalty is imposed at 2% interest per month based on the unpaid amount and can reach up to a maximum of 72% if the taxes are unpaid for 36 months or three years.

Second, if the taxes are still unpaid beyond 36 months or three years, the local government may take some legal actions such as auctioning off your property as a whole or in portions to satisfy the delinquency.

You May Like: Do Dependents Have To File Taxes

How Are Property Taxes Paid After I Pay Off My House

Theres nothing more freeing than making your final mortgage payment, walking out to the backyard of your completely paid-off home, and feeling the grass beneath your feet. It just feels different.

No more monthly house payments for you! But does that mean youre also finished with property taxes?

We hate to be the bearers of bad news, but you have to pay property taxes forever.

The difference is how you pay your property taxesand when you pay your property taxes.

Once you pay off your house, your property taxes arent included in your mortgage anymore, because you dont have one. Now its on you to pay property taxes directly to your local government.

How often you pay property taxes depends on where you live. Your local government may want you to pay your property taxes in a lump sum once a year. Or they may break it into smaller payments that are spaced a few months apart.

The exact day when you have to pay your property taxes also depends on where you live, so make sure you pay close attention to the due date on your property tax bill when it arrives in the mail!

And dont think you can just skip a payment here and there, either. If you get behind on paying your property taxes or you dont pay them at all, the local government can take your house and sell it to recoup the tax debt you owe them . . . and they can do that even though your house is completely paid for. Dont let it come to that!

The best way to handle property taxes on your own is to plan ahead.