Which Should You Choose

Traditional and Roth IRAs are both tax-advantaged ways to save for retirement. While the two differ in many ways, the biggest distinction is how they are taxed.

Traditional IRAs are taxed when you make withdrawals, and you end up paying tax on both contributions and earnings. With Roth IRAs, you pay taxes up front, and qualified withdrawals are tax free for both contributions and earnings.

This is often the deciding factor when choosing between the two.

Roth Ira Vs Traditional Ira: Required Minimum Distributions

Once youre retired, Roth IRAs differ from traditional IRAs in a big way: There are no required minimum distributions with a Roth IRA. All other tax-advantaged retirement accounts require you to begin withdrawing funds once you turn 72.

Annual RMD amounts are calculated based on your life expectancy and total account balance, although youre under no obligation to spend your RMDs. The ability to forgo mandatory withdrawals in retirement can be a big advantage with a Roth IRA.

If You’re Older You Can Continue To Contribute As Long As You Work

As long as you have earned compensation, whether it is a regular paycheck or 1099 income for contract work, you can contribute to a Roth IRAno matter how old you are. There is no age requirement for contributions, but you must be within the income limits in order to contribute to a Roth IRA.

Learn more on Fidelity.com: IRA contribution limits

Don’t Miss: Do I Have To Pay Taxes On My Unemployment

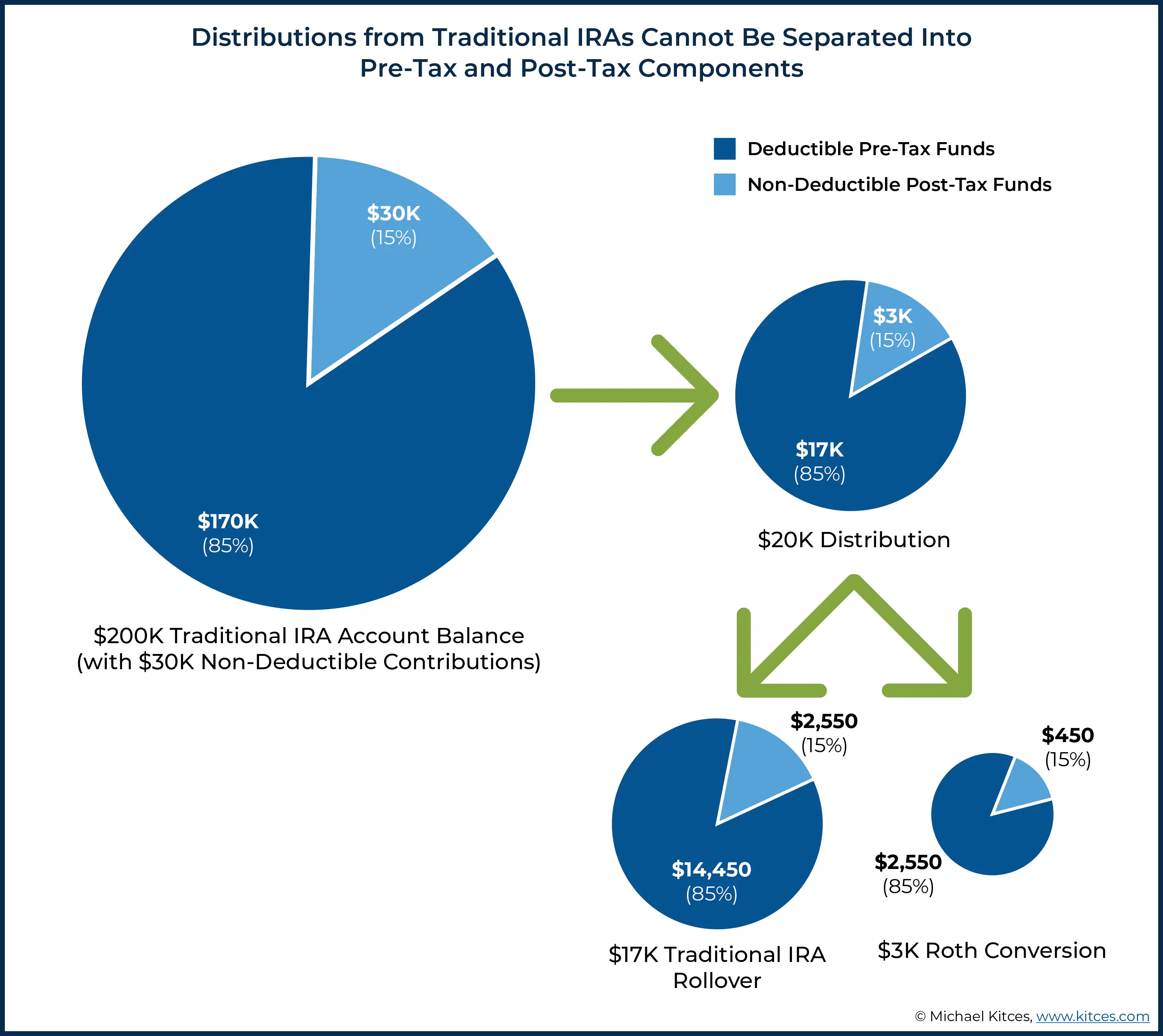

Converting A Traditional Ira To A Roth Ira

If you are strapped for cash, the Roth IRA option may be a tougher commitment to make. The traditional IRA takes a smaller bite out of your paycheck because it reduces your overall tax liability for the year.

Even if you feel that you have to forgo the Roth option for now, you might consider converting your account from a traditional IRA to a Roth IRA in a few years, when youre more financially comfortable. But be aware that all the taxes you were deferring in the traditional IRA will come due in the year when you do the conversion.

A Roth IRA is generally the better choice if you think you will be in a higher tax bracket after retiring. Income tax rates could increase. Or your overall income could be higher due to a variety of factors, such as Social Security payments, earnings on other investments, or inheritances.

If youre considering converting from a traditional IRA to a Roth IRA, you may be able to lessen your tax liability if you time the conversion right. Consider making the move when the market is down , your income is down, or your itemizable deductions for the year have increased.

Withdrawal Plan In Retirement

You also have to look ahead to your retirement years and estimate what your income picture might look like. If you anticipate that you will need the same level in retirement that you have now, even though you might have a shorter time horizon to retirement, it may favor making Roth contributions because your tax rate is not anticipated to drop in the retirement years. So why not pay tax on the contributions now and then receive the earnings on the account tax-free, as opposed to making pre-tax contributions and having to pay tax on all of it. The benefit associated with pre-tax contributions assumes that youre in a higher tax rate now and when you withdraw the money you will be in a lower tax bracket.

Some individuals accumulate balances in their 401 accounts but they also have pensions. As they get closer to retirement, they realize between their pension and Social Security, they will not need to make withdrawals from their 401 account to supplement their income. In many of those cases, we can assume a much longer time horizon for those accounts which may begin to favor Roth contributions. Also, if those accounts are going to continue to accumulate and eventually be inherited by their children, from a tax standpoint, its more beneficial for children to inherit a Roth account versus a pre-tax retirement account because they have to pay tax on all of the money in a pre-tax retirement account as some point.

Don’t Miss: Are There Tax Credits For Solar Panels

Talk With An Investment Pro About Your Roth 401

If you want to learn more about Roth 401s versus traditional 401s and other investment options, its a good idea to sit down with an investment professional who can help. Remember, its never a good idea to invest in something you dont fully understand.

If you need help looking for a qualified investment pro, be sure to try our SmartVestor program. SmartVestor is a free way to get connected with local financial advisors near you.

You can start building a relationship with a pro who understands and can help guide your financial journey today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

How To Determine Your Roth Ira Basis

You can figure out your Roth IRA basis in two easy steps::

- Add up all of the Roth IRA contributions youve made since you started your Roth IA account.

- Subtract any distributions you have already received.

- The math may not be difficult, but keeping track over the years can be difficult.

Your IRA custodian should send you Form 5498 once a year. This form lists your Roth IRA contributions for that particular tax year. Tracking this information will help you determine your Roth IRA basis.

The last thing you want to do one day is to withdraw $10,000 from your Roth IRA, only to discover that your basis was exceeded and that you now owe income taxes and early withdrawal penalties.

You May Like: What Is Sales Tax Exemption

Understand Your Options For An Inherited Ira

The best option for a Roth IRA you inherit depends largely on your circumstances. If you dont have a pressing financial need, you may want to hold off on withdrawals for as long as possible to maximize the tax-free growth.

If youre a surviving spouse, you can avoid withdrawals altogether if you opt for a spousal transfer. Otherwise, if youre a surviving spouse or any other eligible designated beneficiary, taking lifetime distributions will give your inherited investments more time to grow tax-free.

Whether youre a spouse or non-spouse, withdrawing the money over a shorter period or in a lump sum makes sense if you need the money. Youll avoid the early withdrawal penalty no matter how old you are. You also wont be taxed, as long as youve met the five-year rule.

Whats The Difference Between A Roth Ira And A Pre

The difference between Roth IRAs and pre-tax contribution plans is not limited to the tax treatment of contributions and withdrawals.

| Funded with after-tax dollars, so no tax deduction for contributions | Contributions are tax-deductible |

| None while owner is alive | RMDs begin at age 72 |

| Plan Ownership | Individually owned or employer sponsored |

You May Like: How To Stop Unemployment From Taking Tax Return

Tax Planning Considerations To Optimize Your Retirement Portfolio Savings

A strategic tax plan is one of the most important steps toward accumulating wealth, and it is something our financial planners spend a lot of time on with their clients.

In concept, its simple. Investors must redistribute fully taxable income into the most tax-efficient environment possible, allowing them to save more and pay less to the government. Its likely most are already doing the basics like 401, traditional IRAs, Roth IRAs, and so on, but successful investors should periodically evaluate their tax savings plan and ensure it is still applicable to their personal and business goals.

When the goal is to compound savings to increase long-term growth, getting more money into tax-advantaged environments is the most effective way to do this, CPA Brittany Frazier says. Taking advantage of the Roth bucket can be very appealing when looking at the long-term, especially when you can afford to take the tax hit up front.

But a heavy weight toward Roth is not such a slam dunk for all investors. Lets do a quick review of the pre-tax and Roth buckets.

KNOW THE ROTH BASICS

The biggest difference between a Roth savings environment and the traditional, pre-tax savings environment is how contributions and withdrawals are taxed.

The key difference between Roth and traditional pre-tax savings is that over the long-term, the growth in the Roth is never taxed, whereas the growth in the pre-tax is taxed once withdrawn.

WHY ROTH?

HOW TO GET MONEY INTO THE ROTH ENVIRONMENT

Roth IRA

Roth Ira Vs Traditional Ira: An Overview

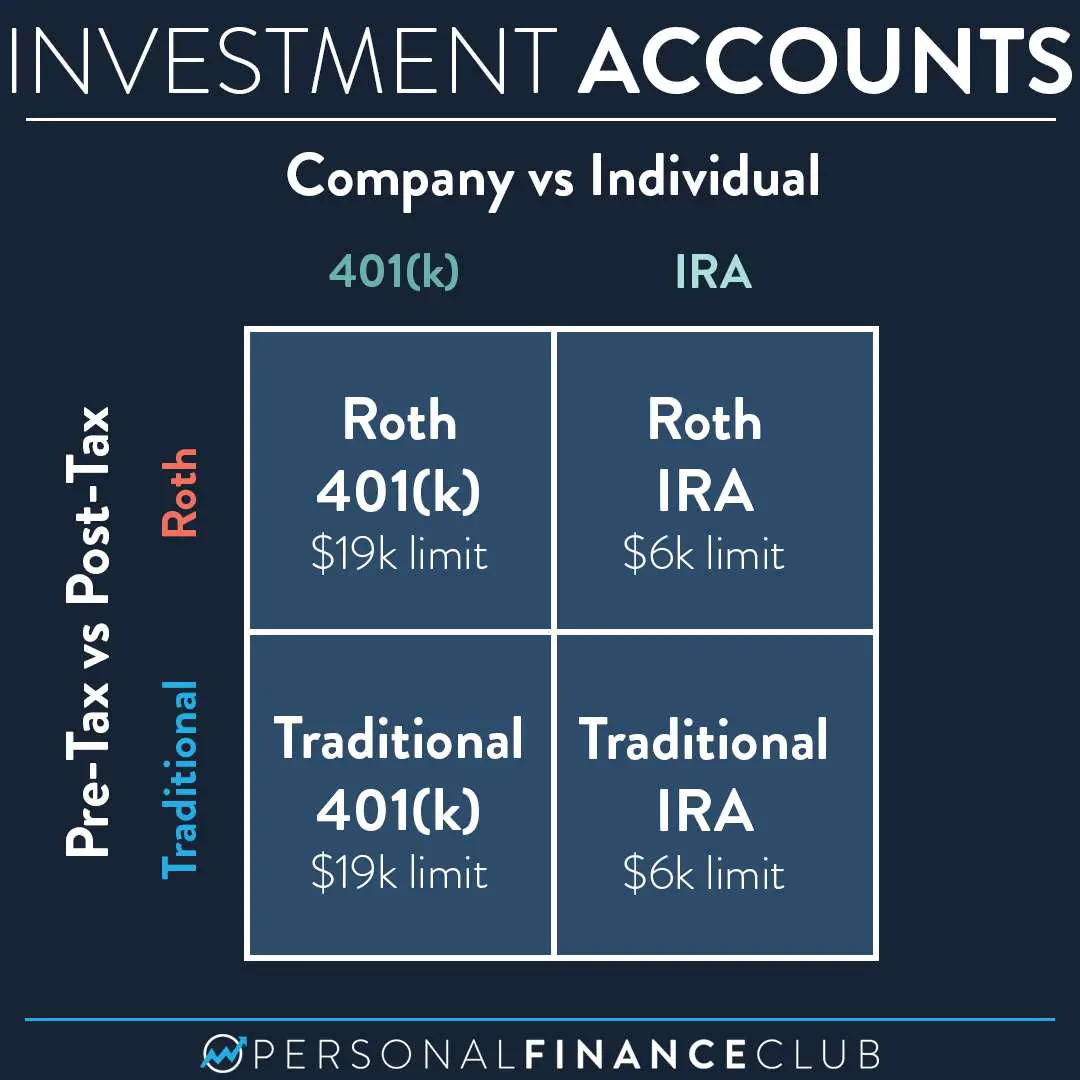

An individual retirement account is a way to save for retirement and save on taxes as well. Designed primarily for self-employed people who don’t have a company retirement plan like a 401 plan. there are two types of IRA: the traditional IRA and the Roth IRA.

Though their goals are similar, traditional and Roth IRAs differ in some key ways:

The traditional IRA allows you to contribute a portion of pre-tax dollars. That reduces your taxable income for the year while setting aside the money for retirement. The taxes will be due as you withdraw the money. The Roth IRA allows you to contribute post-tax dollars. There are no immediate tax savings but once you retire the amount you paid in and the money it earns are tax-free.

You May Like: How To Efile Tax Return

Roth 401 Vs Traditional 401

|

Contributions |

Contributions are made with after-tax dollars. |

Contributions are made with pretax dollars . |

|

Withdrawals |

The money you put in and its growth are not taxed . However, your employer match is subject to taxes. |

All withdrawals will be taxed at your ordinary income tax rate. Most state income taxes apply too. |

|

Access |

If youve held the account for at least five years, you can start taking money out once you reach age 59 1/2. You or your beneficiaries can also receive distributions due to disability or death. |

You can start receiving distributions at age 59 1/2, no matter how long youve had your 401. You or your beneficiaries can also receive distributions due to disability or death. |

How Do Roth Conversion Ladders Work

You’re basically taking a portion … a little bit every year, until such time that either you’ve made your entire retirement tax free, or you’ve exhausted the top of your tax bracket, says Renee Collins, a certified financial planner and certified public accountant at Retire Ready Inc., a financial planning firm in Chicago.

Roth ladders are most helpful to people who have most of their money in traditional IRAs and 401s and expect to be in a higher tax bracket in the future, Collins says. Because those tax-deferred accounts require you to pay taxes once you make withdrawals, moving those funds gradually to a Roth IRA now could mean saving on taxes in retirement.

That way, more of your money could get tax-free growth. You can also make tax-free withdrawals of your converted Roth IRA contributions after five years. And remember, the clock is set to five years for every new contribution you make.

Using a Roth conversion ladder is a form of tax diversification, which is when investors use a mix of taxable and tax-free accounts to help lower the tax they pay when they retire.

Right now, what I find with most clients is that there is no tax diversification, Collins says. And most clients don’t plan for taxes, so they just assume that they’re going to be in a lower tax bracket in retirement.

Recommended Reading: Who Is Eligible For Child Tax Credit 2021

Roth Ira Taxes On Withdrawals

The other thing about Roth IRA taxes is that you get the benefit of tax-free withdrawals in retirement although, technically, thats not so much a blessing as it is delayed gratification. While your investment earnings grow tax-free, its also true that with a Roth IRA you have to pay taxes upfront on your contributions.

That is, your Roth IRA contributions are made with money youve already paid tax on, and then you get entirely tax-free withdrawals in retirement.

Why is paying taxes now a good thing? Because if you think about it, retirement is potentially the worst time to be facing big tax bills. By definition, youre not working. So getting those taxes out of the way long before retirement, when youre still collecting a paycheck, is not a bad idea.

» Like the sound of tax-free retirement income? Find out how and where to open a Roth IRA.

What Are The Similarities Between A Roth 401 And A Traditional 401

Now that we know the differences between a Roth 401 and a traditional 401, lets talk about how theyre similar.

The Roth 401 includes some of the best features of a 401, but thats where their similarities end.

Also Check: How Much Federal Income Tax Do I Pay

Investing An Ira Contribution

Many people make their IRA contribution just before the tax deadline and after they have determined their MAGI for the tax year, and put the contribution into a money market fund. Then they never go back and choose a growth-oriented investment. This is generally not ideal. One of the best ways to give the money a chance to grow over the long term is by having an age- and risk-appropriate level of diversified exposure to stocksin the form of mutual funds, ETFs, and/or individual securities. Of course, that means getting used to riding the ups and downs of the market.

Consider this hypothetical projection: One $6,000 contribution could grow to approximately $64,000 in 35 years.7

If the $6,000 amount seems daunting, even if you can put only $550 into an IRA and leave it there invested for 35 years, earning a hypothetical annual return of 7%, it could be worth nearly $5,900 in 35 years. Make that $550 contribution every year and it could be worth over $87,000 after 35 years, using a hypothetical annual rate of return of 7%.

Summary: Are Roth Ira Contributions Tax Deductible

Since Roth IRA contributions are after-tax they are not tax-deductible, but the earnings on those contributions are tax-free. This makes a Roth IRA an attractive retirement savings option for many people, since it can provide you with future tax diversification..

There are income limits for Roth IRA contributions, so not everyone can contribute. But if you are eligible, a Roth IRA can be a great way to save for retirement.

If you have made it this far you probably appreciated the above article. As a thank you, please help me by:

- Sharing the article with your friends on social media and like and follow us there as well.

- Sign up for the FREE personal finance newsletter below, and never miss anything again.

- Take a look around the site for other articles that you may enjoy.

OTHER NEWS

Don’t Miss: How To Check State Tax Refund

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts.

But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But whatever you do, do not pull that money out of the investment itself!

Before you roll over accounts, sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and figure out whether it makes sense for your situation.

Are Ira Contributions Pre

There are many ways to save for retirement, but one of the best is to get an individual retirement account . These are especially useful if you dont have access to a workplace retirement account, like a 401 or 403. An IRA is essentially a shell into which you deposit and invest money for the purpose of growing your retirement savings. Workplace retirement accounts are generally filled with pre-tax money. But with IRAs, this tax question depends on which type of IRA you decide to open. For help managing your retirement plans, consider working with a local financial advisor.

Also Check: What Is E File Taxes