Social Security Benefits And Taxes

Some people have to pay federal income taxes on their Social Security benefits. This usually happens only if you have other substantial income in addition to your benefits.

No one pays federal income tax on more than 85 percent of his or her Social Security benefits based on Internal Revenue Service rules. Social Security has a sliding scale of taxation depending upon your income. If you file a federal tax return as an “individual” and your combined income is between $25,000 and $34,000, you may have to pay income tax on up to 50 % of your benefits. If your income is more than $34,000, up to 85% of your benefits may be taxable.

If you and your spouse file a joint return, and you have a combined income that is between $32,000 and $44,000, you may have to pay income tax on up to 50 % of your benefits. If you and your spouse have a combined income of more than $44,000, up to 85 % of your benefits may be taxable.

Combined Income is defined by social security as:

- your adjusted gross income

- + nontaxable interest

- + & frac12 of your Social Security benefits

Once you start receiving Social Security benefits, whether they are retirement or disability benefits, you will receive a Social Security Benefit Statement in January, showing the amount of benefits you received in the previous year. You can use this Benefit Statement when you complete your federal income tax return to find out if your benefits are subject to federal income tax.

What Is The Retirement Age In Pa For State Employees

Pennsylvanias statewide State Employees Retirement System, or SERS, is one of the oldest and largest retirement plans for state employees in the country. When the state first hires an employee or when they get close to retirement age, they have lots of decisions to make about their retirement benefits, including at what age they wish to retire.

The SERS normal retirement age is 65, 60, 55 or 50 years of age, depending on what class of service you were in. A SERS employees class of service is determined by when they became a member and the type of work that they did. The annual pension for SERS members is calculated with a formula that includes a few variables about your service as a state employee, including:

- Class of service

What County In Pennsylvania Has The Lowest Property Taxes

Bedford CountyBedford County has some of the lowest property taxes in PA, with a mill rate of three for the county and school district millage rates ranging from around eight to just over 11. Sullivan County. Property taxes in Sullivan County are also among the lowest in PA, with an effective tax rate around 1.46%.

Also Check: What Is The Tax Rate In Tennessee

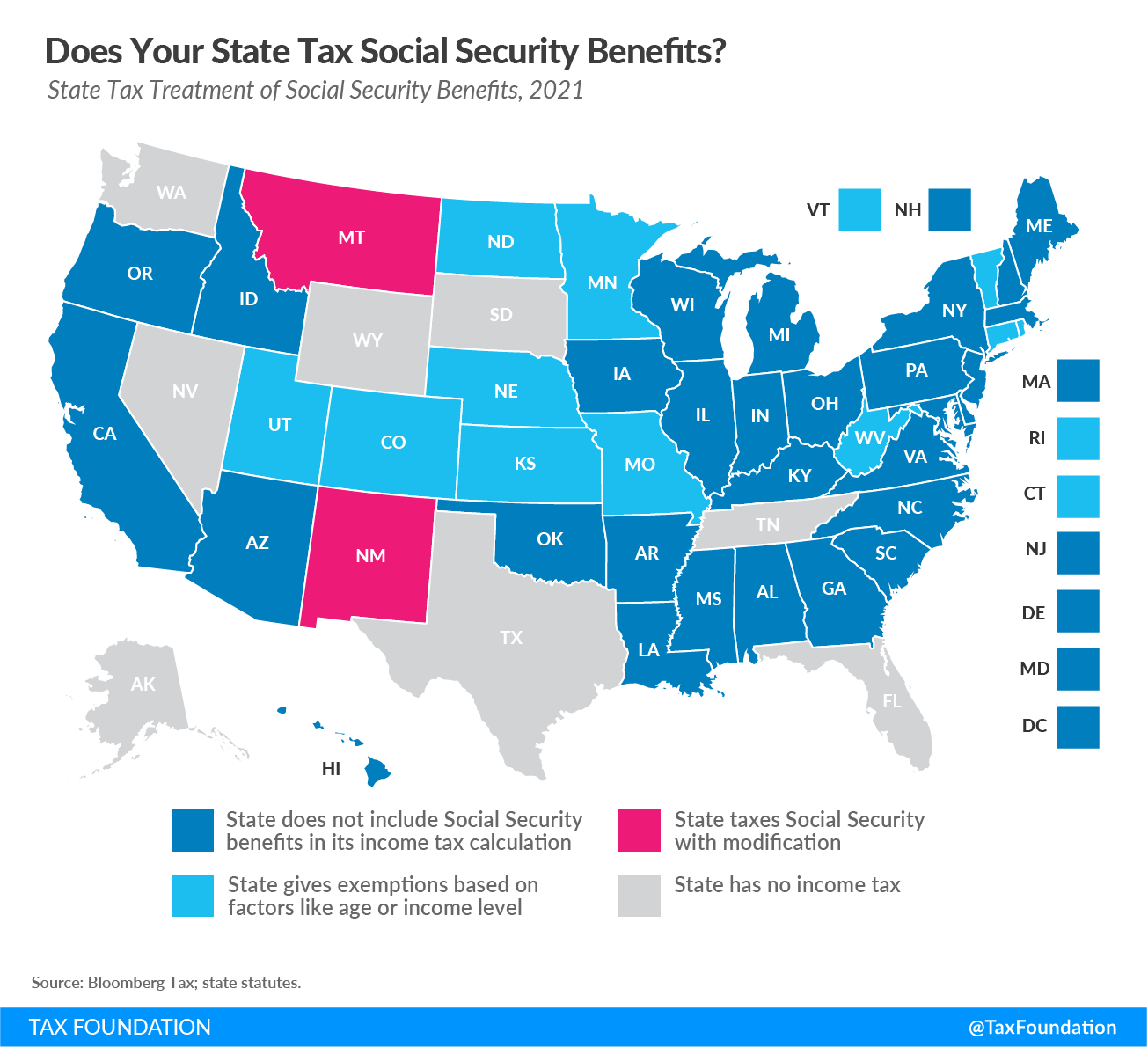

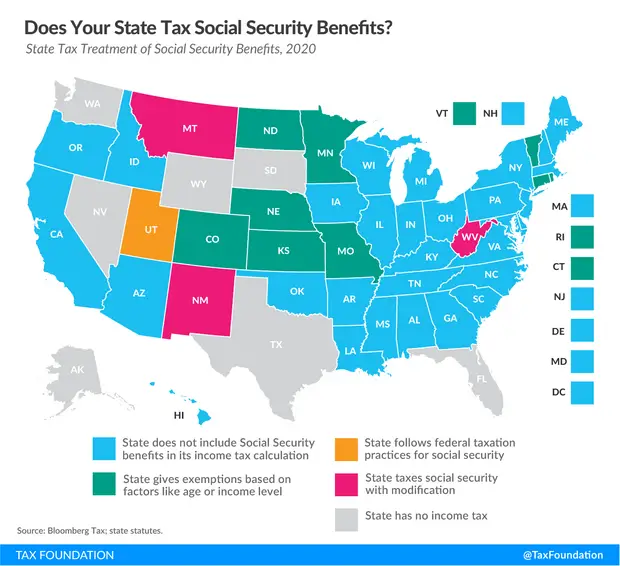

Retirees In The South Get A Free Pass With Social Security Except In One State

All but one of the 16 states of the South are tax-friendly when it comes to Social Security. Florida, Tennessee, and Texas don’t charge state income taxes generally, which makes Social Security taxation largely a moot point. But most of the other states in the region â Alabama, Arkansas, Delaware, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, and Virginia â also have a blanket exemption on taxing Social Security. West Virginia is the only exception it uses the federal rules to determine what gets included in state income taxes.

No Matter How You File Block Has Your Back

You May Like: How To Get Tax Return Information

Are Social Security Disability Benefits Taxable

Some people who get Social Security have to pay taxes on their benefits. The rules are the same regardless as to whether Social Security benefits are received due to retirement or disability. If you file a federal tax return as an “individual” and your combined income is more than $25,000, you have to pay taxes. Combined income is defined as your adjusted gross income + Nontaxable interest + 1/2 of your Social Security benefits. If you file a joint return, you may have to pay taxes if you and your spouse have a combined income that is more than $32,000. If you are married and file a separate return, you will probably pay taxes on your benefits. Social Security has no authority to withhold state or local taxes from your benefit. Many states and local authorities do not tax Social Security benefits. However, you should contact your state or local taxing authority for more information.

Property Taxes In Pennsylvania

When you reach retirement age, your house may be paid off. Your living expenses would be reduced to property maintenance and taxes. In some states, retirees are quick to downsize to lower their tax burden. In other states with high taxes, property taxes on a single-family home can represent a large part of the retirement budget.

Many homeowners hold their property taxes in escrow, which means they pay toward them each month with their mortgage payment. When the mortgage is paid off, and the taxes are collected twice a year, the amount can be shocking. Many communities across the country are struggling with budget shortfalls and are raising taxes to try to close the gap.

In Pennsylvania, if you are over 65, you may be eligible for a rebate on your housing costs, whether you own or rent your home. For seniors who own their home and do not exceed $35,000 in annual household income, the average property tax rebate is $650. With supplemental rebates, that amount can increase. Income calculations to determine eligibility exclude 50 percent of income that comes from social security and Railroad Retirement benefits.

Property taxes for seniors in Pennsylvania are calculated in their favor. Even renters are eligible for a housing rebate if their income is under $15,000. The same exemptions apply in determining the total amount of income.

At a retirement community such as Cornwall Manor, residents do not pay property taxes.

Read Also: When Are Extended Taxes Due

How To Calculate Your Social Security Income Taxes

If your Social Security income is taxable, the amount you pay will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income.

Again, if you file as an individual with a total income thats less than $25,000, you wont have to pay taxes on your Social Security benefits in 2022. For the 2022 tax year , single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

For married couples filing jointly, you will pay taxes on up to 50% of your Social Security income if you have a combined income of $32,000 to $44,000. If you have a combined income of more than $44,000, you can expect to pay taxes on up to 85% of your Social Security benefits.

If 50% of your benefits are subject to tax, the exact amount you include in your taxable income will be the lesser of either:

- half of your annual Social Security benefits OR

- half of the difference between your combined income and the IRS base amount

The example above is for someone whos paying taxes on 50% of their Social Security benefits. Things get more complex if youre paying taxes on 85% of your benefits. However, the IRS helps taxpayers by offering software and a worksheet to calculate Social Security tax liability.

When Is The Best Time To Retire In Pennsylvania

The retirement age is the same in every state. For those born in 1960, the full retirement age according to the Social Security Administration is 67. This means you can receive 100 percent of your social security benefits without any reductions. Beneficiaries receive 50 percent of their spouses retirement benefits when they reach 67 years of age.

If needed, the earliest someone can begin receiving social security retirement benefits is at 62. However, the rate is reduced, and they will only get 70 percent of their own monthly benefits and 32.5 percent of their spouses retirement benefits. As each month passes, the percentage of their retirement benefits grows until it reaches the full amount at age 67.

Don’t Miss: What Is Federal And State Tax

Here Are The 38 States That Don’t Tax Social Security Benefits

The 38 states that do not tax Social Security benefits are listed below:

If you live in one of them, state taxes on your Social Security checks won’t be a concern. Remember, federal taxes still could be, though. The IRS taxes Social Security benefits once countable income is $25,000 for single tax filers or $32,000 for married joint filers. Depending just how high your income is, up to 85% of benefits could potentially be subject to federal tax.

You can calculate countable income by adding up half your Social Security benefit, all your taxable income, and some limited nontaxable income such as MUNI bond interest. If your income is below those thresholds mentioned above and you live in one of the 38 states on this list, you can enjoy spending your Social Security check without having to worry about paying taxes on the money. If it’s above it, you should make certain you are paying in enough to the IRS throughout the year to avoid penalties for paying late.

Information About Social Security Disability Program

Every Pennsylvania resident who is a U.S. citizen is eligible to apply for SSA disability benefits. This is a federal program funded by Federal Income Contribution Act taxes. Because it is a federal program, individuals in each state has the same eligibility requirements to meet. There are more than 4,000 Social Security Administration employees and 140 field offices that service Pennsylvania residents in the Philadelphia Region.

Don’t Miss: Where To Get Tax Transcript

How The Math Works

The math works like this:

- If your wages were less than $137,700 in 2020, multiply your earnings by 6.2% to arrive at the amount you and your employer must each pay for a total of 12.4%. If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax.

- If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you’re self-employed.

For taxes due in 2021, refer to the Social Security income maximum of $137,700 as you’re filing for the 2020 tax year.

Taxable Social Security Benefits

Say your Social Security benefits are taxable based on your combined income. The amount of tax you pay depends on your level of income. Specifically, the difference between your combined income and the IRS base amount .

Youll never pay taxes on more than 85% of your Social Security benefits.

Iowa used to assess taxes on benefits, but it phased the taxes out completely in 2014, while New Mexico exempts some benefits for beneficiaries age 65 and over. These states tax Social Security benefits with varying methods, which can include using adjusted gross income or other figures.

Social Security Administration. “Retirement Benefits,” Page 2.

Don’t Miss: Do You Have To Pay Taxes On Unemployment In California

Does Pennsylvania Tax Military Retirement Pay

Pennsylvania proudly provides tax benefits for military service members and Veterans. Military retirement pay is not taxed as long as you fulfilled your years of service or reach retirement age. Military pay is also exempt from personal income tax for those serving in the PA Army National Guard or United States Army Reserve, even if their active duty service was performed outside of Pennsylvania.

If you receive Military Disability Retirement Pay as an annuity, pension or similar allowance due to sickness or injury resulting from your time in active service, it should not be included in taxable income as long as you meet the criteria.

If youre a survivor of a military service member who died while performing their duties, your Dependency and Indemnity Compensation is a benefit that is not taxed as long as you live in Pennsylvania.

What Is The Homestead Exemption In Pennsylvania

The Homestead Exemption reduces the taxable portion of your propertys assessed value. With this exemption, the assessed value of the property is reduced by $45,000. Most homeowners will save $629 a year on their Real Estate Tax bill. Once we accept your application, you never have to reapply for the exemption.

Don’t Miss: How Much Taxes Deducted From Paycheck Ct

Take Advantage Of Breaks Where You Can Get Them

In 37 states, you don’t have to worry about state income tax on Social Security. Yet even in some of the others, there are often things you can do. For instance, New Mexico has an exemption for some retirement income that lets you shelter Social Security if you choose to use it in that way. However, many residents use the exemption to protect IRA distributions or pension income instead.

Also, just because your benefits are taxable for federal purposes doesn’t mean that they will be even in states that tax Social Security. Many states have much higher thresholds for taxation than the IRS.

Retirees like to hold onto as much of their Social Security as they can, and dealing with taxes is never ideal. Knowing which states tax Social Security at the local level means you can take that into consideration in planning where you want to spend your retirement.

This article was written by Dan Caplinger from The Motley Fool and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

Determining If You Owe Federal And State Income Tax On Disability Benefits In Pennsylvania

While SSDI benefits are taxable, whether you owe taxes depends on whether you file jointly or individually and your provisional income. Provisional income includes half of your SSDI benefits, your adjusted gross income, and any tax-exempt interest you earned over the year.

If your only source of income is SSDI, you will most likely not owe any federal income tax. However, if you are an individual with between $25,000 and $34,000 of provisional income, up to half of your SSDI benefits will be considered taxable income. For individuals with more than $34,000 of provisional income, 85% of their SSDI benefits are taxable.

If you are married, filing jointly, and have a combined income of over $32,000, 50% of your disability benefits are taxable. When the combined income exceeds $44,000, then up to 85% of your SSDI benefits are taxable. It is important to remember that the percentages relate to the amount of taxable income and not your marginal tax rate. Your disability benefits will be taxed at your normal marginal rate. For most people, this falls somewhere between 10% and 28%.

Pennsylvania is one of a small number of states that taxes Social Security disability benefits. The same figures apply when determining your state tax obligation. The experienced Philadelphia Social Security benefits lawyers at Young, Marr, Mallis & Associates are available to answer your questions or concerns regarding your benefits.

Recommended Reading: How To Get Tax Exempt Status For Nonprofit

How Our Social Security Lawyers Can Help You With Back Pay

As mentioned, it is not uncommon for your initial claim to be denied. However, that doesnt mean its not daunting it might put you in a tight spot. If you are experiencing a similar situation, our lawyers can fight to get you the backpay you need to help cover your expenses.

You can rely on us to:

- Act as a messenger between you and the SSA

- Help you comply with deadlines

- Advise and explain your options

- Assist you throughout the appeals process

In reference to the last point, the appeals process can be complicated, and taking it on by yourself is no easy task. A lawyer on our team can represent you throughout all stages:

- Reconsideration

- A hearing in front of the Administrative Law Judge , which can be done via phone, video conference, or in person

- The Appeals Council

Taxing Social Security Disability Income In Pennsylvania

Whether your disability income is taxable or not depends on the type of benefits you are receiving.

SSI benefits are not taxable. If you are receiving SSI benefits, you are not required to report it as income.

SSDI benefits, just as with any other Social Security income, must be reported on your tax returns. While it is considered taxable income, whether you must pay any income tax depends on your total income and benefits for the taxable year.

You might be required to pay income tax on your SSDI benefits if half of your Social Security benefits, excluding SSI benefits, plus your other taxable income, is greater than the base amount for your personal filing status. For instance, if you file jointly with your spouse, your SSDI benefits would be combined with your spouses income. It does not matter whether your spouse is receiving benefits.

You May Like: What Happens When You File Taxes Late