Situations To Consider Tax

OVERVIEW

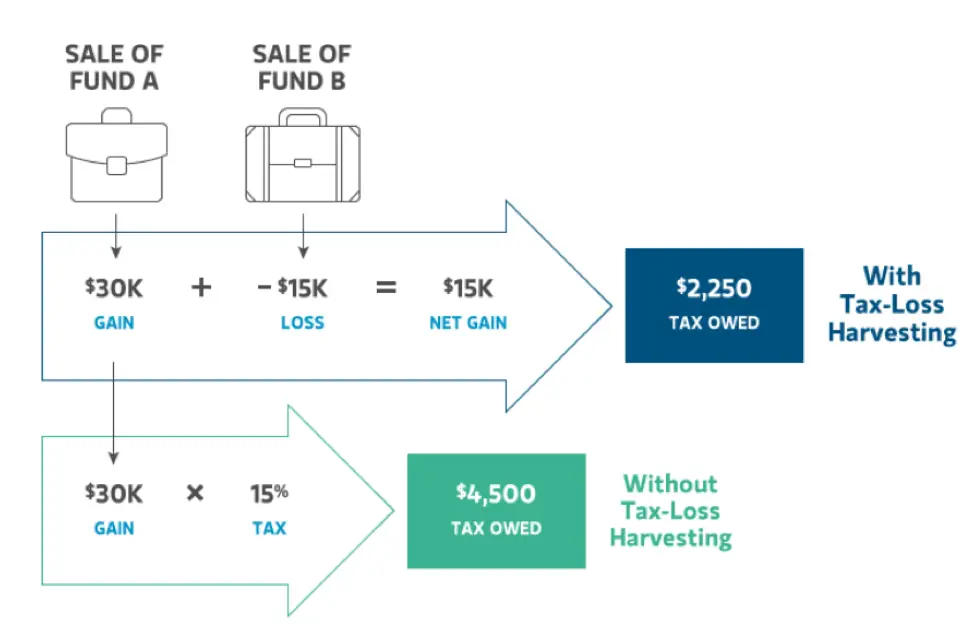

In order to reduce the amount you’ll owe during tax season, you can explore selling investments that have lost value from what you paid for them. But first, you should understand what this means and whether or not you should be considering it as a strategy.

Tax-loss harvesting is the method of selling investments at a loss in order to reduce the amount of money you’ll owe for income taxes. To help you sort this out, we’ve explained some key terms and outlined five instances of when you might consider this.

Confirm The Tax Loss Harvest

After pressing continue, youre done. At that moment, youll be presented with a confirmation.

The amount youre selling from one fund and buying into another is based on the prior days closing price and is not representative of the final trade. Hence, the asterisk.

The next day, you can log in to see the true value of the paper loss you tax loss harvested.

The loss more than doubled in size from an estimated $283.37 to the actual $637.97. I had a pretty good idea this would be the case, as the stock market was down big late in the trading day when I set up this exchange.

A day or two later, I received a confirmation of the trade, which is essentially the same information you see above in a different format, but with the closing price on the day you made the exchange, representing the true value of the paper loss.

Under Notes: I am told that Vanguard wont let me buy back into this fund in the next 30 days to comply with their frequent-trading policy. Thats a good thing the last thing I want to do is buy more VTSAX and create a wash sale. Vanguard is protecting me from making a bonehead move, and I appreciate that.

# 5 Might Cause Bad Behavior

Let’s get out of the weeds now and get into some useful information.

When it comes to successful investing, the investor matters more than the investment. Your behavior in a bear market will have a direct impact on your returns, your retirement date, how much you can spend, and how much you can give. Staying the course and doing nothing in a bear market is a great way to not do the classic buy high and sell low behavior investors, especially physician investors, are famous for. Some people go to an extreme, deliberately locking themselves out of their investing accounts to prevent them from panic selling, not even opening their brokerage statements, and other similar behavioral techniques.

One big issue with tax loss harvesting is it forces you to pay attention to what the markets are doing and actually look at your accounts. If doing so causes you to have to use a less aggressive asset allocation or heaven forbid do something stupid while you’re in the account, you would definitely have been better off never tax-loss harvesting at all.

Don’t Miss: How To Correct State Tax Return

Wash Sales Due To Buying Within 30 Days Prior To Sale

Finally, many investors think of wash sales as only occurring if you re-buy the investment shortly after selling it. That is, they forget that a wash sale can occur if you buy shares within 30 days prior to the sale.

Example: On January 1, Josh buys 100 shares of Vanguard Total Stock Market ETF in his brokerage account for $60 per share. On January 15, Josh buys another 100 shares for $58 per share. On January 20, Josh sells 100 shares, at a price of $56 per share. Josh has a wash sale. His loss will be disallowed and added to the cost basis of his remaining 100 shares.

Note, however, that you do not need to worry about wash sales if you liquidate all of your shares of a given investment and you do not repurchase substantially identical securities within 30 days.

Example: On January 1, Lucy buys 100 shares of Vanguard Total Stock Market ETF in her brokerage account, at a price of $60 per share. On January 10, Lucy sells her 100 shares for $55 per share, and she does not purchase substantially identical securities in any of her accounts within the next 30 days. Lucy will be able to claim her loss of $5 per share, despite the fact that a purchase occurred within 30 days prior to the sale.

How To Avoid A Wash Sale

The simple answer is to avoid buying replacement shares a month before and after tax loss harvesting. It sounds simple enough, but there are several ways to unwittingly foul this up.

The most likely way to inadvertently create a wash sale is with automated new investments and automated dividend reinvestments. Lets look at each of these individually.

Automated investments often take place in a tax-advantaged account like a 401, 403, 457, or SEP or SIMPLE IRA. While investments in these accounts may not be noticed by your taxable brokerage account or the IRS, I believe its best to avoid any gray areas, even if the impetus to report them may be on you.

Note that replacement shares purchased in a spouses accounts can also trigger a wash sale. This is definitely an issue for purchases in your spouses taxable account or any IRA he or she has, including a traditional IRA, SIMPLE IRA, or SEP IRA. Whether your finances are separate or combined, youll each have your own tax-advantaged accounts, and the IRS looks at your accounts as being under one umbrella when it comes to tax loss harvesting and wash sales.

Don’t Miss: Have My Taxes Been Accepted

How Does Tax Loss Harvesting Work

Most of the investors prefer using this strategy at the end of the financial year when they need to file returns. But you can use it throughout the year in a planned manner to keep your capital gains at a relatively lower level. Tax-loss harvesting starts with the sale of the stock or an equity fund which is experiencing a consistent price decline. You feel that the security has lost most of its value and chances of a rebound are bleak. Once the loss is realised, you offset it against capital gains that your portfolio has earned over the period.

Lets understand this with an example. Suppose in a given financial year your portfolio made an STCG and LTCG of Rs 1,00,000 and Rs 1,05,000 respectively. The short-term capital losses were Rs 50,000.

Tax payable = = Rs 15,500

Tax payable = = Rs 8,000

The calculations might seem pretty confusing and time-consuming. You can get assistance on managing and filing LTCG tax at cleartax.in. The amount realised from the sale of the loss-making stock/equity fund can be used to buy a lucrative stock/equity fund. This kind of replacement is necessary to maintain the original asset allocation of the portfolio.

Moreover, it keeps the portfolios risk-return profile intact. Among other measures, tax-loss harvesting is a vital tool to save a lot on taxes. Additionally, you get to know ways to diversify your portfolio to earn higher returns. It doesnt help to nullify the losses, but it can reduce your suffering by helping you save taxes.

Four Capital Gains Rates

How? When you harvest losses and repurchase the stock at the lower price, you also lower your cost basis, or the original cost of the investment. Your cost basis is used to determine your capital gain when you sell the security down the road.

“If I harvest $10,000 in losses every year and I do that for a decade, I created another $100,000 in capital gains that will be subject to tax because I’ve systematically lowered my cost basis by the same amount,” Kitces said. “If the gain is big enough, you will actually drive yourself into the top capital gains rate.”

Read MoreKey tips to minimize tax bite

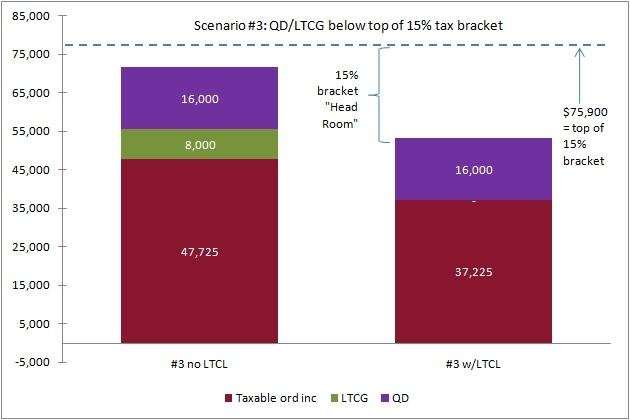

Indeed, for many decades, taxpayers only ever had to contend with two capital gains rates. There was the 0 percent rate for those in the lowest income tax brackets, and a 20 percent rate for everyone else, which was lowered to 15 percent in 2003 before being made permanent for most middle-income taxpayers in 2012.

But now there are four capital gains rates in effect: 0 percent for those in the lowest two brackets, 15 percent for middle-income taxpayers, 18.8 percent for those in the 15 percent bracket who also owe the 3.8 percent Medicare tax, and 23.8 percent for high-income earners who pay the 20 percent capital gains rate plus the 3.8 percent Medicare tax.

“That’s the big issue so many people miss,” Kitces said. “It’s a deferral, not a savings.

Read MoreAdvisors up Social Security smarts

There are a few exceptions to that rule, however.

Read MoreHow to avoid empty pockets at 80

Read Also: Where Do I File My Illinois Tax Return

Wash Sales From Buying In A 401

Update: A few readers asked whether a wash sale can be triggered when, after selling an investment for a loss in a taxable account, substantially identical securities are purchased in a 401 or 403.

This answer is a bit trickier. Section 1091 of the Internal Revenue Code is the law that creates the wash sale rule. It doesnt mention retirement accounts at all. The rule about wash sales being triggered from purchases in an IRA comes from IRS Revenue Ruling 2008-5. If you read through the ruling, youll see that it speaks specifically to IRAs and does not mention 401 or other employer-sponsored retirement plans.

To the best of my knowledge, there is no official IRS ruling that speaks specifically to wash sales being created by a transaction in a 401. In other words, Im not aware of any source of legal authority that clearly says that a purchase in a 401 would trigger a wash sale.

However, in my opinion, it seems pretty clear that the line of reasoning in the above-linked revenue ruling would apply to employer-sponsored retirement plans as well as IRAs.

So, personally, I would not be comfortable taking a position on a tax return thats based on the assumption that purchases in a 401 cannot trigger a wash sale. But thats just my personal opinion. Others may disagree.

Here Is How It Works:

A capital gain or loss is triggered anytime you dispose of a capital asset. In 2014, the IRS declared cryptocurrency to be a capital asset, meaning that every sale or trade of cryptocurrency results in a capital gain or loss.

A capital gain or loss is equal to the value of what you receive at the time of disposal less the value of what you obtained the asset for at the time of purchase .

The following examples illustrate the tax position of two cryptocurrency investors and .

You May Like: Www.1040paytax.com.

Keys To Proper Tax Harvesting

Selling a few underperforming holdings to save thousands in taxes may seem like a relatively easy choice, but there are many factors that should go into a decision to pursue tax-loss harvestingtax efficiency is just one consideration among many. Taxes should not be the first thing you think about when choosing what to buy and sell, explains Roger Young, CFP®, a senior retirement insights manager with T. Rowe Price. Dont let tax reduction techniques derail your overall investment strategy. As with any strategy, there are several key elements to keep in mind, including:

Focus on the fundamentals.Tax-loss harvesting is just one tool in service of your broader investment strategy. Investment fundamentals, such as remaining diversified and staying the course over the long term, are more important overall than short-term tax considerations. Ultimately, you want to make sure any tax-loss harvesting activities do not alter fundamental elements of your portfolio, such as your asset allocation and risk exposure. In addition, you dont want to sell a position unless you can invest the proceeds in something with better expected returns.

Cash can be a useful tool. Holding a cash position within a portfolio can be useful to take advantage of strategic opportunities. If an investor doesnt want to liquidate a holding that has a loss, they could use their cash to increase their holdings temporarily and then consider selling to take losses after 31 days to avoid the wash sale rule.

Harvest Losses To Maximize Your Tax Savings

When looking for tax-loss selling candidates, consider investments that no longer fit your strategy, have poor prospects for future growth, or can be easily replaced by other investments that fill a similar role in your portfolio.

When you’re looking for tax losses, focusing on short-term losses provides the greatest benefit because they are first used to offset short-term gainsand short-term gains are taxed at a higher marginal rate.

According to the tax code, short- and long-term losses must be used first to offset gains of the same type. But if your losses of one type exceed your gains of the same type, then you can apply the excess to the other type. For example, if you were to sell a long-term investment at a $15,000 loss but had only $5,000 in long-term gains for the year, you could apply the remaining $10,000 excess to any short-term gains.

If you have harvested short-term losses but have only unrealized long-term gains, you may want to consider realizing those gains in the future. The least effective use of harvested short-term losses would be to apply them to long-term capital gains. But, depending on the circumstances, that may still be preferable to paying the long-term capital gains tax.

If you still have capital losses after applying them first to capital gains and then to ordinary income, you can carry them forward for use in future years.

Recommended Reading: How To Get A Pin To File Taxes

Daily Checking Diversification And Other Factors That Impact The Benefits Of Tax

Thus far, we have looked at tax loss harvesting in what is arguably one of the most favorable possible scenarios a dramatic -30% loss occurs immediately, in the first year, creating a significant long-term tax loss harvesting opportunity, with all the associated benefits of compounding growth on tax deferral and the potential for tax bracket arbitrage. However, in many cases, investments dont immediately go down right after purchasing them. And in fact, if an investment rises enough in the early years, it may be so far ahead that even with a subsequent market decline, there will be no loss, as the investment may already be so far ahead there the decline doesnt actually trigger a loss below cost basis!

To the extent that available losses to harvest in practice are lower than the examples shown previously, the likely benefit of tax loss harvesting for most investors will be smaller in practice, all else being equal.

Join over 47,178 fellow advisors now

Tax Consequences Of Selling Stock

When you sell stocks, bonds, or funds that havent worked out as planned, you lose money. But you can recoup part of the loss, with tax-loss harvesting.

For example, lets assume that you purchased $10,000 worth of the SPDR S& P 500 ETF in January. Then, the market falls in October and your $10,000 SPY investment declines by -10%. Your investment is now worth only $9,000. If you sell SPY at that point in time, you will have a $1,000 loss.

Despite the pain of losing $1,000, the silver lining is the tax-loss harvesting. You can use the $1,000 loss to reduce your taxes.

Also Check: Www.1040paytax.com

Similar Vs Identical Property

The good news for ETF investors is that you can avoid the superficial loss rule while still maintaining exposure to the same asset class by using similar, but slightly different holdings.

Remember, the superficial loss rule only applies if you sell and then repurchase the same security or an identical property. In 2001, the CRA issued a bulletin stating that two index funds tracking the same benchmark are considered identical property.

Get Your Investment Taxes Done Right

From stocks & crypto to rental income, TurboTax Premier has you covered.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Louisiana Payroll Calculator

Cons Of Automated Tax Loss Harvesting

1. In 2018, the Securities and Exchange Commission charged a robo-advisor for making misleading claims about the benefits of tax loss harvesting. Its crucial for investors to know that there could be no tax savings or even a bigger tax bill. Say for instance, an investor harvests a loss from one ETF and switches to a second one in order to perform tax loss harvesting. When the investor finally sells the second ETF, the gains realized from this second sale could be so high that they cancel out or be greater than the tax benefits from selling the first fund.2. Theres a potential political risk from tax loss harvesting. By deferring their taxes to a later date, investors could be putting themselves at the risk of tax policy changes after a government political transition.3. Individuals with shorter-term financial goals, such as buying a home, tend to benefit less from tax loss harvesting since they may not be able to defer their tax payments for as long. These folks may benefit from other tax-efficient investing strategies.4. In automated tax loss harvesting, by continuously buying into similar but non-identical assets, an investor may be unintentionally distorting their asset allocation.5. Continuously trading assets in automated tax loss harvesting also means an investor may incur additional costs, such as more transaction fees.