Irs Solar Tax Credits:

Solar panels collect light energy from the sun and convert it into electricity for your home and solar hot water heaters use the sun to provide hot water to your home. Heres what you need to know to find out if you qualify for home energy improvement tax credits for installing solar panels or solar hot water heaters. Find out more about how solar energy works on our blog.

History Of The Solar Investment Tax Credit

In the early days of solar energy, residential systems were far more expensive than they are now. By many homeowner standards, however, theyre still expensive today. For example, in 2009, it cost $8.50 per watt to install solar panels the current cost per watt, as of publishing, is about $2.40 to $3.22.

This point-of-entry cost into the world of renewable residential solar power dramatically limited the number of homeowners who could take advantage of solar for their home.

The solar investment tax credit was established by the Energy Policy Act of 2005, which established standards for renewable fuels, mandated an increase in the use of biofuels and established renewable energy-related tax incentives.

Under this law, the original policy was set to expire at the end of 2007. However, the solar ITC has been so popular that its expiration date has been extended multiple times.

Solar panel costs have decreased dramatically in the last 20 years, but the ITC can still save individuals and businesses a great deal on their federal taxes.

Today, solar systems are far less expensive due to changes in the industry and the manufacturing of certain parts that make up the solar system. Solar panels, lithium batteries and inverters are all far less expensive to make and buy now than they were in those early days.

Solar Tax Credit Carryover In 2022

If you are interested in claiming the Solar Tax Credit, you will need to do so for the same tax year that your solar system is installed. This means that if you purchased solar panels at the end of 2021 and the installation isnt complete until January 2022, you will claim the Solar Tax Credit on your 2022 tax return.

So, what if the value of the Solar Tax Credit is more than you owe in income taxes? While you cant use the tax credit to receive money back from the IRS, the Solar Tax Credit rollover lets you roll the tax credit back one year and carry the credit forward for up to five years. So, if you didnt owe federal taxes last year, you can still claim the Solar Tax Credit on this years tax return. And if the Solar Tax Credit offers you more than you owe in federal taxes, you will receive the difference in the next tax year until the credit is fully claimed.

For example, if the Solar Tax Credit credits you $3,000 when you owe $2,500 in taxes, that extra $500 from the credit would roll over into the next tax year. That means you wouldnt have to pay anything in the current tax year, and you will receive a $500 credit on next years taxes as well.

Also Check: How Long Does It Take To File Your Taxes

How To Claim The Federal Solar Tax Credit

Time needed: 45 minutes.

Then, on line 14, calculate any tax liability limitations using the IRSs Residential Energy Efficient Property Credit Limit Worksheet.

The final step is complete the calculations on lines 15 and 16 and then enter the figure from line 15 on line 5 of your Schedule 3 .

Confused?

Your solar installer should supply all the documentation you need and offer guidance on claiming the credit. You can also consult a tax accountant to make sure youre filing your return correctly, especially if youre also claiming solar renewable energy credits and other incentives.

Federal Tax Credit Is Not Calculated From Gross Cost

A lot of homeowners think that the ITC is calculated from the gross cost. That is not the case. As we calculated above, the 30% credit on a $30,000 solar panel system installation would sum up to $9,000. It is only possible if the $30,000 is the net cost. It is against the IRS rules to calculate the gross costs.

In addition, if you received any local or state financial incentives for your residential solar panel installation, it has to be deducted before calculating the 30% credit amount.

Lets dive into this example

Suppose your $30,000 installation qualified for a California solar tax rebate of $2,000 and a $1,000 rebate from your local utility company. It means that your net cost will be $27,000. Hence, the federal solar ITC would then be $8,200 and not $9,000.

Making the ITC calculation from the Gross tax will make you incur a tax bill instead of a deduction.

Recommended Reading: How To Fold Sole F63 Treadmill

Don’t Miss: What If You Forgot To File Taxes Last Year

Eligible Installations And Tax Credit Rates

Residential Installations

Individuals cannot apply for the Iowa credit for residential installations until the installation of the solar energy system is complete.

Qualifying installations must meet the criteria for the federal residential energy efficient property credit related to solar energy provided in sections 25D or 25D of the Internal Revenue Code. The credit amount for a residential installation that occurs after January 1, 2016, is equal to an applicable Iowa credit rate up to $5,000. Residential installations placed in service after December 31, 2021, are not eligible for the Iowa credit.

Business Installations

Businesses cannot apply for the Iowa credit until the installation of the solar system is complete and the system is placed in service. Qualifying installations must meet the criteria for the federal energy efficient property credit related to solar energy provided in sections 48 or 48 of the Internal Revenue Code. The credit amount for a business Installation that occurs after January 1, 2016, is equal to an applicable Iowa credit rate up to $20,000. Installations that begin construction after December 31, 2021, are not eligible for the Iowa credit.

For additional information about the Iowa solar energy system tax credit, please consult Iowa administrative rule 701-42.48.

How The Residential Clean Energy Credit Works

To make sure you understand the value of the tax credit and capitalize on its potential, its important to understand how the Residential Clean Energy Credit works.

The tax credit was put in place to promote solar use, but not everyone who uses solar can qualify and be eligible to make a claim. To be eligible for the full 30% Residential Clean Energy Credit, you must meet the following criteria:

- Installation of the solar power system began between January 1, 2022, and December 31, 2032

- Solar power system was installed in your primary or secondary residence within the United States

- Solar power system is new or being put to use for the first time

- You must own the solar power system, as leased equipment does not qualify

Any costs incurred during the installation of the solar power system can be included in the tax credit. These include components such as mounting equipment, batteries, and wires, as well as related costs such as labor, assembly, and inspection.

After purchasing your solar power system, you should file for the Residential Clean Energy Credit within the tax year, just like you file your federal taxes. For the solar tax credit, you are required to use Form 5695 for Residential Energy Credits. Regardless of whether you use the federal income tax or the alternative income tax to calculate your tax liability, you can still claim the full value of the Residential Clean Energy Credit and receive residential energy credit, as it can be used against both.

Don’t Miss: How To Report Bitcoin On Taxes

Federal Solar Investment Tax Credit

Homeowners and business owners who go solar can make use of the Investment Tax Credit offered by the federal government. The tax credit is a percentage of your system costand theres no cap on the amount.

The ITC is a one-time, non-refundable credit that you receive when you file your taxes for the year you had your solar array installed. You can roll over the tax credit to subsequent years if youre unable to use all of the credit in the first year.

The good news: This tax credit was set to end in 2021, but it was extended until 2023. Yay!

The bad news: The credit decreases over time. Boo.

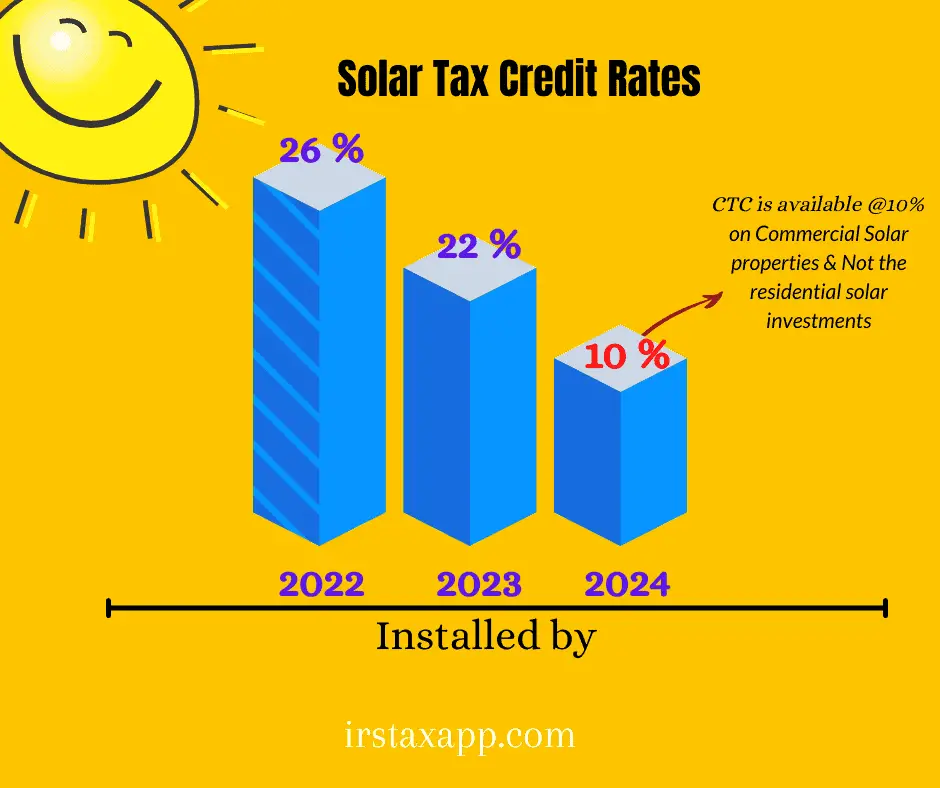

Heres the plan, as it stands:

- 2021 26% of system cost

- 2022 26% of system cost

- 2023 22% of system cost

- 2024 and beyond no credit for residential systems and 10% for commercial systems

Additional Resource:IRS Instructions for Form 5695

How do I get the tax credit?

In most cases, your solar installer will give you a receipt for the total cost of your system after its installed. You can then give this receipt to your accountant and receive a tax credit off the total cost of your system.

If you cant realize the full value of your credit in the first year, you may be able to roll it forward to reduce your tax burden in subsequent years.

To be sure, we recommend that you consult with a tax expert or accountant. Were not tax experts at Solar United Neighbors, so we cant offer tax advice.

Can I include roof improvement or replacement costs in the credit?

What about battery storage?

How Else Can I Qualify As A Solar Tax Credit Investor

The third category of potential solar investors are those who have a significant amount of taxable solar income. Typically, this would include owning a large number of apartments that generate rent or similar income without meeting the qualifications to be actively involved in commercial real estate. For instance, an apartment owner that generates $1 million of net taxable rental income and has a 25% effective tax rate would face a $250,000 tax bill for that year from their passive income. The maximum value that investor could recognize from the non-refundable solar tax credit and depreciation would be limited to that $250,000 of tax on the passive income.

Whether you have some experience or are brand new to solar, Avisen Legal has extensive experience in structuring solar partnerships that mobilize investments in solar in order to benefit investors, benefit property owners, increase the reliability of our electric system, and meet urgent climate goals.

Recommended Reading: How Do I Pay My Quarterly Taxes Online

Ner Tax Corporate Tax

New York

Peter Connors, a tax partner in the New York office, focuses his practice on cross-border transactions. He also has extensive experience in related areas of tax law, including financial transactions, corporate reorganizations, renewable energy investments and controversy matters. He also leads the Orrick’s Section 45Q practice relating to the tax credit for carbon capture and sequestration.

How Does The Solar Tax Credit Work The Ultimate Guide

If youre debating adding solar panels to your business or home, youve probably heard about the federal solar tax credit.

The federal government is offering a solar tax credit to subsidize the purchase and installation costs of solar panel systems for commercial businesses and residential homeowners throughout the U.S.

Although the solar tax credit was set to expire in 2023, the Inflation Reduction Act recently extended it as a financial incentive for green energy. That means it continues to be a relevant and helpful option for anyone looking to go solar.

Heres what you need to know about the solar tax credit.

Recommended Reading: Does United Way Do Taxes For Free

Using The Federal Tax Credit In Combination With Other Incentives

Aside from the ITC, there are several other solar incentives to consider like rebates, state-sponsored programs, and other tax credits depending on where you live. While some of these financial incentives may impact the ITC, others can be combined to lower the cost of going solar. Heres what you need to know about combining solar incentives with the federal ITC:

- Rebates from your utility company: As a general rule of thumb, subsidies from your utility company will be excluded from income tax returns. So, in this case, any utility rebate for installing solar would be subtracted from your system cost before you can calculate the tax credit.

- Rebates from the state: These types of rebates typically do not reduce your federal tax credit.

- State tax credit: If you get any state tax credit for your solar system, it will not decrease your federal tax credits. However, keep in mind that getting a state tax credit means that your taxable income on federal returns will be higher since you will have less state income tax to deduct.

- Payments from renewable energy certificates: Any time you receive money from selling renewable energy certificates, it will likely be considered taxable income that will increase your gross income. But, it will not reduce your tax credit.

Are You Eligible To Claim This Federal Government Solar Incentive

In order to claim the federal solar tax credit of 30% and get money back on your solar investment, you have to meet the following criteria when filing your 2022 taxes:

- Your solar PV system must have been installed and began operating at some point between January 1, 2022, and December 31 of 2032.

- Your system must have been installed at either your primary or secondary residence.

- You must own the solar PV system, whether you paid upfront or are financing the cost.

- The solar system must have been used for the first time. You only get to claim this credit once, for the original installation of your solar PV equipment. So if you move residences, take your panels with you, and install them on your new roof, you wont be able to claim a second credit.

Recommended Reading: How To Calculate Property Tax

Impacts Of Credits In The Ev Market

The market for electric vehicles is expected to be greatly expanded under the new clean vehicle tax credits established by the IRA. This expansion, reflected in changes to IRC Section 30D, is expected to positively impact battery manufacturers. Under the IRA, tax credits for EVs are now available, but there are restrictions based on where the batteries are built and where the critical materials in the batteries are mined, recycled, or processed. There is an important exclusion, discussed below, where foreign entities of concern are involved in the extraction of materials used in the manufacture of the battery or where the components contained in the battery are manufactured or assembled by a foreign entity of concern. We expect that automobile manufacturers and the Internal Revenue Service will develop certification requirements to ensure compliance with these requirements.

1. To receive the $3,750 critical minerals tax credit, the vehicles battery must contain a threshold percentage of critical minerals that were extracted or processed in the United States or in a country with which the United States has a free trade agreement, or which were recycled in North America.

- The threshold percentage is 40% through the end of 2023, then increasing to 50% in 2024, 60% in 2025, 70% in 2026, and 80% after 2026.

Additional guidance from the Internal Revenue Service is likely to be forthcoming.

How Do I Claim The Solar Tax Credit

If you purchase a solar energy system and it belongs to your business or household, youre eligible for the solar tax credit. You can claim the credit when filing your annual federal tax return.

Make sure to let your accountant know youve installed solar panels in the past year. If you file your own taxes, simply use tax form 5695.

Read Also: Does Roth Ira Grow Tax Free

Solar Energy System Eligibility

To be eligible for the Federal Solar Tax Credit, you must install a solar energy system that provides electricity for a residence, such as solar water heaters or a solar photovoltaic system. Since solar water heaters use the suns thermal energy to heat water and solar photovoltaic systems convert the suns light energy into electricity, both systems will qualify for the Federal Solar Tax Credit.

When Does The Federal Solar Tax Credit Expire

The federal solar tax credit is set to expire at the end of 2023. There is hope that the tax credit may be extended once again. The Biden Administration has plans to include a 10-year extension of the tax credit in future legislation. But, theres no guarantee that this will be approved by Congress and it may be at a lower rate.

Because of that, our best advice is to try and add solar panels as soon as possible so youre guaranteed to get the 26% credit.

The best time to go solar is now because the 26% ITC will decrease to 22% in 2023 before becoming unavailable for residential solar systems installed in 2024 and beyond.

Don’t Miss: What’s The Last Day To File Taxes 2021

The Federal Solar Investment Tax Credit: What You Need To Know

Leigh Matthews, BA Hons, H.Dip. NT

Sustainability Expert

Leigh Matthews is a sustainability expert and long time Vegan. Her work on solar policy has been published in Canada’s National Observer.

The U.S. federal government increased the Solar Investment Tax Credit to 30% in August 2022, and the increase applies retroactively to any eligible projects installed earlier in 2022. Read on to learn more about federal solar tax credits.

Solar tax credit extended and increased. The Inflation Reduction Act of 2022 was signed into law by President Biden on August 16, 2022. This reconciliation bill extends the expiring Federal Solar Investment Tax Credit until 2034 and increases its value to 30% for residential solar installations until 2032.

First ever climate bill. With unified support from Senate Democrats, the Inflation Reduction Act includes wide-ranging measures to reduce carbon emissions and tackle climate change. Under the new rules, homeowners can claim 30% of the cost of a home solar installation as a tax credit until 2032. Thereafter, the credit steps down to 26% in 2033 and 22% in 2034.

No maximum. Theres no maximum amount you can claim for your project, meaning its a good idea to maximize your installation to future-proof your energy needs.