Construction For An Older Family Member

If you build living quarters in your house for a family member who is 62 years old or older, you can choose to either exempt the added value of your home or deduct 20% from the total, whichever is less. The family member, however, must have continued to live in the constructed living quarters for you to qualify for this benefit.

How Is The Value Of My Property Estimated

Florida law charges the property appraiser with the task of valuing all property that is not immune from taxation, or otherwise expressly exempt from valuation. Pursuant to Article VII of the Florida Constitution and s. 195.042, F.S., all property shall be assessed according to its market value on January 1 each year. Additionally, the ad valorem assessment process is governed by Florida law, including s. 193.011, F.S.

The property appraiser considers three generally accepted approaches in the development of market value estimates: the cost approach, sales comparison approach and the income approach. The applicability of each approach depends on the character of the property and the availability of market data.

Who Owes Florida Property Taxes

If you own real property as an individual or business, you pay property tax on it in Florida. Even if the property was gifted to you through an estate or you own a rental property, you are still required to pay Florida real property taxes.

There is no minimum or maximum of real property taxes you could owe in Florida. Whether you have a $10,000 or $1,000,000 house, you will owe real property taxes in Florida.

Read Also: Do I Qualify For Child Tax Credit 2021

Florida Property Tax Rates

Property taxes in Florida are implemented in millage rates. A millage rate is one tenth of a percent, which equates to $1 in taxes for every $1,000 in home value. A number of different authorities, including counties, municipalities, school boards and special districts, can levy these taxes.

The table below shows the median property tax payment and average effective tax rate for every county in Florida. The effective tax rate is the median annual tax payment as a percentage of median home value. It can help compare tax burdens between counties and even between states, as it reflects actual payments and incorporates differences in assessments and exemptions.

| County |

|---|

Want to learn more about your mortgage payments? Check out our mortgage loan calculator.

Do You Pay Personal Property Tax In Florida

Florida is one of the states with no personal property tax at all, but until 2007, the state did have an intangible personal property tax, which primarily affected the states wealthiest residents. It was reduced and eventually repealed, though there are a couple intangible property exceptions that are still taxed.

You May Like: What Is The Tax Bracket For 2020

Who Collects Florida Property Tax

In Florida, homeowners do not have to pay property taxes to the state government. Instead, it is the local governments that collect property taxes, which serve as their main source of funding.

Before you purchase a home in Florida, whether as your primary residence or as an investment property, you must take a look at property taxes at the local level. Each county has a different rate. Moreover, the amount you will pay will depend on the value of the property.

Several counties have tax rates that are higher than the national average. It is worth noting that Florida offers certain tax exemptions that can significantly reduce your tax obligation. Property tax rates apply to the taxable value of your home, which already takes assessment limits and exemptions into account.

What Is The Florida Property Tax Rate

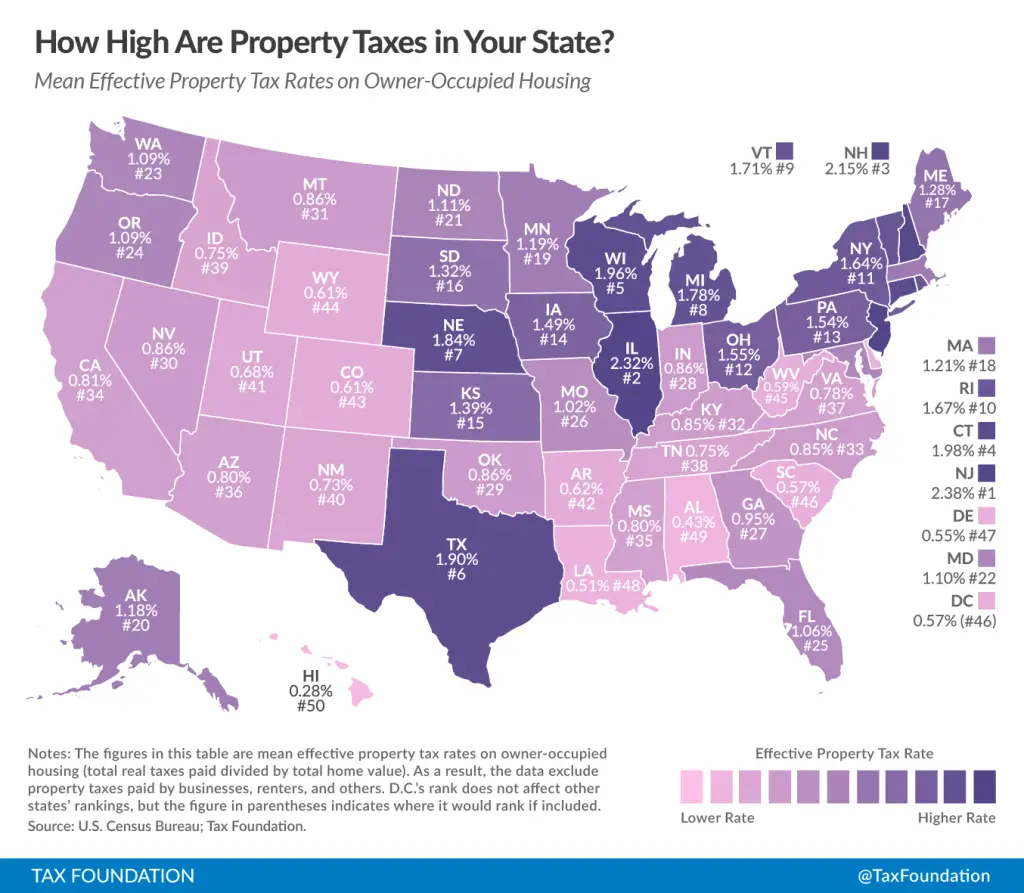

Floridas average real property tax rate is 0.98%, which is slightly lower than the U.S. average of 1.08%. The average Florida homeowner pays $1,752 each year in real property taxes, although that amount varies between counties.

Florida real property tax rates are implemented in millage rates, which is 1/10 of a percent. This equates to $1 in taxes for every $1,000 in home value.

Here are the median property tax payments and average effective tax rate by Florida county.

| County | Average Effective Property Tax Rate |

| Alachua |

Don’t Miss: How Much Do I Get Back In Taxes

Update: Our Offices Are Now Open To The Public By Appointment Only

To better serve our community, our offices are open to the public with certain limitations due to COVID-19. Our main priority continues to be the safety and well-being of the public.

The Downtown Miami and the South Dade Government Center will be open to the public . You may schedule a visit online today. Our regular business hours are 8:00 a.m. to 5:00 p.m. Monday through Friday or you may call us at 305-375-4712, if you have any questions that do not require an in-person visit.

Which States Have No Property Tax For Seniors

Retirees Moving to These States Can Get Some Great Tax Breaks

- New Hampshire has no general income tax.

- South Carolina is friendly to veterans.

- Hawaii has low property taxes.

- South Dakota has no state income tax.

- Nevada doesnt have a state income tax.

- Alabama retirees dont have to pay property tax.

Read Also: Is Ein Same As Sales Tax Number

What Can You Do If You Disagree With The Assessed Value Of Your Home Or Your Denial Of The Homestead Exemption Or Other Special Classifications

Each county has a Value Adjustment Board that handles appeals of assessed values and other property tax issues . The typical process is to send a written complaint and then attend a hearing.

Contact your local Value Adjustment Board for their procedures. If your Value Adjustment Board doesnt have a website or you cant find their information, contact the Clerk of Court for your county.

When Will I Know The Amount Of My Tax Bill

Each August, the property appraiser sends a Truth in Millage notice to all property owners as required by law. This notice is very important look for it in the mail! Youll recognize it by prominent lettering, DO NOT PAY This is not a bill. The TRIM notice tells you the taxable value of your property. Taxable value is the just value less any exemptions. The TRIM notice also gives you information on proposed millage rates and taxes as estimated by your community taxing authorities. It also tells you when and where these authorities will hold public meetings to discuss tentative budgets to set your millage tax rates. The Jefferson County Tax Collector will send each taxpayer a bill on November 1 of each year.

Also Check: How Can I Pay Taxes I Owe

Where Can You Find Your Property Tax Bill

The tax collector typically mails your property tax bill to the property address unless you provided another mailing address. Most tax collectors make property tax bills and payment histories publicly available online.

You should also get a TRIM Notice in August. A TRIM Notice isnt your bill, but it contains your estimated property taxes and other legal inforrmation.

Taxes In Florida Explained

For decades, Florida has had one of the lowest tax burdens in the country, according to the independent research organization Tax Foundation. For 2013, Florida will place the fifth-lowest tax burden on its residents and businesses. But not all taxes are created equal, and the state collects in a variety of ways that residents need to be aware of.

Read Also: What Is The Income Tax Rate In New York

How Does Property Tax Work

The amount owners owe in property tax is determined by multiplying the property tax rate by the current market value of the lands in question. Most taxing authorities will recalculate the tax rate annually. Almost all property taxes are levied on real property, which is legally defined and classified by the state apparatus. Real property includes the land, structures, or other fixed buildings.

Ultimately, property owners are subject to the rates determined by the municipal government. A municipality will hire a tax assessor who assesses the local property. In some areas, the tax assessor may be an elected official. The assessor will assign property taxes to owners based on current fair market values. This value becomes the assessed value for the home.

The payment schedule of property taxes varies by locality. In almost all local property tax codes, there are mechanisms by which the owner can discuss their tax rate with the assessor or formally contest the rate. When property taxes are left unpaid, the taxing authority may assign a lien against the property. Buyers should always complete a full review of outstanding liens before purchasing any property.

Recommended Reading: Do You Have To Pay Taxes On Plasma Donations

Other Potential Property Tax Benefits

Florida has general property tax benefits for the blind, people with physical disabilities, and the elderly. Some are based on income, while others are available regardless of income.

These benefits frequently stack on top of benefits for veterans and can provide an even greater discount on homestead property taxes.

Don’t Miss: Can You File Taxes If You Get Unemployment

Do Seniors Get A Property Tax Break In Florida

Florida offers the following property tax exemptions for senior citizens over the age of 65:

| Exemption | |

| $500 exemptions are available to blind Florida residents | |

|

Total and permanent disability exemption |

Quadriplegics or people confined to a wheelchair may qualify for a total exemption on their property taxes |

|

Veterans exemption |

Exemptions are available for veterans with varying degrees of disability and can fall between a $5,000 reduction in assessed property value and total exemption from property tax liability |

More information on Floridas property tax exemptions can be found here.

Tax Saving Tip #: If Something Is Wrong Get It Fixed

If you are a true do-it-your-selfer, then click HERE to go to a separate article on how to navigate through the process. It starts by getting a Homestead Check which will tell you in detail what you need to do. Itll even give you easy-to-understand videos for every step of the process. However. We will warn you. It is like baking a cake. You MUST follow the directions or your cake will not be very good. You CANNOT solve this issue by calling up the property appraiser and just complaining and telling them that you want an adjustment. Theyll be rid of you in no time, and youll end up paying the extra taxes. If you would like for Florida Homestead Check to help you, just click here to get a Homestead Check, which will first verify that you really do have a problem, and then will connect you with our support team to help you. A full analysis, report, and consultation is included in the price.

Also Check: How To Get Stimulus Check Without Filing Taxes

Meeting Requirements For Property Tax Breaks

There are many tax breaks for property owners that most people arent aware of. You can possibly reduce your property tax burden for your Florida home if you meet one or more of the following requirements:

- Longtime residents/seniors may qualify for an exemption if they have lived in Florida for 25 years or more or are 65 years of age or older, AND who meet certain income thresholds AND have a home worth less than $250,000. Add-ons to a home that were specifically built for a parent or grandparent over the age of 62 may also be exempt from property tax

- Homestead exemptions may apply to up to $75,000 of your primary homes value. Seniors may qualify for an extra exemption for an additional $50,000 of home value. There is an additional exemption of 15% for the next $300,000 of the primary homes value. Deployed service members may also qualify for an additional homestead exemption based on the number of days deployed

- Surviving spouses of military servicemembers or first-responders who died in the line of duty or from service-related causes may qualify for another type of homestead exemption. Disabled veterans over the age of 65 whose disability was caused wholly or partly by combat may also qualify for an additional tax discount.

- Disabled civilians may qualify for a $500 exemption from Florida property taxes if they are blind, or totally or permanently disabled

More information on property tax breaks in Florida can be obtained from the Florida Department of Revenue.

A Guide To Floridas Real Estate And Property Taxes

Real Estate Taxes

Floridians, like most everyone around the world, pay taxes. Florida is one of a few states that does not have state income tax making the state a popular place to retire.

Florida does have a property tax on all properties you own, and if you are renting or selling that property, you may be required to pay federal taxes on any profit made. Short-term rentals have their own set of taxes which are normally shifted to the tenant in the lease agreement.

Property Tax in Florida

Property taxes fund public schools, libraries, medical services, infrastructure, and roads. The local property appraiser sets the assessed value to each property effective January 1st each year. Each Floridian must pay these property taxes according to state law. The only Florida properties exempt from paying property taxes are schools, churches, and government properties.

Regardless of who owns a property, the tax rates stay the same. There are a few ways to receive a property tax reduction. Permanent residents, veterans and widows/widowers are eligible for an exemption of a portion of their property tax if the property is their primary residence, not a second-home or rental.

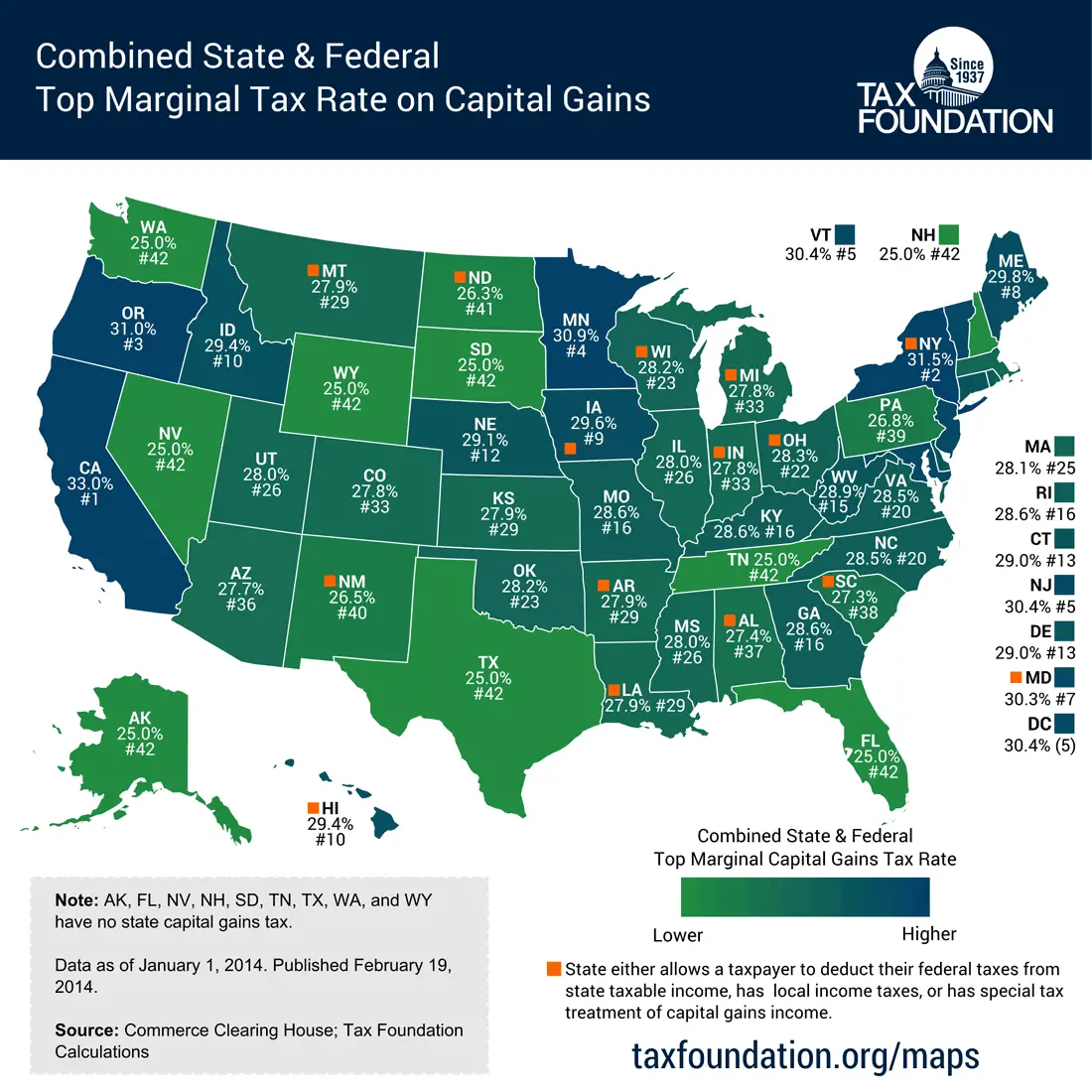

Capital Gains Tax

It is essential to work with your real estate attorney and title company if you are contemplating selling your property. Florida National can work with your attorney to help you determine if a 1031 exchange is beneficial.

Don’t Miss: Can I Claim Child Care On My Taxes

Falling For Scams Is Less Likely With Donotpay

Thanks to AI technology, DoNotPay is a great resource for protecting your privacy and finances from potential scammers. Our bots can help you report robocalls, keep your inbox clean from spam email and shady text messages, or even deal with stalking and harassment, if it comes to that.

In case the issues escalate, skip the expensive lawyers and sue the offenders in small claims court with ease.

Another great way to increase your online security is to use our virtual credit cards and sign up for any free trial without risking unwanted charges. You can even avoid sharing your contact info with our Burner Phone feature.

Tax Saving Tip #: Make Sure That Your Homes Initial Valuation Is As Low As Possible

You cannot assume AT ALL that the tax bill paid on your new home by the prior owner is at all reflective of what your taxes will be in the future! The January 1 that follows your home purchase is a magic day. On that day the County Property Appraiser will push a button on a computer and ZING out will come your propertys FIRST valuation. You get officially notified of that value by a letter that comes about the second week of August called a TRIM notice. However, you can look on your county property appraisers website starting usually in February and see working values for your property. This gives you some indication of what theyre going to come up with. Your initial valuation SHOULD be about 85% of what you paid for your property. If your Assessed Value shows more than that to a significant degree, then you should say something! You cant really say anything until you receive your TRIM notice in August because if you do, theyll just say that everything is preliminary and to wait until its official when you get your TRIM notice. Once you do, be sure and note that on the TRIM notice it shows a date by which you lose your rights to say anything! See below on Make any Necessary Adjustments to see how to officially say something and get an erroneous value fixed.

Don’t Miss: How Do Small Business Owners File Taxes

Income Tax Percentage In Florida

The above table provides you with a broad range of different Florida State income tax rate scenarios. The income tax rates in the table are based on a single taxpayer claiming one personal exemption.

The Florida income tax rates in the table reflect almost a worst-case scenario for a US taxpayer because those that are married and have dependents can typically take advantage of other deductions, which would effectively make the federal income tax you pay, less than what you see in the table.

Again, you must always consult a professional when it comes to calculating your Florida tax liability, since other factors may affect the amount of income tax you pay on your earnings in Florida. The income tax percentage in Florida is 0% as noted on the table, but you are still responsible for paying Social Security and Medicare , totaling 7.65%.

You are also responsible for paying Federal Income Tax regardless of whether you reside in Florida with its favorable 0% income tax rate. To see all the US income tax rates by state have a look at our page that includes a table with all the rates and links to specific income tax rates in each US state.

Donotpay Is Your Resource For Lodging An Appeal In Florida

There are a few other things you can do to lower your property tax bill or get help paying your property tax in Florida. Try thesetips:

- Avoid any renovations or improvement work that could increase the value of your property

- Check your property tax bill thoroughly for accuracy

- Be there when the county assessor performs the assessment

As a last resort, you can appeal your Florida property tax assessment. This can be a scary process, but DoNotPay can help you understand the appeal procedure, prepare the documents you need, and lodge your appeal.

Don’t Miss: How Do Property Taxes Work In Texas