Important 2021 Tax Documents

Organized tax records make preparing a complete and accurate tax return easier and may help taxpayers find overlooked deductions or credits.

Taxpayers should wait to file until they have all their supporting income statements including but not limited to:

- Forms W-2 from employer

- Forms 1099 from banks, issuing agencies and other payers including unemployment compensation, dividends and distributions from a pension, annuity or retirement plan

- Form 1099-K, 1099-Misc, W-2 or other income statement if they worked in the gig economy

- Form 1099-INT if they received interest payments

- Other income documents and records reporting virtual or crypto currency transactions

- Letter 6475, 2021 Economic Impact Payment, to determine eligibility to claim the Recovery Rebate Credit

Can You Staple A Tax Return Partially

If youre looking for a complete guide on assembling and mailing your tax return, you may want to visit thisarticle by The Nest. Though, if youre simply wondering if you can staple a tax return, the answer is sort of. According to the article, you can staple your W-2 and 1099 to the front of your 1040 But, be sure it doesnt staple through the rest of the documents!

Can You Staple A Guide To Stapling Dos & Don’ts

Have you ever wondered if you were supposed to staple that dollar bill, or if it was okay to attach multiple pages of your resume together? There are so many dos and donts of the real world that it can tricky to keep track of them all. But dont sweat it, weve got all the answers. Here is the unspoken list of what you can and cant staple!

You May Like: Do I File Taxes For Unemployment

Can I Go To Jail For Filing Incorrect Taxes

No, you cant be jailed for errors on your tax returns or if you file them incorrectly.

However, if you knowingly leave things that ought to be included out of your tax returns, the IRS can interpret that to be a fraudulent act and you could be sued.

In situations like this, the IRS will assess your intent to know if it was a mistake or an intentional action.

How Can I Assemble My Tax Return Like Schedued A Or C Etc

Sign your return. The IRS wont accept your return for processing unless its signed. If youre married and file a joint return, both of you must sign it. The person whose name appears first on the tax return must sign in the Your Signature box, and the spouse listed second signs in the Spouses Signature box.

Prepare your refund or payment information. If youre due a refund and want direct deposit, include your bank account information in the Refund section above the signature boxes. If you owe taxes, prepare a 1040-V form. This is a voucher form to use when you make a payment. It includes all the information the IRS needs to post your payment to your account.

Gather your tax forms and schedules for assembly. Place your 1040 form on top and other forms and schedules for your return behind the 1040 form. Use the attachment sequence numbers as your guide. Attachment sequence numbers should be followed in numerical order, starting with the lowest number. They are in the upper right hand corner of the forms.

Read Also: How To File An Oregon Tax Extension

Can You Staple Checks Depends

We now know that stapling money is a no go as it defaces the US currency, but can you staple a check? Well, that depends on what you are using the check for. If you are mailing in a check with a document, some states won’t accept paperclips and stapling the document and check together is an acceptable option. However, both staples and paperclips can slow the processing of your documents. If you need to send a check as part of a donation, payment, or non-IRS documents, confirm with the recipient if can be stapled. But paperclips or enclosing the check and documents within envelopes is usually best way to go!

Can I Refile My Taxes If I Forgot To Add Something

Yes, you can refile your tax return if you forgot to add a piece of information. To get this done, youll need to file an amended tax return with Form 1040-X.

You can find Form 1040X on the Internal Revenue Service official website or you visit the nearest IRS local office.

Furthermore, if you dont know how to file an amended tax return, hire a professional tax preparer to get it done for you.

Also Check: Is Medicare Supplemental Insurance Tax Deductible

Schedules And Extra Forms

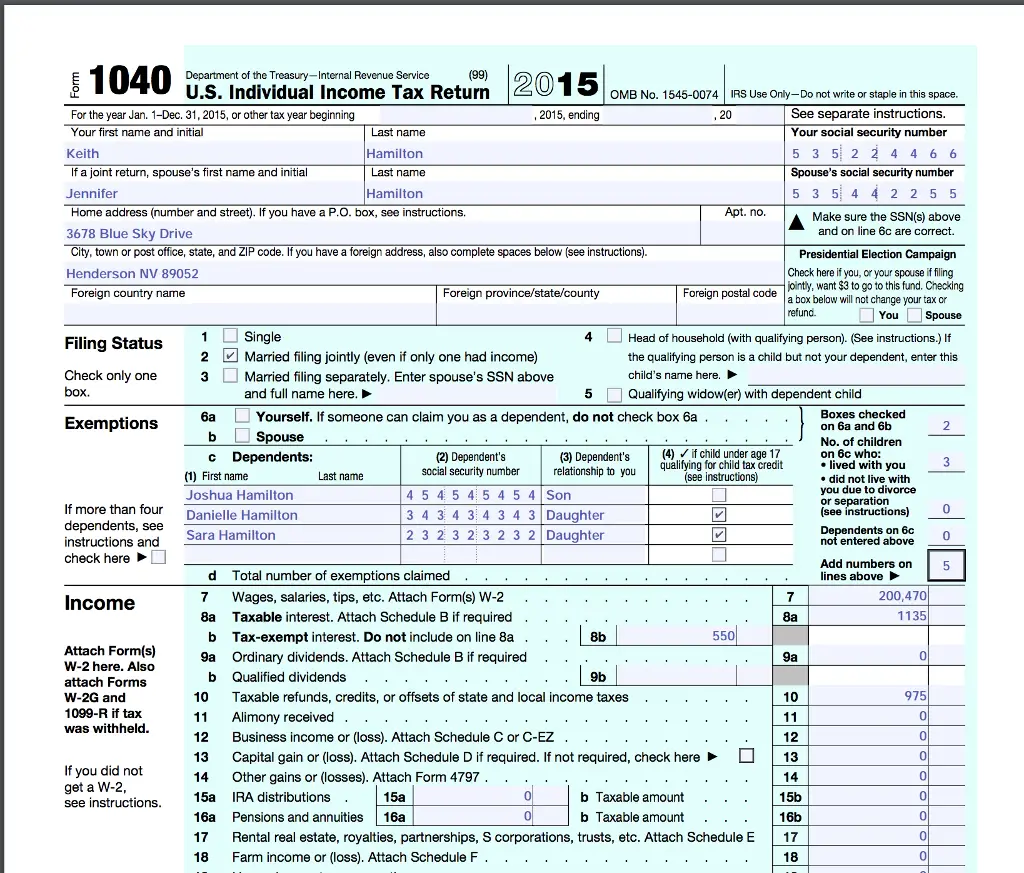

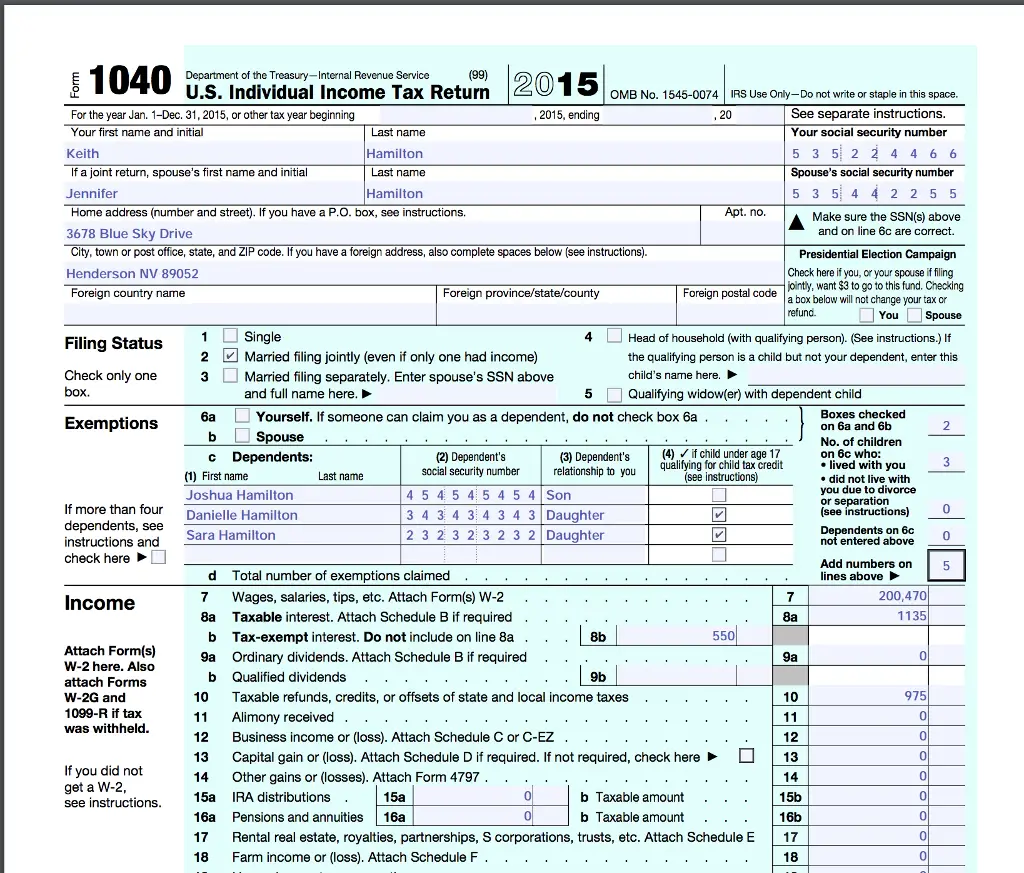

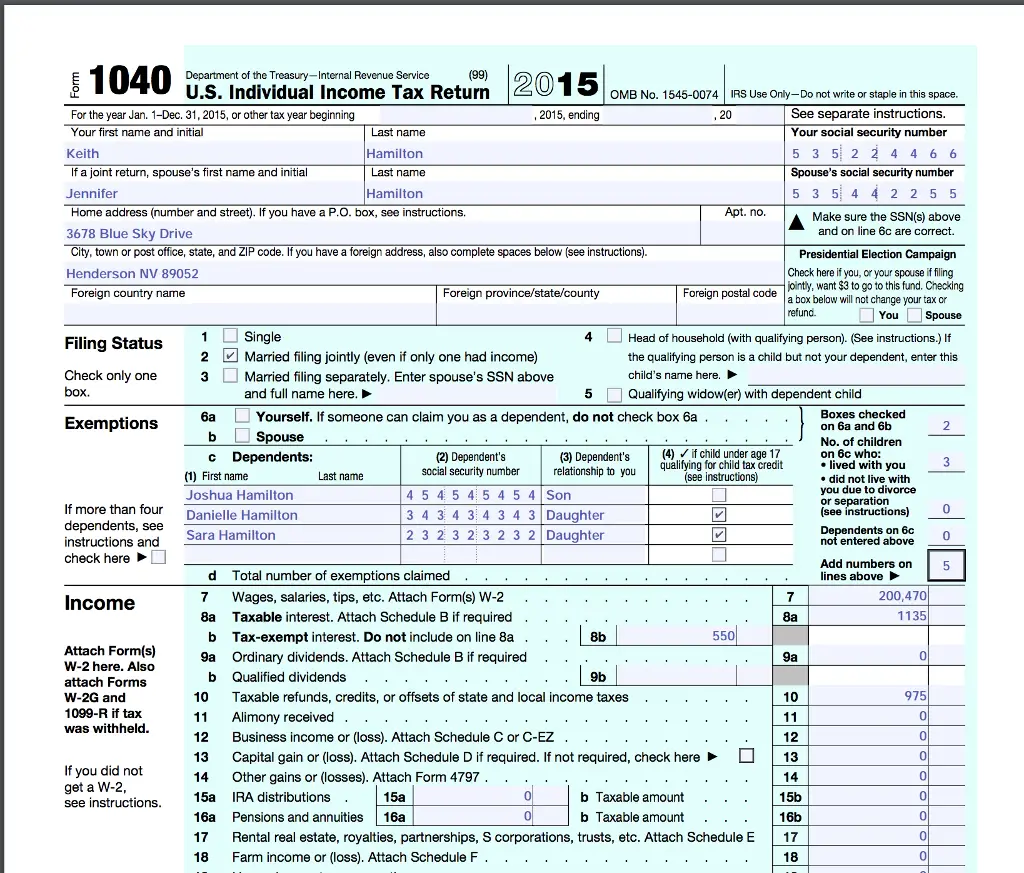

Since 1961 Form 1040 has had various separate attachments to the form. These attachments are usually called “schedules” because prior to the 1961, the related sections were schedules on the main form identified by letter. Form 1040 currently has 20 attachments, which may need to be filed depending on the taxpayer. For 2009 and 2010 there was an additional form, Schedule M, due to the “Making Work Pay” provision of the American Recovery and Reinvestment Act of 2009 .

Starting in 2018, 1040 was “simplified” by separating out 6 new schedules numbers Schedule 1 through Schedule 6 to make parts of the main form optional. The new schedules had the prior old 1040 line numbers to make transition easier.

In addition to the listed schedules, there are dozens of other forms that may be required when filing a personal income tax return. Typically these will provide additional details for deductions taken or income earned that are listed either on form 1040 or its subsequent schedules.

| Type |

|---|

In 2014 there were two additions to Form 1040 due to the implementation of the Affordable Care Actâthe premium tax credit and the individual mandate.

What Does The Irs Do With All The Paperclips People Send Them

On forms like the W-2, the IRS explicitly tells you to avoid using staples to attach documents or checks The 1040, meanwhile, requests that you attach documents and other miscellaneous sheets of paper, but cordons off areas where staples are not allowed.

Missing in the IRSâs language of rules and regulations is the word âpaperclip,â meaning one can assume these mini metal tools are fair game. If even just a small fraction of taxpayers follow this train of thought, then the IRS becomes the proud owner of a huge batch of new paperclips each year. So, what do they do with the influx of office supplies?

The agency doesn’t keep track of exactly how many paperclips are sent in with people’s forms, but they try to make sure they don’t go to waste. âWhen we receive paperclips attached to paper returns, we simply re-use them,â says an IRS representative. âThereâs no need for paperclips if taxpayers E-File, which the majority of people do,â he adds, meaning the stream of free paperclips is quickly coming to an end.

The IRSâs filing statistics state that of the around 149,684,000 individual income tax returns they received in 2014, 125,821,000 were e-filed, a three percent increase from 2013. At this rate, the days of free paperclips for the IRS are numbered.

Recommended Reading: What Do I Make After Taxes

Don’t File Before Ready

While taxpayers should not file late, they also should not file prematurely. People who file before they receive all the proper tax reporting documents risk making a mistake that may lead to processing delays.

Typically, year-end forms start arriving by mail or are available online in January. Taxpayers should review them carefully. If any of the information shown is inaccurate or not available, taxpayers should contact the payer right away for a correction or to ensure they have their current mailing or email address.

New this year, the IRS sent Letter 6419, Advance Child Tax Credit Reconciliation, in January 2022 to help individuals reconcile and receive the full amount of their 2021 Child Tax Credit. This letter includes the total amount of the 2021 advance Child Tax Credit payments issued and the number of qualifying children used to calculate their advance payments. People need this important information to accurately claim the other half of the 2021 Child Tax Credit when filing their 2021 tax return and prevent delays in processing. The IRS reminds people to check this information carefully.

What Can You Do To Help Us Process Your Return More Smoothly

Steps you can take to reduce the chances that your return will be stopped for review :

- Be sure you have all W-2s, 1099s, and other withholding information before filing your return. Dont rely on year-end pay stub information it may not match what your employer reports to us.

- Include your Virginia drivers license or Virginia identification card number on your return. We wont reject returns that dont have a drivers license or ID card number, but providing the information helps us process returns more quickly.

- If you were issued a Virginia Tax personal identification number , you must provide the PIN on your return. Remember that even if you provide your PIN, our systems could stop your return for other reasons.

- Provide all necessary information on your return and attach all required documents and schedules.

- Be sure spelling of your name, Social Security number, and all calculations are correct.

- If you moved since you filed your last return, use your current address.

Recommended Reading: How Much Is Payroll Tax In Louisiana

Should You Staple Tax Pages Together When Mailing And 1099rs To Front Page Or Leave Loose

Staple all your tax pages together in the upper left corner.

If you are filing on paper by mail, staple the 1099-R to your Federal income tax returnONLY if there is an entry in Box 4 for Federal income tax withheld. Staple it to the front on your return.

For more information on assembling your return, please see the following FAQ:

Payment For A Tax Due Return

You may choose a direct debit from a checking or savings account when the return is e-filed and supported by the software. A direct debit is a tax payment electronically withdrawn from the taxpayer’s bank account through the tax software used to electronically file the individual income tax return. Submitting the electronic return with the direct debit information provided, acts as the taxpayer’s authorization to withdraw the funds from their bank account. Requesting the direct payment is voluntary and only applies to the electronic return that is being filed.

Payments can be made by using the Michigan Individual Income Tax e-Payments system.

- If you have received an assessment from the Michigan Department of Treasury’s Collection Services Bureau, use the Collections e-Service payment system.

- Payments for 2021 tax due returns can be made using this system. Prior year payments are currently not accepted electronically.

- Any payment received after April 15th will be considered late and subject to penalty and interest charges. However, you may submit late or partial payments electronically.

- Estimate penalty and interest for a tax due return.

Payment can also be made by check or money order with your return. Make checks payable to “State of Michigan,” print your complete Social Security number and appropriate tax year on the front of your check or money order.

Michigan Department of Treasury-Collection Services BureauP O Box 30199

You May Like: How To Amend My Tax Return

Gather All Your Tax Records And Documents

You may need the following:

- Copies of last years federal and state tax returns

- Personal information including:

- Social Security number

Homeowner And Renter Property Tax Credit Return

If you file a DC Schedule H to claim a property tax credit:

- Include your landlord’s name, address and telephone number and the dollar amount of your rent for the year if claiming the credit based on rent paid

- Report income earned by all those living in your household, and include their names, Social Security numbers and telephone numbers and

- Include a completed and signed physician’s certificate when claiming a credit for blindness or disability for the first time.

Do not file a DC Schedule H to claim the property tax credit if you lived in public or subsidized housing during the year.

If you have questions, feel free to call or visit our Customer Service Center for additional assistance.

Recommended Reading: How To Calculate Tax Return

Tips You Must Read Before Filing Your Taxes

The Internal Revenue Service processes paper tax returns in a specific manner, but dont worry about decoding the IRS systems. On schedules and forms you use in your return, youll notice an attachment sequence number in the upper right corner. This information helps you compile your paper return to match IRS processing requirements. After youre finished preparing your return, it takes just a few minutes to have your tax forms organized and ready for mailing.

Include All Schedules Such As Schedule Hc

If you dont include all the schedules, your return cant be processed, and your refund will be delayed.

The Schedule HC must be completed and enclosed for all resident returns and most part-year resident returns. Nonresidents are not subject to the Massachusetts Health Care Reform Law.

If you amend your return, include all the schedules filed with the original return, even if you did not make any changes to those schedules.

Read Also: Why Do I Owe Taxes If I Claim 0

Worksheet 1 Credit For Qualified Sick And Family Leave Wages Paid This Quarter Of 2022 For Leave Taken After March 31 2020 And Before April 1 2021

| Determine how you will complete this worksheet. | |

| If you paid qualified sick leave wages and/or qualified family leave wages this quarter for leave taken after March 31, 2020, and before April 1, 2021, complete Step 1 and Step 2. Caution: Use Worksheet 2 to figure the credit for qualified sick and family leave wages paid this quarter of 2022 for leave taken after March 31, 2021, and before October 1, 2021. | |

Re: Staple Or Paperclip Your Returnthe Ultimate Tax Question

You have way too much time on your hands.However, Page 66 of the IRS 1040 instructions:Assemble Your ReturnAssemble any schedules and forms be-hind Form 1040 in order of the Attachment Sequence No. shown in the upper right corner of the schedule or form. If you have supporting statements, arrange them in the same order as the schedules or forms they support and attach them last. File your return, schedules, and other attachments on standard size paper. Cutting the paper may cause problems in processing your return. Dont attach correspondence or other items unless required to do so. Attach Forms W-2 and 2439 to Form 1040. If you received a Form W-2c , attach your original Forms W-2 and any Forms W-2c. Attach Forms W-2G and 1099-R to Form 1040 if tax was with-held.The instructions do not mandate any particular method of attachment so you are free to choose paper clip or staples and place them wherever you deem appropriate.

You May Like: When Are We Getting Our Taxes

If You’re Mailing Your Return Staple Your Tax Return Properly

Staple one copy of each of your W-2 statements to the front of your tax return if you’re mailing in a paper copy. Sort them from lowest to highest by using the attachment sequence number if you must file other schedules and statements with your return. You can find this number in the upper right corner of the form.

Mail everything to the correct IRS service center when it’s stapled together. The service center will depend on a variety of factors, such as your state of residence and whether you’re also submitting a payment. The IRS provides a list of its mailing addresses on its website.

Of course, you can skip these details if you file online. The IRS provides a list of e-filing options you can use.

Where To File Your Return

Taxpayers using eFile will have their returns processed electronically once they are submitted.

For taxpayers filing using paper forms:

- If you expect a refund, be sure to mail your return to the North Carolina Department of Revenue, PO Box R, Raleigh, NC 27634-0001.

- If you owe taxes, mail your return and payment to the North Carolina Department of Revenue , PO Box 25000, Raleigh, NC 27640-0640. Make your check or money order payable to the NC Department of Revenue. Important: The Department will not accept a check, money order, or cashier’s check unless it is drawn on a U.S. bank and the funds are payable in U.S. dollars.

Don’t Miss: Has Anyone Received Tax Refund 2021

Individuals Not Required To File Must File A Tax Return To Claim Important Tax Credits

The IRS strongly encourages individuals who are not required to file a tax return to file one this season to claim potentially thousands of dollars in tax credits. By filing a tax return, individuals could claim:

- The Recovery Rebate Credit to receive any remaining 2021 stimulus payments that they might not have received

- The remaining Child Tax Credit for which they are eligible, including any monthly payments that they might not have received and

- The Earned Income Tax Credit, the federal government’s largest refundable tax credit for low- to moderate-income families .