Plan For Major Life Events

The next step is to plan for major life events. If you plan to purchase a home, you may have a number of tax deductions available.

Are you planning to start a new business? The way you file taxes will be totally different. Youll file Form 1040, but youll also file a Schedule C form with all of your business deductions.

You may be responsible for self-employment taxes, as well. There are a number of factors that go into that, such as your business structure and your income.

How To Figure Out Your Tax Bracket

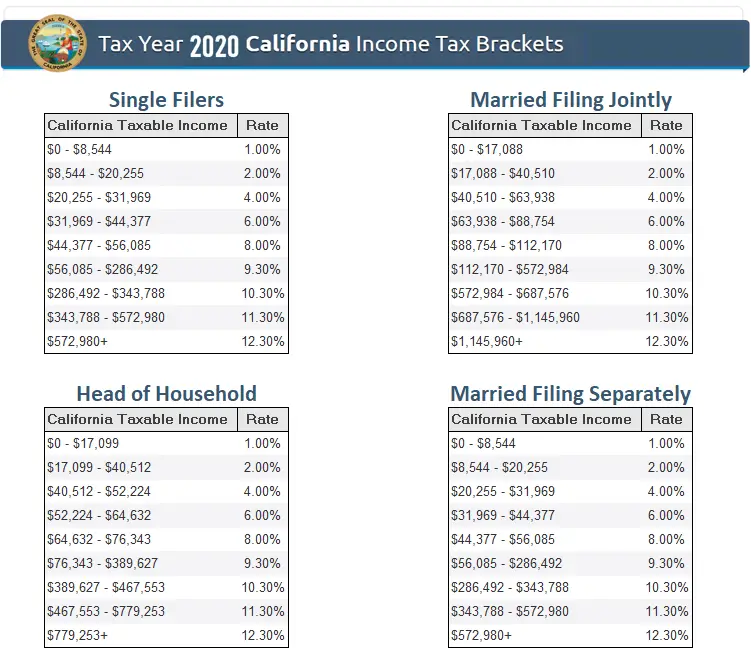

You can calculate the tax bracket you fall into by dividing your income that will be taxed into each applicable bracket. Each bracket has its own tax rate. The bracket you are in also depends on your filing status: if youre a single filer, married filing jointly, married filing separately or head of household.

The tax bracket your top dollar falls into is your marginal tax bracket. This tax bracket represents the highest tax ratewhich applies to the top portion of your income.

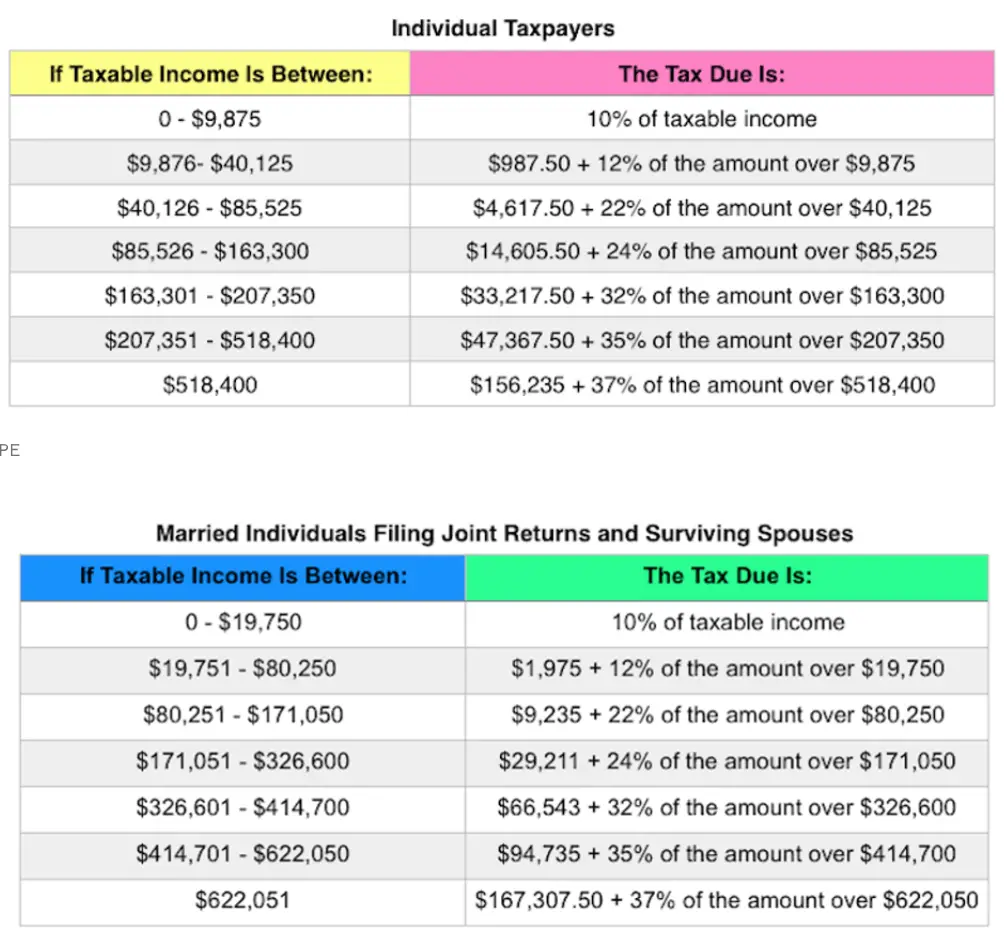

If you are single and your taxable income is $75,000 in 2022, your marginal tax bracket is 22%. However, some of your income will be taxed at the lower tax brackets, 10% and 12%. As your income moves up the ladder, your taxes will increase:

- The first $10,275 is taxed at 10%: $1,027.50.

- The next $31,500 is taxed at 12%: $3,780.

- The last $33,225 is taxed at 22% $7,309.50

- The total tax amount for your $75,000 income is the sum of $1,027.50 + $3,780 + $7,309.50 = $12,117 .

For Married Individuals Filing Jointly:

- 10%: Taxable income up to $19,750

- 12%: Income between $19,750 to $80,250

- 22%: Income between $80,250 to $171,050

- 24%: Income between $171,050 to $326,600

- 32%: Income between $326,600 to $414,700

- 35%: Income between $414,700 to $622,050

- 37%: Income over $622,050

- 12%: Income between $9,875 to $40,125

- 22%: Income between $40,125 to $85,525

- 24%: Income between$85,525 to $163,300

- 32% Income between $163,300 to $207,350

- 35%: Income between $207,350 to $518,400

- 37%: Income over $518,400

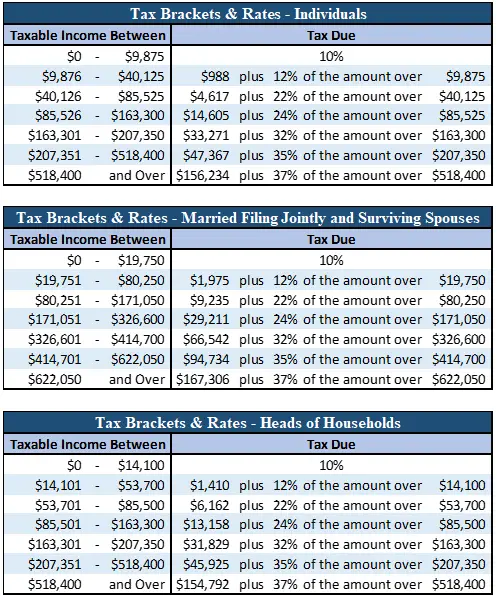

- 12%: Income between $14,100 to $53,700

- 22%: Income between $53,700 to $85,500

- 24%: Income between $85,500 to $163,300

- 32%: Income between $163,300 to $207,350

- 35%: Income between $207,350 to $518,400

- 37%: Income over $518,400

Recommended Reading: How Much Is Sales Tax In Arkansas

Notable Individual Income Tax Changes In 2020

Several states changed key features of their individual income tax codes going into tax year 2020. In addition, some states adopted legislation in 2019 that changed various individual income tax provisions and made those changes retroactive to the beginning of tax year 2019. Notable changes include the following:

Update: This table was updated on February 12, 2020 and July 16, 2020 to reflect the most recent data available for Maine, Maryland, Nebraska, and Oregon.

History Of Federal Tax Brackets

Tax brackets have existed in the U.S. tax code since the inception of the very first income tax, when the Union government passed the Revenue Act of 1861 to help fund its war against the Confederacy. A second revenue act in 1862 established the first two tax brackets: 3% for annual incomes from $600 to $10,000, and 5% on incomes above $10,000. The original four filing statuses were single, married filing jointly, married filing separately, and head of household, though rates were the same regardless of tax status.

In 1872, Congress rescinded the income tax. It didnt reappear until the 16th Amendment to the U.S. Constitutionwhich established Congress right to levy a federal income taxwas ratified in 1913. That same year, Congress enacted a 1% income tax for individuals earning more than $3,000 a year and couples earning more than $4,000, with a graduated surtax of 1% to 7% on incomes from $20,000 and up.

Over the years, the number of tax brackets has fluctuated. When the federal income tax began in 1913, there were seven tax brackets. In 1918, the number mushroomed to 56 brackets, ranging from 6% to 77%. In 1944, the top rate hit 91%. But it was brought back down to 70% in 1964 by then-President Lyndon B. Johnson. In 1981, then-President Ronald Reagan initially brought the top rate down to 50%.

Also Check: How To File Trust Income Tax Return

Capital Gains Tax Rates

It’s important to note that the tax rates on capital gains from the sale of stocks, bonds, cryptocurrency, real estate, and other capital assets aren’t necessarily the same as the tax rates mentioned above for wages, interest, retirement account withdrawals, and other “ordinary” income. When determining the tax on capital gains, the rates that apply generally depend on how long you held the capital asset before selling it.

If you hold a capital asset for one year or less, any gain from the sale is considered short-term capital gain and taxed using the rates for ordinary income listed above. However, if you hold the asset for more than one year, the gain is treated as long-term capital gain and taxed a lower rate either 0%, 15%, or 20%. As with the ordinary tax rates and brackets, which specific long-term capital gains tax rate applies depends on your taxable income. However, the long-term capital gain brackets are set up so that you’ll generally pay tax at a lower rate than if the ordinary tax rates and brackets were applied.

For more on the taxation of capital gains, see Capital Gains Tax 101: Basic Rules Investors and Others Need to Know.

What Are The Major Tax Changes For 2020

Top 9 Tax Law Changes for Your 2020 TaxesThe standard deduction increased for inflation.Changes to retirement savings rules and limits.Mortgage insurance premiums are still deductible.Changes to educational tax breaks.Energy-related tax credits are still available.Higher income limits for the pass-through deduction.More items

You May Like: Is Turbo Tax Audit Defense Worth It

Types Of Federal Tax Brackets

There are four complete sets of tax brackets for different filing types, each with different bracket widths. These bracket types allow taxpayers filing as Married Filing Jointly or Head of Household to pay less in taxes by widening each tax bracket’s width.

Some individuals may have to follow a special tax structure not listed here, such as the Alternative Minimum Tax for certain high-income taxpayers.

S To Take If You’re In Your 40s With No Retirement Savings

Commissions, trailing commissions, management fees, brokerage fees and expenses may be associated with investments in mutual funds and ETFs. Please read the mutual fundâs or ETFâs prospectus, which contains detailed investment information, before investing. Mutual funds and ETFs are not guaranteed. Their values change frequently, and investors may experience a gain or a loss. Past performance may not be repeated.

The statements contained herein are based on information believed to be reliable and are provided for information purposes only. Where such information is based in whole or in part on information provided by third parties, we cannot guarantee that it is accurate, complete or current at all times. It does not provide investment, tax or legal advice, and is not an offer or solicitation to buy. Graphs and charts are used for illustrative purposes only and do not reflect future values or returns on investment of any fund or portfolio. Particular investment strategies should be evaluated according to an investorâs investment objectives and tolerance for risk. Fidelity Investments Canada ULC and its affiliates and related entities are not liable for any errors or omissions in the information or for any loss or damage suffered.

This information is for general knowledge only and should not be interpreted as tax advice or recommendations. Every individualâs situation is unique and should be reviewed by his or her own personal legal and tax consultants.

Recommended Reading: Are Gifts To 529 Plans Tax Deductible

Filing An Amended Return

If you file your income tax return and later become aware of any changes you must make to income, deductions, or credits, you must file an amended Louisiana return. To file a paper amended return:

- Mail an amended return that includes a payment to the following address: Louisiana Department of Revenue

How The Tax Brackets Work

Suppose you’re single and end up with $100,000 of taxable income in 2022. Since $100,000 is in the 24% bracket for singles, will your 2022 tax bill simply a flat 24% of $100,000 or $24,000? No! Your tax is actually less than that amount. That’s because, using marginal tax rates, only a portion of your income is taxed at the 24% rate. The rest of it is taxed at the 10%, 12%, and 22% rates.

Here’s how it works. Again, assuming you’re single with $100,000 taxable income in 2022, the first $10,275 of your income is taxed at the 10% rate for $1,028 of tax. The next $31,500 of income is taxed at the 12% rate for an additional $3,780 of tax. After that, the next $47,300 of your income is taxed at the 22% rate for $10,406 of tax. That leaves only $10,925 of your taxable income that is taxed at the 24% rate, which comes to an additional $2,622 of tax. When you add it all up, your total 2022 tax is only $17,836.

Now, suppose you’re a millionaire. If you’re single, only your 2022 income over $539,900 is taxed at the top rate . The rest is taxed at lower rates as described above. So, for example, the tax on $1 million for a single person in 2022 is $332,955. That’s a lot of money, but it’s still $37,045 less than if the 37% rate were applied as a flat rate on the entire $1 million .

Don’t Miss: How Much Do Tax Free Municipal Bonds Pay

Why Are My Taxes Lower In 2020

Many of taxpayers filing their 2020 returns are wondering the same thing. So, if your tax refund is less than expected in 2021, it could be due to a few reasons:You didnt withhold your unemployment income: The unemployment rate skyrocketed in the U.S. with millions of Americans filing for unemployment benefits.

What Salary Puts You In A Higher Tax Bracket

If your taxable income for 2020 is $50,000 as a single filer, that puts you in the 22% tax bracket, because you earn more than $40,125 but less than $85,525. This is known as your marginal tax rate. Marginal tax rate is the tax rate you pay on your last dollar of income in other words the highest rate you pay.

Read Also: Is Life Insurance Tax Deductible

How To Find Your Own Tax Bracket

There are numerous online sources to find your specific federal income tax bracket. The IRS makes available a variety of information, including annual tax tables that provide highly detailed tax filing statuses in increments of $50 of taxable income up to $100,000.

Other websites provide tax bracket calculators that do the math for you, as long as you know your filing status and taxable income. Your tax bracket can shift from year to year, depending on inflation adjustments and changes in your income and status, so its worth checking on an annual basis.

Tax Rates Vs Tax Brackets

Tax brackets and tax rates are both used to calculate the total taxes owed. However, while they appear to be similar, they are, in fact, distinctly different from each other.

A tax rate is a percentage at which income is taxed, while each tax bracket is a range of income with a different tax rate, such as 10%, 12%, or 22%, referred to as the marginal rate. Most taxpayersall except those who fall squarely into the minimum brackethave income that is taxed progressively, meaning that their income is subject to multiple rates beyond the nominal rate of their tax bracket.

A taxpayers tax bracket does not necessarily reflect the percentage of their income that they will pay in taxes. The term for this is the effective tax rate.

Tax brackets are adjusted each year for inflation, using the Consumer Price Index .

You May Like: How Does Getting Married Affect Taxes

What Are The Trust Tax Rates For 2020

Below are the 2020 tax brackets for trusts that pay their own taxes:

- $0 to $2,600 in income: 10% of taxable income.

- $2,601 to $9,450 in income: $260 plus 24% of the amount over $2,600.

- $9,450 to $12,950 in income: $1,904 plus 35% of the amount over $9,450.

- Over $12,950 in income: $3,129 plus 37% of the amount over $12,950.

Are Tax Laws Changing For 2021

The income taxes assessed in 2021 are no different. Income tax brackets, eligibility for certain tax deductions and credits, and the standard deduction will all adjust to reflect inflation. For most married couples filing jointly their standard deduction will rise to $25,100, up $300 from the prior year.

Recommended Reading: How Can I Pay My Taxes

Recent Changes To The Federal Income Tax

In December 2017, congress passed a sweeping federal income tax overhaul that affects personal income tax rates from tax year 2018 onward. While this overhaul lowered rates, it also eliminated many popular tax breaks such as the Personal Exemption. New tax breaks for business owners, such as the Qualified Business Income Deduction were also introduced.

In tax year 2013, a new 39.6% tax bracket was added, currently applicable to income over $578,125.00 for single taxpayers. For tax years 2012 and earlier, the highest tax bracket was 35%. The new tax bracket was introduced by the American Taxpayer Relief Act of 2012, which among other things also prevented the expiration of the lowest 10% tax bracket, as well as the 25% – 33% brackets, which were set to expire that year.

What Are Tax Brackets

Tax brackets were created by the IRS to determine how much money you need to pay the tax agency each year.

The amount you pay in taxes depends on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above.

Also Check: When I Get My State Tax Refund

The Most Significant Changes To Tax Law In 2020

Youre probably just getting started to organize your 2019 tax return. That makes it the perfect time to start planning for 2020.

There are a number of changes to the tax law in 2020 and the sooner you can plan for them, the less youll owe in taxes.

Tax planning isnt something that you wait to do until its time to file your tax return. Its something that you do all year long. What are the major tax law changes that you need to know for 2020?

Read on to find out.

Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

You May Like: When Do You Have To Have Your Taxes Done By