How To Protect Yourself From Charity Scams

-

Check out the charity with your state consumer protection office or the Better Business Bureau.

-

Verify the name. Fake charities often choose names that are close to well established charities.

-

Use the IRSs database of 5013 organizations to find out if an organization is a registered nonprofit organization.

Dont

-

Dont give in to high pressure tactics such as urging you to donate immediately.

-

Dont send cash. Pay with a check or credit card.

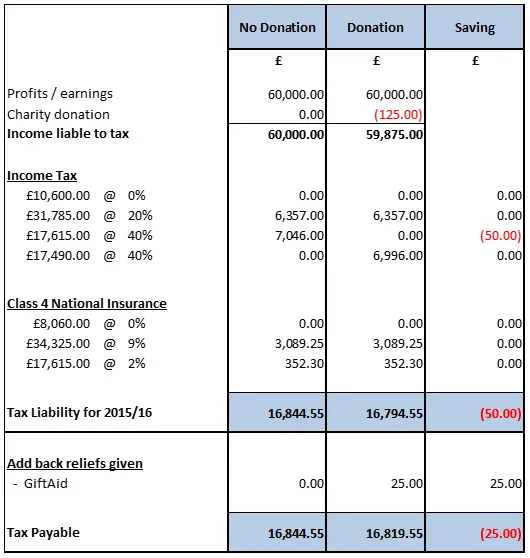

Tax Credit For Donations

You can also receive tax credit for charitable contributions other than cash. This includes assets and property that you donate to qualifying charities. For example, if you donate clothes, furniture, books, or other items to a nonprofit thrift store such as Goodwill or the Salvation Army, you can deduct the fair market value of those items from your tax bill.

For donating food items, the IRS says, there is a special rule allowing enhanced deductions by businesses for contributions of food inventory for the care of the ill, needy or infants. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage of the taxpayers aggregate net income or taxable income.

Whether youre donating money, property, or other assets, here are some basic tips that will help you be prepared to reap those benefits during tax season:

- Request a receipt if you donate $250 or more to a single charity. If the donation is in cash, youll need a receipt or supporting bank records, regardless of amount.

- Get an independent appraisal for gifts of property in excess of $5,000 .

- You wont need an appraisal for exchange-traded stocks, bonds, or mutual funds.Subtract the value of any benefits you received for your charitable contribution before you deduct it.

Donate Now To Boost Your Tax Return

If youd like to donate to charity and boost your tax return, the Sisters of Charity Foundation could really use your support.

Your donations funded a community kitchen for disadvantaged families in Campsie, meaning those experiencing poverty and homelessness had access to a free kitchen facility, cooking equipment and fresh ingredients to prepare healthy meals for their families.

Your donation, of any amount over $2, will be tax deductible if you donate before 30 June. Youll help us fund:

- Innovative approachesto assist the socially marginalised as part of our Community Grants program

- Life-changing tertiary scholarships for students who have lived in out-of-home care

Whether youre donating individually or on behalf of a business, please make your tax deductible donation now.

Please note, this article contains general information only. You should obtain specific, independent professional advice in relation to your particular circumstances.

Sign up to our quarterly newsletter

Don’t Miss: How Much Is Ny State Tax

Why You Cant Claim Galas And Other Types Of Charity Support On Your Return

Why isnt every charitable donation tax deductible, including that party you attended to support a local hospital or those chocolate bars you bought to support an after-school program? If any sort of advantage is received as part of a donationsay, a meal for a charitable fundraiserthe value of that advantage will generally reduce the amount reflected on a donation receipt.

Reducing Inheritance Tax Through Charitable Donations

Inheritance Tax is a tax on a recently deceased persons estate if it is valued over £325,000.

Effective IHT planning can help reduce the level of tax you pay, and charitable donations are one such way.

While leaving a certain amount of money to your descendants can see a proportion of this money subject to tax, any money you donate to a charity is not.

Plus, when you donate 10 per cent of your estate to charity, the IHT on your taxable estate drops from 40 per cent to 36 per cent, meaning that leaving a portion of your estate to charity can be better for your descendants too.

You May Like: When Should You File Your Taxes

Most Charitable Organisations But Not All Are Eligible For A Charitable Donation Deduction

This is one of the major tax benefits of donating to charity. Contributions can only be deducted if they are made to or for the benefit of an eligible recipient. Gifts to several other types of organisations are not eligible for a charitable contribution deduction even if they are tax-exempt. All the rated charities qualify for charitable status, and your gifts to these organisations are tax-deductible.

Topic No 506 Charitable Contributions

Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A , Itemized Deductions. However, for 2021, individuals who do not itemize their deductions may deduct up to $300 from gross income for their qualified cash charitable contributions to public charities, private operating foundations, and federal, state, and local governments.

Gifts to individuals are not deductible. Only qualified organizations are eligible to receive tax deductible contributions.

To determine if the organization that you contributed to qualifies as a charitable organization for income tax deduction purposes, refer to our Tax Exempt Organization Search tool. For more information, see Publication 526, Charitable Contributions and Can I Deduct My Charitable Contributions?

If you receive a benefit in exchange for the contribution such as merchandise, goods or services, including admission to a charity ball, banquet, theatrical performance, or sporting event, you can only deduct the amount that exceeds the fair market value of the benefit received or expected to be received.

For contributions of cash, check, or other monetary gift , you must maintain a record of the contribution: a bank record or a written communication from the qualified organization containing the name of the organization, the amount, and the date of the contribution.

Don’t Miss: Can You E File Arkansas State Taxes

For Most Americans The Standard Deduction Is A Better Option

So, what’s the catch? Why don’t people take advantage of this? The big reason is the standard deduction.

To make tax filing more efficient, the IRS offers all citizens a deal: you can just take a standard deduction rather than making a big list of all of your deductions. You simply choose the highest option for you — either the standard deduction or the total of all the things you can actually deduct, like charity and mortgage interest. The real challenge in figuring out whether to itemize is simply finding evidence for all of your deductible expenses.

For a single person, that standard deduction is currently $12,550. That means that if you don’t have any mortgage interest and haven’t made a single charitable donation this year, you still get $12,550 chopped off your gross income before taxes are calculated. For married couples, that means $25,100 in deductions, and that’s more than most people can find in their expenses.

In order for charitable giving to reduce your tax bill, you need to have deductions that add up to more than the standard deduction. As a result, only around 15% of Americans actually itemize their deductions the rest just take the standard deduction.

How Can I Get A List Of My Charitable Donations

Each charitable institution will send you a tax receipt prior to the income tax due date of your total donations for the tax year. Keep in mind that CRA might request a proof of the donations since charitable donations are on the top of the list for post-assessments. You will be required to provide a tax receipt. CRA will not accept a copy of your original bill of payment.

If you contribute to donations through your employer or pension, you will need to check your income tax slips T4, T4A, T3, T5013 slips, or on partnership financial statements.

Don’t Miss: How To Cash Out Bitcoins Without Paying Taxes

Get More Bang For Your Buck

Reduce your expenses

We pay all closing and recording fees. Plus youll save on future property tax and maintainence fees.

Save on taxes

Youll get a tax deduction for the appraised value of your donation. Plus, avoid capital gains tax.

Make a difference

Your donation will go towards helping kids succeed in school, life & beyond.

Tax Deductible Donation Considerations

Note that your donations will only qualify for a tax deduction if you contribute to an organization that meets the tax-exempt status criteria outlined in section 501 of the Internal Revenue Code. Also, be sure to document your charitable contributions by keeping records related to the transactions, such as receipts, bank statements and canceled checks.

If you volunteer at a nonprofit, you can deduct any expenses directly related to your activities.

You May Like: Is Turbo Tax Audit Defense Worth It

Join Hundreds Of Satisfied Donors

- Donating relieved us of maintaining a property hundreds of miles from our home. We’re delighted that the proceeds will be used for children. Thank you for all your hard work!”Bobby & Elizabeth Y.Fayettville, North Carolina

- My parents spent their whole lives trying to help other and I felt this was something I could do in their honor. They responded quickly and the process was extremely easy.”Shary E.Bokoshe, Oklahoma

- I was unable to sell the property, which I inherited 6 years ago. I grew tired of paying taxes and up keep on the property. Donated it to Kars4Kids, so they could make use of it.”

A Health System Severely Weakened By Seven Years Of Conflict

Ukraine’s health system, including emergency medical services which were already weak has been severely challenged by the dual crises of conflict and the COVID-19 pandemic. Despite efforts by the government and other partners, awareness among medical professionals remains low. Due to pervasive vaccine hesitancy, Ukraine has one of the lowest COVID-19 vaccination rates in Eastern Europe despite a surplus of vaccine supplies. And while routine immunization rates among children have improved in recent years, coverage is poor, heightening risks of another measles outbreak.

UNICEF teams are working to fill these gaps and deliver emergency support to the most vulnerable, working through four field offices two of them in the government-controlled areas and two in non-government-controlled areas, which are separated by a ‘contact line’. In 2021, UNICEF programs reached 800,000 people, including 128,000 children directly impacted by the crises.

The priority is to accelerate this impact in communities where needs are greatest, on both sides of the contact line.

Don’t Miss: How To Claim Refinance On Taxes

Qualified Charitable Distributions Are Easier Than You Think

What is a Qualified Charitable Distribution ? It’s actually my favorite way to donate money to charity. Unfortunately, I can’t do it because I’m too young you have to be 70 1/2 to do it. This is when, instead of taking a Required Minimum Distribution from your IRA or 401, you instead have the IRA provider send all or part of the distribution to your favorite charity. This fulfills the RMD requirement and makes it so you don’t have to pay taxes on the RMD . A QCD essentially allows a retiree to take the standard deduction and still get a deduction for the charitable contribution. I predict they will become more and more popular as people realize the effects of the new higher standard deduction on the value of itemizing.

Giving enriches both the giver and the receiver

I helped my parents do this in 2018 and 2019, and I couldn’t believe how easy it was. At Vanguard, you simply go into the RMD screen, choose sell the fund, choose send me a check, type in the name of the charity, and hit enter. Then Vanguard sends you the check and you can forward it to the charity. Be sure the check is in the charity’s name, not yours. The only way Vanguard could make this easier would be to send the check directly to the charity.

Cash Donations Of $250 Or More

You can claim these if the organization gives you a written acknowledgement of the donation. The acknowledgement must include all of these:

- Amount of cash contributed

- Statement showing if the organization gave you goods or services for your donation. This doesnt include token items or membership.

- Description and good faith estimate of the value of goods and services you received

You must receive this acknowledgement by the earlier of the:

- Date you file your return for the year you made the donation

- Due date, including extensions, for filing your return

Read Also: When Does The Irs Start Accepting 2020 Tax Returns

Understanding Capital Gains Taxes On Stock

Like most investments, taxes are only due on stock when you sell your investment. At that point, the IRS looks at your overall gain in the investment, net of all investment fees. Taxes on the sale are called capital gains taxes, and are assessed based on the length of time that you held the investment before selling.

Assessing the length of time is fairly simple: if you hold your stock for less than 365 days, any gain on that investment is considered short term, and taxed at federal ordinary income tax rates. If you hold your stock for more than a year, then your investment gains qualify as long term, which in general offers lower tax rates.

The higher the gain, the more capital gains taxes that are owed, and if youve held your stock for less than one year, those taxes can be formidable. Fortunately, there is a reliable way to avoid capital gains taxes: charitable donations.

Also Check: Home Ownership Tax Benefit Calculator

Security Precautions To Take

While your business might have other peoples needs at heart, online scammers try to take advantage of peoples generosity.

Adrien Gendre, North American CEO at Vade Secure, believes businesses or individuals that donate to charity via gift card are at risk of being scammed. He said a scam thats on the rise is people or businesses being asked to purchase gift cards from nearby stores and provide the codes to scammers posing as charities. He says to avoid donations like this where almost nothing can be tracked.

Additionally, Gendre says to look out for well-designed email and website scams. If you receive an email soliciting donations that appears to be from a legitimate source, double-check the senders email address and accompanying website to ensure youre not being duped by a minor change to the web address.

Go on Google, type the brand, find the website from Google, and compare the URL, Gendre said when describing how to verify a websites legitimacy. Thats the easiest trick. Compare the two websites and URLs side by side to determine if the email sent to you is fake.

Its also important to understand the complexity of some scams. When it comes to email cons, studies suggest that scammers select days of the week to send phishing emails based on when peoples inboxes are busiest. Dont fall into a trap because youre hurried on a busy day.

Additional reporting by Andreas Rivera. Some source interviews were conducted for a previous version of this article.

Read Also: How Much Do You Have To Make To Pay Taxes

Tax Information On Donated Property

The federal tax code allows individuals and businesses to make noncash contributions to qualifying charities and to claim deductions for these contributions on their tax returns. Gifts of donated property, clothing, and other noncash items have long been an important source of revenue for many charitable organizations and a popular deduction for taxpayers.

The American Jobs Creation Act of 2004 created additional reporting requirements for individual taxpayers making noncash charitable contributions. This website provides information for contributors, charitable organizations, and tax professionals who represent them, about federal tax requirements for donated property.

What About Online Fundraising And Charitable Tax Deductions

In the age of crowdfunding, it has never been easier to support your favorite charity. Technology has changed the way people all over the world help others. Lending a digital hand to those in need is now effortless, and finding best charities to donate to takes no time at all.

The top charity fundraising sites have done an incredible job of simplifying the giving process for donors and organizers alike. Reputable sites now offer fundraising platforms and issue tax-deductible receipts for donations made to certified charity fundraisers. They also give donors a way to easily track their donations in one place.

You May Like: Are Taxes Extended This Year

Reasons To Donate Stock Vs Cash

The main reason to donate stock to charity is that it allows you to give more money than with cash, as the above example shows. If you sold the stock and then donated the cash, you would first have to pay 20% of the cash in capital gains tax. Of course, this only applies if the stock has appreciated in value since you bought it.

Another reason is to reduce future capital gains taxes. If you replace the appreciated shares that you donated, you will be doing so at a higher cost basis than the old shares. Then, if the stock continues to appreciate and you want to sell in the future, you will pay less in capital gains tax than you would have if you still had the original shares.

The final reason is the ease of donation. You could make things cumbersome by giving multiple donations directly to multiple charities. However, if you utilize a donor-advised fund, such as those run by Fidelity Charitable and Schwab Charitable, you can simply put all the stock you want to donate in the fund in one easy transfer, take a full tax deduction for the total amount when you do, then decide later, with no deadline, to which charities you want the stock to go and when. The donation, though, is irrevocable. You canât change your mind and take the stock back.

Organizations that are equipped to receive stock donations will often have a donation form for donors to complete. This form will contain information on the broker, the shares, and the donation.