What Happens If You Dont Owe Taxes Or Get A Tax Refund

Most Americans get a tax refund after filing their federal and state taxes. This occurs when you have paid more in taxes over the course of the year than you owe. Most employers withhold money from each paycheck, which go toward your taxes but those withholdings typically dont account for the rebates and credits that you may be eligible for, resulting in the government needing to pay you back in the form of a tax refund.

If you fall into this category, owing no taxes to the government or being owed a tax refund, then there is no penalty that occurs for not filing your taxes. However, you wont receive your tax refund until you do file your taxes. There will be no penalty for filing late, just get the paperwork in to the IRS so they can process your taxes and issue the refund. Technically, you have three years to file taxes and receive a refund.

Heres What Happens If You File Taxes Late Or Pay Your Taxes Late

Money, Home and Living Reporter, HuffPost

There used to be a time when I couldnt wait to file my taxes. As a 20-something with little income and tons of tax deductions available , I always received a tax refund. How things have changed.

If youre like me, you usually owe money at tax time these days. And some years, it can be tough to come up with the money by April 15.

But what actually happens if youre late paying your taxes? In short, a whole lotta bad stuff.

Not paying your taxes can have painful consequences in the form of penalty fees, interest charges, federal liens, legal charges filed against you and even seizure of your property, said Riley Adams, a certified public accountant, a senior financial analyst at Entergy and owner of personal finance blog Young and the Invested. Its best not to mess with Uncle Sam. He doesnt often play nice.

So before you think about paying late or worse, filing late learn about the potential consequences.

If youre expecting a tax bill that you cant afford this year, the worst thing you can do is ignore it.

You May Like: What Does Payroll Tax Mean

Business Licenses Revocation Or Non

States will also seize and sell certain business licenses. For example, Californias Board of Equalization may seize and sell a liquor license if sales and use tax, corporate taxes, or personal income taxes are unpaid. The state of Illinois will revoke a sales tax business certificate if you have delinquent sales taxes.

Read Also: Where Can I Do My Income Tax For Free

Read Also: How To Calculate House Tax

What To Do If You Cant Afford To Pay Taxes

If you cant afford to pay your taxes, you will want to contact the IRS and inform them of this. The agency is more interested in collecting what it can than penalizing you, and is likely to work with you to set up a payment plan or an installment agreement. Payment plans still carry some interest and penalties, but less than the penalties for those who are not paying. However, failing to make a payment may result in the government requesting the full amount and ending the installment plan.

If you inform the IRS that you cannot pay, it is also open to negotiating a smaller payment. Oftentimes, the IRS will lessen your overall tax burden if you are willing to pay in a lump sum.

Important Property Tax Collection Dates

In What Happens If You Dont Pay Property Taxes in Texas This Year, we provided a property tax assessment and penalty timeline. It gives an overview of key property tax laws and deadlines for paying property taxes late from the Texas Comptrollers Office. Here are a few dates to remembergoing forward.

Appraisals are completed during this time.

Tax bills will start being mailed to property owners.

Property taxes are due.

Property tax bills are considered late, and Taxing Authorities start charging penalties and interest, which begins at 7%

Taxing units tack on more tax penalty fees for legal costs that stem from the collection of your delinquent tax bill.

Also Check: What Is The Website To Pay Federal Taxes

You May Like: What Is California State Tax Rate

What If I Owe The Irs But Can’t Pay

If you find yourself in this situation, you have a few options available, such as:

- installment agreements

- “offers in compromise”

You can also simply file your return and wait for the IRS to bill you, but don’t be surprised if the bill includes interest and penalties. Typically, the failure-to-pay penalty is less than the failure-to-file penalty so you likely should file even if you can’t pay the tax.

Can I Pay My Tax In Installments Over Time

If you find yourself owing more than you can afford, you should still file a return.

- Even if you don’t enclose a check for the balance due, sending in your return protects you from the late-filing penalty that otherwise would keep digging you deeper into a hole.

- Attach a Form 9465 Installment Agreement Request to your tax return asking the IRS to set up a monthly payment plan to pay off what you owe.

About 2.5 million taxpayers are paying off their bills under such an arrangement and recently the IRS made it easier to qualify. In the past, before the IRS would okay an installment plan, the agency demanded a look at your financesyour assets, liabilities, cash flow and so onso it could decide how much you could afford to pay.

- That’s no longer required in cases where the amount owed is under $10,000 and the proposed payment plan doesn’t stretch over more than three years.

- You can also now apply online for the installment agreement. More details are available on the IRS website

Don’t think the IRS is a patsy, though. You may be better off if you can borrow the money to pay your bill, rather than go on an installment plan which means, effectively, borrowing from the IRS.

Read Also: What Is The Property Tax Rate In California

Consequences Of Not Filing Or Paying State Taxes

States can assess penalties and take enforcement collection actions against taxpayers who have not filed a required tax return or paid state taxes owed. In addition to some of the same options the IRS has for unfiled or delinquent federal tax returns, states can revoke, suspend, or not renew specific licenses granted to taxpayers who owe state taxes. The unfiled return consequences can also vary depending on how long its been since you have filed a return.

Below are a few negative consequences of unfiled and unpaid state taxes. It is always best to go directly to your States website or to call your states DOR or tax collection department as laws continuously change. Some U.S. states do not have an individual income tax. For example, Alaska, Florida, Nevada, Tennessee, Texas, Washington, Wyoming, South Dakota, and New Hampshire. However, many of these states tax capital gains, business profits, sales taxes, corporate taxes, and other types of income.

What Happens If Tax Return Is Overdue

Late return / activity statements for individuals, small businesses, and large corporations typically require a FTL of up to $900, as opposed to $4,500 for smaller businesses. Also if taxes are due due but the tax return is unpaid, a General Interest Charge may be applied, typically at a rate of GIC plus 6-10% per year.

Dont Miss: Look Up Employer Ein

Read Also: What Are My Taxes On My Property

Why File For An Extension

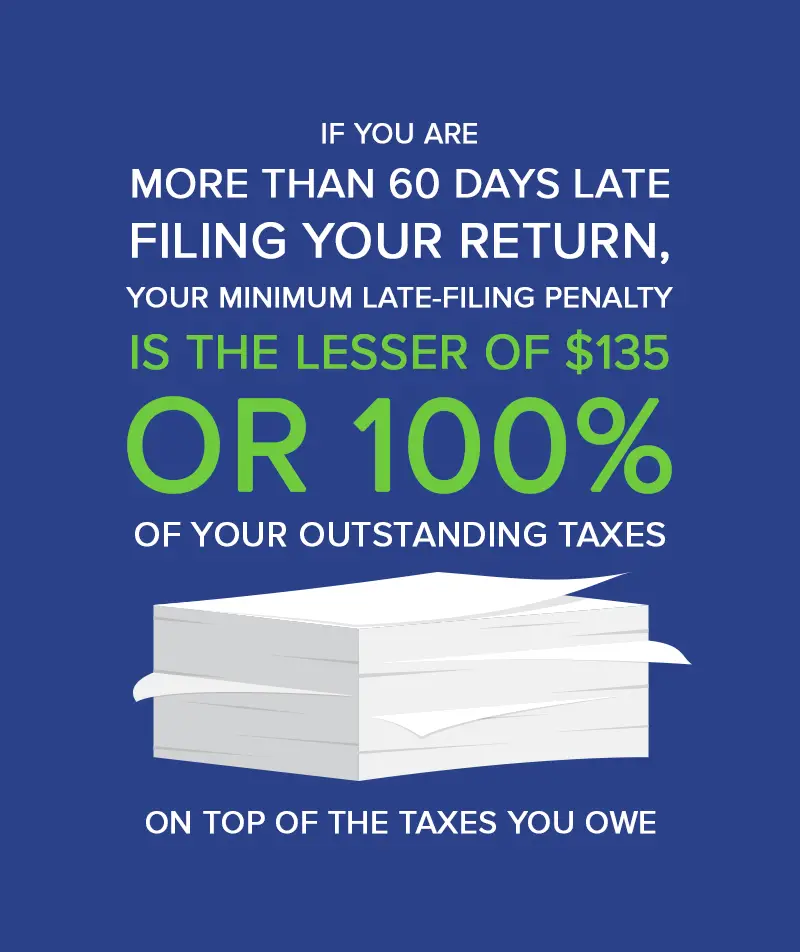

Filing an extension automatically pushes back the tax filing deadline and protects you from possible failure-to-file and penalties. Penalties for filing late can mount up at a rate of 5% of the amount of tax due for each month that you’re late.

- For example, if you owe $2,500 and are three months late, the late-filing penalty would be $375. x 3 = $375

- If you’re more than 60 days late, the minimum penalty is $100 or 100% of the tax due with the return, whichever is less.

- Filing for the extension wipes out the penalty file by the extension deadline.

TurboTax Easy Extension is a fast and easy way to file your extension, right from your computer.

Tax Extension Deadline Oct : What To Know If You Still Havent Filed A 2020 Tax Return

Worried about next months final IRS deadline to submit your taxes? Well explain filing options, refund schedules and how to view your tax account online.

Filing for an extension gives taxpayers extra time, but there are some consequences to be aware of.

While tax day this year was extended until May 17, millions of taxpayers still had to rush to file their 2020 tax return. Many opted to file for an extension to gather their records or get professional advice or to avoid potential mistakes. But that tax extension deadline is now less than a month away.

And missing the Oct. 15 filing date can mean youll owe late fees or more interest. Remember, an extension doesnt postpone having to pay taxes that you owe, it just gives you extra time to file your return. The IRS is still providing several electronic filing options, including free file for individuals whose income is $72,000.

If you havent yet filed your 2020 tax return, you could be missing out on money, like a tax refund, stimulus checks or child tax credit payments. If you wait too long to file and claim a refund, the IRS says you could risk losing it completely. Well explain below how to know if the deadline applies to you, who gets more time to file and what happens if you miss the October deadline. Heres how to track your IRS tax refund and what to know about refunds on 2020 unemployment benefits.

Don’t Miss: How To File Taxes Doordash

What Should I Know

You may need to amend your tax return if you, for example, need to change your filing status, your income, your deductions, your credits, or the amount of tax due in your return. Or, you may have received a notice from the IRS disputing your claim, informing you that they have adjusted your return. It would be necessary to amend your return if this is the case so that the adjusted amounts are changed by the IRS.

The return may also be amended by claiming acarrybackif a loss has occurred or if a credit has been unused. An alternative to Form 1040-X is Form 1045, Request for Tentative Refund, which can provide you with a faster refund.

In general, you need to amend your original tax return three years after filing, including extensions of the date of filing or two years after the date of paying tax, whichever comes later, following the date on which the original tax return was filed. Justifications for late returns might include:

- Disability due to financial hardship

- Disasters declared by the federal government

- Zones of combat

- Deduction or credit for foreign taxes

- Carryback of losses or credits

- Grants for disaster relief

If an amended return is filed within these time limits, the deadline is automatically extended.

The current tax years Form 1040-X is filed along with the previous years Form 1040-X. Your original return has been updated with new information

To learn more about this or to speak with a professional, get aconsultation with YokeTax.

Reducing The Chance Of An Audit When Filing

There is no sure-fire way to audit-proof your tax return, though you can cut the odds. Nevertheless, a messy returncross-outs, sloppy handwriting, smudgesalmost screams audit me. This tells the IRS that you are careless and disorganized. So does the use of round numbers for deductions$1,000 or $12,000 instead of $978 or $12,127. Its an indication that you are estimating things rather than keeping good records.

Here are some suggestions which mayor may notwork to reduce your audit risk:

Read Also: How To Avoid Federal Taxes

Forgot To File Your Taxes Last Year What You Need To Know

If filing your taxes before the deadline went over your head last year, procrastinating can make things worse.

Unlike sales tax, which you pay on the spot, Canadas income tax system is based on self-assessment. Make your money, plan your affairs as best you can and then, pay up.

Not everybody does this, though. So, if the tax filing deadline sneaked up and passed you, here are a few things to keep in mind.

Recommended Reading: When Does Income Tax Have To Be Filed

Drivers License Suspension Or Not

If you do not pay your taxes in some states, you could lose your drivers license. In fact, , Kentucky, New York, California, Massachusetts, Louisiana, South Dakota, Rhode Island, Iowa, and the District of Columbia, all have programs that lead to drivers license suspensions for unpaid taxes. Many states will reinstate your license for paying a certain percentage of your balance, while others have different requirements to get it back.

You May Like: How Do I File My Taxes By Mail

Can I Pay My Tax By Credit Card

Yes, you can pay your tax bill with credit in a variety of ways. Credit card and bank loans are both payment options. You can apply for a bank loan, home equity loan or take a cash advance on a credit card to pay your tax bill.

Third party providers like Official Payments Corporation are also available to facilitate using a credit card to pay your tax bill.

- These companies charge a convenience fee for their service.

- That fee is in addition to any interest and finance charges your credit card company may charge you.

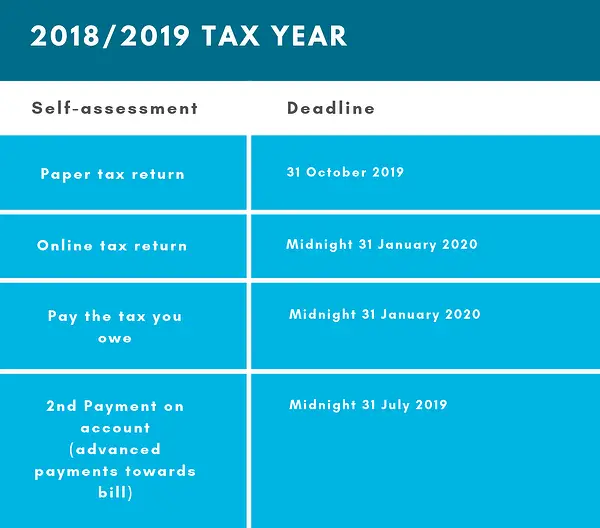

Reasonable Excuses For Filing Late

Sometimes things happen that mean you can’t file your tax return on time. HMRC will accept certain ‘reasonable excuses’ for being late.

A reasonable excuse is defined as being ‘normally something unexpected or outside your control that stopped you meeting a tax obligation.’

If HMRC accepts that you had a reasonable excuse, it should waive any late charges.

Examples of reasonable excuses include:

- the recent death of a partner

- an unexpected hospital stay

- service issues with the tax authority’s online services

- a fire which prevented you completing a tax return, or caused postal delays.

Each case will be considered individually. It’s always best to file your return in plenty of time before the deadline if possible.

Also Check: How Do I Apply For Farm Tax Exemption

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Penalties For Not Paying

If you dont speak to HMRC to arrange a time to pay agreement, theyll charge penalties.

Youll be charged a penalty when your payment is 30 days late, on 3 March unless its a leap year, when youll be charged on 2 March. Youll also be charged another penalty again when the payment is 6 and 12 months late.

The penalty is 5% of the original amount you owe HMRC plus interest if you dont pay straight away.

If youre self-employed and filled in a Self Assessment tax return to work out your income tax, you can check how much your penalty will be on GOV.UK.

Recommended Reading: How Do Millionaires Avoid Taxes

Also Check: Can I File Taxes Without Working

Sign Up For A Payment Plan

If you need more time to repay your unpaid tax balance, you can file a request for an extension and then apply for an extension. There are different costs tied to establishing an installment plan.

A formula exists that considers your particular circumstances and determines the cost.

Riley Adams is a licensed CPA who works at Google as a senior financial analyst. He owns the investing website, Young and the Invested , which teaches younger generations how to invest with confidence.

Can Incorrect Tax Filing Lead To Jail Time

A mistake on a tax return or filing an incorrect return cannot result in jail time. You may be held responsible for fraud if you intentionally leave out items from your tax filing. Intent determines whether an action is criminal. It is not illegal to make a mistake and correct it.

Tax Crimes: Can Ignorance or Mistake Be a Defense?

It is not a valid defense to any tax crime to claim you made a mistake or didn’t know the law. Appeals based on ignorance will not help you avoid penalties if the IRS believes that you intended to violate the law. There is a presumption that everyone knows the law.

Also Check: What Is The Property Tax In New York

What Day Is The Last Day You Can File Your Taxes

If your tax year ends on December 31st, the tax deadline for filing tax returns is usually April 15th every year. If the envelopes are appropriately sent, your declaration will be deemed to have been submitted on time. This is because it was entirely frank, postmarked, and deposited at the post office on time.

For electronic submissions, the date and time of the return submission in the time zone determine the timeliness of the return. Later, you will receive an electronic confirmation that the IRS has accepted the electronically submitted returns.

This period is commonly referred to as tax season.