Other Types Of Income

If you’re self-employed or you receive income from other sources, you’ll need to report that information on your tax return. If you’ve received any of the following IRS forms in the mail, share them with your tax preparer.

- Form 1099 and Form 1099-MISC for self-employment income

- Form 1099-A for foreclosure of a home

- Form 1099-B for proceeds from broker transactions

- Form 1099-DIV for dividends and distributions

- Form 1099-G for unemployment income or a state tax refund

- Form 1099-INT or Form 1099-OID for interest income

- Form 1099-K for business or rental income processed by third-party networks

- Form 1099-LTC for Long Term Care reimbursements

- Form 1099-PATR for patronage dividends

- Form 1099-Q for payments from qualified education programs

- Form 1099-QA for distributions from an ABLE account

- Form 1099-S proceeds from the sales of property

- Form 1099-SA for Health Savings Account and Medical Savings Account distributions

- Form SSA-1099 for Social Security benefits

- Form RRB-1099 for railroad retirement benefits

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Paper Filing Sales Tax Returns

If you determine you do not need to file your sales tax online, you will be able to file a paper return to the CRA. Eligible individuals can either send the GST/HST return through the mail using forms GST34-2 or GST62, or file in person at your Canadian financial institution.

However, be aware that you cannot file your sales return in person at a financial institution if you are claiming a refund, filing a nil return, or opting to offset the owing amount on your return with a rebate or refund.

You May Like: Do You Get Taxed For Donating Plasma

Common Income Deduction Statements

Most taxpayers depend on the same basic data to file returns. If you work for someone else, the IRS expects you, and the agency, to get a statement detailing that income. The data are slightly different, depending on whether you get paid a salary or do contract work, but theres a form for either case.

W-2 This is the key form, and you need one from each employer you worked for during the past year. Your W-2 shows how much money you made, how much income tax was withheld, Social Security and Medicare taxes paid, and any benefit contributions retirement plans, medical accounts and child care reimbursement plans.

1098 For most homeowners, mortgage interest is tax-deductible, and this document will tell you how much you paid last year. Your lender is required to send you one of these forms if you paid at least $600 interest. Actually, your mortgage company probably wont send you an official IRS form, but a document of its own design that contains the same data. In addition to the mortgage interest, other information often found on this statement includes amounts paid toward points to get the loan and escrow disbursements for real estate taxes and property insurance .

RATE SEARCH: Shopping for a mortgage? Compare mortgage rates today at Bankrate.com!

RATE SEARCH: Stretch your retirement income with a CD ladder. Compare CD rates today.

RATE SEARCH: Looking for a high-yielding savings account? Compare rates at Bankrate.com today!

Documents Required To Claim The Following Expenses As Deductions

Certain expenses or investments are eligible for tax deductions. Rs.1.5 lakh is the maximum amount that can be claimed as deductions. It is important to keep the corresponding documents at hand to claim these expenses as deductions. Some of these are documents related to:

- Childrens school tuition fees

- Life insurance premium payment

- Registration and stamp duty charges

- Mutual funds or Equity-linked Savings Scheme investments

Recommended Reading: Appeal Taxes Cook County

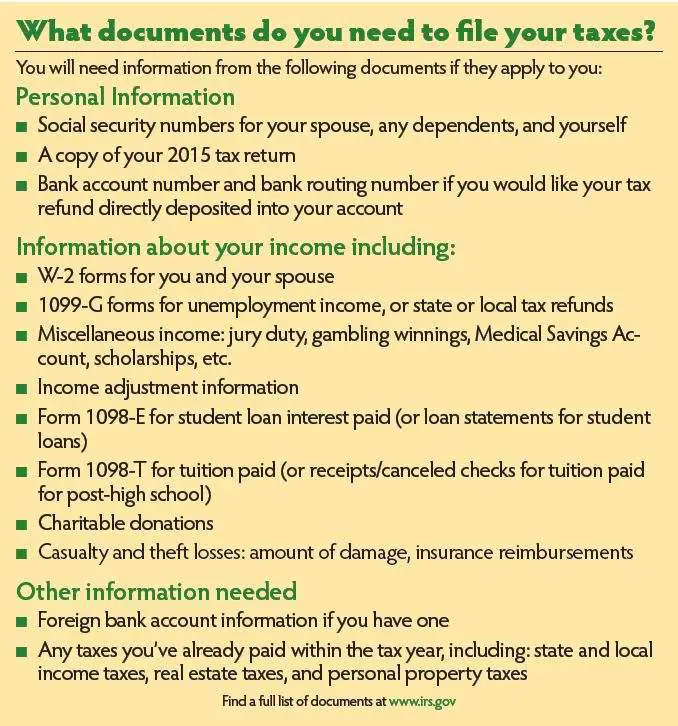

Itemized Tax Deductions And Credits:

The government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket. You’ll need the following documentation to make sure you get all the deductions and credits you deserve.

- Child care costsprovider’s name, address, tax id, and amount paid

- Education costsforms 1098-T, education expenses

- Adoption costsSSN of child, legal, medical, and transportation costs

- Home mortgage interest and points you paidForms 1098

- Charitable donationscash amounts and value of donated property, miles driven, and out-of-pocket expenses

- Casualty and theft lossesamount of damage, insurance reimbursements

- Other miscellaneous tax deductionsunion dues, unreimbursed employee expenses

Properly documenting the taxes you’ve already paid can keep you from overpaying.

- State and local income taxes paid

- Personal property taxesvehicle license fee based on value

What Is A 9465 Form

If you cannot pay your taxes in full when you file, you can use Form 9465 to request a monthly payment plan. If you can pay within 120 days and you owe less than $50,000, you can request a payment plan online, too. Such payment plans will incur a user fee, accrued penalties and interest, but low-income taxpayers may have the user fee reduced, waived or reimbursed. User fees are usually lower when you set up a payment plan online. While a payment plan is in effect, late-payment penalty accruals are cut in half. If you can pay your taxes in full within 120 days, you can apply online for the IRSs payment plan or call the IRS at 800-829-1040 to avoid the fee associated with setting up an installment agreement.

Best for:People who need more than 120 days to pay their taxes in full and owe more than $50,000. If you want to set up a monthly payment plan, the IRS encourages you to request one online.

You May Like: Protesting Harris County Property Tax

Information About Your Income You Need To File Taxes

You have to make sure you have plenty of information to prove any income you want to claim on your taxes. And this is where some people run into problems.

No matter if you work for a large company, are self-employed, or run your own business, you have to have the right forms for your taxes. These can include a W-2 or self-employment paperwork to prove your income.

Heres a quick guide to which IRS forms and/or personal documentation youll need for the most common income situations:

What Are 1099 Forms

1099-G: States will send both you and the federal government a 1099-G form at the beginning of the year, which shows income you received from that state during the previous tax year. The income can include:

- Unemployment compensation.

- State or local income tax refunds, credits or offsets.

- Reemployment trade adjustment assistance payments.

- Taxable grants.

- Agricultural payments.

You will receive a 1099-G in 2021 from any state that gave you money in 2020. This form is where the unemployment compensation you received is listed. Remember: If you made less than $150,000 in 2020, only unemployment benefits over $10,200 are taxable. If taxes were withheld from your unemployment insurance checks, this will be reflected in your 1099-G form.

Best for:People who received unemploymentcompensation.

1099-MISC and 1099-NEC: For tax year 2020 or a prior year, entities or people who have paid you money during the year will mail you a 1099-MISC form for miscellaneous income. If youre a freelancer or a contract worker, you can expect to receive a 1099 form in the mail for each of the people or companies you worked for. Starting with tax year 2020, freelancers will receive the new Form 1099-NEC. There are a number of other reasons you might receive a 1099-MISC form, including if you received monetary prizes or awards, or were paid royalties or rent. Youll use the form to file your own taxes.

Best for:Freelancers, contract workers or anyone who receives miscellaneous income.

Recommended Reading: Tsc-ind

Records To Determine Your Cost Basis

Keep any records and receipts that prove your cost basis. Records like home renovation receipts and invoices are the evidence you need to help reduce your home sale tax liability.

You just need to be very careful when youre adding to your basis. When youre including the cost of your improvements, you need to have your invoices, Rigney says. If you hire a contractor, make sure you have invoices that show that amount.

DIY home improvement projects should be recorded, too, and kept safe with your other home sale tax documents.

If you did it yourself, you cant include the value of your services, but you can include all the materials that went into it and any permits that you had to pay for, says Rigney.

What Documents Do I Need To Bring To My Tax Preparer

OVERVIEW

Whether you prepare your taxes yourself or get help from a tax preparer online or in-store, knowing what documents you’ll need at hand can help prevent tax filing errors and possibly lower your tax bill.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Read Also: How Much Should I Set Aside For Taxes Doordash

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

l i g h t p o e t/Shutterstock.com

Collect These Documents Before You Start Your Tax Return

The challenge of gathering everything you need to file your annual tax return can be either minimal and yawn-worthy or aggravating and time-consuming. How you feel about doing your taxes can depend on your financial situation. You can probably yawn if youre single, rent your home, and work one job, but youll have to dedicate some time to the filing process if youre married, are a single parent with at least one of your children living at home, have investments, are self-employed, or work multiple jobs.

Each of the latter scenarios will require gathering multiple documents.

Weve you can download and print to help you find and gather the information and documents youll need when filing your taxes.

Don’t Miss: Efstatus.taxact

What Is A 4506 Form

Use Form 4506 to request the copies of previously filed tax returns from the IRS. You can also use the form to designate a third party to receive the tax return. The form will ask for personal information, the year and types of forms you would like to recieve, and a $43 fee for each return requested.

Best for:People who need a copy of their tax return and cant get one free of charge from a tax preparer if they used one.

What Documents Will I Require To File Itr

If you are a salaried employee, these are the documents you would need before you sit down to file your I-T Return:

- If you are paying tax, you surely have a Permanent Account Number with the I-T Department. One of the first documents you need is a copy of the PAN Card.

- For salaried individuals, tax is deducted from your salary before it is credited to your account. The employer, at the end of the fiscal year, will provide you with your Form-16, which contains your salary details, the tax exemptions under various heads based on the documents you have provided to your employer, and your personal information. This Form 16 in two documents: Form 16A and Form 16B is mandatory to file your ITR.

- If you are eligible for an income tax refund that is, if more tax has been deducted from your salary than is required then you also need to submit a cancelled cheque to the I-T Department to confirm your bank account number.

Companies that deduct tax at source also ask employees to furnish all documents relevant to additional income and documents proving your investments under various provisions of the I-T Act for tax exemption. Since all this is included in the Form 16, you need not produce any more documents. However, if there are proofs of investments and income that you have not submitted to the company, you can add them to the ITR. These include:

What Investments will give me Tax Exemption?

- 40% to 80% disability Rs. 75,000

- More than 80% disability Rs. 1,25,000

Don’t Miss: How To Get Tax Preparer License

What Kind Of Records Should I Keep

You may choose any recordkeeping system suited to your business that clearly shows your income and expenses. The business you are in affects the type of records you need to keep for federal tax purposes. Your recordkeeping system should include a summary of your business transactions. This summary is ordinarily made in your business books . Your books must show your gross income, as well as your deductions and credits. For most small businesses, the business checking account is the main source for entries in the business books.

Some businesses choose to use electronic accounting software programs or some other type of electronic system to capture and organize their records. The electronic accounting software program or electronic system you choose should meet the same basic recordkeeping principles mentioned above. All requirements that apply to hard copy books and records also apply to electronic records. For more detailed information refer to Publication 583, Starting a Business and Keeping Records.

Online Filing Sales Tax Returns

Like income returns, there are various options for individuals and businesses to file their sale tax returns online. GST/HST NETFILE and GST/HST TELEFILE allow individuals to file their sales tax returns directly online, and are the quickest and easiest options to use. As previously stated above, the My Business Account is also available for filing sales taxes, alongside other business-related taxes.

Individuals can also pay their net tax owed electronically through their Canadian financial institution using the Electronic Data Interchange option . However, those in Quebec will be unable to use this electronic service. Other internet-based filing services include the GST/HST Internet File Transfer, offering business owners the ability to pay their sales taxes to the CRA directly through their third-party accounting software.

Also Check: Pastyeartax Com Review

Income Tax Return Filing Documents

The filing of income tax returns has become much simpler now as an individual can do it just by logging in to the official return filing portal. However, there are chances that an error might occur while filing the returns. It is always better and safer to take precautions to avoid such errors. One of the major precautions that an individual can take before filing his/her income tax returns is to make sure that he/she has ready access to all the required documents.

Contact Us For Small Business Accounting Services Raleigh Today

We offer business and personal tax return preparation for our monthly business accounting clients in the Raleigh area. If you would like to work with an experienced small business CPA who can provide you with an accurate, timely tax return while minimizing your tax liability, we can help. Gather your documents, and reach out to our CPAs in Raleigh today to set up a consultation by calling us at or fill out our contact form.

You May Like: Efstatus.taxact 2014

What To Bring To Your Accountant At Tax Time

Youll need all this information and documentation whether you prepare your tax return yourself or if you decide to use a tax professional. The difference with the professional is that youll have to take all pertinent information with you to your appointment or gather it together in advance to send through fax or electronically. Youll also need some additional documentation if youre using a tax professional for the first time.

Your tax preparer will require identifying information for you, your spouse , and your qualifying dependents, if applicable. This means Social Security cards, although you can typically take a copy of your most recent years tax return instead. This will detail all your identifying information unless youve since acquired another dependent who wasnt listed on that return.

Of course, you wont have to bring all of this with you if youre using the same professional youve used before. Theyll already have everything at their fingertips.

Its a good idea to take your previous years tax return with you to meet a tax professional, even if you have Social Security cards for everyone in your family. This should give your tax preparer an accurate picture of your personal tax situation, in addition to the identifying information it includes.

While it may seem like a lot of paperwork, gathering and organizing it will be worth it, especially if your tax situation is complex and requires a great deal of documentation.