What Documents Do I Need For Capital Gains Tax

As you probably already know, the IRS recently received a significant infusion of funds from the Inflation Reduction Act. The IRS is hoping to increase the audit rate from its current sub-one percent performance, focusing on higher-income tax returns. Examining higher income returns makes sense, as does investigating returns with income from sources that arent easily verified. For example, the IRS reports that for ordinary wages and salary income, compliance with reporting and paying income tax is nearly perfect. In contrast, for income from harder-to-verify sources like small businesses, noncompliance may be as high as 55 percent.

Capital gains are simple for the IRS to validate in most cases, so taxpayers are wise to report and pay whats due. As the IRS has noted, capital assets include almost everything you own:

- Collectibles like coins and stamps

- Jewelry, gems, gold, silver, and other metals

- Business property

A capital gain or loss is the result of selling a capital asset for more or less than you paid for it . The basis is key to reporting a gain or loss. In some cases, it is simply the price . But the basis may be adjusted, particularly when the asset is real estate.

Adjustments to the basis may include property improvements and the cost of acquisition. Adjustments can also include depreciation and receipt of payments from other sources that offset your investment.

If You Experienced A Capital Gain Or Loss

Schedule D

If you sold property like stocks, real estate, artwork, etc. youll need to submit a Schedule D form to declare a profit or loss from that sale.

Note that if the real estate you sold is your primary residence i.e., you owned and resided in the property for two of the five years prior to its sale you wont have to pay tax on up to $250,000 in profit from the sale. If the profit exceeds those limits, youll need to pay capital gains tax.

Tax Prep Checklist: What To Gather Before Filing

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

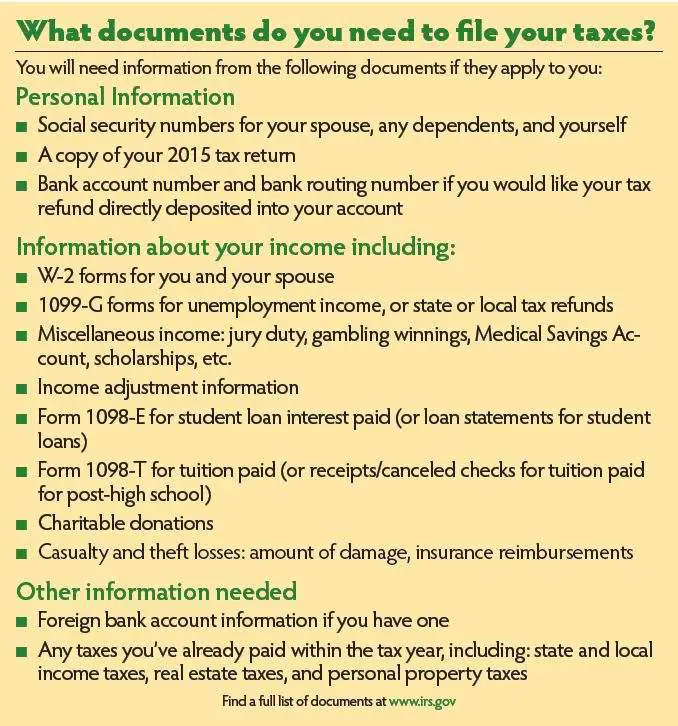

Whether you hire a professional or do it yourself, you need certain information and documentation to file your tax return. Heres a tax prep checklist most taxpayers might need to complete the job.

Read Also: Who To Call About Property Taxes

Get Help Filing Your Return

If the thought of preparing and filing your taxes makes your head spin, have no fear there is help available through OC FREE TAX PREP. Orange County United Way has joined forces with H& R Block, the IRS, and a coalition of local partners to support Orange County residents during tax season. This year, OC Free Tax Prep will continue to provide its free tax preparation service via COVID-friendly options, including:

Tax Filing Step : Gather All Year

COVID Tax Tip 2022-04, January 6, 2022

As taxpayers are getting ready to file their taxes, the first thing they should do is gather their records. To avoid processing delays that may slow their refund, taxpayers should gather all year-end income documents before filing a 2021 tax return.

It’s important for people to have all the necessary documents before starting to prepare their return. This helps them file a complete and accurate tax return. Here are some things taxpayers need to have before they begin doing their taxes.

Forms usually start arriving by mail or are available online from employers and financial institutions in January. Taxpayers should review them carefully. If any information shown on the forms is inaccurate, the taxpayer should contact the payer ASAP for a correction.

You May Like: What Is Nys Sales Tax

How Long Should I Keep Records

The length of time you should keep a document depends on the action, expense, or event which the document records. Generally, you must keep your records that support an item of income, deduction or credit shown on your tax return until the period of limitations for that tax return runs out.

The period of limitations is the period of time in which you can amend your tax return to claim a credit or refund, or the IRS can assess additional tax. The information below reflects the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period after the return was filed. Returns filed before the due date are treated as filed on the due date.

Note: Keep copies of your filed tax returns. They help in preparing future tax returns and making computations if you file an amended return.

What Happens If You File Taxes Late

Will you be stuck with a penalty for late taxes if you file your taxes after this years tax deadline? All taxes filed past the tax deadline without an extension in place are considered late. Theres no standard answer for what happens when you file taxes late because the outcome will depend on how long youve gone without filing taxes, how much you owe in late taxes, and your ability to pay what you owe to the IRS.

The simplest answer is that the IRS will call on you to file your taxes. If you fail to do this, you face a penalty for filing taxes late fees, interest, and liens are not far behind. If you really let the situation get out of control, you could be facing charges for tax evasion. Luckily, the IRS is pretty reasonable about helping you to get caught up without much stress as long as youre willing to take the actions needed.

First, its essential to know that the IRS wont just forget about unfiled and unpaid taxes. While you may think that the IRS hasnt noticed because you made it through the end of tax season without getting any notices, theres a good chance that a letter is on its way. The IRS doesnt just rely on the information you report on your tax returns to determine how much you owe it uses a sophisticated system that cross-references payroll records and tax returns to calculate how much every taxpayer made during any given year. While you may have skipped filing a return, the IRS still knows if youve earned income based on this information.

Read Also: How To Challenge Property Tax Assessment

Canada Tax Checklist: What Documents Do I Need To File My Taxes

Picture this. Tax season has snuck up on you once again and youre scrambling trying to find all the documents you need, trying to make sure youre not forgetting anything.

You may not have an idea of where to start and this is why having a tax checklist is important and a great way to stay organized. In this article, well go through everything you need to have handy when filing your taxes.

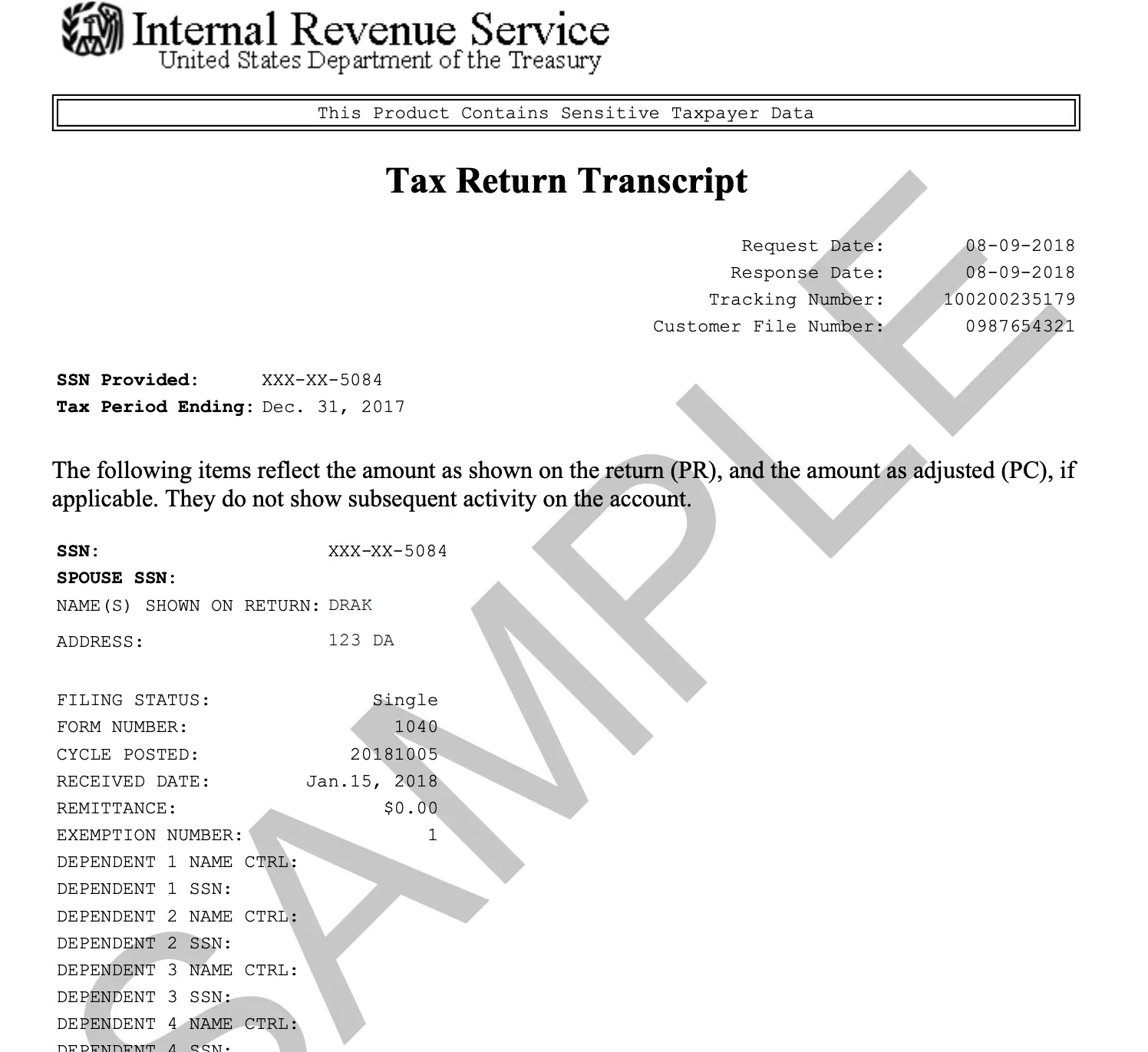

What Is A 4506

Use Form 4506-T to request a transcript of previously filed tax returns free of charge. It contains most of the line items on your full return and is widely accepted by most lenders. Mortgage lenders and student loan lenders, for example, will often ask you to fill out this form to verify your income. With COVID-19 delaying processing of paper forms at the IRS, an easier and faster option is the IRS online Get Transcript tool.

Best for:People who need a transcript of their tax return free of charge.

Recommended Reading: Where To File Federal Tax Return In California

Income Adjustment Credit And Deduction Documents

- Copy of IRS Letter 6475 for EIP payments

- Copy of IRS Letter 6419 that provides the total amounts of Advanced Child Tax Credit payments that were dispersed to you in 2021 .

- Receipts from charitable donations.

- Receipts from moving expenses for active military.

- Receipts from job search expenses.

- Records related to loss of property or insurance claims from a federally declared disaster.

- Bank account and routing number if you want your refund direct deposited.

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Recommended Reading: Can You Deduct Federal Income Taxes Paid

Read Also: What Will I Get Back In Taxes

Documents That Support Tax Deductions

Identifying the documents youll need to claim certain tax deductions can be an arduous process. Ideally, youve been collecting them all year long as you paid certain expenses.

Its not necessary to provide your receipts to the IRS unless youre audited, but youll need them to ascertain how much you can claim for various deductions, and youll want to keep them on hand just in case. While you can take the easy way out and simply claim the standard deduction for your filing status, youll have to know how much you spent on qualifying expenses if you decide to itemize instead. Common itemized deductions include charitable giving, state and local property and income taxes, medical expenses, and health insurance.

How Do I Get A Copy Of My Tax Return In Canada

If you need a copy of your notice of assessment or tax slips from previous years, you can get those from the CRA website. You can sign into your My Account or use the CRA mobile app to view it.

For copies of a previous years tax return, how you get it will depend on how you filed it. If you used a tax preparation service, you should be able to access PDFs through that service. If you used a preparation service or an account, you can contact them to get a copy of your tax return.

Also Check: Do I Pay Taxes On Unemployment

Don’t Miss: What Is Federal Work Opportunity Tax Credit

How To Tax Your Car Online

If you want to tax your car online, youll need either your V5C, your new keeper slips or your V11 reminder if youve got one.

Specifically, if youre current keeper then youll need the 11 digit reference number from your V5C. If you havent yet received a V5C in your name on the other hand, youll need the 12 digit reference number from the new keeper slip.

Your V11 on the other hand will contain an important 16-digit reference number that you can use in place of the 11-digit number on your V5C, or the 12-digit number on your new keeper slip.

Statements Mailed In January And February

Most of the papers you need to document the income, interest and withheld taxes you report arrive in your mailbox in January, with investment-related 1099s often coming in February. Although the postal service may deliver some of themyour W-2, for exampleemail announcements that the documents are available online may land in your inbox.

Mortgage providers, banks and other financial institutions often post those important 1099 forms on your online account. So its a good idea to create an email tax folder for messages relating directly to tax information.

You May Like: How Much Is My Salary After Tax

How Does A Refinance In 2021 Affect Your Taxes

It used to be that being a homeowner could offer some big tax advantages, not the least of which are perks related to that mortgage you pay every month. With the Tax Cuts and Jobs Act changing certain aspects of the tax code starting a few years back, its much less of a certain thing than it used to be.

If you refinanced your mortgage in 2021, there are some specific dos and donts you need to know prior to filing your income taxes, as well as a few pointers that might help you lower your tax bite.

What follows may help to reduce your federal income taxes and get you prepared for mortgage-related tax issues in 2021 and beyond.

Dont Miss: Does Rocket Mortgage Service Their Own Loans

How Much Interest Do You Owe If You File An Extension

Taxpayers who file an extension and owe tax will still have to pay interest, but will avoid having to pay penalties. Heres a simplified example of the difference.

If a taxpayer owes $2,000 in taxes and doesnt file for an extension, they will pay 5% of the total amount owed for every month they are late as a failure-to-file penalty, plus 4% interest compounded daily.

So, if that taxpayer files their return in July, three months after the April deadline, they will owe an additional$300 for failing to file and $20 in interest for a total of $320 in added charges, on top of the $2,000 tax bill that started the trouble.

If that person filed an extension and then paid off their taxes three months later, theyd still be on the hook for an underpayment penalty and interest, but that penalty would be less than $50 far less than the cost if they didnt file at all.

Recommended Reading: Are There Tax Credits For Solar Panels

Its Better To File Late Than Not At All

You might be thinking, âIf Iâve already missed the deadline, whatâs a few more weeks?â But the sooner you submit your tax return, the better . So do your best to file the next day or soon thereafter.

If you earn $73,000 or less per year, you can file your return online using one of the IRSâ free federal tax filing options, which provides complimentary tax-preparation software. If you earn more than $73,000, you can still file online using the IRSâ free electronic forms, but youâll need some tax-prep knowledge if you choose to go this route.

Documents Showing You Had A Work

Did you know that Baby Boomers held an average of 12.3 jobs from ages 18 to 52? Moving for work is not uncommon. Some of those jobs required moving to a new home.

Its possible to qualify for a partial capital gains tax exemption if you had a work-related move. For example:

- Your new job is at least 50 miles farther from your home than your previous job.

- You had no previous work location and started a new job that is at least 50 miles from your home.

- Either of the above is true for your spouse or homes co-owner, if that person lived in the house.

The move must take place within a year of the commencement of employment at the new job and you must work full time for at least 39 weeks of the first year after starting the job.

Its up to you to provide documentation proving that your move was work-related. If you claimed a reduced exclusion because you got a new job in a different city and then moved because of it, youre going to want some evidence of that, says Rigney.

However, Skinner points out, theres no one particular document required by the IRS to prove that a move was work related. Any form of proof issued by the employer should suffice. That could include an offer letter or notice of transfer.

Note that, as per the current IRS guidelines, you can only deduct the actual moving expenses for tax years prior to 2018 unless youre an active member of the U.S. Armed Forces moving because of a permanent change of station.

Also Check: What States Have The Lowest Income Tax

Do I Need To Tax My Car

Yes. All cars need to be taxed in order for them to be road-legal. The confusion around this question seems to have arisen from the fact that certain cars are exempt from actually paying tax, such as electric vehicles, and those used by people with disabilities. However, even if your car fits the definition of a tax-exempt vehicle, youll still need to apply for tax anyway, so that its tax-exempt status can be verified through official means.

Its worth noting that the law surrounding vehicle tax, and the way in which its calculated, changed in April 2017. The RAC has helpfully published an extensive guide to car tax bands if you need a little more detail.

You can choose to pay your vehicle tax either as a single lump sum for the year, or two six-monthly payments, or 12 monthly instalments. If you choose either of the latter two options, youll be charged an additional 5%. You can pay the DVLA in cash, cheque, debit or credit card, or if youre paying at the Post Office, you can also make use of your Post Office Budget Card, Postal Order or Sterling travellers cheque.