When Are Excise Taxes Paid

Federal excise taxes are due on a quarterly basis and theyre due a month after the end of the quarter. To file you must fill out the Form 720 and either mail it to the IRS by the due date or file it online.

» MORE:Here’s a step-by-step guide to filling out Form 720

The IRS accepts both paper and electronic submission of the Form 720. Filing the form online comes at whatever cost the provider determines for the service fee. Be aware that not all excise tax forms can be filed electronically there are still some that you might be responsible for that have to be physically mailed in. Those that can be filed electronically, according to the IRS, are: Form 2290, Heavy Highway Vehicle Use Tax Form 720, Quarterly Federal Excise Tax and Form 8849, Claim for Refund of Excise Taxes .

The state and local excise taxes are on their own schedules. Theyre due at a different time in each state and not always due when the federal excise tax is due, so be sure to check the details of the excise tax your business has to pay to make sure youre on time. In some states, like Massachusetts for example, the excise tax on your vehicle would be due annually at a rate of $25 for every $1,000 your car is considered worth or is valued at.

Excise Duties On Alcohol Tobacco And Energy

Excise duties are indirect taxes on the sale or use of specific products, such as alcohol, tobacco and energy. The revenue from these excise duties goes entirely to the country to which they are paid.

EU countries agreed on common EU rules to make sure that excise duties are applied in the same way and to the same products everywhere in the Union.

This helps prevent trade distortions in the Single Market, ensures fair competition between businesses, and reduces administrative burdens for companies.

In addition, EU law sets out common provisions, which apply to all products subject to excise duties.These common provisions include the framework for the Excise Monitoring and Control System , an IT system for monitoring the movement of excise goods within the EU.

On 19 December 2019, the Council adopted a series of new rules on the common provisions, which will be applicable from 13 February 2023.

Is Your Employment Tax Liability < = $1000 In A Full Calendar Year

Unlike IRS Form 941, which reports much of the same information, but must be filed quarterly, Form 944 is an annual tax return. Businesses whose employment tax liability will be $1,000 or less or in other words, you expect to pay $4,000 or less in total employee wages for the year are eligible to file IRS Form 944.

You May Like: Who Has To File Income Tax Return

How Is An Excise Tax Different From A Sales Tax

Excise and sales taxes are two very different types of taxes. An excise tax is imposed on very specific goods and is generally the responsibility of the merchant to pay to the government. The merchant, in turn, may or may not pass the tax on to the consumer by adding it into the price. A sales tax, on the other hand, is charged on almost everything and is collected from the consumer by the merchant who passes it on to the government. Rather than being a fixed amount like an excise tax, the sales tax is a percentage of the price of the good or service. So the tax on a $25 sweater would be lower than the sales tax on a $200 television set.

History Of Excise Tax In The Us

Excise taxes imposed by the British monarch were but one catalyst to the revolution that spawned a new nation. Although the American colonists had been riled to great anger regarding taxes, the new leaders understood the need to start the new nation off on a secure financial footing. The first federal taxes imposed by the newly elected United States Congress were tariffs and excise taxes on imported goods, approved by the Tariff Act of July 4, 1789.

In an effort to encourage consumers to buy domestic products, Congress set low excise taxes on certain imported goods, such as rum, whiskey, tobacco, and refined sugar. These taxes accounted for the largest portion of federal income, even though they could generally be avoided by simply buying the same products produced domestically.

Although the issue of taxes has been debated throughout the years, the right to tax the people is granted by the U.S. Constitution, Article I, Section 8, which reads:

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States

Recommended Reading: When Do Taxes Need To Be Filed 2021

How Is Excise Tax Different From Sales Tax

A sales tax and an excise tax are very similar, but the main difference is that excise tax is only collected on the sale of very specific items. Sales tax on the other hand is added to nearly every item a customer buys or that you as a small-business owner sells, and its always a percentage of the purchase. Excise tax isnt always a percentage of the purchase.

Examples Of Excise Taxes

Consumers don’t often realize they’re paying excise taxes. These taxes are usually lumped into the price they pay or listed as a line item on a receipt. For these reasons, consumers often aren’t as aware of excise taxes as they may be of sales taxes. But several excise taxes impact purchases you may regularly make.

Common federal excise taxes are imposed on:

Some of these taxes are percentage-based. For instance, the indoor tanning services excise tax is 10% of the amount paid, and the electric outboard motors excise tax is 3% of the sales price. This means if you buy an electric outboard motor from a boat shop for $300, you would pay a $9 excise tax.

Other taxes are a flat dollar amount per unit. The gasoline excise tax is 18.4 cents per gallon. If you buy 10 gallons of gasoline, you’re paying $1.84 in federal excise taxes as part of the purchase price.

Excise taxes can be implemented on several levels, too. Gasoline excise taxes are often charged at both the state and federal levels.

Read Also: How To Find Houses With Unpaid Taxes

Ad Valorem Excise Taxes

Ad valorem is a Latin phrase that literally means according to value. An ad valorem tax is charged on a percentage basis. This results in an excise tax that is based on the value of the product or service.

For example, the Internal Revenue Service levies a 10% excise tax on indoor tanning services. This means that if a tanning salon charges $100 for a tanning session, it must pay the IRS $10 in excise tax. Similarly, if the company charges $200 for tanning, it must pay a $20 excise tax.

Other types of ad valorem excise taxes include firearms , airline tickets , and heavy trucks . Property taxes can also be considered a type of ad valorem excise tax.

What Is The Purpose Of An Excise Tax

Governments craft tax policies to generate revenue and inspire citizens to take specific actions. Excise taxes fulfill both these goals. They can:

- Fund government initiatives. Like other taxes, an excise tax funds government spending programs.

- Discourage certain behavior. An excise tax, sometimes called a sin tax or a Pigouvian tax, can dissuade or discourage harmful, unhealthy, or socially detrimental behavior. Cigarette taxes and alcohol taxes can be considered Pigouvian taxes.

- Generate income without discouraging consumption. Sales taxes generate revenue, but they also can discourage spending since theyre added to a customers bill at checkout. An excise tax may not have the same effect because its incorporated into a product or services overall cost and doesnt appear as a last-minute add-on. An excise taxs lack of visibility makes it less likely to discourage consumption because customers are often unaware theyre paying it.

Don’t Miss: Is Nursing Home Care Tax Deductible

What Is Excise Tax And How Does It Differ From Sales Tax

There are many forms of taxation in the United States, some collected by the federal government and others by local governments and States. One tax in particular that affects the consumption of specific goods is the excise tax a very specific, often very targeted tax that you pay sometimes without realizing it.

Excise tax differs from sales tax in two fundamental ways. First, it is only on specific goods. Whereas sales tax applies to just about everything you buy , excise taxes are applied to specific goods. The most common examples are luxury goods or those that have been linked to specific health issues like cigarettes, alcohol and tanning salons.

Second, sales tax is a percentage of the sale price. So if you buy a Mercedes S Class, you will pay more sales tax than if you bought a Toyota Corolla. The percentage of tax applied is set by the local government and 45 States in the United States have such a sales tax. Excise tax on the other hand is a flat tax applied before the purchase price for specific items, some of them by states and some by the Federal Government.

What Are Types Of Excise Taxes

Excise taxes are either fixed or proportional: specific or ad valorem taxes, respectively:

- Specific taxes. A specific tax is a fixed dollar amount. Its the same for every purchase of a particular taxable item. Think of fixed fees added to a gallon of car gas, an airline ticket, or a month of mobile network service.

- Ad valorem taxes. Ad valorem taxes are assessed as a purchase price percentage . In many countries, the most common type of ad valorem tax is a value-added tax . This is a tax pre-baked into the cost of a consumer good or service, and it is assessed as a percentage of the items value. A VAT differs from a US-style sales tax because the VAT is included in the items price tag. The consumer doesnt pay additional tax at the point of sale.

Recommended Reading: How To Keep Track Of Miles For Taxes

How To Know What Youre Paying In Excise Tax

Because excise taxes are included in the cost of the goods you buy, its hard to know what you are paying. Additionally, there are some statutory excise taxes as well its why gasoline and cigarettes can vary so much between states. For example, the statutory excise tax on cigarettes in Virginia is $0.30, whereas in the tax in New York is $4.35. That applies to every pack. Statutory gasoline taxes can vary significantly as well.

The best way to know what you are paying is to search for the excise tax as it applies in your state. Federal excise taxes are posted on the IRSs website, whereas each state will make the information available on their website or in documentation. It can vary dramatically, but the items affected will remain the same, allowing you to keep a closer eye on what you are actually paying.

What Is The Difference Between Excise Tax And Sales Tax

Excise taxes and sales are different taxes. Both are applied to the cost of consumer goods and services. However, they vary slightly in function:

- Sales tax is direct. Sales tax is added to the retail price of a product or service. Its paid directly by the consumer and appears as a line item on their bill of sale. While the consumer pays the sales tax, the merchant is responsible for remitting it to the appropriate government agencies.

- Excise tax is indirect. Excise taxes are fees, duties, and tariffs added to the cost of a good or service before it reaches the consumer. For instance, imported steel is taxed when it crosses a border. Manufacturers and retailers then absorb the tariff in the retail price, which the consumer pays indirectly.

Don’t Miss: Can I File Past Years Taxes Online

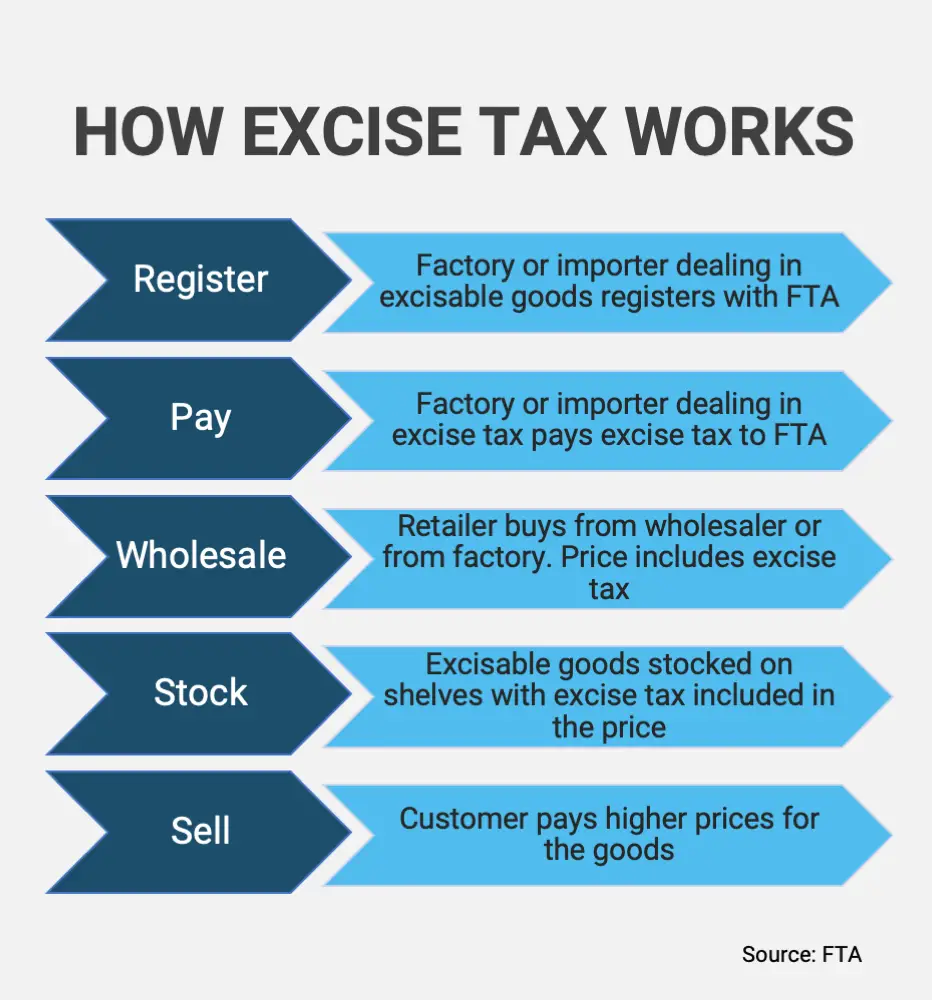

Who Pays The Excise Tax

Excise tax is factored into the cost of the product, rather than listed separately. In most cases, consumers make the excise tax payment without even being aware of it. If your business is required to collect excise tax, youll need to collect it from your customers before making the excise tax payment to the government once per quarter. To do this, youll need to fill out Form 720, Quarterly Federal Excise Tax Return. Its also important to note that on a state-level, there may be additional filing requirements.

What Is The Incidence Of Excise Tax

The incidence of excise tax is the measure of how much of the tax the producer and consumer are responsible for. It is important to note that it often does not matter who officially pays the tax, as the equilibrium outcome is the same.

Incidence of excise tax generally falls unevenly between consumers and producers, as one group bears more of the tax burden than the other. The primary factor in the incidence of excise tax is the price elasticity of supply and the price elasticity of demand.

You May Like: Can I Track My Unemployment Tax Refund

What Is Excise Tax

Excise tax refers to a tax on the sale of an individual unit of a good or service. The vast majority of tax revenue in the United States is generated from excise taxes.

Excise taxes are generally applied to correct the negative externalities generated by the consumption of a unit of the good or service. For example, there are excise taxes levied against gasoline and cigarettes.

Excise Tax: The Ultimate Guide For Small Businesses

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

This article has been reviewed by tax expert Erica Gellerman, CPA.

An excise tax is a tax charged for items that are frequently seen either as socially harmful or as a luxury good or service. Luxury vehicles are subject to excise tax, as are alcohol, gas, airline tickets, indoor tanning and more. Excise tax is sometimes also called a sin tax because its on goods that are considered unhealthy, and it produces billions of dollars in federal and state revenue each year.

» MORE: NerdWallet’s best small-business apps

Excise tax is thought to help decrease the use of potentially harmful products and services that are taxed at a higher rate than other non-harmful products or services might be. In fact, experts concluded that an increase in excise taxes and prices of tobacco products helped reduce overall tobacco consumption, according to a study by the International Agency for Research on Cancer.

Items that incur an excise tax include :

Recommended Reading: How To Estimate Income Tax

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Does The Money Raised By Federal Excise Taxes Pay For

The federal government collects all this money and deposits about 40% of it into its general fund. Taxes on alcohol, tobacco products, indoor tanning, and health insurance are a few of the taxes that go to the general fund. The other roughly 60% goes toward trust funds dedicated to paying for transportation, including highway and airport improvements and maintenance, and health-related spending.

Recommended Reading: How Long To Keep Business Tax Returns

Enforcement Of Excise Tax

The Internal Revenue Service is responsible for collecting federal excise taxes, which amount to about $70 billion in revenue each year. Avoiding excise taxes is a federal crime, and the IRS is authorized to investigate and prosecute people who fraudulently avoid payment of excise taxes. In the case of a corporation dodging these taxes, the IRS may sue the company, and if any of the corporate officers are found to have intentionally committed the fraud, they may be held criminally liable.

On another front, the Bureau of Alcohol, Tobacco, Firearms and Explosives, commonly known as the ATF, is tasked with regulating the manufacture, sale, and transportation of alcohol, tobacco, firearms, and explosives. This includes ensuring these items are not transferred or sold in such a manner as to avoid paying excise taxes.

A major goal of the ATFs enforcement programs is to target organized criminal enterprises engaged in interstate trade in its controlled goods. This is an important endeavor, as such enterprises are often responsible for violent crime, and in introducing a variety of contraband items into the U.S. commerce stream. This stemming of illegal trafficking in alcohol and tobacco products, seeks to apprehend and prosecute those who avoid payment of excise taxes.

As of January, 2003, another federal agency, the Alcohol and Tobacco Tax & Trade Bureau , a division of the U.S. Department of the Treasury, is responsible for: