Claiming A Late Refund

You have three years to claim a tax refund in most cases. The three-year period begins with the tax years original filing deadline. The IRS cant send you a refund after that period has expired.

A refund for tax year 2021 would expire on April 18, 2025, three years past the original tax day deadline of April 18, 2022.

Failure To Report Federal Changes

When a taxpayer fails to report federal changes within six months from the date the taxpayer is notified by the Internal Revenue Service of the correction or final determination, the taxpayer is subject to the failure to file penalty and forfeits the right to any refund as the result of the federal changes. The failure to file penalty begins at the expiration of the six-month period.

Can I Still File My Taxes After The Deadline

Yes, you can still file after the deadline. However, you will incur two penalties. The IRS levies a failure-to-file penalty, which is 5% of unpaid taxes every month, and an inability to pay penalty, which amounts to .5% of total delinquent taxes.

As you can see, paying taxes late is actually cheaper than filing taxes late. A good way to save money from penalties is to ask the IRS to give you a tax extension. You can easily register for an extension with their e-file system. The IRS has tax extension guidelines for those who want to file for an extended filing period. Tax filing extension is usually six months. The extension goes a bit beyond that for the likes of military personnel in active duty.

Also Check: Can I File Taxes On Unemployment

What To Do If Youre Filing Your Taxes Late

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Persuading the IRS to give you more time after the tax-filing deadline to file your tax return is fairly easy. But there are several other things youll need to do if youre filing taxes late.

Dont Miss: Tsc-ind

Dont Fall Back On A Tax Extension

So say youve prepared your tax return and see that you owe money you cant pay. Your first inclination might be to request an extension and push your personal filing deadline all the way back to October. Its a good idea in theory, but what you need to realize is that tax extensions simply give you more time to file your return they dont actually buy you extra time to pay your tax debt. This means that if you file an extension by April 17 but dont pay your tax bill by then, youll start to accrue the aforementioned late payment penalties. You will, however, avoid the failure to file penalty thats far more substantial than the penalty for being late with your payments.

Recommended Reading: Donating Plasma Taxes

Read Also: Are Health Insurance Premiums Tax Deductible For Retirees

Does The Irs Offer Payment Plans

If you cannot pay the full balance and you owe less than $25,000, then the IRS will allow you to use an installment plan. However, you cant continuously use these plans. You only get automatic approval if you and your spouse havent used one in the past five years.

Another option is to ask for an Offer in Compromise. An Offer in Compromise is a settlement offer agreed upon between you and the IRS. To qualify, you must file all outstanding returns and be able to make a reasonable payment towards your tax bill.

As you can see, the IRS has multiple avenues available to help taxpayers manage their payments at a cost. Its always in your interest to engage with the IRS. Ignoring their letters or waiting too long can land you in hot water. When you dont agree to negotiate, the IRS takes the reins, and you no longer have much say in the matter.

Prepare To Pay A Tax Penalty Too

The IRSs late-payment penalty normally is 0.5% per month of the outstanding tax not paid by the tax-filing deadline. The maximum penalty is 25%.

You might catch a break on the penalty if youve paid at least 90% of your actual tax liability by the tax-filing deadline and you pay the rest with your return. The IRS also might let you off the hook if you can show reasonable cause for why you didnt pay on time though youll need to attach a written statement to your return.

» MORE: How to get rid of your back taxes

You May Like: How Much Does Illinois Take Out For Taxes

Penalties For Filing And/or Paying Late

As it turns out, the penalty for failure to file is much steeper than the penalty for a late payment. Thus, if you cant afford the amount due, you should still file your return in a timely manner and then explore alternative payment options.

To be a bit more specific, the penalty for late payment is typically 0.5% of your unpaid taxes per month after the deadline that your taxes go unpaid. This penalty can wind up being as much as 25% of your total amount due, so dont let it slide any longer than absolutely necessary.

In contrast, the penalty for filing your return late is typically a whopping 5% of your unpaid taxes per month after the deadline that they receive your return, topping out at 25%. And if you file more than 60 days late, the minimum penalty is the smaller of $135 or 100% of the taxes that you owe.

Keep in mind that, as long as you request an extension and pay in at least 90% of your actual tax liability by the original due date , youll avoid any underpayment penalties as long as the balance if paid no later than the extended due date.

Ways To File Your 2021 Tax Return

The IRS says that taxpayers can file and schedule their federal tax payments online, by phone or with the mobile IRS2Go app.

If you need to find a tax software service to use, and you make $72,000 or less, you can find an IRS-approved free filing service easily. Youll need to gather the following information: income statements any adjustments to your income your current filing status and dependent information. If you make more than $72,000, you can use the Free File Fillable Form.

If you havent already made a tax payment, the IRS prefers that payments be made electronically, and offers a variety of ways to do so, including IRS Direct Pay, which is directly linked to a checking or savings account. Another option is by credit card using the mobile IRS2Go app, or through the Electronic Federal Tax Payment System.

Also Check: What Does Tax Exempt Mean

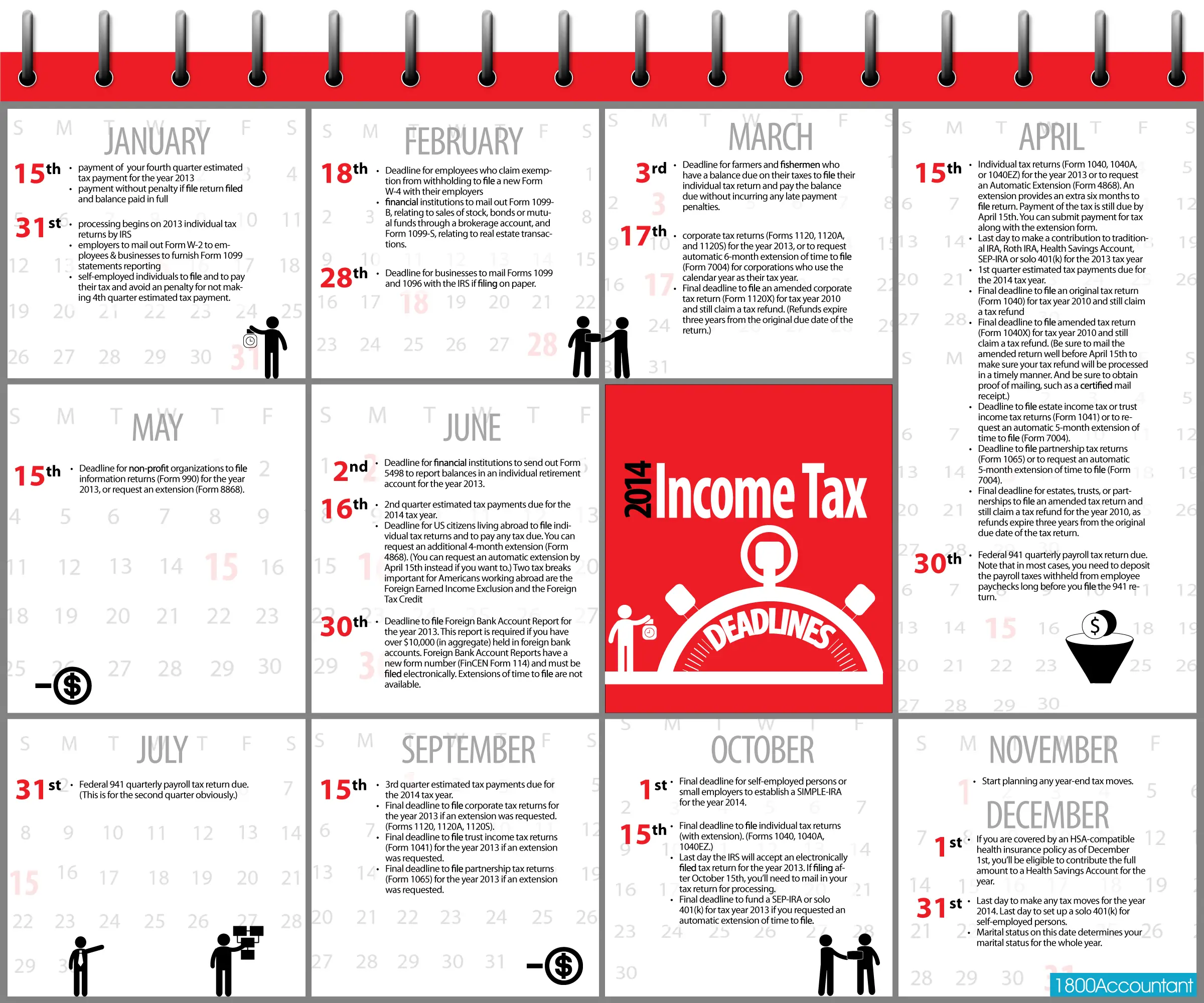

Can You File For An Extension

If you think theres a chance that you might miss the tax-filing deadline, you should file for a deadline extension. This will automatically give you until , to file your taxes. However, you must file an extension before April 18. If you wait until after this date, it will be too late to receive an extension.

To file for an extension, complete IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Note that while filing for an extension will give you more time to file your federal tax return, it does not give you more time to pay your taxes if payments are due. If you think you might owe taxes this year instead of receiving a refund, you should estimate how much youll owe and send this amount in with Form 4868.

Read More:How to File for a Tax Extension

How To File For An Extension

You can successfully apply for a tax extension correctly by filling out the IRS Tax Form 7004 or IRS Tax Form 4868 . You can sign up for any reason whatsoever, and the organization can automatically compromise with you.

Sending an application for an extension of your tax return can be beneficial. Heres why you need to apply for a tax renewal:

- It gives you more time to fill out your taxes perfectly: When a new year begins, the tax season begins, and everyone can feel like they are filing their taxes on time. Applying for an extension not only relieves the stress of submitting on time but also gives you time to organize your paperwork. You also have the option of working with an accountant when they can focus more on you and your needs, rather than trying to handle hundreds of clients and all taxes on time. This is an excellent option for self-employed people.

- It saves you a lot of money: Most tax preparers maintain a higher tax rate during the tax season and raise it further during the deadline week. They tend to lower prices significantly in late spring and summer. By filing a tax return with your accountant at this point, you will pay much less. Tax extensions give you additional time to make various choices on your tax return and receive a tax refund when you submit it after the extended deadline.

Also Check: When Will The First Tax Refunds Be Issued 2021

You May Like: When Is An Ira Taxed

Can I File For An Extension Of Time To Pay My Tax Bill

- The IRS must receive your Form 1127 on or before the date your tax is due.

- Youre required to provide a comprehensive statement of all your assets and liabilities at the end of the month. You must also provide an itemized list of money received and spent for the three months preceding your request for an extension to pay.

- You must be able to show that paying the tax by the deadline would cause undue financial hardship.

- You must be able to demonstrate that paying your tax debt would cause undue financial loss and prove that you dont have the means to raise the money through borrowing or selling property.

What If You Are Owed A Refund

If someone is owed a refund, there’s generally no penalty for claiming it late but you only have a three-year time limit to collect it.

“If you wait too long to file a refund return, you lose the refund,” noted Nina Olson, founder of the Center for Taxpayer Rights and the former National Taxpayer Advocate. “So, even if you had a refund from one year that you could apply to another , if you wait too long to file that return, you won’t have that refund to apply to the back-tax debt.”

Don’t Miss: Who Qualifies For The Premium Tax Credit

What Happens If You File Or Pay Your Taxes Late

So what happens if you fail to make that deadline? Even by just a day?

It depends on whether you file late or pay late or both. It makes a difference.

Taxes are owed by the deadline regardless of when you file, even if you get an extension. So if you file your taxes on time, but dont pay the taxes that you owe on time, youre accruing interest and penalties.

That said, if the IRS owes you money, it wont charge you a penalty other than the fact that it has your money. If you file your taxes late, that delays when you can get your refund. Youre also missing out on other money you might be eligible to receive, such as the Earned Income Tax Credit or a Premium Tax Credit. And heres a nuance if you hold a security clearance, failure to file your taxes even if youre owed a refund could lose it.

Its true that if your income is low enough, you may not need to file a return.

How Much Money Will I Owe For Filing Taxes For My Tax Year Late

If you file your taxes late or are subject to late filing, you wont just receive a friendly reminder email. Its called a Failure to File penalty, and it can be a doozy, especially if you have a large amount of tax owing. This amount is a percentage of the taxes you would have owed if you filed on time and how late you filed your taxes.

In each case, when you miss the tax filing deadline, you still have to pay taxes. In this case, you should talk directly to the internal revenue service or contact a tax professional to ensure you get a tax extension or a reduction in your penalty amount.If youve since filed an extension of your due date and you still didnt file in time, that time factor counts from the original filing date not the extended one.

Also Check: How Much To Withhold For Self Employment Taxes

What Happens If I File My Taxes Late

I have a distinct memory of driving to the post office with my mom when I was about 9 years old. I remember it well as I was allowed to stay up late that night and my mother was in a bit of a panic, something Id rarely seen. It was April 30th.

In those days, we didnt have the option to Netfile. That tax return had to be stamped as received by Canada Post by midnight or else. I didnt learn exactly what that meant until many years later but not much has changed since then. Heres the 2020 version of or else.

I Cant Pay My Tax Debt In Full What Are My Options

- Pay with a credit card: If you dont have the money to pay for your tax debt currently, you can choose to put in on a credit card. At its core, this is essentially trading one debt for another, but choosing the right credit company could help you pay less in the long run, as you can likely qualify for an interest rate that costs less than the penalties the IRS will enforce.

- Offer in Compromise: If its apparent that youll never be able to pay your total tax debt, the IRS may agree to an Offer in Compromise . This solution requires the taxpayer to come up with a new balance if the IRS agrees to this offer, the remainder of your balance is forgiven.

- Installment Agreements: If you cant currently pay off your tax debt in full and would like to receive more time, the IRS may approve your request for an installment agreement.

- Filing for Bankruptcy: This is typically a last-ditch effort for taxpayers in difficult financial straits and should only be considered as a last resort.

Recommended Reading: When To Expect My Tax Refund 2021

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Youll Likely Face A Penalty If You Owe Tax And File Your Return Even One Day Late

If you file your federal return even one day after the tax deadline and you owe tax, you will usually be hit with a penalty, according to H& R Block. In a help article about the failure-to-file penalty, the IRS says that it charges 5 percent of your unpaid taxes for each full or partial month that your tax return is late, up to 25 percent of your unpaid taxes.

Youre also subject to the failure-to-pay penalty if you dont pay the taxes you owe by the tax deadline, as the IRS explains in a separate article. That penalty is 0.5 percent of your unpaid taxes for each full or partial month that your tax payment is late, up to 25 percent of your unpaid taxes.

And for months in which both penalties apply, the failure-to-file penalty will be reduced by the amount of the failure-to-pay penalty from that month. For example, youll be charged 4.5 percent of your unpaid tax for the failure-to-file penalty and 0.5 percent for the failure-to-pay penalty for a combined penalty of 5 percent.

The IRS says that it will send you a notice or letter if either penalty applies to you. And bear in mind that the agency says it charges interest on its penalties, adding to your total bill. That said, the IRS does offer penalty relief, for which you may qualify if you made an effort to comply with the requirements of the law, but were unable to meet your tax obligations due to circumstances beyond your control.

You May Like: How Early Can You File Taxes 2021