Reducing The Chance Of An Audit When Filing

There is no sure-fire way to audit-proof your tax return, though you can cut the odds. Nevertheless, a messy returncross-outs, sloppy handwriting, smudgesalmost screams audit me. This tells the IRS that you are careless and disorganized. So does the use of round numbers for deductions$1,000 or $12,000 instead of $978 or $12,127. Its an indication that you are estimating things rather than keeping good records.

Here are some suggestions which mayor may notwork to reduce your audit risk:

How Many Years Can You File Back Taxes

The IRS wants all taxpayers to file a tax return for every year. This means that you could file a tax return for any previous year. But the first step you should take in getting caught up is making sure you at least have the previous 6 years of tax returns filed and paid. This will officially put you back in good standing with the IRS.

What Happens If You Dont File Your Tax Return In Canada

Most Canadians have to file a tax return every year. However, many Canadians are late in filing their tax returns for various reasons people:

- Dont suspect that they will owe, so they dont file

- Know they will fall into debt and have no money to pay back

- mistakenly believe that if they do not report, they will not be detected and will not have to pay

- Have lost records or receipts and have no idea what they earned and cant prove or estimate what their costs were

- find that dealing with a late tax return is so overwhelming once it has already happened that they think if they avoid it, it will eventually go away

You may ask yourself what happens if you dont file your taxes in Canada or if you file your taxes late. These two situations are different and the penalties for each are different. Failure to file your taxes when required can be considered a criminal offense, so it is essential to file your returns, even if they are late and cannot afford to pay your taxes.

Also Check: Are Home Improvements Tax Deductible

Apply For An Irs Payment Plan

If youâre not able to pay off your taxes in full right away, itâs always best to start paying what you can.

To pull that off, set up an IRS payment plan. These plans come with multiple payment options, including short-term payment and monthly installment agreements.You can even pay by credit card.

Having one of these plans will halt possible penalties and additional interest. Best of all, it wonât cost you any future refunds or affect your credit score â meaning you wonât have any issues when it comes to obtaining loans.

Here’s an important thing to keep in mind: there are fees for setting up a payment plan. However, these are waived if your plan is less than 120 days, or if youâre considered low income.

If You Owe Pay As Much As You Can To Reduce Penalties

Although thereâs no penalty for submitting your taxes late when youâre expecting a refund, the IRS may assess penalties if you owe taxes.

Even if you miss the tax deadline, you should pay as much as possible as soon as you can. Taking this step can reduce any interest or penalties on your tax account, such as the Failure to File or Failure to Pay Penalty.

If you file your tax return late, the IRS may assess the Failure to File Penalty for failing to pay unpaid tax due on the original due date . Unpaid tax is the tax required to be reported on your return less any withholding, estimated tax payments, and refundable credits.

The IRS calculates the Failure to File Penalty as 5% of the unpaid taxes for each month that the tax return is late. However, the penalty wonât exceed 25% of your unpaid taxes.

You may also be assessed a Failure to Pay Penalty if you fail to pay taxes you report on your return by the original due date or an approved extended deadline, such as a federally declared disaster. Taxes that remain unpaid for a month will be assessed a Failure to Pay Penalty of 0.5% per month.

In months where both the Failure to File and Failure to Pay penalties apply, the Failure to File penalty will be reduced by 0.5% . So instead of a 5% Failure to File Penalty for the month, youâll be charged a 4.5%.

To get a better understanding of how penalties may affect your account, speak to a tax professional to determine which penalties may apply to your tax situation.

Don’t Miss: How Much Is H& r Block For Taxes

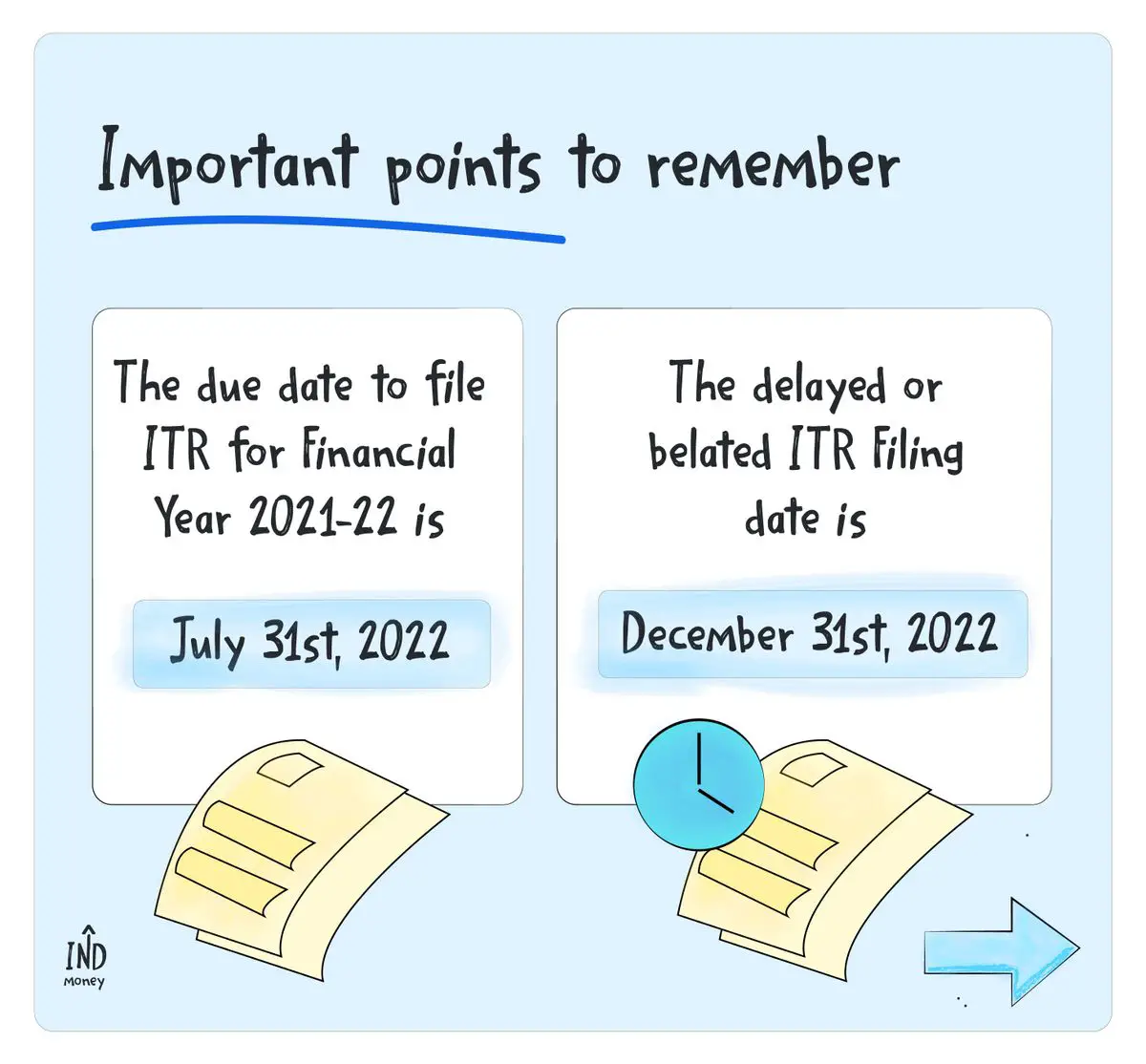

Deadline For Filing Your Tax Return

Meeting the statutory filing deadlines is a basic obligation of every taxpayer. The deadline for filing the German tax return is 31 July of the following calendar year. This deadline for the year 2021 has been exceptionally moved to 31 October, due to special circumstances surrounding COVID19 pandemic. If you fail to comply with this obligation or if you do not file your tax return by the deadline, the German tax authorities may impose a financial penalty.

Whats The Penalty For Filing Taxes Late

The first thing that happens if you file taxes late is youâll start accruing penalties and interest for not filing on or before Tax Day. This penalty and interest are 5% of any tax money you owe the IRS added onto what you owe, per month.

Unpaid taxes also accrue a late penalty and interest. Late payments have a 0.5% penalty for not paying your taxes on time. Both penalty interests cap at 25%.

The longer you are late in filing taxes and paying your tax bill, the more these penalty fees will grow. So, itâs important that you waste no extra time and file your tax return and pay the taxes you owe as soon as possible. These accumulating fees on the taxes you owe are the primary downside to what happens if you file taxes late.

Recommended Reading: Do You Pay Taxes On Life Insurance Payment

How You Can Avoid Or Minimize Penalties

You can skip all IRS late-filing and late-payment penalties completely by filing and paying your tax balance due on time. While thatâs the obvious goal, we all know sometimes life just gets in the way.

If youâre doing your best to catch up, and you just didnât get there before the deadline, consider a few ways to minimize your tax penalties.

-

File an extension. If the April deadline hasnât yet passed, file for a tax extension and use those extra six months to get your finances caught up and organized for filing. Remember that an extension gives you more time for filingânot payment. Payment is still due by April 18. If youâve already missed the deadline, you no longer have the option to file for an extension.

-

File your taxes even if you canât pay them yet. The penalty for missing federal tax filing is larger than the penalty for missing the payment. File your income tax return with the IRS and avoid the larger of the two penalties. There are many ways to sort out how to pay your taxes.

-

Get help to file as quickly as possible. If you missed the deadline, penalties are creeping up every month. File as soon as possible, even if it means paying for help from a tax professional to sort out the numbers and get your tax forms prepared. The cost of bookkeeping and working with a tax agent may be far less than the increasing penalties for leaving your business income taxes unpaid.

What If You Didnt Ask For An Extension

If you dont file your tax return on time and dont ask for an extension, the consequences will depend on whether youre getting a refund or owe money to the IRS. If youre getting a refund, there are no consequences to filing your federal return late and not asking for an extension .

But if you owe the IRS money and dont ask for an extension, you will be subject to a late filing penalty of 5% of the unpaid tax per month, plus interest, up to a maximum of 25%.

And remember that if you fail to file a tax return indefinitely, there is no statute of limitations on how far back the IRS can go to collect past-due taxes.

You May Like: Where Do I Find Tax Id Number

What If You Do Not File A Return You Pay Late Or Are Charged With Tax Evasion

Normally, if you do not file a tax return and are required to, or if you make false statements in completing your tax return, or if you leave out important information so that you under report your income, the Income Tax Act imposes penalties. In circumstances of willful fraud or tax evasion you may be criminally prosecuted.

Dont Miss: Where Do I Find My Agi On My Tax Return

Finding A Tax Professional

You dont have to handle this yourself. Just like you may take your car to a mechanic to be serviced, or hire a lawn service to mow the grass, you can turn to professionals. The IRS has a lot more details on this.

In fact, in some cases, they might even be free. The IRS offers a service called IRS Free File which, just like the name says, helps you file your taxes for free. If your adjusted gross income is $73,000 or less, it hooks you up with an IRS partner if your AGI is more than $73,000, it gives you the online equivalent of the basic 1040 form. It doesnt give you any guidance, however. IRS Free File can be used only for the current tax year.

Even if services are not free, you may find that the amount of money they save you in preparing your taxes might pay for itself, or even more. Remember, theyre professionals.

These days, professionals can also mean computer software, running either on your own computer or in the cloud. You give the software all the information, and it knows what exemptions and deductions youre eligible for. Just be sure that you update your software each year so it has the most current information.

Other services let you come in and work with people in person. This time of year, theyre easy to spot theyre the businesses featuring people dressed up as the Statue of Liberty holding a sign and dancing, or an inflatable character, in front of the office. Just bring in your shoebox of receipts and forms and they can help you out.

Don’t Miss: What Is The Sales Tax In Kansas

How We Calculate The Penalty

We calculate the Failure to File Penalty based on how late you file your tax return and the amount of unpaid tax as of the original payment due date . Unpaid tax is the total tax required to be shown on your return minus amounts paid through withholding, estimated tax payments and allowed refundable credits.

We calculate the Failure to File Penalty in this way:

- The Failure to File Penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won’t exceed 25% of your unpaid taxes.

- If both a Failure to File and a Failure to Pay Penalty are applied in the same month, the Failure to File Penalty is reduced by the amount of the Failure to Pay Penalty for that month, for a combined penalty of 5% for each month or part of a month that your return was late.

- If after 5 months you still haven’t paid, the Failure to File Penalty will max out, but the Failure to Pay Penalty continues until the tax is paid, up to its maximum of 25% of the unpaid tax as of the due date.

- If your return was over 60 days late, the minimum Failure to File Penalty is $435 or 100% of the tax required to be shown on the return, whichever is less.

How Long Must You Worry About Not Filing A Tax Return

The tax code sets out time limits, or statutes of limitations, for the IRS to pursue nonfilers.

Criminal. The government can only bring criminal charges against a nonfiler within six years of the date the tax return was due. For example, after April 15, 2007, you cant be prosecuted for failing to file a 2000 tax return that was due on April 15, 2001.

Civil. There is no deadline, however, on the IRS for going after nonfilers and imposing civil penaltiesin addition to any taxes owed. This means that while you cant be put in jail for not filing a 1988 tax return, you will forever owe the IRS a returnas long as you earned enough to have had an obligation to file. And finespenalties and intereston unfiled tax returns run forever.

IRS policy. Dont worry too much about that missed tax return after six years. The IRS usually doesnt pursue nonfilers after six years from the filing due date. The IRS materials on Taxpayer Delinquency Investigations read as follows:

The IRS can still request a tax return for a period more than six years ago. But if you tell the IRS that you dont have enough information to prepare a return, the agency usually will drop the request. If the IRS computer shows income information on you, such as a W-2 or 1099 form, however, the IRS may calculate and assess the tax anyway.

Read Also: How To Determine Tax Liability

A Word About Aggressive Tax Filing

A question I am often asked is, What deductions and tax benefits can I safely take, and which ones are risky? The best answer is that it depends on your personality. Are you very conservative? Or are you a risk-taker by nature? Most people have at least a little of each trait in their personality. In the end, go with your comfort level.

Aggressive tax filing means interpreting the gray areas of the law in your favorand taking the chance that you will either not be audited or survive if you are. It doesnt mean making up numbers. You may want to peruse Chapter 3 first to find out what happens at an audit if you cross the line.

Tax professional litmus test. I have never met two tax professionals who agreed on the meaning of aggressive. Find out how aggressive your tax adviser is by asking her opinion on deducting something. For instance, if you are self-employed, ask her about deducting business lunch expenses, a combined business and pleasure trip, or health club dues. Or, if you have investment income, ask her about financial publication expenses and trips to check out investments.

How the tax adviser responds clues you into how aggressive or timid she is. If she repeatedly says you cant do that, instead of offering advice on how to make that expense deductible, then she may be too government oriented. At the other extreme, if she says not to worry, deduct anything you want because chances are you wont be audited, she could get you into trouble.

Example:

Caution

Tip

Can You File For An Extension

If you think theres a chance that you might miss the tax-filing deadline, you should file for a deadline extension. This will automatically give you until , to file your taxes. However, you must file an extension before April 18. If you wait until after this date, it will be too late to receive an extension.

To file for an extension, complete IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Note that while filing for an extension will give you more time to file your federal tax return, it does not give you more time to pay your taxes if payments are due. If you think you might owe taxes this year instead of receiving a refund, you should estimate how much youll owe and send this amount in with Form 4868.

Read More:How to File for a Tax Extension

Don’t Miss: Can You Refile Your Taxes From Previous Years

Dont Miss Mondays Tax Extension Deadline

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

This year, the IRS received about 19 million requests for tax extensions.

A tax extension gives you more time to file your tax return until Oct. 17 for the 2021 tax year. It’s not an extension of time to pay your taxes those were still due in April. Heres more about how the tax extension deadline works.

How To File Taxes After The Deadline

First of all, take a deep breath. Dealing with the IRS might not make you want to do a happy dance, but when it comes to your taxes, itâs always better to face the music.

Missing a deadline isnât the end of the world, but the sooner you can get back on top of things, the better. If you haven’t file taxes in a few years, things can really balloon.

Read Also: How To Get Tax Deductions

The Ugly News: Garnished Wages Increased Penalties

Eventually, the IRS will issue a notice that it intends to seize property to satisfy the bill. Ten days after that, the penalty rate increases to 1%.

If you filed for an extension and missed that deadline, the penalty jumps to 5%.

Eventually, the IRS will also likely garnish your wages to pay off your tax bill. This means that the IRS will take the money you owe directly out of your paycheck before it reaches you.

The IRS will get the money you oweand potentially a lot more of your money through interest and penalties.

Theres no benefit to filing late. Your best move is to file and figure out the payment later.

Read Also: Tax Free Weekend In Massachusetts