When You Cant Claim Interest On A Heloc

One of the advantages of a HELOCcompared to other types of loans is that you can use the funds for just about any purpose including starting a business, paying for college, refinancing other high-interest debts or making big-ticket purchases.

But the interest you pay on a HELOC isnt deductible in all circumstances. Using the HELOC funds for anything other than buying, building or substantially improving your home renders the interest nondeductible. This means you cant deduct HELOC interest if you use the funds to pay for a wedding or vacation or refinance other debts.

If youre considering a cash-out refinance instead of a HELOC, Credible makes it easy to compare rates in minutes.

How Do I Calculate The Home Office Tax Deduction

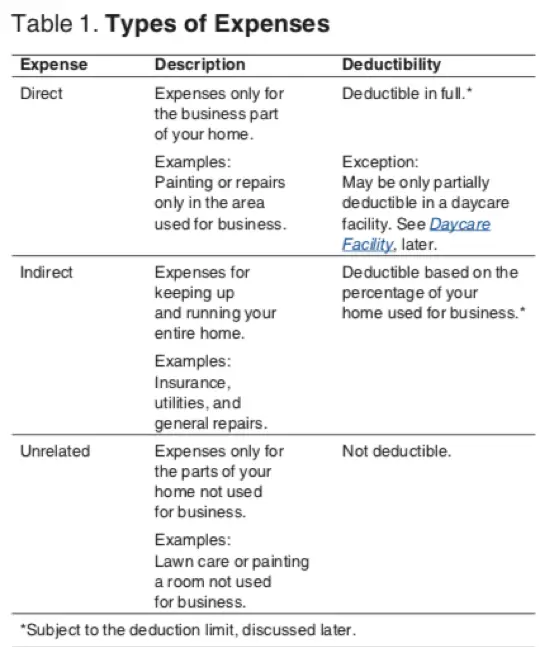

Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation.

The most exact way to calculate the business percentage of your house is to measure the square footage devoted to your home office as a percentage of the total area of your home. If the office measures 150 square feet, for example, and the total area of the house is 1,200 square feet, your business percentage would be 12.5%.

An easier calculation is acceptable if the rooms in your home are all about the same size. In that case, you can figure out the business percentage by dividing the number of rooms used in your business by the total number of rooms in the house.

Special rules apply if you qualify for home office deductions under the day care exception to the exclusive-use test.

- Your business-use percentage must be reduced because the space is available for personal use part of the time.

- To do that, you compare the number of hours the child care business is operated, including preparation and cleanup time, to the total number of hours in the year .

Assume you use 40% of your house for a daycare business that operates 12 hours a day, five days a week for 50 weeks of the year.

- 12 hours x 5 days x 50 weeks = 3,000 hours per year.

- 3,000 hours ÷ 8,760 total hours in the year = 0.34 of available hours.

- 34% of available hours x 40% of the house used for business = 13.6% business write-off percentage.

Can I Claim My Internet Bill On My Taxes

Since an Internet connection is technically a necessity if you work at home, you can deduct some or even all of the expense when it comes time for taxes. You’ll enter the deductible expense as part of your home office expenses. Your Internet expenses are only deductible if you use them specifically for work purposes.

Don’t Miss: When Can I Expect My Unemployment Tax Refund

Can You Claim Car Insurance On Taxes

Car insurance is tax deductible as part of a list of expenses for certain individuals. Generally, people who are self-employed can deduct car insurance, but there are a few other specific individuals for whom car insurance is tax deductible, such as for armed forces reservists or qualified performing artists.

Can you write off car insurance?

How Much Can I Claim For Phone Expenses

Can I include the cost of buying my phone in my phone expenses? If you purchased a phone outright that you use partly for work, you can claim a percentage of the purchase price. If the phone was below $300 you can claim the business percentage of that amount as a one-off tax deduction.

Can you write off groceries on your taxes?

Any groceries which you have purchased for personal consumption or use cannot be claimed as a tax deduction. One of the only exceptions to this rule is if the groceries were purchased as part of a medical prescription.

Read Also: Do Retirees Have To File Taxes

How To Claim The Home Office Deduction On Your Taxes

Because of the unique nature of this write-off, the home office deduction has its own form . This is Form 8829, âExpenses for Business Use of Your Home.â

Youâll fill out this form if you use the actual method. If youâre choosing the simplified method, you can just claim your home office on Schedule C.

Note that you can use as many of these forms as you need. If you lived in three different places during the year and had three different home offices, youâd complete three separate 8829s â one for each office and corresponding expenses.

Hereâs how to claim your deduction. Weâll follow along with a taxpayer called Regular Joe as he fills out his forms.

How To Claim Work

If youre still reading, that must mean youre self-employed and can claim work-from-home tax deductions. If thats the case, youre going to have to fill out a Schedule C. This form lists profit or loss from business, and its where you can deduct all of your business expenses. Hopefully your deductions will add up to a nice little chunk of change!

Recommended Reading: How To Get Tax Form From Unemployment

Work From Home Make Sure You Claim These Expenses

If you use your home for business whether youre a contractor, sole trader, in partnership or own a company you can claim a portion of household expenses. You can claim 100% of expenses that are solely for business purposes, eg a business phone line. For the rest, you can claim the proportion of your house that you use for work.

In this example, the house is 100 square metres and the office 10 square metres 10% of the total area. So the owner can claim 10% of expenses not solely for business, eg a power bill. Whatever you claim, remember to keep a record of each item.

- Landline phone costs:

- 50% if thats how much you use for business purposes.

- 100% if its for business use only.

Will I Get Audited By The Irs If I Take The Home Office Deduction

It is a common belief that claiming the home office deduction will automatically trigger an IRS audit however, while the IRS rules about home office deductions are very strict, it’s not automatic that you will get audited simply for claiming your home office. There are measures you can take to reduce your chances of getting audited.

Before taking the home office deduction, youll want to make sure your business qualifies to avoid claiming any deductions you arent eligible for. Maintain records of all your business expenses and purchases, and ensure that your residence, home office usage and type of employment qualify for this expense.

The IRS has an automated system that helps detect red flags. The system will compare your tax situation and deductions to others in your industry. If you claim something that others in your profession dont generally claim, the system may see that as a red flag, which could lead the IRS to investigate.

Additionally, the system will flag those who claim too much space for a home office. An example of this would be claiming your office space takes up 80% of your residence, as opposed to most people in your profession claiming their home office uses 10% of their residence. The IRS could see this as a discrepancy and conduct an audit.

Regardless, if you do decide to take the home office deduction, it’s essential to follow the IRS guidelines to the letter, as they change somewhat frequently.

Don’t Miss: How To Pay Ky State Taxes

Capital Gain Exclusion When Selling Your Home

The IRS has a special gift for you when you sell your home: You probably won’t have to pay taxes on all or part of the gain from the sale. Your home is considered a capital asset. Normally, you have to pay capital gains tax when you sell a capital asset for a profit. However, if you’re married and file a joint return, you don’t have to pay tax on up to $500,000 of the gain from the sale of your home if you owned the home for at least two of the past five years, lived in the home for at least two of the past five years, and haven’t used this exclusion to shelter gain from a home sale in the last two years. So, for example, if you bought your home five years ago for $600,000 and sold it for $700,000, you won’t pay any tax on the $100,000 gain if all the exclusion requirements are satisfied. Any profit over the $500,000 or $250,000 exclusion amount is reported as capital gains on Schedule D .

Caution: When you sell your home, you might have to pay back any depreciation you claimed for a business use of your home, first-time homebuyer credits if you purchased your home in 2008, or any federal mortgage subsidies you received.

Home Equity Loan Interest

A home equity loan is essentially a second mortgage on your house. With a home equity loan, you can access the equity youve built in your home as collateral to borrow funds that you need for other purposes.

Like regular mortgage interest, you can deduct the interest youve paid on home equity loans and home equity lines of credit. However, you can only make this deduction if you used the borrowed funds to pay for a home improvement. Prior to the Tax Cuts and Jobs Act of 2017, you could deduct the interest on these loans regardless of how you spent the funds.

You May Like: How Much Do I Need To Make To File Taxes

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

How To Calculate Your Home Office Deduction

If you have too much self-employment income â- a good problem to have! â your home office deduction is a great way to lower self-employment taxes.

There are two ways to claim it. You can either:

- Write off a portion your actual home expenses

- Claim a fixed rate using the simplified option

Letâs look at the two options in more detail:

Read Also: How Can I Find My Previous Tax Returns

Illegal Tax Avoidance Schemes

Also, we want to touch on a tax avoidance scheme relatedto home-based businesses.

Most taxpayers with home-based businesses accurately reporttheir income and expenses while stillenjoying the benefits that a home-basedbusiness can offer. However,some individuals have received advicethat they can operate any kind of unprofitable businessout of their home and then claim personalexpenses as business expenses.

No matter how convincing any informationyou read about this might be,non-deductible personal living expenses cannot betransformed into deductible business expenses.

We encourage you to go to www.irs.govfor more information on how to avoid these types of schemes.

Tax Deductions For Medical Expenses

The IRS allows a deduction for medical expensesbut only for the portion of expenses that exceed 7.5% of your AGI. So if your AGI is $50,000, you can only deduct the portion of your medical expenses that total over $3,750. If your insurance company reimburses you for any part of your expenses, that amount cannot be deducted. If insurance reimburses you in a future tax year for any portion of expenses claimed in the current year, you will need to add the reimbursement as income in the future year.

A portion of the money you pay for long-term care insurance can also minimize your tax burden. Long-term care insurance is a deductible medical expense, and the IRS lets you deduct an increasing portion of your premium as you get older, but only if the insurance is not subsidized by your employer or your spouses employer.

Another benefit is that you can deduct transportation and travel costs related to medical care, which means you can write off any bus, car expenses , tolls, parking, and lodging as long as the total exceeds the 7.5% limit for 2021. Keep in mind that you can only deduct up to $50 per person per night of lodging .

Contributions to health savings accounts are tax-deductible. If you have a high-deductible health plan , you can contribute up to $3,600 to an HSA in 2021 . In 2022, the limits rise to $3,650 and $7,300, respectively.

Also Check: How Much Taxes You Pay On Stocks

Can I Write Off My Internet Bill If I Work From Home

Since an Internet connection is technically a necessity if you work at home, you can deduct some or even all of the expense when it comes time for taxes. You’ll enter the deductible expense as part of your home office expenses. Your Internet expenses are only deductible if you use them specifically for work purposes.

Tips For Managing Your Finances During Tax Season

- A financial advisor can be a key resource in helping you figure out your taxes. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you dont know whether youre better off with the standard deduction versus itemized, you might want to read up on it and do some math. You could save a significant amount of money by educating yourself before the tax return deadline.

- SmartAsset has you covered with a number of free online tax resources to help you during tax season. Check out our income tax calculator and get started today.

Also Check: How To Cash Out Bitcoins Without Paying Taxes

Tax Deductions For Charitable Donations

You donated your skinny jeans and wagon-wheel coffee table to Goodwill, which, in turn, reduces your taxes by increasing your charitable deductions. The IRS requires that you provide a qualified appraisal of the item or group of items if you claim a deduction of more than $5,000 per item (or a group of similar items. For items such as electronics, appliances, and furniture, you may need to pay a professional to assess the value of your donation.

For the 2021 tax year, you can deduct up to $300 in cash donations made to qualifying charities, even if you take the standard donation. This is called an above-the-line deduction.

If you itemize, you can usually write off up to 20% to 60% of your adjusted gross income for charitable contributionsthe amount varies depending on the type of contribution and the type of charity. For 2021, however, you can deduct up to 100% of your AGI for cash contributions to qualifying charitable organizations.

The 100% limit on cash contributions is not automatic. You must choose to take the new limit, or else the usual limit will apply. You can make your election on your 1040 or 1040-SR form.

Use The Funds To Buy Build Or Substantially Improve Your Property

For home equity line of credit interest to be tax-deductible, you must use the funds to purchase, build or substantially improve the home securing the line of credit, according to IRS guidelines.

When it comes to HELOCs, this usually means taking out a HELOC to pay for a remodeling project that adds to the homes value, such as a new kitchen.

The project also has to improve the property securing the loan. So, for example, if you take out a HELOC on your primary home and use the funds to buy, build, or improve a vacation home, the interest isnt deductible.

Also Check: How To Pay Ny State Taxes

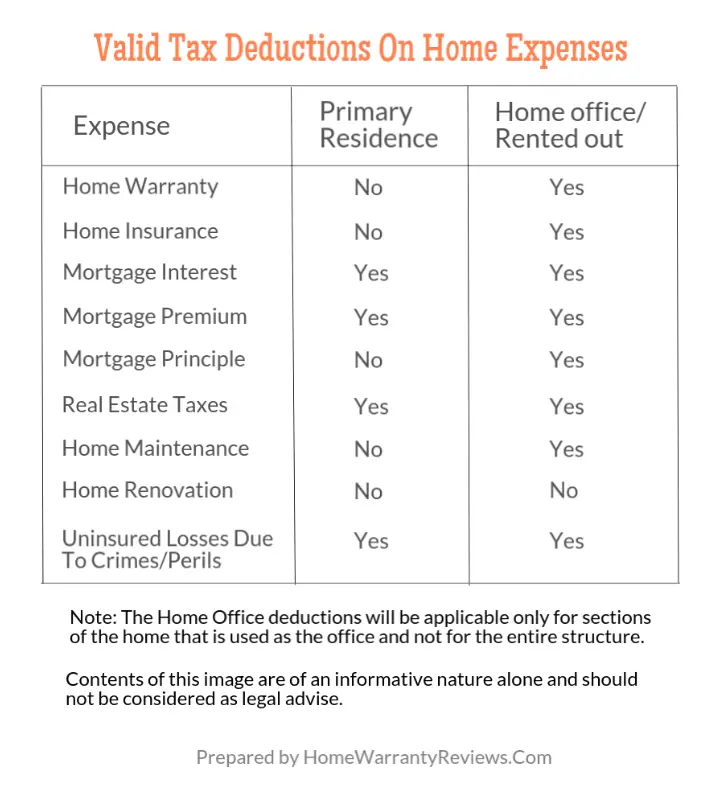

Home Office Tax Deductions

The home office deduction is one of the most popular work-from-home tax deductions. Once you understand how to calculate, record, and report home office expenses, you can benefit from the home office tax write off.

That can lower your income tax bill, freeing up more money to reinvest in your business.

Simplified Home Office Deduction

The simplified method as announcedin Revenue Procedure 2013 13 is an easier way than the method providedin the Internal Revenue Code, to determine the amountof expenses you can deduct for a qualifiedbusiness use of a home.

The standard method has some calculation,allocation, and substantiation requirements that can becomplex and burdensome for small business owners.

The simplified method is intended to reducethat burden.

The simplified method or optional deductionis capped at $1,500 per yearbased on $5 a square foot for up to 300square feet.

You may elect to use either the simplified methodor the standard method for any taxable year.

However once you have elected a method for a taxable year,you cannot later change to the other methodfor that same year.

You cannot use the simplified methodfor a taxable year and deduct actual expensesrelated to the qualified business use of the home.

The amount allowed as a deductionwhen using the simplified method is in lieu of a deductionfor your actual expenses.

Recommended Reading: Do You Pay Taxes On Cash Out Refinance