What Is An Amended Return

An amended return is a form filed in order to make corrections to a tax return from a previous year. An amended return can correct errors and claim a more advantageous tax status, such as a refund. For example, one might choose to file an amended return in instances of misreported earnings or tax credits. Mathematical errors, however, do not require amendments because the IRS automatically corrects for such errors when processing the tax return.

Submit Your Amended Forms

Beginning with the 2019 tax year, the IRS allows you to e-file amended tax returns if you filed the original return electronically and provided that your tax software supplier supports electronically filing amended returns. To amend a return for 2018 or earlier, you’ll need to print the completed Form 1040-X and any other forms you’re amending. Attach any necessary supporting documentation, such as:

- Any new or amended W-2s or 1099 forms

- Other forms or schedules that changed, such as Schedule A if you updated your itemized deductions

- Any notices that you received from the IRS regarding your amended return

Mail all the forms and documents to the address provided in the instructions or electronically file the return if you are able to.

If amending your tax return results in a higher tax bill, you will need to make an additional tax payment. You can mail a check with the amendment or go online and make a payment at the IRS website after logging into their system. By making a payment now instead of waiting for the IRS to send an invoice, you can minimize the interest and penalties you’ll owe.

Keep in mind that if you file an amended tax return on paper rather the e-filing, it can take the IRS eight weeks or longer to process the amendment. You can check the status of your amended return using the IRS’ Where’s My Amended Return? Wait about three weeks from the date you mailed your return for the information to show up in the IRS system.

Changing Your Filing Status

Many people may think there are just two filing statuses to worry about: single and married. Taxpayers may miss that they can file as head of household. Including the wrong status can greatly impact your tax refund, so an amended tax return can solve this problem.

Assess the error or omission you may have made on your tax return. Penalties for missing something or including something youre not eligible for can be costly. Failing to pay enough in taxes the first time may result in the IRS charging you for the rest of what you owe plus accrued interest. Added penalties will make this amount even higher. Contact a tax expert if you have questions.

Also Check: How To File Taxes When You Moved States

Where Is My Amended Tax Return And When Will I Get My Refund Checking 2022 Payment Status And Direct Deposit

While the IRS promises to have regular season tax returns and associated refunds processed within 21 days for the vast majority of filers, it does take quite a bit longer for them to process amended tax returns and associated refund payments.

As discussed below, many tax payers have been waiting months or years to get their amended return processed due to IRS backlogs and capacity constraints.

Covered in this Article:

Primary Reasons For An Amended Return

1. Correcting an error on a previous tax return

If you realize that your previously reported income is inaccurate, an amended return must be filed to correct the error. The error correction can lead to additional taxes owed or a refund on taxes paid.

If youve underreported income, the IRS can identify the discrepancy by cross-checking information from third parties. If it happens, you will receive a CP2000 notice from the IRS which must be resolved .

2. Changing your deductions

If you previously included or left out a dependent, you should file an amended return correcting the errors. Also, if you incorrectly claimed expenses, you should correct the error through an amended return. Depending on the correction, it could result in a material impact on taxable income.

3. Changing your filing status

Filing status determines what tax return form an individual will fill out. Filing status is related to the family situation and marital status. Ultimately, it could affect the taxable income. The five filing statuses are:

- Qualifying widow or widower with dependent child

4. Adjusting tax credits

Tax credits reduce income tax payable, whereas deductions impact taxable income. Often, credits are related to dependents claimed on your return. If your entitlement to tax credits differs from the return filed, an amended return should be filed. An amended return can assist taxpayers in recovering their maximum tax refund.

Below are the three basic types of tax credits:

- Partially refundable

Recommended Reading: Do I Pay Tax On Selling My House

What If My Refund Claim Is Overstated

The IRS has the ability to impose penalties if you file an amended return that overstates the amount of refund you are entitled to. The IRS may impose an excessive refund penalty in this situation. This penalty is set out in Section 6676. The penalty is equal to 20% of the excessive amount, which is the amount by which your claim for refund or credit exceeds the amount allowable for the tax year at issue.

Where’s My Amended Return

Track the progress of your amended tax return using the IRS’s online tracking tool. You can also the progress of your amended tax return by calling the IRS.

-

It can take three weeks for an amended return to show up in the IRSs system and up to 16 weeks to process an amended return.

-

If nothing has happened after 16 weeks, call the IRS again or ask someone at a local IRS office to research your amended return.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

Also Check: Does Walmart Offer Tax Services

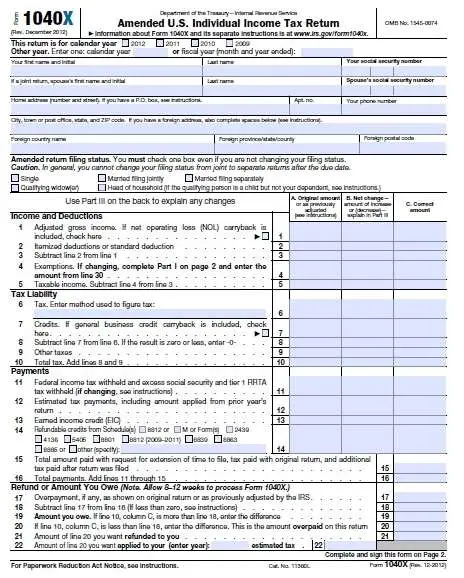

Electronic Filing Now Available For Form 1040

You can now file Form 1040-X electronically with tax filing software to amend 2019 or later Forms 1040 and 1040-SR, and 2021 or later Forms 1040-NR. For more details, see our on this topic.

Paper filing is still an option for Form 1040-X.

File Form 1040-X to:

- Correct Form 1040, 1040-SR, or 1040-NR .

- Make certain elections after the deadline.

- Change amounts previously adjusted by the IRS.

- Make a claim for a carryback due to a loss or unused credit.

How Long Does It Take For The Irs To Amend My Return

Due to COVID-19, the IRS is taking longer to process mailed documents, such as paper tax returns. The IRS is processing mailed documents in the order that it is received.

Your amended return can take up to:

- 3 weeks from the date you mailed it to show up in the IRS system.

- 16 weeks to process.

Amended returns may take longer than 16 weeks to process if the return is incomplete, has errors, is unsigned, is associated with identity theft or fraud, or includes Form 8379, Injured Spouse Allocation. In some cases, the IRS may contact you if more information is needed to process your return.

You can track the status of your amended return starting three weeks after you have filed. Visit Wheres My Amended Return? or call 866-464-2050. Both these tools are available in English and Spanish.

Read Also: Will Rav4 Prime Qualify For Tax Credit

What Is An Informal Refund Claim

The IRS provides tax forms for most amended tax returns. You do not always have to use these tax forms. In fact, the courts have said that several other documents sent to the IRS are informal refund claims.

The courts have put limits on what counts as an informal refund claim. Generally, the claim has to be in writing and it has to provide sufficient information as to your tax liability for the year to allow the IRS to decide whether it wants to conduct an audit. This means that it has to state the factual and legal bases for the refund claim.

With that said, you should not plan on submitting an informal refund claim. The risk is too great that the IRS and/or courts may conclude that it was insufficient. It is better practice to simply use the IRSs forms where possible.

You can see how this goes in court cases that address informal refund claims. These cases usually cite various letters and documents sent to the IRS prior to the IRS making an unfavorable adjustment . The taxpayers then go back and try to sue the IRS for a refund, and have to argue that these prior documents were refund claims that were denied by the IRS. This is required as an amended tax return is a prerequisite to being able to sue the IRS for a refund.

Ask If Your Preparer Charges For An Amended Tax Return

If you used a human tax preparer, dont assume they will amend your tax return for free or pay the extra taxes, interest or penalties from a mistake. For example, if you forgot to give the preparer information or gave incorrect information, youll likely have to pay for the extra work.

If the error is the preparers fault, who pays for an amended tax return may depend on the wording in your client agreement.

» MORE: How to get rid of your back taxes

You May Like: Where To Find Real Estate Taxes Paid

Where Is My Amended Return

You can track the progress of your amended return with, the IRSs online tracking tool. The IRS can also track the progress of your amended return. An amended return can take up to three weeks to appear in the IRS system. It may also take up to 16 weeks for it to be processed. If nothing happens after 16 weeks, you can call the IRS or ask someone at your local IRS office for assistance in researching your amended return.

Disadvantages Of An Amended Tax Return

The drawback of filing an amended tax return is that Form 1040-X cannot be submitted electronically for every tax year, although the IRS has recently started accepting e-filed amended returns for tax year 2019. If filling out the form manually, the taxpayer has to mail the printed-out document to the IRS Service Center that processed the original tax form. The IRS manually processes amended returns, and the process can take 16 weeksor even longer, if the amended return is not signed, is incomplete, has errors, requires additional information, needs clearance by the IRS bankruptcy department, has been routed to another specialized area, or has been affected by identity fraud.

There is, however, a three-year statute of limitations for issuing tax refund checks. Therefore, the taxpayer must file any amended returns that will result in a tax refund within three years after the date they filed the original tax return. An amended return filed to account for additional income or overstated deductions does not fall under any such statute and can be filed at any time.

-

You can correct errors on an amended tax return.

-

You can claim a refund you were owed even if you didn’t file for it.

-

You can correct for circumstances that changed since you originally filed.

-

Form 1040-X cannot be filed electronically for all tax years.

-

Processing an amended return can take 16 weeks or longer.

-

There is a three-year statute of limitations for collecting tax refunds.

You May Like: How To Get Tax Return From Turbotax

Amended Returns: Is It A Good Idea

There can be some drawbacks to making a tax amendment. One downside is that you arent able to do this electronically for every year. As of now, the IRS accepts amended returns that are e-filed for the tax year 2019.

This means that for other years you have to manually fill out the form and mail it to the IRS Service Center that was responsible for processing the original return. It can take sixteen weeks or longer for the IRS to manually process tax amendments.

It is particularly likely to take longer if the return:

- Has to go to a specialized area of the IRS

- Needs IRS bankruptcy department clearance

- Is impacted by identity theft or fraud

Its important to understand that there is a three-year statute of limitations when it comes to getting tax refund steps. You will therefore want to file any amended returns within three years. Also you need to understand that there is high likely hood of an IRS Audit, if you file an amended return.

Can An Amended Tax Return Be Filed Electronically

Amended tax returns need to be filed on paper they cant be filed online through e-file. If you need to amend more than one tax return, you should print out and prepare a separate Form 1040X for each tax year. Each years return must be mailed to the IRS in separate envelopes. Attach any other relevant tax forms or schedules and include them in the envelope with your return.

RELATED ARTICLES

Also Check: Who Do I Call About My Taxes

What Are Some Of The Benefits Of Filing An Amended Irs Return

The benefits of using an amended return are numerous, believe it or not.

- Claim a tax credit, You can take a deduction that you have not taken

- Additional income and withholding reporting You might be able to redeem an additional amount

- As a result, you may owe additional taxes

After receiving your amended return, the IRS will send you a refund if you are due one.Send the IRS the tax amount due along with the 1040X tax form if you owe taxes.The IRS will bill you if you owe interest, a penalty, or both.

When To File A Tax Amendment

Generally, for a credit or refund, an amended return must be filed within 3 years after the date the original return was filed or within two years after the date the taxpayer paid the tax, whichever is later.

The time limit for filing a claim for a credit or refund on a Form 1040-X can be suspended for certain people who are physically or mentally unable to manage their financial affairs.

Processing Time

At the present time, a federal amended return can take more than 20 weeks to process once the IRS receives it.

Checking Status

A taxpayer can check on the status of their amended return by using the Wheres My Amended Return? application on the IRS website.A taxpayer will need their Social Security Number, Date of birth, and Zip Code to check on the status of their amended return.The status of a taxpayers amended return may take up to 3 weeks to show up on the Wheres My Amended Return? tool.

Don’t Miss: Are Mud Taxes Included In Property Taxes

How Can I Check My Amended Return Status

Its important to realize that the standard WMR or IRS2Go refund status checking tools from the IRS do not track amended tax return status.

You need to instead use IRS tool, Wheres My Amended Return instead . You can use this tool to check the status of your Amended Federal Tax Return , for this year and up to three prior years.

The WMAR tool is updated once a day, usually at night. So checking it multiple times a day wont help.

You will need to provide your SSN, Date of birth and Zip code to use the tool.

This tool is normally updated weekly, starting 3 weeks after your mailed submission, in line with your IRS processing cycle. But can update more or less frequently depending on IRS actions.

Finally, its important to remember that filers can only submit up to three accepted Amended Returns. So if you have submitted more than these subsequent filings will get rejected and you wont see any status for these on WMAR.

Amended Returns Must Be Filed By Paper For The Following Reasons:

Also Check: How To Amend 2020 Tax Return

How Can I Stop Mistakes From Happening On My Tax Return

As with most things in life, the more organized you are, the easier your taxes will be.

Try to keep your tax information organized as you go, throughout the tax year. When that April 15 deadline is around the corner, spend some time getting all your information organized before you even start filling out your tax return.

Submit Online Or By Mail:

- Online

- Through your tax representative or tax preparation software

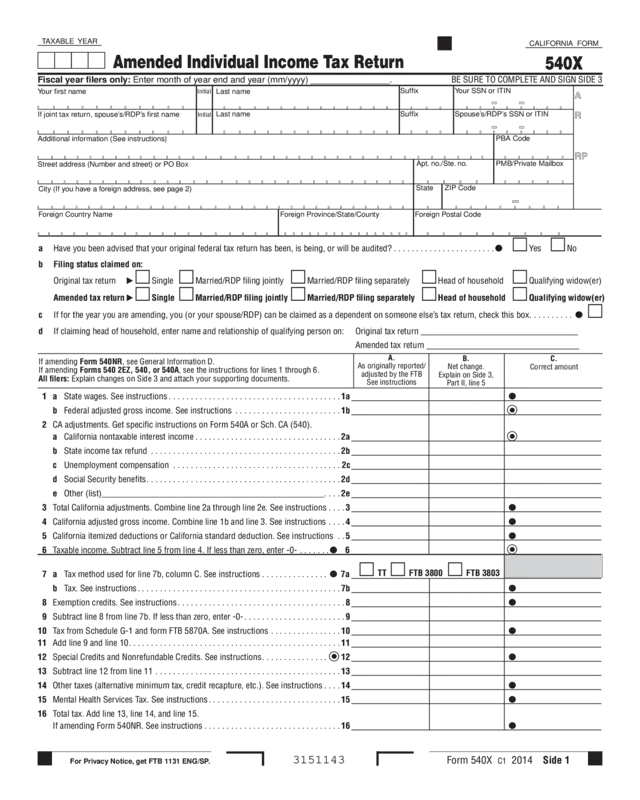

File a California Fiduciary Income Tax Return for estates and trusts:

- Check the amended tax return box

- Complete the entire tax return

- On a separate paper, explain all changes

- Include the estate or trust name and FEIN with each item

Make sure to give a copy of the amended 541 Schedule K-1 to each beneficiary.

Don’t Miss: Does Texas Have State Income Tax