Evaluating Proposals To Increase The Corporate Tax Rate And Levy A Minimum Tax On Corporate Book Income

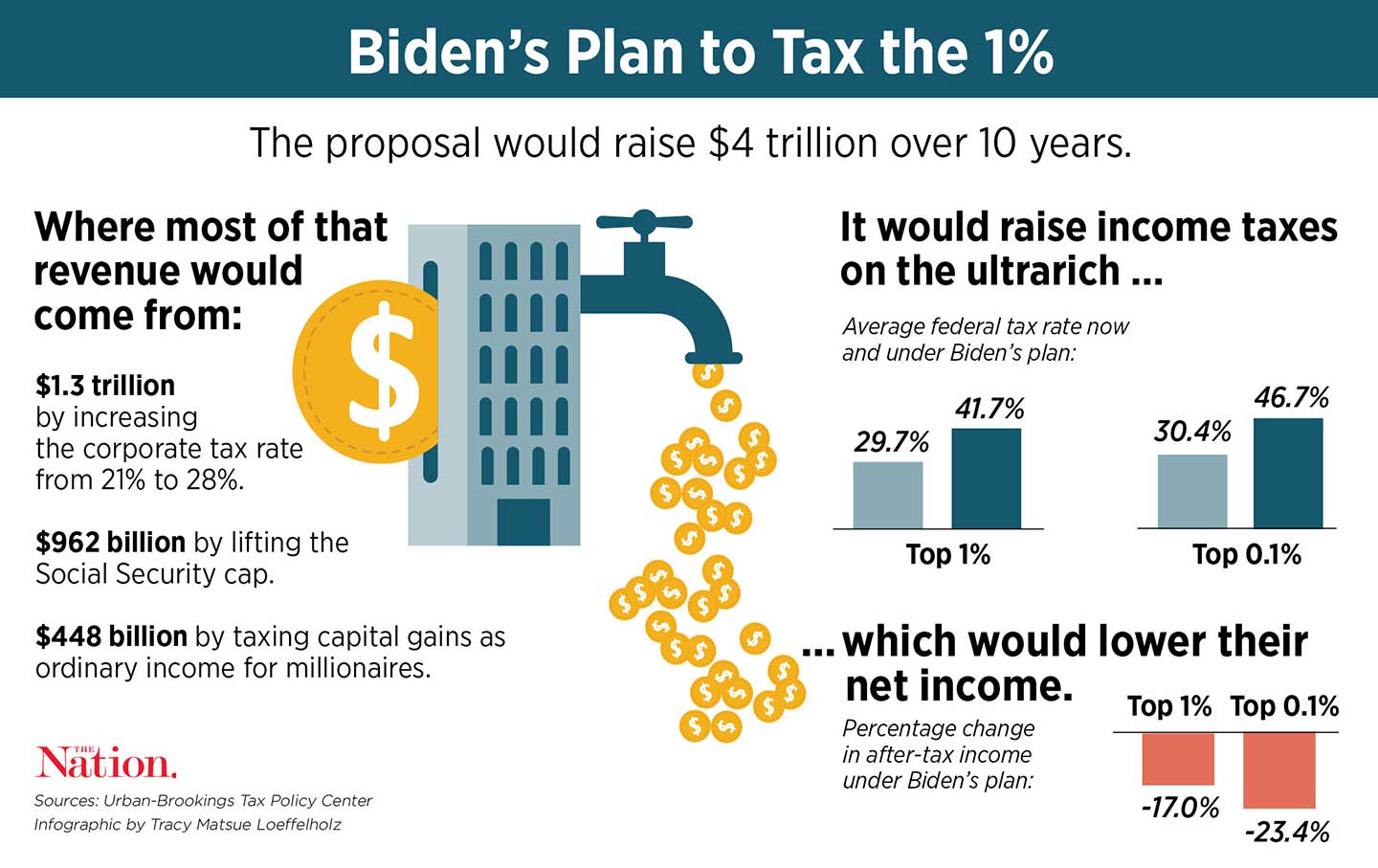

President Biden and congressional policymakers have proposed several changes to the corporate income tax, including raising the rate from 21 percent to 28 percent and imposing a 15 percent minimum tax on the book income of large corporations, to raise revenue for new spending programs. Our new modeling analyzes the economic, revenue, and distributional impact of these proposals.

Depending On Your Income The Build Back Better Act Recently Passed By The House Could Boost Or Cut Your Future Tax Bills

President Biden’s “Build Back Better” social spending and tax bill is slowly working its way through Congress. It was recently passed by the House of Representatives and has been sent to the Senate. While there’s still plenty of political wrangling to come, and additional changes are expected in the Senate, we now have a pretty good sense of where the Democrats are headed with this budget reconciliation bill. The proposed legislation calls for sharp spending increases for a wide variety of social programs that would impact childcare, health care, higher education, climate change, and more. The package also contains a number of tax law changes that would boost taxes for some people and cut them for others.

How might these changes affect your future income tax bills if the Build Back Better Act ultimately becomes law? First, the bill calls for higher taxes and fewer tax breaks for the wealthy. That’s no surprise, because Biden and Congressional Democrats have said for months that they want to make the rich pay their “fair share” of taxes and use the additional revenue to strengthen the social safety net. The proposed legislation would also extend enhancements to certain tax credits for lower- and middle-income families. These enhancements were designed to help ordinary Americans pay for some of the day-to-day expenses they incur. There are also new or improved tax breaks for higher education costs, clean energy initiatives, and expenses paid by certain workers.

Tips For Tax Planning

- A financial advisor can help you create a financial plan and optimize your tax strategy. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- SmartAssets free income tax calculator can help you figure out how much you will owe in taxes.

Recommended Reading: How To Order Tax Forms From Irs

Economists Have Been Surprised By Recent Strength In The Labor Market As The Federal Reserve Tries To Engineer A Slowdown And Tame Inflation

- Jobs Report: Job growth slowed in August but stayed solid, suggesting that the labor market recovery remains resilient, even as companies pull back on hiring.

- Black Employment: Black workers saw wages and employment rates go up in the wake of the pandemic. But as the Federal Reserve tries to tame inflation, those gains could be eroded.

- Slow Wage Growth: Pay has been rising rapidly for workers at the top and the bottom. But things havent been so positive for all professions, especially pharmacists.

Republican critics of the Biden tax plan have argued that the administrations focus on a global minimum tax is evidence that it realizes that raising the U.S. corporate tax rate unilaterally would make American businesses less competitive around the world.

How Would Bidens Tax Plan Change The Competitiveness Of The Us Tax Code

While the Biden campaign is certainly focused on increasing taxes on U.S. businesses and high-income earners, it is important that policymakers also understand what that reversal might do to U.S. competitiveness, and the competitive global environment in which U.S. companies and U.S. workers operate.

You May Like: When Does Irs Open For 2021 Tax Season

Taxing Unrealized Capital Gains At Death Is Unlikely To Raise Revenue Advertised

As part of the tax proposals in President Bidens American Families Plan, unrealized capital gains over $1 million would be taxed at death. However, this policy would likely raise less revenue than advocates expect after considering the proposals impact on taxpayer behavior, including capital gains realizations, and historical capital gains and estate tax revenue collections.

Top Tips For A Successful Tax Season In 2021

Utilise your bonus exemption while you can Bonus exemptions, referring to the difference between the current exemption rate minus the expected future amount, are use it or lose it amounts, so your clients may be wise to use their bonus exemptions while they can.

You May Like: How To Pay Payroll Taxes

Business Tax Collections Within Historical Norm After Accounting For Pass

When looking at the tax burden on businesses over time, it is important to provide a complete picture by accounting for the different types of businesses in the U.S. and the timing effects of the 2017 tax law. Doing so provides important context on existing tax burdens and for considering the impact of raising taxes on corporations and pass-through firms.

Why The Biden Capital Gains Tax Increase Is Controversial

So, whatâs the problem? What could be the downside of raising the taxes on a small portion of Americans to help needy children and kids go to college? Just 0.7% of households would face a tax hike, according to the Institute on Taxation and Economic Policy, with almost the entire burden being felt by the richest 1%.

Nevertheless, there are some issues to be concerned aboutâeven putting aside how Biden plans to help poor children with these tax hikes.

First of all, itâs not altogether certain that raising capital gain tax rates will reap that much revenue. One analysis out of the Wharton Business School at UPenn found that raising the capital gains rate could actually lower federal tax revenue by $33 billion between 2022 and 2031. That analysis dovetails with findings from the Tax Foundation, which said the policy would cost the Treasury $124 billion over 10 years.

How can that be? Well, a lavish stock portfolio isnât taxed annually. Unlike with your home, there isnât a county tax collector who appraises its value every year. You only pay taxes when you realize a gain, i.e. when you sell. The key is that you get to decide when to sell, so affluent stock owners adjust to the new rules.

Another concern is that higher taxes could imperil the creation of new business, which is especially troubling since there are fewer startups than in the past.

Also Check: How Much Do You Need To Donate For Tax Deduction

Tax Treatment Of Nuclear Energy Should Be Simplified Neutral With Renewable Energy Sources

Tackling climate change and shifting the economy towards renewable energy has been a key part of the Biden administrations agenda. However, this effort must first confront an overly complicated and non-neutral tax code, particularly in how it treats nuclear energy, for the White House to reach its ambitious goals.

What Is A Tax Credit

A tax credit is a direct offset to the amount of taxes owed by a taxpayer. It is a dollar-for-dollar reduction in tax liability. Unlike deductions, which reduce income, tax credits provide the same amount of benefit to all taxpayers regardless of tax bracket. Some tax credits are refundable and thus particularly benefit taxpayers who owe less in taxes than the credit amount. Those taxpayers get a refund of the balance.

A 20% tax credit for an eligible expenditure of $100 will reduce taxes by $20 for every taxpayer regardless of income level or tax bracket. On the other hand, an exclusion, exemption, or deduction reduces income and thus provides a larger benefit to taxpayers in higher tax brackets. Some examples:

- For a taxpayer in the 37% marginal tax bracket, a deduction of $100 will save the taxpayer $37i.e., 37% of the $100.

- For a taxpayer in the 24% marginal tax bracket, the savings for a deduction will be lower: $24i.e., 24% of $100.

Also Check: When Should I Get My Taxes

Four Revenue Scores On Options To Change Us International Tax Rules

Changes to international tax rules are likely on the way, and it is therefore important for lawmakers to understand how various reform options would impact U.S. tax burdens on multinational companies. Moreover, policymakers should also recognize the need for prudent policies that do not put U.S.-based multinationals at a competitive disadvantage or severely curtail investment and hiring.

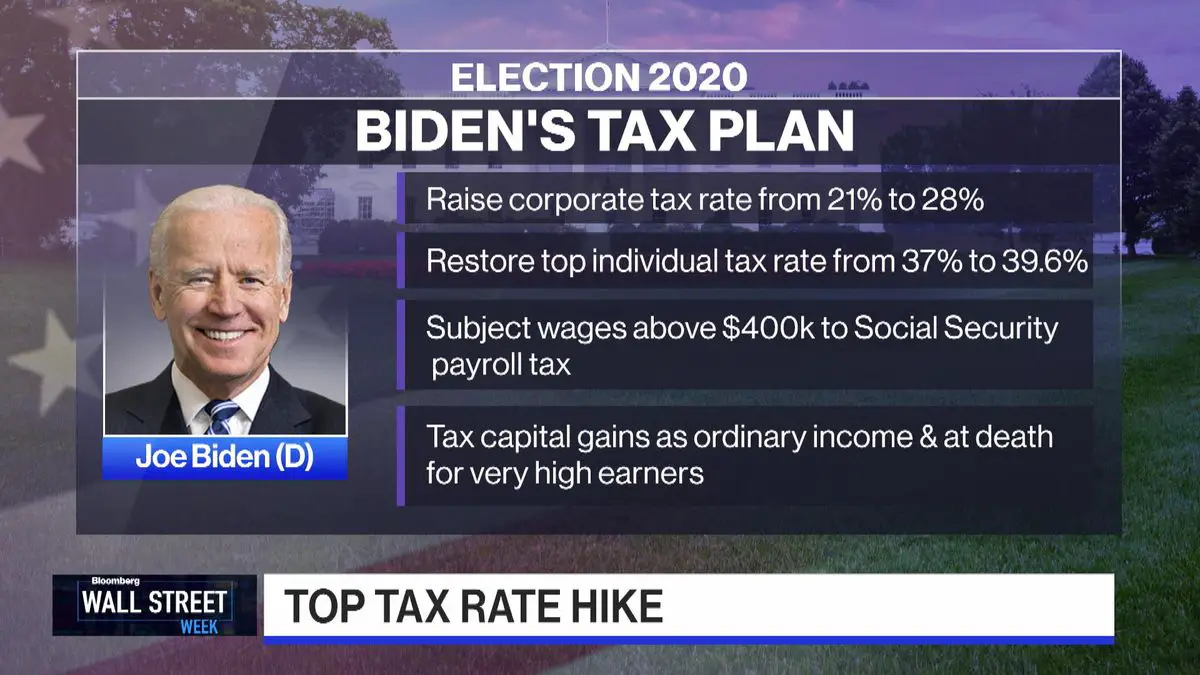

Raise Corporate Tax Rate To 28%

Biden is proposing to raise the tax rate for corporations based in the U.S. from 21% to 28%. That may seem like a big leap, but it is actually still below the 35% corporate tax rate that existed before Congress passed a major tax overhaul in 2017.

Generally, corporate tax rates dont have too large an impact on average consumers. There is an argument, generally made by anti-tax conservatives, that the increased tax is passed on to consumers in the form of higher prices and labor in the form of wage reductions or layoffs, but there are many opinions on the overall impacts of corporate tax rates.

Don’t Miss: How Do I Pay Sales Tax In Texas

Blackrock: Modest Tax Hike Likely

To be fair, the lack of headway on tax reform is not necessarily for lack of effort by the Biden administration.

Any mention of raising the domestic corporate tax rate from its current 21% is a nonstarter for Republicans and some economists, who say it’s still too early into the economic recovery to ask the nation’s businesses to send an even greater proportion of their profits to Uncle Sam.

That opposition poses a significant barrier for Democrats, who hold a narrow majority in the House and are split 50-50 with the GOP in the Senate.

Despite a $1.9 trillion Covid-19 rescue law, a $1.2 trillion physical infrastructure plan and another $1.8 trillion proposed for families, child care and paid worker leave programs, the Biden administration has failed thus far to bring its tax proposals to fruition.

Tax increases are “off the table,” Sen. Mitt Romney, a Utah Republican involved in the bipartisan infrastructure talks, told reporters last month. Sen. Jon Tester, a Montana Democrat who has joined in the negotiations, said at the time that paying for infrastructure “is probably the toughest part about this, from my perspective.”

BlackRock, the world’s largest asset manager, told clients in late June that it still expects the Biden White House to raise some taxes to help offset the historic level of spending.

Establish A Corporate Tax Minimum

This plan is the one aimed at companies like Amazon, which have been the subject of ire from many progressives for not paying taxes. Currently, some companies are able to use a series of breaks and loopholes to effectively pay no taxes, but this proposal would make sure that no matter what, corporations would pay at least 15% on all profits reported to investors.

Read Also: How Do I Know If I Filed Taxes Last Year

Updates From Our April 2020 Analysis

Since we released our first analysis of Bidens tax proposals, the campaign has proposed several new tax policies that have impacted our revenue and distributional estimates.

That includes proposals to expand several credits, including the CTC and the CDCTC. The proposed expansion to the CTC would be a major increase in the generosity of the credit by increasing the maximum credit amount up to $3,600 for children under 6 and by making the credit fully refundable without regard to a taxpayers income level. The CDCTC would be expanded to a maximum value of $8,000, with a higher maximum refundable percentage of 50 percent.

The Biden campaign has proposed that the CTC expansion remain for 2021 and as long as economic conditions require, based on an original proposal in the House-passed HEROES Act. For this proposal, we assume that the expansion lasts for one year, as estimated by the Joint Committee on Taxation for the HEROES Act proposal.

In addition to proposed changes to the CTC and CDCTC, Biden has released a proposed plan to reduce offshoring of production and jobs from the United States by modifying the way GILTI is taxed and through other tax incentives. In addition to doubling the GILTI rate to 21 percent, Biden would eliminate the 10 percent deemed return exemption based on qualified business asset investment and would assess the tax on a country-by-country basis.

How Will Brexit Affect Accounting And Finance

The Biden Administration’s initial tax policy mainly focuses on passing tax proposals that will help revive the US economy, including benefits targeted for low and middle income families. Here are the main changes the new president intends to make:

On the other side, Bidens tax plan also includes a number of benefits for the USs lower-income earners:

- Hell increase the Child and Dependent Tax Creditto$8,000 or $16,000 for more than one dependent.

- Bidens tax policy will also offer tax relief for student debt forgiveness and restore the first-time homebuyers credit.

- The estate tax exemption would drop by about 50%.

Recommended Reading: How To Pay My Property Tax

Treasury Rule On State Tax Cuts Limitation Raises New Questions

Today, the U.S. Treasury issued an interim final rule on the $350 billion in State and Local Fiscal Recovery Funds provided under the American Rescue Plan Act . The proposed rule resolves several important questions but continues to involve the federal government in state finances at an extraordinary level.

Raise Corporate Tax Rates

What: Increase the corporate rate to 28% from 21%Who pays: Not corporations. They pass the added tax costs to customers, employees and shareholdersHow much more the rich would pay: $2.1 trillion over 10 years

Former President Donald Trump’s signature tax bill lowered the corporate income tax rate to a flat 21% from a top rate of 35%. Mr. Biden’s plan is to raise the corporate rate to 28%. He would also like to eliminate some of the tax breaks U.S. companies get for paying taxes overseas as well as moving operations overseas.

The most novel portion of Mr. Biden’s plan is to make sure all corporations pay at least 21% of their income in taxes, no matter what deductions they claim.

Companies can pass along some portion of their tax increase to customers, by raising prices, and to workers, by cutting wages or limiting raises. Researchers at the University of Pennsylvania’s Wharton business school predict Mr. Biden’s proposed corporate tax increases will hold back wage growth.

But the vast majority of corporate taxes are paid by a company’s investors, experts say. What’s more, those investors are mostly wealthy Americans.

“Having larger companies in the U.S. pay their fair share is a good thing,” Signum’s Meyer said. “And that fair share is being set at a level that is still under where it was before the corporate tax rate was lowered by Trump.”

Recommended Reading: Can You Bankruptcy Tax Debt

Surtax On Estates And Trusts

Current lawThe current unified gift and estate tax exemption of $12.06 million per person is set to expire at the end of 2025. At that time, the exemption amount will be reduced by roughly half the current level. Previous proposals under consideration would have accelerated the expiration of the higher exemption amount to 2022, but this broad aspect of estate and gift taxation is not addressed by the Green Book. However, a number of other provisions are included.

Proposed changesUnrealized gains on appreciated assets transferred by gift during life or held at death would be treated as a realization event for tax purposes and taxed as if the underlying property was sold. The unrealized gain of property transferred by gift during life or held at death would be subject to a $5 million lifetime exclusion for a single tax filer. Any unused exclusion during life can be applied towards the unrealized gain on property held at death. Also, the proposed exclusion would be portable and may be used by a surviving spouse. This results in an effective aggregate exclusion amount of $10 million that married couples filing a joint return can use towards unrealized gains.

In addition, unrealized capital gains in appreciated assets would be taxed if they are transferred into or distributed in kind from an irrevocable trust, partnership or other non-corporate entity if such transfers are effectively a gift to the recipient.

How Do Build Back Better Taxes Affect 5g Competition

One unintended consequence of the tax proposals in the Build Back Better Act is a higher potential burden on wireless spectrum investments, which could slow the build out of 5G technology as the U.S. races to compete with other countriesmoving in the opposite direction of countries like China that are actively subsidizing 5G expansion.

Don’t Miss: Is The Stimulus Check Taxed

How Will Bidens Tax Reform Affect Capital Gains

The IRS applies the capital gains tax to the profits that are made from selling investments. These profits can come from short-term and long-term gains, and the agency taxes them differently.

Short-term capital gains come from investments that were sold after being held for less than one year. Whereas long-term capital gains come from investments that were sold after being held for longer than one year.

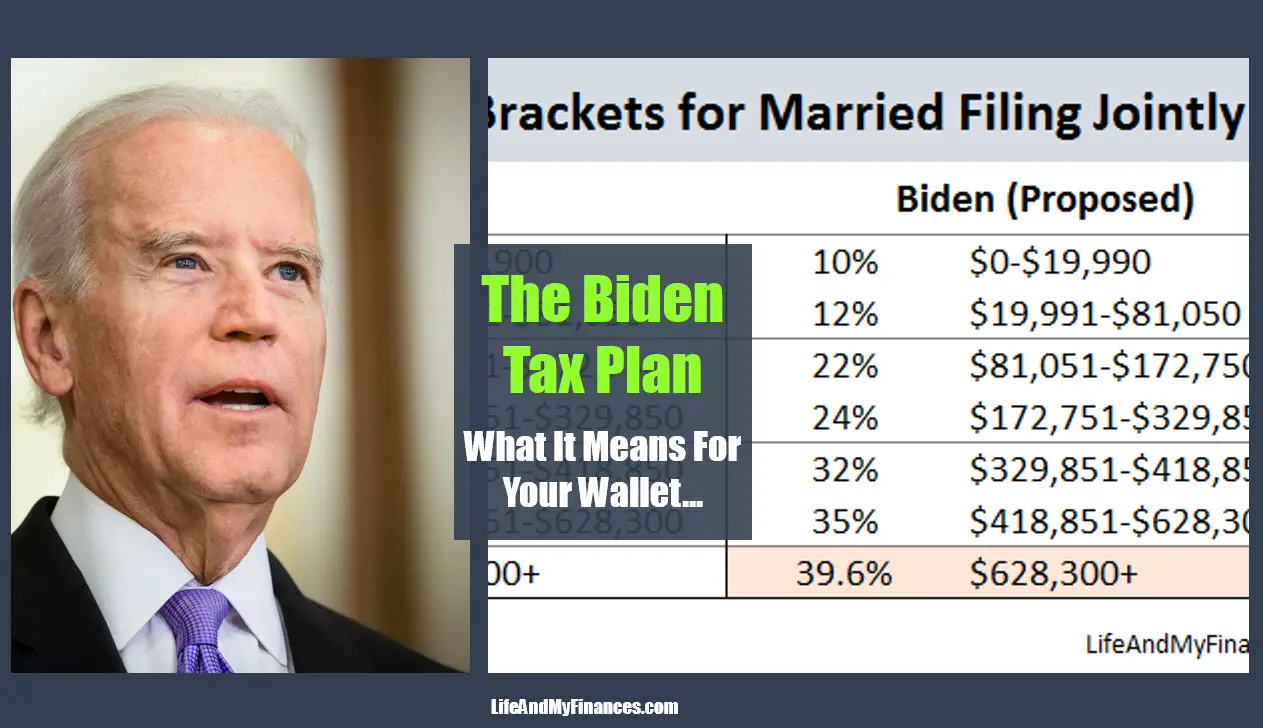

The IRS taxes short-term capital gains like ordinary income. This means that high-income single investors making over $539,901 in tax year 2022 have to pay the top income tax bracket rate of 37%. Its important to note that Biden is also proposing a tax hike that will raise the top income tax bracket from 37% to 39.6%.

Bidens tax plan would impact long-term capital gains significantly by nearly doubling the rate for high-income investors. Currently, individuals pay a 20% tax rate for long-term gains made over $459,750. The table below breaks down current long-term capital gains tax rates and income brackets for tax year 2022:

| 2022 Federal Tax Rates for Long-Term Capital Gains | |

| Rate | |

| $258,601+ | $488,501+ |

The proposed increase would tax long-term gains over $1 million as ordinary income, which means that these high-income investors would have to pay a top rate of 39.6%.

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022. It also includes income thresholds for Bidens top rate proposal and the 3.8% NIIT: