Chaotic Irs Filing Season Shows The Perils Of Running Social Policy Through The Tax Code

Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a hidden tax, as it leaves taxpayers less well-off due to higher costs and bracket creep, while increasing the governments spending power.

A pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets the federal corporate income tax system is flat.

A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

The standard deduction reduces a taxpayers taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

Add Futa Taxes To Employee Pay Stubs

You may choose to add FUTA taxes paid for an employee in their pay stubs. With 123PayStubs, you can easily add the employer-paid taxes such as FUTA, SUTA, and other state-specific employer-paid taxes to the pay stubs, along with accurate tax calculations. to know how to add FUTA taxes to pay stubs..

Effective Tax Rate Vs Marginal Tax Rate

The U.S. tax system is a progressive system. It uses marginal tax rates instead of a single tax rate. The more you earn, the more of a percentage youll pay on your top dollars.

Your marginal tax rate is 22% at a total taxable income of $60,000. The marginal rate is applied only to your additional income over that certain tax-bracket threshold amount. Your effective tax rate is the average rate you pay on all $60,000. It’s a much clearer indication of your real tax liability.

| Effective Tax Rate | |

|---|---|

| Average of three rates: 14.98% |

Read Also: Can You Track Your Tax Return

Understanding The Current Federal Income Tax Brackets

Our current tax brackets were adjusted when Congress passed new legislation in 2017 that changed the brackets and how taxes are filed. The tax reform passed by President Trump and Congressional Republicans lowered the top rate for five of the seven brackets. It also increased the standard deduction to nearly twice its 2017 amount.

For the most recent taxes filed, for the 2021 tax year, the standard deduction was $12,550 for single filers and married filers who file separately. Joint filers will have a $25,100 deduction and heads of household get $18,800.

Does Everyone Pay Payroll Tax

In general, most employers and employees pay Social Security and Medicare taxes. Exemptions apply, however, for certain classes of nonimmigrant and nonresident aliens. Examples include nonimmigrant students, scholars, teachers, researchers and trainees , physicians, au pairs, summer camp workers, and other nonimmigrants temporarily present in the United States in F-1, J-1, M-1, Q-1 or Q-2 status.1

Also Check: Can You Bankruptcy Tax Debt

More About Tax Brackets

What Is My Tax Bracket?

The federal income tax system is progressive, which means different tax rates apply to different portions of your total income. Tax bracket refers to the highest tax rate charged on your income.

What Are Tax Tables?

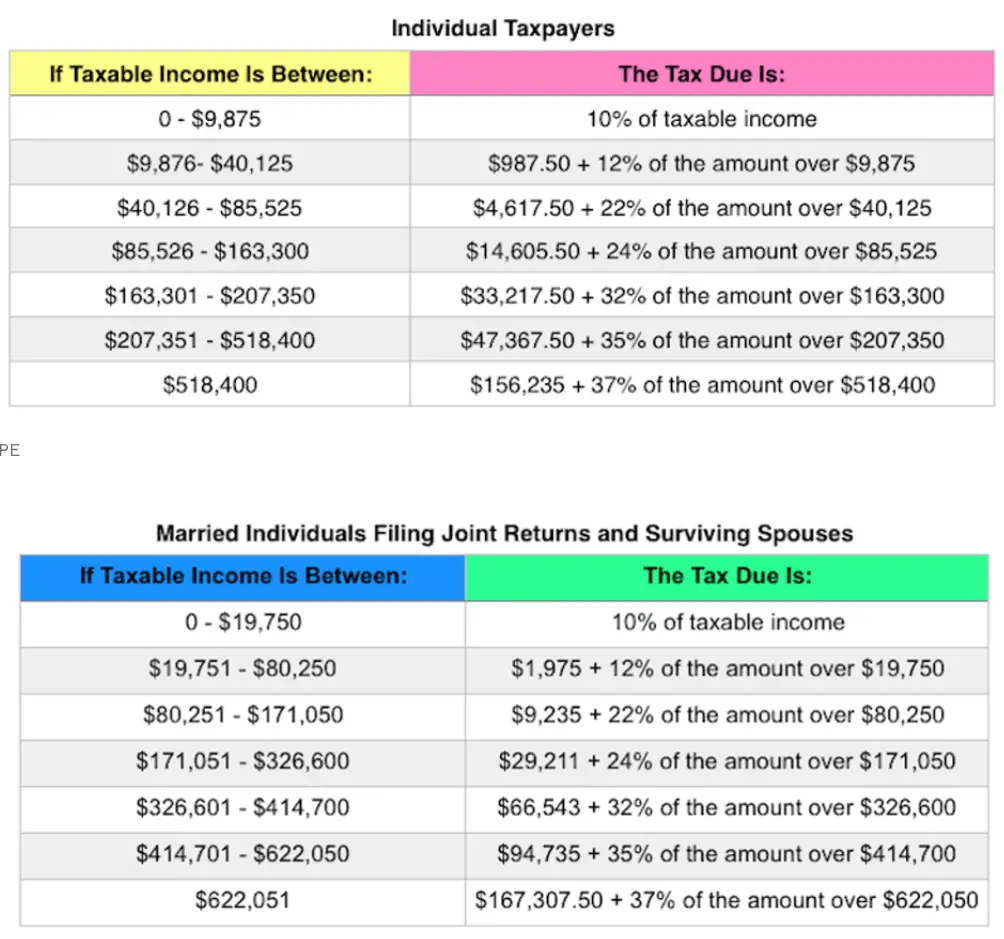

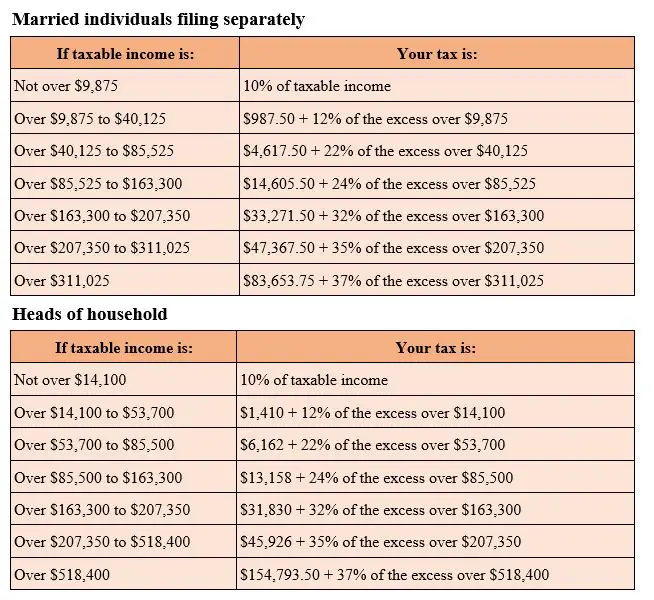

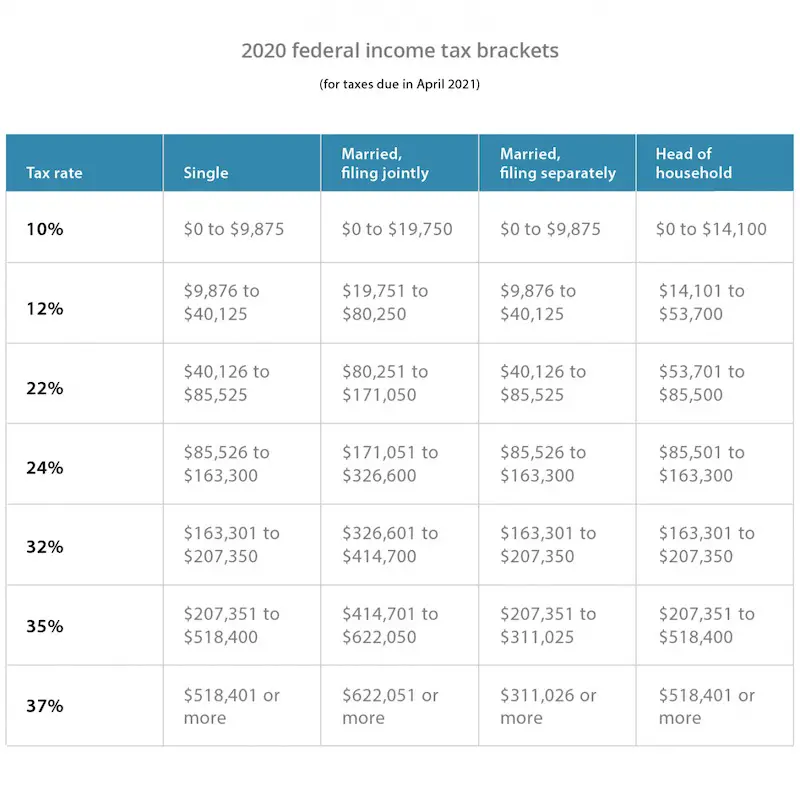

Tax tables like the one above, help you understand the amount of tax you owe based on your filing status, income, and deductions and credits.

Tax brackets only apply to your taxable income. Your deductions and taxable income may drop you into a lower tax bracket or potentially a higher one.

Taxable Income vs. Nontaxable Income

Income comes in various forms, including wages, salaries, interest, tips and commissions. Nontaxable income wont be taxed, whether or not it is entered on your tax return.

File faster and easier with the free TurboTax app

- Limited interest and dividend income reported on a 1099-INT or 1099-DIV

- IRS standard deduction

- Earned Income Tax Credit

- Child tax credits

* More Important Details and Disclosures

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Read Also: Where Can I Do My Taxes For Free Online

How Long Is A Tax Extension

A tax extension gives you until October 17, 2022, to file your tax return.

However, getting an extension does not give you more time to pay it only gives you more time to file your return. If you cant file your return by the April 18 deadline, you need to estimate your tax bill and pay as much of that as possible at that time.

-

Anything you owe after the deadline is subject to interest and a late-payment penalty even if you get an extension.

-

You might be able to catch a break on the late-payment penalty if youve paid at least 90% of your actual tax liability by the deadline and you pay the rest with your return.

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

You May Like: How Much Do Taxes Take Out

How To Figure Out Your Tax Bracket

You can calculate the tax bracket you fall into by dividing your income that will be taxed into each applicable bracket. Each bracket has its own tax rate. The bracket you are in also depends on your filing status: if youre a single filer, married filing jointly, married filing separately or head of household.

The tax bracket your top dollar falls into is your marginal tax bracket. This tax bracket represents the highest tax ratewhich applies to the top portion of your income.

If you are single and your taxable income is $75,000 in 2022, your marginal tax bracket is 22%. However, some of your income will be taxed at the lower tax brackets, 10% and 12%. As your income moves up the ladder, your taxes will increase:

- The first $10,275 is taxed at 10%: $1,027.50.

- The next $31,500 is taxed at 12%: $3,780.

- The last $33,225 is taxed at 22% $7,309.50

- The total tax amount for your $75,000 income is the sum of $1,027.50 + $3,780 + $7,309.50 = $12,117 .

How To Get Into A Lower Tax Bracket

You can lower your income into another tax bracket by using tax deductions, such as the write-offs for charitable donations, property taxes and the mortgage interest. Deductions help cut your taxes by reducing your taxable income.

Tax credits, such as the earned income tax credit, or child tax credit, can also put you into a lower tax bracket. They allow for a dollar-for-dollar reduction in the amount of taxes you owe.

Read Also: How Do You Pay Owed Taxes

Putting It All Together: Calculating Your Tax Bill

But, wait. Theres more!

Effective tax rates dont factor in any deductions. To get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction, the amount of AGI that went to the IRS was more like 10% less than half of 22%.

Heres how that works out:

Subtract the standard deduction to determine taxable income .

Break the taxable income into tax brackets the next chunk, up to $41,775 x .12 and the remaining $15,000 x .22 to produce taxes per bracket of $1,025 + $3,780 + $3,300 = total tax bill of $8,105.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid charitable deductions and divide your tax bill by that number. The overall rate for our single filer with $80,000 in adjusted gross income could be in the high single digits.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: How Much Is Sales Tax In Kansas

Who Has To Pay Federal Income Tax

All individuals who earn over a certain amount of income in the United States, resident or non-resident, must pay the Federal Income Tax. See the table below for filing thresholds based on filing status.

While everyone who earns over the filing threshold is required to file, a significant number of taxpayers will owe no income tax due to deductions and tax credits.

In fact, refundable tax credits like the Earned Income Tax Credit mean that extremely low-income filers may actually see a net gain when they receive their income tax refund check.

| Filing Status |

| $17,550 |

What Is The Futa Tax Rate For 2020

Thus far in 2020, the FUTA tax rate remains consistent. Consistent with prior years, employers should withhold 6% of the first $7,000 of an employees wages. The tax credit of up to 5.4% for state unemployment tax is also unchanged.

Companies must continue to withhold FUTA if they have paid wages of $1,500 or more in any calendar quarter in 2019 or 2020, or they have paid employees for at least a portion of a day in any 20 weeks in 2019 or 2020. Separate tests are applied toward agricultural workers and household workers.

The recent CARES Act has extended the deadline for the payment of the employers share of Social Security taxes in 2020, but FUTA deadlines have not changed. The next federal unemployment tax payment due date is July 31st. At this time, FUTA withheld during the second quarter of 2020 that is greater than $500 must be deposited.

The CARES Act also provides an Employee Retention Credit to assist companies who continue to pay wages to employees unable to work during the pandemic. This credit will first be applied to Social Security tax owed. Any excess credit will be refunded to employers.

For additional information on how the CARES Act affects payroll taxes, please visit the Paychex Coronavirus Help Center.

Tags

Recommended Reading: Where To File Georgia State Taxes

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is The Standard Deduction

The standard deduction is an automatic deduction of your taxable income that you can receive without doing any itemized deductions.

If youre trying to decide whether to use the standard deduction amount or try to get more by doing itemized deductions, it is important to remember that under former President Donald Trump, a new tax law was introduced called the Tax Cuts and Jobs Act starting in tax year 2018. This act significantly raised the standard deduction amount for both households filing together and single individuals filing alone, Fan says.

For the 2021 tax year , the standard deduction amounts are:

- $12,550 for single and married filing separate taxpayers

- $18,800 for head of household taxpayers

- $25,100 for married filing jointly or qualifying widow taxpayers

Before the TCJA was passed in 2017, the amount was $6,350 for single filers and $12,700 for married filing jointly.

Since the standard deduction amounts rose so much, it does make it harder for people to have enough expenses to be able to itemize deductions, he says.

Read Also: How To Start Filing Taxes On Turbotax

Resident Individual Income Tax

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return,IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana. A temporary absence from Louisiana does not automatically change your domicile for individual income tax purposes. As a resident taxpayer, you are allowed a credit on Schedule G for the net tax liability paid to another state if that income is included on the Louisiana return.

Residents may be allowed a deduction from taxable income of certain income items considered exempt by Louisiana law. For example, Louisiana residents who are members of the armed services and who were stationed outside the state on active duty for 120 or more consecutive days are entitled to a deduction of up to $30,000. In each case, the amount of income subject to a deduction must be included on the Louisiana resident return before the deduction can be allowed.

Individual Income Tax Brackets

The federal tax brackets are broken down into seven taxable income groups, based on your filing status. The tax rates for 2020 are: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Its important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate. Only the money you earn within a particular bracket is subject to the corresponding tax rate.

Here are the tax rate brackets for each filing status:

Also Check: Can I File My Taxes For Free

Not Just A Flash In The Pan: 26 Companies Pay Zero Federal Income Tax Over The Entire Tcja Era So Far

Corporate effective tax rates tend to be volatile, just as are corporate earnings. Yet for many companies reporting paying no tax on their profits in 2020, this result is part of a longer-term pattern. As the table below shows, 26 of the 55 companies were profitable tax avoiders for the three-year period during which the TCJA has been in effect. These 26 companies were profitable in each of the three years and their total corporate federal income tax over that period was zero or negative.

Duke Energy paid, on balance, no federal income taxes on a total of $7.9 billion over the first three years of the TCJA.

FedEx achieved the same zero tax result on almost $6.9 billion of U.S. income during the past three years.

And Nike has paid no federal income tax in the TCJA era on $4.1 billion of U.S. pretax income.

All told, these 26 companies reported $77 billion in pretax U.S. income in the first three years of the TCJA, and collectively enjoyed a tax rebate of $4.6 billion.

What About The 2023 Tax Brackets

The IRS typically provides the tax brackets for the upcoming year in late October or early November. At this point, there’s no reason to believe that the timetable will be modified this year, so that’s when we expect the 2023 tax brackets to be released.

Again, the 2023 rates won’t change, but the brackets will be adjusted for inflation. And, since inflation is much higher now than it has been in the recent past, the extent to which the brackets will get “wider” is expected to be greater for 2023 than it has been for the past several years.

For example, the 22% bracket for a single person in 2021, which ran from $40,526 to $86,375 of taxable income, covered $45,849 of taxable income . For the 2022 tax year, that same bracket covers $47,299 of taxable income . So, for 2022, the 22% bracket for single filers is $1,450 wider than it was for 2021. However, for 2023, the width of the same bracket is expected to increase by more than twice the rate of growth seen in 2022.

Wider tax brackets are generally a good thing, since it helps prevent “bracket creep.” In other words, if a bracket gets wider, you’re less likely to end up in a higher tax bracket if your income stays flat or doesn’t increase at the rate of inflation from one year to the next.

Read Also: When Do I Pay Taxes On Stocks