Exempt From Filing Income Taxes On Form W

When you start a job, youll hand over a Form W-4 to the employer providing your personal and tax details.

A common reason why your employer did not deduct any income tax from your paycheck could be that you wrote exempt on your Form W-4.

It might be due to several reasons. For instance, you may be working as a freelancer or your job entitles you as an independent contractor.

Youll need to satisfy certain criteria to be exempted from income tax withholding by your employer.

In other cases, you may have wrongly ticked the exempt box on Form W-4. Either way, your employer wouldnt deduct income taxes from your paycheck.

It is an easy mistake to ratify and you shouldnt wait until April 15 or an IRS notice.

What If My Federal Income Tax Withheld Is Zero

The fact that you have zero withheld for federal means you will probably not see any refund, but will end up owing taxes on the tax return. You need to go to your employer and ask to complete a new W-4 and make sure youve chosen the correct number of allowances.

How much federal tax is taken out of my paycheck?

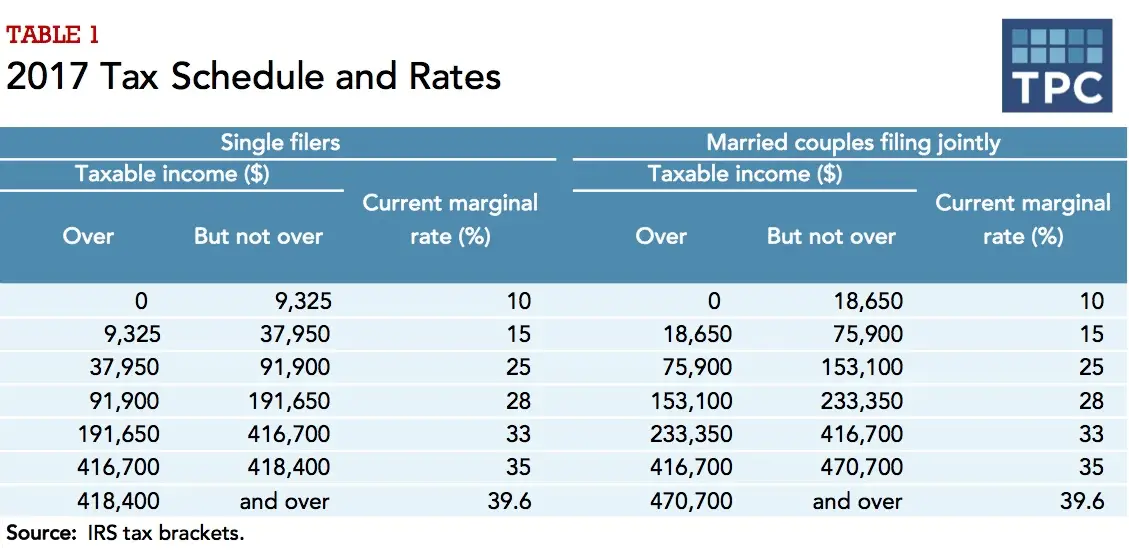

- The percentage of federal income taxtaken out of taxable wages starts at zero and increases in a series of steps called tax brackets to a maximum of 39.6 percent. Suppose you are single, claim two withholding allowances and make $800 per week. Your taxable pay equals $646.16. Tax on the first $44 is zero.

What Changed In 2020

Another reason to check in on your withholdings this year? The IRS gave the W-4 form a big makeover starting in 2020. The new form was redesigned to make it easier to understand and to make the whole withholding process more accurate and crystal clear. Good on them!

The W-4 change is a result of the 2018 tax reform bill. Since the bill got rid of personal exemptions, the new W-4 form has done away with using personal allowanceslike claiming 1 if youre single and have one job or claiming 3 if youre married and have one childto figure out how much to withhold from your paycheck.

But the basics of the form are the same, so no need to panic! This isnt a complete overhaul. The new W-4 form just replaces the old headache-causing worksheets with simplified questions, which makes it easier to fill out all your iinformation and make sure youre getting your tax withholding right.

Also Check: How To Avoid Taxes On Stocks

There Has Been A Payroll Error

So, your state charges taxes, your employer is located in the same state as you, you are not exempt from tax, and you earn enough money every month yet your federal income tax still wasnt withheld from your paycheck? If you checked all of the points above, then the answer to that might be a very simple one: there has been an error in your payroll.

For example, your employer might have attempted to withhold the taxes, but they did not give you a correct W-2 form. In that case, you might want to discuss this matter with your employer, so that they might give you the correct W-2 form.

There is a high chance that if you are a taxable person, your employer just made a simple and honest mistake. Perhaps they added the incorrect amount or just forgot to file in that tax altogether. If that were to happen, you need to make sure your employer withholds the right amount for the future.

Why? Because the moment you file for the returns, youll owe what your employer should have paid for you. For the state, those are simply unpaid taxes.

Federal Estimated Tax Payments Made In 2020

Enter the federal estimated income tax payments made in 2020. You may include the credit applied from your 2019 federal income tax overpayment only if the overpayment is included on line 27. You can deduct only the federal estimated income tax payments made during calendar year 2020.

For example, include a federal estimated income tax payment for 2019 paid in January 2020, but not an estimated tax payment for 2020 paid in January 2021.

Federal income tax includes the net investment income tax on federal form 8960 and any payments made in 2020 associated with federal section 965 net tax liability.

Taxpayers can deduct their entire estimated payment amount on line 31. However, certain amounts must be added back on line 28, including the following:

- Excess advance premium tax credit repayment reported on the federal 1040, Schedule 2, line 2.

- Federal self-employment tax reported on the federal 1040, Schedule 2, line 4.

- Unreported Social Security and Medicare tax on the federal 1040, Schedule 2, line 4.

- Additional tax on IRAs and other qualified retirement plans reported on the federal 1040, Schedule 2, line 6.

- Federal household employment tax reported on the federal 1040, Schedule 2, line 7a.

- First-time homebuyer credit repayment reported on the federal 1040, Schedule 2, line 7b.

- Additional Medicare tax from federal form 8959 reported on the federal 1040, Schedule 2, line 8a.

- Other additional federal taxes reported on the federal 1040, Schedule 2, line 8c.

Recommended Reading: How To Lower Property Taxes In Illinois

You Are Working In A Different State Than Your Home State

The calculation and deduction of income taxes withheld work differently if the employee has a resident status of one state and works in another state. In that case, resident/non-resident taxation rules are applied for tax deduction purposes.

The following states have special regulations and rules for resident employees who have relocated to another state for work purposes:

Alabama

Resident employees working for a non-resident employer are not subject to Alabama withholding tax. However, all wages are applicable for taxation at the end of the tax year.

Arkansas

Residents working in another state shall pay the Arkansas withholding if the state where they work does not have any income tax laws.

Colorado

Residents working in another state shall not be charged Colorado withholding if theyre already charged in the state where they work.

Illinois

Irrespective of working state income tax laws, the residents working in another state are exempt from the Illinois withholding.

Georgia

Residents working in another state shall not be charged Georgia withholding if theyre already charged in the state where they work.

Minnesota

If the tax liability to Minnesota state is less than the tax withheld in the working state, no tax is charged by Minnesota. However, the difference between withheld tax and tax liability in Minnesota is withheld from residents wages in another case.

Mississippi

Missouri

Montana

Nebraska

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Youve Claimed Exemption From Federal Taxes

The second possibility why no income tax was deducted from your paycheck is your claimed exemption from withheld tax. You can check your employers tax settings & tax exemption status to check if its one of the reasons why no amount was deducted from your paycheck.

Therefore, its important to consider if youre exempt from federal income tax withheld, it might not necessarily mean that you are also exempt from other taxable income or wages. Make sure to go through your W-2 to see all of your taxable wages.

Read Also: How Much Is Sales Tax In Louisiana

Federal Withholding Tax Table

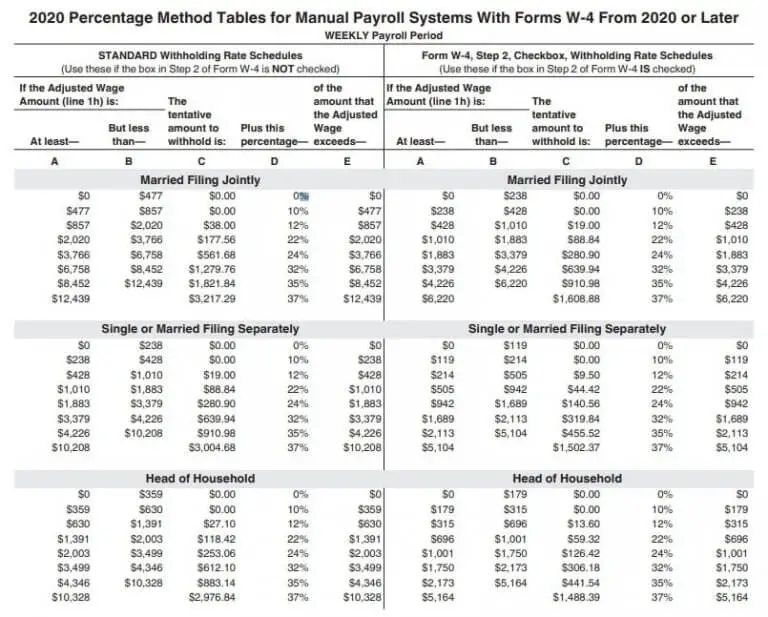

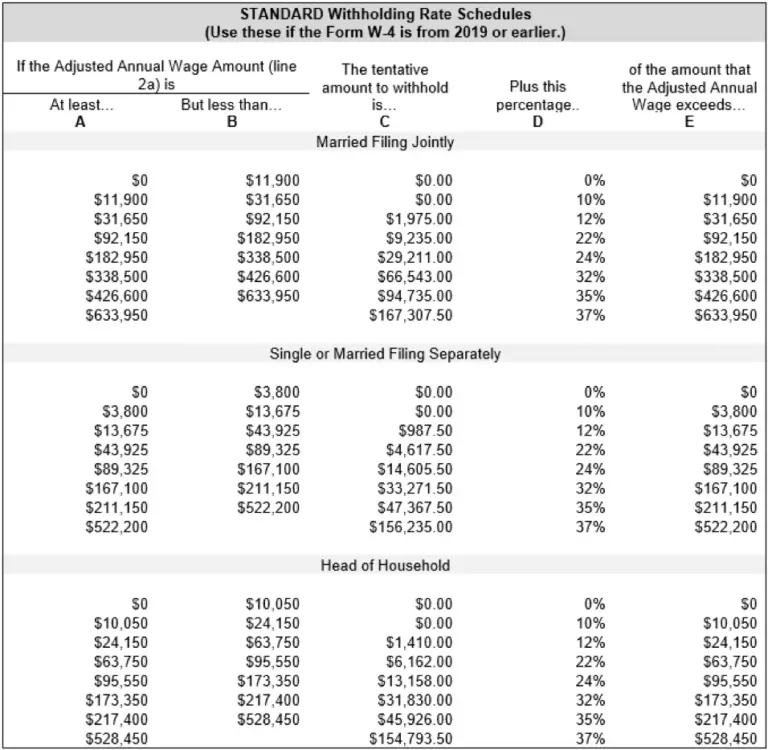

When it comes to running a business, you need to be aware of many payroll factors. Setting up payroll can be a difficult process. You need to obtain an Employer Identification Number , collect important paperwork, establish a pay period, and choose a payroll system . But in addition to setting up payroll for your employees, you also have to understand federal withholding tax tables. Withholding tables are important for business owners to understand because they need to calculate how much tax to withhold from employee paychecks.

Not calculating federal withholding tax correctly can result in many issues for your business. An employer has legal responsibility to withhold payroll taxes and pay those taxes to the Internal Revenue Service . Not doing so will impact both the employer and the employee and can even lead to more serious consequences, like having to pay a heavy fine. So it is crucial you stay on top of these taxes.

Understanding what a federal withholding tax table is will take some time, so lets break it down into key components. Read the post in full or navigate using the links below to jump ahead:

Go Through Payroll Details

Next up is reviewing the payroll details of your employees. Basically, you have to determine two things:

- The payroll period is how frequently do you pay our employees that is weekly biweekly or monthly

- The total amount paid in a payroll period either in terms of a salary or wage is also known as the gross pay amount.

Don’t Miss: How To Review My Tax Return Online

Youre Not Earning Enough Money

The most probable reason why no amount was withheld in lieu of federal income tax from your paycheck is that your income doesnt exceed the minimum taxable amount. According to the recent changes in the W-4 form, employees having too low income wont be charged the withholding tax on the paycheck.

However, its important to know the process of calculating the withholding tax. The most important factors considered are:

All of these factors are considered and accounted for when checking an individuals eligibility for withholding tax deduction. To add more context, lets understand it with an example.

An employee receives weekly paychecks from his employers. The value of each paycheck is $1500. There is another individual who gets a monthly paycheck from his employer, and the amount is $1500. The calculation of the amount to be withheld for an employee getting paid weekly will differ from the one getting a monthly paycheck. Similarly, the way federal income taxes are withheld will be different for a married person and a single person.

Wrong Amount Of Income Tax Withheld

Depending on your work nature, your gross salary may change from your employer. It means the estimated income tax amount would change.

Therefore, your employer may not withhold enough income tax from your gross income. If so, youll owe the IRS at the end of the tax year.

The IRS provides useful online tools to calculate and estimate income taxes. You can work with your employer to estimate the withholding taxes correctly to avoid any inconvenience.

You should provide a new Form W-4 to your employer with updated information. You may confirm the changes from your employer later.

Read Also: Are Pre Paid Funeral Expenses Tax Deductible

Federal Income Tax Withholding Errors

While mistakes can happen, you must correct any mistakes by filing a corrected form. Use Form 941-X to correct any errors on your quarterly forms and check which quarter you are correcting. Form 944 has a correction form as wellForm 944-X.

If you withhold and deposit too much tax, submit the correction form to the IRS for a refund. Should you discover an error where you did not calculate or deposit enough tax, use Form 941-X to fix the mistake and submit a payment to the IRS for the owed amount.

This article has been updated from its original publication date of May 10, 2017.

This is not intended as legal advice for more information, please

How Do I File A New Form W

Your payroll or HR department can supply a new form for you to fill out. Many employers provide an easy way to change your W-4 online, or you can also print the form directly from the IRS website. The IRS W-4 form also provides a Multiple Jobs Worksheet and a Deductions Worksheet to help you calculate an accurate withholding if these circumstances apply to you.

Once you complete the form, dont send it to the IRS just give it to your payroll or human resources department to file.

Read Also: What Form Is The State Tax Return

Everyone Should Check Withholding

The IRS recommends that everyone do a Paycheck Checkup in 2019. Though especially important for anyone with a 2018 tax bill, its also important for anyone whose refund is larger or smaller than expected. By changing withholding now, taxpayers can get the refund they want next year. For those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year. In addition, taxpayers should always check their withholding when a major life event occurs or when their income changes.

Is It Better To Withhold Taxes Or Not

Withholding decreases evasion and underpayment Because of the aforementioned savings dilemma, withholding makes it more likely that the government will receive all the taxes it is due. Withholding also makes it more difficult for tax protesters and tax evaders to keep their money out of the IRSs hands.

Don’t Miss: When Are Irs Taxes Due

You Work As A Contractor Or Self

If there was no mistake from your side and you noticed no deduction from your paycheck for income tax withholding, then you should consult your employer.

Your job contract may specify you as an independent contractor rather than a permanent employee.

Generally, you should know this condition when signing your job contract with the employer. Youll notify the same on your Form W-4 to your employer as well.

In rare cases, your employer and you may different opinions about your job contract type.

Youll still need to pay estimated taxes if you are working as an independent contractor. Youll directly file these taxes with the IRS.

As an independent contractor you will:

- File a Schedule C to report your income and expenses.

- Also, need to file the Schedule SE to file your Medicare and Social Security tax.

Your employer will provide you the Form 1099-MISC rather than a W-2.

How Do I Fill Out Form W

The W-4 requires basic personal information, like your name, address, and Social Security number. Previously, the number of allowances and your tax filing status determined how much income tax was withheld from your pay.

Now, its much simpler than that. The new Form W-4 provides taxpayers with different sections to fill out depending on your tax situation . When filling out the form, you only need to complete the steps that apply to you.

- Step 1: Personal Information

- Step 4 : Other Adjustments

- Step 5: Sign and Date

You can submit a new W-4 whenever you like. Its always a good idea to review and adjust your W-4 withholding after major life events that may impact your tax liability such as getting married, having a child, or receiving a big raise.

You May Like: How Much Can You Earn Before You Owe Taxes

What Is Federal Income Tax

The Federal Income Tax is a tax that the IRS withholds from your paycheck. This tax will apply to any form of earning that sums up your income, whether it comes for employment or capital gains.

The government uses federal tax money to help the growth of the country and maintain its upkeep. In a way, you can say that the federal income tax is the rent that youll have to pay for living in that country, to enjoy the benefits, or even to have a nice walk in the park .

How To Calculate Tax Withholding

The IRS recommends checking your withholding for lots of reasons, including if you work a seasonal job, claim the child tax credit or had a large refund or tax bill last year.

To see whether you may need to change your withholding, you can use the IRSs Tax Withholding Estimator. Before you get started, have the following information ready for yourself : your most recent pay stubs, information about other sources of income and your most recent income tax returns. You can also use our tax withholding calculator below:

If you need to change your withholding, the process is fairly straightforward: Just fill out a new W-4 and submit it to your employer. Withholding tax comes out of your paycheck throughout the year, so its better to make changes to your withholding sooner rather than later.

» Bonuses can impact your tax bill. More on the bonus tax rate and how bonus taxes are withheld.

You May Like: Is The Solar Tax Credit Going Away

Understanding Federal Income Tax Withholding

Federal Income Tax Withholding is annual taxable earnings withheld on all wages paid to employees. Employers that pay wages are required to deduct federal income taxes from employee wages and submit them to the Internal Revenue Service . Heres what you need to know Federal Income Tax Withholding:

How Do you Know How Much to Withhold?

Employers use the information an employee provides on their completed and signed Form W-4, the amount of the employees taxable earnings, and the frequency the employee is paid to determine the amount of federal income tax to withhold from each paycheck. Employers are required to calculate, withhold, file, and remit this payroll tax according to the tables established by the Secretary of the Treasury. These tables can be found in Publication 15 from the IRS.

As you onboard new employees, it is your responsibility to ask them to provide a completed and signed Form W-4. If an employee does not provide a completed and signed Form W-4, treat the new employee as if they had checked the box for Single or Married filing separately in Step 1 and made no entries in Step 2, Step 3, or Step 4 of the 2022 Form W-4.

Withholding Allowances

- A pay cut or a pay raise

- A dependent aged out of the tax credit

Special Cases

Filing as Exempt

An Employee Doesnt Know How to Fill out Form W-4

Nonresident Aliens

More Questions?

Depositing Federal Income Tax

Once you calculate your employees withholding, the IRS requires that you deposit the taxes on a regular schedule. Do not keep the taxes or use them for other purposes. Keeping or using the money is illegal, and you could be subject to civil and criminal sanctions.

The IRS determines your income tax deposit frequency and will notify you of any changes. The two deposit schedules are monthly or semi-weekly.

You must pay monthly deposits by the 15th of the month following the end of the calendar month. For example, January deposits are due on February 15th. If the 15th of the month falls on a weekend or holiday, deposit the taxes the next business day.

Semi-weekly deposits depend on your pay date. If your payment date falls on a Wednesday, Thursday, or Friday, deposit the taxes by the following Wednesday. Pay dates that occur on Saturday, Sunday, Monday, or Tuesday have a deposit date of the following Friday.

The IRS uses your Form 941 to determine your deposit schedule based on a specified lookback period. Further instructions for deposit schedules are available in Publication 15.

Deposit your FICA taxes at the same time you deposit the FITW.

Use the Electronic Federal Tax Payment System to deposit the taxes electronically. If you do not make your deposits on time, you may have to pay a penalty.

Recommended Reading: Where Do I File My Federal Tax Return