Who Should File Income Tax Returns

According to the Income Tax Act, income tax has to be paid only by individuals or businesses who fall within certain income brackets. Mentioned below are entities or businesses that are required to compulsorily file their ITRs in India:

All individuals, up to the age of 59, whose total income for a financial year exceeds Rs 2.5 lakh. For senior citizens , the limit increases to Rs. 3 lakh and for super senior citizens the limit is Rs. 5 lakhs. It is important to note that the income amount should be calculated before factoring in the deductions allowed under Sections 80C to 80U and other exemptions under section 10.

All registered companies that generate income, regardless of whether they’ve made any profit or not through the year.

Those who wish to claim a refund on the excess tax deducted/income tax they’ve paid.

Individuals who have assets or financial interest entities that are located outside India.

Foreign companies that enjoy treaty benefits on transactions made in India.

NRIs who earn or accrue more than Rs. 2.5 lakh in India in a single financial year.

How Federal Income Tax Works

Tax is collected from individuals and corporations by the city, state, or country where they reside or operate. When the tax collected is credited to the country’s government, it is referred to as a federal tax.

Governments use the money collected through federal taxes to pay for the growth and upkeep of the country. Some look at federal tax as rent charged to live in a country or the fee to use the resources provided by a country. When you pay tax to the U.S. government, youre in effect investing in your economy, as the government uses the funds to do the following:

- Build, repair, and maintain infrastructure

- Fund the pensions and benefits of government workers

- Fund Social Security programs

- Fund major health programs, including Medicare, Medicaid, CHIP, and marketplace subsidies

- Fund “safety net” programs to assist lower-income households

- Fund defense and international security programs

- Improve sectors such as education, health, agriculture, utilities, and public transportation

- Embark on new feats such as space exploration

- Provide emergency disaster relief

In 2021, the U.S. government collected $4.05 trillion in revenue and spent $6.82 trillion, resulting in a $2.77 trillion deficit.

How To Check Itr Status Online

Once you have filed your income tax returns and verified it, the status of your tax return is ‘Verified’. After the processing is complete, the status becomes ‘ITR Processed’.

If you wish to know which stage your tax return is after filing it and want to check your ITR status online, here’s how you can do it in easy steps.

Option One

Without login credentials

You can click on the ITR status tab on the extreme left of the e-filing website.

You are then directed to a new page where you have to fill in your PAN number, ITR acknowledgement number and the captcha code.

Once this is done, the status of your filing will be displayed on the screen.

Option Two

Don’t Miss: Can I Deduct State Income Tax On Federal Return

How To File Itr Online

You can now submit your tax return sitting at home if you have an internet connection. This has been made possible with e-filing that uses pre-approved tax preparation software by the Income Tax Department. More and more taxpayers are increasingly filing their returns online given its benefits such as:

1. Getting Refund: If tax has been deducted at source on the payment made to you and you want to claim a refund of the amount, you need to furnish your ITR for the financial year for the refund to be processed.

2. Verification Proof: When you apply for a loan, your eligibility is measured using your yearly income as the yardstick. An ITR form with details of your earnings gives the borrower a clear picture of your previous income, lending credibility to your application. Similarly, visa applications also require income proofs for which tax returns are the most accepted documents.

3. Proof of Income: When you buy a term plan your insurer might require your ITR to decide the compensatory amount to be paid to your nominees in the event of death or disability. The ITR is considered as an officially verifiable proof of income for the purpose.

What Is The Minimum Income Required To File A Tax Return I Cannot Find Anything On The Irsgov Website For My Children Who Had Summer Jobs With W2s

Even if youâre a dependent, youâll generally need to file your own 2021 tax return if:

- Your unearned income exceeds $1,100

- Your business or self-employment net income is at least $400

- Your gross income exceeds the larger of $1,100 or your earned income plus $350

But even if your income falls below these filing requirements, youâll want to file your own tax return to get a refund of any federal or state taxes withheld from your paychecks.

Donât Miss: What Is The Tax Percentage Taken Out Of My Paycheck

Don’t Miss: When Do You Have To Pay Self Employment Tax

Nonresident Athlete Individual Income Tax

A nonresident individual who is a member of the following associations is considered a professional athlete and is required to electronically file a Louisiana income tax return, IT-540B reporting all income earned from Louisiana sources:

- Professional Golfers Association of America or the PGA Tour, Inc.

- National Football League

- East Coast Hockey League

- Pacific Coast League

Income from Louisiana sources include compensation for the services rendered as a professional athlete and all income from other Louisiana sources, such as endorsements, royalties, and promotional advertising. The calculation of income from compensation is based on a ratio obtained from the number of Louisiana Duty Days over the total number of Duty Days. Duty Days is defined as the number of days that the individual participated as an athlete from the official preseason training through the last game in which the individual competes or is scheduled to compete.

Which Itr Form Should You Fill

The official website of the Income Tax Department lists several forms that taxpayers may be required to fill up based on their income. While some of these forms are easy to fill, others require additional disclosures such as your profit and loss statements. To help you better understand the forms available, here’s a quick guide:

ITR-1: Sahaj or ITR- 1 is to be filed individuals being a resident having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources , and agricultural income upto Rs.5 thousand.

ITR-2: This form should be filed by Individuals and HUFs not having income from profits and gains of business or profession.

ITR-3:This form is for individuals and HUFs having income from profits and gains of business or profession

ITR-4 : : If your business attracts presumptive income for you, then you need to fill this form. This form is to be filed by Individuals, HUFs and Firms being a resident having total income upto Rs.50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE.

You May Like: Where To Pay Irs Taxes

Which States Have No Income Tax

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not collect state income taxes. New Hampshire doesnt tax earned wages, but it does tax income earned from interest and dividends. At the end of 2023, New Hampshire will begin phasing out these taxes, and all personal income in the state will be tax free by 2027.

History Of Income Tax

The United States imposed the nations first income tax in 1862 to help finance the Civil War. After the war, the tax was repealed, but it was reinstated after passage of the Revenue Act of 1913. That same year, Form 1040 was introduced.

Most countries, including the U.S., employ a progressive income tax system in which higher-income earners pay a higher tax rate compared with their lower-income counterparts. The idea behind progressive tax is that those who earn high incomes can afford to pay more tax. In 2022, federal income tax rates range from 10% to 37%.

Also Check: How To Change Address For Taxes

Forms To Report Your Income

If you’re working as an employee, your employer is required to send you a W-2 form by the end of January in following the tax year. The W-2 reports the amount of income you made and how much the employer withheld from your paycheck for taxes. This will help you determine whether you need to write the IRS a check when you mail in your Form 1040, or if you should start thinking about how to spend your refund.

Independent contractors might receive a 1099 form from their clients, which reports annual payments received from them, but does not usually include any tax withholding.

Tax Credits And Taxes Paid

Page 2 of Form 1040 calculates the tax you owe on your taxable income. This is where the amount that has already been withheld from your paycheck, as well as any estimated tax payments you made during the year, will be recorded and subtracted. Certain refundable tax credits can be deducted here as well, because they act just like payments made.

You May Like: What Is Homeowners Property Tax Exemption

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

File An Estate Tax Income Tax Return

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.The types of taxes a deceased taxpayer’s estate can owe are:

- Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

Read Also: When Do We Get Tax Refund

The Cbdt Has Extended The Due Date For Filing Income Tax Return By Corporate And Individuals Whose Accounts Need To Be Audited To November 7 2022 The Extended Due Date Is Applicable To All Taxpayers Where Audit Is Required Said Experts

CBDT extends the due date for furnishing Income Tax Return for AY 2022-23 to 7th November, 2022 for certain categor https://t.co/ZQDlqjIVuS

Income Tax India 1666784555000

How will this move benefit income taxpayers?What is income tax audit report?Also Read:

Read More News on

What Is Federal Income Tax

The U.S. federal income tax is a tax levied by the Internal Revenue Service on the annual earnings of individuals, corporations, trusts, and other legal entities. Federal income taxes apply to all forms of earnings that make up a taxpayer’s taxable income, including wages, salaries, commissions, bonuses, tips, investment income, and certain types of unearned income.

In the U.S., federal income tax rates for individuals are progressive, meaning that as taxable income increases, so does the tax rate. Federal income tax rates range from 10% to 37% and kick in at specific income thresholds. The income ranges the rates apply to are called tax brackets. Income that falls within each bracket is taxed at the corresponding rate.

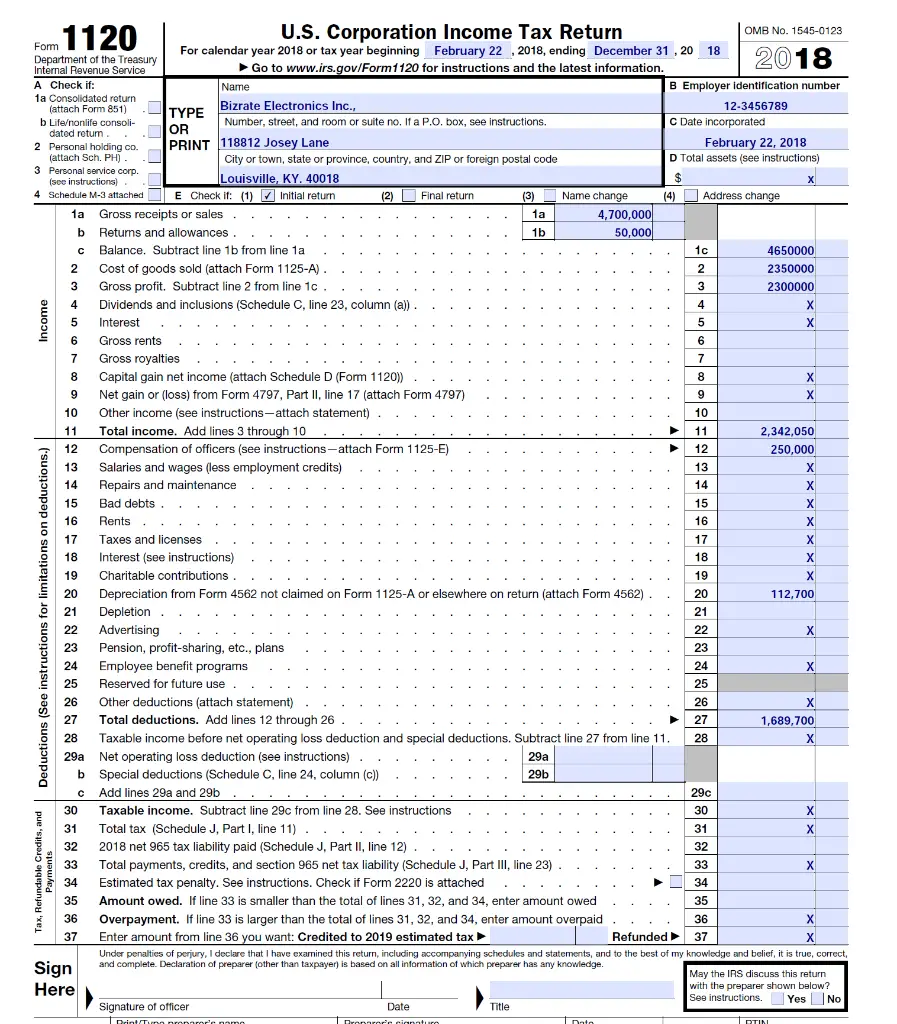

The federal corporate tax rate is a flat 21% .

Recommended Reading: How To Find Out Why I Owe Taxes

How Much Do You Have To Make To File Taxes If Youre Claimed As A Dependent

If you are claimed as a dependent, there are certain circumstances when the IRS could require you to file a tax return:

Single dependents under 65 and not blind are required to file taxes if:

- Earned income exceeded $12,200

- Gross income was more than the total 2019 threshold

Single dependents 65 years or older or blind are required to file taxes if:

- Earned income exceeded $13,850

- Their gross income exceeded the total 2019 threshold

Single dependents 65 years or older and blind are required to file taxes if:

- Earned income exceeded $15,500

- Gross income was at least $5 and your spouse files a separate return and itemizes deductions

- Earned income exceeded $14,800

- Unearned income exceeded $3,700

- Gross income was at least $5 and your spouse files a separate return and itemizes deductions

The minimum income requirement to file taxes are the combined total of your standard deduction and personal exemption. If you claim the standard deduction, take note that you cannot itemize deductions as well.

Recommended Reading: What Is Required To File Taxes

Extension To File Your Tax Return

If you cant file your federal income tax return by the due date, you may be able to get a six-month extension from the Internal Revenue Service . This does not grant you more time to pay your taxes. To avoid possible penalties, estimate and pay the taxes you owe by the tax deadline of April 19, 2022, if you live in Maine or Massachusetts or April 18, 2022, for the rest of the country.

Don’t Miss: Which States Do Not Have Property Taxes

How To Link Aadhar To Income Tax Returns

it is compulsory for every individual taxpayer to quote their Aadhar number while filing tax returns. He/she is also required to link their PAN card to their Aadhar number. One cannot file a tax return either digitally or manually unless the Aadhar number is quoted. Senior citizens can file their tax returns manually but those below 80 years of age have to file it electronically.

To link your Aadhar number to your income tax return-

Type or write down the number in the additional spaces provided in the new ITR forms provided in the Income Tax website.

If you have applied for an Aadhar number but have not received it, you can use the 28 digit enrolment ID in place.

The Aadhar number gets automatically populated in the ITR forms if it has been electronically added before.

Individual Income Tax Forms

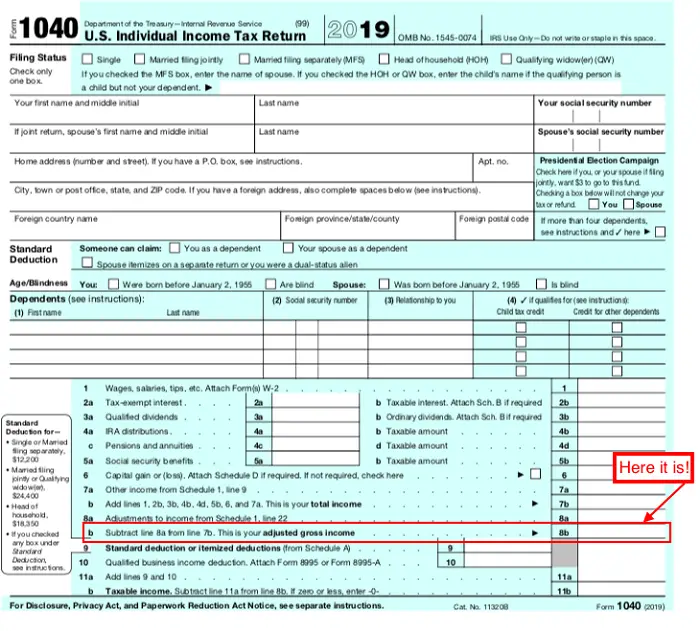

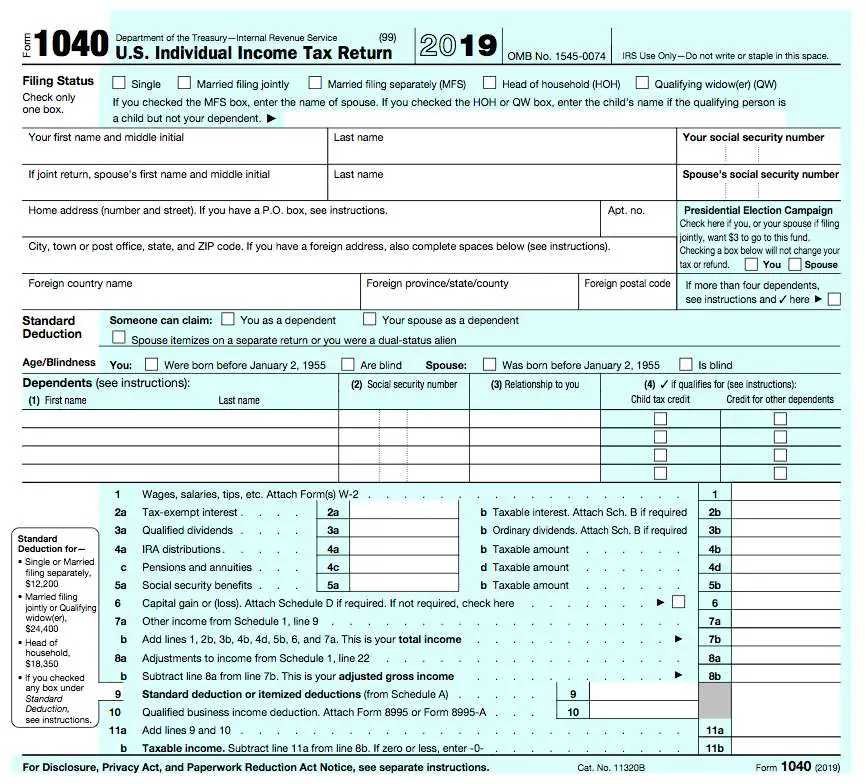

The Arizona Department of Revenue will follow the Internal Revenue Service announcement regarding the start of the 2022 electronic filing season. Because Arizona electronic income tax returns are processed and accepted through the IRS first, Arizonas electronic filing system for individual income tax returns is dependent upon the IRS’ launch date. Remember, the starting point of the Arizona individual income tax return is the Federal Adjusted Gross Income.

Taxpayers can begin filing individual income tax returns through Free File partners and individual income tax returns will be sent to the IRS upon e-file season opening. Tax software companies also are accepting tax filings in advance of the IRS’ launch date.

Please refer to the E-File Service page for details on the e-filing process.

You May Like: How To Get Last Year’s Tax Return

Office Of The Taxpayer Advocate

The Office of the Taxpayer Advocate, also called the Taxpayer Advocate Service, is an independent office within the IRS responsible for assisting taxpayers in resolving their problems with the IRS and identifying systemic problems that exist within the IRS. The current head of the organization, known as the United States Taxpayer Advocate, is Erin M. Collins.

What Are Income Tax Forms

OVERVIEW

Income tax forms are the official government documents you’re required to fill out when you pay your taxes.

|

Key Takeaways Most taxpayers use Form 1040 to report their taxable income to the IRS. Taxpayers aged 65 or older can use Form 1040-SR, which older taxpayers may find easier to read. The IRS may require you to fill out additional forms, including a Schedule C to report your business earnings and deductions, a Schedule E to report profit or loss from rental properties, royalties or pass-through entities, or a Schedule D to report capital gains or losses from the sale of capital assets. If you work as an employee, you may receive a W-2, which reports the amount of income you made and how much the employer withheld from your paycheck for taxes. Independent contractors generally receive a Form 1099 from their clients, which also reports annual earnings, but does not usually include any tax withholding. |

Recommended Reading: Do I Have To Pay Taxes On Inherited Money

How To Download Itr V Form Online

After you have duly submitted your tax return, the Income tax Department generates a verification form that lets you authenticate the e-filing of your taxes done online. This is allowed only for those who file their returns without digital signature. Let us take a look at how to download the ITR V form online:

1. Visit the Income Tax Department of India website at

2. Click on ‘View Returns/ Forms’ to view your e-filed return

3. Then select income tax returns from the available options

4. This will display the returns filed for all years by you

5. Download ITR V by clicking on the acknowledgement number and selecting ‘ITR-V Acknowledgment’

6. When asked for your password, enter PAN number in lower case and your date of birth to open the document

Take a print out of the document and sign it. Send it by post to CPC Bangalore within 120 days of having e-filed your tax return. The other option is to generate Aadhar OTP via net-banking, ATM etc and complete e-verification of your ITR. File your ITR on time and avoid missing the due dates to stay on the safer side. If you somehow miss the due date for filing ITR, you can file your ITR on a later date on or before 31st March of the next year. That means either you can file your ITR before the completion of assessment year or by the end of the assessment year.

Related Articles