Who Is Responsible For Collecting And Filing Sales And Use Taxes

The vendor must collect and file sales tax. A vendor is a person in the retail business, who sells finished goods to consumers. Anyone who sells taxable services to consumers must also collect and file sales tax.

Read the Law: Md. Code, Tax-General § 11-701

A vendor includes entities defined in the law as marketplace facilitators. To illustrate what a marketplace facilitator is, consider Amazon. Many goods sold on Amazon.com are not sold by Amazon, but by third party sellers. Amazon handles payment and delivery of the product. Maryland law requires marketplace facilitators to collect sales tax at the time of purchase.

Use tax must be filed by any consumer who makes a tax-free purchase in another state.

Does Maryland Have A Sales Tax Holiday

Yes, two breaks a year from the tax mans ever watchful gaze. The first is Shop Maryland Tax Free Week, which starts the second Sunday in August to the following Saturday and grants a reprieve on back to school type items under $100. Then there is Shop Maryland Energy, a three-day weekend that starts on the Saturday that follows the third Monday in February. During that tax holiday sales of certain Energy Star appliances are exempt from tax.

*****

We have now covered who you need to collect sales taxes from, how to determine whether goods for sale are deemed taxable, what goods and services fall under tax exemptions, who is eligible for tax exemption certificates, and, finally, the process of collecting sales tax in Maryland state.

Now that were this far down the rabbit hole theres only one thing we need to learn about next how to pay the piper!

What Is Exempt From Sales Taxes In Maryland

Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales tax altogether. Here’s how Maryland taxes five types of commonly-exempted goods:

Clothing

OTC Drugs

For more details on what types of goods are specifically exempt from the Maryland sales tax see . To learn more about what types of transactions are subject to the sales tax to begin with, see what purchases are taxable in Maryland? Taxation of vehicle purchases in particular are discussed in the page about Maryland’s sales tax on cars.

Also Check: Reverse Ein Lookup Irs

Does The Comptroller Of Maryland Offer A Discount For Filing On Time

Yes, Maryland offers a rather generous timely discount! Theyll chop 1.2% off the first $6k and 0.9% on the remainder up to a maximum of $500 per return. Take advantage and file and pay on time.

*****

Now that we covered all our bases for filing and paying sales taxes in the state of Maryland, you should feel more at ease about the process.

Some things to remember:

- Due dates are important. If anything, file and pay your taxes early.

- There are three payment plans for filing and paying your sales taxes depending on how much you collect in sales tax on average in a month.

- You can file and pay your taxes electronically or by mail

- If you need to amend a return, you may do so electronically or by paper.

- If you dont collect sales tax and you were supposed to, you is liable to pay the sales tax to the state of Maryland.

- You will have to pay late fees if you fail to file your tax return on time and/or if you fail to make your tax payment on time.

- Even if you collect no sales tax, you still need to file a return.

- You need to file a Final return when you close your business.

Now, you are ready to file and pay your sales tax in Maryland. If you have any more questions, feel free to contact us.

What Creates A Tax Nexus With The State Of Maryland

Having nexus, also known as “sufficient business presence, with Maryland means your business has established a taxing connection with a state. When this happens, you are required to collect and remit sales tax in Maryland because you created a sales tax Nexus.

Even if your business maintains its main headquarters in another state, you may still have to charge and pay sales tax to the Comptroller of Maryland even if you never step foot in Maryland.

So, how do you create a sales tax Nexus in Maryland?

A business establishes a nexus in Maryland by:

- having a business location in Maryland

- having property stored in Maryland

- employing any person in Maryland

- contracting with a salesperson or other agent in Maryland

- leasing equipment used in Maryland

- performing services in Maryland

- licensing the use of intangible property in Maryland, or transporting property in Maryland using the taxpayers vehicles.

Lets talk a bit more specifically about where your goods are stored such as in the instance of an Amazon warehouse.

Recommended Reading: Buying Tax Liens California

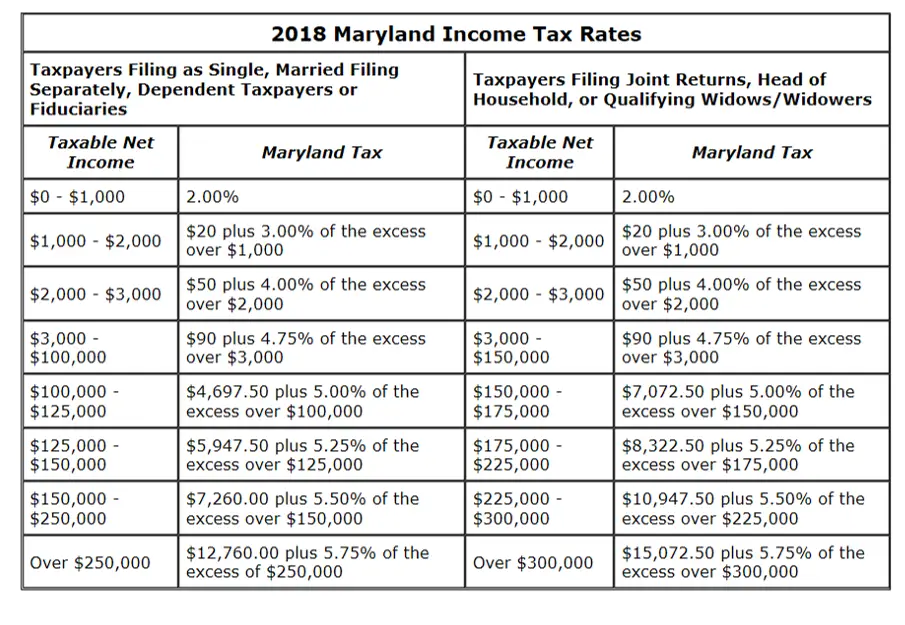

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

How Do I Collect Maryland Sales Tax

Because Maryland is a destination-based sales tax state, your business should charge sales tax based on the location of the purchaser, at the time of the transaction. This is usually as simple as configuring the Point-of-Sales system accordingly. The nice thing with Maryland is there are no complicating, compounding jurisdictions. Just one simple rate for the state.

Also Check: How Much Does H& r Block Charge To Do Taxes

What Are The Current Maryland Sales Tax Rates

At the time of this articles publication, Marylands state-wide sales tax rate is 6% for most tangible goods. There are special taxes on alcohol , car rentals , and small truck rentals . There is some variability for certain special situations. Since sales tax rates may change, we suggest utilizing the above links to stay up to date.

It always helps to be accurate and up to date with this type of information! 🙂

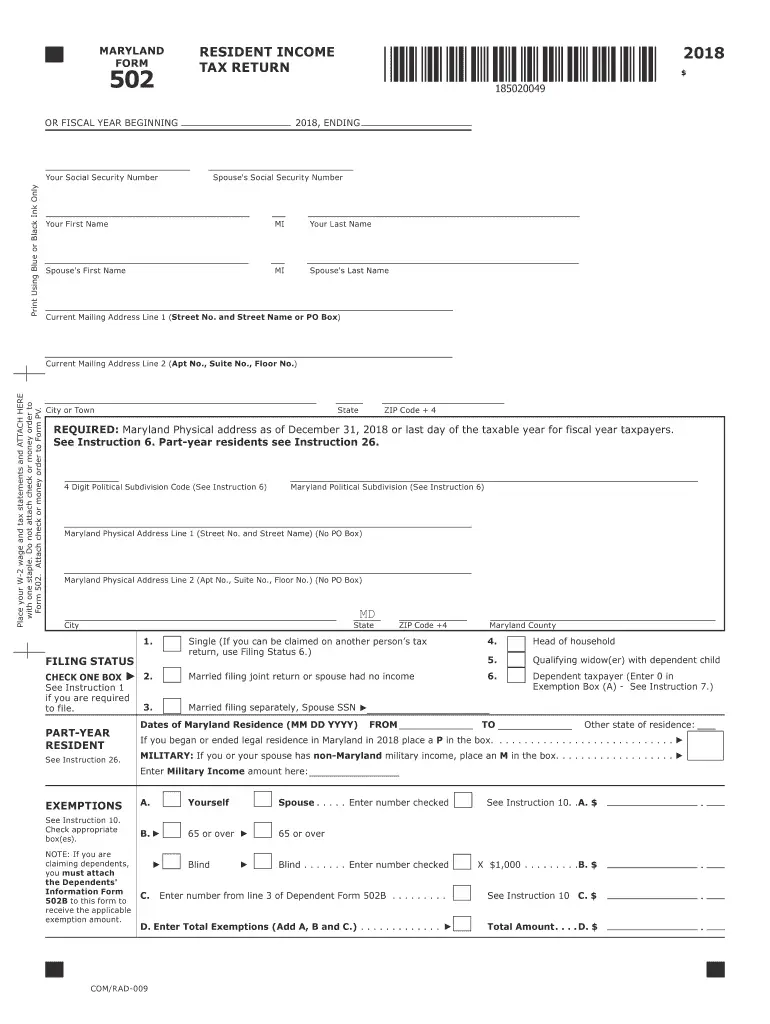

Other Maryland Tax Facts

With i-File Maryland, the states taxpayers can e-file personal income tax returns, along with the most commonly associated schedules and forms.

Under Maryland law, all people offering individual tax preparation services must be licensed with the State Board of Individual Tax Preparers. More information is available at the Department of Labor, Licensing and Regulation website.

For more information, contact the comptroller of Maryland. If you have additional tax questions, send an email to the states service.

To download tax forms on this site, you will need to install a free copy of Adobe Acrobat Reader. Click here for instructions.

Related Links:

You May Like: How Much Does H& r Block Charge To Do Taxes

Tax Policy In Maryland

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in Maryland |

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Does Amazon Have Fulfillment Centers In Maryland

Yes, there are three of them at the time of this articles publishing:

- 2010 Broening Hwy // Baltimore, MD // 21224

- 5501 Holabird Ave // Baltimore, MD // 21224

- 600 Principio Parkway West // North East MD // 21901-2914

This is relevant if you sell your products on Amazon or are recognized as an Amazon FBA seller. When Amazon stores your products in one of its fulfillment centers in any state, including Maryland, this triggers a sales tax requirement. If Amazon is storing your products in a warehouse in Maryland, you have created a taxing connection with the state of Maryland.

We can help guide your small business through this. We use tools like A2X and Wherestock to identify where our clients’ inventory is currently being held and shipped from so that we can keep them in compliance.

You May Like: How Much Is H& r Block Charge

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

What Is Sales And Use Tax

Sales tax is a state tax on the purchase of most tangible personal property and on some services in Maryland. Tangible personal property is property that can be physically touched, manufactured, and moved. In Maryland, it also includes electricity, natural gas, and the right to stay/rent a room .

Read the Law: Md. Code, Tax-General §11-101

Use tax applies when a purchase of tangible personal property is made outside the state of Maryland. If the individual makes an out-of-state, tax-free purchase, then the individual must file a Consumer Use Tax Return within three months of the purchase.

Throughout this article, we will use the term goods to mean tangible personal property.

Recommended Reading: Efstatus Taxact Com Login

Residential Clean Energy Grant Program

This MD solar rebate program is beautiful in its simplicity: If you install a solar energy system, Maryland will pay you $1,000. As easy as that. Just make sure your system is smaller than 20 kilowatts , is located at your primary residence, and that your installer has the standard NABCEP certification.

What Other Maryland Taxes Should I Be Concerned About

The Maryland estate and inheritance taxes do not affect everyone, but if you’re planning your estate, it’s a good idea to be familiar with them. The current estate tax exemption is $5 million, a little under half of the federal exemption.

In addition to an estate tax, Maryland also collects an inheritance tax. Most direct relatives are exempt from this tax, including children and other direct descendants, spouses, parents, siblings and stepchildren. Non-relatives and distant relatives who receive an inheritance are taxed at a rate of 10%.

Recommended Reading: Www Michigan Gov Collectionseservice

What If I Owe And Cant Pay

If you cant pay your taxes by the filing deadline, you can request a payment plan. But you should still file your state tax return by the filing deadline. You can seek a payment arrangement by

- Setting up a new payment agreement online

- Replying to the tax bill you receive for the amount due

If you dont arrange a payment plan or pay your taxes, the state can take a number of enforcement actions, including

- A late payment penalty of up to 25% of the tax amount you owe

- Interest charges

- Nonrenewal of motor vehicle license and registration

- Withholding renewal of certain state-issued business or professional licenses

- Interception of state or federal tax refunds or vendor payments

- Salary lien

- Seizure of bank accounts, cash, liquor licenses, equipment, vehicles, business inventory or real property

- Posting tax delinquency information online

- Referral of debt to a collection agency

Filing And Paying Sales Tax In Maryland

It is time to talk about filing and paying your sales taxes in Maryland. In this section, We are going to cover the following frequently asked questions from our clients:

- When is Maryland Sales Tax due?

- What are the Maryland Sales Tax thresholds?

- What if a Maryland Sales Tax filing date falls on a weekend or holiday?

- How do I file a Maryland Sales Tax Return?

- How do I correct a Maryland Sales Tax return?

- What happens if I dont collect sales tax?

- What happens if I file or pay my sales tax return late?

- Do I need to file a return if I dont collect any sales tax in Maryland?

- If I close my business, do I need to file a final sales tax return?

- Does the Comptroller of Maryland offer a discount for filing on time?

Also Check: Do I Need W2 To File Taxes

The Federal Solar Tax Credit

Dont forget about federal solar incentives! With the Investment Tax Credit , you can reduce the cost of your PV solar energy system by 26 percent. Keep in mind that the ITC applies only to those who buy their PV system outright , and that you must have enough income for the tax credit be meaningful.

How Do I Register To Collect Sales Tax In Maryland

You can apply or register for a Maryland state sales tax permit by visiting the Comptroller of Maryland website and following the instructions provided.

Maryland also has an old school paper based form you can print and mail in, but this is going to be a much slower setup and with a greater possibility for errors. We dont recommend it, but want to make the option available in case it suits the needs of someone out there.

You May Like: Www Aztaxes Net

Is The Maryland Sales Tax Destination

Maryland is a destination-based sales tax state, which meansthat sales tax rates are determined by the location of the buyer when the transaction is completed. This means that, for orders placed via the internet/mail by a customer within Maryland from a Maryland vendor, the vendor must collect a sales tax rate applicable at the buyer’s address . This can significantly increase the complication of filing your sales tax return, because different sales tax rates must be charged to different buyers based on their location.

What Should I Do If My Customer Is Exempt From Sales Tax In Maryland

Purchasers who are tax exempt must have completed an exemption certificate and must present their completed exemption certificate at the time of purchase. It is then incumbent upon the seller to hold on to this exemption certificate. Failure to do so may leave you unable to justify tax exempt sales.

Maryland provides a website to determine whether an exemption certificate is valid. Note that determining the validity via the website doesnt reduce the requirement to hold on to the certificate for bookkeeping purposes.

You May Like: How Much Does H& r Block Charge To Do Taxes

Find Your Maryland Tax Id Numbers And Rates

Look up your Central Registration Number online by logging into the Comptroller of Marylands website.

Locate your eight digit Central Registration Number on any previously filed Annual Reconciliation Return .

Locate your ten-digit Unemployment Insurance Employer Number on any previously filed quarterly report .

Look up your UI tax rate online.

You are responsible for ensuring Square Payroll has the correct tax ID numbers and tax rates for your business. Please contact us if you need to update either of your tax ID numbers or your UI rate.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

You May Like: How Much Does H & R Block Charge For Taxes

Agency: Maryland State Income Tax Information

- Virtual appointments only, available Mon – Fri 8:30AM – 4:30PM.

- Must have completed federal return, all W-2 statements, supporting documents and picture ID.

- Appointments must be scheduled using the online appointment scheduler.

- Taxpayer must have internet access and able to connect with “Microsoft Teams”.

- Appointments can be accessed using camera on computer or cell phone.

- Individual will receive an e-mail with instructions and the “invite link” to virtual meeting.

- Individual should join 5 minutes before scheduled virtual appointment time.

- 2020 ELIGIBILITY:

- – $50,954 with three or more qualifying children-$47,440 with two qualifying children-$41,756 with one qualifying child-$15,820 with no qualifying children