Social Security And Medicare Tax Withholding Rates And Limits

| Tax | |

| Earnings to $200,000 in 2020 | |

| No employer contribution | Earnings to $200,000 in 2021 |

Employees are no longer required to pay the Social Security tax in a given year when their earnings hit the contribution and benefits base, often referred to as the taxable minimum. Youand your employerwould pay the Social Security tax on only the first $142,800 in 2021 if you earned $143,000, for example. That remaining $200 is Social Security tax-free.

The Social Security tax will apply again on January 1 of the new year until your earnings again reach the taxable minimum.

The Medicare taxes work somewhat in reverse. All income is subject to Medicare taxation, but the Additional Medicare Tax does not apply until after your income reaches a certain threshold: $200,000 in 2020 and 2021.

Which Wages Are Subject To Medicare Tax

Almost all wages earned by an employee in the United States are subject to the Medicare tax. How much an individual is taxed will depend on their yearly earnings.

However, certain pretax deductions are exempt from the FICA tax, which includes Social Security and Medicare taxes. These pretax deductions include retirement contributions, like 401 accounts and individual retirement accounts, as well as life insurance premiums.

Why Do I Need To Pay Additional Medicare Tax

To cover the costs of the countrys Medicare program, your employer is obliged to withhold a Medicare tax from your paycheck. By law, employers are required to collect both Social Security and Medicare tax. This money is then submitted to the IRS every quarter.

If you, or you and your spouse, earn wages over a certain threshold, you will be liable for additional Medicare tax. This additional Medicare tax is designed to lean on wealthier U.S. citizens to pay for the medical care and health welfare of lower-income Americans.

Read Also: Where Do I Mail My Taxes In California

What Does Medicare Tax Mean

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

Generally, all U.S.-based workers must pay the tax on their wages. The tax is grouped together under the Federal Insurance Contributions Act , and when looking at your paycheck, you may see the Medicare tax combined with the Social Security tax as a single deduction for FICA.

The Medicare tax was established in 1966 to solve a health care problem. For many seniors, there was an affordability issue because incomes usually decline after retirement, and during aging, health care costs can increase. There was also an access issue because insurers were canceling some policies of the elderly because their age made them a high risk to insure.

The Medicare program has many components, but a key change at the time was the working population would pay a new Medicare tax to support Medicare hospital insurance.

Where Social Security Taxes Go

The bulk of the FICA tax revenue goes to funding the U.S. government’s Social Security trusts. These trusts are solely designated to fund the programs administered by the Social Security Administration, including:

- Retirement benefits

- Survivor benefits

- Disability benefits

The Social Security tax revenue that’s collected from wage earners and employers is placed into these trusts, which in turn fund the monthly benefits to these individuals:

- Retirees and their spouses who have qualified for Social Security .

- Surviving spouses and minor children of workers who have died .

- Disabled workers .

Costs associated with administering the plan also come directly from these trusts, but they’re minimal: Less than one cent out of every dollar collected pays for administrative costs, according to the Social Security Administration.

The taxes collected can exceed the cost of current benefits. The money is put in the trusts and invested to pay for future program benefits when this occurs.

Investments made from the funds placed in these trusts allow the federal government to essentially borrow against the surplus to fund other parts of the government. This practice has many worried about the longevity of these Social Security programs, but the government has repaid its loans from the Social Security trusts with interest so far.

You May Like: How To Get My Income Tax Return Copy Online

Are Medicare Taxes Also Charged On Investment Income

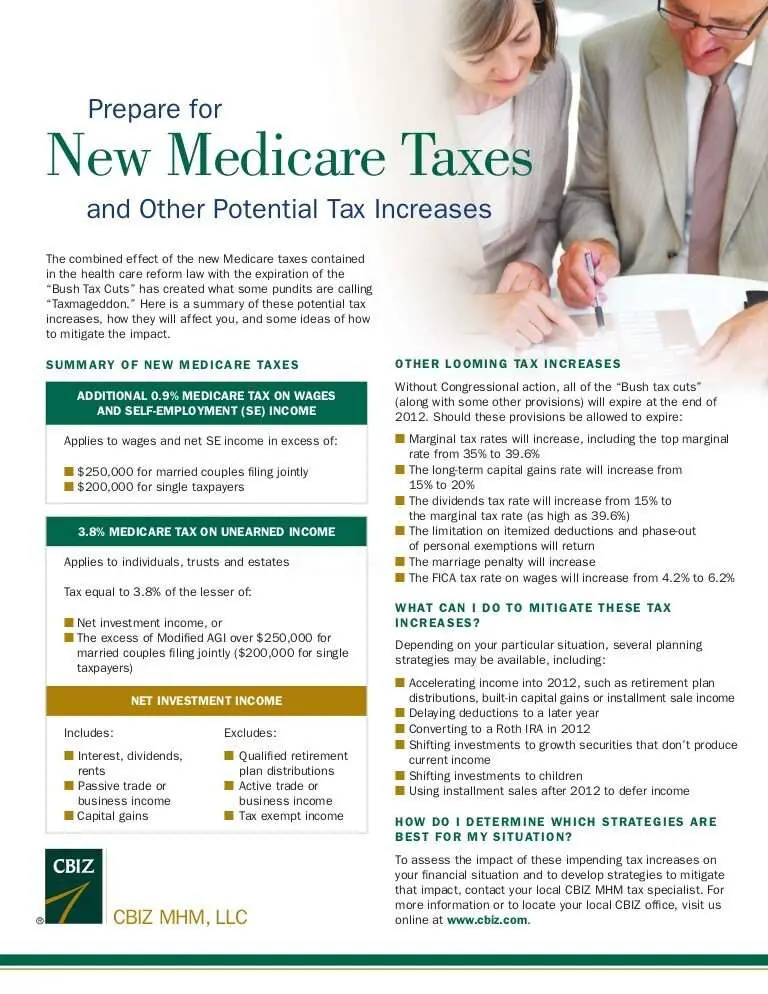

The Net Investment Income Tax was established in part 2 of the Affordable Care Act in a section titled the Unearned Income Medicare Contribution. For those who received investment income, this act charges a 3.8% tax on whichever is less â net investment income or modified adjusted gross income in excess of the annual threshold .

Even though the tax is thought of as contributing to Medicare because of its title, the revenue goes into a general fund and is not earmarked for Medicare. According to the Joint Committee on Taxation’s Description of the Social Security Tax Base , “No provision is made for the transfer of the tax from the General Fund of the United States Treasury to any Trust Fund.”

What Is The Medicare Tax Rate

The Medicare tax rate is 1.45% of an employees wages. Again, Medicare is an employer and employee tax. You must withhold 1.45% from an employees pay and contribute a matching 1.45%. Altogether, Medicare makes up 2.9% of the FICA tax rate of 15.3%. The rest goes toward Social Security taxes.

Lets say an employee earns $1,000 in gross wages each pay period. Withhold $14.50 from their wages for Medicare tax. And, contribute a matching $14.50.

Unlike the Social Security wage base, there is no limit to taxable Medicare wages. Continue withholding Medicare tax regardless of what your employees earn. And if an employee earns a certain amount, they are subject to an additional Medicare tax.

Also Check: What Are The Different Tax Forms

Payroll Withholding For The Amt

Employers might not always be aware that an employee is subject to withholding for the AMT. If an employee works more than one job, their incomes from Employer A and Employer B might both fall under the threshold individually, so neither employer would withhold this tax.

The taxpayer would still be liable for the AMT on their combined incomes.

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.

If you are subject to the AMT, you must complete and file Form 8959 with your tax return.

And 2022 Irmaa Brackets

The IRMAA income brackets started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and 2022 coverage. Before the government publishes the official numbers, Im able to calculate based on the inflation numbers and the formula set by law. Remember the income on your 2020 tax return determines the IRMAA you pay in 2022. The income on your 2021 tax return determines the IRMAA you pay in 2023.

| Part B Premium |

|---|

| Single: > $500,000Married Filing Jointly: > $750,000 |

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes. Does making them pay another $1,400/year make that much difference? Nickel-and-diming just annoys people. People caught by surprise when their income crosses over to a higher bracket by just a small amount get mad at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and dont accidentally cross a line for IRMAA.

Recommended Reading: Do You Have To Claim Social Security On Taxes

How Social Security Determines You Have A Higher Premium

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

How Medicare Tax Works

Just about anyone who works in the U.S. is required to pay Medicare taxes. Under the Federal Insurance Contributions Act , employers are required to withhold Medicare tax and Social Security tax from employees paychecks. Likewise, the Self-Employed Contributions Act mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax.

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury. Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B and Medicare Part D are covered by the Supplemental Medical Insurance Trust Fund, which is funded with premiums paid by beneficiaries, tax revenue, and investment earnings.

The money is intended to be used for both current and future Medicare beneficiaries. However, the Hospital Insurance Trust Fund has been facing solvency and budget pressures and is expected to be exhausted by 2026, according to the 2019 Trustees Report. If this happens, then Medicare services may be cut, or lawmakers may find other ways to finance these benefits.

In 2020, the Coronavirus Aid, Relief, and Economic Security Act expanded the Medicare program to cover treatment for individuals affected by the COVID-19 pandemic. This included increased Medicare payments for hospital stays and durable medical equipment related to COVID-19.

Recommended Reading: Which Tax Return Did You Have From Last Year

When Would You Owe The Late Enrollment Fee

If you don’t enroll in Medicare when you’re eligible, you could owe a late enrollment penalty. For example, if you turn 65 and don’t have another health plan, you’d pay the penalty if you decide to enroll in Medicare later.

For Part B, the late enrollment fee means your monthly premium would increase by 10 percent for each 12-month period you could have had Part B but didn’t. Plus, you’d have to pay for all healthcare costs out-of-pocket until you had coverage.

If you choose not to enroll when you’re eligible AND you don’t have creditable coverage elsewhere, you will not qualify for an SEP. Therefore, you must wait for Medicare’s General Enrollment Period to sign up. This occurs every year from January 1 through March 31, with coverage beginning on July 1. .

Medicare Taxes: The Basics

Like Social Security benefits, Medicares Hospital Insurance program is funded largely by employment taxes. If you work under the table you wont pay into these systems. Thats why payroll tax withholding, although it takes a chunk out of your take-home pay, is actually providing you with something in return for those lost dollars in your paychecks.

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though its still below the Social Security tax rate. The current Social Security tax is 12.4% with employees and employers each paying 6.2%.

Today, the Medicare tax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.

Recommended Reading: How To File Taxes At H& r Block

When Did Additional Medicare Tax Start

The Affordable Care Act was passed in 2010. However, the final regulations for the additional Medicare tax were only issued by the Internal Revenue Service at the end of 2013. The surtax applies to wages, self-employment income, and compensation. These regulations require that employers are responsible for withholding the tax on employee wages.

Payroll Tax Responsibilities For Employers

That was a lot of information lets summarize it in a few easy steps:

Recommended Reading: How To Pay Back Taxes Online

Incorrect Ss And Medicare Withholding

If SS and Medicare is Withheld in Error

The process for reimbursing a person for SS and Medicare taxation withheld in error depends on whether the adjustment is for the current calendar year or a previous calendar year. If the adjustment is for the

- current calendar year, the money withheld in error can be included in the persons next paycheck .

- previous calendar year, a prior year adjustment must be made to the payroll record and a check produced through the accounts payable module for the amount withheld in error. Manual corrected tax statements must be produced for the individual and for reporting to the IRS and SSA. A W-2c must be produced.

If SS and Medicare Was Not Withheld but Should Have Been

If SS and Medicare was not withheld from a persons earnings, the location must attempt to recover withholding amounts dating back to the time when the person first became subject to taxation. If the collection of withholding amounts is for the

What Is The Net Investment Income Tax

Beyond your payroll withholdings and possibly the Additional Medicare tax, theres one other way you could end up paying Medicare tax. And this one has to do with investments.

The Net Investment Income Tax , like the Additional Medicare tax, is basically an extra tax for high earners. The NIIT tax takes your investment incomewhich includes dividends, interest, passive income, annuities, royalties and capital gainsand applies the 3.8% NIIT tax to it.6

This particular Medicare tax looks at investment income and your modified adjusted gross income . Your MAGI is your household adjusted gross income plus tax-exempt interest income and certain deductions added back inso, your gross income, but modified. If youre a single filer making $200,000 or more, or a joint filer earning $250,000 or more, then you might have to pay the NIIT.

Depending on your income, and the sources of your income, its possible to owe both the Additional Medicare tax and the NIIT. Thats because the Additional Medicare tax applies to your wages and other forms of compensation, and the NIIT applies to your investment income.

Don’t Miss: How To Find Tax Amount

How Is The Additional Medicare Tax Calculated

Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act . Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings. Self-employed people pay the entire 2.9 percent on their own.

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are:

- Single tax filers: $200,000 and above

- $250,000 and above

- $125,000 and above

- Head of household tax filers: $200,000 and above

- Qualifying widow tax filers with a dependent child: $200,000 and above

Employers are required to withhold the additional 0.9 percent for employees with salaries that are at or over these income limits. If you have income from other sources that will put you over that limit, you can request that your employer withhold this amount from your checks. Self-employed taxpayers who are at or over the limits need to include this calculation in their estimated tax payments for the year.

When you file taxes, youll calculate your Additional Medicare Tax liability for the year. In some cases, you might owe more, and in other cases, you might have paid too much. Any payment owed or refund adjustment needed will be added to your overall required payment or refund amount.

The Additional Medicare Tax helps supplement the cost of these new Medicare benefits.

Remitting And Reporting Social Security Tax

Most employers must use Form 941 to report FICA taxes and federal income tax withholding. You must submit this form on a quarterly basis.

Some employers might be able to use Form 944 to report Social Security, Medicare, and federal income taxes. This is an annual form. The IRS will notify you if your business qualifies to use Form 944.

You will deposit Social Security taxes on either a monthly or semiweekly basis. Your deposit schedule is based on a lookback period of the taxes you previously reported on Form 941 or Form 944. You can learn more about the lookback period and how to determine your deposit schedule in Publication 15. Your lookback period can change, so make sure you verify your lookback period before the beginning of every calendar year.

You must use EFTPS to deposit your payroll taxes. Late tax deposits may be subject to a fee.

By January 31 each year, you will give each of your employees a Form W-2. This form lists the amount of all the employment taxes you withheld from their wages during the previous year. You will also submit Form W-2 and Form W-3 to the Social Security Administration, which records the taxes withheld for the year. Forms W-2 and W-3 must be filed by January 31. You may also have to submit these forms to the state tax agency.

This article is updated from its original publication date of 10/19/2015.

Don’t Miss: Does California Have An Inheritance Tax