How To Figure Out Your Tax Bracket

You can calculate the tax bracket you fall into by dividing your income that will be taxed into each applicable bracket. Each bracket has its own tax rate. The bracket you are in also depends on your filing status: if youre a single filer, married filing jointly, married filing separately or head of household.

The tax bracket your top dollar falls into is your marginal tax bracket. This tax bracket is the highest tax ratewhich applies to the top portion of your income.

For example, if you are single and your taxable income is $75,000 in 2022, your marginal tax bracket is 22%. However, some of your income will be taxed at the lower tax brackets, 10% and 12%. As your income moves up the ladder, your taxes will increase:

- The first $10,275 is taxed at 10%: $1,027.50.

- The next $31,500 is taxed at 12%: $3,780.

- The last $33,225 is taxed at 22% $7,309.50

- The total tax amount for your $75,000 income is the sum of $1,027.50 + $3,780 + $7,309.50 = $12,117 .

More About Tax Brackets

What Is My Tax Bracket?

The federal income tax system is progressive, which means different tax rates apply to different portions of your total income. Tax bracket refers to the highest tax rate charged on your income.

What Are Tax Tables?

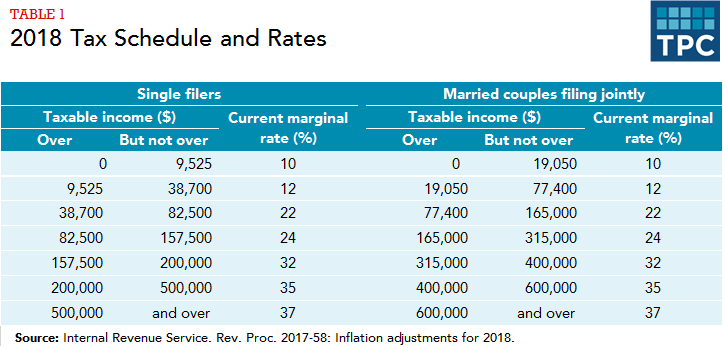

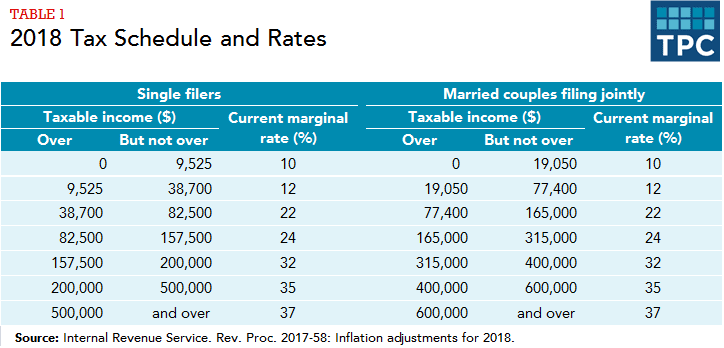

Tax tables like the one above, help you understand the amount of tax you owe based on your filing status, income, and deductions and credits.

Tax brackets only apply to your taxable income. Your deductions and taxable income may drop you into a lower tax bracket or potentially a higher one.

Taxable Income vs. Nontaxable Income

Income comes in various forms, including wages, salaries, interest, tips and commissions. Nontaxable income wont be taxed, whether or not it is entered on your tax return.

What Is The Extra Deduction For Over 65

If you are age 65 or older, your standard deduction increases by $1,700 if you file as Single or Head of Household. If you are legally blind, your standard deduction increases by $1,700 as well. If you are Married Filing Jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,350.

Don’t Miss: Do You Have To Pay Back Taxes For Doordash

Federal Tax Rates For 2021

- 15% on the first $49,020 of taxable income, plus

- 20.5% on the next$49,020 of taxable income , plus

- 26% on the next$53,939 of taxable income , plus

- 29% on the next $64,533 of taxable income , plus

- 33%of taxable income over$216,511

The chart below reproduces the calculation on page 5 of the Income Tax and Benefit Return.

Income Tax Brackets: Important Terms

The terminology around income tax brackets and tax rates can be confusing at times. To clarify whats meant, lets review a few relevant terms that relate to this topic.

- Income Tax Rate These are the various percentages at which taxes are applied.

- Income Tax Brackets These are the ranges of income to which a tax rate applies. Currently there are seven ranges or segments.

- This is the rate at which the last dollar of income is taxed. In the example above, Sarahs marginal tax rate is 22%.

- Effective or Average Tax Rate This is the total tax paid as a percentage of total income taxed. In Sarahs case, her average tax rate is 13.6% .

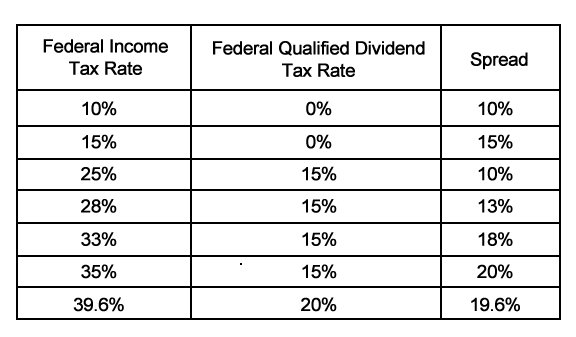

In addition to these definitions, its helpful to understand that the percentages in the table above apply to income from ordinary sources. A separate set of tax rates apply to other categories of income. For instance, to the extent your gains fall below a rate threshold amount, any long-term capital gains you receive are taxed at 0% or 15%.

Recommended Reading: Is Plasma Donation Taxable

Tax Preparation: How Much Does It Cost

While you can certainly choose to sit down at the kitchen table with nothing but IRS forms, financial documents, and a pencil, a growing number of people choose to cough up the extra cash to use tax prep software or even a real, live tax professional. The best part? This expense is deductible. The question remains, how much does it cost?

There are a variety of online tax filing solutions. Names you’ve heard of like TurboTax, TaxAct, H& R Block, Quicken, Tax Slayer…the list goes on. In general, expect to pay more the more complicated your tax life is. The cost to use software also rises when you need to file self-employment forms or a Schedule C. Credit Karma Tax is the only software that offers a free option to file simple federal and state returns at no cost. For the rest, expect to pay around $50 to $100 to accomplish the task.

If you prefer to interact with a human being, there are a multitude of choices, from well-known franchises like H& R Block on down to independent one-person bookkeeping services. As with tax software, you pay more for complicated circumstances. A brand-name chain might cost in the $400-500 range to get the deed done. Local independent tax professionals are all over the map when it comes to price. You might place less than with the big names or you might pay more. Your best advice is to nail down the exact cost upfront so there are no surprises.

The Irs Has Announced Its Inflation Adjustments For 2021 Taxes

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

The Internal Revenue Service updates tax rates, allowances, and thresholds every year. These figures are applicable to the tax law provisions that are adjusted annually for inflation. The top tax rate will continue to be 37% for returns filed by individual taxpayers for the 2021 and 2022 tax years but the standard deduction, tax bracket ranges, other deductions, and phase-outs will increase.

Read Also: Cook County Appeal Property Tax

How Are Dividends Taxed In Canada

There are two types of dividends in Canada: “Eligible Dividends” and “Other Than Eligible Dividends”. Corporations will designate their dividends as either âeligibleâ or âother than eligibleâ for tax purposes.

Dividends are paid out of a corporation’s after-tax profits. This means that tax has already been paid on the dividend amount. However, not all corporations have the same tax rate.

Canadian Controlled Private Corporation are eligible for the small business deduction, which reduces their corporate income tax rate. Dividends paid out by them are “other than eligible”. Since a lower amount of tax has already been paid on them, you will receive a smaller tax credit rate.

Public corporations are not eligible for the small business deduction, and so their dividends are designated as eligible dividends. As a higher tax rate applies to these public corporations, your dividend tax credit amount will be larger.

A dividend gross-up multiples your actual dividend amount by a certain multiplier, which attempts to replicate what the dividend-paying corporation had to earn in order to pay out the dividend after taxes.

Do You Have To Pay Income Tax After Age 80

For tax year 2020, for which the deadline to file in 15 April 2021, many seniors over the age of 65 do not have to file a tax return. If Social Security is your sole source of income, then you don’t need to file a tax return, says Turbo Tax. The exceptions to this are as follows, if you are over 65 and

Read Also: Doordash Independent Contractor Taxes

Calculator Variables And Results

Choose the year that you want to calculate your US Federal Tax

Filing Status

Choose one of the following: Single, Married Filing Jointly, Married Filing Separately, or Head of Household

Taxable Income

The income amount that will be taxed

Estimated Tax

The estimated tax you will pay

Tax Bracket

The tax bracket you fall into based on your filing status and level of taxable income

Tax as a percentage of your taxable income

Since taxes are calculated in tiers, the actual tax you pay as a percentage of your taxable income will always be less than your tax bracket.

Net Income after Tax is paid

This is the amount you have left over after you pay your Federal taxes. This does not account for state and local taxes.

How Tax Brackets Work

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

Example #1: Lets say youre a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket in 2021. But do you pay 12% on all $32,000? No. Actually, you pay only 10% on the first $9,950 you pay 12% on the rest.

-

Example #2: If you had $50,000 of taxable income, youd pay 10% on that first $9,950 and 12% on the chunk of income between $9,951 and $40,525. And then youd pay 22% on the rest, because some of your $50,000 of taxable income falls into the 22% tax bracket. The total bill would be about $6,800 about 14% of your taxable income, even though you’re in the 22% bracket. That 14% is called your effective tax rate.

» MORE:See state income tax brackets here

Recommended Reading: Do You Have To Pay Tax On Doordash

Federal Income Tax Brackets For Tax Years 2020 And 2021

The federal income tax rates remain unchanged for the 2020 and 2021 tax years: 10%, 12%, 22%, 24%, 32%, 35% and 37%. The income brackets, though, are adjusted slightly for inflation. Read on for more about the federal income tax brackets for Tax Year 2020 and Tax Year 2021 .

Go beyond taxes to build a comprehensive financial plan. Find a local financial advisor today.

An Example Of How Canadas Federal Income Tax Brackets Work

If your taxable income is less than the $48,535 threshold you pay 15 percent federal tax on all of it. For example, if your taxable income is $30,000, the CRA requires you to pay $4,500 in federal income tax.

However, if your income is $200,000, you face several tax rates. This example shows how much federal tax you will pay on your 2020 taxable income. You need to make a separate calculation for your provincial tax due.

- The first tax bracket $0 to $48,535 is taxed at 15%, plus

- The next tax bracket over $48,535 to $97,069 is taxed at 20.5%, plus

- The following tax bracket over $97,069 to $150,473 is taxed at 26%, plus

- At this point, $150,473 of your income has been taxed. The final bracket on your remaining $49,527 is taxed at 29%.

- If you earn more than $214,368 in taxable income in 2020, the portion over $214,368 is taxed at the federal rate of 33%. This is called the top tax bracket and a common misconception is if your taxable income is in this top bracket, you will be taxed at 33% on your entire income.

You May Like: Do I Have To Claim Plasma Donations On My Taxes

State And Local Tax Brackets

States and cities that impose income taxes typically have their own brackets, with rates that tend to be lower than the federal governments.

California has the highest state income tax at 13.3% with Hawaii , New Jersey , Oregon , and Minnesota rounding out the top five.

Five states and the District of Columbia have top rates above 7%, with Illinois scheduled to join them if Gov. J.B. Pritzker gets his way.

Seven states Florida, Alaska, Wyoming, Washington, Texas, South Dakota and Nevada have no state income tax.

Tennessee and New Hampshire tax interest and dividend income, but not income from wages.

Not surprisingly, New York City lives up to its reputation for taxing income with rates ranging from 3.078% to 3.876% remarkably, the Big Apple is not the worst. Most Pennsylvania cities tax income, with Philadelphia leading the way at 3.89% Scranton checks in at 3.4%. Ohio has more than 550 cities and towns that tax personal income.

What Is The Federal Tax Rate For 2021

Asked by: Imogene Cole

There are seven tax brackets for most ordinary income for the 2021 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket depends on your taxable income and your filing status: single, married filing jointly or qualifying widow, married filing separately and head of household.

Read Also: Payable Doordash 1099

Us Tax Bracket Questions

Want to understand how the changes to the tax brackets affect you? Or learn how you may be able to lower your taxable income? The knowledgeable tax pros at H& R Block can help.

This year, most people will get a Form 1095 to report details about their health insurance. Learn more about Forms 1095-A, B and C at H& R Block.

How To Get Into A Lower Tax Bracket

Americans have two main ways to get into a lower tax bracket: tax credits and tax deductions.

Tax credits are a dollar-for-dollar reduction in your income tax bill. If you have a $2,000 tax bill but are eligible for $500 in tax credits, your bill drops to $1,500. Tax credits can save you more in taxes than deductions, and Americans can qualify for a variety of different credits.

The federal government gives tax credits for the cost of buying solar panels for your house and to offset the cost of adopting a child. Americans can also use education tax credits, tax credits for the cost of child care and dependent care and tax credits for having children, to name a few. Many states also offer tax credits.

While tax credits reduce your actual tax bill, tax deductions reduce the amount of your income that is taxable. If you have enough deductions to exceed the standard deduction for your filing status, you can itemize those expenses to lower your taxable income. For example, if your medical expenses exceed 10% of your adjusted gross income in 2021, you can claim those and lower your taxable income.

Also Check: Does Door Dash Take Out Taxes

Federal Tax On Taxable Income Manual Calculation Chart

If your taxable income is $49,020 or less.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $49,020, but not more than $98,040.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $98,040, but not more than $151,978.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $151,978, but not more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

How To Get Your Effective Tax Rate

Look at your completed 2021 tax return. Identify the total tax you owed on line 24 of the 2021 Form 1040. Now divide the number on line 24 by what appears on line 15 . The result of this calculation is your effective tax rate.

The IRS has redesigned Form 1040 three times, once for the 2018 tax year, again for the 2019 tax year, and once more for 2020. Then the 2021 form underwent some minor tweaks. Your taxes owed were on a different line in 2019 than they are on the 2021 return.

Read Also: Have My Taxes Been Accepted

Tax Rates And Brackets

As noted above, the top tax bracket remains at 37%. The other tax brackets set by the IRS are 10%, 12%, 22%, 24%, 32%, and 35%. This means that the highest earners fall into the 37% range while those who earn the least are in the 10% bracket.

The tax rates and brackets for 2021 and 2022 are provided in the two charts below:

| 2021 Tax Brackets |

|---|

There is no personal exemption, according to the 2017 Tax Cuts and Jobs Act.

Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

Don’t Miss: Doordash File Taxes

How To Reduce Your Tax Bill

There are steps you can take to legally reduce your tax bill by getting into a lower tax bracket. These generally work best if you are on the edge of a higher tax bracket where slightly lowering your income could keep you from crossing that line.

Options To Move Into a Lower Tax Bracket

- Tax deductions

- Tax deductions such as charitable contributions can lower your taxable income, reducing your tax bill and possibly keeping you in a lower tax bracket.

- Earned income tax credit

- The EITC helps low to moderate income taxpayers with a tax break. People who qualify can use the credit to reduce their tax liability and this may move them to a lower tax bracket.

- Child tax credit

- You can claim the child tax credit for each dependent child. This reduces your tax liability on a dollar-for-dollar basis and may add up to enough to move your taxable income to a lower tax bracket.

- Other strategies

- If you delay income until after the first of the year, this may keep that income from being taxed at a higher rate this year. You can also make last-minute contributions to tax-deferred or tax-exempt accounts such as a health savings account, 401 or individual retirement account to lower your taxable income.

You may be able to use multiple strategies, credits and deductions to significantly reduce your tax liability, keeping your taxable income within a lower tax bracket. Tax preparation software and professionals may also help you find additional tax breaks that can help reduce your tax bill.