Tax Rate On Short Term Capital Gains How To Calculate Your Taxes

Capital gains tax rates are different than tax rates for short term capital gains. If you sold an asset that was held less than a year, then the tax is automatically calculated at your usual income level .

For example if you fall under the second-highest tax bracket and have up to $38k in taxable income then any taxes owed will be calculated using 20% as shown below:

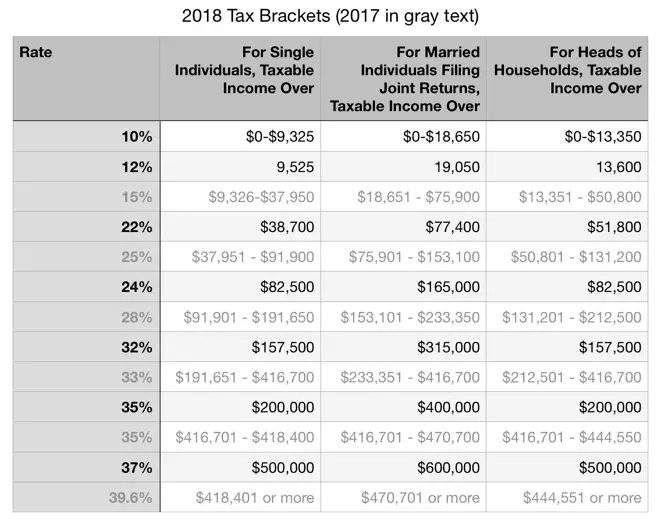

If you look closely at the table above and compare those two numbers , even though they are both labeled as being part of the highest tax bracket there is only number tax rate that applies to both. Therefore tax rates for short term capital gains remain static regardless of your filing status or level of net income.

Adjusting Tax Bracket Parameters

Congress decides how many tax brackets there are and what the rates will be for each bracket. It’s the Internal Revenue Service’s job to adjust income thresholds to keep pace with inflation.

For example, in the 2020 tax year, for a married couple filing a joint return,

- The 10% bracket applied to the first $19,750 in taxable income.

- The 12% bracket went up to $80,250.

- The 22% bracket went up to $171,050, and so on.

- The top rate, 37%, applied when taxable income topped $622,050.

For single taxpayers, the thresholds were lower. The IRS announces the tax brackets for each year before that year begins.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

We also offer a handy Tax Bracket Calculator to help you easily identify your tax bracket.

Federal Income Tax Brackets For 2019

At the federal level, the Internal Revenue Service has adjusted the individual and joint income tax brackets for inflation for the 2019 tax year. The current federal income tax brackets are as follows:

- 10% for taxable income up to $9,700

- 12% for taxable income over $9,700

- 22% for taxable income over $39,475

- 24% for taxable income over $84,200

- 32% for taxable income over $160,725

- 35% for taxable income over $204,100

- 37% for taxable income over $510,300

Despite being published in this manner, the federal tax brackets are marginal, just as they are in California. In other words, if you and your spouse earn $150,00 in taxable income and file jointly, you would pay federal income tax as follows:

- 12% on $19,400 of your joint income

- 22% on your joint income between $19,401 and $78,950 and,

- 24% on your joint income between $78,951 and $150,000.

Read Also: What Does Agi Mean In Taxes

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

There Are Seven Different Federal Income Tax Brackets For Your 2021 Tax Return Each With Its Own Marginal Tax Rate Which Bracket You End Up In For 2021 Depends On Your Taxable Income

Smart taxpayers are planning ahead and already thinking about their next federal income tax return. For most Americans, that’s their return for the 2021 tax year which will be due on April 18, 2022 . Effective tax planning also requires an understanding of what’s new or changed from the previous tax year. When it comes to federal income tax rates and brackets, the tax rates themselves didn’t change from 2020 to 2021. There are still seven tax rates in effect for the 2021 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year, the 2021 tax brackets were adjusted to account for inflation. That means you could wind up in a different tax bracket when you file your 2021 return than the bracket you were in for 2020 which also means you could be subject to a different tax rate on some of your 2021 income, too.

The 2021 and 2020 tax bracket ranges also differ depending on your filing status. For example, the 22% tax bracket for the 2021 tax year goes from $40,526 to $86,375 for single taxpayers, but it starts at $54,201 and ends at $86,350 for head-of-household filers.

So, now that you’re focused on your 2021 taxes, here are the tax brackets you’ll use when you file your tax return next year:

Don’t Miss: Do I Need To Report Roth Ira Contributions On My Tax Return

Tax Rates Vs Tax Brackets

People often refer to their tax brackets and their tax rates as the same thing, but theyre not. A tax rate is a percentage at which income is taxed each tax bracket has a different tax rate , referred to as the . However, most taxpayersall except those who fall squarely into the minimum brackethave income that is taxed progressively, so theyre actually subject to several different rates, beyond the nominal one of their tax bracket. Your tax bracket does not necessarily reflect how much you will pay in total taxes. The term for this is the effective tax rate. Heres how it works.

Consider the following tax responsibility for a single filer with a taxable income of $50,000 in 2020:

- The first $9,875 is taxed at 10%: $9,875 × 0.10 = $987.50

- Then $9,876 to $40,125, or $30,250, is taxed at 12%: $30,250 × 0.12 = $3,630

- Finally, the top $9,875 is taxed at 22%: $10,524 × 0.22 = $2,172.50

Add the taxes owed in each of the brackets, and you get $987.50 + $3,630 + $2,172.50 = $6,790.

Result: This individuals effective tax rate is approximately 13.5% of income.

What Is A Flat Tax

A flat tax, also known as a regressive tax, applies the same tax rate to every taxpayer regardless of income bracket. Typically, a flat tax applies the same tax rate to all taxpayers with no deductions or exemptions allowed, but proposals for allowing certain deductions are being considered. Most flat tax systems or proposals do not tax income from dividends, distributions, capital gains, or other investments.

You May Like: How Can I Make Payments For My Taxes

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

How The Effective Tax Rate Works

To calculate your effective tax rate, you divide your income by the taxes you paid. What makes effective tax tricky is that two people in the same tax bracket could have different effective tax rates.

Heres an example. Someone who earns $80,000 would pay the 22% rate on $39,875 of their income over $40,125 in 2020, whereas you would only have to pay a 22% rate on $19,875 of your income at $60,000 in taxable earnings. Yet you would both have the same marginal tax rate of 22% and fall into the same tax bracket.

You would owe $8,991 in taxes on $60,000 in income:

- $988 on the first $9,875 at 10%

- $3,630 on $9,876 up to $40,125 at 12%

- $4,373 on $40,126 up to $60,000 at 22%

The taxpayer who earned $80,000 in taxable income would owe $13,390 in tax:

- $988 on the first $9,875 at 10%

- $3,630 on $9,876 up to $40,125 at 12%

- $8,772 on $40,126 up to $80,000

The first persons effective tax rate would be 14.99%, while the second persons rate would be 16.74%. The second person has a higher effective tax rate because they made $20,000 more than the first person and therefore paid more taxes.

Your effective tax rate doesnt include taxes you might pay to your state, nor does it factor in property taxes or sales taxes. Its only what you owe the federal government in the way of income tax.

Knowing your effective tax rate can help with tax and budget planning, particularly if youre considering a significant change in life, such as getting married or retiring.

Recommended Reading: How Does H And R Block Charge

Tax Rate On Capital Gains For Self Employed

Self employed individuals who earn taxable income from the sale of goods or services have to pay taxes at their own individual tax bracket, which could be anywhere between 15% and 39.60%.

However, when they sell an asset that was used in a business operation then tax rate will change depending on how long it was held.

For example if Joe makes $50k in net income but he sold his houseboat after owning it for less than one year , then the full amount of profit will fall under short capital gains even though most of the tax bracket he falls into is for high income earners.

This means that tax rate on capital gains for self employed individuals will be much higher than the tax rates associated with your net income because its based off of business operation rather than just personal assets only .

For example if Joe sold his boat after owning it less than a year, then he would pay 15% in taxes which comes out to $7500 dollars instead of 25%. However this also means even more money saved when you hold onto an asset longer!

How To Reduce Taxable Income & Drop Into A Lower Tax Bracket

Two common ways to reduce your tax bill are by using . The first is a dollar-for-dollar reduction in the amount of tax you owe. The second trims your taxable income, possibly slipping you into a lower tax bracket.

Tax credits come in two types: nonrefundable and refundable.

Nonrefundable credits are deducted from your tax liability until your tax due equals $0. Examples include the child and dependent care credit, adoption credit, savers credit, mortgage interest tax credit, and alternative motor vehicle credit.

Refundable credits are paid out in full, no matter what your income or tax liability. Examples include the earned income tax credit , child tax credit, and the American Opportunity Tax Credit.

Which of these tax credits apply to your situation?

Deductions, on the other hand, reduce your taxable income. Accumulate enough of them in qualifying number or amount, and you can slide a tax bracket or two.

Popular deductions include:

You May Like: Where’s My Tax Refund Ga

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Ways To Get Into A Lower Tax Bracket

You can lower your income into another tax bracket by using tax deductions such as charitable donations or deducting property taxes and the mortgage interest paid on a home loan and property taxes. Deductions can lower how much of your income is ultimately taxed.

Tax credits, such as the earned income tax credit, or child tax credit, can also put you into a lower tax bracket. They allow for a dollar-for-dollar reduction on the amount of taxes you owe.

Recommended Reading: How Much Does H & R Block Charge For Taxes

How To Find Your Tax Bracket

There are numerous online sources to find your specific federal income tax bracket. The IRS makes available a variety of information, including annual tax tables that provide highly detailed tax filing statuses in increments of $50 of taxable income up to $100,000.

Other websites provide tax bracket calculators that do the math for you, as long as you know your filing status and taxable income. Your tax bracket can shift from year to year, depending on inflation adjustments and changes in your income and status, so its worth checking on an annual basis.

How The Calculation Works For A Single Taxpayer

One notable thing about this kind of tax setup is that the amount of taxes owed by someone steadily increases as that person’s amount of income increases. It’s not a monumental change when people jump from one tax bracket to another.

Answers to your tax questions

Let’s run through how this would work for an imaginary person calculating taxes for 2020: John, who earns $40,000. To keep it simple, let’s say he makes all his money from his work salary, has no dependents, and no itemized deductions.

For his 2020 taxes, John would subtract the standard deduction and take zero personal exemptions, since they were eliminated with the GOP tax law

That makes his taxable income $27,600, putting him in both the 10% and 12% tax brackets.

Here’s how to estimate how much he would owe in taxes:

Read Also: Www Aztaxes Net

Do You Need To Pay The Effective Tax Rate On Your Take

No, you wont pay the government your effective tax rate on what you earn during the tax year. Rather, you pay the rate on your taxable income, which is whats left after you subtract from your gross income any deductions and above-the-line adjustments.

For example, if your gross income for 2020 was $60,000 and you took the $12,400 standard deduction for a single taxpayer, your taxable income would be $47,600. And this assumes that youre not eligible for any other tax breaks at all youre only taxed on the balance of your income after you take every tax break that youre eligible to claim.

What Is A Tax Bracket

A tax bracket refers to a range of incomes subject to a certain income tax rate. Tax brackets result in a progressive tax system, in which taxation progressively increases as an individuals income grows. Low incomes fall into tax brackets with relatively low income tax rates, while higher earnings fall into brackets with higher rates.

Recommended Reading: How To Buy Tax Lien Properties In California

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

How Are Dividends Taxed In Canada

There are two types of dividends in Canada: “Eligible Dividends” and “Other Than Eligible Dividends”. Corporations will designate their dividends as either âeligibleâ or âother than eligibleâ for tax purposes.

Dividends are paid out of a corporation’s after-tax profits. This means that tax has already been paid on the dividend amount. However, not all corporations have the same tax rate.

Canadian Controlled Private Corporation are eligible for the small business deduction, which reduces their corporate income tax rate. Dividends paid out by them are “other than eligible”. Since a lower amount of tax has already been paid on them, you will receive a smaller tax credit rate.

Public corporations are not eligible for the small business deduction, and so their dividends are designated as eligible dividends. As a higher tax rate applies to these public corporations, your dividend tax credit amount will be larger.

A dividend gross-up multiples your actual dividend amount by a certain multiplier, which attempts to replicate what the dividend-paying corporation had to earn in order to pay out the dividend after taxes.

You May Like: How Much Does H& r Block Charge To Do Taxes