Heres How Federal Tax Brackets Work

Think of Canadas federal income tax brackets as a ladder: Rates apply only to the earnings that fall within each tier or rung of the ladder. Most provincial tax brackets work this way as well.

Heres how this gets calculated: The lowest federal tax bracket for 2022 is $0 up to $50,197. If you earned, say, $40,000 from all sources of taxable incomethat includes paid work, bank interest, benefits and moreyou would fall into that bracket. That means you will pay 15% in federal taxthats $6,000.

Now lets say your annual income is $90,000this would put you into the second federal tax bracket. You would pay that same 15% on your first $50,197 in earnings, and any income above that would be taxed at 20.5%, the rate for the second federal tax bracket.

Its easy to find yourself in the table above: First, find the tier range your annual income falls into. Then, subtract the minimum dollar value of that range from your annual income. Multiply that amount by the applicable tax rate. Finally, add the maximum total tax from the previous bracket to estimate your 2022 federal taxes.

Heres how that looks for someone earning $90,000 who is in the second federal tax bracket:

$90,000 annual income $50,197 = $39,803

x 2nd bracket rate of 20.5%= $8,159.62

+ 1st bracket maximum total tax of $7,529.55= $15,689.17 total federal taxes payable

For someone in the top tax bracket earning $500,000, heres what that would look like:

$500,000 annual income $221,708 = $278,292

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Things To Know About California State Tax

California’s standard deduction for state income taxes is $4,803 and $9,606 .

Californias tax-filing deadline generally follows the federal tax deadline.

Tax software will do your state taxes .

Wondering “Where is my California state tax refund?” Good news: You can check the status of your state tax refund online.

If you cant pay your California state tax bill on time, you can request a one-time, 30-day delay.

If you cant afford your tax bill and owe less than $25,000, California offers payment plans. Typically, you get three to five years to pay your bill. Theres a fee to set up an agreement.

You can also apply for the states offer in compromise program, which might allow you to pay less than you owe.

You May Like: How Much Is The First Time Home Buyers Tax Credit

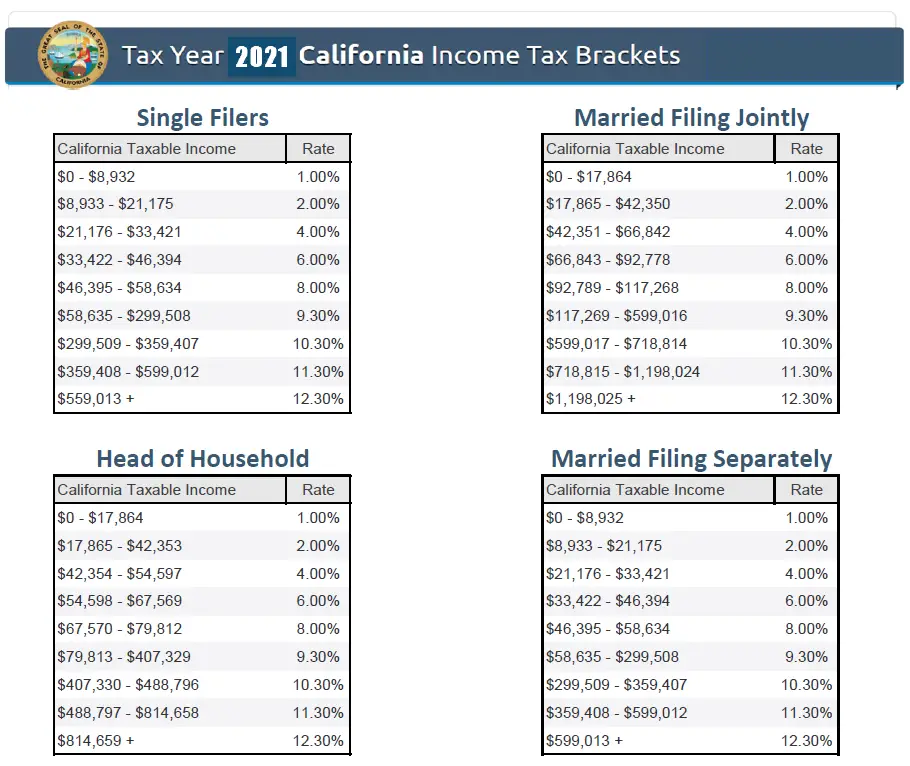

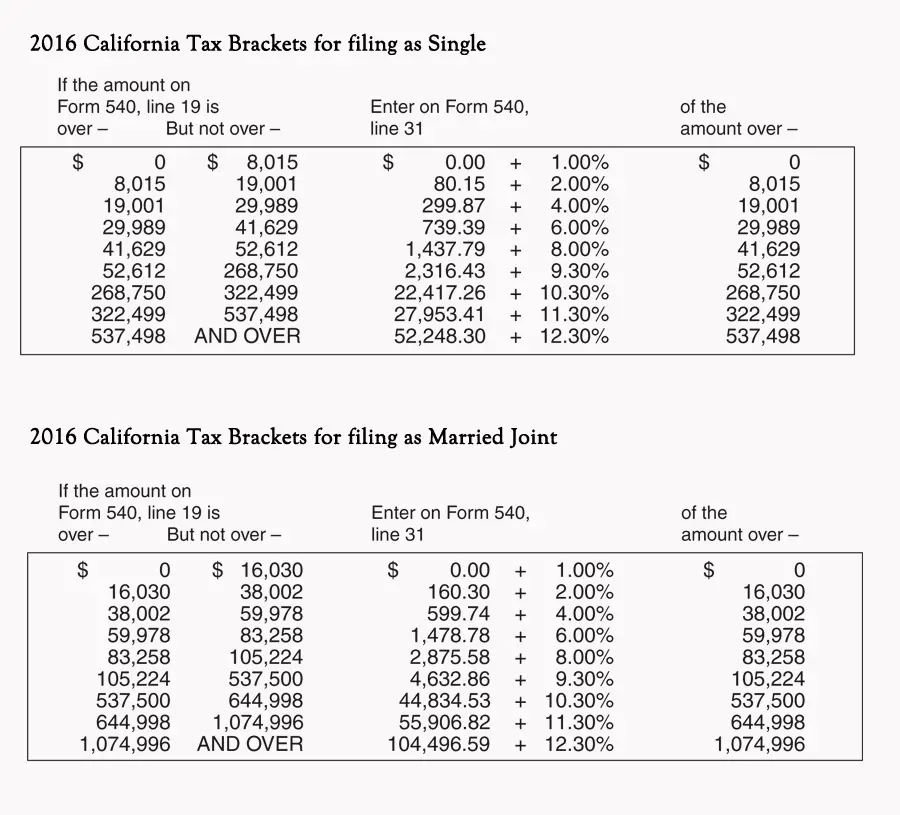

More About The California Tax Rate Schedules

We last updated California Tax Rate Schedules in April 2022 from the California Franchise Tax Board. This form is for income earned in tax year 2021, with tax returns due in . We will update this page with a new version of the form for 2023 as soon as it is made available by the California government.

Local Sales Tax Reduction Or Repeal Using Proposition 218

Proposition 218 was a 1996 initiative constitutional amendment approved by California voters. Proposition 218 includes a provision constitutionally reserving to local voters the right to use the initiative power to reduce or repeal any local tax, assessment, fee or charge, including provision for a significantly reduced petition signature requirement to qualify a measure on the ballot. A local sales tax, including a sales tax previously approved by local voters, is generally subject to reduction or repeal using the local initiative power under Proposition 218.

Examples where the reduction or repeal of a local sales tax may be appropriate include where there has been significant waste or mismanagement of sales tax proceeds by a local government, when there has been controversial or questionable spending of sales tax proceeds by a local government , when the quality of the programs and services being financed from sales tax proceeds is not at a high level expected by voters, when the local sales tax rate is excessive or unreasonably high , or when promises previously made by local politicians about the spending of local sales tax proceeds are broken after voter approval of the sales tax #General_Tax_Abuses_By_Local_Governments” rel=”nofollow”> legally nonbinding promises concerning the spending of general sales tax proceeds that are not legally restricted for specific purposes).

Don’t Miss: How To Get Tax Id Number For Llc

States With Graduated Tax Rates

Graduated, or progressive, tax rates use a series of income thresholds called brackets to assess taxes.

Progressive tax systems are more common and apply a higher tax rate to higher earners, says Tyler Davis, a CPA with Simplify LLC, which provides free resources for small business owners. The more you make, the higher your tax rate is.

Heres a simple example of how it would work in Alabama, where there are three tax brackets that start at $0, $500, and $3,000 of income, taxed at 2%, 4%, and 5%, respectively:

Under that system, someone earning $10,000 a year would pay $460 altogether in state taxes. The first $500 would be taxed at 2%, for a total of $10. The next $2,500 gets taxed at 4%, for a total of $100. And the remaining $7,000 is taxed at 5%, for a total of $350. Each chunk of income is taxed at progressively higher rates as the total income climbs higher up the scale.

The argument for graduated tax rates is that theyre tied to your income so those who earn more pay more. A flat tax, on the other hand, can have a disproportionate impact on low-income taxpayers.

How Tax Brackets Work

The United States has a progressive tax system, meaning people with higher taxable incomes pay higher federal income tax rates.

-

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

-

The government decides how much tax you owe by dividing your taxable income into chunks also known as tax brackets and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket youre in, you wont pay that tax rate on your entire income.

-

The percentage of your taxable income that you pay in taxes is called your effective tax rate. To determine effective tax rate, divide your total tax owed on Form 1040 by your total taxable income .

-

Income thresholds for tax brackets are updated annually. Several provisions in the tax code, including the income thresholds that inform the federal tax brackets, are adjusted annually to reflect the rate of inflation. This indexing aims to prevent taxpayers from experiencing “bracket creep,” or the process of being pushed into a higher tax bracket because of inflation.

-

That’s the deal only for federal income taxes. Your state might have different brackets, a flat income tax or no income tax at all.

» Learn more:See state income tax brackets here

You May Like: Do You Have To Report Roth Ira On Taxes

State Income Tax Vs Federal Income Tax: An Overview

The U.S. has a multitiered income tax system under which taxes are imposed by federal, state, and sometimes local governments. Federal and state income taxes are similar in that they apply a percentage rate to taxable incomes. However, they differ considerably regarding those rates and how they’re appliedand by the type of income that is taxable and the deductions and tax credits allowed.

Sign Up To Get A Weekly Round

This time, however, wealthy Californians are donating heavily to a campaign against the measure. At least one reason might be that under a 2017 federal tax overhaul, they can no longer deduct state and local taxes over $10,000 on their federal tax returns.

In effect, that means that Californias high-income taxpayers now feel the full brunt of state tax increases. The SALT cap also encourages some of the states wealthy to leave California for low- or no-income tax states such as neighboring Nevada, Texas or Florida electric car tycoon Elon Musk most spectacularly.

House Speaker Nancy Pelosi and other Democratic politicians have been trying to scrap the SALT deduction limit on behalf of California and other high-tax states, such as New York, but so far have failed.

This week saw another unusual wrinkle in the perpetual efforts to increase taxes on the wealthy: The campaign against Proposition 30 is broadcasting an ad in which Gov. Gavin Newsom denounces the measure, citing Lyfts sponsorship.

Dont be fooled. Prop 30s been advertised as a climate initiative, Newsom says. But in reality, it was devised by a single corporation to funnel state income taxes to benefit their company. Put simply, Prop 30 is a trojan horse that puts corporate welfare above the fiscal welfare of our entire state.

This time around, therefore, one cannot say that raising taxes on the rich will be an easy sell.

We want to hear from you

You May Like: Do My Taxes Myself Online

How Do I File And Pay My California State Taxes

Eligible businesses and tax preparers can use the FTBâs e-filing system, CalFile. Youâll need to create a MyFTB account before using CalFile. The state recommends signing up for direct deposit to ensure the âfastest refund possible.â

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Friends donât let friends do their own bookkeeping. Share this article.

Do I Pay California State Income Tax

In general, if you are a non resident, full-time resident, and part-year resident, you will have to file a California state tax return. Also, if you are required to file a federal tax return, you may have to pay California state income tax. Anyone who has income above certain tax thresholds or who received a source of income from California during the tax year will also need to file a return.

There are three residency statuses in California: nonresident, part-year resident, and a full-time resident. Each of these statuses determines what portion you will have to pay state taxes on.

If you are a full-time resident, the state will tax all of your income from all sources regardless of it is inside or outside of California. Part-time residents will have all income received while they were a resident taxed.

If the part-time resident receives income from California sources while they were a nonresident of the state, that will also be taxed. Nonresidents must pay taxes on all income from any California sources.

Also Check: What States Do Not Tax Social Security

Estimate Your Tax Bracket

Having a rough idea of your tax bracket can help you estimate the tax impact of major financial decisions.

Have you ever been asked for your approximate tax bracket by an advisor, attorney, financial provider, or even a Fidelity representative? Knowing your tax bracket can be useful in many scenarios, including when you open new accounts.

While your tax bracket won’t tell you exactly how much you’ll pay in taxes, it can help you assess the tax impact of financial decisions. For instance, if you’re in the 35% tax bracket, you could save 35 cents in federal tax for every dollar spent on a tax-deductible expense, such as mortgage interest or charity.

Supplementary Local Sales Taxes

Supplementary local sales taxes may be added by cities, counties, service authorities, and various special districts. Local county sales taxes for transportation purposes are especially popular in California. Additional local sales taxes levied by counties and municipalities are formally called “District Taxes.”

The effect from local sales taxes is that sales tax rates vary in California from 7.25% to 10.75% . For example, the city of Sacramento, the state capital, has a combined 8.75% sales tax rate, and Los Angeles, the largest city in California, has a combined 9.50% sales tax rate.

Local sales tax rate cap

The combined tax rate of all local sales taxes in any county is generally not allowed to exceed 2.00 percent. However, this is a statutory restriction and the California Legislature routinely allows some local governments, through the adoption of separate legislation, to exceed the 2.00 percent local tax rate cap. The 2.00 percent local tax rate cap is exceeded in any city with a combined sales tax rate in excess of 9.25% .

As of July 1, 2022, the following 140 California local jurisdictions have a combined sales tax rate in excess of the 2.00 percent local tax rate cap:

| CITY |

|---|

| SAN MATEO |

SB 566 and the rise in local sales tax increases

Local jurisdictions with at least 10.00% combined sales tax rates

As of July 1, 2022, the following 68 California local jurisdictions have a combined sales tax rate of at least 10.00%:

| CITY |

|---|

| SUTTER |

Read Also: How To Contribute To Ira Pre Tax

Federal And California Tax Preparation Services In Roseville And Sacramento

In light of the many changes caused by the TCJA, this year will likely be one of the most tumultuous yet for thousands of taxpayers and small business owners. That makes it especially important to make sure you have dependable tax guidance from an experienced accountant this upcoming tax season.

Dont let 2019 catch you off-guard. Get trustworthy, professional tax help on your side by contacting Cook CPA Group online for a free consultation, or by calling us at 432-2218 today.

Consulting Services

Claim Military Members Deductions

Perhaps you are working in the military reserve for instance, the National Guard. In this situation, you may frequently have to go more than 100 miles away from your home, staying overnight in most circumstances.

When this happens, you should know that you can easily deduct those taxes. If there were any other unreimbursed travel expenses , then you may claim those costs at the end of the tax year.

Likewise, if you are an active member of the service, you may have to deal with tax liability. In that regard, you may deduct tax costs related to your movement from one station to another.

Don’t Miss: Where To Find Tax Forms

Why Are California State Income Taxes Required

You already pay federal taxes, why are state income taxes required as well in California?

Each state has its own set of state income tax laws. The primary purpose of state income taxes is to raise revenue for the state government. California taxes are used to fund state-level programs, such as public schools, Medi-Cal, social services, and more.

California Franchise Tax Board

The FTB is the state taxing authority responsible for enforcing the Revenue Tax Code for the State of California. Though the FTB does serve other functions their main purposes is to assess and collect state income tax for California. For more information on the FTB see our blog California Franchise Tax Board FTB Collections.

Read Also: Can I File Taxes If I Have No Income

California State Income Tax

Self-employed workers, independent contractors and unincorporated businesses in California might not have to pay state corporate or franchise taxes, but most still have to pay state income taxes. Same goes for people who earn income from pass-through entities like S Corporations and LLCs.

The California state income tax rate ranges from 1 to 12.3 percent. Your income tax rate is based on which of the nine California tax brackets you fall into, and also your filing status.

If your filing status is âSingleâ or âMarried Filing Separately,â youâll calculate your 2020 California income tax based on the following schedule:

| Over | Enter on Form 540, line 31 | |

|---|---|---|

| $0 | $0.00 + 1.00% of the amount over $0 | |

| $8,932 | $89.32 + 2.00% of the amount over $8,932 | |

| $21,175 | $334.18 + 4.00% of the amount over $21,175 | |

| $33,421 | $824.02 + 6.00% of the amount over $33,421 | |

| $46,394 | $1,602.40 + 8.00% of the amount over $46,394 | |

| $58,634 | $2,581.60 + 9.30% of the amount over $58,634 | |

| $299,508 | $24,982.88 + 10.30% of the amount over $299,508 | |

| $359,407 | $31,152.48 + 11.30% of the amount over $359,407 | |

| $599,012 | And over | $58,227.85 + 12.30% of the amount over $599,012 |

Consult the FTBâs schedules here if youâre filing your taxes jointly with a spouse, are a qualifying widow, or are using the âHead of Householdâ filing status.

No Extra Deduction For Charitable Giving

The Coronavirus Aid, Relief and Economic Security Act, or CARES Act, had a provision that allowed taxpayers to deduct an extra $300 for single taxpayers or $600 for married couples on their 2020 and 2021 taxes.

This provision allowed people who rely on the standard deduction, which represents the majority of taxpayers, to take an extra deduction for charitable giving. But that above-the-line charitable deduction wasn’t renewed in 2022, which means that taxpayers who don’t itemize won’t get an extra deduction for their charitable gifts this year.

Don’t Miss: How To File Taxes In The Military

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |