How Do I Figure Out What My Marginal Tax Rate/tax Bracket Is

The easiest way to figure out your marginal tax rate is to look at the federal tax brackets and see in which bracket your taxable income ends. This represents your marginal tax rate. If you need help determining your tax bracket, visit TurboTaxs Tax Bracket Calculator. Simply provide your filing status and taxable income to estimate your tax bracket.

Effective Tax Rate Vs Marginal Tax Rate

The effective tax rate varies from the marginal tax rate, which is the tax rate paid on an additional dollar of income. The effective tax rate is a more accurate representation of a persons or companys overall tax liability than their marginal tax rate, and it is typically lower.

When considering a marginal tax rate versus an effective tax rate, bear in mind that the marginal tax rate refers to the highest tax bracket into which a persons or companys income falls. In the United States, an individuals income is taxed at rates that increase as income hits certain thresholds. Two individuals with income in the same top marginal tax bracket may end up with very different effective tax rates, depending on how much of their income was in the top bracket.

Consider the example above where a company pays an effective tax rate of 18%. In reality, the company is likely assessed the flat 21% flat corporate tax rate. Because of tax-advantaged shelters and tax benefits, a company’s marginal tax rate will likely vary from the actual rate of interest it pays.

Personal Income Tax Brackets And Rates

| Taxable Income – 2022 Brackets | |

| Over $227,091 | 20.5% |

Tax rates are applied on a cumulative basis. For example, if your taxable income is more than $43,070, the first $43,070 of taxable income is taxed at 5.06%, the next $43,071 of taxable income is taxed at 7.70%, the next $12,760 of taxable income is taxed at 10.5%, the next $21,193 of taxable income is taxed at 12.29%, the next $42,738 of taxable income is taxed at 14.70%, the next $64,259 is taxed at 16.80%, and any income above $227,091 is taxed at 20.5%.

You May Like: Are Raffle Tickets Tax Deductible

Who Pays The Highest Effective Tax Rate

Individuals within the highest marginal tax bracket may have the highest effective tax rate as a portion of their income is being assessed taxes at the highest marginal rate. However, these taxpayers may also have the means and resources to implement tax-avoidance strategies, thereby reducing their taxable income and resulting effective tax rate.

Federal Income Tax: W

W-2 employees are workers that get W-2 tax forms from their employers. These forms report the annual salary paid during a specific tax year and the payroll taxes that were withheld.

This means that employers withhold money from employee earnings to pay for taxes. These taxes include Social Security tax, income tax, Medicare tax and other state income taxes that benefit W-2 employees.

Both employers and employees split the Federal Insurance Contribution Act taxes that pay for Social Security and Medicare programs. The FICA rate due every pay period is 15.3% of an employees wages. However, this tax payment is divided in half between the employer and the employee.

Recommended Reading: When Will I Get My Unemployment Tax Break Refund

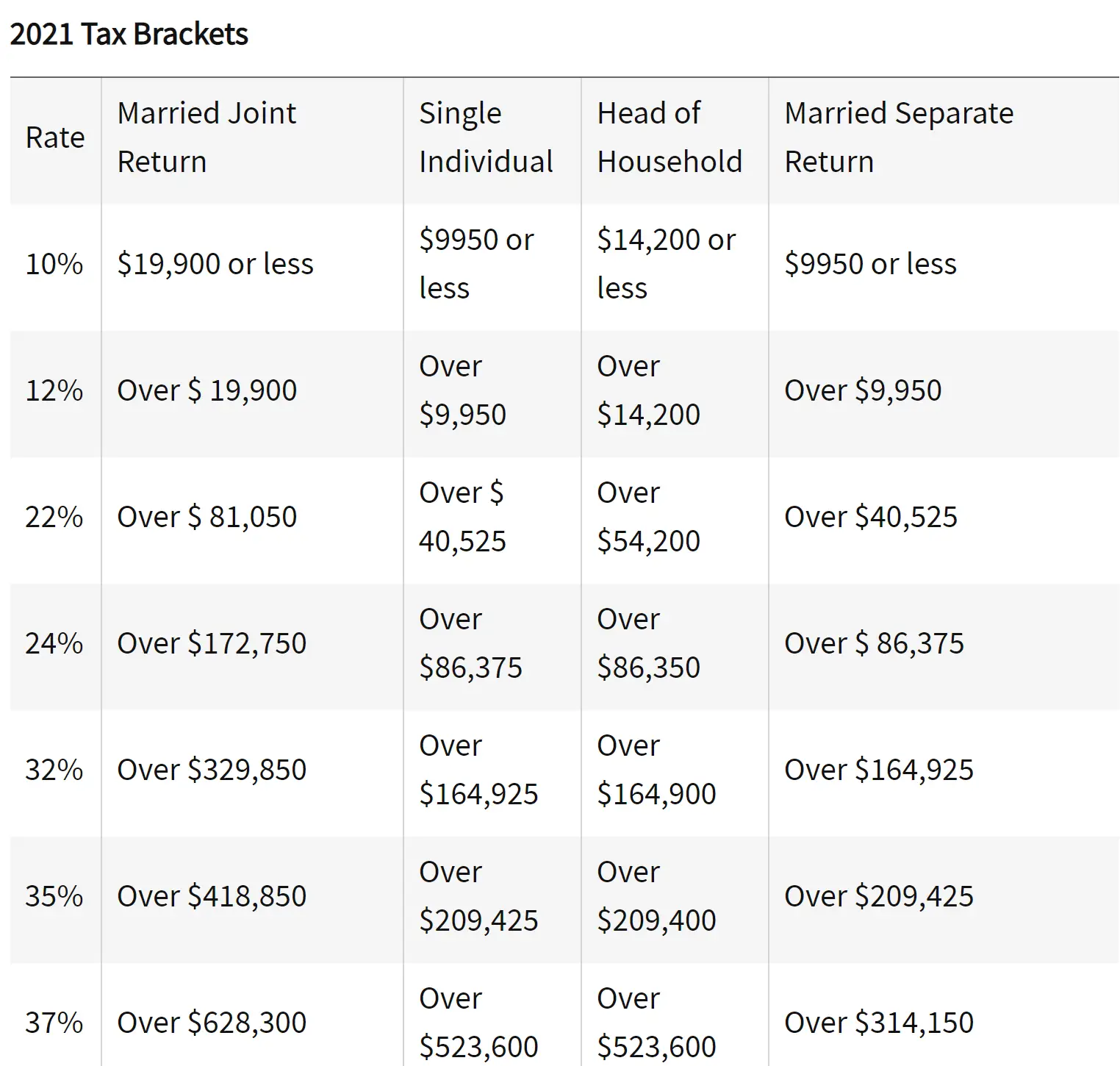

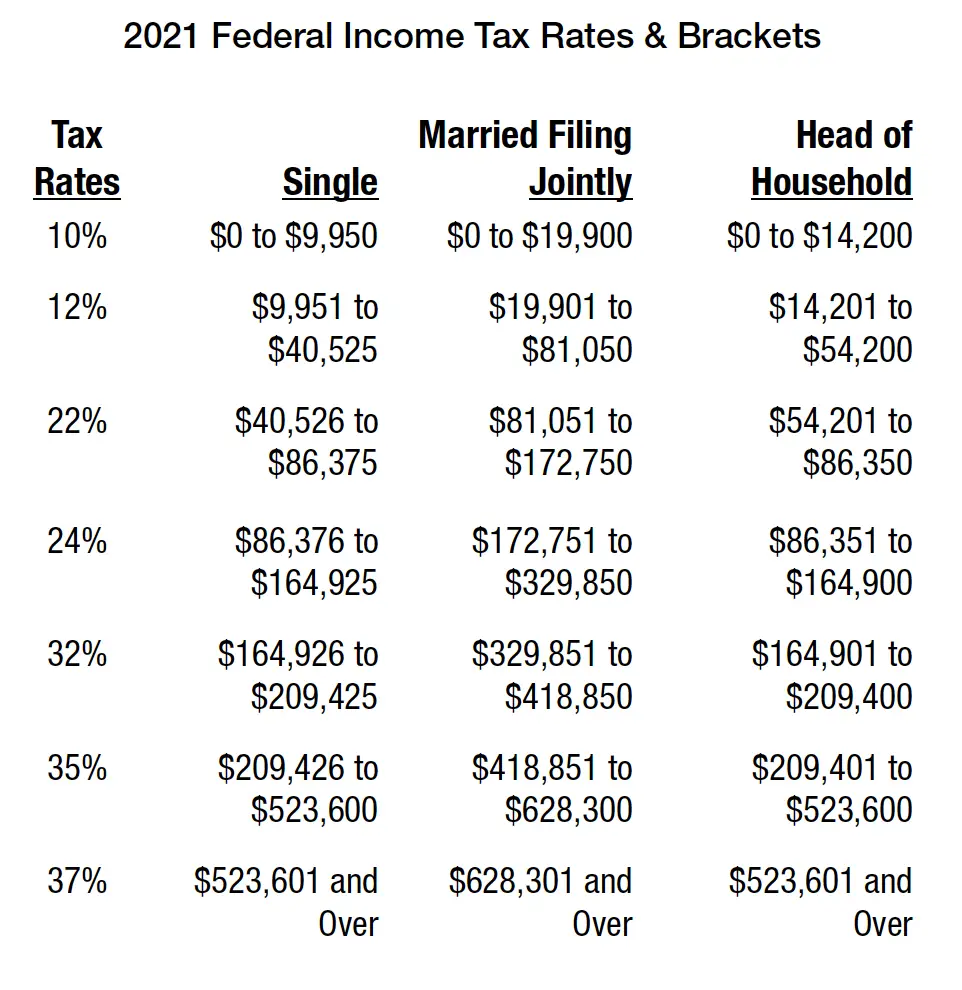

What Are The 2021 Federal Income Tax Brackets

Single filing status

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $9,950 | $995 plus 12% of the amount over $9,950 |

| $40,525 | $4,664 plus 22% of the amount over $40,525 |

| $86,375 | $14,751 plus 24% of the amount over $86,375 |

| $164,925 | $33,603 plus 32% of the amount over $164,925 |

| $209,425 | $47,843 plus 35% of the amount over $209,425 |

| $523,600 | $157,804 plus 37% of the amount over $523,600 |

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $19,900 | $1,990 plus 12% of the amount over $19,900 |

| $81,050 | $9,328 plus 22% of the amount over $81,050 |

| $172,750 | $29,502 plus 24% of the amount over $172,750 |

| $329,850 | $67,206 plus 32% of the amount over $329,850 |

| $418,850 | $95,686 plus 35% of the amount over $418,850 |

| $628,300 | $168,994 plus 37 % of the amount over $628,300 |

| If taxable income is over: | but not over: |

| 10% of the amount over $0 | |

| $9,950 | $995 plus 12% of the amount over $9,950 |

| $40,525 | $4,664 plus 22% of the amount over $40,525 |

| $86,375 | $14,751 plus 24% of the amount over $86,375 |

| $164,925 | $33,603 plus 32% of the amount over $164,925 |

| $209,425 | $47,843 plus 35% of the amount over $209,425 |

| $314,150 | $84,497 plus 37% of the amount over $314,150 |

Head of Household filing status

Calculating Effective Tax Rate

The effective tax rate is the overall tax rate paid by the company on its earned income. The most straightforward way to calculate effective tax rate is to divide the income tax expense by the earnings before taxes. Tax expense is usually the last line item before the bottom linenet incomeon an income statement.

Effective Taxes \begin\textbf=\frac}}\end Effective Tax Rate=Earnings Before TaxesTax Expense

For example, if a company earned $100,000 before taxes and paid $18,000 in taxes, then the effective tax rate is equal to 18,000 ÷ 100,000, or 0.18. In this case, you can clearly see that the company paid an overall rate of 18% in taxes on income.

You can easily calculate a company’s effective tax rate based off their income statement, while you can easily calculate an individual’s effective tax rate off their 1040.

Also Check: How Many Tax Forms Are There

What Happens To My Net Income

One of the most common misconceptions about moving into a higher tax bracket is that the new tax rate affects all your income. Barrow said that the reality is more income equals more income.

You are only taxed on a percentage of your income, and the increased tax rate would typically apply only to the new income, Barrow said.

As such, your income below the other tax rate thresholds is taxed the same.

Home Improvements For Medical Needs Can Be Deducted

Medical expenses can be a major tax deduction, but only if they go over 7.5% of your adjusted gross income, which is essentially your taxable income. Any home improvements — safety bars, accessibility ramps, wider doorways, railings and lifts, for example — related to medical conditions can be included in your tax deductions for medical expenses.

Keep all your receipts and invoices and include the total cost of the improvements or additions with all of your additional medical and dental expenses on Line 1 of 1040 Schedule A.

Read Also: What Is Federal Withholding Tax

Example Of Tax Calculation

Meet a fictional chap named John who lives in British Columbia. John has been contributing to a Wealthsimple RRSP to reduce his taxable income. After his RRSP contribution and other tax deductions and tax credits, he has taxable income of $55,000. Here’s what his tax calculation might look like:

John’s Federal tax bill The first $50,197 is taxed at 15% , which works out to $7,529.55. He has $4,803 remaining, that amount will be taxed at a higher rate of 20.5% which works out to $984.62. This means his total federal tax owing is $7,529.55 + $984.62 = $8,514.17

John’s provincial tax bill Remember, John’s provincial rate is based on his province of residence as of December 31 of the calendar year. John’s first $43,070 will be taxed at 5.06%, which works out to $2,179.34. The remaining $11,930 will be taxed at 7.7% which works out to $918.61. His total provincial tax is $3,097.95.

John’s total tax bill John’s combined federal and provincial taxes owing is $8,514.17 + $3,097.95 = $11,612.12.

Significance Of Effective Tax Rate

Effective tax rate is one ratio that investors use as a profitability indicator for a company. This amount can fluctuate, sometimes dramatically, from year to year. However, it can be difficult to immediately identify why an effective tax rate jumps or drops. For instance, it could be that a company is engaging in asset accounting manipulation to reduce its tax burden, rather than a managerial or process change reflecting operational improvements.

Also, keep in mind that companies often prepare two different financial statements one is used for reporting, such as the income statement. The other is used for tax purposes. Expenses that are allowed as deductions or for tax purposes may cause variances in these two documents. If a company is effectively utilizing tax deductions and credits, then its effective tax rate will be lower than a company that is not effectively using these strategies.

Also Check: Are Charity Donations Tax Deductible

Wait What About The Surtax

Looking at Prince Edward Island and Ontario tax rates, you might think those numbers seem low compared to other provincial rates. However, personal income in these two provinces gets taxed again with a surtaxwhich amounts to a tax on a tax.

In P.E.I., residents pay a surtax of 10%, unless your basic provincial tax payable is less than or equal to $12,500in which case you pay no surtax. To calculate the surtax, multiply your annual income by 0.10.

The Ontario surtax is more complex, so the calculation takes a few more steps, which youll see in the table below.

| Provincial Tax Owed | |

|---|---|

| Over $6,387 | 56% |

For your 2022 income, if your base provincial tax is up to $4,991, you do not pay a surtax. If your base provincial tax is between $4,991 and $6,387, you pay 20% on the portion of provincial tax owed that surpasses $4,991. Finally, if your base provincial tax exceeds $6,387, you pay 20% on the portion of provincial tax owed over $4,991, plus 36% on the portion over $6,387. But good news: Most personal tax programs automatically figure this out.

Example Of Tax Brackets

Below is an example of marginal tax rates for a single filer based on 2022 tax rates.

- Single filers with less than $10,275 in taxable income are subject to a 10% income tax rate .

- Single filers who earn more than $10,275 will have the first $10,275 taxed at 10%, but earnings beyond the first bracket and up to $41,775 will be taxed at a 12% rate .

- Earnings from $41,776 to $89,075 are taxed at 22%, the third bracket.

Consider the following tax responsibility for a single filer with a taxable income of $50,000 in 2022:

- The first $10,275 is taxed at 10%: $10,275 × 0.10 = $1,027.50

- Then $10,276 to $41,775, or $31,499, is taxed at 12%: $31,499 × 0.12 = $3,779.88

- Finally, the remaining $8,225 is taxed at 22%: $8,225 × 0.22 = $1,809.50

Add the taxes owed in each of the brackets:

- Total taxes: $1,027.50 + $3,779.88 + $1,809.50 = $6,616.88

The individuals effective tax rate is approximately 13% of income:

- Divide total taxes by annual earnings: $6,616.88 ÷ $50,000 = 0.13

- Multiply 0.13 by 100 to convert to a percentage, which is 13%.

Taxes that you pay on 401 withdrawals are also based on tax brackets.

You May Like: Why Does It Cost So Much To File Taxes

What Is The Purpose Of An Effective Tax Rate

Calculating a company’s tax rate benefits individuals inside and outside of a company. Investors outside of a company can take a company’s effective tax rate and better understand their corporate structure and methodologies implemented to be most resourceful. Those within a company are interested in the effective tax rate as it is used when budgeting and planning.

When Must Tax Be Paid

Generally, tax must be paid throughout the year, as it accrues. Most employers deduct an amount for taxes from your paycheques, and submit it to the federal government on your behalf. If your employer has not deducted enough during the year, you will have to pay tax when you file your tax return. If your employer deducted too much because you have deductions or credits to claim, you will usually get money back after you file your return for the year.

Many people prepare their own tax returns either by carefully following the steps in the tax return packages provided by CRA, or by purchasing a computer program that will ask you to input information and then calculate your taxes.

For general information, contact Canada Revenue Agency.

For legal advice and assistance with tax planning, a CRA tax dispute, or other tax issues, contact Tax Chambers LLP

Don’t Miss: How To File Taxes As Student

States Inaugurate A Flat Tax Revolution

A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

Inflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a hidden tax, as it leaves taxpayers less well-off due to higher costs and bracket creep, while increasing the governments spending power.

A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets the federal corporate income tax system is flat.

The standard deduction reduces a taxpayers taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

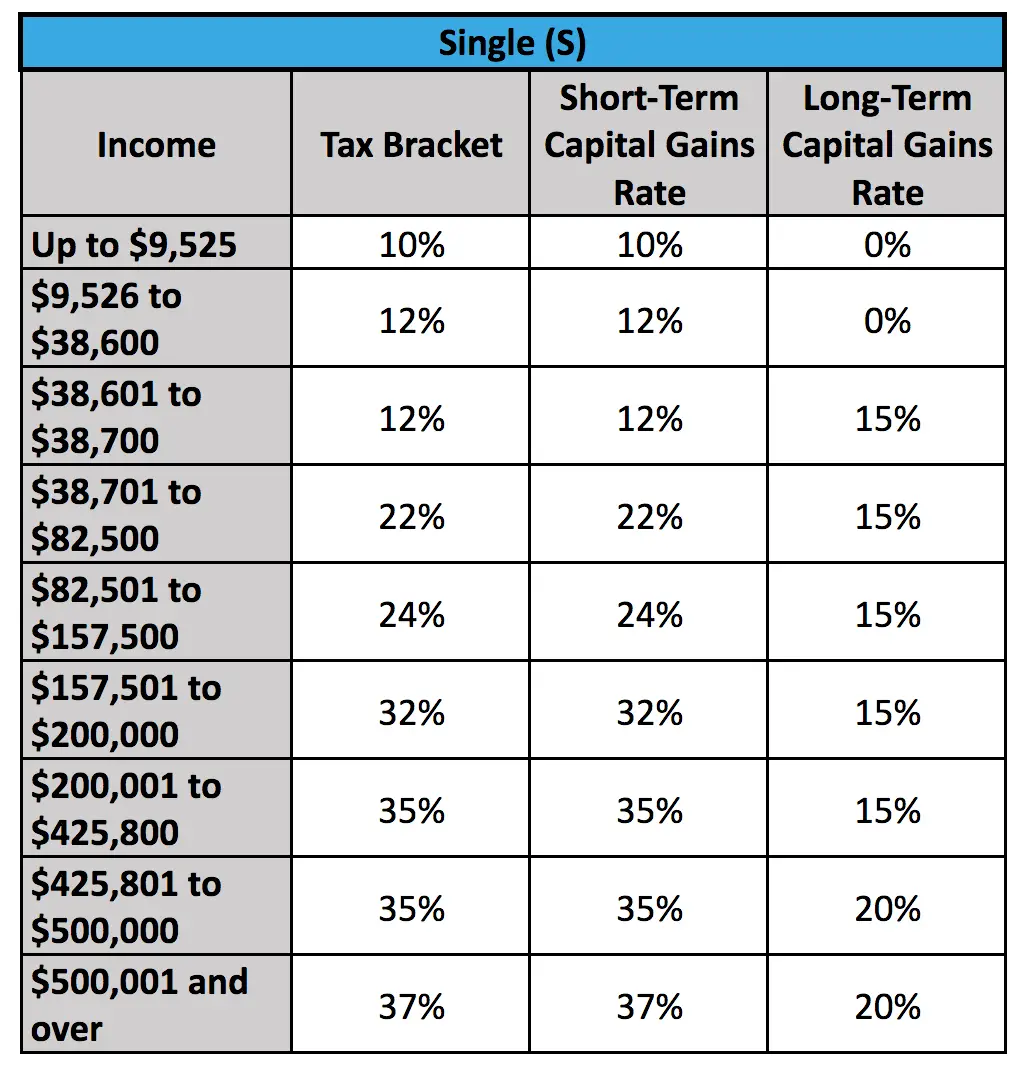

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

Home Office Expenses Are Only Deductible If You’re Self Employed

Homeowners who use any part of their house, apartment or condo “exclusively and regularly” for their own business or side gig can claim home business expenses using IRS Form 8829. These deductions are available to renters too.

The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for deducting a home office involves calculating the percentage of your home that is used for business. Both methods use Form 8829 for reporting.

Home-office deductions aren’t available to remote employees of companies.

You May Like: What Is The Sales Tax For Texas

Personal Income Tax Rates

Indexing the personal income tax system

Albertas government is indexing the personal income tax system for inflation, beginning for the 2022 tax year. Tax bracket thresholds and credit amounts will increase by 2.3% over their 2021 value.

Many Albertans will first see the benefit of indexation through lower tax withholdings on their first paycheques of 2023. In addition, since indexation will resume for 2022, Albertans will receive larger refunds or owe less tax when they file their 2022 tax returns in spring 2023.

The Type Of Taxable Income Matters

Tax brackets rely on using your taxable income to determine your federal income tax bill. However, not all income is treated the same for tax purposes. Income you earn from your job gets taxed through the tax brackets used on ordinary income. Long-term capital gains, on the other hand, are taxed at a rate between 0% and 20%, depending on your income level. Regardless of what type of income you make or the marginal tax bracket youre in, your goal should be to get your effective tax rate as low as possible. Past tax brackets:

2020 Tax Brackets

| $311,026 or more | $518,401 or more |

Knowing your tax bracket and your effective tax rate can be the first steps to lowering your taxable income and lowering your tax.

If you need help determining your tax bracket, visit TurboTaxs Tax Bracket Calculator. Simply provide your filing status and taxable income to estimate your tax bracket.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Recommended Reading: Can I Pay My Federal And State Taxes Online

Which Home Expenses Are Not Tax Deductible

Despite all of the tax breaks available for homeowners, there are some home-related expenses that can’t be deducted from your income.

- Your down payment for a mortgage

- Any mortgage payments toward the loan principal

- Utility costs like gas, electricity and water

- Fire or homeowner’s insurance

- House cleaning or lawn maintenance

- Any depreciation of your home’s value

Everyone’s tax situation is unique. Before making major tax decisions, we recommend consulting a tax professional who can help you with both federal and state tax laws.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: When Are Federal Income Taxes Due This Year