New York City Income Tax

New York City has a separate city income tax that residents must pay in addition to the state income tax. The city income tax rates vary from year to year. The tax rate you’ll pay depends on your income level and filing status. It’s based on your New York State taxable income. There are no city-specific deductions. But some tax credits specifically offset the New York City income tax.

If you work for the city but don’t live there, you must still pay an amount equal to the tax you would have owed if you had lived there. This rule applies to anyone who began employment after January 4, 1973.

What Is New York Citys New Congestion Tax Scheme

Posted by Boldizsar Hajas on Wednesday, December 1st, 2021, 4:59 PMPERMALINK

Back in 2019 the New York State legislature approved a congestion pricing plan for downtown New York City.

The basic concept is simple: tax people for entering highly congested areas, thus reducing the traffic.

This idea is meant to harness the nonlinear nature of traffic congestion. As a highway reaches its design capacity, each additional vehicle added to the road creates more congestion than the vehicle that came before it. Also, the reverse is true. That is what the policy is built upon: even a small decrease in the number of vehicles can visibly ease congestion.

New York would be the first stateto introduce such a plan, formally named the Central Business District Tolling Program. The planned pricing area would consist of Manhattan downtown, that is all streets and roadways south of 60th Street, except the FDR Drive, the West Side Highway, sections of the Battery Park Underpass and Hugh Carey Brooklyn-Battery Tunnel that connect the FDR Drive to the West Side Highway.

The pricing is not determined yet and will be decided according to how many credits and exemptions are given out, but it will likely be around $12 14 for passenger vehicles, and $25 for trucks. The fee would operate on a once-a-day basis.

Taken on 23 April 2018, 08:49:52

Posted by Garrett Smith on Friday, January 14th, 2022, 10:49 AMPERMALINK

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Don’t Miss: Do You Have To Pay Taxes On Retirement Income

Was Brooklyn Its Own City

Although Brooklyn has been a borough of New York City for more than a century, it had a long and illustrious history as an independent city until that time. In 1890, the last census before it was annexed, Brooklyn ranked as the fourth largest city in the United States.

New York City Income Tax Credits

Tax credits reduce the amount of income tax that you owe. They come directly off any tax you owe to the taxing authority. Some credits are refundableyoull receive a refund of any portion of the credit thats left over after reducing your tax liability to zero.

New York City offers several tax credits. They can offset what you owe the city, but they wont affect the amount of New York State income tax you might owe.

You May Like: How Much Are Tolls From Maryland To New York

Don’t Miss: When Did I Last File Taxes

What Are The Tests For New York City Residency

There are two tests for residency: the Domicile Test and the Statutory Residency Test. Note that New York State has the same residency tests as the city.

The domicile test determines the one place you intend to have as your permanent home. This is a subjective test but auditors will look at objective factors to determine your intent, such as how the use, maintenance, value, and size of your New York City home compares to your other homes where you conduct your business activities where your family resides and you keep special items and how much time you spend in the city versus outside the city. If these are not conclusive in establishing your domicile, the city will look at other factors as well. Notably, even if you do not spend significant time in the city, it can still be considered your domicile.

The second test is the statutory residency test. Under this test, an individual who is not domiciled in New York City can still be a resident if he or she maintains a permanent place of abode in the city for substantially all of the year and spends more than 183 days in the city. A permanent place of abode is defined as a residence that is maintained by the taxpayer and is suitable for year-round use. Under day count rules, generally, a partial day counts as a full day, with some limited travel and medical exceptions.

New York City Sales Tax

On top of the state sales tax, New York City has a sales tax of 4.5%. The city also collects a tax of 0.375% because it is within the MCTD. The total sales tax in New York City is 8.875%. This is the highest rate in the state. With such a high sales tax, its no wonder the cost of living in New York City is so high.

You May Like: Can You File State Taxes Before Federal

Who Is A New York City Resident For Tax Purposes

A New York City resident for tax purposes is someone who is domiciled in New York City or who has a permanent place of abode there and spends more than 183 days in the city. These two tests for residency are complicated and look at multiple factors to determine whether you should be taxed as a city resident. Because of the citys high tax rate, it is important to understand the residency rules to avoid paying taxes if you dont have to do so. The best course of action is to contact a New York tax attorney for help.

What Is Long Island City Known For

This former manufacturing epicenter is one of NYCs most exciting neighborhoods, with a lively nightlife scene, must-visit restaurants and contemporary art museums. Along the waterfront, green spaces Gantry Plaza State Park and Hunters Point South Park are well suited for picnics and sunset strolls.

You May Like: How To Calculate Federal Income Tax Withholding

Escape From New York City: The Pandemic And Its Tax Implications

CEO & Founder of Global Taxes, LLC 212-803-3327 or 917-834-9307

The phrase unprecedented times has often been repeated in the news when reporting about the current Covid-19 pandemic. Truth be told, we are not living in precedented times at all. In fact, if you know your global history, the world has experienced many plagues and pandemics far worse than the one it is experiencing now. However, there are aspects of this pandemic that lend itself to being described as unprecedented. For example, the virus itself acts in ways that scientists have never witnessed before in the life cycle of other viruses.

In a similar vein, New York City is experiencing events that are unprecedented. It is observing a mass exodus of its residents. They are moving out of the City to other parts of the state or out-of-state. With this mass exodus comes the questions being asked by taxpayers as to the implication a change of residency has on their 2020 tax bill. There is a lot of misinformation being circulated in the press and elsewhere that is convincing taxpayers a move out of New York City will reduce, if not eliminate, their City taxes. Cited here is a thumbnails sketch of the rules and regulations associated with residency and taxes. It is being presented here in the hope that it will prevent you, the reader, from making a grievous error. Consider this message wholeheartedly and you just may avoid being hit with a hefty City income tax bill comes Tax Day 2021.

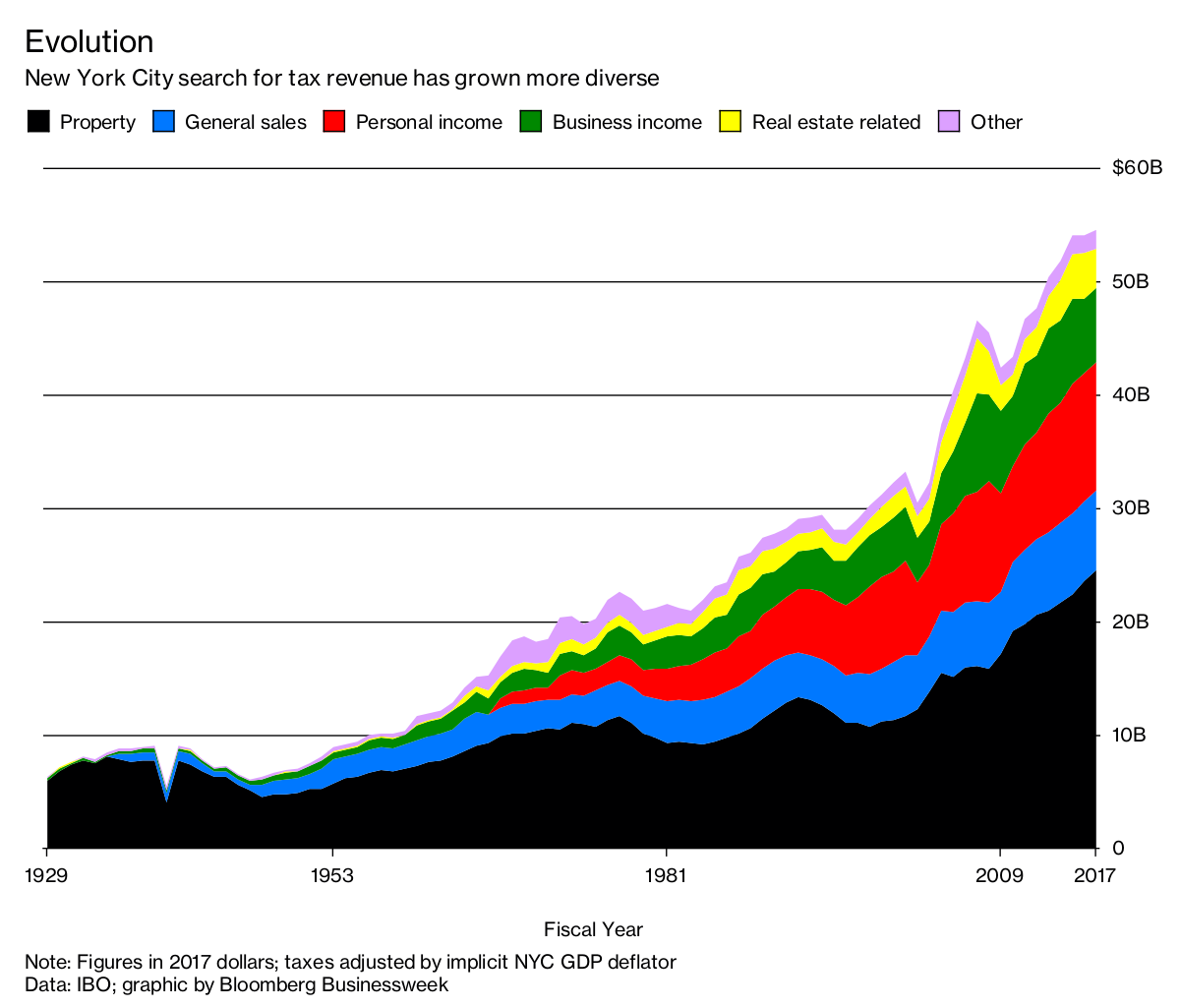

Tax Bills Go Up Even When The Tax Rate Does Not

Since the 1990s, changes in the overall property tax rate have been infrequent.3 The City enacted an 18.5 percent rate increase effective January 1, 2003 a rate reduction for fiscal year 2008 was repealed the following year, and the rate has been the same since then. Despite the stable tax rate, taxpayers bills have continued to increase because property values have grown.

Table 1 indicates the average tax bill for commercial property and for four types of residential property in fiscal years 2001, 2005, and 2017.4 In fiscal years 2005 and 2017, the bill is shown in two ways: the actual amount under the rate increase and an amount adjusted to eliminate the effect of the rate increase.

For commercial property the average bill is shown per parcel and per square foot, which takes into account changes in the average size of buildings. From 2001 to 2017 the average bill per commercial parcel grew from just above $49,000 to more than $111,000, or 5.2 percent annually adjusting for the rate change, the average annual increase was 4.1 percent. Per square foot, the adjusted bill more than doubled from $3.69 to $7.45 from 2001 to 2017.

Recommended Reading: What Is Income Tax Return

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

Things start to get bad when you look at sales taxes. New York’s average combined state and local sales tax rate is the 10th-highest in the country, according to the Tax Foundation.

And then things go from bad to worse when property taxes are added to the mix. New York’s median property tax rate is the eighth-highest in the U.S. New York also has an estate tax with a special “cliff” feature that can result in a big tax bill when you die.

On the bright side, New York is sending tax rebate payments to people who received at least $100 for either or both of the state’s child credit or earned income credit for 2021 tax year . New York started sending the child credit/earned income credit payments on October 12, 2022.

Who Must Pay New York City Income Tax

Every income-earning individual, estate, and trust residing or located in New York City must pay the city’s personal income tax. Taxpayers who live in NYC for only part of the year can calculate their tax based on the number of days they resided there.

New York City government employees who were hired on or after January 4, 1973, must pay the tax even if they don’t live in the city. They must pay a city income tax equal to what they would have paid had they resided there.

Also Check: How To Calculate Quarterly Taxes

Is It Cheaper To Live In Nj Or Ny

Newark and Jersey City are both generally cheaper than New York City’s outer boroughs with the exception of Hoboken, which rivals Manhattan in costliness despite New Jersey boasting the highest property tax rate in the country. Keep scrolling for a full breakdown of the fixed monthly costs in each place.

Child And Dependent Care Credit

You qualify for the child and dependent care credit if you are eligible for the federal child and dependent care credit, whether you claim it or not on your tax return. The is determined by the number of your qualifying children and the amount of child care expenses paid during the year. The credit is worth up to $2,310 for the tax year 2020. If the credit is more than the amount you owe in taxes, you can receive a tax refund.

Recommended Reading: Where To Find Adjusted Gross Income On Tax Return

Earned Income Tax Credit

You can claim the earned income tax credit in New York if you have a qualifying child and can also claim the federal earned income tax credit. You are not entitled to this credit if you claimed the Noncustodial Parent New York State Earned Income Tax Credit . The credit equals to 30% of your allowable federal earned income tax credit minus your household credit.

First Legal Recreational Marijuana Shop Opens In New York City

New York’s first legal recreational marijuana dispensary opened on Thursday in the heart of Manhattan.

More than 100 people crowded into the dispensary in New York City’s East Village, run by the nonprofit Housing Works, a group dedicated to fighting homelessness and AIDS.

“The first legal adult-use cannabis sales mark a historic milestone in New York’s cannabis industry,” said Governor Kathy Hochul, who oversees the fourth most populous US state.

Hochul said in a statement that she expects New York to serve “as a national model for the safe, equitable and inclusive industry we are now building.”

Don’t Miss: Can I File My Business And Personal Taxes Separately

How Your New York Paycheck Works

When you start a job in the Empire State, you have to fill out a Form W-4. Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck.

The 2020 W-4 includes notable revisions. The biggest change is that you wont be able to claim allowances anymore. Instead, youll need to input annual dollar amounts for additional income and things like non-wage income, total annual taxable wages, income tax credits and itemized and other deductions. The form also utilizes a five-step process that asks you to enter personal information, claim dependents and indicate any extra income or jobs.

All employees hired as of Jan. 1, 2020 must complete the form. If you were hired before then, you dont need to worry about filing a new W-4 unless you plan on changing your withholdings or getting a new job.

You May Like: Can I Go To College For Free In New York

Tips For Filing Taxes

- A financial advisor can help you develop a tax strategy to benefit your investing and retirement goals. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors, get started now.

- If you dont know whether youre better off with the standard deduction versus itemized, you might want to read up on it and do some math. Educating yourself before the tax return deadline could save you a significant amount of money.

- Figure out whether youll be getting a refund or will owe the government money so you can plan your household budget accordingly. SmartAssets tax return calculator can help you figure this out.

Don’t Miss: How To File Quarterly Taxes Online

New York Real Property Taxes

In New York, the median property tax rate is $1,720 per $100,000 of assessed home value.

New York Property Tax Breaks for Retirees

New York State law gives local governments and public-school districts the option of granting a reduction on the amount of property taxes paid by qualifying senior citizens by reducing the assessed value of residential property owned by seniors by 50%. To qualify, seniors must be 65 or older and meet certain income limitations and other requirements. For the 50% exemption, the law allows each county, city, town, village or school district to set the maximum income limit between $3,000 and $50,000. Under the so-called sliding-scale option, localities may also grant an exemption of less than 50% to senior citizens with yearly incomes over $50,000 but less than $58,400.

There is also an Enhanced STAR program for seniors. The Enhanced STAR exemption is available for the primary residences of senior citizens with annual household incomes not exceeding the statewide standard. Combined income must be $92,000 or less for 2022 benefits . For qualifying senior citizens, the Enhanced STAR program exempts part of the value of their home from school property taxes.

How Do I Avoid New York City Taxes

Recommended Reading: Does Mortgage Include Property Tax

Is Long Island City Safe

Safety. Long Island City is patrolled by the 108th Precinct of the NYPD. According to the NYC Crime Map, between January 2019 to April 2020, LIC has seen lower amounts of crime compared to Queens and NYC. During the last 16 months, there were 1,334 crimes, which amounts to about 11.7836 crimes per 1,000 residents.