Collection Payment And Tax Returns

Sales taxes are collected by vendors in most states. Use taxes are self assessed by purchasers. Many states require individuals and businesses who regularly make sales to register with the state. All states imposing sales tax require that taxes collected be paid to the state at least quarterly. Most states have thresholds at which more frequent payment is required. Some states provide a discount to vendors upon payment of collected tax.

Sales taxes collected in some states are considered to be money owned by the state, and consider a vendor failing to remit the tax as in breach of its fiduciary duties. Sellers of taxable property must file tax returns with each jurisdiction in which they are required to collect sales tax. Most jurisdictions require that returns be filed monthly, though sellers with small amounts of tax due may be allowed to file less frequently.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed , these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns.

Purchasers of goods who have not paid sales tax in their own jurisdiction must file use tax returns to report taxable purchases. Many states permit such filing for individuals as part of individual income tax returns.

Top Ten States With The Highest Sales Tax Rates In The Us

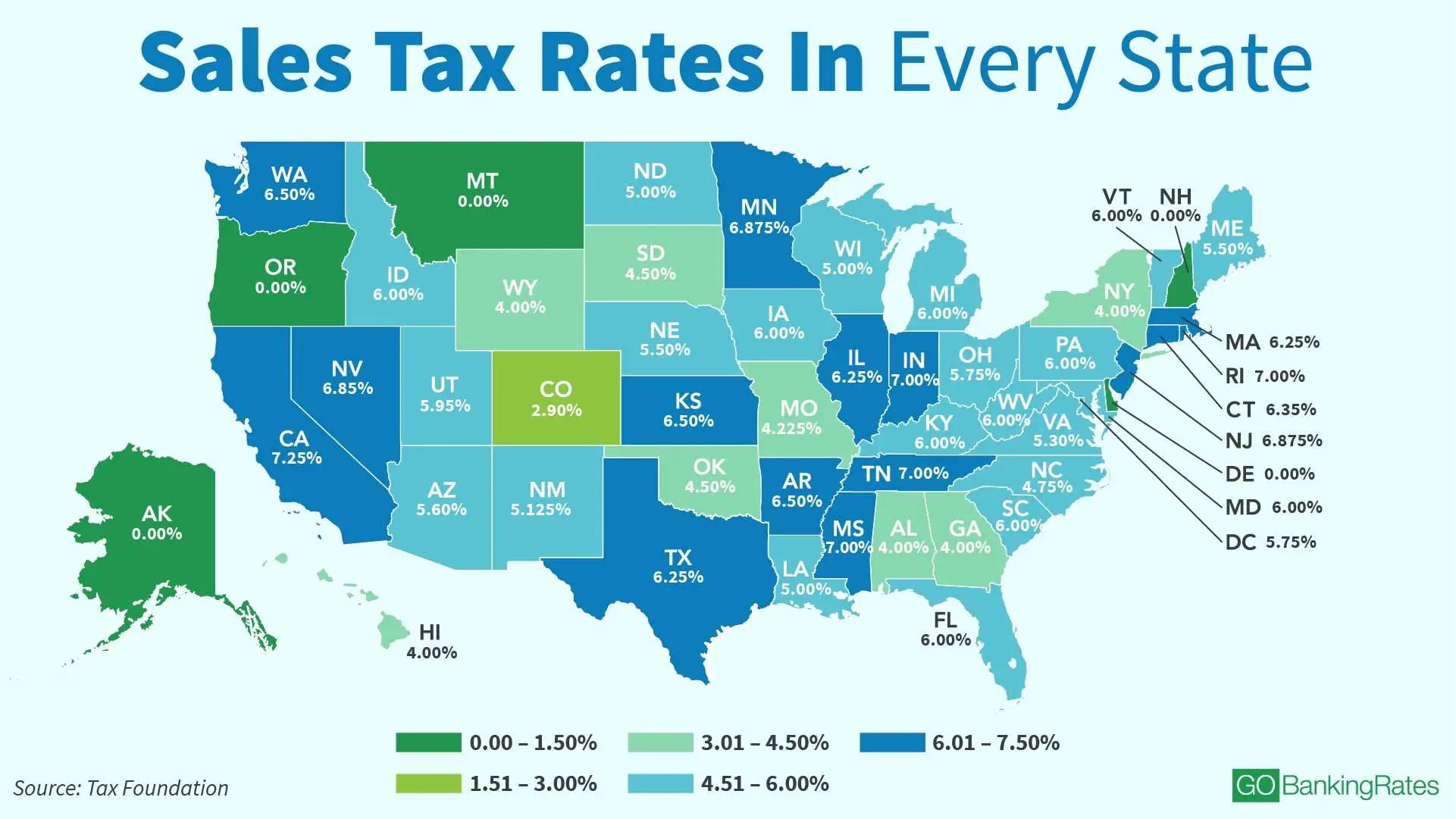

Sales tax is collected at the state level in forty-five states and in the District of Columbia. New Hampshire, Oregon, Montana, Alaska, and Delaware, otherwise known as the NOMAD states, are the only states that do not have a state-level sales tax, although some local levels in Alaska do impose a sales tax.

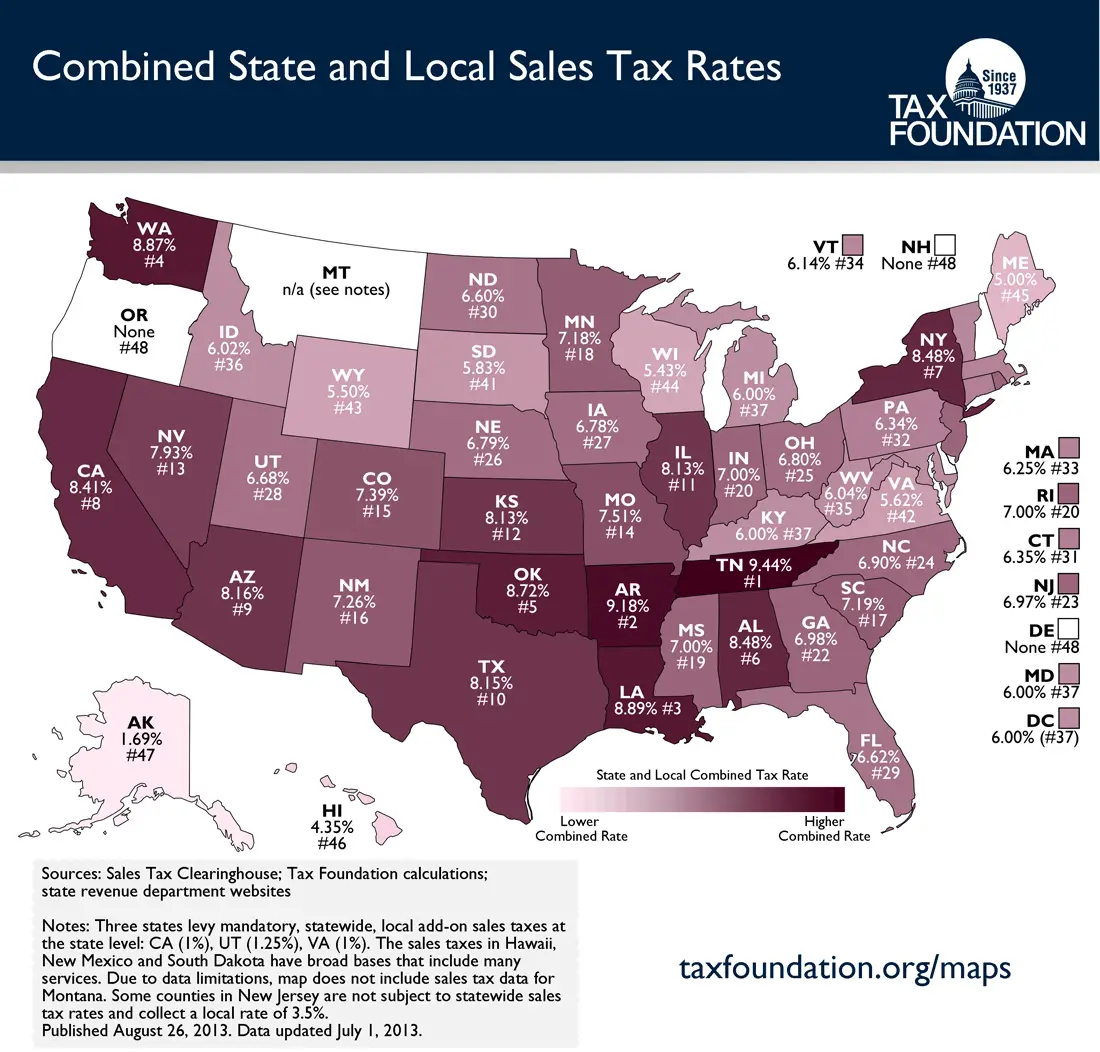

Sales tax rates vary significantly from state to state. Below is a list of the ten states with the highest average combined state and local sales tax rates.

What Is Sales And Use Tax

When you read about sales tax in New York, youll see talk of Sales and Use Tax. What is use tax and why do you have to pay it?

As you might know, sales tax applies to goods and services you buy within a state. Use tax is an equivalent tax that you pay on items that you purchase outside of the state.;It ensures that;out-of-state retailers dont benefit just because they dont have to pay the in-state sales tax. The use tax in New York is the same as the sales tax. The two taxes are also mutually exclusive so if you pay one of them, you wont have to pay the other.

Lets look at an example to show how use tax works: Imagine youre a New York resident and you buy a computer somewhere within;the state. The seller will collect the regular New York sales tax. But if you buy a computer;from New Hampshire, the seller wont collect the New York sales tax. That means you can get the computer without paying the full tax on it. So New York collects a use tax.;New York requires residents to report their out-of-state spending in their;New York income taxes.

Don’t Miss: Where To File Taxes For Free

Paper Carryout Bag Reduction Fee

The New York State Bag Waste Reduction Act authorizes counties and cities to impose a five-cent paper carryout bag reduction fee on paper carryout bags that sales tax vendors of tangible personal property provide to customers. Sales tax vendors that sell tangible personal property in a locality that imposes the paper bag fee must charge the fee for each paper carryout bag provided to a customer, even if the vendor does not sell any tangible personal property or a service to the customer. For a current listing of the localities that enacted the fee, see Publication 718-B, Paper Carryout Bag Reduction Fee. The fee is reported on Schedule E, Paper Carryout Bag Reduction Fee.

New York Documentation Fees

Dealerships may also charge a documentation fee or “doc fee”, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. These fees are separate from the taxes and DMV fees listed above.

The average doc fee in New York is $751, andNew York law caps dealer’s doc fees at 1.Because these fees are set by the dealerships and not the government, they can vary dealership to dealership or even vehicle to vehicle.

1 – Average DMV and Documentation Fees for New York calculated by Edmunds.com

Read Also: How To File Taxes Doordash

New York Auditing Income Tax Returns Of Certain Nonresident Remote Employees

New York tax authorities are focused on auditing 2020 income tax returns filed by nonresidents who work for New York employers. During the course of the Coronavirus Pandemic, the New York Department of Taxation and Finance directed nonresidents whose primary office is in New York to count telecommuting days as time working in the state. More specifically, TSB-M-06I, issued in 2006, provides that in order for any work days to be allocated outside of New York State, such services must be because the employers necessity and not the employees convenience.; Applying this rule, unless telecommuting was because of necessity of the employer, employee services rendered remotely were to be considered New York work days. However, there may be legal challenges to that position because taxpayers are arguing telecommuting was a requirement and, in many cases, mandated; rather than simply being based upon convenience. Moreover, the U.S. Supreme Court will;rule on a similar issue as requested by New Hampshire, which is challenging Massachusetts taxation of residents working remotely.

New York Proposes Capital Gains Business Tax Surcharges

Revised budget proposals from each of the New York State Assembly and the New York State Senate would include a one percent surcharge on the capital gains of certain individuals for tax years beginning on or after January 1, 2021. The capital gain surcharge would be imposed in addition to individual income tax. Further, both proposals call for a surcharge to be imposed on corporations for tax years beginning on or after January 1, 20201. While both surcharges are structured differently, in either case the tax would apply to corporations with income or receipts above a designated threshold. The Assembly proposal calls for an 18 percent surcharge, while the Senate proposal would permanently raise the corporate franchise tax rate from 6.5% to 9.5%. Lastly, the Assembly version of the Bill would reinstate the 0.15 percent capital base tax that had previously been repealed for tax years beginning in 2021.

Also Check: How To Get The Most Out Of Tax Return

Nyc May Abate Ubt Late Filing/late Payment Penalties But Interest Still Accrues

The New York City Department of Finance, upon request, will waive late filing and late payment penalties for individual unincorporated business tax taxpayers, if such taxpayers complete filing payment on or before May 17, 2021. However, interest will accrue at the underpayment rate for the late payments. UBT taxpayers can request a penalty abatement by using the Departments portal, sending an email, filing a paper return and writing 21 at the top of the page, or request an abatement in writing.

New York State Taxes: Everything You Need To Know

Taxes in the Empire State won’t make you feel like royalty. Taxes 101

New York state tax has the second-highest average tax rate in the country, with the typical New Yorker paying over a quarter of their income to state and federal governments. And thats just at the state level. For the 8.5 million-plus people living in New York City the least tax-friendly city in America additional city taxes mean theyre shelling out even more.

So, why are New Yorkers paying more in taxes than most of the rest of the country? Heres a closer look at all of the state taxes in New York state.

| New York State Taxes | |

| State Sales Tax Rate Range | 7% 8.875% |

| State Income Tax Rate Range | 4% 8.82% |

| 3.06% 16% |

You May Like: Can You File Missouri State Taxes Online

How To Calculate Nyc Sales Tax

To calculate the amount of sales tax to charge in New York City, use this simple formula:

Sales tax = total amount of sale x sales tax rate .

Or to make things even easier, input the NYC minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need.

Factors To Consider When Calculating Ny Car Sales Tax

The following are factors to consider when calculating how much sales tax you will pay for a vehicle in New York:

- Manufacturer or dealership cash incentives

- Manufacturer rebates

- Whether the vehicle is sold below fair market value

If you receive incentives or rebates when purchasing your car, the sales tax you will pay will be based on the price of the car after the incentives or rebates are subtracted. Additionally, when buying a car from a private party, you must submit a DTF-802 form with details of the transaction in the event that the car is bought for less than the market value.

Also Check: Where To Mail Federal Tax Return 2021

Definition Of Qualified New York Manufacturer Changes

For tax years beginning on or after January 1, 2018, the definition of a qualified New York manufacturer has been changed to use the New York State adjusted basis rather than the federal adjusted basis when determining whether a manufacturer meets the $1 million or $100 million property thresholds for determining eligibility for the manufacturers tax rate reductions and the real property tax credit. A qualified New York manufacturer is a manufacturer that is principally engaged in the production of goods by manufacturing, processing, assembling, refining, mining, extracting, farming, agriculture, horticulture, floriculture, viticulture, or commercial fishing during the tax year that either has property in New York State of the type described for the investment tax credit that has an adjusted basis for New York State tax purposes of at least $1 million at the end of the tax year, or has all of its real and personal property in New York State. C, I, 10/18/2019.)

How Are Rebates And Dealer Incentives Taxed

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000.

New York taxes vehicle purchases before rebates or incentives are applied to the price, which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full $10,000.

You May Like: How To Subtract Taxes From Paycheck

Save With Wise When Invoicing Clients Abroad

If you’re invoicing clients abroad, you could get a better deal on your international business transfers with a Wise Business account. We give you the same exchange rate you see on Google, no hidden markup fees. Link your Wise account to PayPal to receive and withdraw funds in different currencies to save on fees and set up direct debits for all your recurring payment needs.

New York State Income Tax

Personal income tax in New York is on a progressive system with eight brackets ranging from 4 percent up to 8.82 percent, which is only paid by people earning more than $1 million a year.

| New York State Income Tax | |

| 2018 Estimated Income Taxes | |

| ;$1,077,550 up | 8.82% |

New York state income tax is also notable for the addition of a separate bracket for top earners that started with a 2009 bill, which created whats now known as the millionaires tax that boosts rates to close to 9 percent for top earners.

Find Out:;How Much Money You Would Have If You Never Paid Taxes

You May Like: Where Can I Find My Property Tax Bill

New York State Property Taxes

The average property tax rate across the state of New York is 1.578 percent, but that can vary widely depending on the locality in question. Anyone in New York County has a rate of 1.925 percent, and some counties in Western New York have effective rates over 3 percent.

See:;Heres How Much Americans Pay in Taxes in Every State

New York Temporarily Suspends Hotel Occupancy Tax

New York City Mayor Bill de Blasio has issued an executive order suspending the 5.875% hotel occupancy tax imposed by;NYC Administrative Code Section 11-2502;from June 1, 2021 through August 31, 2021. The daily hotel room tax under;NYC Administrative Code;§ 11-2502;remains in effect. For additional information, please see the executive order released on May 18, 2021.

May 13, 2021

You May Like: Do You Pay State Taxes On Unemployment

Is There A Tool That I Can Use To Calculate Ny Car Sales Tax

To calculate the sales tax you may pay for a vehicle in New York, you can use the tool provided by the New York State Department of Taxation and Finance website. This tool enables individuals to input their zip code and address to get an estimate of the total state and local taxes they may be subjected to pay for a vehicle. You will then multiply the sales price of your vehicle by the tax rate provided for your address in New York.

New York Sales Tax Nexus

Businesses that have a physical location in the state of New York are required to collect sales tax. This is known as “nexus”. Most other businesses will not have New York sales tax nexus, except for the following:

- Businesses that sell tangible personal property and make 12 or more deliveries of these products using their own vehicles. In other words, delivery by common carrier or LTL providers do not count toward these deliveries.

- You have employees or other representatives in state who solicit sales or products or services.

- You solicit the sale of tangible personal property or services via catalog or other advertising materials, and have some additional connection with the state.

- If you are associated with a vendor in-state, via an ownership test. (See this PDF for complete details.

- If you have New York affiliates, and your sales to New York buyers exceeds $10,000 in a calendar year, you will incur click-through nexus, and be required to collect and remit sales tax, the same as an in-state retailer.

Read Also: Can You Claim Rent On Your Taxes

New York City Musical And Theatrical Production Tax Credit For Corporate And Personal Income Tax

On July 23, 2021, Governor Andrew Cuomo announced the New York City Musical and Theatrical production tax credit which is designed to revitalize the theater district after its close due to the Covid-19 pandemic by offering up to $100 million in tax credits. The two-year program for approved companies which will allow tax credits for up to 25% of qualified production expenditures such as sets, costumes, sound, lighting, salaries, fees, advertising costs, etc. First year program applicants can receive up to $3 million per production and second year applicants up to $1.5 million. Companies can receive credits for tax years beginning on or after January 1, 2021 but before January 1, 2024.; Applications must be submitted by December 31, 2022 and final applications no later than 90 days after the production closes or 90 days following the program end date of March 31, 2023, whichever comes first.

The Basics Of New York State Taxes

The New York State Department of Taxation and Finance administers the various types of tax that you may be subject to in the Empire State. That includes income tax, sales tax, property tax, estate taxes and other taxes.

Whether you live or work in New York, or are a visitor, its important to know what types of taxes you may be on the hook for, and how much you can expect to pay. Heres a summary of what you can expect from each type of tax note that tax rates can change from year to year, so check the Department of Taxation and Finance website for the most up-to-date information.

Like the federal tax system, the Empire State has a progressive schedule for income taxes, which means that lower-income taxpayers typically pay a lower marginal rate than those with higher incomes. Your tax rate is determined not only by your adjusted gross income, or AGI, but also by your filing status.

While tax rates may be updated each year, here are the and tax brackets for the 2019 tax year.

| New York state income tax rates |

| Tax rate |

| $60,001 and more | $90,001 and more |

Also, the city of Yonkers has a resident income tax surcharge of 16.75%, which is withheld from your paycheck if youre a W-2 employee.

You May Like: How To File Taxes With No Income

Tax Relief For New Yorkers Impacted By Post

The Acting Tax Commissioner has extended certain filing and payment deadlines for taxpayers who were directly affected by Post-Tropical Depression Ida.

For more information, visit , Announcement Regarding Relief from Certain Filing and Payment Deadlines due to Post-Tropical Depression Ida.

Sales tax applies to retail sales of certain tangible personal property and services. Use tax applies if you buy tangible personal property and services outside the state and use it within New York State.

- For information on the Oneida Nation Settlement Agreement,;see;.

- and identifying the correct local taxing jurisdiction