Taxable And Exempt Shipping Charges

North Carolina sales tax may apply to charges for shipping, handling, delivery, freight, and postage.The general rule of thumb in North Carolina is that if the sale is exempt, related delivery charges are exempt. However, if the sale is taxable, delivery-related charges may be fully taxable, partially taxable, or non-taxable.

If both taxable and exempt sales are listed on an invoice, shipping and handling charges should be allocated proportionally to each item. However, if shipping and handling charges are based on a flat rate per package, the retailer can allocate the charges to any of the items in the package rather than apportion the charges.

If your records dont show the actual cost of an individual delivery, tax generally applies to the entire charge for delivery of a taxable sale.

There are exceptions to almost every rule with sales tax, and the same is true for shipping and handling charges. Specific questions on shipping in North Carolina and sales tax should be taken directly to a tax professional familiar with North Carolina tax laws.

For additional information, see the North Carolina Department of Revenue Sales and Use Tax Technical Bulletins.

Exemption For Computer Software

Computer software that is sold to a person who operates a data center and that is used within the data center is exempt from sales tax. Computer software is defined as a set of coded instructions designed to cause a computer or automatic data processing equipment to perform a task.

North Carolina’s economic tier system is incorporated into the Eligible Internet Data Center Sales Tax exemption to encourage economic activity in the less prosperous areas of the state. For more information about county tier designations, visit our County Development Tier Designations page.

Penalties And Interest For Late Payments

If payment is remitted late, there is a 10% failure to pay penalty that will be due with the next payment. Interest will be charged as well from the date of the last received payment.

If payment is on time but filing is late, there is a failure to file penalty of 5% per month with a maximum fine of 25% for a single return.

For those with a zero return, filing is still required by the listed due date. There is no penalty for failing to file a zero return, but after 18 months, the permit may be revoked for lack of filing.

Also Check: How Much Should You Set Aside For Taxes

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about North Carolina sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Is Meat Taxed In Nc

However, it is possible the items sold at the convenience store do not count as groceries, and that makes a difference. North Carolina reduces the sales tax rate to just 2% for qualifying grocery items, like fruits, vegetables, meats and snacks. These items exclude unhealthy foods, like sodas and candy.

You May Like: How To File Federal Taxes Electronically

What Transactions Are Generally Subject To Sales Tax In North Carolina

In the state of North Carolina, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Some examples of items that exempt from North Carolina sales tax are prescription medications, some types of groceries, some medical devices, and machinery and chemicals which are used in research and development.This means that an individual in the state of North Carolina who sells school supplies and books would be required to charge sales tax, but an individual who owns a store which sells groceries is not required to charge sales tax on all of its products.

Sales Tax Payment And Filing Date:

If your tax liability is consistently between $100 and $20,000 per month, you should file a return monthly and pay taxes on or before the 20th day of each month for all taxes due for the previous calendar month.

If your tax liability is consistently less than $100 per month, then you need to file a return quarterly and pay taxes due on or before the last day of the month for all taxes due for the previous calendar quarter.

If your tax liability is more than $20,000 per month, you should file a return monthly and pay taxes on or before the 20th day of each month for all taxes due for the previous calendar month. In addition to the tax payment, you must make a prepayment for the next months tax liability. Monthly tax returns and prepayment are should be filed online.

Don’t Miss: When Is An Estate Tax Return Due

North Carolina Sales Tax Audit Process

Theaudit process usually follows the process laid out in this flowchart. See the detailed guidance for each stage of the process in the sections below.

What to Expect After You Receive a North Carolina Sales and Use Tax Audit Notice

Many audits begin with a call out of the blue from a North Carolina Department of Revenues sales tax auditor. Shortly after the call, your business will receive an audit notice which confirms that you were lucky enough to be chosen for a North Carolina sales and use tax audit. To prepare for the audit, it is likely a good idea to start by getting a state and local tax professional involved.

What to Expect From A North Carolina Sales Tax Auditor

- Auditor will conduct pre audit research.

- Auditor will often schedule and perform an entrance conference.

- Records will be requested .

What to Expect During The Audit

- Once the necessary records are received, the auditor will:

- Conduct the audit by comparing your North Carolina sales and use tax returns to your federal income tax returns or bank statements to determine whether all applicable sales, or gross sales, were reported on your North Carolina sales tax return.

NOTE: A slight error in how tax was charged on even a single type of transaction, when multiplied over three years, can add up to a considerable sales tax liability.

After the Audit Understand and Defend Your Businesses Rights

North Carolina Sales Tax Audit Protest Process Flow Chart

Contesting Audit Findings with the Auditor

What You Need To Know About North Carolina State Taxes

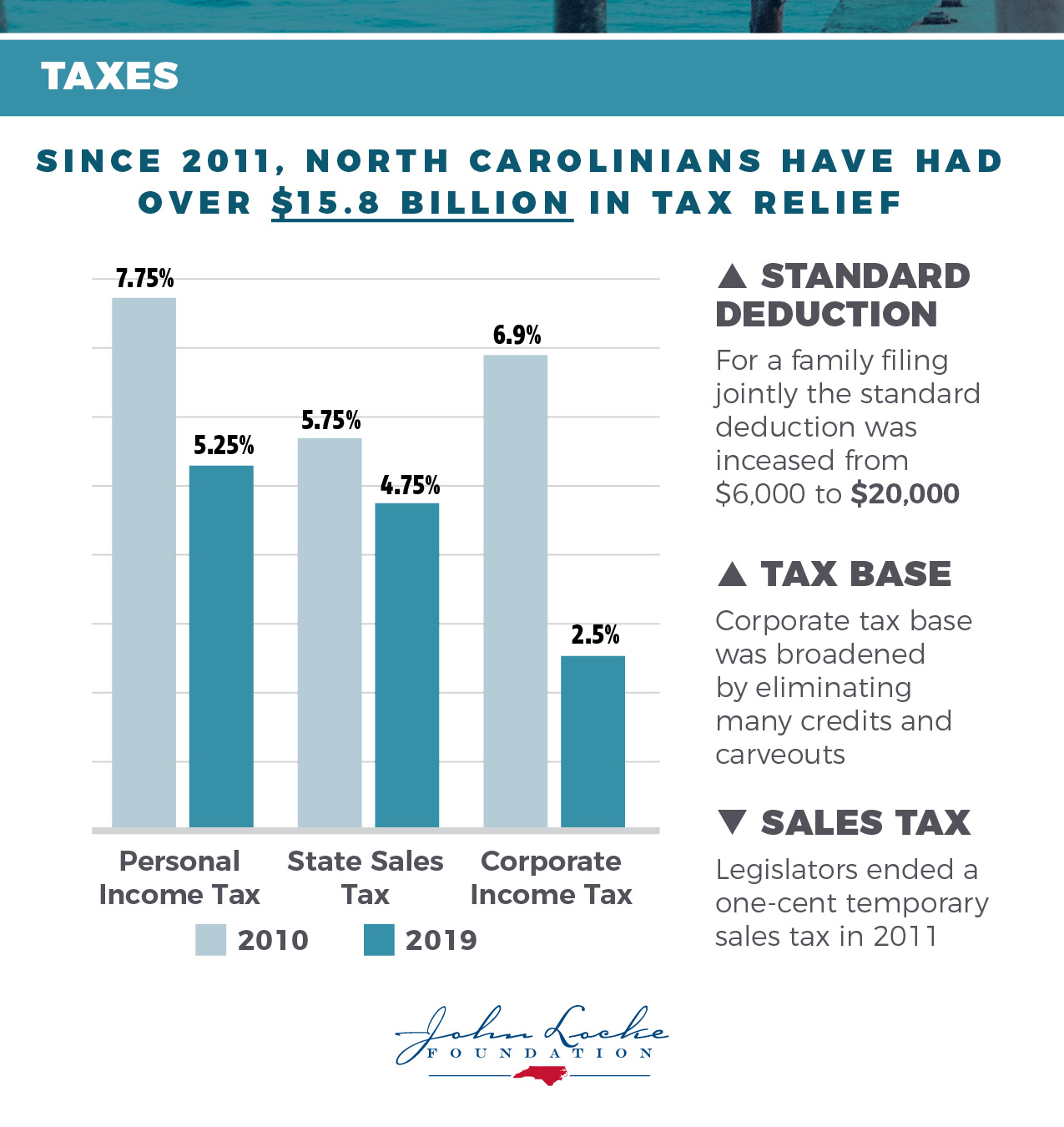

The state of North Carolina requires you to pay taxes if you are a resident or nonresident that receives income from a California source. The state income tax rate is 5.25%, and the sales tax rate is 4.75%.

North Carolina offers tax deductions and credits to reduce your tax liability, including a standard deduction or itemized deductions.

Don’t Miss: How To Pay Taxes For Free

Should I Get My Home Classified As A Farm To Save On My Property Tax Bill

Trying to receive an agricultural land classification is a common move to save on property taxes in other states such as Florida. It can also work in North Carolina, but North Carolinas rules are much stricter.

The North Carolina General Assembly really wants to limit this tax benefit to actual farmers not homeowners looking for a tax loophole.

Most people wont meet the minimum land requirements. Remember that the minimum acreage generally needs to be land in productive use, so the portion of your property with your home or other features may not count in some cases.

Renting your property out as pastureland for someone elses livestock is probably the easiest way to meet the requirements if you have enough land. Youll typically want to have a formal lease agreement in place to document the agricultural use of your land.

North Carolina State Sales Tax 101

A sales tax is a tax charged at the time of purchase of goods or services and paid to the local tax authority. Sales tax North Carolina is administered by the North Carolina Department of Revenue . Similarly to other states, North Carolina sales tax is collected from the purchaser at the point of sale and falls on the final consumer of the product or service.

Becoming a sales tax collector is usually determined by fulfilling one or more criteria described as establishing a nexus or a strong bond with the state. Once a nexus is established, the company becomes responsible for collecting the right amount of sales tax and submitting it to NCDOR. The total sales tax rate North Carolina -based businesses must charge vary based on the location of the sale because an additional local sales tax rate is added to the base sales tax. In addition to the sales tax, North Carolina also required filing the use tax due to North Carolina tax sales -exempt businesses.

Also Check: How To Efile Tax Return

How Much Is Restaurant Tax In Nc

Prepared Meals Tax in North Carolina is a 1% tax that is imposed upon meals that are prepared at restaurants. The tax is only imposed by local jurisdictions upon the granting of approval by the North Carolina General Assembly. The provision is found in G.S. 105-164.3 and reads as follows: 28) Prepared food.

How Much Is Sales Tax On A Car In Nc

North Carolina assesses a 3 percent sales tax on all vehicle purchases, according to CarsDirect. This sales tax is known as the Highway Use Tax, and it funds the improvement and maintenance of state roads. Funds collected from this tax also go into the states General Fund and the North Carolina Highway Trust Fund.

Also Check: How Will My Tax Refund Appear On My Bank Statement

Failure To Collect North Carolina Sales Tax

If you meet the criteria for collecting sales tax and choose not to, youll be held responsible for the tax due, plus applicable penalties and interest.

Its extremely important to set up tax collection at the point of sale its near impossible to collect sales tax from customers after a transaction is complete.

When You Need To Collect North Carolina Sales Tax

In North Carolina, sales tax is levied on the sale of tangible goods and some services. The tax is collected by the seller and remitted to state tax authorities. The seller acts as a de facto collector.

To help you determine whether you need to collect sales tax in North Carolina, start by answering these three questions:

If the answer to all three questions is yes, youre required to register with the state tax authority, collect the correct amount of sales tax per sale, file returns, and remit to the state.

Recommended Reading: When Will I Get My Unemployment Tax Break Refund

North Carolina Administrative Court

If you cannot resolve the case within the agency or missed your deadlines, you still have one last shot to fight your North Carolina sales tax assessment by going to the North Carolina State Office of Administrative Hearings . Although we generally dont recommend it, you always have the option to skip the agency protest process and file in administrative court. That said, because neither party wants to spend the time and resources on the uncertainty of administrative court, continuing to challenge the assessment is often an effective way to maximize your settlement potential.

If your case is filed in administrative court, and the case proceeds to hearing, it is heard and decided by a neutral administrative law judge. Our team has handled hundreds of administrative court cases and can help your company receive the resolution it is entitled to. It is very similar to a court hearing and having an experienced representative is imperative.

Sales Tax On Tangible Personal Property Sales

The University must comply with North Carolina General Statute 105-164.4 to collect sales taxes on sales of tangible personal property currently at 7%.

Examples of tangible personal property sales include the following:

- Sales of prepared food and drinks

- Sales of prepaid meal plans to students, faculty and staff

- Sales of merchandise such as clothing, pictures, books, etc.

- Sales of over the counter drugs

Also Check: Where Does Aarp Do Taxes For Free

Exemption For Eligible Internet Data Center

Purchases of electricity for use at an eligible internet data center and eligible business property to be located and used at such a facility is exempt from sales tax.

An eligible internet data center is defined as a data center that satisfies each of the following conditions:

- The Secretary of Commerce must have made a written determination that at least $250 million in private funds has been or will be invested in real property and/or eligible business property at the facility. The investment must take place within five years of the commencement of construction of the facility.

- The facility is used primarily by a business engaged in software publishing included in industry 511210 of the North American Industry Classification System or an internet activity included in NAICS industry 519130.

- The facility is located in a Tier 1 or Tier 2 county.

- The facility comprises a structure or series of structures located or to be located on a single parcel of land or contiguous parcels of land that are commonly owned or owned by affiliation with the operator of that facility.

Is The North Carolina Sales Tax Destination

North Carolina is a destination-based sales tax state, which meansthat sales tax rates are determined by the location of the buyer when the transaction is completed. This means that, for orders placed via the internet/mail by a customer within North Carolina from a North Carolina vendor, the vendor must collect a sales tax rate applicable at the buyer’s address . This can significantly increase the complication of filing your sales tax return, because different sales tax rates must be charged to different buyers based on their location.

You May Like: Will I Get Any Money Back From My Taxes

What Is The Sales Tax Rate In North Carolina

The total North Carolina sales tax rate consists of the general and local rates. To calculate how much sales tax in North Carolina you should collect, you must know the local sales tax rate of the sales location.

The base sales tax rate in North Carolina is 4.75 %. Local sales tax rates that include city and county rates range from 0 to 2.75 %. Therefore, the maximum sales tax percentage you could charge is 7.5 %.

If you have additional questions about sales tax rates North Carolina, please use our Sales Tax Calculator or contact our team.

Sales Tax Exemptions In North Carolina

In North Carolina, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers.

Several examples of exemptions to the state sales tax are prescription medications, some types of groceries, some medical devices, and machinery and chemicals which are used in research and development.

Many states have special, lowered sales tax rates for certain types of staple goods – such as groceries, clothing and medicines. Restaurant meals may also have a special sales tax rate. Here are the special category rates for North Carolina:

Clothing

OTC Drugs

These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items. Groceries are generally defined as “unprepared food”, while pre-prepared food may be subject to the restaurant food tax rate.

Candy and soda may be included or excluded from any preferential tax rate depending on whether or not the state considers them to be a “grocery”:

is NOT considered a groceryis NOT considered a grocery

Recommended Reading: How To Pay Unemployment Tax

Are Shipping & Handling Subject To Sales Tax In North Carolina

In the state of North Carolina, the laws regarding tax on shipping and handling costs are relatively simple. Essentially, the vast majority of items shipped in North Carolina have shipping costs which are taxed. If both exempt and non-taxable items are being shipped together, the percentage of the shipping charge that relates to the taxable items must be taxed.

General Sales And Use Tax

The general State and applicable local and transit rates of sales and use tax apply to the sales price of each article of tangible personal property that is not subject to tax under another subdivision in N.C. Gen. Stat. § 105-164.4. Tangible personal property is defined in N.C. Gen. Stat. § 105-164.3 as “personal property that may be seen, weighed, measured, felt, or touched or is in any manner perceptible to the senses. The term includes electricity, water, gas, steam, and prewritten computer software.” The general sourcing principles are set forth in N.C. Gen. Stat. § 105-164.4B.

In instances where the correct amount of sales tax has not been paid on taxable tangible personal property, use tax is due.

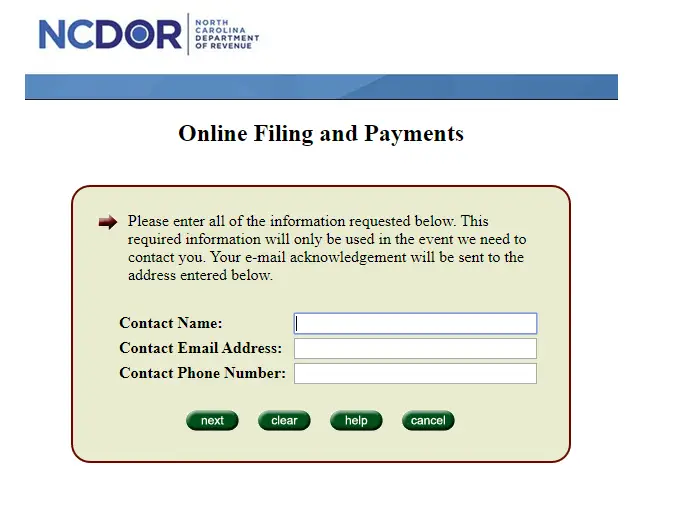

Gross receipts derived from the sale of tangible personal property and the sales and use tax thereon are to be reported to the Department on Form E-500, Sales and Use Tax Return, or through the Departments online filing and payment system.

For additional information, refer to the main web page for sales and use tax.

You May Like: How Much Taxes Do I Have To Pay For Unemployment