Do I Have To Pay New York State Income Tax

Generally, you have to file a New York state tax return if:

-

Youre a New York resident and youre required to file a federal tax return or your federal gross income plus New York additions was more than $4,000 .

-

Youre not a New York resident but got income from a source in New York during the tax year.

If youre not a resident of New York but your primary workplace is there, your days telecommuting during the pandemic are still considered days worked in New York unless your employer established an office at your telecommuting location. Generally, you will continue to owe New York State income tax on income earned while telecommuting.

» MORE:See what federal tax bracket youre in

Nys Unemployment Tax Rate Lookup

The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020. Log into your NYGov ID account click Unemploment Services and select ViewPrint 1099-G to view the form.

Coronavirus Covid 19 Resources For Long Island Businesses Listnet

New York Temporarily Suspends Hotel Occupancy Tax

New York City Mayor Bill de Blasio has issued an executive order suspending the 5.875% hotel occupancy tax imposed by NYC Administrative Code Section 11-2502 from June 1, 2021 through August 31, 2021. The daily hotel room tax under NYC Administrative Code § 11-2502 remains in effect. For additional information, please see the executive order released on May 18, 2021.

May 13, 2021

You May Like: Prontotaxclass

How Much Is The Car Sales Tax In New York

When buying a car in New York, you will pay a 4% sales tax rate for your new vehicle, according to Sales Tax States. This statewide tax does not include any county or city sales taxes that may also apply. Sales taxes for a city or county in New York can be as high as 4.75%, meaning you could potentially pay a total of 8.75% sales tax for a vehicle in the state.

The lowest city tax rate in New York is found in Pleasantville, which has a rate of 4%. The highest possible tax rate is found in New York City, which has a tax rate of 8.88%. The average total car sales tax paid in New York state is 7.915%. New York is one of the five states with the highest rate of local vehicle sales taxes.

S In Using Earthodyssey Sales Tax Calculator For New York

EarthOdyssey is a great resource for calculating the vehicle sales tax in New York. Use the following steps when inputting your information into EarthOdyssey:

Don’t Miss: Michigan.gov/collectionseservice

What Is Fdm Tax Based On

For S-corporations, the FDM tax is based on the corporation’s New York State receipts and is as follows:

- $25 Receipts not exceeding $100,000

- $50 Receipts exceeding $100,000 but not more than $250,000

- $175 Receipts exceeding $250,000 but not more than $500,000

- $300 Receipts exceeding $500,000 but not more than $1,000,000

- $1,000 Receipts exceeding $1,000,000 but not more than $5,000,000

- $3,000 – Receipts exceeding $5,000,000 but not more than $25,000,000

- $4,500 – Receipts exceeding $25,000,000

Total Estimated 2020 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Don’t Miss: What Does Locality Mean On Taxes

Additional Ny Payroll Tax Resources:

Our calculator can help you do most of the heavy lifting, but here are some additional resources and contact information you may need to start running payroll in New York:

New York Department of Taxation & Finance : 485-6654 | Register for Withholding Taxes

New York Department of Labor : 457-9000 | Register for NY Unemployment Taxes

You can also learn more about city taxes and determine the appropriate withholding rates for your employees here:

What Is The History Of The New York City Real Property Transfer Tax

New York City has collected the RPTT since 1959.

The city raises approximately $1-2 billion annually from the transfer tax alone. According to the citys tax revenue forecasting documentation, the RPTT accounted for 2.2% of the citys overall tax revenue in 2012.

Here is a brief timeline of the history of New Yorks Real Property Transfer Tax:

-

1959 RPTT enacted with a tax rate of 0.5% of the sale price

-

1968 NYS enacts its own transfer tax of 0.4% on residential and commercial property

-

1971 RPTT tax rate raised from 0.5% to 1.0%

-

1982 RPTT tax rate raised from 1% to 2% for commercial transfers on/above $500k

-

1989 NYS imposes a Mansion Tax of 1% on the sale of residential real property valued above $1 million

-

1989 NYC raises the RPTT tax rates and expands the tax base to include the sale of residential co-operative apartments

-

1997 NYC enacts a RPTT reduction for the amount of any mortgage assumed by the transferee

-

2019 NYS updates the Mansion Tax to a progressive system with 8 individual tax brackets ranging from 1% on sales above $1m and below $2m and 3.9% on sales of $25 million or more. NYS also increases the NYS Transfer Tax from .04% to 0.65% on residential sales of $3 million or more and commercial sales of $2 million or more.

Pro Tip: Estimate your seller flip tax with Hauseits Interactive Co-op Flip Tax Calculator.

Recommended Reading: Turbo Tax 1099q

How You Can Affect Your New York Paycheck

If you find yourself always paying a big tax bill in April, take a look at your W-4. One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. For example, you can have an extra $25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. This paycheck calculator will help you determine how much your additional withholding should be.

Another way to manipulate the size of your paycheck – and save on taxes in the process – is to increase your contributions to employer-sponsored retirement accounts like a 401 or 403. The money you put into these accounts is taken out of your paycheck prior to its taxation. By putting money away for retirement, you are actually lowering your current taxable income, which can help you save in taxes right now. Another option is to put money in a spending account like a health savings account or a flexible spending account if your employer offers them. The money you put in these accounts is also taken from your paycheck before taxes, and you can use those pre-tax dollars to pay for medical-related expenses like copays or certain prescriptions. Just keep in mind that only $500 in an FSA will roll over from year to year. If you contribute more than that and then dont use it, you’re out of luck.

What Is The Nyc Real Property Transfer Tax

The NYC Real Property Transfer Tax is a seller closing cost of 1.4% to 2.075% which applies to the sale of real property valued above $25,000 in New York City. Although its commonly referred to by brokers, buyers and sellers simply as the NYC Real Property Transfer Tax, this jargon technically includes two separate Transfer Taxes: a NYS Transfer Tax and a NYC Transfer Tax.

There are three specific NYC & NYS Transfer Tax rates for residential property which are as follows:

-

1.4%: sales below $500k

You May Like: Otter Tail County Tax Forfeited Land

Nyc Releases Changes For Business Tax Filers

The New York City Department of Finance has released a new issue of its Business Tax Practitioner Newsletter, which discusses the Tax Cuts and Jobs Act as it relates to changes for business tax filers including reporting IRC § 965 income, foreign-derived intangible income , and global intangible low-taxed income . In addition, the newly amended Real Property Income and Expense rules were discussed with respect to the increased penalties for owners of income-producing property who fail to file RPIE statements for three consecutive years. The penalty is increased to 5% of the final actual assessed value for the calendar year in which such statement was to be filed.

What Is Tax Abatement In Nyc

A tax abatement is a tax break on property or business taxes. In NYC, owners of co-ops and condos who meet certain requirements can qualify to have their property taxes reduced. The requirements include using the co-op or condo as a primary residence, not owning more than three residential units in any one development , and not being part of the Urban Development Action Area Program.

Recommended Reading: Where’s My Tax Refund Ga

New York Does Tax Unemployment Income Excluded Under The Federal American Rescue Plan Act

The New York Department of Taxation and Finance has issued a bulletin explaining the states treatment of the federal American Rescue Plan Act of 2021s $10,200 unemployment compensation exclusion. Because New York decoupled its personal income tax laws from any changes to the Internal Revenue Code as of March 1, 2020, the State does not permit this exclusion for purposes of New York income tax. Therefore, taxpayers must add back this unemployment compensation on their New York income tax return, which is excludable for federal income tax purposes. Taxpayers that have already filed their 2020 personal income tax returns and did not add back the excluded income must file an amended New York State tax return by using IT-558 Form, New York State Adjustments due to Decoupling from the IRC.

How Do Nonresident Shareholders Pay Taxes

If you are a nonresident shareholder or a part-year resident shareholder, you will only pay tax on the S corporation’s items that are derived from New York sources. This determination will be made at the corporate level. There is a special form to be filed with the IRS to elect S status however, New York does not recognize the federal S election unless a New York election form is filed as well.

Don’t Miss: Www.1040paytax.com

New York Sales Tax Rates By City

The state sales tax rate in New York is 4.000%. With local taxes, the total sales tax rate is between 4.000% and 8.875%.

New York has recent rate changes .

Select the New York city from the list of popular cities below to see its current sales tax rate.

Sales tax data for New York was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

How Your New York Paycheck Works

When you start a job in the Empire State, you have to fill out a Form W-4. Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck.

The 2020 W-4 includes notable revisions. The biggest change is that you won’t be able to claim allowances anymore. Instead, you’ll need to input annual dollar amounts for additional income and things like non-wage income, total annual taxable wages, income tax credits and itemized and other deductions. The form also utilizes a five-step process that asks you to enter personal information, claim dependents and indicate any extra income or jobs.

All employees hired as of Jan. 1, 2020 must complete the form. If you were hired before then, you don’t need to worry about filing a new W-4 unless you plan on changing your withholdings or getting a new job.

Also Check: How Does H And R Block Charge

New York State Extends Income Tax Filing Deadline

New York states income tax filing deadline is being moved to July 15 to comply with the federal governments decision to push back the traditional filing date due to the coronavirus outbreak.

Disclaimer: Please note this is the information that is readily available at this time, it is subject to change so please consult your Withum tax advisor.

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

You May Like: How Much Time To File Taxes

More Help With Taxes In New York

So, get help with H& R Block Virtual! With this service, well match you with a tax pro with New York tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your NY taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find New York state tax expertise with all of our ways to file taxes.

Related Topics

Do you own real property in Louisiana ? Get your Louisiana property tax questions answered with help from the experts at H& R Block.

New York Holds Purchase And Lease Of Picasso Painting Was Not A Sale For Resale

An LLC taxpayerowned by two family trustspurchased a one-half interest in a Picasso painting. The other 50-percent purchaser was the father of the two sons in whose name the trusts were established. Sales tax was paid on the transaction by both purchasers. A few years latersubsequent to a lease of the painting structured between the LLC and the fatherthe LLC sought a refund for the sales tax it paid on its original purchase of the painting on the grounds the purchase was a sale for resale. Retroactively going back and using the lease as a basis for sale for resale argument was not successful. New York reasoned that in order to be a sale for resale, the taxpayer would have needed to show its sole purpose for purchasing the painting was to lease it. Here, however, the additional purpose for purchasing the painting was because it was an investment and added to the taxpayers art collection.

May 2, 2020

Also Check: How Much Does H& r Block Charge For Doing Taxes

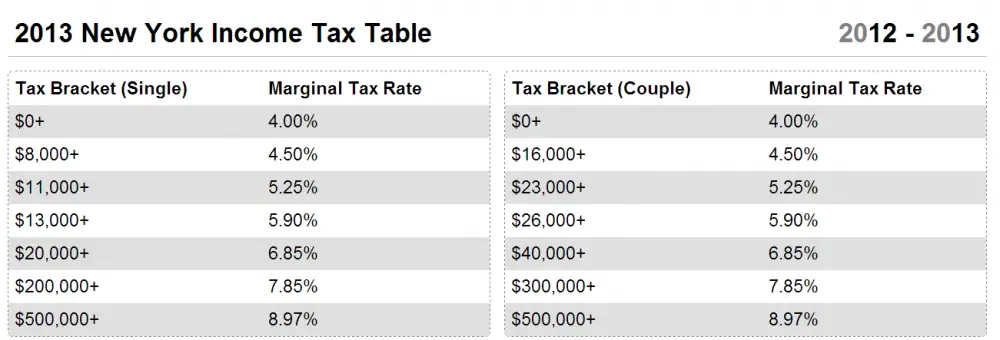

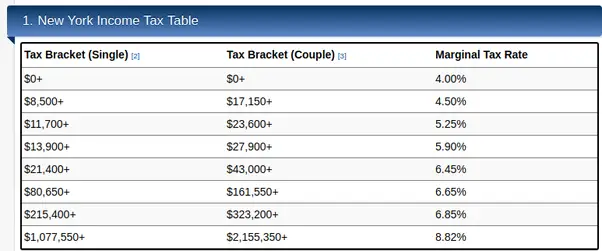

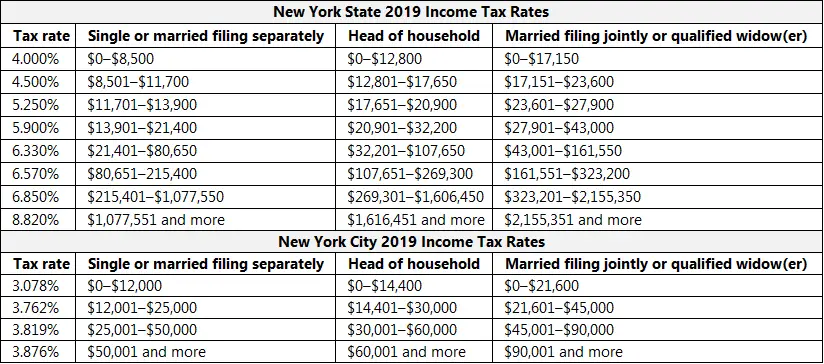

How Do New York Tax Brackets Work

Technically, you don’t have just one “tax bracket” – you pay all of the New York marginal tax rates from the lowest tax bracket to the tax bracket in which you earned your last dollar. For comparison purposes, however, your New York tax bracket is the tax bracket in which your last earned dollar in any given tax period falls.

You can think of the bracketed income tax as a flat amount for all of the money you earned up to your highest tax bracket, plus a marginal percentage of any amount you earned over that. The chart below breaks down the New York tax brackets using this model:

| For earnings between $0.00 and $8,500.00, you’ll pay 4% |

| For earnings between $8,500.00 and $11,700.00, you’ll pay 4.5%plus $340.00 |

| For earnings between $11,700.00 and $13,900.00, you’ll pay 5.25%plus $484.00 |

| For earnings between $13,900.00 and $21,400.00, you’ll pay 5.9%plus $599.50 |

| For earnings between $21,400.00 and $80,650.00, you’ll pay 6.21%plus $1,042.00 |

| For earnings between $80,650.00 and $215,400.00, you’ll pay 6.49%plus $4,721.43 |

| For earnings between $215,400.00 and $1,077,550.00, you’ll pay 6.85%plus $13,466.70 |

| For earnings over $1,077,550.00, you’ll pay 8.82% plus $72,523.98 |