Sales Tax Exemptions In Ohio

In Ohio, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers.

Sales tax exemption in the state applies to certain types of food, some building materials, and prescription drugs.

Many states have special, lowered sales tax rates for certain types of staple goods – such as groceries, clothing and medicines. Restaurant meals may also have a special sales tax rate. Here are the special category rates for Ohio:

Clothing

OTC Drugs

These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items. Groceries are generally defined as “unprepared food”, while pre-prepared food may be subject to the restaurant food tax rate.

Candy and soda may be included or excluded from any preferential tax rate depending on whether or not the state considers them to be a “grocery”:

IS considered a groceryis NOT considered a grocery

Sales And Use Tax For Retail Sales And Services

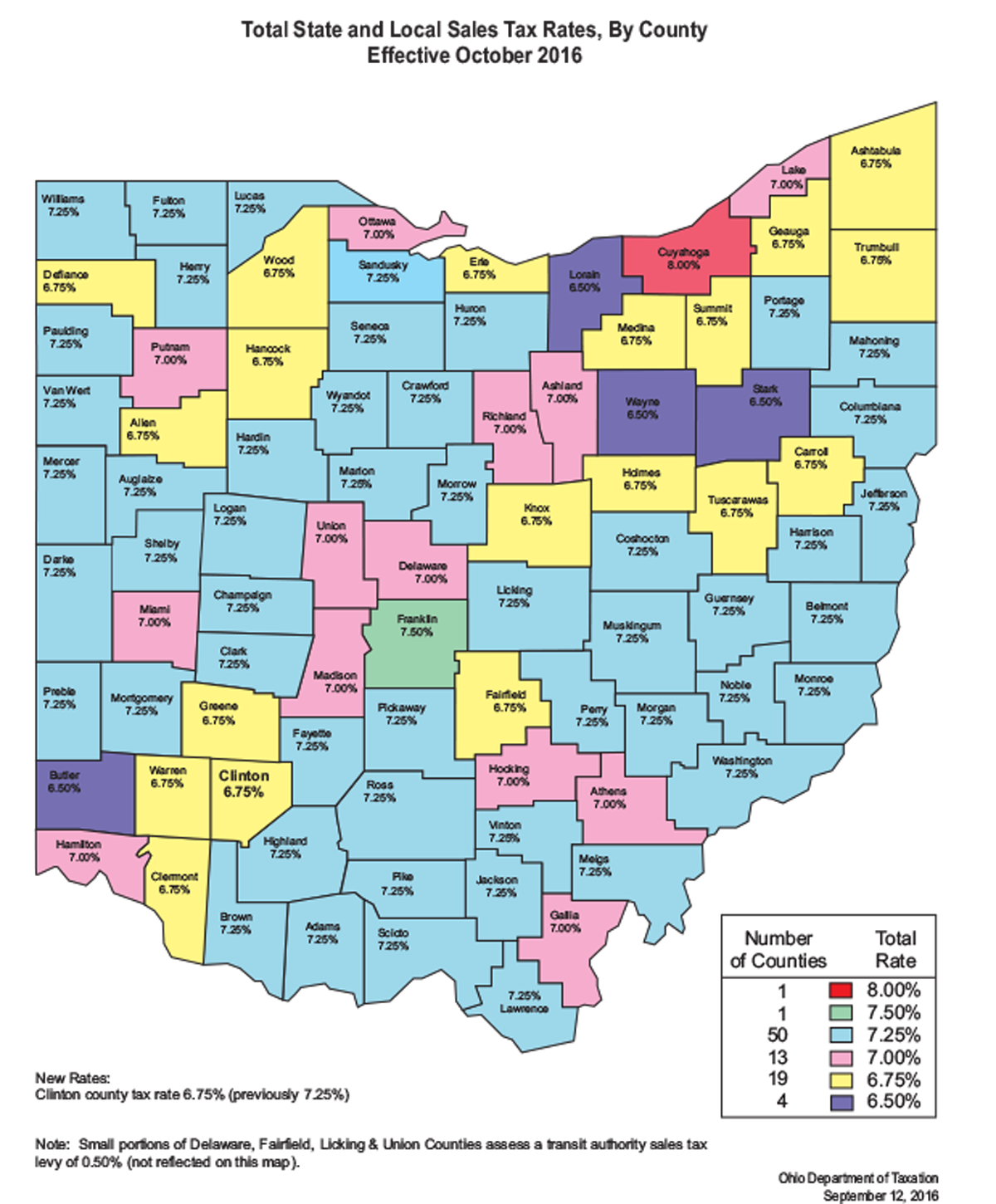

Businesses collect the state sales tax rate of 5.75 percent, plus the additional sales and use tax rate if any, that their counties charge. For example, a business located in Adams County pays the state tax rate of 5.75 percent, plus the countys tax rate of 1.50 percent.

Any business owner who purchases taxable tangible personal property without paying the tax and uses or stores the property instead of reselling it must pay the use tax on the purchase. The use tax rate is the same as the sales tax rate.

Misplacing A Sales Tax Exemption/resale Certificate

Ohio sales tax exemption and resale certificates are worth far more than the paper theyre written on. If youre audited and cannot validate an exempt transaction, the Ohio Department of Taxation may hold you responsible for the uncollected sales tax. In some cases, late fees and interest will be applied and can result in large, unexpected bills.

Also Check: How To File Taxes Separately While Married

How To Collect Sales Tax In Ohio

Now itâs time to tackle the intricate stuff! Tax rates can vary based on the location of your business and the location of your customer, plus the levels of sales tax that apply in those specific locations.

The state-wide sales tax in Ohio is 5.75%.

There are additional levels of sales tax at local jurisdictions, too.

Ohio has an origin-based sales tax system, which keeps it simple for you. If youâre a local business, then you must charge the tax rate according to your location in Ohio. So that would be the state-wide 5.75%, plus any local taxes if necessary.

If you have more than one location in Ohio, then charge the sales tax rate of where the sale occurred.

If youâre not based in Ohio but have nexus in the state, you may charge only the 5.75% use tax rate. * Use tax is similar to sales tax, but charged only by âremote sellersâ â businesses like you, who arenât based in a state but have nexus there.

* Important to note for remote sellers: This is not always true. While some states allow out-of-state retailers to charge a flat use tax rate, other states have peculiar rules for remote sellers. Contact the stateâs Department of Revenue to be sure.

Are Shipping & Handling Subject To Sales Tax In Ohio

Ohio usually considers shipping charge as part of the piece of item and is therefore taxable. Therefore if you are a seller you should consider charging sales tax on the price of every item. In the case where the item you are shipping is not taxable then you shouldnâââ‰â¢t charge sales tax on the shipping price of the item. If you have a combination of both taxed and untaxed items then you should charge taxes on goods that are tax related.

Read Also: How Do You Get Your Tax Return

Wise Is The Cheaper Faster Way To Send Money Abroad

Exporting or importing goods from abroad to sell in the US? Want to pay your sales tax via direct debit?

With Wise for Business, you can get a better deal for paying supplier invoices and buying goods overseas. Well always give you the same rate you see on Google, combined with our low, upfront fee so youll never have to worry about getting an unfair exchange rate.

That means you spend less on currency conversion, and have more to invest in growing your business.

Set up recurring direct debits from your Wise account, where payments will be automatically taken out on schedule. So it’s not only money you’ll be saving with Wise, but time as well.

What Are The Tax And Title Fees In Ohio

Ohio collects a 5.75% state sales tax rate on the purchase of all vehicles. There are also county taxes that can be as high as 2%. Some dealerships may also charge a 199 dollar documentary service fee. In addition to taxes, car purchases in Ohio may be subject to other fees like registration, title, and plate fees.

You May Like: How Long Are Taxes Taking To Get Back 2021

Lump Sum Retirement Credit

If you claim this credit, you canât claim the retirement income credit on this yearâs return or any future return. If you received a total, lump sum distribution on account of retirement, and your modified adjusted gross income, less exemption, is less than $100,000 you can claim this credit. The lump sum retirement credit can only be claimed once per lifetime.

Car Sales Tax For Trade

In Ohio, sales tax is not applied to the value of a trade-in. In other words, when calculating sales tax, be sure to subtract any trade-in amount from the purchase price before multiplying it by the tax rate.

For example, lets say that you agree to purchase a new SUV for $35,000 and you trade in your old SUV for $10,000. This would bring the total purchase price of your new SUV to $25,000, which is the taxable amount.

Don’t Miss: When Is Tax Day 2021 In Texas

How To Register For A Seller’s Permit

You can register for a Ohio sellers permit online through the Ohio Department of Taxation. To apply, youll need to provide the department with certain information about your business, including but not limited to:

- Business name, address, and contact information

- Federal EIN number

- Date business activities began or will begin

- Projected monthly sales

- Products to be sold

Do You Have Nexus In Ohio

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in Ohio.

You probably have nexus in Ohio if any of the following points describe your business:

- A physical presence in Ohio: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- Online ads or links on an Ohio-based website, which channels potential customers and new business.

- A significant amount of sales in Ohio within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in Ohio is $100,000 in annual sales or 200 separate sales transactions, whichever your business reaches first. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

Also Check: How To Pay Estimated Taxes

Do I Have To Pay Income Tax In Ohio

Youâre required to file an Ohio tax return if you receive income from an Ohio source, and you fall into one of the following categories:

- Resident: Your abode is in Ohio. Youâre considered a resident even if you take temporary absences from your home in Ohio, no matter how long the absences are.

- Part-year resident: You lived in Ohio for part of the tax year. Part-year residents are entitled to the nonresident credit for any income earned while they were a resident of another state. Theyâre also eligible for the resident credit on any non-Ohio income earned while living in Ohio, as long as they paid tax on it in another state.

- Nonresident: Youâre a resident of another state for the entire tax year. If you earned Ohio-sourced income, you will have to file an Ohio state tax return, but youâll be eligible to claim the nonresident credit to all income earned outside of Ohio to avoid being taxed twice. If you live in Indiana, Kentucky, Michigan, Pennsylvania or West Virginia, you donât need to file an Ohio state tax return if your only Ohio-sourced income is wages.

Sales Tax On Shipping Charges In Ohio

Ohio does apply sales tax to shipping costs. The rule of thumb is that if what youâre selling is subject to tax, then the shipping charges are also subject to tax.

If you happen to be shipping products that are both taxable and nontaxable, then shipping charges for the entire shipment are subject to tax.

Read Also: What Time Is The Deadline To File Taxes

Repeal Of Sales Tax On Employment Services And Employment Placement Services

According to existing law, the definition of a taxable sale includes both an employment service and an employment placement service.

An employment service” means providing or supplying personnel, on a temporary or long-term basis, to perform work or labor under the supervision or control of another, when the personnel so provided or supplied receive their wages, salary, or other compensation from the provider or supplier of the employment service or from a third party that provided or supplied the personnel to the provider or supplier.

An employment placement service means locating or finding employment for a person or finding or locating an employee to fill an available position.

H.B. 110 removes employment service and employment placement service from the definition of a taxable sale, effectively repealing the tax on such services.

The change is applicable on the first day following the first month beginning after the effective date of the change. The legislative website indicates the general effective date is September 30, 2021, which would suggest the employment service and employment placement service exclusions are applicable starting October 1, 2021.

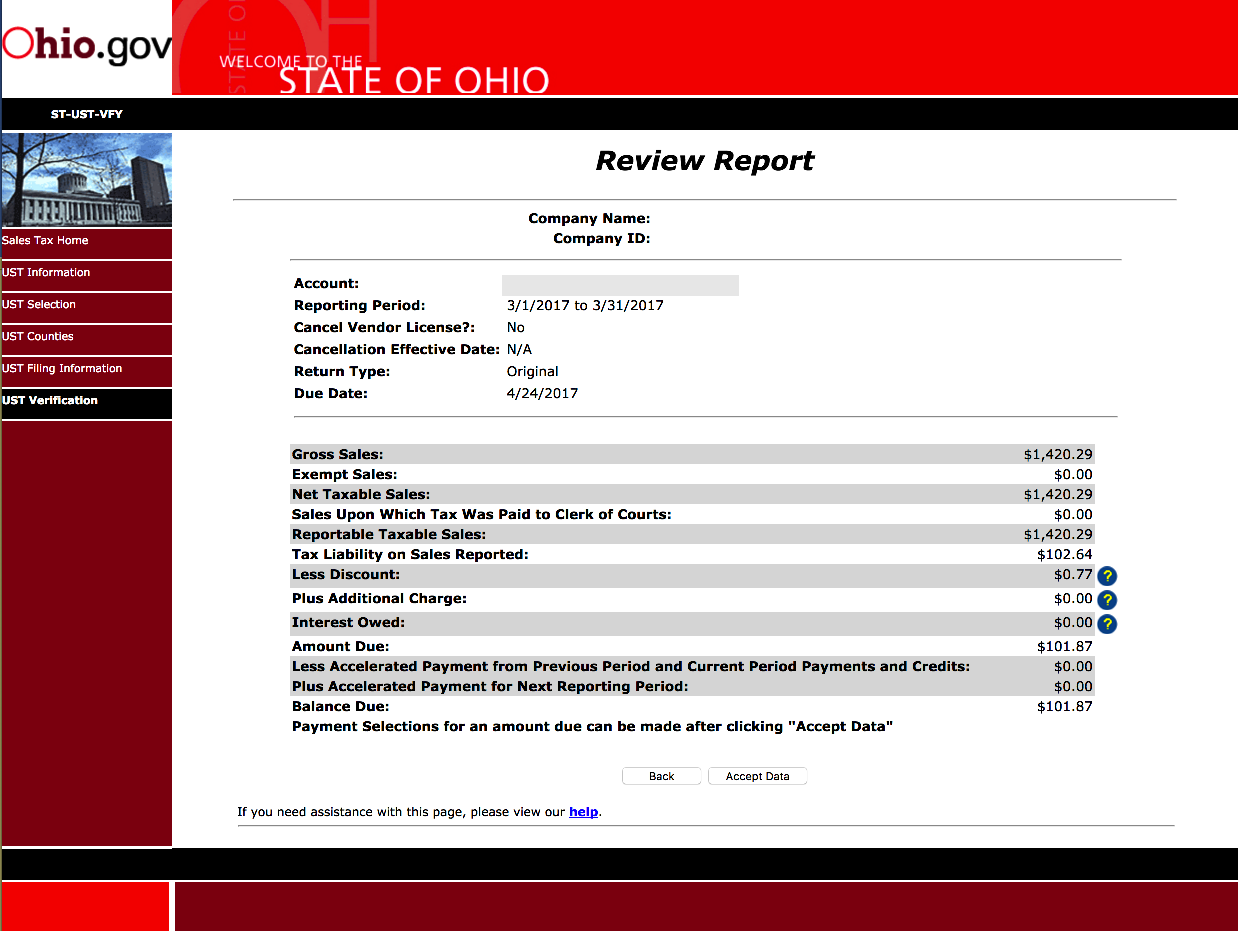

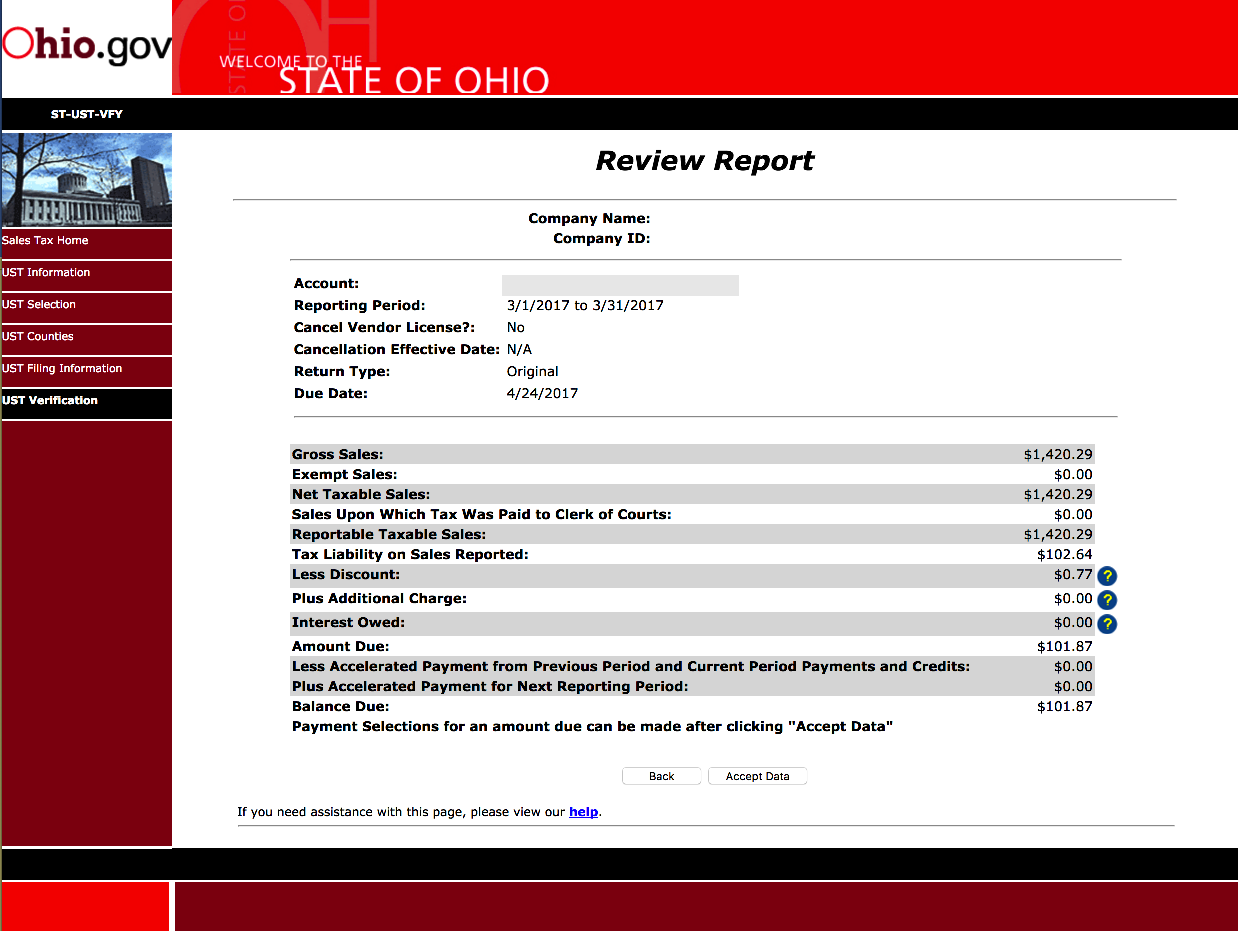

How To Fill Out And Sign A Form Online

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Finding a legal professional, making a scheduled visit and going to the business office for a private conference makes doing a Printable Ohio Sales Tax Chart from start to finish tiring. US Legal Forms allows you to quickly create legally binding papers according to pre-created online templates.

Execute your docs in minutes using our easy step-by-step guideline:

Swiftly produce a Printable Ohio Sales Tax Chart without needing to involve specialists. We already have over 3 million users benefiting from our unique collection of legal documents. Join us right now and get access to the #1 catalogue of browser-based samples. Try it out yourself!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Don’t Miss: How Can I Get Money Back On Taxes

Ohio Counties Coshocton Mahoning Lucas And The City Of Rossford To Increase Sales And Use Rates

Effective April 1, 2022, the following jurisdictions in Ohio will increase their sales and use tax rates:

- Coshocton County 7.75% from 7.25%

- Mahoning County 7.50% from 7.25%

- Lucas County and City of Rossford are part of The Toledo Area Regional Transit Authority which enacted 0.50% sales and use tax. The rate in Rossford, Wood County will be 7.25% an increase from 6.75%. The rate in Lucas County increases to 7.75% from 7.25%.

Taxpayers should ensure that the rate changes are accurately reflected in their systems so that customers are charged the appropriate sales tax rate. This may include retailers updating cash registers and point-of-sale software and systems. It is a good practice to review sales on the effective date of the rate change to confirm systems are properly calculating the tax. In addition, businesses need to update their use tax rates in order to capture the rate increases when self-assessing use tax in these jurisdictions. Use tax rates are typically updated in a firms accounting software or ERP system.

Additional Ohio sales and use tax rate information can be found here.

I am happy to answer further questions regarding how this increase may affect you or your business. Please contact HBKs SALT Advisory group at .

Economic Nexus In Ohio

Ohio has also adopted an “Economic Presence Standard” requiring out-of-state sellers who make significant sales in Ohio to collect and remit sales tax. Within the previous calendar year, if your small business has gross receipts in Ohio of $100,000 or more, or if you make 200 or more sales in Ohio, you must register for sales tax compliance collection.M/p>

Don’t Miss: How To File Taxes With No Income For Stimulus Check

Ohio Sales Tax Nexus Regulations

Of course, you dont have to worry about Ohio state sales tax at all unless you have a significant presence or nexus there. For the purposes of assessing sales tax responsibility, Ohio considers a seller to have a nexus if they:

- Have a physical place of business in the state, whether operated directly by the seller or by an affiliated group.

- Are represented by agents, employees, technicians, or any other individual who conducts their business within the state.

- Maintain a presence in the state in the form of an employee or agent who receives or processes orders.

- Make deliveries into the state that are not through a common carrier.

- Are the owner of tangible personal property that is rented or leased by a customer in Ohio.

- Own, maintain, leases, rents, or has the right to use property located within Ohio.

- Are registered to make sales to customers in the state with the appropriate state agency.

As in many states, this combination of regulations comes to mean that if you store your goods in a warehouse in the state, you must collect and remit sales tax from your Ohio customers. For anyone using fulfillment through Amazon, this will apply in Ohio due to the presence of two fulfillment centers in the state.

Ohio’s Sales Tax By The Numbers:

Ohio has ahigher-than-average sales tax, includingwhen local sales taxes from Ohio’s 576 local tax jurisdictions are taken into account.

Rankings by Average State + Local Sales Tax:

Ranked 20th highest by combined state + local sales tax

Ranked 29th highest by per capita revenue from state + local sales taxes

Rankings by State Sales Tax Only:

Ranked 9th highest by state sales tax rate

Ranked 28th highest by per capita revenue from the statewide sales tax

Ohio has a statewide sales tax rate of 5.75%, which has been in place since 1934.

Municipal governments in Ohio are also allowed to collect a local-option sales tax that ranges from 0% to 2.25% across the state, with an average local tax of 1.504% .The maximum local tax rate allowed by Ohio law is 2.25%.You can lookup Ohio city and county sales tax rates here.

This page provides an overview of the sales tax rates and laws in Ohio. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Ohio Sales Tax Handbook’s Table of Contents above.

Also Check: How Much Tax Will I Pay On 15000 Self Employed

Ohio Sales Tax Compliance Services

Agiles experienced sales tax consultants can help by completing your companys ongoing compliance filings in the state of Ohio. In fact, weve offered an outsourcing solution for this process since 2005. You can learn more about our outsourcedsales tax complianceservices or simply give us a call at 350-4829. We are interested to learn more about your needs, and you might be surprised how little it will cost to have a sales tax expert take this responsibility off your hands!

What Transactions Are Generally Subject To Sales Tax In Ohio

In the state of Ohio, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer, with the exception of certain building materials, prescription drugs and groceries.This means that an individual in the state of Ohio who sells school supplies and books would be required to charge sales tax, but an individual who owns a store which sells groceries is not required to charge sales tax on all of its products.

Recommended Reading: How Far Back Do I Have To File Taxes

Ohio Sales Tax Compliance

When it comes to tax laws, Ohio is one of the more painless states to understand, since they have little variation between rates. Ohio sales tax compliance has a state-level sales tax rate of 5.75%, and the state does not offer reduced rates. Businesses have two options: they will either be exempt from taxes, or they will collect and remit a 5.75% sales tax rate on all sales along with local jurisdiction rate, which we will explain later. Pretty straight-forward!