What Happens If My Family Size Or Income Changes During The Year

Life-changing events can impact your tax credit eligibility by either increasing or decreasing the amount that you are allowed to claim. Events that can affect your premium tax credits may include:

- Change in your household income

- Adoption

- Gaining or losing health insurance coverage

Since the marketplace determines your tax credit, it is important to report changes immediately so your health plan eligibility can be updated. And if you’re currently using the advance premium tax credit, then it is particularly important to report any life changes to the marketplace as soon as possible.

If you wait to report such changes, there may be discrepancies between what you paid and what you should pay. In this case, if you used more advance premium tax credits than you are allowed, you may have to pay back money when filing your federal income tax return. On the other hand, if you used less than allowed, you may get an added refund. This is known as “reconciling” your advance premium tax credits.

Who Qualifies For The Aptc

People who buy health insurance through Healthcare.gov or their state insurance marketplace can qualify for the advance premium tax credit based on their income.

You aren’t eligible for the credit if you can be claimed as a dependent on another person’s tax return or if you use the married filing separately filing status. You also can’t receive this credit if you get health insurance in another way, such as Medicare or through your job.

How Do I Access The Premium Tax Credits

To receive your premium tax credit, you must purchase health insurance through the federal marketplace, healthcare.gov, or your state’s marketplace.

Most states have a website where you can view and compare policies, enroll in a plan, and receive the premium tax credit. A licensed health insurance broker is a great resource for help selecting a health plan. Look up your state marketplace here.

Recommended Reading: Www.1040paytax

What Is Excess Advance Premium Tax Credit

The size of the advance premium tax credit is based on the household income estimate you provided when you applied for health insurance at Healthcare.gov or your state marketplace. So, you may find that you received excess advance payments.

You need to reconcile that amount with your actual income for the year and file Form 8962 with the IRS when you file your income tax return. If your actual income is higher than your estimate, you received a larger advance premium tax credit than was needed.

You usually need to repay the extra tax credit when you file your tax return. However, the federal government suspended the requirement to repay excess payments for 2020.

Eligibility Requirements For The Premium Tax Credit

You must meet all of the following criteria to qualify for the premium tax credit:

- You must get your health care coverage through the Marketplace

- You can’t be eligible for health care coverage through alternative options such as your employer or the government

- Your income needs to fall within a certain range

- Another person can’t claim you as a dependent on their return

- You must file a joint return if you’re married

Changes in income and family size may affect your eligibility, so report these to the Marketplace to ensure you receive the appropriate tax credit. The premium tax credit program uses the federal poverty line to determine the income ranges that qualify you for the credit.

The U.S. Department of Health and Human Services reports the annual federal poverty levels, which vary depending on whether you live in the contiguous 48 states and the District of Columbia, Hawaii, or Alaska.

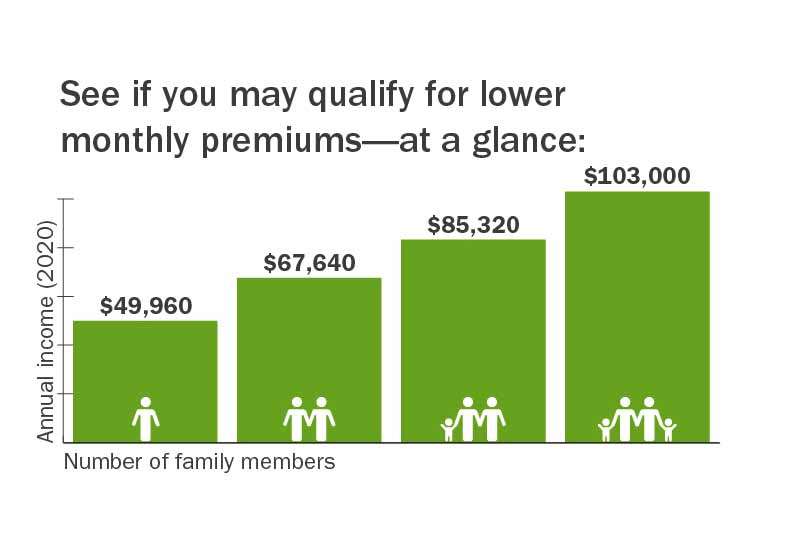

The range is 100% to 400% of the federal poverty line amount for the size of your family for the current tax year.

For example, an individual earning between $12,880 and $51,520 in 2021 meets the income criteria to qualify, while a family of four qualifies with household earnings between $26,500 and $106,000.

Even if your income makes you eligible, you must meet the other qualification criteria as well. You’ll use Form 8962 to determine your full eligibility to claim the premium tax credit.

Recommended Reading: Where Is My Federal Tax Refund Ga

Overview Of The Premium Tax Credit

Shereen Lehman, MS, is a healthcare journalist and fact checker. She has co-authored two books for the popular Dummies Series .

The health insurance premium tax credit is part of the Affordable Care Act . It’s often referred to as a premium subsidy, and it’s designed to help make health insurance premiums more affordable for middle and low-income people.

But the terms “low-income” and “middle class” are subjective. To clarify, premium tax credits are normally available for people with household incomes as high as 400% of the poverty levelthat amounted to $103,000 for a family of four in the Continental U.S. in 2020. But for 2021 and 2022, the American Rescue Plan has removed the upper income cap for subsidy eligibility, meaning that some households with income well above 400% of the poverty level can qualify for premium subsidies.

Most people who buy their coverage through the ACA’s health insurance exchanges are receiving premium subsidies. And for enrollees who receive subsidies, the subsidies cover the majority of the monthly premiums.

The premium subsidy is often referred to as “the ACA subsidy,” but there’s another ACA subsidy that applies to cost-sharing and shouldn’t be confused with the premium tax credit.

Who Can File Irs Form 8: Premium Tax Credit

You only need to complete IRS Form 8962 if you purchased health insurance through the Affordable Care Acts Health Insurance Marketplace. If youre covered by a health insurance plan at work or you purchased health insurance directly from an insurance company outside of the exchange, you dont need this form to complete your tax filing.

If you received a Form 1095-B from your insurance company or a Form 1095-C from your employer, you dont file Form 8962.

Customarily, you must fill out and file Form 8962 if:

- You paid your health insurance premiums out of pocket, and now want to claim the premium tax credit, or

- Advance premium tax credits were paid for you or a family member covered by your plan

However, for the tax year 2020, the IRS has decreed you are not required to file Form 8962 if it turns out you have excess advance premium tax credits.

If you enrolled for health insurance through the Marketplace and received a Form 1095-A, you will use it to complete Form 8962. This form, called a Health Insurance Marketplace Statement, has information about your coverage, including:

- Premiums paid

- Premium tax credits used

- Who is covered under your plan

Form 1095-A is issued to you by the Marketplace, not the IRS. If you dont get one in the mail, you should be able to view your form by logging into your Marketplace account online.

Also Check: How Can I Make Payments For My Taxes

What Is Tax Form 8962

If you purchased health insurance from the Healthcare.gov site â or your state healthcare marketplace if you live in a state that maintains one â you’ll need to use Tax Form 8962. This form has two parts you’ll need to fill out:

Form 8962 is also used to reconcile the premium tax credit you might be eligible for with any advanced premium tax credit payments youâve already received.

The first part of the form determines your annual and monthly contribution amount based on your family income and tax family size. Your tax family generally includes you and your spouse if filing a joint return and your dependents. You must include all of your family’s or household’s income.

After filling in this information and determining your applicable federal poverty level, you can figure out the amount of credit you can claim. You have two choices for how to claim it:

- A credit to reduce your monthly payments on your health insurance premiums

- A credit to reduce your taxes on your return

If you choose the monthly payments, the government pays your insurer over the course of the year, which lowers your monthly premium costs.

If you can claim the premium tax credit and your insurer received advanced payments from the government, the second part of Form 8962 compares how much credit you used and your final available credit. There are three possible scenarios:

Health Coverage Tax Credit Vs Premium Tax Credit

Health coverage tax credits also lower your health insurance costs, but they’re not related to premium tax credits. HCTCs are refundable tax credits that pay 72.5% of the qualified health insurance premiums for eligible individuals and families. You would pay the remaining portion of the premium.

Eligibility for the HCTC differs from the health care tax credit mentioned above, as those credits depend on your income and family size. If you decide to claim HCTCs, then you’ll fill out Form 8885 .

You may be eligible if you are:

- In a Trade Adjustment Assistance program because of a qualifying job loss.

- Between 55 and 64 years old and receive payments from the Pension Benefit Guaranty Corporation.

If you receive the HCTC, then you’ll receive a Form 1099-H that outlines your disbursements. You can’t claim both the health coverage tax credit and the premium tax credit for the same health insurance coverage during the same months.

Read Also: How Can I Make Payments For My Taxes

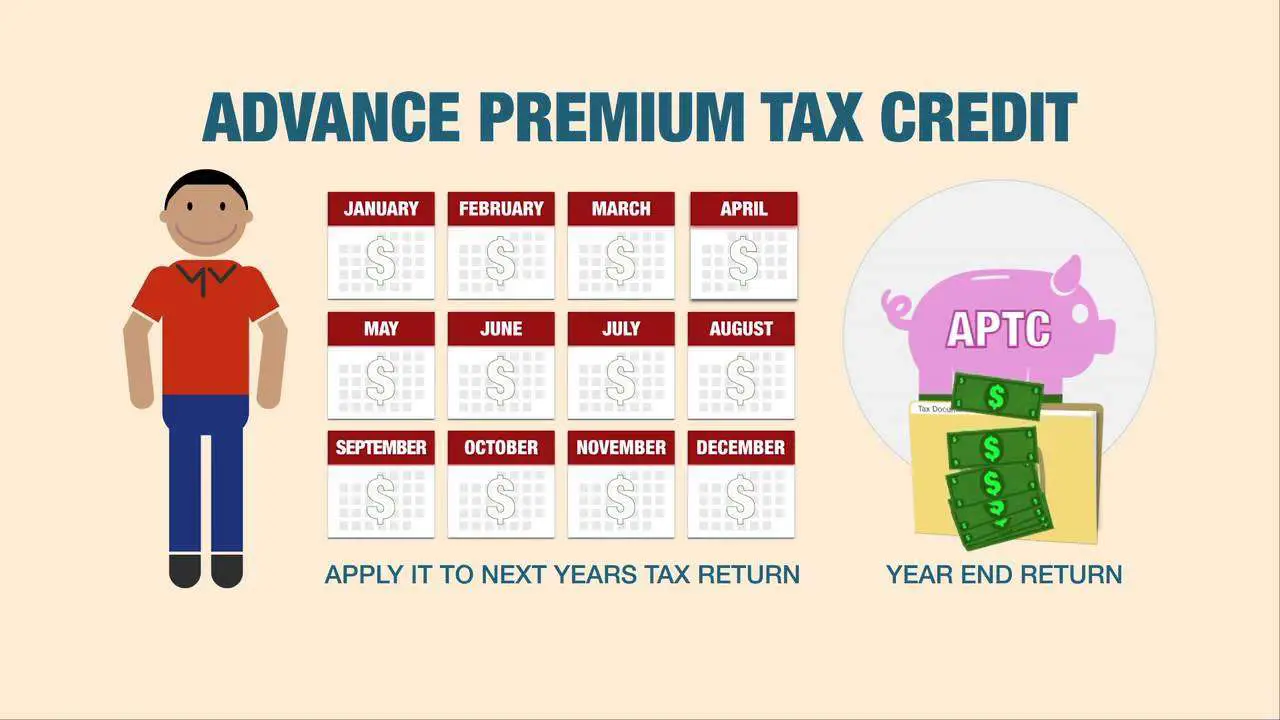

When Do You Receive Your Tax Credit

There are two ways to receive your premium tax credit. One option is to delay the benefits of your premium tax credit until tax time. When you file your tax returns, youll receive the total amount of the credit you qualify for. Since the premium tax credit is a refundable credit, you may be eligible for a tax refund at the end of the year.

You can also choose to receive advance payments of the premium tax credit during the year. The government will make payments to the insurance company every month on your behalf. This will lower your out-of-pocket costs for insurance premiums. However, youll be responsible for paying the remaining amount of the insurance bill that is not covered by the advance payments.

You May Be Allowed A Premium Tax Credit If:

- You or a tax family member enrolled in health insurance coverage through the Marketplace for at least one month of a calendar year in which he or she was not eligible for affordable coverage through an eligible employer-sponsored plan that provides minimum value or eligible to enroll in government health coverage like Medicare, Medicaid, or TRICARE.

- Your health insurance premiums for at least one of those same months are paid by the original due date of your return. They can be paid either through advance credit payments, by you, or by someone else.

- You are within certain income limits.

- You do not file a married filing separately tax return.

- There are exceptions for certain victims of domestic abuse and spousal abandonment. For more information about these exceptions, see the Premium Tax Credit questions and answers.

You are not eligible for the premium tax credit for coverage purchased outside the Marketplace. Answer the yes-or-no questions in our eligibility chart or use the Am I Eligible to Claim the Premium Tax Credit interview tool to see if you may qualify for the premium tax credit.

You May Like: Where’s My Tax Refund Ga

How Many People Receive Ptcs

- According to Kaiser Family Foundation data, in 2020 9.1 million Americans received a total of $53.7 billion in PTCs

- Thats an average subsidy of about $5,900 per enrollee

- The average subsidy significantly differed by state, with a range of as low as $3,216 per enrollee in Massachusetts to $10,968 per enrollee in Wyoming

What Is An Advance Payment Of Premium Tax Credit

The advance premium tax credit reduces health insurance payments of the premium for those with ACA marketplace plans.

When you buy health insurance on Healthcare.gov or from the 14 states that run their own insurance marketplaces, you can receive a subsidy to help reduce your premiums based on your income.

This subsidy is technically a tax credit paid in advance. The federal government can send the money directly to your health insurance company to reduce your monthly premiums rather than having people wait to receive the money when you file your income tax return.

The lower your income, the larger the tax credit — and the less you’ll pay each month.

Key Takeaways

- The federal government offers advance premium tax credits to those with plans from the health insurance marketplace.

- People who get insurance through an employer, Medicare or any other source arent eligible for the subsidies.

- The Affordable Care Act marketplace will factor in the tax credit when estimating your health insurance premiums for the coming year.

- The health insurance tax credit is based on your household income.

- The American Rescue Plan expanded the subsidy for 2021 and 2022, so now everyone with a marketplace plan is eligible for the tax credit.

Recommended Reading: How To Buy Tax Lien Properties In California

Are There Other Ways To Save On Health Insurance Premiums

Aside from premium tax credits, your employer can also help you with the cost of your individual health insurance plan by setting up a health reimbursement arrangement .

Through an HRA, you choose your own individual insurance plan, and your employer reimburses you for the cost of the premium and other qualifying medical expenses up to your monthly allowance.

Whats more, if youre enrolled in the qualified small employer HRA you can even coordinate your premium tax credits with your HRA allowanceyour premium tax credit will simply be reduced by your allowance amount.

What Is Irs Form 8: Premium Tax Credit

Form 8962 is used to calculate the amount of premium tax credit youre eligible to claim if you paid premiums for health insurance purchased through the Health Insurance Marketplace. Claiming the premium tax credit could reduce your tax liability for the year. Completing Form 8962 can tell you how much credit youre eligible to receive or whether you owe the Internal Revenue Service because you received too much in advance premium tax credit .

Also Check: Www Michigan Gov Collectionseservice

Definition And Example Of The Advance Premium Tax Credit

The advance premium tax credit is an estimated percentage of a taxpayers premium tax credit that’s paid directly to that persons health insurance company by the Health Insurance Marketplace. It’s taken as a credit on the taxpayers income tax return for the year.

- Alternate names: Advanced premium tax credit, advance payments of the premium tax credit, advance credit payments

- Acronym: APTC

For instance, if the Health Insurance Marketplace estimates at the time of your enrollment that you’re eligible for a $1,000 premium tax credit, your advance premium tax credit amount would also be $1,000 if you chose to take the entire credit rather than some or none of it.

How To Calculate The Advance Premium Tax Credit

The tax credit is based on your income and the calculation assumes that a household shouldnt pay more than 8.5% of their income for health insurance premiums. The lower your income, the smaller percentage of the cost youre expected to pay.

The American Rescue Plan expanded this subsidy for 2021 and 2022. In the past, the calculation assumed you wouldn’t pay more than 9.8% of your household income for health insurance premiums. The new calculations can increase the subsidies by hundreds — and sometimes thousands — of dollars for the year.

The calculation is based on the premiums for a Silver-level health insurance policy in your area for your age and family size. Health insurance policies sold on the marketplace are divided into four different metal levels:

- Bronze policies generally have the lowest premiums but the highest deductibles and out-of-pocket costs.

- Silver policies have mid-level premiums and deductibles.

- Gold and Platinum policies tend to have the highest premiums and lowest deductibles and out-of-pocket costs.

The tax credit is calculated based on premiums for a Silver-level policy, but you can then use the money to buy any type of policy available on the marketplace. For instance, if you buy a Bronze policy, you may end up paying even less for coverage.

You May Like: How Can I Make Payments For My Taxes

Premium Tax Credits Explained

The premium tax credit is a federal refundable tax credit that lowers your monthly premiums on plans from the Health Insurance Marketplace. Your premium tax credit amount depends on your household income and other factors.

Lets take a closer look into what the premium tax credit is, how it works, and how you can qualify.

Can I Receive A Tax Subsidy If I’m Eligible For Medicaid Because Of Aca’s Medicaid Expansion

Eligibility for premium tax credits begins at 100% of the federal poverty level in states that did not implement ACAs Medicaid expansion. However, the ACA allowed states to expand Medicaid to adults under 65 with incomes up to 138% of the poverty level.

As discussed earlier, taxpayers arent eligible for premium tax credits if theyre eligible for Medicaid or CHIP. In the 36 states that have adopted the Medicaid expansion, premium subsidies are available beginning above 138% of the poverty level.

Eligibility limits for CHIP are much higher than for Medicaid and can be above 300% of the poverty line in some states. This means that in many households, adults qualify for premium subsidies and children qualify for CHIP.

Don’t Miss: How To Buy Tax Forfeited Land