How Do I Check The Status Of My Refund

The IRS website features a handy web-based tool that lets you check the status of your refund, and there’s also a mobile app, IRS2Go. You can usually access your refund status about 24 hours after e-filing or four weeks after mailing in a return. To check your status, you’ll need to provide your Social Security number or ITIN, filing status and the exact amount of your refund. If your status is “received,” the IRS has your return and is processing it. “Approved” means your refund is on its way.

Read more: What’s your 2020 tax return status? How to track it and your refund money with the IRS

What Happens If I Miss The Tax Deadline

If you received an extension and fail to file your income taxes by midnight on Oct. 15, what happens next depends on your situation. If you are owed a refund, there is no penalty for filing late, though this may be different for your state taxes. But if you owe the IRS, penalties and interest start to accrue on any remaining unpaid tax due. There’s also a $330 failure-to-file penalty under the Taxpayer First Act of 2019.

In most states, taxpayers who are granted a federal extension to file automatically receive an equivalent extension to file their state income tax return.

An important note: If you are owed a refund or you filed for an extension through Oct. 15, you were supposed to pay your taxes by May 17. If you owe money, you would have been required to estimate the amount due and pay it with your Form 4868. If you did that, you should have automatically been granted an extension.

Another caveat: If you’re serving in the military — in a combat zone or a contingency operation in support of the armed forces — you may be granted additional time to file, according to the IRS.

Bottom line? It’s best to e-file or postmark your individual tax return as early as possible. CNET’s roundup of the best tax software for 2021 features an array of packages that can help you take care of business quickly and affordably.

See also

How The Irs Child Tax Credit Portals Can Assist Parents With Payments

This summer, the IRS opened its child tax credit online portals. The first portal is for people not normally required to file an income tax return, including low-income families. And the Child Tax Credit Eligibility Assistant tool — available in English and now in Spanish — helps families quickly determine whether they qualify.

The Child Tax Credit Update Portal currently lets families see their eligibility, manage their payments and unenroll from the advance monthly payments. Parents can also update their direct deposit information and mailing address using the portal. The IRS said that later this fall this portal will allow families to update other information if their circumstances changed — for example, if a new child has arrived or will arrive in 2021 and isn’t reflected on your 2020 tax return. You should also then be able to update your marital status, income or dependents to have the most up-to-date eligibility information.

This handy PDF also describes what the portals do.

Don’t Miss: Where’s My Tax Refund Ga

Save Hours Of Admin Time With Wise Business

Doing taxes can be stressful, but managing your business account doesnt have to be.

With the Wise Business account, you can easily manage invoices and payments online or even from the app.

You can make batch payments and add team members to help with payments. All past payment info is saved for the future, saving you hours of work.

Youll get the real exchange rate when you send invoices in other currencies, saving you on average up to 19x compared to PayPal.

Over 400k businesses use Wise. Interested to learn more? You can read how Alternative Airlines saved over £75K in 9 months with Wise.

Us Tax Deadline : For Citizens Living Abroad

The events of the Coronavirus pandemic are unlike any we have ever seen before. The outcome of the crisis will play out in our memories and our history books. In response to the crisis, the IRS has issued several important tax changes, including new US tax deadlines 2021 for citizens living abroad, special guidelines regarding the expat tax credits, and small business relief.

Read Also: Do You Have To Report Roth Ira On Taxes

Corporate Taxes Payment Due Date

While you have six months to file your corporate tax return, you do not have much time to pay the taxes. Typically your owing balance due day is two months after the end of your tax year. By that day, you have to pay the remainder or full amount of the tax you owe for the tax year.

However, some corporations have three months to pay their taxes in some cases. Click on the link below to see if you are qualified.

Check if you qualify.

The balance of tax is due three months after the end of the tax year if conditions 1 and 2 that follow are met, as well as condition 3 or 4:

Schedule Federal Tax Payments Electronically

Taxpayers can file now and schedule their federal tax payments up to the October 15 due date. They can pay online, by phone or with their mobile device and the IRS2Go app. When paying federal taxes electronically taxpayers should remember:

- Electronic payment options are the optimal way to make a tax payment.

- They can pay when they file electronically using tax software online. If using a tax preparer, taxpayers should ask the preparer to make the tax payment through an electronic funds withdrawal from a bank account.

- IRS Direct Pay allows taxpayers to pay online directly from a checking or savings account for free, and to schedule payments up to 365 days in advance.

- Choices to pay with a credit card, debit card or digital wallet option are available through a payment processor. The payment processor, not the IRS, charges a fee for this service.

- The IRS2Go app provides the mobile-friendly payment options, including Direct Pay and debit or credit card payments on mobile devices.

- The Electronic Federal Tax Payment System is convenient, safe and easy. Choose to pay online or by phone by using the EFTPS Voice Response System.

Read Also: How Much Does H And R Block Charge To Do Your Taxes

Can Etax Help Me Get Out Of An Ato Fine

If you receive a fine for lodging your tax return after the deadline, our team of tax experts can contact the ATO on your behalf and try to get your penalties cancelled or reduced.

You may be eligible for the ATO to waive your fine if:

- All of your tax returns up to date

- You have no other amounts outstanding to the ATO

If you do have any outstanding tax returns, it is highly unlikely the ATO will be lenient and waive your fine.

Whether the ATO agrees to waive a fine is ALWAYS at their discretion. As your tax agent, we will push the ATO for an outcome that is in your favour.

We can also request a payment plan on your behalf to make any amount due to the ATO easier for you to manage.

Paying A Tax Assessment Bill

If you self-lodge your tax return and need to pay the ATO money, youll need to pay this bill by 21 November , even if you lodge late. The ATO says that interest applies to any money you owe after this date.

Generally, for individual tax returns submitted on or before lodgement due dates , any tax you owe needs to be paid to the ATO on the later of 21 days after:

This is the case regardless of whether you lodge on time. So if you lodge your tax return more than three weeks late or dont lodge it at all, you will likely need to pay interest on any income tax you may owe. The ATO says it will generally send you a warning letter and then potentially a default assessment in these circumstances.

Recommended Reading: How Much Does H& r Block Charge To Do Taxes

Quick Facts: Top Coronavirus Tax Changes For Us Expats

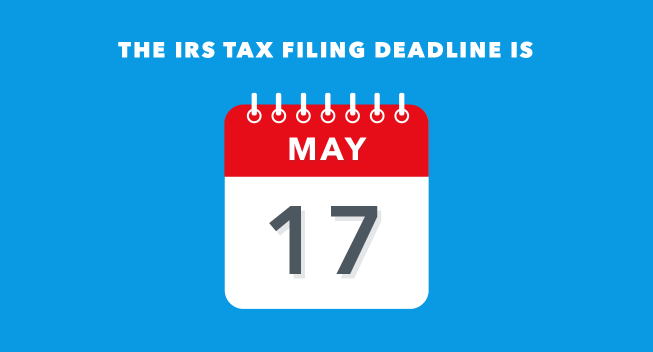

- The IRS has postponed the April 15, 2021 filing deadline to May 17, 2021.

- Despite the extension, the IRS recommends you file as soon as possible, especially if you may be owed a refund or missed stimulus payments.

- Tax credits and loans may help small businesses offset the economic impact of the COVID-19 Emergency.

Want the latest updates direct to your inbox? for monthly expat tax news.

I Dont Know What To Enter In A Certain Part Of The Tax Return

If youre not sure where something goes on the return, just use the Any other questions or documents section down at the bottom of your Etax return. Then after you sign your return, our accountants will make sure your information goes into the right part of your tax return.

You can also use live chat or phone to connect with a friendly, qualified accountant at Etax.

Also Check: How Much Does H& r Block Charge To Do Taxes

Will Interest Be Levied On Tax Payable If Returns Are Filed By New Deadline

Yes. If income tax, after the reduced tax deducted at source , advance tax etc., exceeds Rs 1 lakh, then interest at the rate of 1% per month beyond the original deadline of July 31 will continue to be levied on the tax amount, until the return is filed. Tax practitioners thus suggest that returns be filed as soon as possible to avoid further accumulation of interest.

Financial Institution And Insurance Company

Overview

These are due dates for calendar year filers. Fiscal year filers must determine due dates based upon tax period end date. Extension and estimated payment due date information is included below.

Due on or before April 15, 2021

Form 63FI:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Form 63-20P:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Form 63-23P:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Form 121A:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Due on or before May 17, 2021

Form 63-29A:

- File a 2020 calendar year return and pay any tax due. If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment.

Read Also: How To Buy Tax Lien Properties In California

The States That Pushed Back Tax Deadlines To May 17

There are 35 states that have extended 2020 tax filing and payment deadlines to May 17, 2021, according to a list compiled by the American Institute of Certified Public Accountants. In most cases, the grace period does not include individual 2021 estimated tax payments. Click on your state for more detailed information.

Families First Coronavirus Response Act: Payroll Tax Credits For Employee Leave

On March 18, 2020, President Trump signed the Families First Coronavirus Response Act . The FFCRA requires certain employers to provide paid leave to employees who are unable to work due to circumstances related to COVID-19.

The FFCRA also includes provisions to help companies with fewer than 500 employees fund paid leave for workers during the crisis. If you are an expat who runs a small business with employees in the US, these provisions may apply to you.

Qualifying employers can use tax credits to offset certain Coronavirus-related costs dollar-for-dollar:

- Sick Leave Tax Credit If an employee who is unable to work due to a Coronavirus quarantine, self-quarantine, or Coronavirus symptoms, eligible employers can claim a tax credit at the employees regular rate of pay, up to $511 per day for up to 10 days.

- Child Care Leave Tax Credit If an employee who is unable to work because they need to care for a child whose school or care provider is unavailable due to the Coronavirus, businesses can take a credit equal to two-thirds of the employees regular pay, capped at $200 per day or $10,000 total for up to 10 weeks.

Read Also: How Much H And R Block Charge For Taxes

How Many Days Are Left To Unenroll From The Remaining Payments This Year

Advance payments are optional, and even though the majority of US families are eligible there are still families that don’t qualify. If you know your household situation is changing significantly this year, you may prefer to opt out to avoid needing to repay the IRS. The next deadline to opt out of monthly payments is today, Nov. 1 at 8:59 p.m. PT . You can use the IRS Child Tax Credit Update Portal online anytime between now and December to unenroll. You may want to unenroll if you don’t meet income or other eligibility requirements.

To stop advance checks, the IRS says you must unenroll three days before the first Thursday of the following month. See the chart below for deadlines. Once you unenroll from this year’s advance payments, you can’t currently re-enroll, though the IRS still says it will make that option available later. Also note that for couples who are married and filing jointly, each parent must unenroll separately.

What If You Cant Pay Your Taxes

File your return anyway, and immediately apply for a payment plan if you can’t pay the tax you owe all at once. The IRS will generally let you pay over time, as long as you make arrangements to do so.

Go to IRS Direct Pay and have the payment debited directly from your bank account if you owe money and don’t want to send a check to the IRS via snail mail, risking the extra time that might entail.

Recommended Reading: How To Buy Tax Lien Properties In California

If You Miss The Tax Filing Deadline And Are Owed A Refund

If you overpaid for the 2020 tax year, there’s typically no penalty for filing your tax return late. However, you should file as soon as possible.

Generally, you have three years from the tax return due date to claim a tax refund. That means for 2020 tax returns, the window closes in 2024. After three years, unclaimed tax refunds typically become the property of the U.S. Treasury.

When Are Taxes Due Important Tax Deadlines And Dates

OVERVIEW

Make sure your calendar is up-to-date with these important deadlines, dates, possible extensions and other factors in play for both individuals and businesses in 2021.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Read Also: Can You File Missouri State Taxes Online

Is The Income Tax Portal Working Now

The government had given Infosys, the service manager for the new income tax portal, until September 15 to sort out technical problems. Several issues persist–auto-population of 26AS isn’t always available and the previous year’s tax returns arent accessible by individual taxpayers apart from tax credit mismatch and rectification of challans.

Other income tax deadlines extended

Is There Any Extension To Make Tax Payments

Yes, the Arizona Department of Revenue has moved the deadline for filing and paying state individual income taxes for the 2020 tax year from April 15 to May 17, 2021. For making electronic payments, select the day you want the payment to be withdrawn. Payments made on AZTaxes must be completed before 5:00 p.m. Mountain Standard Time the Arizona business day prior to the due date, in order for the payment to settle the next business day.

Recommended Reading: 1040paytax.com Official Site

Get More With These Free Tax Calculators And Money

-

See if you qualify for a third stimulus check and how much you can expect

-

Know what dependents credits and deductions

-

Know what tax documents you’ll need upfront

-

Learn what education credits and deductions you qualify for and claim them on your tax returnGet started

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.