The 2021 Tax Deadline Extension: Everything You Need To Know

OVERVIEW

In response to the Coronavirus pandemic, the Treasury and IRS issued new instructions that call for a tax deadline extension, moving the customary April 15 deadline to May 17, 2021. Read more to learn about the relevant details and how they impact your situation.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

How Do I File An Extension For Business Taxes 2020

To request a filing extension,use the California Department of Tax and Fee Administrations online services. You must have a CDTFA Online Services Username or User ID and Password. You must submit a request for extension no later than one month after the due date of your return or prepayment form and payment.

Why Is The Tax Deadline Different In 2021

In the previous couple of years, the tax return deadline was extended to May 17. This was to allow the IRS to prioritize Covid-19 relief payments such as Stimulus Payments to businesses or individuals that were suffering as a result of the pandemic.Many peoples taxes were also affected by unemployment benefits, increased child tax credits and insurance changes. This made filing for tax a little more complex and meant that reclaims and credits needed to be made for missed stimulus payments.The extension here gave tax filers and the IRS a little more time to get everything in order before the deadline.However, as 2021 was the final year for stimulus payments, the deadline has been pulled back to the normal April date each year.

Recommended Reading: When Should We Expect Tax Refund 2021

Requesting An Extension To File A Tax Return 2021

You can request an extension to file your tax return 2021 if you have mitigating circumstances which might mean that you cant fully file it before April 2022.The maximum extension deadline would be until October 2022 for your 2021 return or 6 months from the original deadline.If you need to request an extension, you must still contact the IRS and request an automatic extension online. In most cases, these extensions are granted automatically. But, even with an extension you would need to initially provide an estimate of your tax return finances and how much you expect to receive back as a credit. You must also pay a percentage of your taxes due at the time of the extension request.

When filling out the form to request an extension, you will need to provide a valid reason why your tax return will be late. Possible reasons for extension are:

- You havent received all of your year-end financial statements yet.

- An organization you work with has also been delayed in their returns, so you are waiting on them.

- A family emergency or illness.

- You need to make a few more contributions to a retirement fund.

What If The Irs Owes Me Money

If you file an accurate return electronically, and are owed a refund, the IRS will likely have that money sent to you or direct deposited into your bank account within 21 days of receiving your return.

You can check the status of where things stand by using the IRS online tool Wheres My Refund?

If youre not legally required to file a 2021 tax return because your income was too low, you may want to file a return anyway since youre likely due a refund thanks to the enhanced child tax credit and other tax breaks that you are eligible to claim even though you dont owe income tax.

Read Also: Does Optima Tax Relief Work

Pay Your Taxes From Abroad With Wise

Getting your head around taxes can be a nightmare, but paying them shouldnt cost you even more money. If you are paying your taxes from overseas with a non-US bank account, you can use Wise to get the real mid-market rate .

A Wise account can reduce the costs of paying from abroad. You can save 4-5% compared to typical banks.

File For An Extension By Tax Day

If you cant finish your return by the April 18 tax deadline, file IRS Form 4868. This will buy most taxpayers until Oct. 17 to file their tax returns. See more about how extensions work.

Note: A tax extension gets you more time to file your return, not more time to pay your taxes. You still must pay any tax you owe, or a good estimate of that amount, by the tax deadline. Include that payment with your extension request or you could face a late-payment penalty on the taxes due.

Dont Miss: Where To File Connecticut State Taxes

Also Check: How To Calculate How Much Tax You Owe

When Are 2023 Tax Extensions Due

You have right up until tax day to file for an extension. For individuals, that means you can still file for a tax extension right on April 18, 2023. The same goes for businesses: S corps and partnerships can still get an extension on March 15, and the last day for C corps to file for an extension is April 18.

State Tax Deadlines For Filing 2021 Individual Returns

Most states require individual taxpayers to file their state income taxes by Tax Day. Thats easy to remember because it is the same deadline as the federal tax deadline. However, there are several states that impose different deadlines and nine states that have no income tax. You can see the deadline for each state and the District of Columbia in the table below.

| 2022 State Income Tax Deadlines |

| State |

You May Like: Do Your Taxes Online Free

Avoid Refund Delays And Understand Refund Timing

Many factors can affect a refund’s timing after the IRS receives a return. Although the IRS issues most refunds in less than 21 days, the IRS cautions taxpayers not to rely on obtaining a 2022 federal tax refund by a specific date, especially when making major purchases or paying bills.

In addition, some returns may require additional review and may take longer to process if IRS systems detect a possible error, the return is missing information, or there is suspected identity theft or fraud.

Also, the IRS cannot issue refunds for people claiming the EITC or Additional Child Tax Credit before mid-February. This is because the law requires the IRS to hold the entire refund not just the portion associated with EITC or ACTC.

Filing Due Dates For The 2021 Tax Return

For most people, the 2021 return has to be filed on or before April 30, 2022, and payment is due .

File your return early or before the due date to avoid being charged interest and penalties and to prevent a disruption to your benefit and credit payments, such as:

- GST/HST credit, including any related provincial or territorial credits

- Canada child benefit , including related provincial or territorial payments

- Old age security benefits

You May Like: How Much Do You Have To Make To Claim Taxes

Recommended Reading: Where’s My Income Tax Return

How To Get Your Tax Refund As Soon As Possible

Last tax filing season, the IRS website reported the service receiving approximately 145 million calls between January 1, 2021, and May 17, 2021. That 145 million is more than four times the average amount of calls the IRS typically receives during tax filing season. In 2022, as phone volumes continue to rocket, the IRS continues to encourage taxpayers to file electronically.

According to IRS Commissioner Chuck Rettig, The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund dont face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year.

With so many up-to-date online resources available, the vast majority of taxpayers have access to both free and paid tax professionals and services. When you successfully e-file and choose direct deposit, you should expect your tax refund within about twenty-one days. If you owe taxes, you may also opt to deduct the amount from your tax return. That way, you dont have to worry about any unpaid tax!

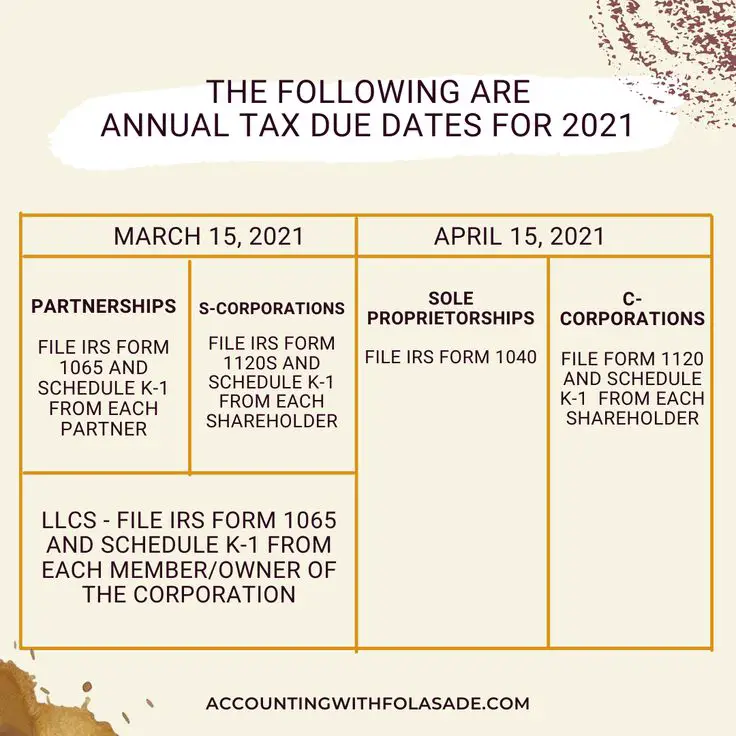

What Is The Business Tax Deadline For 2022

The main tax date in 2022 will be . Individuals, sole proprietors, and C corporations need to file their taxes by this date. The main tax day usually falls on April 15. However, April 15, 2022, is Emancipation Day.

Residents of Maine and Massachusetts have until , as April 18th is also a legal holiday .¹

Depending on the type of business you run and what your primary source of income is, you may have different business tax filing deadlines.

Read Also: Can I Track My Unemployment Tax Refund

How Do I Check The Status Of My Refund

The IRS website features a handy web-based tool that lets you check the status of your refund . There’s also a mobile app, IRS2Go.

You can usually access your refund status about 24 hours after e-filing or four weeks after mailing in a return. To check your status, you’ll need to provide your Social Security number or ITIN, your filing status and the exact amount of your refund. If your status is “received,” the IRS has your return and is processing it. “Approved” means your refund is on its way.

Deadline For Filing Your Income Tax Return

The deadline for sending us your personal income tax return is April 30. If you or your spouse carried on a business or earned income as a person responsible for a family-type resource or an intermediate resource, you have until June 15 to file your return.

Any balance due must be paid by April 30.

NoteannonceIncome tax filing deadline extended

Since the regular filing deadline falls on a Saturday this year, you have until May 2, 2022, to file your 2021 income tax return and pay any income tax you may owe. No interest or penalty will be charged.

End of noteNote

Even if you are unable to pay the full amount of your balance due by April 30, file your return no later than the deadline to avoid a late-filing penalty.

End of note

Also Check: How Much Taxes Come Out Of Paycheck

Winter Storm Disaster Relief For Louisiana Oklahoma And Texas

Earlier this year, following the disaster declarations issued by the Federal Emergency Management Agency , the IRS announced relief for victims of the February winter storms in Texas, Oklahoma and Louisiana. These states have until June 15, 2021, to file various individual and business tax returns and make tax payments. This extension to May 17 does not affect the June deadline.

For more information about this disaster relief, visit the disaster relief page on IRS.gov.

Whats The Deadline To Pay Your Taxes

Even if you successfully apply for an extension, the payment deadlines donât change. The penalty for late payment is 0.5% of the taxes owed each month compared to 5% for late filing. Regardless of whether you can pay your small business taxes, it always pays off to file on time.

If youâre sending your return via snail mail, the IRS considers your return âon timeâ if itâs addressed correctly, has enough postage, and is in the mail before the end of business on your filing deadline. Otherwise, you can e-file your return before midnight on your tax filing deadline day.

If youâre self-employed, your business probably pays taxes in four sums throughout the year, rather than on one day. These are called estimated tax payments and you can think of them as a prepayment of your income and self-employment taxes . The due dates for these 2023 payments are April 18, June 15, September 15, and January 15 .

Weâll set you up with a dedicated team of bookkeepers and a tax team to provide year round tax advice and file your taxes for you. With these teams, youâll have a tax planning session to ensure you are more prepared for next year. Weâll take both headachesâbookkeeping and taxesâoff your hands, for good.

You May Like: Where Is Amended Tax Return

Alert: Highest Cash Back Card We’ve Seen Now Has 0% Intro Apr Until 2024

If you’re using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Will My Refund Be Issued By Paper Check Or Electronically

Previously, the Department might have issued you a paper check, even if you selected to receive your refund by direct deposit or prepaid debit card. This protection helped the Department avoid sending your money to an account or debit card that is controlled by a criminal.

While the Department honors taxpayer requests to issue a refund electronically, there may be situations in which we will determine its safer to issue a paper check. In some cases, we may send a letter requesting verification of taxpayer identity instead of automatically changing your request to a paper check. The letter instructs you to go to myVTax, select Return filing verification, and enter the verification code included on the letter. This verifies your request and allows us to proceed with processing your refund.

Read Also: How Much Will I Get Paid After Taxes

You May Like: How Much Is The First Time Home Buyers Tax Credit

When Are Taxes Due If I File An Extension

If you file Form 4868 and receive the automatic six-month extension, you will have until Oct. 17, 2022, to submit your 2021 tax return.

If you already know that youll need an extension, plan on filing Form 4868 sooner rather than later. That way, if anything goes wrong with your application, youll have plenty of time to fix any errors and resubmit it ahead of the April 18 tax deadline. This also ensures you have time to get your documents together for your extended deadline in October. The IRS website has all the forms, deadlines and information youll need.

I Was Working Remotely For Much Of 2021 Will That Affect My Taxes

It depends. If you worked from a state other than the one where your employer is based, you could be subject to the income tax rules of two or more states.

At the very least youll likely have to file more than one state tax return for 2021, which will cost you more if youre paying someone else to prepare your taxes.

And in some instances primarily involving five states that have so-called convenience rules you may even be double-taxed on the same income.

Also Check: How Do I Amend My Tax Return

What If You Are Unable To Pay Your Tax At The Tax Return Deadline

Many people make the mistake of filing late because they just cant afford to pay the full tax amount at the tax return deadline. If you are struggling to meet payments by the tax return 2021 deadline, then its still best to file your return as soon as possible.This is because your penalties will grow for each day that you dont file, potentially making your financial difficulties much worse if you hold off.The IRS will be more lenient on you if your tax return is filed on time. You should file by the deadline and pay as much as you possibly can on that date. You should be able to set up a payment plan through the IRS for the remaining balance.If you dont file at all, you run the risk of higher penalties and you wont be able to request an extension or payment plan either.

Personal Income Tax Guide: The Deadline For Filing Your 2021 Return Tax Brackets And More

By Lisa Hannam and Luca Tatulli on April 5, 2022 Estimated Reading Time: 5 minutes

Dont miss the deadline to file your tax return! Our 2021 income tax guide for Canadians is here to help.

The year 2021 has been a year about money, from the latest crypto to inflation to housing prices to taxes. While money trends can go up and downor up and up for certain matterstaxes can be more predictable, if youre prepared. This years MoneySense income tax guide includes the things you need to know: the deadline for filing your 2021 return, which tax brackets you fall into, COVID-related tax breaks, often-missed tax deductions and more.

Read Also: How To Amend My Taxes

How To File Revised Itr

In case a taxpayer filed original ITR but later discovers an omission or wrong statement in it due to a bonafide mistake, they have the option to revise their tax return u/s 139 of the IT Act. The revised ITR is a kind of amendment of previously furnished return in case of any mistake or inadvertence from the side of assessee.

The process to file a revised ITR is the same as original ITR. However, you need to select Section 139 in the income tax return form and must have the original ITR as the figures put in the original ITR will also be needed in the process. Revised ITR can be filed till 31 December of the relevant AY, subject to completion of assessment.

For breaking news and live news updates, like us on or follow us on and . Read more on LatestBusiness News on India.com.