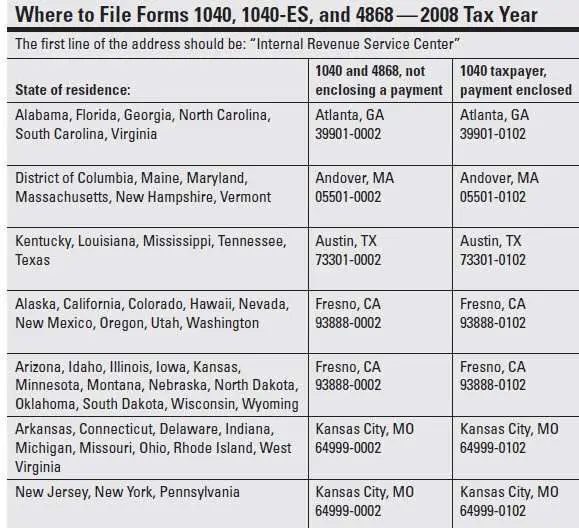

Where To Send Your Individual Tax Account Balance Due Payments

| Internal Revenue Service CenterAustin, TX 73301-0010 | |

| Alabama, Alaska, Arkansas, California, Delaware, Georgia, Hawaii, Illinois, Indiana, Iowa, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Missouri, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Vermont, Virginia, Washington, Wisconsin | Internal RevenueService CenterKansas City, MO 64999-0010 |

| Arizona, Colorado, Connecticut, District of Columbia, Idaho, Kansas, Maryland, Montana, Nebraska, Nevada, North Dakota, Oregon, Pennsylvania, Rhode Island, South Dakota, Utah, West Virginia, Wyoming | Internal RevenueService CenterOgden, UT 84201-0010 |

| All APO and FPO addresses, American Samoa, nonpermanent residents of Guam or the Virgin Islands*, Puerto Rico , a foreign country: U.S. citizens and those filing Form 2555, 2555-EZ, or 4563 | Internal Revenue |

When To Contact The Irs

1. IRS Audit

One of the most common reasons why tax filers contact the IRS is due to receiving a dreaded IRS audit letter. If you receive one, try not to panic as most tax issues are simple to fix. Before you contact the IRS, start by finding out what section of your tax return the government wants to audit. Once you know what the auditor is questioning, you can start gathering the requested information. An audit doesnt always indicate a problem. You may be getting audited for one of the following reasons:

Random selection and computer screening

This type of IRS audit is selected based solely on a statistical formula. The IRS compares your tax return against norms for similar returns. The IRS develops these norms from audits of a statistically valid random sample of returns.

Related examinations

The IRS may select your returns when they involve issues or transactions with other taxpayers, such as business partners or investors, whose returns were selected for an audit.

2. Missing W-2

Missing tax forms such as a W-2 is another popular reason why filers contact the IRS. However, if you havent received your form by mid-February, there are a few options available to you, including contacting the IRS.

Contact your Employer. Ask your employer for a copy. Be sure they have your correct address.

How Do I Request An Irs Tax Return Transcript

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.

An IRS Tax Return Transcript can be obtained:

- ONLINE: Visit www.irs.gov. Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

- Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.

- If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

Step-by-step instructions for completing the paper form:

You May Like: Doordash Mileage Calculator

Also Check: How To Calculate Federal Tax

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

How To Contact Irs Customer Service

You’re welcome to call the main IRS number . The agency’s average telephone service waiting time is 13 minutes during filing season and 19 minutes off-season . Call volume may be higher on Mondays and Tuesdays as well as around the tax deadline.

If you’ve got a question about any of the topics below, one of these lesser-known IRS phone numbers might get you to help faster.

|

TOPIC |

Recommended Reading: How Do I Pay Taxes

Texas Accountant Pleads Guilty To Embezzling Funds From Employer And Filing False Tax Return

Contact:

A Texas man pleaded guilty today to embezzling funds from his employer and filing a false tax return. The plea was entered before U.S. Magistrate Judge Dustin Howell.

According to court documents and statements made in court, Steven Marquez embezzled more than $700,000 from his employer, an Austin-based company , where he worked as an accountant and cash manager. From at least April 2010 through October 2017, Marquez without authorization caused funds to be transferred from Company A’s bank accounts into an account he controlled. He then used some of this money to pay his credit card bills and other personal expenses. To conceal his embezzlement, Marquez altered the business’s bank statements, and then provided the altered statements to Company A’s bank reconciliation group. Marquez also filed a false tax return for 2017 that did not report the embezzled funds.

Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division made the announcement.

IRS-Criminal Investigation is investigating the case.

Assistant Chief David Zisserson and Trial Attorney Kavitha Bondada of the Tax Division are prosecuting the case.

Extension To File Your Tax Return

On the off chance that you cant document your government income tax form by the due date, you might have the option to get a six-month expansion from the Internal Revenue Service . This does not grant you more time to pay your taxes.

Know that the ordinary cutoff time for filing government tax returns has been extended by three months, to July 15, 2020, due to the coronavirus emergency.

Source usa.gov

Ayush Sharma

This page is purely informational. Line does not provide financial, legal or accounting advice. This article has been prepared for informational purposes only. It is not intended to provide financial, legal or accounting advice and should not be relied on for the same. Please consult your own financial, legal and accounting advisors before engaging in any transactions.

Don’t Miss: What Happens If You File Your Taxes One Day Late

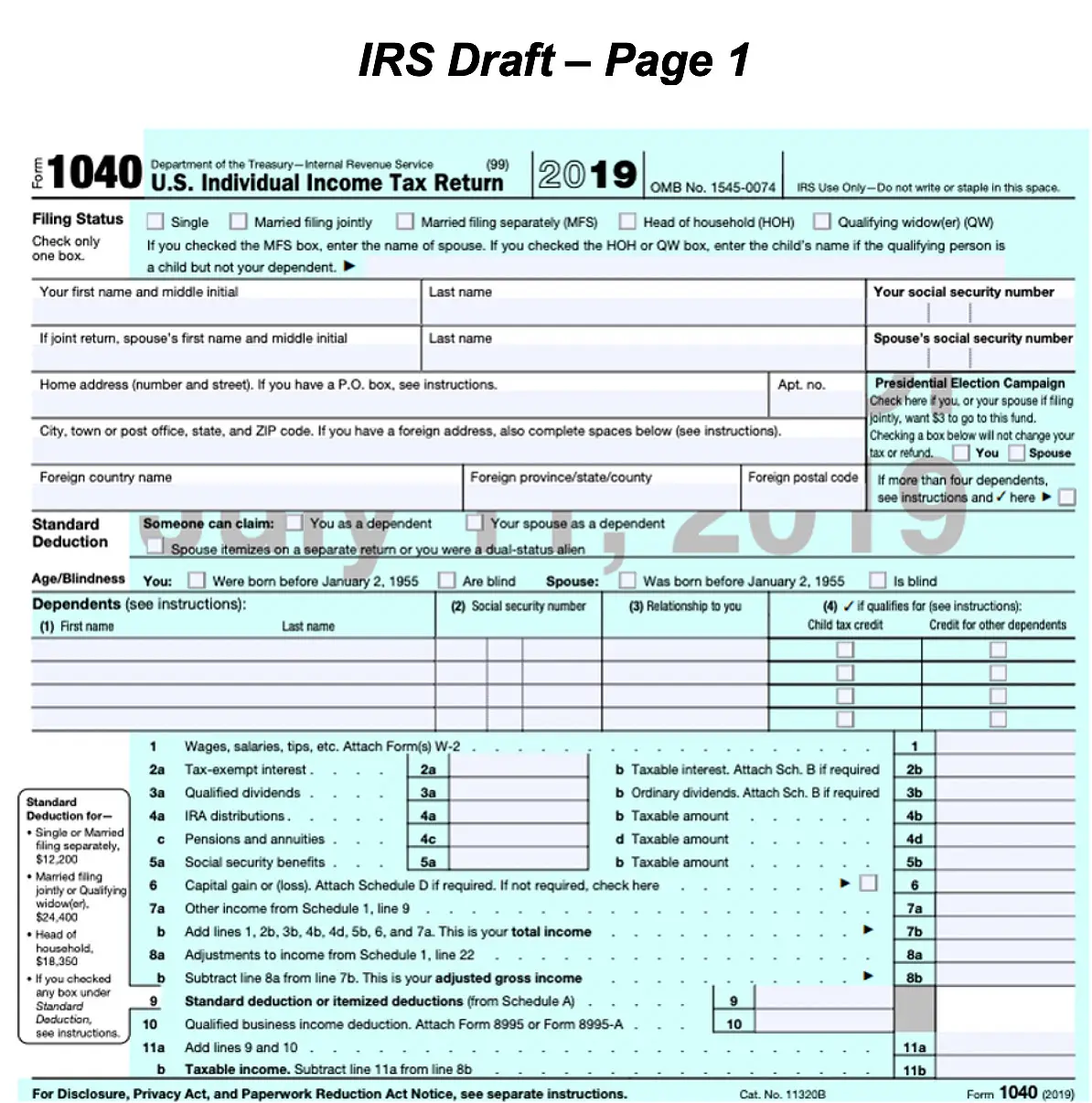

Addresses For Forms Beginning With The Number 1

|

Form Name |

Address to Mail Form to IRS: |

|---|---|

|

Form 11-C, Occupational Tax and Registration Return for Wagering |

Department of the Treasury |

|

Form 1040-C, U.S. Departing Alien Income Tax Return |

Department of the Treasury |

|

Form 1040-NR, U.S. Nonresident Alien Income Tax Return Exception Estates and Trusts filing Form 1040-NR |

Department of the Treasury |

|

Form 1040-NR, U.S. Nonresident Alien Income Tax Return |

Internal Revenue ServiceCharlotte, NC 28201-1303USA |

|

Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents |

Department of the TreasuryInternal Revenue ServiceAustin, Texas 73301-0215 |

|

Form 1040-NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents |

Internal Revenue Service |

What Do I Do When I Receive A Cp518 Notice

CP518 notices contain instructions for the steps to take based on your specific unfiled taxes situation.

If you need to file, follow these steps:

- File your tax return as soon as possible. This involves completing and signing tax returns and schedules for the tax years requested. In many cases you may be able to e-file: .

- Include all payments for any taxes due or pay online using the IRS payment portal: . If you cannot pay all your taxes in full, pay whatever amount you can now and apply for an IRS payment plan or other tax relief for the remaining balance.

- Provide an explanation as to why you are filing late.

Don’t Miss: Where Can I File Taxes For Free

Heres Where You Want To Send Your Forms If You Are Enclosing A Payment:

- Alabama, Georgia, Kentucky, New Jersey, North Carolina, South Carolina, Tennessee, Virginia: Internal Revenue Service, P.O. Box 931000, Louisville, KY 40293-1000

- Florida, Louisiana, Mississippi, Texas: Internal Revenue Service, P.O. Box 1214, Charlotte, NC 28201-1214

- Alaska, Arizona, California, Colorado, Hawaii, Idaho, New Mexico, Nevada, Oregon, Utah, Washington, Wyoming: Internal Revenue Service, P.O. Box 7704, San Francisco, CA 94120-7704

- Arkansas, Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Dakota, Wisconsin: Internal Revenue Service, P.O. Box 802501, Cincinnati, OH 45280-2501

- Delaware, Maine, Massachusetts, Missouri, New Hampshire, New York, Vermont: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7008

- Connecticut, District of Columbia, Maryland, Pennsylvania, Rhode Island, West Virginia: Internal Revenue Service, P.O. Box 37910, Hartford, CT 06176-7910

If youre filing a different 1040 income tax form, the IRSs website has a nifty breakdown of where each form has to go, most depending on whether or not a payment is enclosed.

Connect With The Irs Online

One of the best ways to get the information you need is directly from the IRS website at IRS.gov. You can download almost any form or publication here. Youll find a lot of information right at your fingertips, including answers to frequently asked questions, tax law changes, and even planning calculators. Its not a substitute for talking directly with a tax expert, but the site can point you in the right direction when you need answers to basic tax questions.

As for that tax refund youre expecting, theres a special tool available to track its status, too. Just go to Wheres My Refund? and click on Check My Refund Status.

Don’t Miss: When Will California Accept Tax Returns 2021

Submit Irs Forms By Fax

The IRS put an end to faxing and mailing tax transcripts in June 2019. Receiving forms and instructions by fax isnt the best way to transmit sensitive information, but you can still fax some documentation.

Fax to the number listed on your CP06 audit notice if you have to transmit required supporting documentation during an audit of your tax return.

Dont Miss: Doordash Tax Deduction

How Much Time Do I Have To Respond To My Cp518 Notice

Each CP518 notice typically contains a time limit to respond to the IRS. If you require more time to file, call the IRS at the phone number listed on the notice and request an extension. Since CP518 is a final notice, you will want to respond ASAP before the IRS files a substitute return on your behalf.

Read Also: How To Find Property Tax

How Do I Contact The Irs If My Tax Return Was Not Received

Can I chat with IRS online?

IRS unveils voice and chat bots to assist taxpayers with simple collection questions and tasks provides faster service, reduced wait times.

Is the IRS answering the phone?

Rettig said the IRS expects to return to normal levels of phone service during the 2022 fiscal year, which he defined as right around 70% of calls answered, as the agency recovers from the COVID-19 pandemic. Were currently running about 19% to 20% level of service, Rettig said.

When was the 3rd stimulus check 2021?

The IRS started sending the third Economic Impact Payments to eligible individuals in March 2021 and continued sending payments throughout the year as tax returns were processed. The IRS has issued all third Economic Impact Payments and related plus-up payments.

Can I amend a tax return from 5 years ago?

The IRS will only accept an amended return within three years of the date you filed the original return or within two years of the date you paid the tax for that year, whichever is later. You cant e-file your amended return. You can prepare amended returns online, but you cant electronically file them.

Does the IRS look at every return?

The IRS does check each and every tax return that is filed. If there are any discrepancies, you will be notified through the mail.

Mailing Address For Estimated Tax Payment

For people who are required to make an estimated tax payment, Form 1040-ES, which is the estimated tax voucher can be used to submit your payment to the IRS using the following addresses.

Tip: The mailing address of Form 1040-ES can be slightly different every year. Normally, you can find the latest mailing address in Page 5 of 2022 Form 1040-ES.

Visit IRS about Form 1040-ES to learn more.

| The State You Live in | Where to Mail |

|---|---|

| P.O. Box 802502Cincinnati, OH 45280-2502 |

The following group of people should mail their Form 1040- E.S. to the Internal Revenue Service, P.O. Box 1300, Charlotte, NC 28201- 1300 USA.

- People who live in a foreign country

- People who live in American Samoa

- People who are excluding income under internal revenue code 933

- People who live in Puerto Rico

- People who use an FPO or APO address

- People who file form 2555, 2555 EZ, 4563

- People who are dual-status aliens, or non-permanent residents of Guam, or the U.S. Virgin Islands.

However, it is important to note that if you are a bona fide resident of Guam, you are expected to mail your Form 1040-ES to the Department of Revenue and Taxation, Government of Guam, P.O. Box 2307, GMF, GU 93921.

For a bona fide resident on U.S. Virgin Islands, the mailing address is: Virgin Islands Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802.

Also Check: Where Is My Ms State Tax Refund

Apply For Interest Abatement

Interest abatement is a limited remedy that allows taxpayers to avoid liability for interest only. As the IRS explains, this remedy is available when interesthas been applied because of an IRS officer or employees unreasonable error or delay. Abatement is available for interest imposed on income, estate, gift and certain excise taxesit is not available for interest imposed on employment taxes. Taxpayers seeking interest abatement must file within three years of the relevant return filing date or two years from the payment date of the relevant tax, whichever is later.

Cutting It Close The Mailbox Rule

Can you mail your tax return on the same day that its due?

Yes, a document delivered by U.S. mail is considered timely if the envelope is properly addressed to the recipient with sufficient postage, the postmark date falls on or before the deadline, and the document is mailed on or before that date.

If sending via private delivery services, only the following services are designated by the IRS to meet the timely mailing as timely/filing/paying rule:

DHL Express:

Also Check: How Do I Apply For Farm Tax Exemption

Apply For Penalty Relief

For taxpayers that owe interest on penalties, another potential option for reducing their liability to the IRS is to file forpenalty relief. The IRS offers relief from the following penalties in appropriate cases:

- Accuracy-related penalties

- Failure to deposit employment taxes

- Failure to file tax returns

- Failure to file information returns

- Failure to pay taxes

- Penalties imposed due to dishonored checks

- Underpayment of estimated tax liability

Individual and corporate taxpayers seeking penalty relief must do so either under one of the IRS three general penalty relief programs or under a program established temporarily for a specific purpose . The IRS three general penalty relief programs are:

- First-Time Penalty Abatement and Administrative Waiver

- Reasonable Cause and Good Faith

- Statutory Exceptions Eligible for Relief

What Are These Irs Tax Refund Statuses

Both IRS tools will show you one of three messages to explain your tax return status.

- Received: The IRS now has your tax return and is working to process it.

- Approved: The IRS has processed your return and confirmed the amount of your refund, if youre owed one.

- Sent: Your refund is now on its way to your bank via direct deposit or as a paper check sent to your mailbox.

Read Also: Www.1040paytax.com Review

Don’t Miss: Are Roth Contributions Tax Deductible

Table : Fedex Ups And Dhl Tax Return Mailing Address For Form 1040

See Table 1 for the City where the submission center is located for taxpayers living in your state.

Private Delivery Services should deliver returns, extensions and payments to the following Submission Processing Center street addresses only:

Austin Internal Revenue Submission Processing Center3651 S IH35,

Kansas City Internal Revenue Submission Processing Center333 W. Pershing,

Ogden Internal Revenue Submission Processing Center1973 Rulon White Blvd.

source: IRS.gov

When Preparing To Contact The Irs Be Sure To Have The Following Information Available

When Calling About Your Own Account

- Social Security cards and birth dates for those who were on the return you are calling about

- An Individual Taxpayer Identification Number letter if you dont have a Social Security number

- Filing status Single, Head of Household, Married Filing Joint or Married Filing Separate

- Your prior-year tax return

- A copy of the tax return youre calling about

- Any letters or notices sent to you by the IRS

When Calling About Someone Elses Account

- Verbal or written authorization to discuss the account

- The ability to verify the taxpayers name, SSN/ITIN, tax period, form

- IRS PTIN or PIN if you are a third-party designee

- A current, completed, and signed Form 8821, Tax Information Authorization or a completed and signed Form 2848, Power of Attorney and Declaration of Representative

What Does the IRS Help With?

The IRS can assist with concerns such as

Filing requirements/ status/ dependents/ exemptions

|

Department of the Treasury Internal Revenue Service Fresno, CA 93888-0045 |

Don’t Miss: Do You Pay Taxes If You Sell Your House