Does It Make Sense To Buy Audit Protection

That all depends on your budget, how much youre willing to pay for peace of mind, and if theres anything in your return thats likely to flag an audit.

If you have a simple return W-2 wages and maybe some income from interest and dividends reported on 1099 forms you probably dont need it. If you have a complicated return with numerous sources of business income and various types of deductions, it might be worth considering.

Taxact: Best For S Corps And C Corps

| Pros | |

|---|---|

|

Year-round support with estimated quarterly tax payments Deduction Maximizer helps freelancers and independent contractors find common tax deductions |

Expensive if you need to file multiple state returns Difficult to navigate, with limited on-screen help and search results that arent always targeted |

Best Tax Software For 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Taxes are confusing enough without the added stress of figuring out which tax software is the best tax software. So we did the research to help you choose the ideal option to file taxes online. We focused on well-known and widely used tax-preparation software, and while the tax code is the tax code, theres a crucial difference between paying for what you’ll use and paying for stuff you dont need.

Read Also: How Does Unemployment Tax Work

Simple Tax Return Vs Complex Tax Return

A simple tax return is the most basic type of tax return you can file, and many tax software programs let you file this return for free. A simple return generally includes W-2 income, limited interest and dividend income, standard deductions and unemployment income.

Some free plans also include the earned income tax credit , child tax credits and student loan/education deductions .

If your finances are more complicated and you don’t qualify for a simple tax return, you’ll need to file a complex tax return, and most tax software programs will charge you fees to file. Complex tax situations typically include anyone with freelance income , small business owners and landlords, as well as anyone with earnings from investments and stock sales.

The tax program you use will notify you if you can’t file a free simple tax return and instead need to upgrade and pay to file a more complex return. And even if you can file a simple tax return, you may want to pay for the next-tier plan to benefit from more deductions.

Winner: Cash App Taxes

Why: Cash App Taxes is the only major software program that provides free state and federal filing for most tax situations. The semi-guided navigation and freebies like Audit Defense make Cash App Taxes software thats tough to overlook. Active traders won’t be happy to find that Cash App Taxes doesn’t have any brokerage integrations. But most other filers will enjoy the free price point and the excellent user experience.

Also Check: How Do I Calculate My State Taxes

Best For Those Beginning To Itemize: H& r Block Deluxe Edition

NerdWallet Take: When we evaluated each companys entry-level paid software package for itemizers and studied things such as ease of use, features, help and support options, price and other factors, H& R Block Deluxe was our choice for value, support and modern features.

H& R Block Deluxe lets you:

- Itemize and claim deductions and credits for mortgage interest, property taxes, medical expenses, contributions to a health savings account and charitable deductions.

H& R Blocks Online Assist unlimited, on-demand sessions with a tax expert via chat, phone or video conference is available for an extra charge.

NerdWallet says this software package is not for freelancers, those who own a small business, landlords or investors who have capital gains and losses.

What Is A ‘simple’ Tax Return

When you file only a single W-2 from an employer, it’s considered a simple tax return. With a simple return, you won’t be itemizing deductions, claiming investment income or rental property, reporting freelance income or claiming business expenses like a home office.

Companies like Intuit and H& R Block explain the added complexity commensurate with their higher-tier products, so if you aren’t sure, double-check their lists before purchasing. You can also start filing with a free return in most cases and upgrade your service level if needed.

Also Check: How Much Is Capital Gains Tax On Stocks

Tips To Make Filing Taxes Easier

- You might also consider turning to a financial advisor for tax planning services, which can ensure tax efficiency. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Start gathering financial documents early. Set a deadline for when youll have your W-2 forms, 1099 forms, investment income information, last years tax refund, student loan interest and the rest of the items listed on the IRS Tax Form checklist. By breaking the intimidating task of filing your taxes into smaller chunks, you have a better chance of avoiding a last-minute marathon session to meet the filing deadline.

- Educate yourself as soon as possible about what you can and cant deduct from your taxes. It pays to know everything you can about how taxes impact your situation in order to maximize your tax return.

Runner Up: Turbotax Premium

Why: TurboTax offers similar functionality as H& R Block. It integrates with tons of brokerages which makes tax filing easy. The point and click interface offers superior usability compared to H& R Block’s interface. However, the enhanced usability fails to justify the higher price tag. Most users will save money by using H& R Block Premium.

Also Check: How To File Taxes Without W2 Or Paystub

Best For Simple Returns: H& r Block Free Edition

NerdWallet Take: When it comes to tax prep software that can do simple returns at a reasonable price without sacrificing user-friendliness, we think H& R Block Free stands out from the crowd.

NerdWallet defines a simple return as one that has W-2 wages, limited income from interest or dividends and taking the standard deduction.

With H& R Block Free edition you can prepare a federal and state return, and file them for free.

How Do I Claim My Economic Impact Payment On My Tax Return

If you did not receive your third Economic Impact Payments , you could claim it on your 2021 tax return through the Recovery Rebate Credit. The credit will either increase your tax refund or reduce the amount you owe .

To determine your claim amount, refer to your Letter 6475, Your Third Economic Impact Payment, including the stimulus payments received. The notices went out by mail in early 2022.

Don’t Miss: Do Teenagers Have To File Taxes

Filing And Disbursement Options

Filing your small businesss taxes can sometimes require multiple forms, depending on the type of income you received over the year. Its imperative, then, that any tax software program you choose supports the types of forms you need to file. Many tax software solutions list the forms they support on their websites.

You should also consider state taxes, which must be filed at the same time as your federal taxes. Make sure the vendor you select helps you file taxes in your state, but keep in mind that this will likely cost extra.

When Should I Pay Extra To Get Live Assistance From Online Tax Software

The beauty of well-designed tax software is that most filers won’t need to pay extra for expert help. All of the answers you need should only be a few clicks away, and if you need technical assistance , support should be easily accessible.

If you find yourself constantly wanting to speak with a human tax expert or if you know your tax situation is complicated, you may be better off selecting tax software with tax expert support or simply hiring a CPA, or certified public accountant, on your own.

Don’t Miss: When Are Self Employment Taxes Due

Tax Preparer Vs Tax Software For Small Business

If you are overwhelmed by the idea of doing your own taxes or dont feel confident using computers, you definitely dont have to do your taxes yourself. In those cases, you can hire a professional tax preparer, often a CPA, to do your taxes for you.

Tax professionals often have a detailed understanding of tax laws and can offer money-saving advice. However, behind the scenes, accountants use similar tax software to what you use when doing it yourself, so you certainly dont have to pay extra for a professional preparer.

Good For Complex Returns: Turbotax Premier Or Turbotax Self

NerdWallet Take: TurboTax is generally pricier than everything else out there but while confident filers may not need all the bells and whistles its software offers, many people especially with complex tax situations will find the experience worth a few extra bucks.

TurboTax Premiere is for someone with various investments and/or rental income.

TurboTax Self-Employed has everything the Premiere package does and it supports extra deductions for freelancers and independent contractors, as well as someone who has a home office. It includes a one-year subscription to QuickBooks Self-Employed.

TurboTax Live, a paid service, gives you unlimited live tax advice via video chat. You can also have a CPA or enrolled agent review your return before you file. If you want, they will sign the return and e-file it for you. Live also includes a years worth of tax advice.

Read Also: Can I Do My Taxes Myself

Best Tax Software For Tax Preparers

Identify the best Tax Software per your requirements based on the comparison and features of top Tax Preparation Software listed here:

Worried about how to file your taxes? Here we have come up with solutions for you!

Many people find it difficult to calculate taxes on their own. If you do not pay taxes deliberately or do not pay the accurate amount, you can face a penalty of thousands of dollars or even imprisonment.

Taxable income is calculated by calculating your total household income and then doing some deductions from it, for example, your contributions to your 401, etc.

Most of the time, you will need an expert who knows how to maximize the deductions for taxes so that you can save as much money as possible. Plus, he/she will also guide you on how to do tax planning, for instance, marital status, number of dependents, and many other factors that influence the net amount of tax that you need to pay.

Thus, there is tax preparation software out there. You can use them either to file your own taxes or for your clients. They help in calculating taxes accurately while saving much of your time.

What You Will Learn:

H& r Block: Best Overall

| Pros | |

|---|---|

|

On-demand, unlimited help from a tax professional Can import business income and expenses directly from apps like Uber and Wave Import data from W-2s and 1099s by taking a photo on your phone |

DIY options only available for sole proprietors, not corporations or partnerships H& R Block tax professionals arent necessarily CPAs or Enrolled Agents Difficult to import data if you do your small business bookkeeping in QuickBooks |

Also Check: Where Do You Pay Taxes

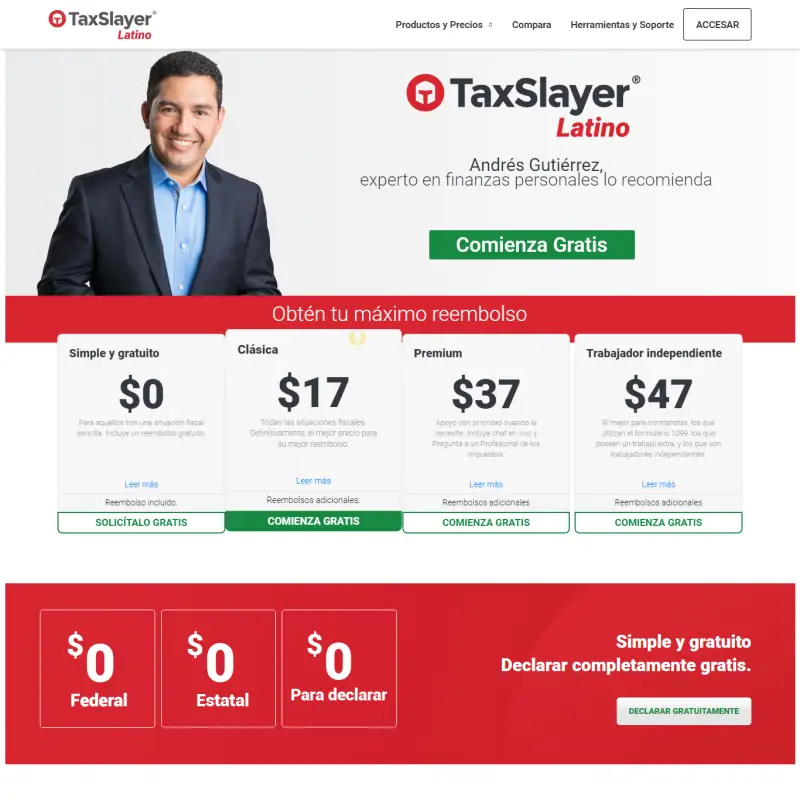

How To Find Free Tax Filing Software

If you have any experience trying to file your personal taxes for free, you likely had a hard time finding a service that was actually free. It may seem like that kind of free service obfuscation was by design, and youd be right. Lobbying groups have spent decades making it harder for the average person or small business owner to file their taxes. Even though the IRS announced its own free tax filing solution earlier this year, that doesnt mean that it will make it easier to file your taxes for free with the tax software companies.

Key among these issues is that most major tax software companies hide their actual free services behind some web design and advertising smoke and mirrors. When looking for a companys free solution, be wary of any instance where youre upsold on basic filing functionality. Since these companies are required to have free filing functionality as part of their previous agreement with the U.S. government, here are three free file pages that you can use if you are eligible:

These are just some of the free pages available out there. If youre looking to use a free service, be sure that its free at the end of the process.

Key takeaway: Tax filing companies have long fought to keep the IRS from allowing taxpayers to file their taxes for free, but you can now file with the IRS directly.

What Is Tax Software

Tax software is a type of digital application designed to help you complete your legally required annual tax filings. For most people, that means completing a version of Form 1040 with supporting documentation.

With tax software, you can enter your tax details from your employer and other income sources as well as details related to tax credits and deductions. All tax software programs let you type in your details manually. However, some of the better apps allow you to import prior year returns, data from your employer, and other tax form details from a photo, PDF file, or digital link to your employer or financial institution.

When youre done filing your taxes through the software, you can generally choose between filing your taxes online or printing and mailing them, though online filing with eFile is the easiest option for most people.

Recommended Reading: How Do Tax Liens Work

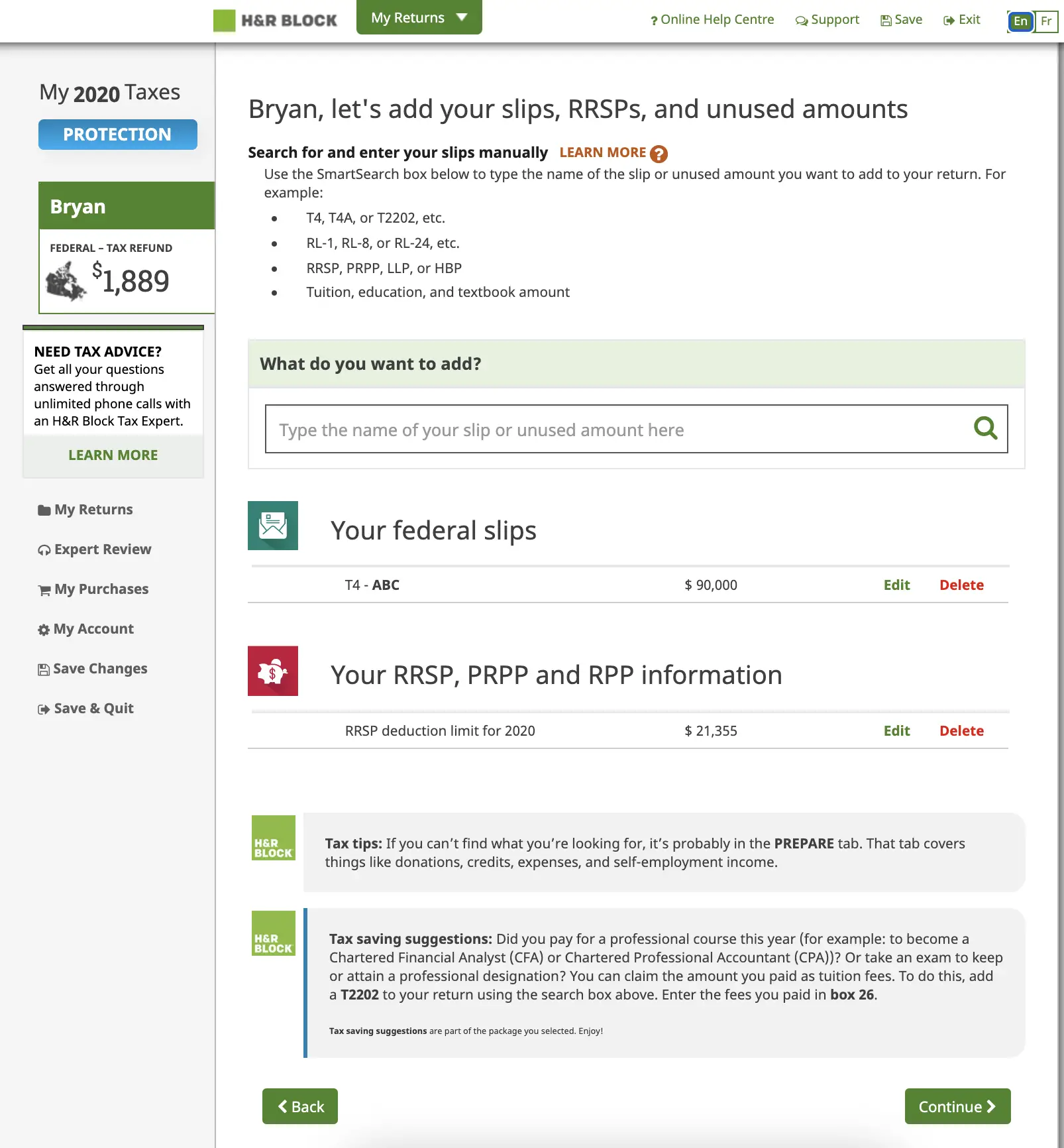

Best Overall: H& r Block Online

H& R Block

H& R Block Online covers most common taxpayer needs and many less-common scenarios, too. Users can reach a human tax professional for help during tax preparation for an added fee. Pricing is comparable with those of industry competitors, and the overall user experience is a good one, making it our best overall pick.

-

Coverage for a long list of tax forms and situations

-

Multiple options to upgrade for additional help

-

Helpful features including the option to upload W-2 forms from your phone without downloading an extra app

-

High filing cost per state

-

Add-on products increase tax prep costs

-

High added cost for multiple states

The best overall tax software for this year is H& R Block Online because it does a good job of covering nearly all tax situations U.S. filers are likely to come acrossand it does it for a reasonable price. More than 20 million people used H& R Block to file their taxes for the 2018 filing season.

H& R Block offers four versions of its online tax filing software. Those include a free online version for basic taxes as well as versions that cost $54.99, $74.99, or $114.99, though they may be available with a discount. These higher-priced versions are for added tax filing needs such as itemized deductions, investments, freelance earnings, or self-employment. State filings cost up to $44.99 extra per state. You dont pay until you file, so you can try it out and see your actual results before buying.

What Do You Really Get For Free

We compared the top free tax software to find out what each one offers and how they compare. Explore the details below to see whether one of these services could help you get your taxes done convenientlyand for free.

All software listed makes similar promises when it comes to accuracy and refunds, but it’s important to check the fine print to ensure that none of your personal details will end up triggering an unexpected charge.

For example, some services only offer free tax services for people whose income falls below a set limit. Others only offer one free year of filing, so you’ll have to pay more or switch to another service if you used it last year.

Keep an eye on any extra fees for state tax returns as well.

Many services also charge extra for more advanced tax services.

Also Check: When Are Federal Tax Payments Due

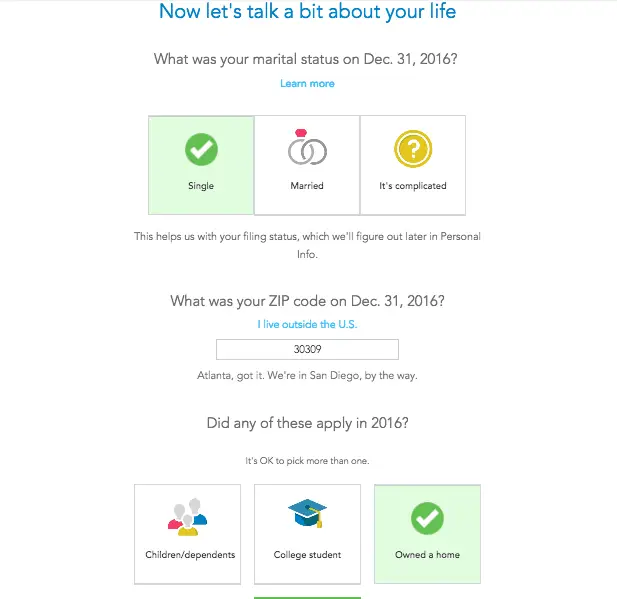

How Did We Choose The Best Tax Software

We realize that if you’re searching for the best tax software, you’re probably either willing to spend time filing your own return or you’re looking for a more affordable option than hiring a tax professional.

Several of the companies we reviewed offer full-service packages, where you can pay an expert to do your taxes for you. We didn’t consider these offerings in our evaluation because they’re comparable to hiring a CPA. But taxes can be confusing, and it’s valuable to have an expert on hand should you need help.

With that in mind, we considered five factors when reviewing each platform, as outlined below with their corresponding weights. Each of these factors was rated on a five-point scale. We then calculated the weighted average to determine an overall editor’s rating.

- Cost : Is there a free filing package? How does the cost of the paid packages compare to similar offerings from competitors?

- Value : Does the cost justify what you get? Can you get the same features elsewhere for a lower price?

- User experience : Is the platform easy to use? Can you seamlessly upload or import documents? Is the guidance clear and non-jargony?

- Expert help : Can you chat, email, or call a tax professional when you have questions? Is this feature included with the standard packages or does it cost extra?

- Support : Is there an accuracy guarantee or audit support? Is customer service reachable and helpful?