What Is The Best Free Tax Software In Canada

If youre filing taxes for the first time in Canada, the process might seem a little bit overwhelming. Do you file online? Can you file directly with the CRA ? Do you need to hire an accountant? What is the cheapest way to file your taxes? Luckily, the actual process is much simpler than it looks, and there are plenty of free tax filing options available to all Canadians.

How To Find Free Tax Filing Software

If you have any experience trying to file your personal taxes for free, you likely had a hard time finding a service that was actually free. It may seem like that kind of free service obfuscation was by design, and youd be right. Lobbying groups have spent decades making it harder for the average person or small business owner to file their taxes. Even though the IRS announced its own free tax filing solution earlier this year, that doesnt mean that it will make it easier to file your taxes for free with the tax software companies.

Key among these issues is that most major tax software companies hide their actual free services behind some web design and advertising smoke and mirrors. When looking for a companys free solution, be wary of any instance where youre upsold on basic filing functionality. Since these companies are required to have free filing functionality as part of their previous agreement with the U.S. government, here are three free file pages that you can use if you are eligible:

These are just some of the free pages available out there. If youre looking to use a free service, be sure that its free at the end of the process.

Key takeaway: Tax filing companies have long fought to keep the IRS from allowing taxpayers to file their taxes for free, but you can now file with the IRS directly.

Best Ecommerce Sales Tax Software For 2022

With COVID-19 restricting physical businesses, more companies are opting to sell their products online. This has led to an expansion of ecommerce divisions and an unprecedented number of transactions online.

But with the aspect of selling online also comes the complicated world of sales tax.

As an expanding ecommerce business, you just want to engage your customers and sell more products. The last thing you want in a COVID-affected economy is to rack your brains about sales tax laws and rates .

This is where ecommerce sales tax software comes into the picture.

These sales tax tools simplify the complications related to calculating sales tax and use tax rates, using the latest rules for different jurisdictions. Apart from that, they also help in filing returns, making a business audit-ready, and maintaining exemption certificates.

To help you in selecting your ecommerce sales tax tool, I have compiled a list of the best ecommerce sales tax software. I have outlined their different qualities, along with various aspects to consider.

So stop being your own accountant and use this cherry-picked list of tools that will take care of all your sales tax needs and help you focus on growing your business.

Don’t Miss: What Is The Best Program To Do Your Taxes

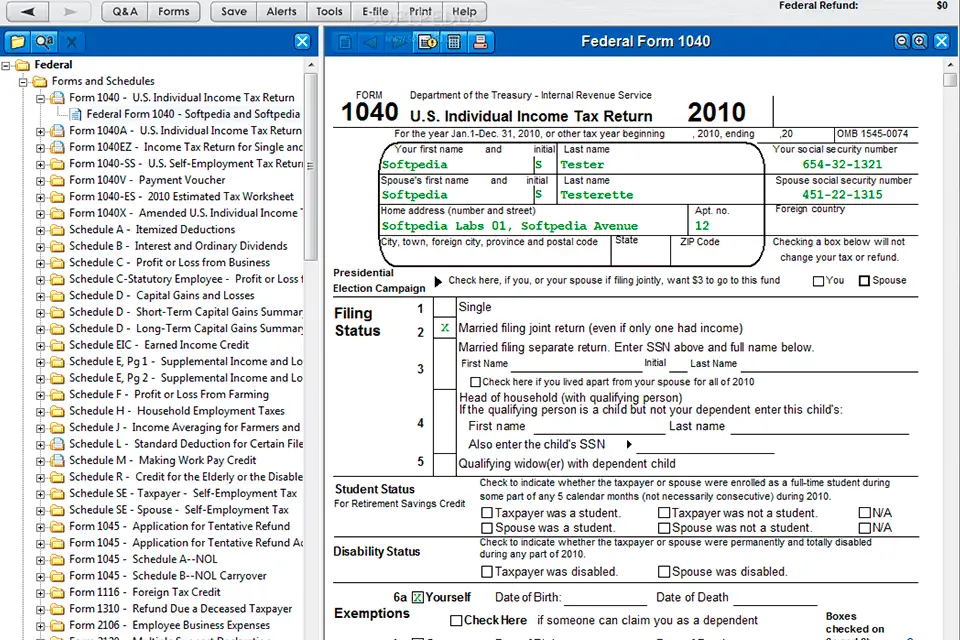

Taxact Comprehensive Filing System $25 To $65

Whats great about TaxAct is its well-curated bundles that target different classes of individuals: the homeowner, the investor and the self-employed .

Along with specialized options, TaxAct provides virtual live assistance from CPAs and other tax experts with the Xpert Assist add-on. And, in the event of a tax refund, you can even get reimbursed from TaxAct with its Refund Transfer option.

Thomson Reuters Onesource Best Tool For Sales Tax Policy Configuration

![7 Best Tax Software for Small Businesses in 2021 [Recommended] 7 Best Tax Software for Small Businesses in 2021 [Recommended]](https://www.taxestalk.net/wp-content/uploads/7-best-tax-software-for-small-businesses-in-2021-recommended.png)

Though it may sound like an old school news bureau, Thomas Reuters packs a massive punch in the world of ecommerce tax software. It uses the latest rules and rates to ascertain sales tax, use tax, VAT, and GST.

It makes managing sales and use tax a breeze, with GST and VAT compliance done in a streamlined way through one system.

The team also provides step by step sales tax guidance and answers, all in a single place.

Pricing for Thomas Reuters ONESOURCE is available upon request.

Pros

Read Also: What Can Be Written Off On Taxes

Best For T1 & T: Taxtron

TaxTron used to be GriffTax and is still the only fully functional user-friendly Canadian tax preparation software available in both individual and corporate versions for both the MacOS and Windows. All versions are quick, easy, and fully bilingual, using a step-by-step approach to guide you through the tax preparation and filing process.

-

Covers T1 and T2 returns

-

Fully compatible with MacOS or Windows

-

No import options

Whether you have a Mac or a Windows computer, you’ll be able to file your returns using TaxTron. T1 and T2 returns are available for both operating systems. Perhaps the biggest downside to this software is the inability to import data from other programs, so you’ll likely need to input everything manually.

Editions:

- TaxTron Individualâone return of any income and up to 19 additional returns with total income under $31,000 eachâ$12.99 for Windows, $19.99 for MacOS

- TaxTron FamilyâUp to five returns with total income > $31,000 each and up to 15 additional returns with total income under $31,000 eachâ$24.99 for Windows, $39.99 for MacOS

- TaxTron Corporateâfor corporate T2 â$99.99 for Windows or MacOS, free if you have a net loss for tax purposes

- Free web-based app for Canadian T2 tax returnsâthe company claims that “For CCPC companies with no income/expense/asset/liability during the year with single jurisdiction the web-application has facility to file a return in five minutes”

Import options: None

Import options: None

Need Expert Help Selecting The Right Ecommerce Solutions Software

Weve joined up with the software comparison platform Crozdesk.com to assist you in finding the right software. Crozdesks eCommerce Solutions Software advisors can create a personalized shortlist of software solutions with unbiased recommendations to help you identify the solutions that best suit your businesss needs. Through our partnership you get free access to their bespoke software selection advice, removing both time and hassle from the research process.

It only takes a minute to submit your requirements and they will give you a quick call at no cost or commitment. Based on your needs youll receive customized software shortlists listing the best-fitting solutions from their team of software advisors . They can even connect you with your selected vendor choices along with community negotiated discounts. To get started, please complete the form below:

Read Also: When’s The Last Day To File Taxes 2021

How Much Does It Cost To Hire A Cpa Is It Worth It

According to the 2020-21 Fees Practices Survey released by the National Society of Accountants, working with a CPA for your tax filing will cost $200 to $500, depending on the complexity of your return — how many schedules and extra forms need to be completed — and where you live. Each additional schedule, for things like rental income or investment gains, could cost around $100.

If you have self-employment income, itemized deductions, investments or other complicated tax situations, the extra cost is likely to be worth it. It can also be easier to send off your forms to an expert and know they’ll take care of everything. Remember that the extra amount you’re paying in fees could get you a better return, making the upfront cost a smart investment.

Keep in mind, however, that it depends a lot on your individual filing situation, your withholdings and your tax bracket. As good as many software programs are, a human expert is often the way to go.

Best Free Tax Software: Simpletax

Key Features

Cons

- Not available on Android devices

If youre looking for a completely free online tax return software, SimpleTax may just be for you. Much like TurboTax, SimpleTax offers a web version that can be used on Windows and Mac, as well as a mobile version that can be used on-the-go.

The main issue is, SimpleTax is available for iOS devices only, not Android. This is something that must be taken into consideration when choosing the right tax software for your personal needs.

Compared with the other free versions of tax return software we have tested, SimpleTax offers the most features, including partial auto-fill returns, free customer support and a convenient RRSP calculator.

Smart Search Box Included

In addition to these features, this free tax return software comes with a smart search box that makes adding things such as medical expenses and gifts to your return a quick and easy process.

When it comes to accuracy, we truly believe that SimpleTax is an online tax returning software that you can trust. If youre not convinced, SimpleTx comes with an 100% Awesome Guarantee, meaning that if they make a mistake and you end up paying a penalty or any extra interest, SmartTax will reimburse you.

While this tax return software is 100% free, you have the option to pay what you want after submitting your tax return to the CRA if you feel like supporting SimpleTax.

Also Check: Which State Has The Lowest Tax Rate

What Information Do I Refer To When Filing Taxes

Its important to have on hand all of the relevant income sources when filling out your tax return, including but not limited to W2 forms for wage income and any taxable benefits, interest income from sources like a savings account and self-employment income, Watson said.

If you have self-employment income, having a good understanding of your total gross income and expenses that can be deducted from that gross income helps ensure youre not overpaying or underpaying in taxes, too.

What Happens If You Miss The Deadline To File Taxes

The deadline to file your state and federal tax return is April 15, 2021, for nearly every individual and business in the country, though some exceptions exist. Its important to file your taxes on time. If you know that you wont be able to make the original deadline, you can always file for an extension, but only as a preemptive measure. If you are granted an extension, you will have until Oct. 15 to file.

If you fail to meet the deadline and owe the IRS money, you could be charged with a failure-to-file penalty. You can incur this penalty even if you pay taxes but fail to pay everything that you owe. According to the IRS, the penalty is usually 5% of the tax owed for each month, or part of a month that your federal return is late, up to a maximum of 25%. Once youre over 60 days late, the minimum penalty for a late filing is either $210 or 100% of the tax you owe, whichever is the smaller amount.

If you fail to pay your taxes on time, the IRS will charge a failure-to-pay penalty thats half of 1% of the unpaid taxes due. While that may not seem like much, that penalty compounds.

If you fail to file but are owed a refund from the government, the consequences become far less dire. The IRS does not levy any penalties against taxpayers who file late and are owed money from the IRS. Taxpayers have a three-year grace period to claim their tax refund, though if they miss that deadline, the money will go to the U.S. Treasury.

Read Also: What Happens When You Owe Back Taxes

Tax Reports With All The Information You Need

Crypto has its own tax forms. They vary from country to country, but there is some information that is consistently asked by tax authorities, including:

-

Dates of acquisition and sale of assets

-

Cost basis

-

Sales proceeds

-

Gains/losses on each crypto trade

Additionally, you may need to split your gains/losses into long-term and short-term due to the difference in tax rates.

The tax reports you generate on a crypto tax tool should have all this information.

Depending on your country, your crypto tax tool can generate reports with pre-filled information in the forms you need.

Which Tax Software Gives The Most Refund

Using the right tax software can help ensure you get the most refund possible. TaxSlayer, Credit Karma, and Jackson Hewitt all offer a range of features to help you easily and accurately file your taxes so you can get the most out of your return. When it comes to getting the biggest refund, its important to consider the base price, free version, and mobile app offered by each software.

Based on features such as free filing options for simple returns, customer support available year-round, and easy navigation and user-friendly design, TurboTax is the best tax software for getting the biggest refund. With the best reviews and range of services, TurboTax can help ensure you get the most out of your tax return. So if youre looking for the best refund, be sure to try it out today!

Don’t Miss: Are Uber Rides Tax Deductible

Proconnect Tax Online: Best Tax Software For Quickbooks Online Proadvisors

If youre an avid user of QuickBooks Online, youre probably going to like ProConnect Tax Online. ProConnect Tax Online is designed specifically to serve the tax preparation function for firms centered on QuickBooks Online Accountant. The programs integrate very tightly and can be managed from a single dashboard inside QuickBooks Online Accountant. ProConnect Tax is priced on a pay-per-return basis with no annual fee. QuickBooks Online ProAdvisors can try ProConnect for free and not pay until the return is filed.

Best Tax Software For Small Business Owners

Small business owners have a lot to think about when it comes to their tax returns. Beyond just entering income and expenses, there are considerations around business structure, asset depreciation, individual retirement plans, and more.

While many small business owners would likely benefit from an accountant, those that want to DIY it need to have software that is up for the challenge.

Read Also: Is The Child Tax Credit Free Money

Taxact Free Federal Edition

This is one of the best free best tax software for taxpayers although it does not match the advancements on offer at H& R Block and TurboTax. However, TaxAct covers all basic requirements for successful tax filing. It does well in customer service by offering tax guides, free email support, and other resources to make things easier for users and help them file their taxes without complications.

Pros:

- Its paid version is cheaper than its competitors.

- Its free version is not limited to first-time filers or simple returns.

Cons:

Top Tax Software For Accountants

This list of the best tax software of 2022 for accounting professionals was compiled from multiple sources, including ZDNet and PC Mag. Programs with repeated mentions in reputable technology and accounting publications received consideration.

The three recommendations included here earned top scores from multiple professional reviewers. Their order was determined by a qualitative analysis balancing the availability of advanced features with user friendliness and affordability.

Don’t Miss: How Much Is Sales Tax In Arkansas

The Cons Of Turbotax:

- Free version does not include itemized deductions

- Free version does not include deductions for students or student-loan borrowers

- Frequent offers to upgrade

The bottom line:TurboTax is ideal for filers who want to itemize personal or business deductions, or have gig economy income. You’ll find everything you need, but it won’t be cheap. The platform offers unique features, including seamless data import from QuickBooks, Square, and various rideshare platforms.

Should You Use Tax Software

While there are some interesting new features in this years crop of programs, there werent any breakthroughs that led us to change our overall impressions from last years tests. And after testing each of these programs, Ive realized that doing my complex taxes myself isnt for me and I still prefer a professional. But for simpler returns, using a tax program is definitely a cost-effective option.

Fortunately, if you start your tax return directly at any of the four tax program websites, you dont have to pay upfront you only pay at the end of the process when you file. So, if you end up going through your taxes and realize that doing it yourself is not for you, theres no money lost. Or if you start with one tax program and arent happy with the way its going, you can always try another one to see if it works better for your particular tax scenario.

Recommended Reading: What Taxes Does Texas Have

Tax Software Makes It Easy

Tax software can help you track your expenses throughout the year, so reporting is easy when tax season rolls around. You might be surprised to learn just how many deductions and write-offs you’re eligible for. You could even deduct a portion of your mortgage, utility bills or even vehicle payments .

If youre self-employed, Benzinga is here to support your financial goalswhether youre looking to grow your business or just make it through this tax season. We offer a wealth of resources to help you. Check out our guide to saving for retirement when self-employed to get started.

Runner Up: H& r Block Virtual

Why? Upload your tax documents to H& R Block through a secure online portal, and a CPA or Enrolled Agent will handle the filing from there. The software will even provide an estimated time until completion when you select your tax professional. You may need to answer a few questions via phone or email, but the process is simple compared with filing yourself.

Read Also: Is Medicare Part B Premium Tax Deductible

About William Mcconnaughy Cpa

When it comes to revenue, what you make is one thing, what you keep is another. Make sure you never pay more in taxes than you have to with comprehensive tax preparation services from William McConnaughy, CPA.

We get taxes, and are highly experienced and know the tax code, inside and out. Theres no tax deduction, break, or incentive that will escape our notice no matter how small because, to us, every dollar counts. You can rely on us for the best service possible as we make it our personal goal to minimize taxes for every client from individuals to businesses.

Call our Sacramento, CA CPA firm now at 916-979-7645 to find out how we can decrease your tax obligations. We offer a to new clients so contact us today.