How Does The Child Tax Credit Work

For tax year 2022, the child tax credit starts phasing out for families with a modified adjusted gross income above $200,000 for single filers .

For a comparison, the expanded child tax credit began to phase out at a MAGI of $75,000 for single filers .

In 2022, qualifying families will no longer get advanced credit payments. This means that those taxpayers will get the credit when they file that return in 2023.

For the expanded child tax credit, the Internal Revenue Service began sending monthly payments on the 15th of every month . Half of the credit amount was paid in advance installments and the other half could be claimed by families on their 2022 tax returns.

As a reminder, tax credits directly reduce the amount you owe the IRS. So, if your tax bill is $3,000 but youre eligible for $1,000 in tax credits, your bill is now $2,000. This differs from a tax deduction, which reduces how much of your income is subject to income tax.

Who Is Eligible For A Third Stimulus Check

Some people may or may not be eligible for receiving a stimulus check. Among people that can expect this check include:

- Individuals with an $80,000 AGI or less

- Head of household with a $120,000 AGI or less

- Couples filing jointly with a $150,000 AGI or less

- Dependents of every age, if the guardian qualifies

- Families with mixed US citizenship

- US citizens who live abroad

- Citizens living on US territories

- Incarcerated people

- Non-citizens that pay taxes

Most people living in the US can indeed be expected to receive a stimulus check, provided they have US citizenship, have a visa, or at least pay U.S. taxes. With that in mind, certain categories are disqualified from receiving a stimulus check and this will precisely help you determine whether you are eligible for receiving it as well or not.

Eligibility is based on your adjusted gross income, and the amount of money that you receive will be calculated on the same basis.

Recommended Reading: Didnt Get Any Stimulus Checks

Wheres My Stimulus Check

There is, however, at least one benefit related to this thats already guaranteed for 2022.

If you add up all six child tax credit check amounts you got last year? You should have also gotten a tax credit for that same amount this year when you filed your federal taxes. That will represent the second half of your child tax credit. And, for now, that will be the end of the enhanced credit.

Theres always a chance the Senate could revisit the legislation supporting an extension of these checks. For the moment, though, that possibility seems highly unlikely.

Recommended Reading: Is Property Tax Paid Monthly

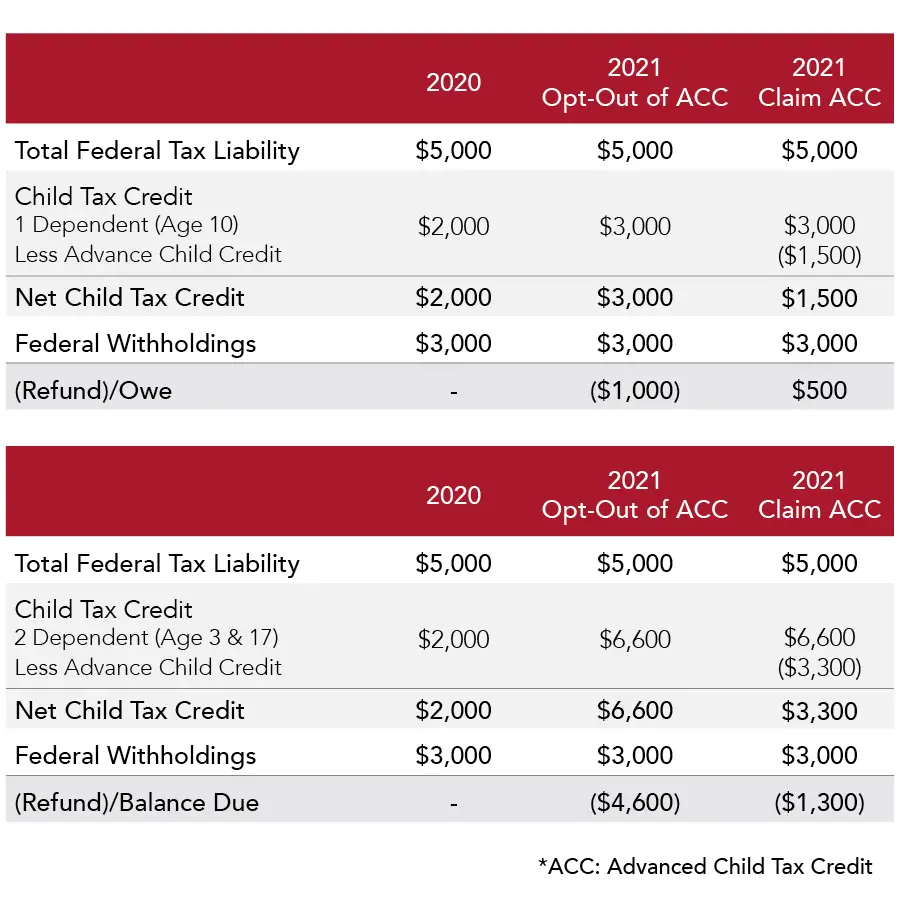

Stimulus Impact On The Child Tax Credit And On The Additional Child Tax Credit For 2021

Advance Child Tax Credit Payments

The expanded and newly-advanceable Child Tax Credit was authorized by the American Rescue Plan Act, enacted in March of 2021. Most families do not need to do anything to get their advance payment. Normally, the IRS will calculate the payment amount based on your 2020 tax return. Eligible families will receive advance payments, either by direct deposit or check.

These payments are an advance of your 2021 Child Tax Credit. The amount that you receive will be reconciled to the amount that you are eligible for when you prepare your 2021 tax return in 2022. Most families will receive about one-half of their tax credit through the advance payments. If you receive too little, you will be due an additional amount on your tax return. In the unlikely event that you receive too much, you might have to pay the excess back, depending on your income level.

Child Tax Credit Changes

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to $3,600 for qualifying children under the age of 6 and to $3,000 per child for qualifying children ages 6 through 17. Before 2021, the credit was worth up to $2,000 per eligible child, and 17 year-olds were not eligible for the credit.

In addition, the entire credit is fully refundable for 2021. This means that eligible families can get it, even if they owe no federal income tax.

For updates and more information, please visit our 2021 Child Tax Credit blog post.

How Much Is The Child Tax Credit For 2022 2023

The Child Tax Credit under the American Rescue Plan rose from $2,000 to $3,000 for every qualified child over the age of six, and from $2,000 to $3,600 for each qualifying child under the age of six, beginning in tax year 2021 .

Families with 17-year-old children will be eligible to claim the Child Tax Credit for the first time under the new rule. If your income is less than $150,000 for married couples filing jointly, $75,000 for singles, or $112,500 if you are the head of household, you will be eligible for the entire credit.

Families that earn more than the modified adjusted gross income listed above and are not qualified for the extended $3,000 or $3,600 credit may still be able to claim the Child Tax Credit for each qualifying child under 17 up to $2,000 under the current tax policy.

Individuals earning up to $200,000 or married couples filing jointly earning up to $400,000. may still take advantage of this credit amount.

Don’t Miss: Do I Charge Sales Tax On Services

Who Qualifies For A Stimulus Check And How Much Will I Receive

According to the IRS, approximately 80% of Americans will be eligible to receive full or partial stimulus payments through the CARES Act. If you have an adjusted gross income of up to $75,000 , you should be eligible for the full amount of the recovery rebate.

For tax filers with income above these amounts, the stimulus payment decreases by $5 for each $100 above the thresholds. The stimulus check rebate completely phases out at $99,000 for single taxpayers, $136,500 for those filing as Head of Household and $198,000 for joint filers with no kids. Your eligibility will be based on information from your most recent tax filings .

Use our Stimulus Check Calculator to see if you qualify and how much you can expect.

Also Check: Direct Express Pending Deposit Stimulus Check

What Is The Child Tax Credit And How Do You Qualify In 2020

Some of America’s most effective social support policies work through the tax code. Programs like the Earned Income Tax Credit and the mortgage interest deduction have made life easier for millions of taxpayers, while the polite fiction of the payroll tax helped ensure political survival of Social Security and Medicare.

Among those success stories is the child tax credit, a policy that helps families with the costs of raising children.

And those costs are not small. According to the Department of Agriculture the average American family will pay more than a quarter of a million dollars raising a single child to age 18, a price tag that does not include college tuition. Finding child care and juggling employment can add even more to this number, putting a traditional family further and further out of reach for precisely the same young adult population already struggling with weak job opportunities and historic debt due to student loans.

A simple tax credit can’t fix all of the problems of the cost of college and rising rents. But it can help at least a little bit. Here’s how it works.

Read Also: How Much Will I Get Taxed

The 2020 Earned Income Tax Credit

The Earned Income Tax Credit, or EITC, is one of the few fully refundable tax credits in the United States Tax Code. Designed to reduce the financial burden on lower-income workers, particularly those with children, the EITC can be worth thousands of dollars for larger families of modest incomes.

As the name implies, the EITC is only available to taxpayers who have earned income for the year which means income from a job or self-employment activities. And families can have no more than $3,650 in investment income, or they’re ineligible for the EITC.

For the 2020 tax year, here’s a quick guide to the maximum AGI to be eligible for the credit, as well as the maximum credit that families of various sizes could qualify for:

|

Number of Qualifying Children |

AGI Limit: Married Filing Jointly |

AGI Limit: Single or Head of Household |

Maximum EITC for 2020 Tax Year |

|---|---|---|---|

Data source: IRS.

Is There A Maximum Number Of Checks A Household Can Receive

All dependents are now eligible for stimulus payments in the third round. The payment should include all eligible dependents and will be paid in one lump sum to whoever claims them, according to Tucker.

There is no limit defined in the law, however normal IRS checks and balances probably will trigger a second look with a tax return with 10 family members but certainly is legal, says Steber. Remember, any individual who is a taxpayers dependent will not get their own check, instead they should be on the parent return giving the parent the additional money.

Previously, if you had a child over the age of 16 or had an adult dependent, they didnt receive a stimulus. The payments would amount to $1,400 for each dependent child. Eligible families will get a $1,400 payment per qualifying dependent claimed on their tax return, including college students, adults with disabilities, parents and grandparents.

You May Like: Someone Stole My Stimulus Check

Recommended Reading: How To File Federal Taxes Electronically

Coronavirus Relief For Small Businesses Under The Cares Act

Shutting down nonessential businesses may have been necessary to slow the coronavirus, but its nonetheless leaving staggering economic hardship in its wake. Recognizing the impending financial crisis, especially to small businesses, Congress passed two important bills to provide economic relief. The first was the CARES Act in March 2020. The second was the Paycheck Protection Program and Health Care Enhancement Act on April 21.

When Will I Start Receiving My Monthly Payments

People who receive payments by direct deposit got their first payment on July 15, 2021. After that, payments continue to go out on the 15th of every month. If you havent provided the IRS with your bank account information on a recent tax return, a check will be sent out to you around the same time to the address the IRS has for you.

Recommended Reading: Which State Has The Lowest Income Tax

Additional Child Tax Credit For 2022

Understanding the Additional Child Tax Credit begins with the standard Child Tax Credit .

The Child Tax Credit is worth up to $2,000 for each child who meets the following requirements:

- The child is younger than age 17 at the end of the tax year.

- The child is your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, grandchild, niece, or nephew.

- You claim the child as a dependent.

- The child doesnt provide more than half of their own support.

- The child lived with you for more than half of the year.

- The child is a U.S. citizen, U.S. national, or U.S. resident alien.

- The child doesnt file a joint return with anyone else, unless the only reason they file a return is to claim a refund of taxes withheld or estimated taxes paid.

Like other tax credits, the Child Tax Credit is a dollar-for-dollar reduction in your tax.

If your available Child Tax Credit is greater than your tax liability, the Child Tax Credit can only reduce your tax bill to zero you dont get any unused portion of the credit back as a refund.

However, you may be able to claim the Additional Child Tax Credit, which allows you to receive up to $1,400 of the $2,000 Child Tax Credit per child as a refund. This means you get a check for the remaining Child Tax Credit after your tax bill is reduced to zero.

Dont Miss: Whats The Deadline For Taxes

Worksheet For Calculating How Much Child Tax Credit You Can Claim

The IRS provides a Child Tax Credit worksheet to help calculate the amount of credit available to take on your tax return. This worksheet and additional information about the Child Tax Credit can be found in IRS Publication 972.

The calculation for this credit can also be done free of charge,using online software.

- Based on the six tests mentioned above, you must determine how many qualifying children you can claim.

- Multiply the number of dependent children you can claim by $3,600 (maximum amount of the Child Tax Credit.

- Determine your modified adjusted gross income . This amount can be found on Form 1040, line 38 Form 1040A, line 22 or Form 1040NR, line 37.

- Subtract your MAGI by the following amounts below depending on your filing status:

- Single, head of household, or qualifying widow: $200,000

Example:

A single taxpayer with 2 qualifying children and modified adjusted gross income of $80,000 can claim a Child Tax Credit of $1,750.

Step 1: Number of Children x $2,000 Maximum Credit.

2 Children x $2,000 = $4,000

Step 2: Determine the modified adjusted gross income calculated on your Form 1040.

MAGI = $80,000

Step 3: Subtract the MAGI based on your filing status by the limitation mentioned above. If your MAGI is less than the limitation, you are eligible for the full credit of $2,000.

$80,000 $75,000 = $5,000.

5 x $50 = $250.

Recommended Reading: How To Get Your Property Taxes Lowered In Texas

State Stimulus Checks In 2022

Although the federal government isnt sending out stimulus checks this year, some states are sending similar tax rebate payments in 2022. These state stimulus checks are designed to help residents battle rising inflation and deal with other economic difficulties. Funding for the state payments typically comes from a budget surplus or federal COVID-relief aid. To see if your state is sending a rebate this year, see State Stimulus Checks in 2022.

How To Qualify For The Child Tax Credit

To qualify for the tax credit, your child must meet the following requirements:

- You must have claimed them as a dependent.

- They must be your child or you must be their legal guardian. Note that related children such as siblings and cousins will qualify for this credit as long as you are their guardian and claiming them as a dependent on your taxes.

- They must have been 16 years old or younger at the end of the tax year in question.

- They must have lived with you or in your care for at least half the year and must have provided no more than half of their own financial support during this time.

- They must be a legal U.S. citizen, national or resident.

- They must have had a Social Security number in the year for which they are being claimed.

Recommended Reading: When Do People Get Tax Returns

Will I Keep Getting The Expanded Credit Amounts And The Advance Payments Next Year

The American Rescue Plan enacted these historic changes to the Child Tax Credit for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit for years and years to come. President Biden proposes that in his Build Back Better agenda.

Who Is Eligible For The Child Tax Credit

There are eligibility requirements for the taxpayer and the dependent. The taxpayer must meet certain relationship requirements with the dependent, and the taxpayer’s income may limit their ability to claim the Child Tax Credit. The taxpayer must have a social security number, and only one taxpayer may claim the Child Tax Credit for any single dependent .

It’s often more difficult to meet the requirements for the qualifying child. The individual must be under the age of 18 at the end of the year, provide no more than half of their own financial support, and have lived with the taxpayer for at least half of the year. The qualifying child must be the taxpayer’s son, daughter, stepchild, brother, sister, stepsibling, half-sibling, or a descendant of any of these.

Don’t Miss: When Are Taxes To Be Filed

There Are Other Tax Credits

To be clear, this is not intended to be a full list of every tax deduction available in the United States, just an in-depth look at eight of the most common. There are other tax credits that might apply to you, such as:

- The Foreign Tax Credit, if you paid any taxes to a foreign government.

- The Residential Energy Efficient Property Credit

- The Plug-In Electric-Drive Motor Vehicle Credit

Social Security Numbers And Individual Taxpayer Identification Numbers

You and your spouse, if married and filing a joint return must have either a Social Security Number or an Individual Taxpayer Identification Number issued by the Internal Revenue Service to be eligible to claim the Child Tax Credit.

In order for you to qualify for the Child Tax Credit, your child must have an SSN that is valid for employment. An SSN is valid for employment if your child is able to legally work in the United States, even if they are currently too young to work or do not work.

If your childs Social Security card has the words NOT VALID FOR EMPLOYMENT on it then you cannot claim the Child Tax Credit for them. If those words do not appear on your childs Social Security card, and their immigration status hasnt changed since it was issued, then your childs SSN is valid for employment.

If your child is not a qualifying child for the Child Tax Credit, you may be able to claim the $500 Credit for Other Dependents for that child when you file 2021 your tax return. For more information about the Credit for Other Dependents, see the Instructions for Schedule 8812 .

Read Also: What Property Tax Exemptions Are Available In Texas

You May Like: How To Pay Social Security Tax