Sole Proprietorship Taxes In Florida

For small businesses in Florida, sole proprietorships are perhaps the easiest business entity to form. This business entity has the owner operate their own business.

As a result, sole proprietors must file federal income tax. However, their income is individual income, not one based on their business. The sole proprietor will then pay taxes based on an individuals tax rate.

Since a sole proprietorship isnt a corporation, a sole proprietor also wont have to pay state taxes.

Florida To Have Sales Tax Holiday For Admissions To Outdoor Activities From Thursday July 1 2021 To Wednesday July 7 2021

During this sales tax holiday period, admissions to music events, sporting events, cultural events, specified performances, movies, museums, state parks, and fitness facilities are exempt from sales tax. Also exempt from sales tax during this holiday period are qualifying boating and water activity supplies, camping supplies, fishing supplies, general outdoor supplies, and sports equipment. The sales tax holiday does not apply to the rental or repair of any of the qualifying items listed below, and sales in a theme park, entertainment complex, public lodging establishment, or airport. For more information, please see Florida Tax Information Publication #21A01-05.

May 26, 2021

Corporate Tax In The United States

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% due to the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return.

Some corporate transactions are not taxable. These include most formations and some types of mergers, acquisitions, and liquidations. Shareholders of a corporation are taxed on dividends distributed by the corporation. Corporations may be subject to foreign income taxes, and may be granted a foreign tax credit for such taxes. Shareholders of most corporations are not taxed directly on corporate income, but must pay tax on dividends paid by the corporation. However, shareholders of S corporations and mutual funds are taxed currently on corporate income, and do not pay tax on dividends.

You May Like: Is Door Dash 1099

Nexus Tax Bill Passed 18

On Thursday, March 4th, the Floridas Senate Bill 50 was unanimously passed by the Committee on Appropriations and is expected to move to the full Senate floor for consideration in regards to marketplace facilitators and remote sellers in Florida. The bill introduces the new requirement of remote sellers to register with the department and begin to collect and remit tax if, during the 2020 calendar year, they have had $100,000 or more in sales into the state of Florida. If the bill is enacted, the requirement will take effect July 1, 2021.

The bill includes amendments to include tax, interest, and penalty relief for Florida customers, marketplaces and dealers from outside of Florida before the effective date of the bill unless under audit or a tax bill has been received. State provisions allowing the Florida tax department to waive local options surtax for purchases of items by residents in other states that are transported into Florida would remain the same. If the bill is passed, marketplace facilitators will also be required to start collecting and remitting other state taxes such as the emergency 911 fee, waste tire fee, and lead-acid battery fee effective April 1, 2022.

After the Wayfair decision, Florida is currently one of two remaining states that have not adopted requirements for remote sellers to collect and remit sales and use taxes. Florida is also one of three states that currently do not have marketplace facilitator laws in effect.

What Is The Small Business Tax Rate

The small business tax rate for the 2019 tax year is a flat 21% for a C-corporation and will remain so for the 2020 tax year. On average, the effective small business tax rate is 19.8%. However, businesses pay different amounts in taxes based on their entities. Generally, sole proprietorships pay a 13.3% tax rate, small partnerships pay a 23.6% tax rate, and small S-corporations face a 26.9% tax rate.

Taxes are complicated, and many small business owners struggle to understand how their tax liability is determined. Many business owners dont know the corporate income tax rate, what tax cuts they are eligible for, or what terms like pass-through income even mean. Plus, in addition to income taxes, businesses also have to pay payroll taxes, unemployment taxes, and other kinds of taxes.

To make things even more complex, small business tax rates, deductions, and applicable laws can change from year to year, meaning you have to stay up to date on these changes to ensure youre meeting your tax obligations completely and accurately.

While understanding how small business taxes are calculated and applied can seem overwhelming to any business owner, learning some basics can help you make the right decisions and work with your tax professional. This guide breaks down the types of taxes your company may be subject to, as well as the different small business tax rates applied to your earningsâplus, it also includes updates to tax laws that may affect your business.

Don’t Miss: Taxes Taken Out Of Paycheck Mn

Florida Issues Sales Tax Update For Transient Accommodations

The Florida Department of Revenue has issued an updated version of its brochure on the collection of sales and use tax on transient accommodations. The document explains: which types of rental accommodations are subject to tax and which are exempt how to register to collect sales tax who must register to collect sales tax the taxation of trailer camps, recreational vehicle and mobile home parks and filing, reporting and remitting procedures. For specific information, please see GT-800034: Sales and Use Tax on Rental of Living or Sleeping Accommodations, Fla. Dept. of Rev., 05/01/2021.

How High Is Corporate Income Tax Rate In Your State

Florida’s corporate tax rate of 5.5 percent is very comparable to rates in other states. The state of Arkansas charges corporation tax on income that exceeds $100,000. They take 5.4 percent on the first $100,000 and 6.5 percent on anything over $100,000.

The tax rate in Arkansas also involves a large surtax though, which can increase corporate tax to a much larger 8.25 percent. Surtax is applied only to corporations that earn $100 million or more.

Other states, including Washington, do not charge corporate tax on income, but have a different system, known as “gross receipts tax”. Some states have gross receipts tax, which is charged on top of corporate income tax.

Taxes vary from state to state, of course, and businesses across the country will find themselves subject to different taxes. In Florida, with a flat rate of corporate income tax, it’s easy to calculate and then file your corporate returns.

If you need help with your Florida Corporate Tax, you can post your legal need on UpCounsel’s marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved

You May Like: Form 5498 H& r Block

% Personal Income Tax

Florida residents enjoy a 0% tax burden when it comes to state income tax. This means that even Social Security retirement benefits, pension income and income from an IRA or a 401 are all untaxed at the state level. While residents still pay federal income tax, the relief from these state-level taxes offers more opportunities for investment.

How Do Corporation Taxes Work

A corporation, or C Corp, is a type of business structure where owners enjoy limited liability protection. Corporations are separate legal entities, meaning they are separate from their owners. Owners are not responsible for their corporations actions and debts .

But because corporations are separate legal entities, they are subject to double taxation. The company itself pays taxes on its earnings and the owner also pays taxes. In other business structures , taxes pass through to the owner so they only pay taxes on earnings once.

If you own a corporation, report its profits and losses on Form 1120, U.S. Corporation Income Tax Return. And, report your personal income on your individual tax return.

Corporations are generally taxed at both the federal and state level. When a corporation pays taxes on its taxable income, it must pay at a rate set by both the federal and state levels.

So if you structure as a corporation, you need to know the corporation tax rates.

Recommended Reading: How To Calculate Mileage For Doordash

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

What Kind Of Tax Will You Owe On Florida Business Income

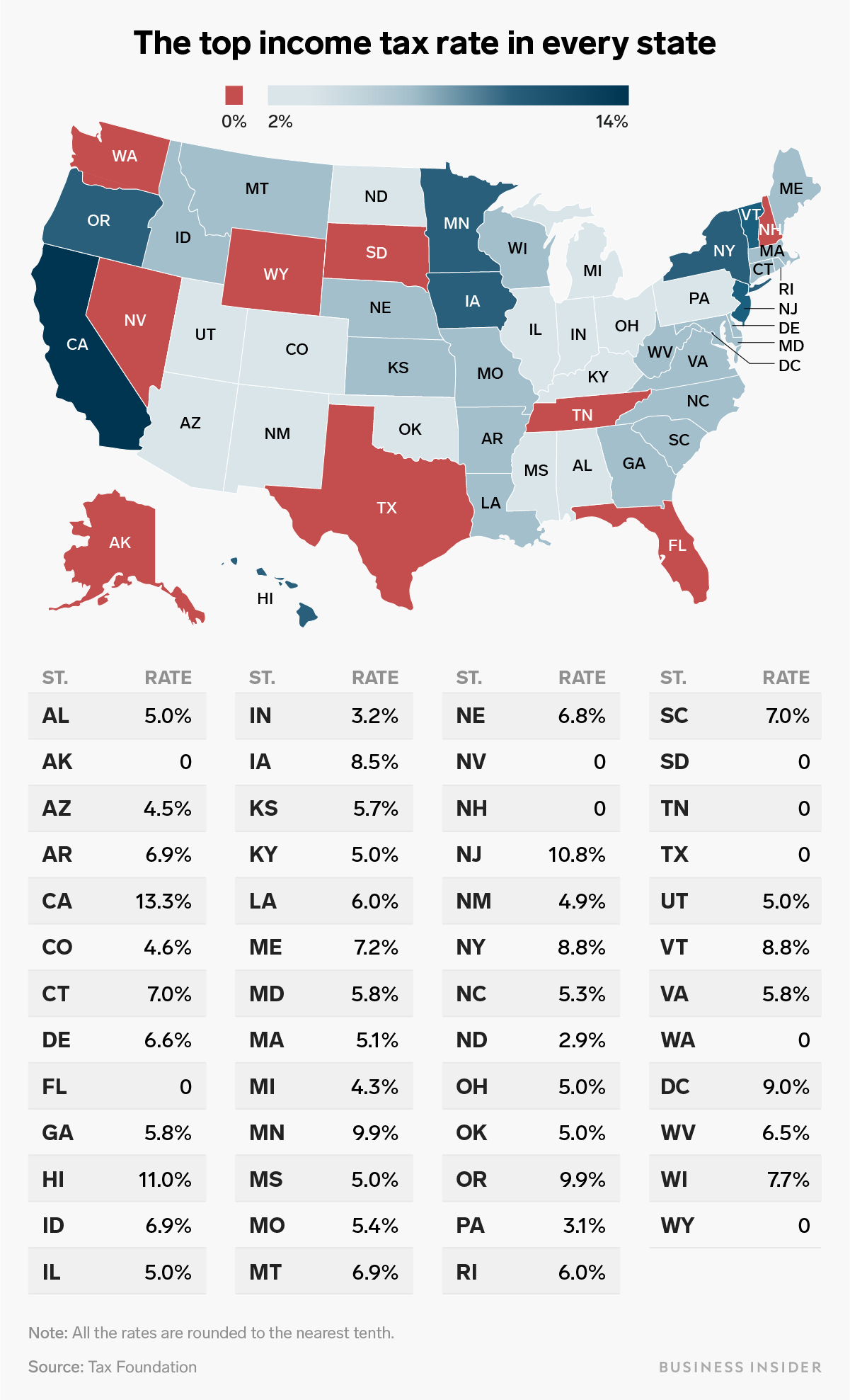

Most states tax at least some types of business income derived from the state. As a rule, the details of how income from a specific business is taxed depend in part on the business’s legal form. In most states corporations are subject to a corporate income tax, while income from pass-through entities such as S corporations, limited liability companies , partnerships, and sole proprietorships is subject to a state’s tax on personal income. Tax rates for both corporate income and personal income vary widely among states. Corporate rates, which most often are flat regardless of the amount of income, generally range from roughly 4% to 10%. Personal rates, which generally vary depending on the amount of income, can range from 0% to around 9% or more in some states.

Currently, six states Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming do not have a corporate income tax. However, four of those states Nevada, Ohio, Texas, and Washington do have some form of gross receipts tax on corporations. Moreover, five of those states Nevada, South Dakota, Texas, Washington, and Wyoming as well as Alaska and Florida currently have no personal income tax. Individuals in New Hampshire and Tennessee are only taxed on interest and dividend income.

Payment of the corporation net income tax is due on May 1st if the corporation’s tax year is the same as the calendar year. Otherwise, the return is due on 1st day of the fifth month after the close of the corporation’s tax year.

Read Also: Is Freetaxusa Legit

S Corporations In Florida

A lot of small business owners in Florida elect to set up their companies as S corporations, which provide many of the same legal protections as C corporations but do not subject the business to the state’s 5.5% corporate tax.

S corporations are especially popular in Florida because they effectively shield a business and its owners from paying any state income tax, whether on the business’s income or individual income. This designation provides many of the legal benefits of incorporation, such as protection of personal assets if a judgment is entered on the business. Unlike a C corporation, however, an S corporation is not subject to federal income tax, since the income earned by the business passes through to the business owners. Therefore, the owners must pay federal income tax on their income from the business at ordinary income tax rates.

As for state income taxes, the business owners pay nothing. Florida recognizes the S designation. The state does not treat S corporations as traditional corporations for tax purposes, nor does it tax the income that passes through to the business owners.

Special Supplemental Nutrition Program For Women Infants And Children

Congress allows increased fruit and vegetable benefits. At present, WIC provides $9 for children and $11 for women monthly for fruits and vegetables. The American Rescue Plan Act makes funding available for a four-month increase in the benefit of up to $35 monthly, if a state chooses to do so.

DOH attains waiver allowing remote issuance: Department of Health obtained a waiver of the requirement that participants pick up their EBT cards in person at recertification or during nutritional education appointments.

âWIC participants allowed to substitute certain food. Under a waiver from USDA, WIC participants in Florida are allowed to substitute milk of any available fat content and whole wheat or whole grain bread in package sizes up to 24 oz. when 16 oz. packages are unavailable.

âUSDA waived physical presence requirements: Although the scope and logistics are unclear at this time, USDA has given DOH permission to waive the requirement that persons be physically present at each certification or recertification determination in order to determine eligibility under the program through May 31, 2020.

USDA extends certification periods through May 31, 2020, for some participants.

For a list of current WIC waivers for Florida from USDA, go here.

HHS provides guidance. HHS has issued guidance on the flexibilities in TANF to respond to COVID-19.

Mobile app deployed. DEO has deployed a mobile app for RA applications.

- PUA provides up to 79 weeks of benefits.

Don’t Miss: Is A Raffle Ticket Tax Deductible

How Deductions And Credits Affect Your Small Business Tax Rate

As we explained in regard to the 20% deduction sole proprietors and other pass-through entity business owners can take, figuring out your final small business tax rate isnât as easy as multiplying your net income by your tax rate. Instead, there are several factors that could affect your final tax bill:

- Tax Deductions: Many business owners take advantage of tax deductions on business expenses to lower their taxable income. Some deductions can make a huge difference to your bottom line. For example, the Section 179 deduction lets businesses deduct the total cost of an asset, like a vehicle or machinery, in the year of purchase.

- Net Operating Losses: Other companies might have net operating loss deductions carried forward from a prior year that reduce the amount of the current years taxable income.

- Tax Credits: Your business could also be eligible for tax credits that can reduce the amount of tax you pay and your effective small business tax rate. Tax credits are better than deductions because they allow you to subtract the amount of taxes you owe on a dollar-for-dollar basis. For instance, businesses that use alternative sources of fuel or alternative sources of energy might be eligible for a tax credit.

Ultimately, because of deductions and credits, two businesses with the same net income for the year could end up paying different amounts of federal income tax.

Florida Legislature Will Consider Major Corporate Tax Changes In 2022 Session

Each year, the Florida Legislature updates state tax laws to conform or piggyback on changes in the federal tax code contained in new laws passed by Congress. In effect, we adopt a current version of the U.S. tax code each year. In a few instances, the state will decouple, or explicitly depart from the federal code. Either way, the state legislative action brings clarity to tax laws, usually makes it easier for businesses to calculate their taxes in a way that conforms to both state and federal tax codes, and allows businesses to more accurately make financial projections.

This annual update usually reaches back to at least the first day of the year, meaning Floridas tax laws currently conform to the federal tax code as of Jan. 1, 2021. This year, the Legislature will consider several significant issues that have lingered since the 2018 Legislature had to respond to the 2017 Tax Cuts and Jobs Act . Legislative adjustments that were debated but not passed last year will be addressed again in this session because of the certainty that the corporate tax rate will come off a temporary reduction of just over 3.5% last year and return to 5.5%.

Businesses will want to monitor the potential changes closely this year. Significant tax changes passed Congress in 2020 and how Florida responds may have a substantial effect on financial projections and require significant restatements for prior tax years.

$624 Million in Refunds is in Play

QIP Changes

You May Like: Is Doordash Taxed

Income Tax Rates For Pass

The federal small business tax rate for pass-through entities and sole proprietorships is equal to the owners personal income tax rate. For the 2019 tax year, personal income tax rates range from 10% to 37% depending on income level and filing status. For example, a single filer who reports $100,000 in net business income will pay a 24% tax rate.

Its important to note, however, as of the 2018 tax year, sole proprietors and owners of pass-through entities can deduct up to 20% of their business income before their tax rate is calculated. In the above example, the tax filer could deduct up to $20,000 from the net business income. Then, theyd only have to report $80,000 in income, reducing their tax rate to 22%.

There are limits, however, on this small business tax deduction based on income and type of business. In general, you must earn less than $157,500 or $315,000 to qualify for the full deduction. Additionally, professional service businesses, such as law firms and doctors offices, typically cant claim the full deduction either.