Supplementary Local Sales Taxes

Supplementary local sales taxes may be added by cities, counties, service authorities, and various special districts. Local county sales taxes for transportation purposes are especially popular in California. Additional local sales taxes levied by counties and municipalities are formally called “District Taxes.”

The effect from local sales taxes is that sales tax rates vary in California from 7.25% to 10.75% . For example, the city of Sacramento, the state capital, has a combined 8.75% sales tax rate, and Los Angeles, the largest city in California, has a combined 9.50% sales tax rate.

Local sales tax rate cap

The combined tax rate of all local sales taxes in any county is generally not allowed to exceed 2.00 percent. However, this is a statutory restriction and the California Legislature routinely allows some local governments, through the adoption of separate legislation, to exceed the 2.00 percent local tax rate cap. The 2.00 percent local tax rate cap is exceeded in any city with a combined sales tax rate in excess of 9.25% .

As of July 1, 2021, the following 140 California local jurisdictions have a combined sales tax rate in excess of the 2.00 percent local tax rate cap:

| CITY |

|---|

| SAN MATEO |

SB 566 and the rise in local sales tax increases

Local jurisdictions with at least 10.00% combined sales tax rates

As of July 1, 2021, the following 68 California local jurisdictions have a combined sales tax rate of at least 10.00%:

| CITY |

|---|

| SUTTER |

What Is Capital Gains Tax

Capital gains is a tax best defined as an assessment placed on the value of an investment when an individual or organization sells that investment. Thus, the profit made from the initial purchase price to the selling price is the value taxed on the acquisition or capital gains.What is not taxed are investments that appreciate over time without being sold off. These are referred to as unrealized capital gains and are treated as untaxed until they are sold.

When an investment is held for less than a year, it is known as short-term capital gains, while investments held longer than a year are defined as long-term capital gains.

Various financial vehicles generate capital gains, from purchasing and selling Real Estate to buying and selling stocks or bonds to crowdfunding investment opportunities. Understanding the capital gains tax code for both the Federal and State of California is essential in choosing the best investment vehicle for you.

Help With California Income Tax Rates & More

Understanding California income tax rates can be tricky. Luckily, were here to save the day with H& R Block Virtual! With this service, well match you with a tax pro with California tax expertise. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your CA taxes, including federal deductions for paying state taxes.

Prefer a different way to file? No problem you can find California state tax expertise with all of our ways to file taxes.

Related Topics

Is your personal property tax deductible? Learn more from the tax experts at H& R Block.

Also Check: Www.1040paytax

What Are Californias Income Tax Brackets

It is the holiday season and, while that means different things for different people, there is one thing that all U.S. residents share in common this time of year: It is time to start thinking about your California income tax returns. Learn more about California income tax brackets.

California residents have to pay income tax at the state and federal levels. San Francisco residents also have to pay a 0.38% payroll tax . So, with 2020 right around the corner, how much do you need to be prepared to pay?

How The Capital Gains Tax Is Calculated In California

In general, to determine your capital gains tax in California, you can use a simple formula that helps you calculate your gross tax rate.

To determine your taxes related to capital gains, use this simple formula:

Recommended Reading: Buying Tax Liens California

Personal And Real Property Taxes

In the state of California, all real property is taxable and shall be assessed at fair market value.

The California Board of Equalization acts in an oversight capacity to ensure compliance by county assessors with property tax laws, regulations and assessment issues. BOE conducts periodic compliance audits of the 58 county assessors programs and develops property tax assessment policies and informational materials to guide county assessors and local assessment appeals boards.

Any homestead exemptions are handled at the county level, and residents must contact the local county tax assessors office to inquire.

The states property tax postponement program allows eligible homeowners to postpone payments of property taxes on their principal places of residence. Some California counties may also offer a property tax postponement program for properties located in the county.

California previously offered a homeowner and renter assistance program under which a once-a-year payment was made to qualified individuals based on part of the property taxes assessed and paid on their homes or paid indirectly as part of their rent. However, this program was suspended due to budget constraints.

States With The Lowest Taxes And The Highest Taxes

OVERVIEW

Where you live can help or hinder your ability to make ends meet. A myriad of taxesproperty, license, state and local sales, property, inheritance, estate and excise taxes on gasolineeat away at your disposable income. Weighing the tax landscape against your financial picture lets you stretch your dollars. Here’s a roundup of the highest and lowest taxes by state.

“Location, location, location” is a focus that applies to more than just housing. Where you live can help or hinder your ability to make ends meet.

A myriad of taxes such as property, license, state and local sales, inheritance, estate, and excise taxes can eat away at your income. Often, the biggest tax ticket citizens face after paying the Internal Revenue Service is the one their state presents. As a result, identifying the states with the lowest taxes might be a smart financial move to make.

Currently, 41 states and the District of Columbia levy a personal income tax. Weighing the tax landscape against your financial picture could help you stretch your dollars further.

Recommended Reading: Reverse Ein Lookup Irs

How To Get Into A Lower Tax Bracket And Pay A Lower Federal Income Tax Rate

Two common ways of reducing your tax bill are credits and deductions.

-

Tax credits directly reduce the amount of tax you owe they don’t affect what bracket you’re in.

-

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words: Take all the tax deductions you can claim they can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

The Open Secret About California Taxes

Californias tax system, which relies heavily on the wealthy for state income, is prone to boom-and-bust cycles. While it delivers big returns from the rich whenever Wall Street goes on a bull run, it forces state and local governments to cut services, raise taxes or borrow money in a downturn. During the Great Recession, the capital-gains taxes that sustained the state in good times plummeted. School districts handed out 30,000 pink slips to teachers, and the state was so cash-strapped it gave out IOUs when it couldnt pay some of its bills.

California is now enjoying one of the longest economic expansions in state history, but the good times cant last forever. With an inevitable recession lurking in our future, Gov. Jerry Brown has warned, state and local governments are more vulnerable than ever to teacher and police layoffs, park and library closures and cuts in health and welfare services for the poor.

Past bipartisan efforts to reduce volatility without raising taxes on the poor and working class have had limited success. The overall tax structure hasnt been updated, leaving parts of the economy taxed at some of the nations highest rates while other sectors, such as serviceswhich many other states do taxarent taxed in California. Politicians like to talk about the problem, explaining how Proposition 13, the famous 1978 measure that limited property taxes, has created unequal tax burdens. Yet few have been willing to initiate change.

We want to hear from you

You May Like: How To Buy Tax Lien Properties In California

Getting Your California Tax Refund

If your state tax witholdings are greater then the amount of income tax you owe the state of California, you will receive an income tax refund check from the government to make up the difference.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. E-filing your return and filing early can help ensure your refund check gets sent as quickly as possible.

Once you’ve filed your tax return, all you have to do is wait for your refund to arrive. If you want to check the status of your California tax refund, you can visit the California Income Tax Refund page.

Filing Your California Income Tax Return

As we mentioned before, almost every resident in California must file an income tax return. There are many different ways to file your California state taxes online, starting with the FTBs free online portal, CalFile. Even if your taxes are being withheld at the proper rate, and even if you expect a refund, you have to file or you could face a penalty.

The deadline for filing your California income tax return is April 15. If you do not owe any tax or are owed a refund, you have an automatic 6-month extension until October 15. If you are non-military living or traveling abroad on tax day, you get another 2 month extension, making the final deadline December 15. Military personnel may qualify for additional extensions.

If you miss the deadline to file and ignore reminder notices from the FTB, you could face a Failure to File penalty of 5% of the tax due for every month that the return is late, up to a maximum of 25%.

If they suspect fraud, the penalty jumps from 5% to 15% and from 25% to 75% respectively. The minimum penalty is the lesser of $135 or 100% of the tax required to be shown on the return.

You May Like: How Much Does H & R Block Charge To Do Taxes

Accurately Calculating Your Taxable Income Is Important

As you prepare to file your California and federal income tax returns, it is important to be certain that you are accurately reporting your taxable income and fully paying what you owe. Failing to report income from all sources, taking deductions for which you are ineligible, and otherwise evading your state and federal tax obligations whether intentionally or unintentionally can have severe consequences.

Using tax software or hiring a certified public accountant to prepare your taxes can help you avoid mistakes. However, as the taxpayer, you are the one who is ultimately responsible for ensuring that you meet your state and federal income tax obligations.

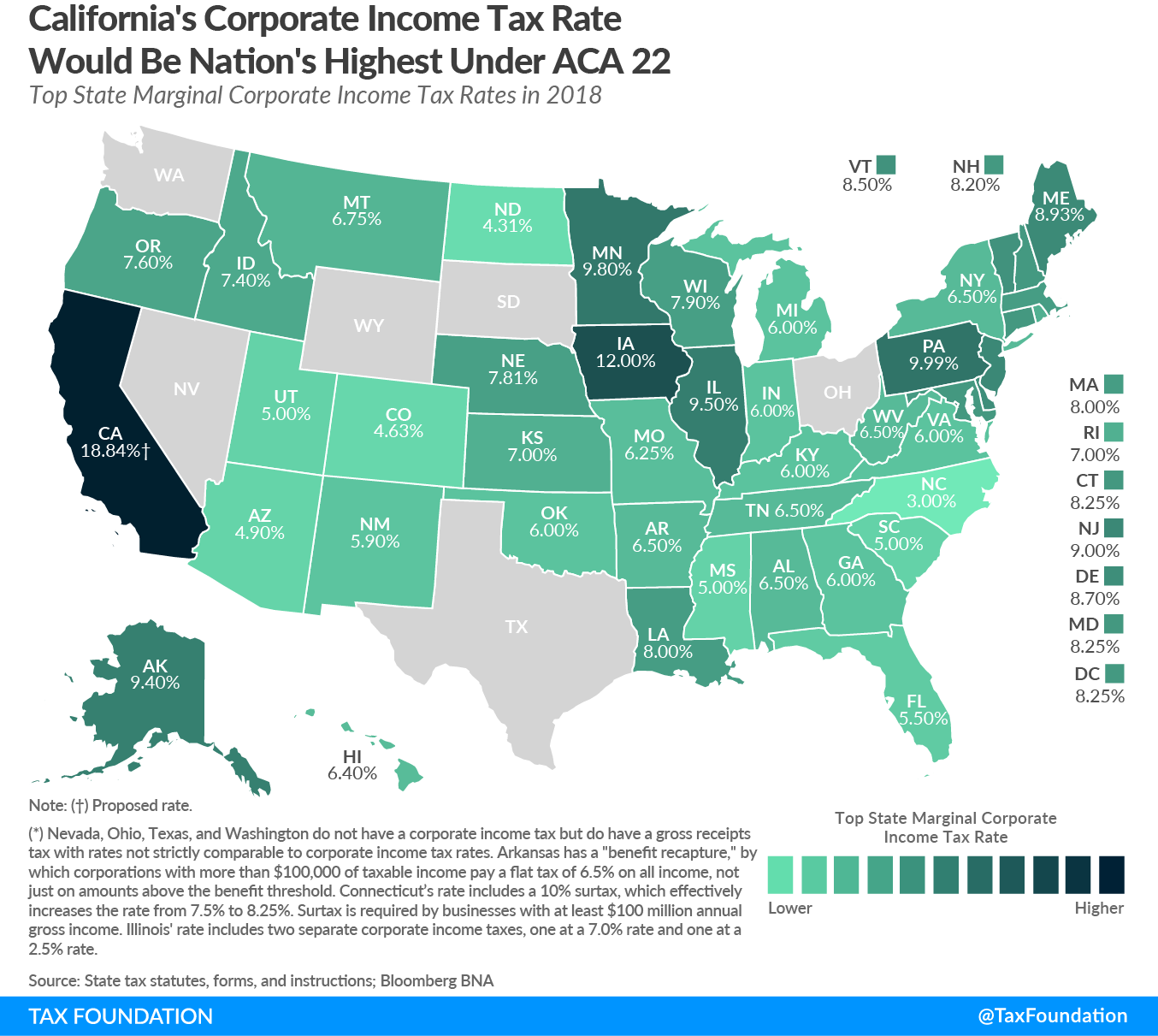

California Corporate Tax Rate

The California corporate tax rate has not yet provided small business owners with incentives for doing business in the state. However, California is known as the home to several diverse, vibrant and growing metropolitan cities, including Los Angeles, Oakland, and Sacramento. These metro areas are booming with talented individuals, many of whom are upper-class, prosperous residents, and are hosts to admired colleges and universities that continuously pump out young, educated adults.

California could be doing a much better job of attracting small business owners to the state. Corporate taxes in California are some of the highest of any other state in the U.S. High taxes, in conjunction with burdensome regulations, have caused many business owners to go out in search of a different state to incorporate in that will be friendlier to small businesses, such as Texas and Florida.

Don’t Miss: How Do I Get My Pin For My Taxes

Californias Income Tax Brackets For 2019

Californias individual tax brackets apply to single taxpayers as well as married taxpayers and registered domestic partners who are filing separately. For spouses and registered domestic partners who file jointly, the income levels are simply doubled . As published on Bankrate.com, Californias income tax brackets for 2019 are:

- 1% for taxable income up to $8,544

- 2% for taxable income between $8,545 and $20,255

- 4% for taxable income between $20,256 and $31,969

- 6% for taxable income between $31,970 and $44,377

- 8% for taxable income between $44,378 and $56,085

- 9.3% for taxable income between $56,086 and $286,492

- 10.3% for taxable income between $286,493 and $343,788

- 11.3% for taxable income between $343,789 and $572,980

- 12.3% for taxable income between $572,981 and $999,999

- 13.3% for taxable income of $1,000,000 or more

What Are State Payroll Taxes

California has four state payroll taxes which are administered by the EDD:

- Unemployment Insurance and Employment Training Tax are employer contributions.

- State Disability Insurance and Personal Income Tax are withheld from employees wages.

Wages are generally subject to all four payroll taxes. However, some types of employment are not subject to payroll taxes and PIT withholding. For more information, refer to Types of Employment .

Most employers are tax-rated employers and pay UI taxes based on their UI rate. Nonprofit and public entity employers that choose another method are known as reimbursable employers. School employers can elect to participate in the School Employees Fund, which is a special reimbursable financing method.

You May Like: Www Michigan Gov Collectionseservice

Local Sales Taxes Subject To Voter Approval Under Proposition 218

All local sales taxes are subject to voter approval under Proposition 218 which California voters approved in November 1996. Whether simple majority voter approval or two-thirds voter approval is required depends upon the type of sales tax levied and the type of local government imposing the sales tax.

Unrestricted general sales taxes are subject to majority vote approval by local voters. General sales taxes can be spent by local politicians for any general governmental purpose, including public employee salaries and benefits. General sales tax spending decisions are made after the tax election by local politicians as part of the regular annual local government budget process. Some local governments may engage in general sales tax abuses in an effort to evade the two-thirds vote requirement applicable to special sales taxes.

Special sales taxes dedicated for one or more specific purposes are subject to two-thirds voter approval by local voters. Any sales tax imposed by a local government other than a city or a county must be a special tax subject to two-thirds voter approval by local voters.

Proposition 218 does not legally authorize any local government to levy a sales tax. The legal authority to levy a local sales tax must come from a state statute. A two-thirds vote of all members of the legislative body of the local government is usually required before a local sales tax measure may be presented to voters at an election.

County transportation sales taxes

Overview Of California Taxes

California has the highest top marginal income tax rate in the country. Its a high-tax state in general, which affects the paychecks Californians earn. The Golden States income tax system is progressive, which means wealthy filers pay a higher marginal tax rate on their income. Cities in California levy their own sales taxes, but do not charge their own local income taxes.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

- Our Tax Expert

Jennifer Mansfield, CPATax

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. SmartAssets tax expert has a degree in Accounting and Business/Management from the University of Wyoming, as well as both a Masters in Tax Laws and a Juris Doctorate from Georgetown University Law Center. Jennifer has mostly worked in public accounting firms, including Ernst & Young and Deloitte. She is passionate about helping provide people and businesses with valuable accounting and tax advice to allow them to prosper financially. Jennifer lives in Arizona and was recently named to the Greater Tucson Leadership Program.

…read more

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Don’t Miss: How Can I Make Payments For My Taxes