Tax Rates For Previous Years

To find income tax rates from previous years, see the Income Tax Package for that year. For 2018 and previous tax years, you can find the federal tax rates on Schedule 1. For 2019, 2020 and later tax years, you can find the federal tax rates on the Income Tax and Benefit Return. You will find the provincial or territorial tax rates on Form 428 for the respective province or territory . To find the Quebec provincial tax rates, go to Income tax return, schedules and guide .

Nys And Yonkers Withholding Tax Changes Effective January 1 2021 And Before July 1 2021

We revised the 2021 New York State personal income tax rate schedules to reflect certain income tax rate reductions enacted under the Tax Law. We also updated the New York State and Yonkers resident withholding tax tables and methods for 2021. These changes apply to payrolls made on or after January 1, 2021, and before July 1, 2021.

- Calculate 2021 New York State withholding tax amounts using Publication NYS-50-T-NYS , New York State Withholding Tax Tables and Methods.

- Calculate 2021 Yonkers resident withholding tax amounts using Publication NYS-50-T-Y , Yonkers Withholding Tax Tables and Methods.

- NOTE: There were no changes to the New York City resident wage bracket tables and exact calculation methods. Please continue to use Publication NYS-50-T-NYC , New York City Withholding Tax Tables and Methods.

New York Property Tax

Property taxes are assessed exclusively by counties and cities in New York State, which means that rates vary significantly from one place to the next. Effective rates – taxes as a percentage of actual value as opposed to assessed value – run from less than 0.7% to about 3.5%.

Surprisingly, the city with the lowest effective property tax rate is New York City, where property taxes paid total an average of just 0.88% of property value. The reason for that relatively low rate is that the taxable value of most residential property in New York City is equal to just 6% of the market value. That is, if your home is worth $500,000, you will only be charged taxes on $30,000 of that amount. Outside of New York City, however, rates are generally between 2% and 3%.

Regardless of city, if you are looking to refinance or purchase a property in New York with a mortgage, check out our guide to mortgages in New York. Weve got details on average mortgage rates and other information about getting a mortgage in the Empire State. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

You May Like: Michigan.gov/collectionseservice

New York Income Tax Calculator

taxnew-yorktax

New York Income Taxes. New York States top marginal income tax rate of 8.82% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively , with higher earners paying higher rates. For your 2020 taxes , only individuals making more than $1,077,550 pay the top rate, and earners in the next bracket pay nearly 2% less.

Changes For Some In New York City Create The Highest Combined Local Tax Rate In The Country

New York Citys highest earners would be taxed at a top combined state and city income-tax rate of 14.8% under a new state law.

Taxes are going up for New Yorks highest earners.

Legislation passed Wednesday raises income-tax rates on single filers with more than about $1.1 million of income and joint filers reporting more than about $2.2 million. The changes mean top earners in New York City will be subject to the highest combined local tax rate in the country.

Don’t Miss: Where’s My Tax Refund Ga

How To Avoid Paying Capital Gains Taxhow To Avoid Paying Capital Gains Tax

We recently discussed how depreciation serves as a non-cash deduction, which delays income taxes due. However, there is more good news for those that have sold an investment property for a profit. The IRS allows for individual property exchanges that can kick tax payments even further down the road.

The Nyc Enhanced Real Property Tax Credit

This credit is offered to renters and homeowners living in residences that weren’t totally exempted from real property taxes during the tax year. Your household income must be less than $200,000 as of 2020.

You must have resided within the city for the entire year and in the same residence for at least six months. You can’t be claimed as a dependent on anyone else’s federal tax return. This credit can be as much as $500.

You May Like: How Much Does H& r Block Charge To Do Taxes

New York Gasoline Tax

The Motor Fuel Excise Taxes on gasoline and diesel in New York are 8.05 cents per gallon and 8.00 cents per gallon, respectively. Furthermore, the Petroleum Business Tax is paid by petroleum businesses for certain types of fuel and paid at different points in the distribution chain. As of Jan. 1, 2020, the PBT is 17.4 cents per gallon.

Other Taxes In New York State

The Empire State also has several other taxes that you may run into. Here are some of the main ones.

- Alcoholic beverages tax Varies by type of alcohol. For example, beer and wine are taxed at 14 cents and 30 cents per gallon, respectively. New York City also has a separate tax on wine and certain spirits containing more than 24% alcohol by volume. The distributor pays the tax.

- Cigarette and tobacco tax The state assesses an excise tax of $4.35 per package of 20 cigarettes, and New York City levies an additional tax of $1.50 per 20-cigarette package. The distributor pays the tax.

- Motor fuel tax The tax rate is 17.7 cents per gallon for motor fuel, but the rate can vary with other types of fuel. The tax is paid by the distributor.

- New York City taxicab ride tax Theres a 50-cent tax on each taxi trip that starts and ends in New York City or starts in New York City and ends in Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk or Westchester county. The tax is paid by the medallion owner, agent or hail base.

While most residents likely wont pay any of these taxes directly, the distributors and others paying the taxes may pass it on to you via an increase in the price of the product or service youre buying.

You May Like: Efstatus Taxact Com Login

New York Income Tax Rate And Ny Tax Brackets 2020

incometaxtaxratesnew-york

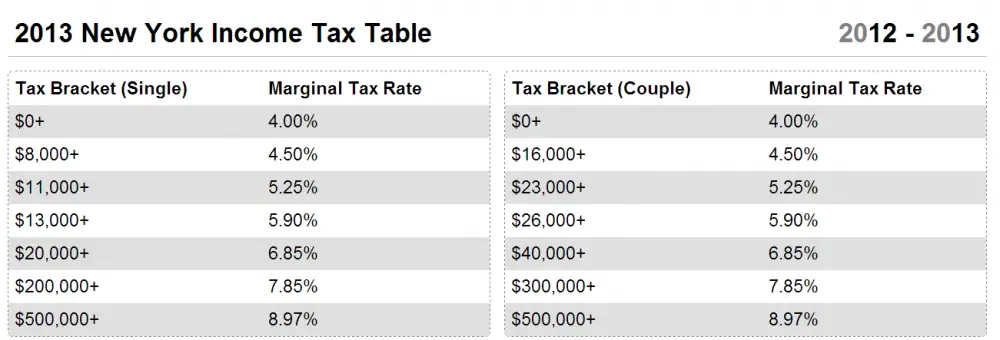

New York state income tax rate table for the 2020 – 2021 filing season has eight income tax brackets with NY tax rates of 4%, 4.5%, 5.25%, 5.9%, 6.09%, 6.41%, 6.85% and 8.82% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses. The New York tax rate is mostly unchanged from last year.

New York Tax Brackets 2020

Looking at the tax rate and tax brackets shown in the tables above for New York, we can see that New York collects individual income taxes differently for Single versus filing statuses, for example. We can also see the progressive nature of New York state income tax rates from the lowest NY tax rate bracket of 4% to the highest NY tax rate bracket of 8.82%.

For single taxpayers living and working in the state of New York:

- Tax rate of 4% on the first $8,500 of taxable income.

- Tax rate of 4.5% on taxable income between $8,501 and $11,700.

- Tax rate of 5.25% on taxable income between $11,701 and $13,900.

- Tax rate of 5.9% on taxable income between $13,901 and $21,400.

- Tax rate of 6.09% on taxable income between $21,401 and $80,650.

- Tax rate of 6.41% on taxable income between $80,651 and $215,400.

- Tax rate of 6.85% on taxable income between $215,401 and $1,077,550.

- Tax rate of 8.82% on taxable income over $1,077,550.

For married taxpayers living and working in the state of New York:

- Tax rate of 4% on the first $17,150 of taxable income.

- Tax rate of 4.5% on taxable income between $17,151 and $23,600.

- Tax rate of 5.25% on taxable income between $23,601 and $27,900.

- Tax rate of 5.9% on taxable income between $27,901 and $43,000.

- Tax rate of 6.09% on taxable income between $43,001 and $161,550.

- Tax rate of 6.41% on taxable income between $161,551 and $323,200.

- Tax rate of 6.85% on taxable income between $323,201 and $2,155,350.

- Tax rate of 8.82% on taxable income over $2,155,350.

Read Also: Do You Report Roth Ira Contributions Your Tax Return

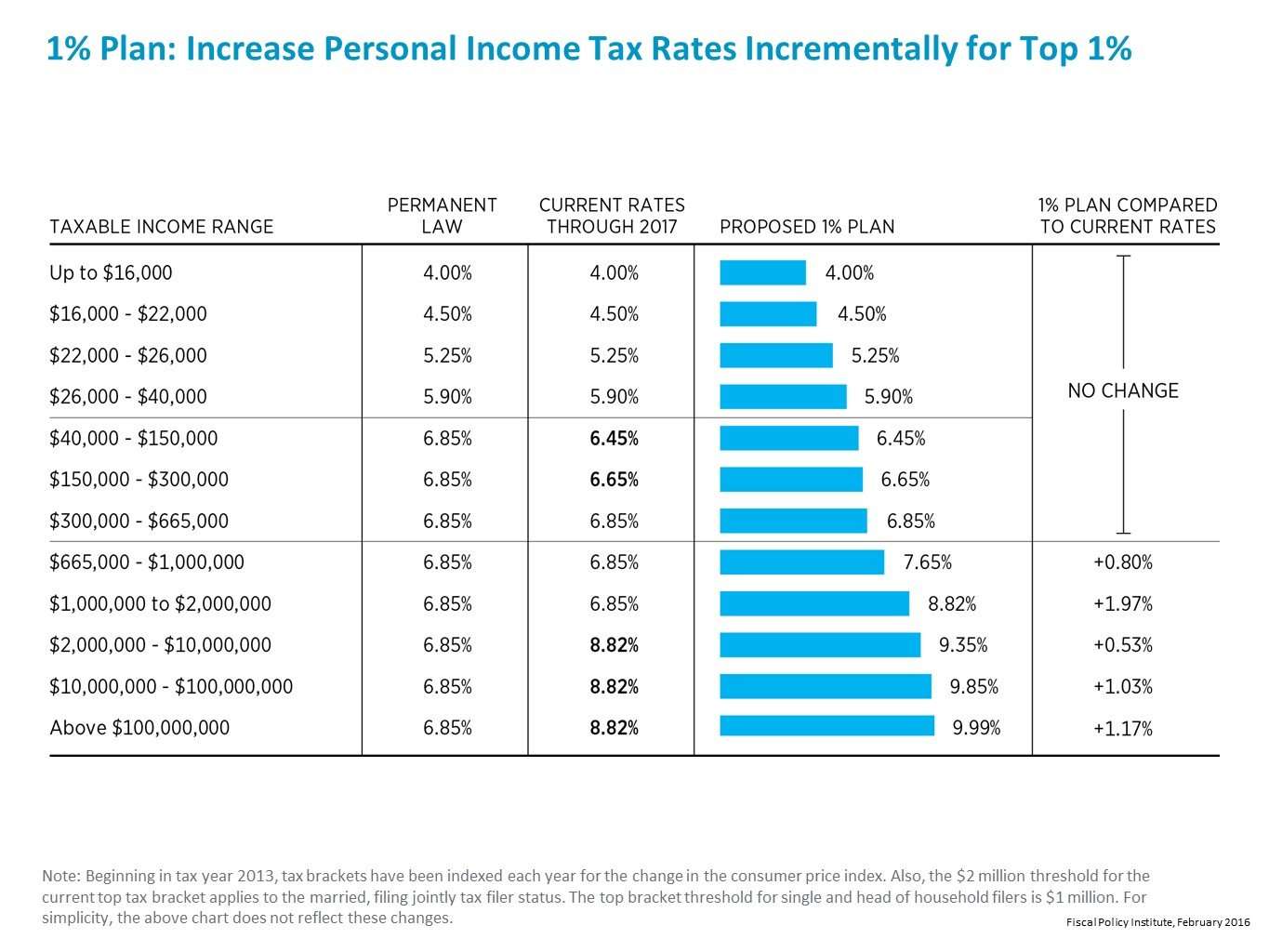

New York State Is Set To Raise Taxes On Those Earning Over $1 Million

The deal, a sign of Gov. Andrew Cuomos weakened influence, would mean wealthy New York City residents would pay the highest combined local tax rate in the nation.

- Read in app

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

- Read in app

By Luis Ferré-Sadurní and Jesse McKinley

Gov. Andrew M. Cuomo and New York State legislative leaders were nearing a budget agreement on Monday that would make New York Citys millionaires pay the highest personal income taxes in the nation, a stark result of the pandemics economic fallout.

For years, Mr. Cuomo resisted such a move, arguing that raising taxes, especially on the wealthy, would drive business out of state. But the coronavirus-related revenue shortfalls combined with the growing strength of the Legislatures progressive wing and the governors waning influence created sudden momentum.

If enacted, the deal would raise income and corporate taxes to generate an extra $4.3 billion a year and would potentially legalize mobile sports betting to raise an additional $500 million in new tax revenue.

Under the proposed new tax rate, the citys top earners could pay between 13.5 percent to 14.8 percent in state and city taxes, when combined with New York Citys top income tax rate of 3.88 percent more than the top marginal income tax rate of 13.3 percent in California, currently the highest in the nation.

Do I Have To Pay New York State Income Tax

Generally, you have to file a New York state tax return if:

-

Youre a New York resident and youre required to file a federal tax return or your federal gross income plus New York additions was more than $4,000 .

-

Youre not a New York resident but got income from a source in New York during the tax year.

If youre not a resident of New York but your primary workplace is there, your days telecommuting during the pandemic are still considered days worked in New York unless your employer established an office at your telecommuting location. Generally, you will continue to owe New York State income tax on income earned while telecommuting.

» MORE:See what federal tax bracket youre in

Recommended Reading: How To Buy Tax Lien Properties In California

Federal Tax On Taxable Income Manual Calculation Chart

If your taxable income is $49,020 or less.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $49,020, but not more than $98,040.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $98,040, but not more than $151,978.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $151,978, but not more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

If your taxable income is more than $216,511.

Line 63Line 64Line 65Line 66Line 67Line 68Line 69

How Your New York Paycheck Works

When you start a job in the Empire State, you have to fill out a Form W-4. Your new employer will use the information you provide on this form to determine how much to withhold from your paycheck in federal income taxes. How much you pay in federal income taxes depends on several factors like your marital status, salary and whether or not you have additional taxes withheld from your paycheck.

The 2020 W-4 includes notable revisions. The biggest change is that you won’t be able to claim allowances anymore. Instead, you’ll need to input annual dollar amounts for additional income and things like non-wage income, total annual taxable wages, income tax credits and itemized and other deductions. The form also utilizes a five-step process that asks you to enter personal information, claim dependents and indicate any extra income or jobs.

All employees hired as of Jan. 1, 2020 must complete the form. If you were hired before then, you don’t need to worry about filing a new W-4 unless you plan on changing your withholdings or getting a new job.

Don’t Miss: How Much Does H& r Block Charge To Do Taxes

New York City Income Tax Credits

Tax credits reduce the amount of income tax you owe. They come directly off your liability to the taxing authority. Some credits are refundableyou’ll receive a refund of any portion of the credit that’s left over after reducing your tax liability to zero.

New York City offers several tax credits. They can offset what you owe the city, but they won’t affect the amount of New York State income tax you might owe.

Types Of Residency Status In New York

|

If your New York residency type is … |

New York taxes this part of your income |

|---|---|

|

Resident |

» MORE: Track the status of your state tax refund

RESIDENT STATUS RULES

In general, youre a resident of New York for tax purposes if your permanent home is there , or if you leased or owned a place there and spent 184 days or more in New York state during the tax year.

-

New York considers your permanent home the place you intend to return to after things like vacations, business trips, military assignments or the end of a college semester.

-

There are special rules for people who were in a foreign country for at least 450 of 548 consecutive days.

-

Where you vote, where your drivers license and registration are issued or where your will is are not primary factors in establishing domicile. Its more about where your stuff is and where you spend your time.

You file Form IT-201. You may have extra paperwork if you live in New York City or Yonkers, since those cities assess local income tax on top of state tax.

PART-YEAR RESIDENT STATUS RULES

Generally, youre a part-year resident of New York if you were a nonresident for some of the tax year. This is often the case for people who moved to New York from another state.

-

If youre a part-year resident, you pay New York state tax on all income you received during the part of the tax year you were a resident of New York, plus on income from New York sources while you were a nonresident.

NONRESIDENT STATUS RULES

You May Like: Www Michigan Gov Collectionseservice

In Detailcorporate Tax Rates

The legislation increases the corporate franchise tax rate to 7.25% from 6.5% for tax years beginning on or after January 1, 2021 and before January 1, 2024 for taxpayers with a business income base greater than $5 million.

In addition, the scheduled phase-out of the capital base tax has been delayed. The rate of the capital base was to have been 0% starting in 2021. The legislation imposes the tax at the rate of 0.1875% for tax years beginning on or after January 1, 2021 and before January 1, 2024, with the 0% rate to take effect in 2024. However, the delay does not apply to deemed small businesses.

Another Way To Minimize The Taxable Gainanother Way To Minimize The Taxable Gain

The IRS lets you deduct capital losses from your capital gains. If you determine to sell other investments and realize the damage, you can offset the profit in your home. Since the IRS only allows a maximum capital loss of $3,000 in one year, you may have impairments in prior years that you can roll forward.

For example, if you had a $10,000 loss from a stock sale, you can claim $3,000 for the first three years and $1,000 for the fourth year. For simplicitys sake, if you sell your home the same year the loss was realized and have a $20,000 gain , you can use the $10,000 loss and only pay a capital gains tax of $10,000.

Recommended Reading: How To Buy Tax Lien Properties In California

New York Share Of Us Millionaires Is Decreasing

Between 2010 and 2017 the number of United States tax filers with adjusted gross incomes of $1 million or more increased 75 percent, which is more than 50 percent faster than growth in New York. In 2010 New Yorks share of millionaires was 13 percent compared to 7 percent in Florida. Between 2010 and 2017 New Yorks share of the nations millionaires decreased by 15 percent , while Floridas increased by 26 percent . The decreasing share of millionaires may be caused by a number of factors, including personal income tax rates. It is concerning because New York State and New York City are very dependent on tax revenues from millionaires, with almost 40 percent of personal income tax revenues coming from this group of taxpayers.6

There were even greater shifts in the share of capital gains earned by New Yorks millionaires, which have important revenue impacts for states coffers. Ordinary income is taxed where it is earned however, capital gains are taxed by the state of residency . For example, if a New Jersey resident works in New York, he or she pays New York taxes on wages earned in New York, but if the person earns capital gains, that income is taxed only by New Jersey.7 Individuals who derive most of their incomes from capital gains have a strong incentive to establish residency in a low tax state.