Does California Currently Have An Inheritance Tax

California does not have an inheritance tax. When the federal government enacted the Economic Growth and Tax Relief Reconciliation Act, a lot of states inheritance taxes were phased out and California was one of them. Furthermore, California requires a majority vote by its residents before enacting new legislation. Therefore, California has not had California inheritance tax laws since 2005.

However, federal income tax law still applies, although, as stated above California does not have a state income tax in 2019. More recently the California legislature attempted to pass a law that would have reinstated the California estate tax and imposed a new gift and generation-skipping tax on California residents beginning on January 1, 2021.

The proposed tax would have given California residents that leave an estate worth $3.5 million or more would have been subject to the state estate tax at a rate of 40%, which is equal to the federal estate tax. The proposed tax would have been phased out at the current federal estate tax exemption of $11.4 million and avoiding double taxation. This law did not pass and therefore the state of California remains a state without an inheritance tax.

Revisiting The Inheritance Exclusion

It has been decades since Californians voted to create the inherited property exclusion. Since then, this decision has had significant consequences, yet little attention has been paid to reviewing it. Moreover, indications are that use of the exclusion will grow in the future. In light of this, the Legislature may want to revisit the inheritance exclusion. As a starting point, the Legislature would want to consider what goal it wishes to achieve by having an inheritance exclusion. Is the goal to ensure that a family continues to occupy a particular property? Or to maintain ownership of a particular property within a family? Or to promote property inheritance in and of itself?

Different goals suggest different policies. If the goal is to unconditionally promote property inheritance, maintaining the existing inheritance exclusion makes sense. If, however, the goal is more narrowsuch as making sure a family continues to occupy a particular homethe scope of the existing inheritance exclusion is far too broad.

Reasons the Existing Policy May Be Too Broad

Potential Alternatives

Limit to Homes Used as a Primary Residence. One option is to limit the exclusion to homes that are occupied by the family member following inheritance. Inherited homes used as rentals or second homes would be subject to reassessment. Such a change could possibly cut in half the property tax losses resulting from the existing exclusion.

What Is The Difference Between An Inheritance Tax And An Estate Tax In California

Many get an estate tax and an inheritance tax to get inheritance tax confused because they are similar in form. The biggest difference between the two taxes depends on who is paying the tax. For example, when applying an estate tax the person who owns the estate is paying the tax. In an inheritance tax the who inherits the property must pay the tax on the inheritance. To summarize, an estate tax is responsible for paying the estate tax while the person inheriting is responsible for paying the inheritance tax.

An inheritance tax is different from an estate tax. Both calculate the fair market value of a deceased persons property, usually as of the date of death. But an estate tax is assessed on the estate itself, before its assets are distributed and inheritance tax is imposed on a beneficiary as they receive assets.

If a person who left you money lived in one of the above states during a period of time where an inheritance tax was valid, you may still owe tax on that gift. The major difference between estate and inheritance taxes rests on who is responsible for paying it. An estate tax hinges on the total value of a deceased persons money and property and is paid out of the decedents assets before any distribution to beneficiaries.

Recommended Reading: How Do Taxes On Cryptocurrency Work

How Much Can You Inherit Without Paying Taxes In 2022 In California

B. Taxes on Estates: The estate tax exemption, which can be decreased by certain gifts made during ones lifetime, will increase to $12,060,000 in 2022 and will remain at that level until after 2025. However, the tax rate on the excess value of an estate will continue to be 40%.

Federal Estate Tax Rates 2020

| Taxable amount | Tax rate |

|---|---|

| 40% | $345,800 base tax+ 40% on taxable amount |

In each tax bracket, the estate pays a base tax, plus the applicable rate on the income that falls within that bracket.

For example, if the taxable estate is $120,000, the tax owed would be the $23,800 base tax in the $100,001 to $150,000 bracket, plus 30% of the amount over $100,000 . Thus, the total federal estate tax due would be $29,800 .

You May Like: How To Calculate Long Term Capital Gains Tax

Stressed About Selling Your Inherited Home

Selling an inherited home in California can be a long stressful process. If you want to sell your inheritance with the least amount of hassleand avoid further headaches, . Were prepared to make you an all-cash offer and have it to you within 48 hours. We can help you close faster than listing so you can move on with life sooner than later.

California Inheritance Tax And Gift Tax

California does not have an inheritance tax, estate tax, or gift tax. However, California residents are subject to federal laws governing gifts during their lives, and their estates after they die.

Each California resident may gift a certain amount of property in a given tax year, tax-free. In 2021, this amount was $15,000, and in 2022 this amount is $16,000. Estates valued at less than $12.06 million in 2022 for single individuals are exempt from an estate tax.

If the gift or estate includes property, the value of the property is determined by the fair market value of that property.

Read Also: How To View Previous Tax Returns

We Can Make Selling Your Home Painless

Selling an inherited home in California can be a long stressful process. If you want to sell your inheritance with the least amount of hassleand avoid further headaches, . Were prepared to make you an all-cash offer and have it to you within 48 hours. We can help you close faster than listing so you can move on with life sooner than later.

Children In California Inheritance Laws

Before getting into the specific laws that surround the inheritances of children in California, its important to know how the state qualifies who is and isnt an individuals child, even if it might seem obvious. First and foremost, biological children have the strongest rights, as they are the direct bloodline of the decedent. Adopted children share this claim, while grandchildren dont, provided their parent is alive.

As far as husbands are concerned, the state of California assumes that any child born to their wife or domestic partner while theyre still engaged in a relationship is their child as well. This gives such a child automatic inheritance rights even if he or she is found not to be the decedents child biologically, provided its proven the decedent treated the child as his own. The same applies to illegitimate children, though the same burden of proof falls on them.

If you conceived a child and die prior to its birth, the child will retain rights of inheritance over your estate. Also, should a child be conceived via your stored genetic material within two years of your death, it will earn a portion of your estate if you gave consent for the material to be used for the purposes of conception.

| Intestate Succession: Spouses, Children & Extended Family |

| Inheritance Situation |

You May Like: Can You File Taxes For Unemployment

What About Capital Gains Tax

But while properties in California are not subjected to either state inheritance tax or estate tax, the last common addition to your inheritance tax bill, capital gains tax, remains the biggest tax expense facing beneficiaries in California.

Capital gains are a special type of tax that relates to the profit an asset like real estate generates once its sold, and if you decide to sell the inherited house down the line, you will be subjected to it in the state of California. This means that the taxes youll pay will be based on the difference between the step-up basis, meaning the fair market value at the time of inheritance established by the IRS and the final selling price.

If you decide to keep the home and either use it as a residence or rent it out to tenants, on the other hand, you will be eligible for capital gains tax exclusion.

Check The Houses Insurance Policy

Contact the insurance company for your parents home insurance policy. Let them know about the death and ask them about any policy changes you might need to make. Many insurance companies will not cover damages caused by vandalism if a house is left vacant for an extended period. You can usually get a vacant home insurance policy until the house is sold.

Recommended Reading: Is Personal Loan Interest Tax Deductible

How Can I Avoid Them

If you are already in the probate process, it is too late. You might have to pay death taxes.

But, if you arent in the probate process just yet, this is a better question for your estate planning attorney. And since they will have a better idea of your specific case. They will give you better guidance on creating an estate plan that avoids probate and minimizes or avoids estate taxes.

Does California Impose An Inheritance Tax

As of 2020, only six states impose an inheritance tax and California is not one of them. Be careful, however, if you inherited property located in another state. If that state levies an inheritance tax, you could be responsible for paying the tax even though you are not a resident of that state. Always check with an experienced probate attorney if you inherit property to ensure that you understand what taxes, if any, must be paid on the inheritance.

Also Check: Does Puerto Rico Pay Taxes

Is There A Federal Inheritance Tax

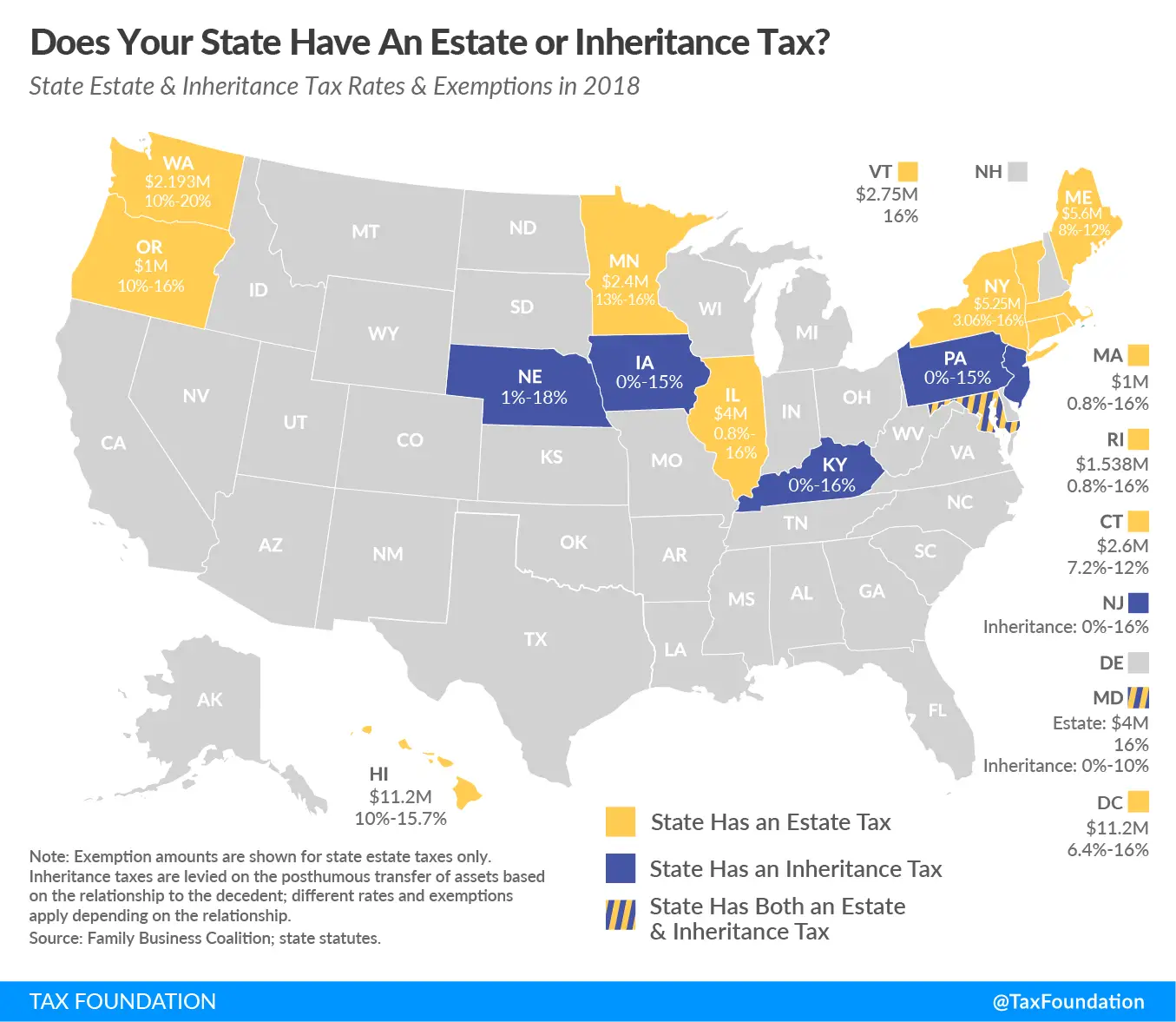

The state levies an estate tax on an estate before distributing it among its heirs. The inheritance tax is a state tax that the government imposes on the inheritance when an heir receives it. California does not have an inheritance tax, and neither does the IRS. Only 17 states currently have an inheritance tax or an estate tax.

Some of them have both, and some have only one or the other. Tax rates on state estate taxes and state inheritance taxes are much lower than the federal estate tax rate of 40 percent they hover between a fraction of a percent and up to about 20 percent for certain estates.

If you are a resident of California and wish to minimize the tax impact of your death, its crucial to be forward-thinking. The process is extremely complex, and youll likely need questions answered. Consult a local tax professional on potential tax hikes and considerations for the near future and plan your estate accordingly.

What Do We Do

The lawyers and staff at CunninghamLegal help people plan for some of the most difficult times in their lives then we guide them when those times come.

Make an appointment to meet with CunninghamLegal for California Estate Planning and Trust Administration. We also offer a robust, overall tax-planning service for high net-worth families. We have offices throughout California, and we offer in-person, phone, and Zoom appointments. Just call or book an appointment online.

Please also consider joining one of our free online Estate Planning Webinars.

We look forward to working with you!

Best, Jim

Read Also: How Can You Track Your Tax Refund

What Is The Federal Inheritance Tax Rate

There is no federal inheritance taxthat is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022. The tax is assessed only on the portion of an estate that exceeds those amounts. The rate is on a sliding scale, from 18% to 40%.

How Much Can You Inherit From Your Parents Without Paying Taxes

There is no federal inheritance tax, which is a tax on the total value of assets received by an individual from a deceased person. This tax does not exist. On the other hand, a federal estate tax is imposed on estates with a value that is greater than $11.7 million in 2021 and $12.06 million in 2022.

Also Check: How Much Taxes Deducted From Paycheck Mn

Should I Seek Legal Help

If you are considering a legal remedy involving inheritance tax, and have questions about your inheritance tax, you should consider discussing your options with an experienced California estate lawyer. While it is possible to represent yourself pro se the majority of people who are interested in learning more about inheritance tax do so with the advice of an attorney.

There are several different types of taxes, and rules that go along with each one. Therefore having a knowledgeable estate attorney will be an invaluable resource. An estate attorney can help you decide whether or not to collect an inheritance tax. Finally, an estate lawyer can give you additional details on what exemptions you may be entitled to and ensures you are on the right path collecting your inheritance tax.

Inheritance Tax In California

While an estate tax is charged against the deceased persons estate, regardless of who inherits what, states with an inheritance tax assess it on the beneficiary . California also does not have an inheritance tax.

In fact, just six states do Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. Notably, only Maryland has both an estate and an inheritance tax.

The federal government does not assess an inheritance tax.

Don’t Miss: How Do You Have To Make To File Taxes

Why Does Property Tax Change In California When You Inherit A House

The property tax bill on your inherited house is the result of Californias Proposition 13, which was passed 40 years ago. Faced with rapidly increasing property taxes back then, voters decided that property values for tax purposes should be frozen at their 1978 assessments. And with a 1% general levy that can increase by no more than 2% per year to account for inflation. There can be small local add-ons to the frozen tax rate, such as for bond repayment or to finance schools and fire protection. In sum, the Prop 13 bill reigns in the cost of California property taxesuntil the house changes hands, that is.

When a California house is inherited, property taxes will be reconfigured based on the current market value. Which can amount to a really big jump in cost. Property values here have risen much faster than 2% per year in California since 1978. So, when you inherit a house that has not been changed hands for a long time. The new tax assessment on a property may be dramatically higher than it had been. There is one exception, however: low tax rates provided by Proposition 13 have been made inheritable for houses passed on to children or grandchildren.

If you did not inherit the house from a parent or grandparent. However, the property tax for the year is due immediately and will probably amount to several thousand dollars. If you dont have that money to spare, you can pay the tax late, of course. But then you have to pay penalties and interest as well.

Access Their Financial Accounts

Your parents had monthly bills. If they have direct debit payments, you will need to make sure there is enough money to cover those payments. Or, if the services are no longer necessary, you will need to cancel those accounts.

To access your parents financial accounts, you will need to provide a copy of the death certificate. You may also need their Social Security number and any other legal documents provided by the court. This will allow you to close any standing accounts.

If your parents set you up as a beneficiary or created an account that was transferable upon death, gaining access to the account can be even easier.

You will have to continue paying basic monthly expenses, such as the electric and water bills, for as long as it takes to settle the estate.

While analyzing your parents financial information, look for accounts like:

- Checking and savings accounts

- Household services

- Communication services

- Insurance policies

While some accounts you can close immediately, like phone and cable, others will need to remain open until you sell the house.

Also Check: How To Calculate Uber Miles For Taxes

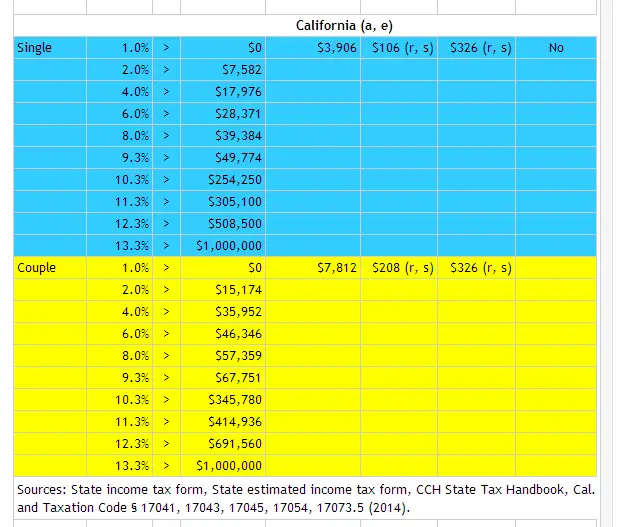

Federal Gift And Estate Taxes

The federal gift and estate tax is a tax that is imposed by the federal government on all qualifying gifts made by a taxpayer during his/her lifetime and all assets owned by the taxpayer at the time of death. For example, if you made gifts of assets during your lifetime valued at $8 million and you owned assets valued at $10 million at the time of your death, your estate would be subject to federal gift and estate taxes for the combined value of $18 million at a tax rate of 40 percent. Without any deductions, your estate would lose a shocking $7.2 million to federal gift and estate taxes. Any federal gift and estate taxes that are due from your estate must be paid during the probate of your estate after your death.

The good news is that every taxpayer is entitled to make use of the lifetime exemption to reduce the amount of gift and estate taxes owed by their estate. ATRA set the lifetime exemption amount at $5 million, to be adjusted for inflation each year. In 2018, the President signed tax legislation into law that changed the lifetime exemption amount for several years to come. Under the new law, the exemption amounts doubled. These exemption amounts are scheduled to increase with inflation each year until 2025. On January 1, 2026, the exemption amounts are scheduled to revert to the 2017 levels, adjusted for inflation.