How Much Do You Have To Make To File Taxes In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Filing a tax return is an annual ritual for most people but actually, not everyone has to file taxes. Generally speaking, if your income is below a certain level, you might not have to file a tax return with the IRS. Here’s how much you have to make to file taxes in 2022 , and the general rules for whether you have to file a federal tax return this year.

You can see all the details in IRS Publication 501.

The American Opportunity Tax Credit

This credit covers up to $2,500 for qualified college expenses and is partially refundable. If the credit brings the amount of tax you owe to zero, you can have 40% of any remaining amount of the credit, up to $1,000, refunded to you.To be eligible for the AOTC, students must be within their first four years of higher education and be enrolled at least half time at some point during the tax year.

To claim the AOTC, you must file a federal tax return with a completed Form 8863 attached to your Form 1040 or Form 1040A.

Chat With Charlie Unread Messages

The Educator School Supply Tax Credit and the Return of Fuel Charge Proceeds to Farmers Tax Credit have received Parliamentary approval. This means that the CRA can now process your 2021 income tax and benefit return if you claimed these credits. Contact Us if you have questions.

Find out what’s new for the 2021 tax season and your filing and payment due dates. Begin by gathering your documents to report income and claim deductions, and choose how you want to file and send your completed tax return to the CRA.

Also Check: Where Is My Property Tax Rebate

You Can Start The Clock On The Statute Of Limitations

The IRS generally has three years from the date you filed to audit your tax returnsix years if your return includes a substantial understatement of income. But if you dont file a tax return, the clock on that statute of limitations never starts running. In effect, the IRS could come after you in a decade or more and claim that you should have filed a return.

If youre worried about an IRS audit, you may want to file a tax return even if you didnt earn enough to trigger a filing requirement.

Uncommon Income Tax Filing Situations

There are even more situations where you will still have to file income taxes with the IRS, even if you dont meet the minimum income. For example, if you owe any special taxes.

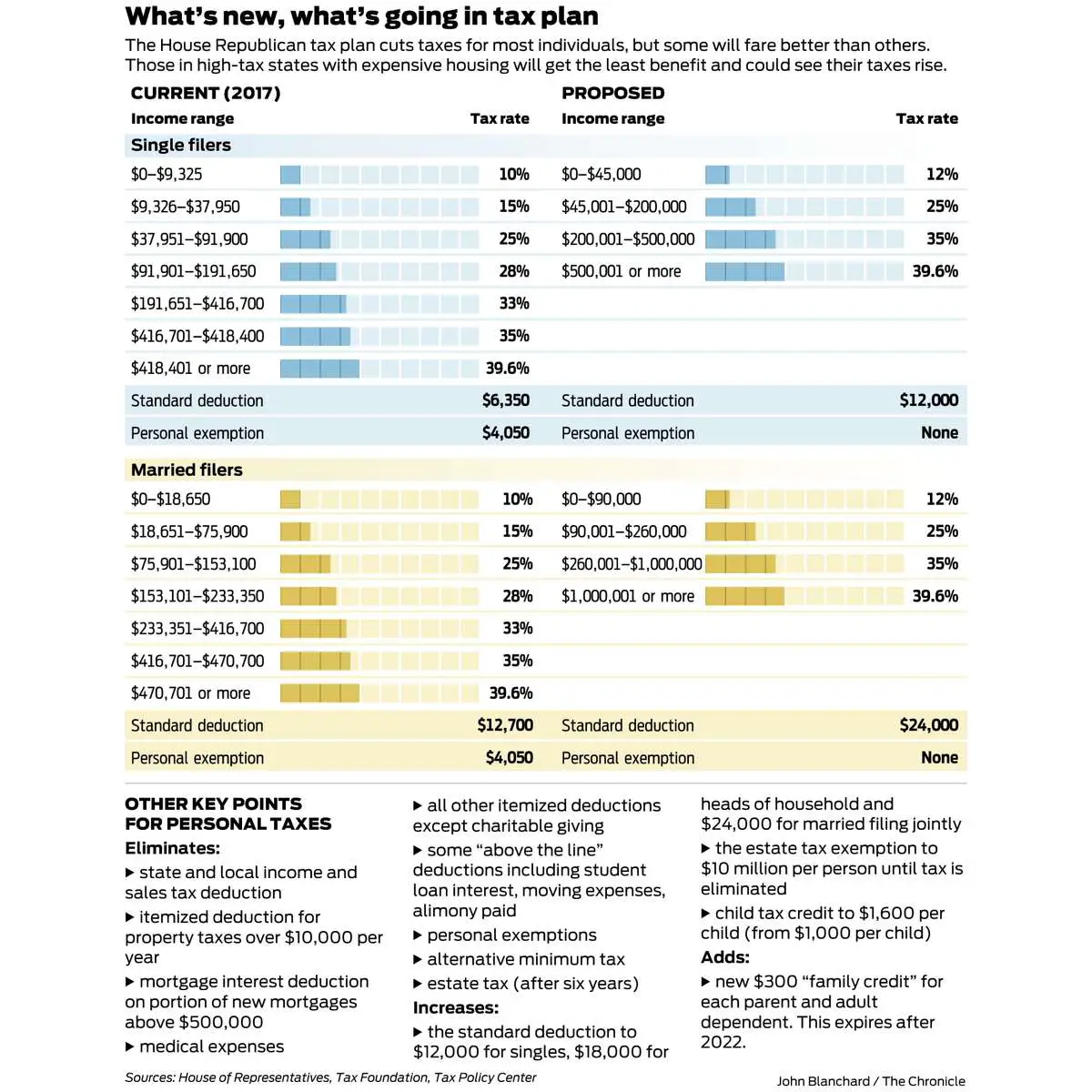

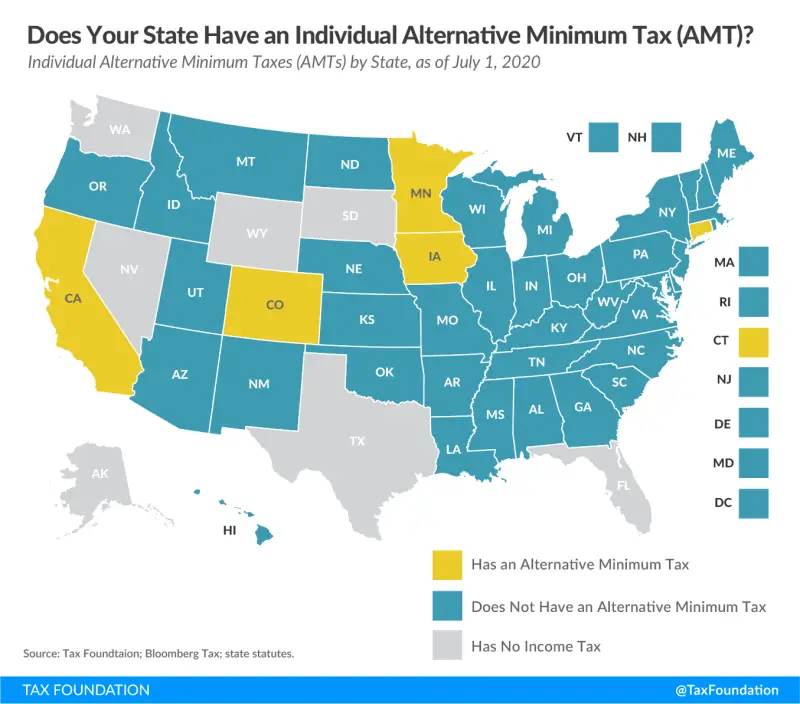

These could come from an IRA , in which case IRS Form 5329 would be utilized. There are also things like the Alternative Minimum Tax, as well as the Medicare tax, and even Social Security.

These could be utilized for tips you received but did not report to your employer or if an employer did not withold these taxes from any paychecks they gave you. Another unique situation is self-employment where you must report any earnings of at least $400 and any money over $108.28 earned from a tax exempt organization .

Read Also: Do You Have To Pay Inheritance Tax On Life Insurance

Understanding Income Tax Brackets: What Are Your Rates

The progressive nature of California income tax means that the more you earn, the higher your rate of tax will be. The income tax rates are based on brackets, as follows:

- 1% on the first $9,325 of taxable income

- 2% on taxable income between $9,326 and $22,107

- 4% on taxable income between $22,108 and $34,892

- 6% on taxable income between $34,893 and $48,435

- 8%on taxable income between $48,436 and $61,214

- 9.3% on taxable income between $61,215 and $312,686

- 10.3% on taxable income between $312,687 and $375,221

- 11.3% on taxable income between $375,222 and $625,369

- 12.3% on taxable income of $625,370 and above

Those are the rates for taxpayers filing as single or married, filing separately. For married filing jointly, or head of household, the tax rates are the same, but the income thresholds are doubled.

So, for example, a married couple filing jointly will pay 1% on the first $18,650 of their combined income. Also, these rates are based on your adjusted gross income: that is the amount of your income after all the applicable deductions and exemptions have been subtracted.

An important thing to remember is that when you jump up a tax bracket, you only pay the higher rate on the part of your income which falls into that bracket, which is why they are often referred to as marginal tax rates.

Filing Requirements For Corporations And Partnerships Without Income

The tax filing requirements for corporations and partnerships depend partially upon whether the business is foreign or domestic. A domestic corporation or partnership is an entity that does business in the state where it was formed. A foreign corporation or partnership is an entity that operates in a different state, or in some cases, a different country from where it was formed.

As noted above, both S corporations and C corporations are generally required to file an annual tax return. However, exceptions might apply depending on whether the corporation is foreign or domestic. For example, certain domestic corporations may be exempt from income reporting requirements under 26 U.S. Code § 501. However, as the IRS notes, a foreign corporation is typically required to file a tax return even if it has no income effectively connected with the conduct of a trade or business in the United States during the taxable year.

As mentioned previously, it is not necessary for a domestic partnership to file a tax return if the domestic partnership neither receives income nor intends to claim credits or deductions. Even if a foreign partnership has no income, it is mandatory to file a return if the business makes an election for example, to amortize organization expenses.

You May Like: Can You Still File 2016 Taxes

Nerships And Sole Proprietorships

Tax treatment of partnerships depends on the specific type. Limited liability partnerships and LPs must pay the $800 minimum franchise tax, and the business owners must pay personal income tax on any income that passes through from the partnership.

For general partnerships in which income is distributed directly to business owners, only the personal income tax applies. This is also the case with sole proprietorships.

When Social Security Benefits May Be Taxable

When determining whether you need to file a return and you receive Social Security benefits, you need to consider tax-exempt income because it can cause your benefits to be taxable even if you dont have any other taxable income.

Heres an example of where you may need to file, even with tax-exempt income:

- You are under age 65 and receive $30,000 in Social Security benefits, but also receive another $31,000 in tax-exempt interest. $14,700 of your Social Security benefits will be considered taxable income.

- This is greater than your standard deduction and you would need to file a tax return.

To figure out if your Social Security benefits are taxable:

- Add one-half of the Social Security income to all other income, including tax-exempt interest.

- Then compare that amount to the base amount for your filing status.

- If the total is more than the base amount, some of your benefits may be taxable.

TurboTax can help you estimate if youll need to file a tax return and what income will be taxable.

Read Also: How To Do Taxes Doordash

Also Check: What Time Is The Deadline To File Taxes

Determining California Taxes For Expats

If youre an American living abroad who came from California, you may not know whether your former state still considers you a resident. If thats the case, you may need to file a state tax return along with your expatriate tax return. Pay close attention to how your former state home regards you in order to know whether you should file state tax returns. Otherwise, you may have back taxes in your near future especially when it comes to Californian taxes for expats.

Consider Your Gross Income Thresholds

Most taxpayers are eligible to take the standard deduction. The standard tax deduction amounts that youre eligible for are primarily determined by your age and filing status. These amounts are set by the government before the tax filing season and generally increase for inflation each year.

The standard deduction, along with other available deductions, reduces your income to determine how much of your income is taxable. As long as you dont have a type of income that requires you to file a return for other reasons, like self-employment income, generally you dont need to file a return as long as your income is less than your standard deduction.

For example, in 2021, you dont need to file a tax return if all of the following are true for you:

- Dont have any special circumstances that require you to file

- Earn less than $12,550

Recommended Reading: How To File Your Taxes For Free

Filing On Your Child’s Behalf

If your child is required to file a tax return for unearned income, the IRS gives you the option of claiming the money on your return instead. There are certain restrictions, including a limit to the amount of money involved, and the tax youll owe may be greater than if your child filed an individual return. If you qualify, file Form 8814 with your 1040 and the IRS will not require your child to file.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Qualifying Rules If You Can Be Claimed As A Dependent

According to a draft of IRS Publication 501, you must file a tax return for 2022 under any of the following circumstances if you’re single, someone else can claim you as a dependent, and you’re not age 65 or older, or blind:

- Your unearned income was more than $1,150.

- Your earned income was more than $12,950.

- Your gross income was more than $1,150 or $400 plus your earned income up to $12,550, whichever is greater.

Dependents who are students must include taxable scholarships and fellowship grants in their incomes.

You May Like: How Much Is Car Tax

Benefits Of Filing A Tax Return

Get money back. In some cases, you may get money back when you file your tax return. For example, if your employer withheld taxes from your paycheck, you may be owed a refund when you file your taxes.

Avoid interest and penalties. You may avoid interest and penalties by filing an accurate tax return on time and paying any tax you owe in the right way before the deadline. Even if you can’t pay, you should file on time or request an extension to avoid owing more money.

Protect your credit. You may avoid having a lien placed against you when you file an accurate tax return on time and pay any tax you owe in the right way before the deadline. Liens can damage your credit score and make it harder for you to get a loan.

Apply for financial aid. An accurate tax return can make it easier to apply for help with education expenses.

Build your Social Security benefit. Claiming your self-employment income on your return ensures that it will be included in your benefit calculation.

Get an accurate picture of your income. When you apply for a loan, lenders will look at your tax return to figure your interest rate and decide if you can repay. If you file accurate tax returns, you may get a loan with a lower interest rate and better repayment terms.

Get peace of mind. When you file an accurate tax return and pay your taxes on time, you’ll know that you’re doing the right thing to follow the law.

Dependents May Have To File

If you are a dependent of another taxpayer, then you follow a different set of rules.

The rules determining whether a dependent needs to file a tax return are somewhat complicated, but Ill try my best to keep it simple. Dependents who are under 65 and have unearned income over $1,100, or earned income over the standard deduction of $12,550, must file a tax return.

That parts pretty easy. Heres where it gets more complex: If you received both earned and unearned income in 2021, you must file a return if your combined income adds up to more than the larger of $1,100 or total earned income plus $350.

For example, 18-year-old Danielle is claimed as a dependent by her parents. In 2021, she received $200 in unearned income from taxable interest from an investment and also earned $4,050 from her part-time job at the library. Danielles unearned income and earned income each fall below the individual thresholds. Her total income of $4,250 is also less than her earned income plus $350 . Since all three of these factors apply, Danielle does not have to file a 2021 tax return.

Still confused? Understandable. Basically, if you are a dependent and have both earned and unearned income you have to file a tax return if your total income was more than $1,100 and your unearned income was more than $350.

Related:Where to Get Your Taxes Done

Recommended Reading: How To Access Past Tax Returns

Minimum Income To File Taxes In California

Most people are required to file a state return in California, even with minimal income, but what about a federal return? The answer depends primarily on your age, income, and filing status. Here is a basic breakdown for filing:

| IF your filing status is . . . | AND at the end of 2021you were* . . . | THEN file a return if your grossincome** was at least . . . |

| 65 or older 65 or older | $25,100 | |

| $25,100$26,450 |

In addition, if you are self-employed, received a 1099-MISC form, or received an advanced tax credit through the California state or federal healthcare marketplace, you may be required to file a tax return

How Much Do You Have To Make If Youre A Dependent

You may still have to file a tax return even if youre being claimed as a dependent, depending on a number of factors. Theres the earned income you make, the unearned income you make and your gross income, and the minimums for all of these will be determined by either your age or whether or not you are blind.

If you are a single dependent under the age of 65 and not blind, you will have to file a tax return if:

Read Also: Doordash Write Offs

Recommended Reading: Where To Send Kentucky State Tax Return

Topic No 556 Alternative Minimum Tax

Under the tax law, certain tax benefits can significantly reduce a taxpayer’s regular tax amount. The alternative minimum tax applies to taxpayers with high economic income by setting a limit on those benefits. It helps to ensure that those taxpayers pay at least a minimum amount of tax.

Talk To A Tax Attorney

Need a lawyer? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Recommended Reading: What Is The Federal Inheritance Tax

Is It Better To Claim 1 Or 0

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. If your income exceeds $1000 you could end up paying taxes at the end of the tax year.

Dont Miss: Oklahoma Tag Title And Tax Calculator

How Much Do You Have To Make To File Taxes

Income-based tax requirements will be dependent on how you plan on filing a tax return. Inevitably whether youll need to file a tax return who have to do with whether youre income can even make it past the first tax bracket and how much more if so, but those tax brackets vary depending on how you file.

Don’t Miss: How Much Can Teachers Claim On Taxes

Get To Know California Income Tax Brackets

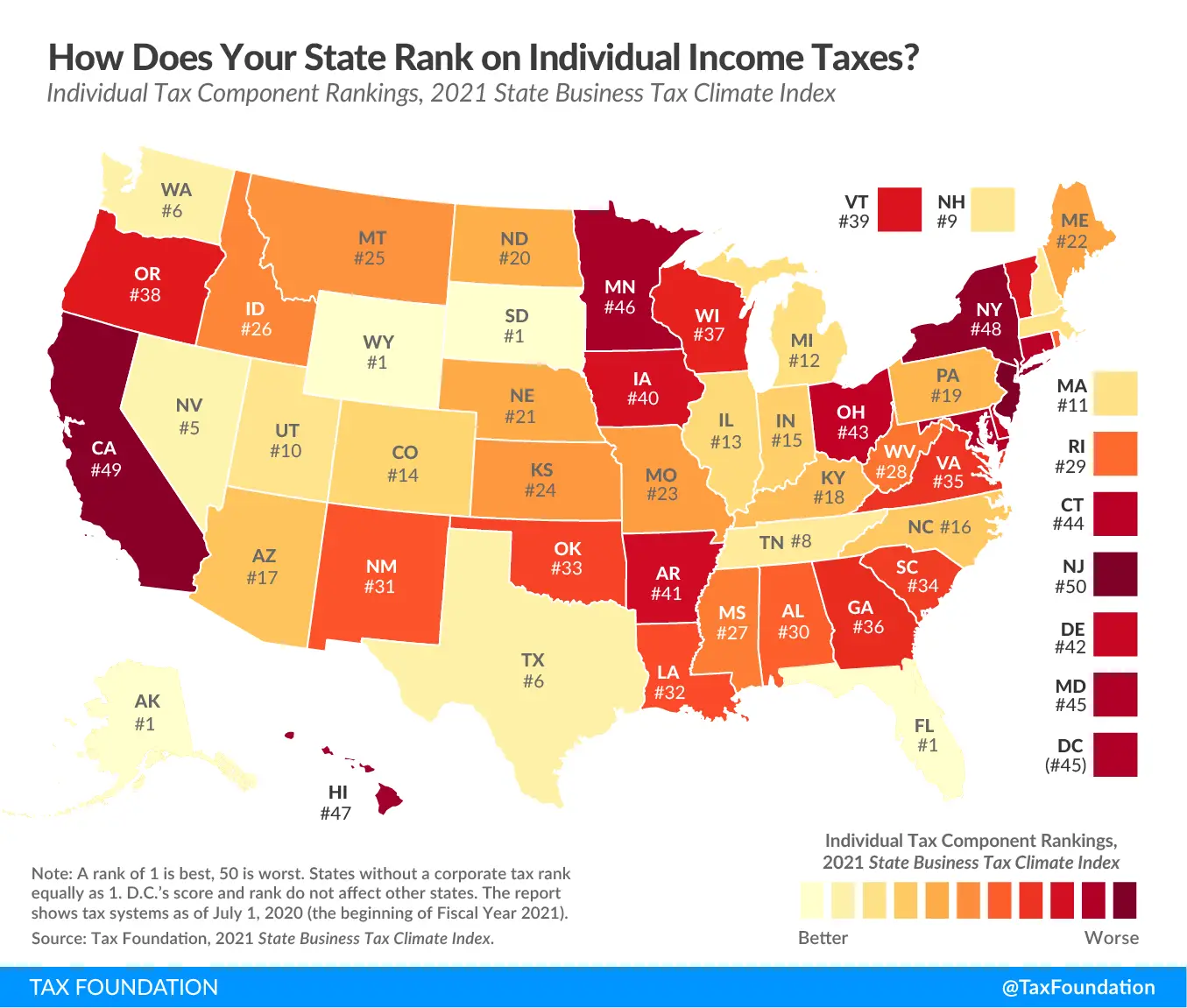

In California, state income taxes are generally among the highest in the country, but the burden is spread among different segments of the population. The rate of California income tax is arranged on something of a sliding scale, separated by income tax brackets.

Low earners pay a smaller percentage of tax on their wages, while people who earn more pay higher rates. Understanding which bracket you fall into is the first step towards calculating how much income tax you owe the state.