In Texas When Do You Have To Charge Sales Tax

If your business has a sales tax nexus in Texas, you must charge sales tax. In different states, the term sales tax nexus signifies different things. It could be having a physical site or having someone working for you in the state. It can also refer to having a affiliate or click through sales tax nexus in the case of ecommerce.

Check the Texas governments sales tax website to see if you should be charging sales tax in your state.

Texas Sales Tax By The Numbers:

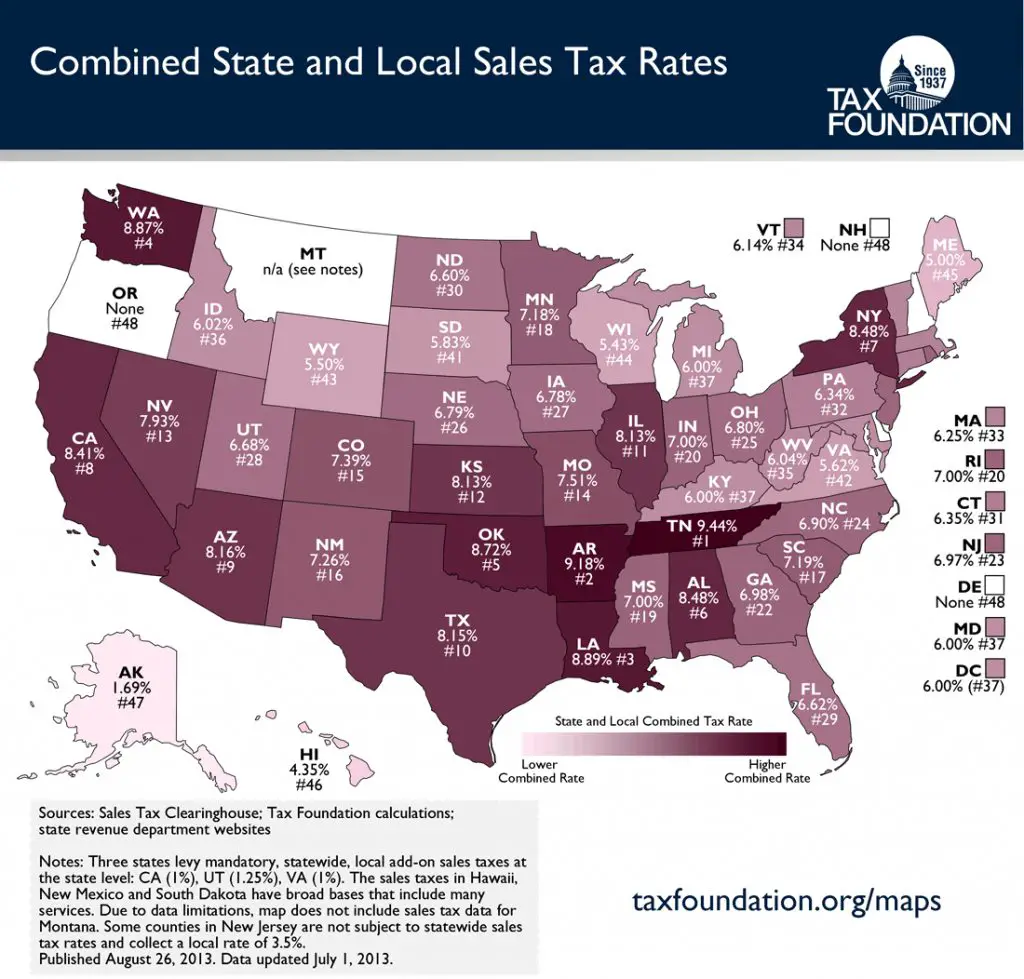

Texas has ahigher-than-average sales tax, includingwhen local sales taxes from Texass 988 local tax jurisdictions are taken into account.

Rankings by Average State + Local Sales Tax:

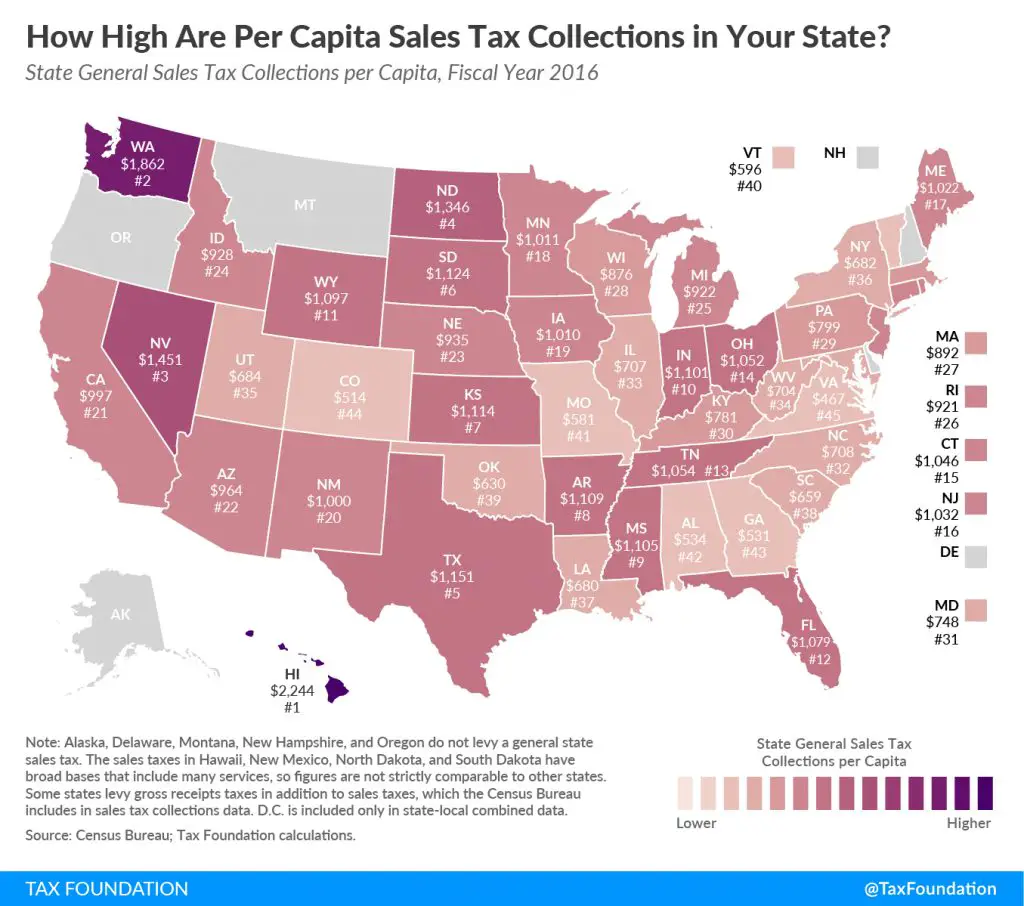

Ranked 14th highest by combined state + local sales tax

Ranked 14th highest by per capita revenue from state + local sales taxes

Rankings by State Sales Tax Only:

Ranked 7th highest by state sales tax rate

Ranked 13th highest by per capita revenue from the statewide sales tax

Texas has a statewide sales tax rate of 6.25%, which has been in place since 1961.

Municipal governments in Texas are also allowed to collect a local-option sales tax that ranges from 0% to 2% across the state, with an average local tax of 1.69% .The maximum local tax rate allowed by Texas law is 2%.You can lookup Texas city and county sales tax rates here.

This page provides an overview of the sales tax rates and laws in Texas. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Texas Sales Tax Handbooks Table of Contents above.

The Texas Franchise Tax

Texas has no individual income tax, but it does levy a franchise tax of 0.375% on some wholesalers and retail businesses. The rate increases to 0.75% for other non-exempt businesses. Also called a “privilege tax,” this type of income tax is based on total business revenues exceeding $1.23 million in 2022 and 2023.

Don’t Miss: How To Do Your Tax Return Online

Texas Alcohol And Tobacco Taxes

Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer. Liquor, on the other hand, is taxed at $2.40 per gallon. All of these taxes are below average for the U.S.

Texas taxes on a pack of 20 cigarettes totals $1.41, which ranks in the middle of the pack on a nationwide basis.

Read Also: Can I Do My Taxes Online

Local Sales And Use Tax Frequently Asked Questions

The Texas state sales and use tax rate is 6.25 percent, but local taxing jurisdictions also may impose sales and use tax up to 2 percent for a total maximum combined rate of 8.25 percent. You will be required to collect both state and local sales and use taxes. For information about the tax rate for a specific area, see Local Sales and Use Tax Rates on our sales and use tax web page.

For information on collecting and reporting local sales and use tax, see 94-105, Local Sales and Use Tax Collection A Guide for Sellers. For a list of local tax rates, see Texas Sales and Use Tax Rates. We also provide tax rate cards for all combined tax rates.

Sales and use taxes are collected at the same rate. See Purchases/Use Tax for additional information.

As a seller, you are responsible for collecting and remitting the correct amount to the Comptrollers office. If you do not, you can owe any additional tax and may be assessed additional penalties and interest.

You May Like: How Much Tax Deduction For Car Donation

Do You Have Nexus In Texas

The word ânexusâ refers to a commercial connection in the state. Nexus determines the following questions for a state tax agency: Do you do business here, what kind, and how much? And when you do have nexus, that means youâre obligated to collect tax on your sales there.

So the first question for you to answer is whether you have nexus in Texas.

You probably have nexus in Texas if any of the following points describe your business:

- A physical presence in Texas: a store, an office, a warehouse or distribution center, storage space, you, an employee, a representative, etc.

- Any affiliate businesses or individuals in the Texas, which generate sales.

- A significant amount of sales in Texas within twelve months. *

* This is called an economic nexus, a sales tax nexus determined by economic activity, i.e. – the amount of sales you make in a particular state. Any kind of economic activity could trigger the nexus, once your total sales reach a certain threshold amount.

The threshold in Texas is $500,000 in annual sales. To learn more about how this works, check out the Ultimate Guide to US Economic Nexus.

Sweeny Sales Tax Could Take On New Use

SWEENY A shift of the sales tax pie to fund a new Crime Control Prevention District will come at the expense of the Sweeny Economic Development Corp.

After 30 minutes of discussion at Tuesdays city council meeting, the board decided to put a measure on the ballot that would divide its half-cent sales tax into one-eighth toward the Crime Control and Prevention District and three-eighths for the development corporation.

Initially, splitting the two with a quarter apiece was suggested. This was the basis for the first motion, but it failed. The second motion for one-eighth towards CCPD and three-eighths for EDC carried.

If passed, it would mark the first time the EDC did not receive the entire one-half cent sales tax apportionment since 1997.

A survey, organized by City Manager Lindsay Koskiniemi, was circulated to Sweeny residents to get their opinion on how the split should be made, if at all. The city made a concerted effort to push the survey out to the city, through various platforms, including Facebook, the citys website and word of mouth.

Koskiniemi organized the three question survey and gave the results of what the community had urged. Former councilman Neil Best also spoke about the issue to help provide a community member standpoint.

Neither the executive director nor the president of the Economic Development Corporation were in attendance at the meeting.

Talks of raises and new vehicles were discussed for the polices funds should they be approved by voters.

Recommended Reading: When Are Taxes Accepted 2021

Overview Of Texas Sales Taxes

Determining whether sellers have nexus to Texas is only step one. Not all goods and services are taxed in Texas. Depending on the situation, some products and services are nontaxable and in other situations they may be classified as tax exempt. Sellers are responsible for charging the proper amount of sales tax on each good sold or service provided, keeping a detailed accounting of such taxes, and remitting the proper amount of tax to the Texas Comptroller.

With certain exceptions, the sale of tangible goods is subject to sales tax in Texas. In addition, the following services may require the payment and collection of sales tax:

- Shipping and delivery charges

- Property repair, restoration, and labor

- Debt collection

- Construction and labor charged separately from materials

- Data processing services

This list merely provides a list of common examples. Other services may be subject to sales tax as well.

Medical, educational, emergency assistance, nonprofit animal shelters , and certain wellness services are generally exempt from taxation. Bartered-for goods and services may also be subject to taxation in Texas, as determined by the overall value of the service bartered for.

In Texas, the state sales tax rate is 6.25%, and localities may charge an additional local rate up to 2%. As a result, the total sales and local tax in Texas is generally 8.25%.

State and Local Tax Services

But What If You Paid Less Than The Standard Presumptive Value

In such cases, you would be qualified to pay a lower price. If you paid less than the SPV for the vehicle, your sales tax on the transaction must be calculated based on a certified appraisal amount for the car.

TIP: This appraisal must be conducted by a licensed insurance adjuster or motor vehicle dealer within 20-days of the purchase.

Don’t Miss: What Is The Tax Rate On Social Security

Is A Sales Tax Permit The Same As A Resale Certificate In Texas

No. These are two different documents. When a business has a sales permit, it is part of the states tax-collection process, in essence collecting the tax on the states behalf and remitting it to the Texas Comptroller.

A Resale Certificate is a document that allows a business owner to buy products from a wholesaler for the purposes of reselling to your customers. Purchasing inventory for resale does not require a business owner to pay a tax, as long as they have a resale certificate. The sales tax obligations will be paid by the customers purchasing the item from your store or business. Resale Certificates for Texas businesses can be obtained by completing Form 01-339 .

Houston Texas Sales Tax Rate

houston Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Houston, Texas?

The minimum combined 2022 sales tax rate for Houston, Texas is . This is the total of state, county and city sales tax rates. The Texas sales tax rate is currently %. The County sales tax rate is %. The Houston sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Texas?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Texas, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Houston?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Houston. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Texas and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Read Also: How To File Income Tax Online For Free

Texas Sales Tax Deadlines

Once a businesss sales tax application has been approved, it will receive a letter with instructions on how often it must file a sales tax return. Returns may be due monthly, quarterly, or yearly.

Monthly Filers: Due on the 20th of the following month.

| Period |

|---|

Annual Filers: Due on January 20 for the previous years taxes.

If a due date falls on a Saturday, Sunday, or legal holiday, the deadline is extended until the next business day.

How To Figure The Amount Of Sales Tax In Texas

Related

If you do business in Texas, you may be required to collect and submit state sales taxes. Texas law mandates the collection of taxes on most retail goods and services, and also allows local jurisdictions to impose sales taxes as well. Owners of new businesses in Texas, as well as mail order or e-commerce companies that sell a significant amount of merchandise to Texas consumers, must register to collect and submit Texas sales taxes.

Recommended Reading: How Much To Withhold For Taxes

Recommended Reading: How Much Can You Donate For Taxes

Settling A Texas Sales Tax Liability

Along the way, or even after one the critical notices are issued, there is the possibility to settle your Texas sales tax case by negotiating with the Texas Comptroller. Often, you can get better results here than with the auditor. If you or your professional seldom does state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements. DO NOT try to negotiate a settlement without an experienced Texas state and local tax lawyer or other professional.

Texas Sales Tax Filing Frequency

Texas has taxpayers file on a monthly, quarterly, or annual basis depending on their average annual tax liability :

Monthly: For average annual tax liabilities above $100,000

Quarterly: For average annual tax liabilities between $10,000 to $100,000

Annually: For average annual sales tax liabilities between $0 to $10,000.

Discounts: There is an early filing discount of 0.5% in Texas. There is also an early payment discount of 1.25%.

Late Fees: There is a $50 late filing penalty in Texas per each late return. Read more here.

Recommended Reading: How To Calculate Tax From Total Amount

Texas Sales Tax Exemptions For Manufacturing

Texas offers broad sales and use tax exemptions for manufacturers. Machinery and equipment used in the production process qualify for sales tax exemptions within Texas. Repair parts and labor to qualifying machinery and equipment are also exempt. Consumables including lubricants and chemicals consumed during the manufacturing process are exempt if their use is necessary and essential to prevent the failure, decline or deterioration of exempt manufacturing equipment. Safety apparel or clothing used by employees during the manufacturing or processing of tangible personal property is exempt provided that the apparel or clothing is not sold to the employees and the manufacturing process would not be possible without the use of such apparel or clothing. Utilities consumed during production also qualify for an exemption, however a valid utility study conducted by an engineer must document the percentage of utilities consumed for exempt purposes on any meter with mixed taxable and non-taxable use. Agile Consulting Groups sales tax consultants have a wealth of experience within the state of Texas and can ensure taxpayers are maximizing the benefit of Texas sales tax exemptions for which they qualify.

For more information on Texas sales tax exemptions please visit the sites below.

Collecting Sales Tax In Texas: An Overview For Small Business Owners

Mr. Freeman is the founding member of Freeman Law, PLLC. He is a dual-credentialed attorney-CPA, author, law professor, and trial attorney.

Mr. Freeman has been named by Chambers & Partners as among the leading tax and litigation attorneys in the United States and to U.S. News and World Reports Best Lawyers in America list. He is a former recipient of the American Bar Associations On the Rise Top 40 Young Lawyers in America award. Mr. Freeman was named the Leading Tax Controversy Litigation Attorney of the Year for the State of Texas for 2019 and 2020 by AI.

Mr. Freeman has been recognized multiple times by D Magazine , a D Magazine Partner service, as one of the Best Lawyers in Dallas, and as a Super Lawyer by Super Lawyers, a Thomson Reuters service. He has previously been recognized by Super Lawyers as a Top 100 Up-And-Coming Attorney in Texas.

Mr. Freeman currently serves as the chairman of the Texas Society of CPAs . He is a former chairman of the Dallas Society of CPAs . Mr. Freeman also served multiple terms as the President of the North Texas chapter of the American Academy of Attorney-CPAs. He has been previously recognized as the Young CPA of the Year in the State of Texas .

Also Check: Are Donations To Nonprofit Organizations Tax Deductible

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See Prepayment Discounts, Extensions and Amendments FAQs.

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

Texas Sales Tax Rates By City

The state sales tax rate in Texas is 6.250%. With local taxes, the total sales tax rate is between 6.250% and 8.250%.

Texas has recent rate changes .

Select the Texas city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Texas was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Recommended Reading: What If I Am Late With My Tax Return

Does Your Business Have A Nexus For Sales Tax For Texas

Companies based in Texas are considered to have a physical nexus with the state. Remote sellers and companies that have business ties with the state might have a nexus that can be defined by several different criteria.

Here are the types of sales tax Texas nexus, applicable to out-of-state businesses: Economic nexus. Suppose that in the last 12 months, your company does not have a physical presence in Texas but has reached $500 000 in gross revenue from sales to customers in the state. Such turnover is a nexus trigger, resulting in an obligation to charge and collect the correct Texas sales tax rate from your Texas-based customers.

Affiliate nexus. This type of nexus is normally triggered by a business using the help of sales representatives or other types of affiliates in the state.

Storing inventory in the state. If you store goods for sale in Texas, including the use of Amazon-owned warehouses , you must register for a Texas sales tax permit.

Attending trade shows and exhibitions. If your company has made sales during a trade show in Texas, you might be responsible for collecting the sales tax.