Arizona Sales Tax Filing Frequency

Your TPT filing frequency in Arizona is based on your estimated annual combined tax liabilities.

Annual Filing: Less than $2,000 estimated annual combined tax liability

Quarterly Filing: $2,000 $8,000 estimated annual combined tax liability

Monthly Filing: More than $8,000 estimated annual combined tax liability

Seasonal Filing: 8 months or less

To update your filing frequency, submit the Business Account Update form to the Department of Revenue. You can read more on the Arizona Department of Revenue website.

Discounts: Arizona allows an on-time filing discount of 1%, up to $10,000 per business entity for a calendar year.

Late Fees: Arizona has one late fee for the return being late, and another for the payment being late. The late return penalty is 4.5%, and the late payment penalty is 0.5%. Additional penalties may be added, up to 25% of the tax due. For more information, see page 1 on the TPT-2 return instructions.

Arizona does not currently have any sales tax holidays.

List Of Taxable Activities

Gross receipts generated from the following types of business are subject to the City of Scottsdale privilege tax.This summary provides only broad guidelines as to which activities are taxable and is not intended to be acomprehensive list ofsuch activities.

Transient Lodging – Hotel/Motel

In addition to the one and seventy-five hundredths percent privilege tax on the rental ofreal property, there is a five percent transient lodging tax on any hotel, motel,apartment, or individual charging for lodging spaceto any person for 30 days or less.

Transient Lodging – Short TermRental

In addition to the one and seventy-five hundredths percent privilege tax on the rental of real property, there is a five percent transient lodging tax on any hotel, motel, apartment, or individual charging for lodging space to any person for 30 days or less.

Utility Services

Includes providing water, electricity or gas.

How Are Rebates And Dealer Incentives Taxed

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000.

Arizona taxes vehicle purchases after rebates or incentives are applied to the price, which means that the buyer in this scenario will only pay taxes on the vehicle as if it cost $9,000.

Don’t Miss: How Do Day Traders Pay Taxes

Tax On Rebates & Dealer Incentives

The state of Arizona does not tax rebates and dealer incentives. In other words, be sure to subtract the incentive amount from the car price before calculating the sales tax amount.

As an example, lets say you want to purchase a new truck for $47,000 and the dealer provides a $2,500 rebate. You do not have to pay a sales tax on the $2,500 rebate. Therefore, the taxable amount is $44,500.

Collecting Sales Tax On University Sales

TPT requirements must always be considered when making external sales. When conducting a taxable transaction, departments must separately state the tax amount on the invoice or receipt unless a written statement is provided to the customer that the price includes tax. This statement must be displayed when the terms of the sale are being offered and once stated, the University must factor sales tax out of the total collected. Departments are required to record sales using the appropriate object codes for either scenario so the correct amount of TPT is reported and remitted to ADOR. Only if an external customer provides a valid exemption certificate for a taxable sale should the department consider not collecting tax.

The most common taxable sales made by the University to outside customers include:

- Printing, copying, and binding services

- Bookstore sales

Refer to Policy 8.11 Sales Tax for more detailed information about departmental responsibilities, taxable sales, object codes, and other related topics. If a department does not collect required tax from its customers, it will be factored from gross receipts and assessed to the department. ADOR provides a factoring sheet for this purpose as a reference on their website. If any departmental collection or recording error results in additional tax, penalties, or interest, Financial Services will charge these fees to the department.

Local & In-State Sales

Online & Out-of-State Sales

Read Also: What Tax Year Is The Third Stimulus Based On

What Transactions Are Generally Subject To Sales Tax In Arizona

In the state of Arizona, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Several examples of exceptions to this tax are certain types of groceries, some medical devices, certain prescription medications, and machinery and chemicals which are used in research and development.This means that someone in the state of Arizona who sells textbooks would be required to charge sales tax, but an individual who sells groceries might not be required to charge sales tax.

Correcting Use Tax Errors

Because it is self-assessed, errors in use tax are corrected internally. The correction process varies based on the original purchase method: PCard purchase or Purchase Order.

Purchase via PCard

To correct use tax erroneously processed on a Procurement Card Transaction , refer to our documentation onCorrecting Use Tax on a PCDO. Most use tax errors related to PCard transactions result from incorrect reconciliation or failure to use a purchase invoice when reconciling transactions. Guidance for best reconciliation practices can be found in thePurchasing Card Policies Manualon the PCard website.

Purchase via Purchase Order

If use tax was charged inappropriately on a purchase order,Accounts Payableshould be contacted directly. The same procedure is followed if use tax was not paid on a purchase but should have been assessed.

Occasionally, both sales and use tax are paid on a purchase. When sales and use tax have both been paid, the use tax should be reversed. Follow the guidelines outlined above to correct the error making sure that the amount being reversed is the use tax amount, not the sales tax amount.

Don’t Miss: How Do I Fill Out My Tax Return

Do Arizona Nonprofit Organizations Pay And/or Collect Sales Taxes

In many states, nonprofit organizations are exempt from paying sales tax. In Arizona, what is often thought of as a sales tax is, technically, a Transaction Privilege and Use Tax and is actually a tax on a vendor or company doing business, not a true sales tax. The tax is generally passed on to purchasers, including nonprofit organizations, but it is in fact a tax on the vendor, not the consumer. This is helpful to the understanding of whether or not nonprofit organizations are exempt from this tax.

In general, nonprofit organizations in Arizona are not exempt from the Transaction Privilege and Use Tax passed on by vendors. However, as vendors themselves, nonprofits in Arizona are generally exempt from the transaction privilege tax for retail sales. In other words, sales to nonprofit organizations are not exempt, but retail sales 5013 nonprofit organizations usually are exempt.

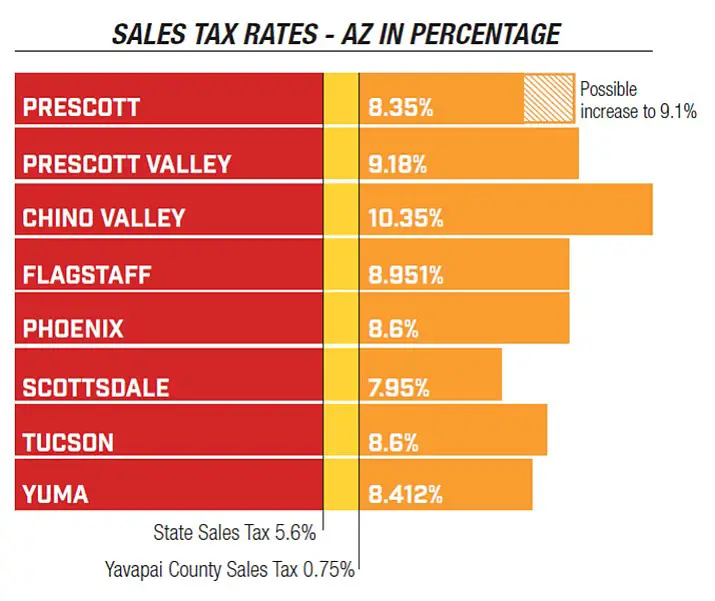

Scottsdale Arizona Sales Tax Rate

scottsdale Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Scottsdale, Arizona?

The minimum combined 2022 sales tax rate for Scottsdale, Arizona is . This is the total of state, county and city sales tax rates. The Arizona sales tax rate is currently %. The County sales tax rate is %. The Scottsdale sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Arizona?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Arizona, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Scottsdale?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Scottsdale. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

You May Like: Is Turbo Tax Fixing The Stimulus Problem

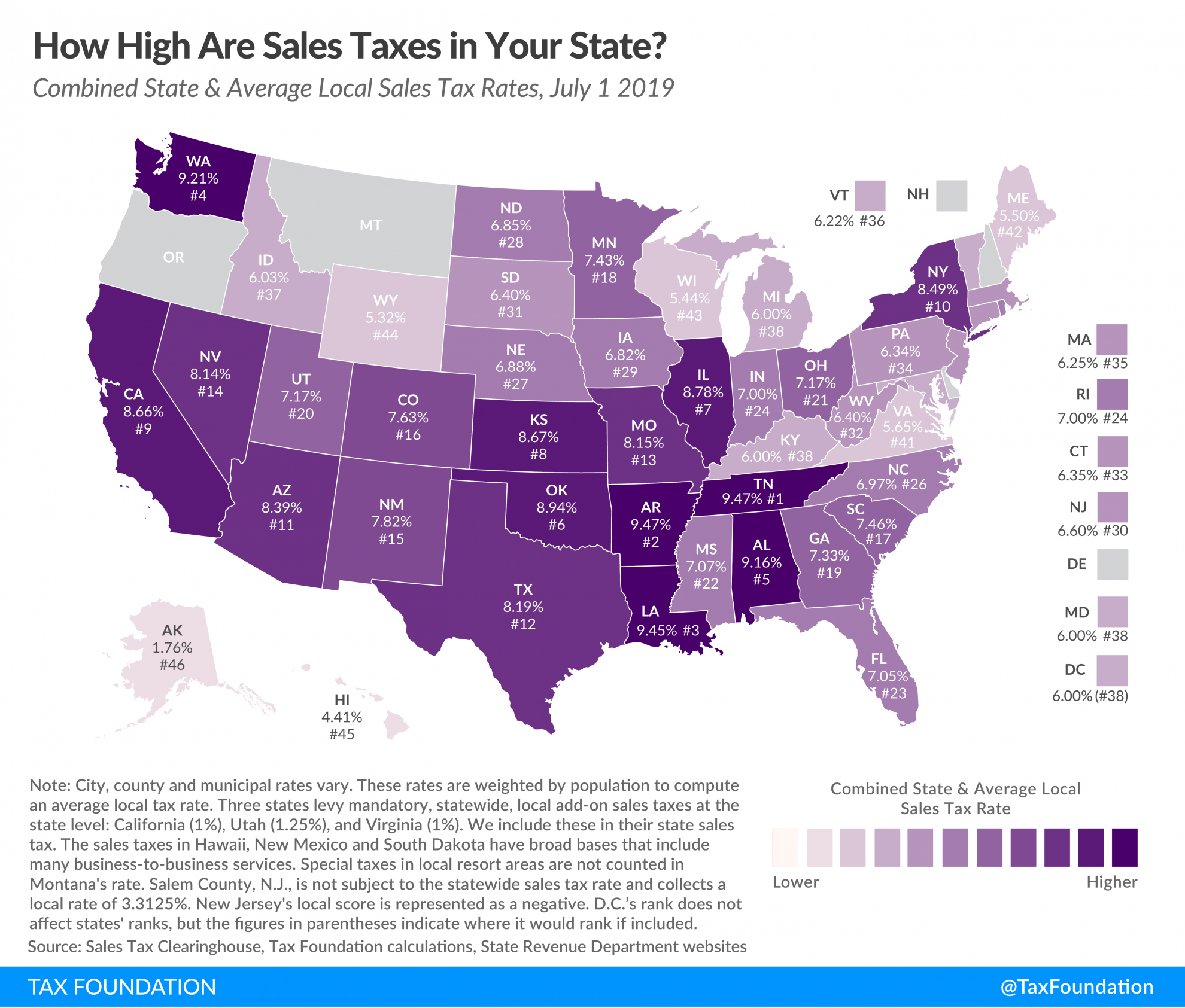

Arizona Sales Tax Rates By City

The state sales tax rate in Arizona is 5.600%. With local taxes, the total sales tax rate is between 5.600% and 11.200%.

Arizona has recent rate changes .

Select the Arizona city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Arizona was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

About The Arizona Sales Tax

The state of Arizona has a slightly complicated sales tax system. The system Arizona utilizes is called the Transaction Privilege Tax, which is also known as the TPT. This tax system is not technically a sales tax system, although they are similar. It is a gross receipts tax, which means that the taxes are levied from the gross receipts of each vendor as opposed to the liability of the buyer . However, in addition to the TPT, cities and counties have the ability to add various local taxes to the total compounded rate. These local additions may vary significantly depending on which jurisdiction you are in. It is also worth noting that Indian reservations in the state of Arizona apply their own sales tax, which is usually higher than the average rate.

Don’t Miss: How To Grow Your Tax Business

Registering For Arizona’s Taxes

To register to pay Arizona sales tax, use tax, and certain other taxes, complete the Arizona Joint Tax Application Form and mail it to the address on the form. This is the method that takes the longest.

A business can also register at AZTaxes.gov. Businesses use the same website to file and remit the sales taxes they collected.

The third way is to download the form, complete it, then visit one of the offices to deliver the completed JT-1 Form directly. Arizona has three offices you can hand-deliver completed forms to:

- Phoenix Office, 1600 W. Monroe, Phoenix, AZ, 85007

- Mesa Office, 55 N. Center, Mesa, AZ 85201

- Tucson Office, 400 W. Congress, Tucson, AZ 85701

If you have more than one business location, you can get one license number for all locations, or you can opt to apply for a different license for each location.

It takes three to five business days to process the application if you drop it off or apply online. However, if you mail the form in, you must add mailing time to the wait time.

Arizona Sales Tax Software

Because of the complicated nature of Arizonas sales tax system for out of state sellers, if you are looking to streamline and simplify the process, TaxTools sales tax software is a good fit. We offer data review and sorting tools that will help you determine the proper sales tax rate for each sale you make in Arizona. It can work with your existing e-commerce website or other transactions from within a single interface. Contact us today to learn more about TaxTools or signup here for a free trial.

AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps. See how much time you can save by using AccurateTax.

Solutions

You May Like: How To Pay If You Owe State Taxes

What To Expect During An Audit

The typical audit process is shown in this flowchart. Detailed guidance for each stage of theprocess follows in the sections below.

Arizona regularly audits businesses required to charge, collect, and remit various taxes in the state.

Many audits begin with a call from an Arizona Department of Revenue’s sales tax auditor.

Shortly after the call, your business will receive aNotification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for an Arizona sales tax audit.

It is good to start with getting a state and local tax professional involvedto prepare for the audit.

I Received an Arizona Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

- If you dont have sales tax audit experience, how can you trust that the state’s auditor abides by the rules and follows proper procedures?

- How will you know when to provide documents or when to push back?

- Do you have a thorough understanding of your sales and use tax areas of exposure?

- Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option.Contact us to learn how our sales tax professionals can give you the peace of mind and confidence youll need during your audit.

Arizona Ev Rebates & Incentives

Arizona may offer reduced tax rates to those who own an electric or alternative fuel vehicle.

Also, in addition to the federal tax incentives, Arizona utility companies offer reduced electricity rates when charging during off-peak hours.

Tax information and rates are subject to change, please be sure to verify with your local DMV.

Recommended Reading: How To File Quarterly Taxes

Is Saas Taxable In Az

Arizona does impose sales and use tax on SaaS and cloud computing. Prewritten computer software or canned software, which includes software that may have originally been written for one specific customer but becomes available to others, are also taxable and considered sales of tangible personal property.

Chandler Arizona Sales Tax Rate

chandler Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Chandler, Arizona?

The minimum combined 2022 sales tax rate for Chandler, Arizona is . This is the total of state, county and city sales tax rates. The Arizona sales tax rate is currently %. The County sales tax rate is %. The Chandler sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Arizona?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Arizona, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Chandler?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Chandler. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Arizona and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Also Check: What States Have The Lowest Property Taxes

Determining Sales Tax Nexus In Arizona

For those who live and operate in Arizona, collecting sales tax is relatively simple. You collect and pay local, county, and state sales tax to the areas in which you live. However, for those who are not wholly based in Arizona, the state expects sales tax to be collected if you have nexus there.

There are several situations in which a business is considered to have sales tax nexus in Arizona. These include:

- A physical office or location in the state

- Inventory in a warehouse located in the state

- Ownership of any property in the state

- A full-time employee who works in the state more than two days per year

- A contractor or other representative who is in Arizona for more than two days per year

- Delivery of any goods in taxpayer owned vehicles

You can learn more about what constitutes sales tax nexus in Arizona and how to confirm if you are subject to these factors on the Arizona Department of Revenues website.

For those that sell goods online through Amazons FBA program , there are five fulfillment centers in the state four of them are in Phoenix and the fifth is in Goodyear. Make sure you know exactly where your inventory is being held if you use Amazon or another online retailer for fulfillment as this constitutes nexus in the state.

How To File Taxes In Arizona

When tax time rolls around in Arizona, whether itâs monthly or annually, you must do three things:

Arizona requires that any seller with a sales tax permit file a sales tax return on your due date, even if you donât have any sales tax to report or pay. Even if you didnât make a single sale in Arizona during the reporting period, you should must do a âzero tax filing.â

Also Check: Do Seniors Have To File Taxes

Is The Arizona Sales Tax Destination

Arizona is a origin-based sales tax state, which meanssales tax rates are determined by the location of the vendor, not by the location of the buyer. The origin-based method of determining sales tax is less complicated for vendors than destination-based sales tax, because all in-state buyers are charged the same sales tax rate regardless of their location.