Is The Pennsylvania Sales Tax Destination

Pennsylvania is a origin-based sales tax state, which meanssales tax rates are determined by the location of the vendor, not by the location of the buyer. The origin-based method of determining sales tax is less complicated for vendors than destination-based sales tax, because all in-state buyers are charged the same sales tax rate regardless of their location.

Reinstating A Revoked Sales Tax License

If you or your business have outstanding tax debts of any kind, including personal and corporate, the Pennsylvania Department of Revenue could revoke your sales tax license, but you can get it back if you follow the proper steps. This process includes filing any overdue tax returns and paying any amounts owed, although a payment plan with the Department may be possible.

What Transactions Are Generally Subject To Sales Tax In Pennsylvania

In the state of Pennsylvania, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Some examples of items that exempt from Pennsylvania sales tax are food, most types of clothing, textbooks, gum, candy, heating fuels intended for residential property, or pharmaceutical drugs.This means that an individual in the state of Pennsylvania who sells makup would be required to charge sales tax, but an individual who sells college textbooks would not.

Read Also: How To Fill Out Tax Forms For Work

Sales Tax On Shipping Charges In Pennsylvania

Pennsylvania does apply sales tax to shipping costs. The rule of thumb is that if what youâre selling is subject to tax, then the shipping charges are also subject to tax.

If you happen to be shipping products that are both taxable and nontaxable, then shipping charges for the entire shipment are subject to tax.

Failure To Comply With Pennsylvania Sales Tax License Requirements

Potential penalties for noncompliance with Pennsylvania sales tax license requirements can be quite severe and even include imprisonment of up to 30 days. Generally, fines range between $300 and $1,500 for each offense.

For more information on how to get set up to collect and remit sales taxes in Pennsylvania, check out the Pennsylvania Department of Revenue’s publication, Retailer’s Information , which goes into all of the above information in much more detail.

About the Author

Michelle Kaminsky, Esq.

Freelance writer and editor Michelle Kaminsky, Esq. has been working with LegalZoom since 2004. She earned a Juris DoctoRead more

Recommended Reading: How To Make Tax Payments

What Is The Current Sales Tax In Pennsylvania

As mentioned previously, to determine how much sales tax in Pennsylvaniayou should collect, you must take into account the general and local sales tax rates. The base Pennsylvania sales tax percentage is 6 %. It is combined with municipality rates that range from 0 to 2 %. The highest total sales tax rates Pennsylvania go up to 8 %. If you have trouble calculating whats the sales tax in Pennsylvania you should collect from clients in different municipalities, please try using our Sales Tax Calculator and if you have more questions, contact our team.

Are Services Shipping Installation Etc Taxable In Pennsylvania

The taxability of transactions involving services, shipping, and installation of tangible goods can be slightly complicated with various laws applying to slightly different situations. To learn more about how these transactions, and other more complicated situations, are subject to the Pennsylvania sales tax see the Pennsylvania sales taxability FAQ page.

Also Check: How To File Past Taxes

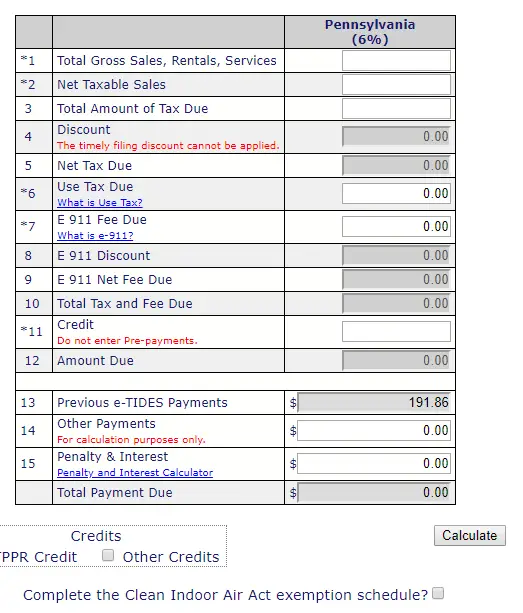

How Often Should You File

For all businesses, when they are first formed and obtain their sellers permit, their will be required to file their sales tax quarterly. Annually, the state of Pennsylvania will determine if the filing frequency needs to be changed. This determination is done in November based on the collected sales tax for the third quarter .

Note: Pennsylvania requires you to file a sales tax return even if you have no sales tax to report.

Extra Sales Tax With The Motor Vehicle Understated Value Program

The MVUVP allows the Department of Revenue to tack on more sales tax to vehicle purchases. This will be done if they deem the sale price to be much lower than the market value of the vehicle. This program was created by the Pennsylvania government to target those who attempt to sell cars well below market value in order to lower the sales tax on the purchased vehicle.

According to the Department of Revenue, the fair market price of a vehicle is decided not by the seller or buyer of the vehicle but by the Pennsylvania state government. Before listing a vehicle for sale or buying a privately sold vehicle, it’s a good idea to check the Pennsylvania Department of Revenue’s website to read about this program and find the fair market value of the vehicle you’re considering selling or buying.

Also Check: What Does Tax Deferred Mean

Pennsylvania Sales Tax Software

If you operate in the State of Pennsylvania and know youll need to collect sales tax there for upcoming transactions, there are a number of things youll need to keep track of to ensure tax compliance. From data review to sorting of transactions and determining the best rate for each sale made into the state, its important that you get it right. Thats why TaxTools sales tax calculator software is a good fit for so many sellers who do business in the state. If you have an eCommerce site or other online platform, it can work with your existing system and help you get the sales tax collection process right. Contact us today to learn more or to .

Sales Tax Exemptions In Pennsylvania

In Pennsylvania, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers.

Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

Many states have special, lowered sales tax rates for certain types of staple goods – such as groceries, clothing and medicines. Restaurant meals may also have a special sales tax rate. Here are the special category rates for Pennsylvania:

Clothing

OTC Drugs

EXEMPT

These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items. Groceries are generally defined as “unprepared food”, while pre-prepared food may be subject to the restaurant food tax rate.

Candy and soda may be included or excluded from any preferential tax rate depending on whether or not the state considers them to be a “grocery”:

IS considered a groceryis NOT considered a grocery

Read Also: How Can I Check My Income Tax Refund Status

Remote And Marketplace Sellers

Remote sellers and marketplace facilitators must collect Pennsylvania sales tax if they have over $100,000 in gross receipts into the state for the previous year. Previously, the state had an option for out-of-state businesses to advise buyers to pay use tax. However, that option is no longer available. Collecting sales tax if a business meets the financial nexus is mandatory.

Pennsylvania Ev Rebates & Incentives

Going green and buying an electric or hybrid vehicle in Pennsylvania could save you some money. In addition to the federal rebate, here are some incentives specific to Pennsylvania:

Pennsylvania residents can apply for a rebate within six months of purchasing a new, pre-owned, or demonstration electric vehicle for under $50,000.

If you drive a hydrogen fuel cell vehicle, you qualify for a rebate of $1,000.

Rebate recipients will receive $750 for electric vehicles.

Those purchasing a plug-in hybrid vehicle will receive a rebate of $500.

Tax information and rates are subject to change, please be sure to verify with your local DMV.

Recommended Reading: How To Find Your Tax Id

Determining Sales Tax Nexus In Pennsylvania

If you operate your small business in Pennsylvania, then you are required to collect and remit payment for sales tax here. However, its not always so simple for those who operate outside of Pennsylvania but do business in the state in one form or another. For those businesses, it is important to establish nexus.

The following factors will allow you to determine if you have sales tax nexus in Pennsylvania and therefore are required to collect business tax here:

- A physical location in the form of an office, place of business, or real estate property

- An employee, independent contractor, or other representatives in the state

- Physical goods stored in a warehouse

- Leasing any property located in the state

- Delivering merchandise into the state

For more information about what constitutes nexus and how Pennsylvania defines the term, they offer a detailed breakdown on the Department of Revenue website here.

You should also consider if you use the Amazon FBA program to fulfill shipments for your company. Because there are several fulfillment centers in Pennsylvania, there is a good chance that at least some of your items are stored here. It is recommended that you check inventory with Amazon to determine if this will affect you and require you to collect sales tax in the state.

Pennsylvanias economic nexus tax law requires remote sellers who make $100,000 or more in annual gross sales to collect and remit sales tax to Pennsylvania.

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

Like neighboring New Jersey, property taxes in the Keystone State are rather high . The state’s median property tax rate is the 12th-highest in the U.S.

But sales taxes are below average in Pennsylvania. The state’s modest 6% sales tax is all that’s due, except in Allegheny County and Philadelphia. That’s certainly some good news for shoppers in most parts of the state.

In addition, Pennsylvania is sending property tax/rent rebates to eligible residents in 2022. The rebate amount depends on your income, age, and whether you own or rent your home. You must apply for a rebate before the end of 2022.

Don’t Miss: How Much Is Capital Gains Tax On Real Estate

Contest A Pennsylvania Jeopardy Assessment

Pennsylvania may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives PDOR accelerated rights and it may immediately begin to try and collect. Due to the jeopardy nature, the taxpayer only hasa short period of time to contest the assessment and must place a security deposit to fight the issue.

Erie Sales Tax Region Zip Codes

The Erie sales tax region partially or fully covers 29 zip codes in Pennsylvania. Remember that ZIP codes do not necessarily match up with municipal and tax region borders, so some of these zip codes may overlap with other nearby tax districts. You can find sales taxes by zip code in Pennsylvania here

16501Help us keep our data updated!

If you notice that any of our provided data is incorrect or out of date, please notify us and include links to your data sources . If we can validate the sources you provide, we will include this information in our data.

Data Accuracy Disclaimer

Tax-Rates.org provides sales tax data for “Erie” on an AS-IS basis in the hope that it might be useful, and we can offer NO IMPLIED WARRANTY OF FITNESS. While we attempt to ensure that the data provided is accurate and up to date, we cannot be held liable for errors in data or calculations we provide or any consequence or loss resulting from the of use of the Data or tools provided by Tax-Rates.org.

Don’t Miss: Where Can I Get My Tax Returns

Sales Tax In Pennsylvania

I think I saw somewhere that the State of Pennsylvania does not charge a sales tax on clothing and something else. Is that the case? Also I have forgotten what the something else is. Can someone please set me straight?

Thank you

Clothing and food items are not taxed in PA. This is why the clothing outlets are so popular here. We get many shoppers from surrounding states coming in for “back to school” clothes shopping every year.

Regular sales tax for everything else in 6%. There are some additional taxes in some areas for hotel rooms.

Clothing is a little tricky:

Generally, clothing is nontaxable except the following: Formal day or evening apparel Articles made of real, imitation, or synthetic fur where the fur is more than three times the value of the next most valuable component material and Sporting goods and clothing normally worn or used when engaged in sports. Luggage, handbags, carrying bags, and wallets are subject to Sales Tax.

Thanks for the explanation. That is very helpful.

Not all grocery store food is exempt. It’s really tricky on what is and isn’t taxable, food-wise.

Also, it’s not 6% in the entire state. It’s higher in Allegheny County and the City Of Philadelphia. It’s 7% in Allegheny County and 8% in the City Of Philadelphia. And you may pay additional on hotels, depending.

I Should Have Collected Pennsylvania Sales Tax But I Didnt

Unlike many of our competitors who offer a one size fits all solution and blindly suggest filing a Voluntary Disclosure Agreement in each state, our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus but you have not collected Pennsylvania sales tax, the primary options are to:

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes the best solution for a business is simply to register with Pennsylvania and pay back taxes, penalties, and interest. A VDA is not cost-effective if the past liabilities and penalties are minimal. Be wary of the tax professionals that recommend doing a VDA in these cases, they are looking to make a buck rather than looking out for your best interests. If youre unsure what your past liabilities are,contact us and one of our state tax professionals will work with you to conduct an analysis and help you make the right choice for your business.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: registering does not generally eliminate past liabilities

Read Also: When Do I Pay Taxes On Stocks

Pennsylvania State Tax Guide

State tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact Pennsylvania residents.

Retirees: Not Tax-Friendly

For an East Coast, original 13-colonies state, Pennsylvania’s state income tax rates aren’t very high at a flat 3.07%. However, most cities and towns in Pennsylvania tack on their own local income tax .

Reactivating An Expired Retail Sales Tax License

If your sales tax license has expired, you may be able to reactivate it by once again completing form PA-100, although you must do so by sending a hardcopy version to the Department of Revenue you cannot complete the form online.

Be careful to check all of the appropriate boxes concerning the reactivation of your license and to also update any information about your business that may have changed from your original license.

Don’t Miss: How Much Is To Do Taxes

Forming A Nexus In Pennsylvania

Only after you form a nexus can you begin charging the correct Pennsylvania sales tax rates from your clients. Here are the ways you can establish a sales tax nexus:

- Physical nexus. Your company becomes automatically eligible for collecting Pennsylvania state sales tax rate if it has a physical presence in the state.

For remote sellers:

- Economic nexus. Gross sales of over USD 100 000 in the last 12 months are considered a substantial economic presence in the state and put a sales tax burden on the seller. This provision was confirmed in 2019, overthrowing the previous system, which allowed sellers to elect to either collect the Pennsylvania tax sales or send notices to their customers.

- Affiliate or click-through nexus. Using the support of physical persons in Pennsylvania or aiding sales by advertising to Pennsylvania residents via an affiliate link establishes a sales tax nexus in the state.

- Trade shows. Taxable sales in trade shows in Pennsylvania might be enough to trigger a sales tax nexus in the state.

- Inventory in the state. If your company stores inventory in Pennsylvania , you might need to account for the sales tax.

What Is Pennsylvania Sales Tax On Cars

Buying or selling a vehicle may seem like a small task, but it’s easy to get bogged down in the fees and legal papers that follow a sale. The Pennsylvania sales tax on cars can significantly raise the cost of a vehicle, and making sure the vehicle is legal for you to drive takes a little legwork.

Buying or selling a vehicle may seem like a small task, but it’s easy to get bogged down in the fees and legal papers that follow a sale. The Pennsylvania sales tax on cars can significantly raise the cost of a vehicle, and making sure the vehicle is legal for you to drive takes a little legwork. Before you buy or sell a vehicle, know your way around the Pennsylvania sales taxes and the paperwork needed to make your vehicle street-legal.

Don’t Miss: How To Fill Out Tax Form 8962