Where To Go If You Need Help Registering For A Sales Tax Permit In Washington Dc

If you are stuck or have questions, you can either contact Washington, D.C. directly or reach out to us and we can register for a sales tax permit on your behalf.

How to contact the Washington, D.C. Office of Tax and Revenue if you have questions: You can contact the Washington, D.C. Office of Tax and Revenue by phone at 727- 4TAX between 8:15 am 5:30 pm.

How to contact TaxValet if you want someone to handle your permit registration for you: You can learn more about our sales tax service by .

Washington Dc Sales Tax

For registered Washington D.C. taxpayers, there are three tax return filing frequencies: monthly, quarterly, and annually. Your filing frequency will be determined by the D.C. OTR after registration. All returns are due by the 20thof the month following the reporting period. If the due date falls on a weekend or national holiday, then the correct due date for your filings will get pushed back to the next business day.

Luckily for taxpayers, Washington D.C. sales tax compliance does not require any pre-payments or accelerated payments. Unfortunately, Washington D.C. does not offer vendor compensation, vendor discounts, timely filing discounts, or anything similar to reward the taxpayer for on time filing. An extra factor to keep in mind while reviewing your taxes is that if a ones tax liability is over $5,000 then the taxpayer is required to file and pay their taxes electronically.

As previously mentioned, the established tax laws in Washington D.C. are pretty straight-forward in comparison to other state sales tax laws. Their simplicity makes it easier to keep that 6% tax rate in the back of your head when checking to make sure you are filing everything correctly. The hardest part about Washington D.C. sales tax compliance is remembering which purchases have atypical sales tax rates. Since these rates refer to specific items, it can be slightly more difficult to remember which materials are included within these varying tax rates, so be sure to double check!

Other Taxes And Fees Applicable To District Of Columbia Car Purchases

In addition to state and local sales taxes, there are a number of additional taxes and fees District of Columbia car buyers may encounter. These fees are separate from the sales tax, and will likely be collected by the District of Columbia Department of Motor Vehicles and not the District of Columbia Office of Tax and Revenue.

Title Fee: Registration Fee: Plate Transfer Fee:

Average DMV fees in District of Columbia on a new-car purchase add up to $4971, which includes the title, registration, and plate fees shown above.

You May Like: Do Beneficiaries Pay Taxes On Life Insurance Policies

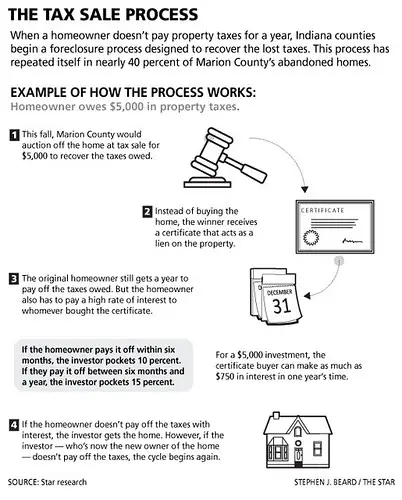

Real Property Tax Sale

Notice is hereby given that all real properties described on the list below, for which real property taxes or vault rents were levied and in arrears on October 1, 2021, for which Business Improvement District taxes were levied and in arrears before September 1, 2021, or for which any other tax certified to the Office of Tax and Revenue for collection hereunder remains unpaid, shall be sold at public auction to the highest bidder at the 2022 Real Property Tax Sale . The Sale shall be held pursuant to DC Official Code § 47-1330, et. seq.

The Sale shall begin on Tuesday, July 19, 2022, and continue, except Saturdays, Sundays and legal holidays, until all the real properties available for sale are sold. During each day, the Sale shall be conducted from 8:30 am until 12 noon and from 1 pm until 4 pm or until all the real properties scheduled for sale for that day are sold. The Sale shall occur at OTR located at 1101 4th Street, SW, Suites W244 and W250, Washington, DC 20024.

All real properties are listed in square, suffix and lot, or parcel and lot, number order. The name of the owner of record and premise address of each real property are also stated. Certain real properties on this list do not have street numbers or premise addresses therefore, none can be provided. A real property without a street number is generally stated on the below list as having 0 as a street address number.

Washington Dc Sales Tax Compliance Services

Agiles experienced sales tax consultants can help by completing your companys ongoing compliance filings in the state of Washington D.C. In fact, weve offered an outsourcing solution for both this process since 2005. You can learn more about our outsourcedsales tax complianceservices or simply give us a call at 350-4829. We are interested to learn more about your needs, and you might be surprised how little it will cost to have a sales tax expert take this responsibility off your hands!

Don’t Miss: How Can I Find My Tax Id Number

Information Needed To Register For A Sales Tax Permit In Washington Dc

Before you begin the process of registering with the state, make sure you have access to the following information:

- Federal tax ID, typically called the EIN, issued by the IRS

- Knowledge of your business entity structure

- Business owner information

- Start date with Washington, D.C.

- Your business address

- The name, title, home address, and Social Security number of the proprietor, partners, or principal officers

- Any former entity information, if previously registered with the District

- The addresses for all locations where you will collect sales tax in the District of Columbia

- Washington, D.C. requires submission of specific forms depending on your entity type. See the table below.

| Business Type |

To get started, choose the link titled Register a New Business: Form FR-500 on the website.

Click Next and follow the prompts that walk you through the process of registering with Washington, D.C.

What Happens After You Apply for a Sales Tax Permit in Washington, D.C.?

Keep in mind, once you have an active sales tax permit in Washington, D.C., you will need to begin filing sales tax returns. Our team can handle your sales tax returns for you with our Done-for-You Sales Tax Service. You can also learn more about how to file and pay a sales tax return in Washington, D.C. by .

A paper copy of your sales tax permit will arrive at your mailing address within 7-10 business days.

Overview Of District Of Columbia Taxes

Washington, D.C. residents pay a progressive district income tax if they’ve lived there for at least 183 days out of the year. Rates are quite high compared to national averages, as the district raised its rates for the 2021 tax year. The District of Columbias property taxes would rank as the eighth-lowest among U.S. states, and it has a sales tax rate of 6%.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Read Also: How Can I Check My Income Tax Refund Status

Relaxthis Tax Is Everywhere

Its easy to get upset about hotel taxes, but remember that every city has high hotel taxes. Why? Well, its an easy political sell for the city council the city gets to raise money but doesnt have to tax its own residents.

There are actually a lot of cities with higher hotel taxes that we have. According to the HVS Lodging Tax Report, Washington, DC isnt even in the top 50 U.S. cities for hotel taxes. For example:

- In Philadelphia, the tax is 15.5%.

- In Columbus, OH its17.5%.

- And in Omaha, NE its20.5%.

So comparatively, a trip to DC isnt bad atall.

District Of Columbia Sales Tax Lookup By Zip Code

Look up sales tax rates in District of Columbia by ZIP code with the tool below.

Sales-Taxes.com last updated the District of Columbia and District Of Columbia sales tax rate in February 2018 from the District of Columbia Office of Tax and Revenue

Sales-Taxes.com strives to provide accurate and up-to-date sales tax rates, however, our data is provided AS-IS for informational purposes only.

Please verify all rates with your state’s Department of Revenue before making any financial or tax decisions.

© 2022 Sales-Taxes.com. All rights reserved. Usage is subject to our Terms and Privacy Policy.

Recommended Reading: What Happens If I Forgot To File Taxes Last Year

How Often Should You File

How often you need to file depends upon the total amount of sales tax your business collects.

- Annual filing: If your business collects less than $200 in sales tax per month then your business should file returns on an annual basis.

- Quarterly filing: If your business collects between $200 and $800 in sales tax per month then your business should file returns on a quarterly basis.

- Monthly filing: If your business collects more than $800 in sales tax per month then your business should file returns on a monthly basis.

Taxes In The District: The Evolution Of Dc Tax Rates Since The Early 2000s

The District has changed substantially since the early 2000s, finding stable footing after the governmental and economic crises of the 1990s, rebounding from the 2008 recession, transforming into an economic powerhouse in the region, and adopting many policies to reduce income inequality. As the District has undergone these changes, our tax system has evolved as well.

Taxes generated 87 percent of DCs General Fund revenues in fiscal year 2017. The rates for DCs main tax revenue sourcesthe individual income tax, business taxes, the real property tax, and the sales and use taxhave remained largely stable over past two decades, and a number of deductions, credits, and other forms of tax relief have been adopted. This report provides an overview of the changes made to these major tax sources from the early 2000s to the present. Unless noted otherwise, all years refer to the fiscal year a policy became effective, and figures are not adjusted for inflation.

Individual Income Tax

The individual income tax is one of the largest sources of tax revenue in the District, generating 26 percent of total tax revenue in 2017 . The Districts income tax, like the federal income tax and most states income taxes, has a graduated rate structure where higher tax rates apply to higher income levels.

Income Tax Rates

The Tax Revision Commission package created two additional tax brackets, with reduced marginal tax rates on the new brackets:

Standard Deduction and Personal Exemption

Ibid.

You May Like: Where To Get 1040 Tax Forms

What Is Exempt From Sales Taxes In District Of Columbia

Many states have special sales tax rates that apply to the purchase of certain types of goods, or fully exempt them from the sales tax altogether. Here’s how District of Columbia taxes five types of commonly-exempted goods:

Clothing

For more details on what types of goods are specifically exempt from the District of Columbia sales tax see District of Columbia sales tax exemptions. To learn more about what types of transactions are subject to the sales tax to begin with, see what purchases are taxable in District of Columbia? Taxation of vehicle purchases in particular are discussed in the page about District of Columbia’s sales tax on cars.

District Of Columbia Real Property Taxes

In the District of Columbia, the median property tax rate is $575 per $100,000 of assessed home value.

District of Columbia Property Tax Breaks for Retirees

In the District of Columbia, the median property tax rate is $564 per $100,000 of assessed home value.

Homeowners 65 and older may be able to reduce their property tax by 50%. For 2022 property tax reductions, the total 2020 federal adjusted gross income of everyone living on the property, excluding tenants, must be less than $139,900.

Homeowners 65 and older whose adjusted gross income is less than $50,000 may qualify for property tax deferral.

In addition, if you’re 65 or older, any property tax increase might also be capped at 2%.

Seniors age 70 and older also have a higher income threshold for claiming the homeowner and renter property tax credit on their D.C. income tax return . For the 2022 tax year, residents 70 and older are eligible for the credit if their federal adjusted gross income is $78,600 or less. For younger residents, the threshold is $57,600 or less.

Read Also: What Is The Sales Tax In Georgia

Washington Dc Sales Tax Rates

There is only one general sales tax rate in Washington, DC, and thats 6%. There are no local sales taxes or special jurisdiction sales taxes, so regardless of whether youre shipping goods into Washington, DC or you have a physical storefront there, the applicable sales tax rate will always be the same.

The District does have special sales tax rates for certain items. Liquor sold for consumption elsewhere is subject to a 10% sales tax rate, for example, as are restaurant meals and rental vehicles. The sales tax rate for hotel accommodations is 14.5%, and the rate for parking in commercial lots is 18%. Additionally, there is a 6% sales tax on medical marijuana.

How To File Taxes In Washington Dc

When tax time rolls around in Washington DC, whether itâs monthly or annually, you must do three things:

Washington DC requires that any seller with a sales tax permit file a sales tax return on your due date, even if you donât have any sales tax to report or pay. Even if you didnât make a single sale in Washington DC during the reporting period, you should must do a âzero tax filing.â

Read Also: Can I File Bankruptcy On State Taxes Owed

What Is Transfer Tax

So what exactly are real estate transfer taxes? Transfer taxes are taxes imposed by states, counties, and cities on the transfer of the title of real property from one person to another within the jurisdiction. It is based on the propertys sale price and is paid by the buyer, seller, or both parties upon transfer of real property. Unlike property tax, transfer tax is a one-time, nonrecurring tax.

Washington Dc Property Tax

D.C. has some of the lowest property taxes in the country. The citys listed tax rate on residential property is 0.85%, but that rate is applied to assessed value, which is not necessarily equal to a homes actual market value. In fact, the effective property tax rate in the district is a mere 0.56%.

To learn more about getting a mortgage in D.C., check out our D.C. mortgage guide. It highlights important information about rates and getting a mortgage in the nations capital.

Recommended Reading: How Do I Find Out About My Tax Return

Taxes In Washington Dc: What Visitors Need To Know

Taxes may not seem like the most riveting subject in the world, but when you travel its important to understand how taxes in Washington, DC will affect you. In this post well cover the taxes that tourists will pay in the course of their visit. So, heres everything you need to know about taxes in Washington, DC.

Quick disclaimer: these numbers are accurate as of 2020 but be aware that tax rates could change in the future.

To Begin You Have To Ask Yourself 3 Questions

1. Do I have Sales Tax Nexus in Washington DC?

The first step to determining if you need to worry about sales tax is understanding if you have sales tax nexus in a particular state, dont worry, Ill define that for you below.

2. Is what Im selling taxable in Washington DC?

Next, you need to know that particular states sales tax source. This will give you the sales tax rate, which Ill also define below.

3. What rate do I charge in Washington DC?

Lastly, youll need to know if what youre selling is taxable in that particular sates. This falls into four categories: physical goods, digital goods, services, and shipping. Again, all are defined for you below.

You May Like: How To Get Tax Transcript

Washington Dc Tax Credits

Once you have calculated your income tax in D.C., you may be eligible for a number of credits that will reduce your income taxes owed. Credits for individual taxpayers in D.C. include:

- The Early Learning Tax Credit allows filers up to $1,000 for each dependent under the age of four who attends a licensed child care facility.

- The Earned Income Tax Credit is equal to 40% of the federal credit.

- The state income tax credit is credit for income taxes paid in other states.

- The Alternative Fuel Credit is available to taxpayers who install alternative vehicle infrastructure in their homes or who convert their vehicles from gasoline to an alternative fuel.

How Are Rebates And Dealer Incentives Taxed

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. For example, a $1,000 cash rebate may be offered on a $10,000 car, meaning that the out of pocket cost to the buyer is $9,000.

District of Columbia taxes vehicle purchases before rebates or incentives are applied to the price, which means that the buyer in this scenario will pay taxes on the vehicle as if it cost the full $10,000.

You May Like: Can I File Taxes After Deadline

Do Non Residents Pay Dc Income Tax

If you are not a resident of DC you must file a Form D-4A with your employer to establish that you are not subject to DC income tax withholding. You qualify as a nonresident if: Your permanent residence is outside DC during all of the tax year and you do not reside in DC for 183 days or more in the tax year.