What Is The Washington State Sales Tax 2021

Washington has a 6 percent sales tax. 500%. On a county level, sales taxes are in the range of 6.5 to 7.5 percent. A score of 1,000 and a score of ten is considered great. 500%. There are new rate changes in Washington . For an overview of Washingtons current sales tax rate, choose from the list of popular cities below.

What Transactions Are Generally Subject To Sales Tax In Washington

In the state of Washington, legally sales tax is required to be collected from tangible, physical products being sold to a consumer. Several exceptions to this tax are certain types of groceries, prescription medicines, and newspapers. This means that the owner of a cafe would have to charge sales tax on certain types of food and drink sold, while a web designer would not have to charge sales tax at all.

Are Shipping & Handling Subject To Sales Tax In Washington

In the state of Washington, the laws regarding tax on shipping and handling are very simple. If the item being shipped is taxable in itself, then the shipping charge is considered taxable. If the item being shipped is not considered taxable, then the shipping charge is not taxable. If you are shipping multiples items, both taxable and nontaxable items, then you should have two shipping charges fairly divided between the taxable and nontaxable pieces of merchandise, based on the percentage of the charge that is applied to the taxable items. It must also be noted that any shipping and handling charges that are made after the buyer has received the receipt of the goods are exempt from taxes.

Read Also: Can You E File Arkansas State Taxes

Are Services Subject To Sales Tax In Washington

Washington often does collect sales taxes on services performed. For instance, if the services provided have to do with construction services, the state of Washington will most likely see them as being taxable. Also taxable in Washington are recreation services, personal services . Miscellaneous services are also taxed, such as catering, towing automobiles, washing vehicles, personal chefs, leasing or renting physical, personal property, network and competitive phone services, charges made by abstract, title insurance, or escrow and credit bureau businesses, digital automated services, remote access software, digital goods, or maintenance agreements

You can find a table describing the taxability of common types of services later on this page.

What Is The Washington State Vehicle Sales Tax

Washington State vehicle sales tax is the tax due on the majority of purchases or acquisitions of motor vehicles in Washington State. Before you choose to purchase a vehicle, it’s important to be aware of the ins and outs of vehicle sales tax and everything associated with it.

Washington State vehicle sales tax is the tax due on the majority of purchases or acquisitions of motor vehicles in Washington State. Before you choose to purchase a vehicle, it’s important to be aware of the ins and outs of vehicle sales tax and everything associated with it.

Recommended Reading: When Will Irs Refund Unemployment Taxes

What Is The Total Sales Tax Rate For Washington

The Washington state sales tax rate is currently 6.5%. Depending on local municipalities, the total tax rate can be as high as 10.4%.

about 8.87 percent a 6.5 percent state tax plus an average 2.37 percent local tax rate. Washington State

5.75% for Washington D.C. just in case you meant there….

You can use this link to get a more accurate sales tax rate for each state, locality by zip code:

I hope this was helpful?

Motor Vehicle Lease/sales Tax

The sales/lease tax on motor vehicles applies to leases, rentals, and sales of vehicles, which currently includes:

- Passenger cars

- Commercial trucks

- Sport utility vehicles

The tax applies to charges for any additional features and extras included on the vehicle before it is delivered to the person who purchased it.

To report the motor vehicle lease/sales tax, the Department of Revenue’s tax returns have a separate section where you can include this information. The section is titled ‘Motor Vehicle Sales/Leases’.

Under RCW 82.14.450, there is an exemption from the public safety element of the retail sales tax, which applies to:

- Motor vehicle retail sales

- The first three years of lease payments on vehicles

To report any sales/leases which qualify, the Department of Licensing has created special area codes for the partial sales tax exemption. Motor vehicle leases which extend beyond three years don’t qualify for this partial exemption.

According to Hotwire, retail car rentals are not subject to the same taxes and are taxed at 5.9 percent of the selling price. This is regardless of whether or not the vehicle is licensed in Washington State.

Unless an exemption applies, these sales are subject to regular sales tax:

- Warranties and maintenance agreements by dealers

- Motor vehicle repairs

- Charges to the vehicle owner for delivery equipment/installation

- Motor vehicles that aren’t subject to sales tax

You May Like: Where Do I Get Federal Tax Forms

Other Things To Note:

Washington collects destination-based sales tax, that is, local sales tax based on the destination of shipment or delivery within the state by businesses. This was changed on July 1, 2008 prior to that, Washington was an origin-based state. There is no sales tax charge for deliveries outside the state.

Resources:

Seattle Sales Tax Calculator

Invoicing clients or selling to customers and need to know how much sales tax to charge? Use our simple sales tax calculator to work out how much sales tax you should charge your clients. Input the amount and the sales tax rate, select whether to include or exclude sales tax, and the calculator will do the rest. If you dont know the rate, download the free lookup tool on this page to find the right combined Seattle rate.

Read Also: Where’s My Income Tax Return

Who Should Collect Washington Sales Tax

Unlike many of our competitors who offer a one size fits all solution and blindly suggest filing a Voluntary Disclosure Agreement in each state, our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus but you have not collected Washington sales tax, the primary options are to:

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes the best solution for a business is simply to register with Washington and pay back taxes, penalties, and interest. A VDA is not cost-effective if the past liabilities and penalties are minimal. Be wary of the tax professionals that recommend doing a VDA in these cases, they are looking to make a buck rather than looking out for your best interests. If youre unsure what your past liabilities are,contact us and one of our state tax professionals will work with you to conduct an analysis and help you make the right choice for your business.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: registering does not generally eliminate past liabilities

Seattle Washington Sales Tax Rate

seattle Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Seattle, Washington?

The minimum combined 2022 sales tax rate for Seattle, Washington is . This is the total of state, county and city sales tax rates. The Washington sales tax rate is currently %. The County sales tax rate is %. The Seattle sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Washington?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Washington, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Seattle?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Seattle. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Don’t Miss: How To Get Copy Of Tax Return

What Is Washington State And Local Sales Tax Rate

In Washington, a sales tax of six percent applies. Local governments can impose up to a 3% sales tax on local options with this tax break. Each of the 106 taxing districts in Washington State collects 2 percent in local taxes on average. 341%. For sales tax maps larger than this, check out the larger one, or for sales tax tables in larger sizes check out the tables below.

Washington Sales Tax Calculator

You can use our Washington Sales Tax Calculator to look up sales tax rates in Washington by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

| $0.00 |

|---|

Washington has a 6.5% statewide sales tax rate,but also has 105 local tax jurisdictions that collect an average local sales tax of 2.373% on top of the state tax. This means that, depending on your location within Washington, the total tax you pay can be significantly higher than the 6.5% state sales tax.

For example, here is how much you would pay inclusive of sales tax on a $200.00 purchase in the cities with the highest and lowest sales taxes in Washington:

Recommended Reading: When’s The Last Day To File Taxes 2021

What Is A Sales Tax

A sales tax is levied by the government on the sale of goods and services. When you purchase a good or service, the sales tax is the amount of money thats added when you pay at checkout.

The specific goods and services subject to sales tax vary by state. For instance, some states do not apply sales tax to food purchases. Check with your state government to determine which sales tax rates apply to you.

Retail businesses bear the responsibility of tracking and collecting this sales tax from shoppers, and paying it out to their state government on a recurring basis.

Washington State Public Utility Tax On Solid Waste

The Washington State Public Utility Tax on solid waste is 3.6%. This tax is collected by the City of Anacortes but is forwarded entirely to the State of Washington. This is a tax on public service businesses, including businesses that engage in transportation, communications, and the supply of energy, natural gas, and water. The tax is in lieu of the business and occupation tax.

Don’t Miss: How To File State Taxes By Mail

Washington Sales Tax Software

AccurateTaxs TaxTools products completely handle all aspects of Washingtons sales tax rate lookup and calculation for all destinations within the state of Washington, and all special tax classes such as prepared food. Configuring sales tax on your ecommerce store has never been easier. Contact us for more information or register for a free trial of the TaxTools software.

You can also use our free sales tax calculator to look up the rate for any address in the state of Washington.

AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps. See how much time you can save by using AccurateTax.

Solutions

Washington Sales Tax Nexus

Having nexus within a state means that a retailer becomes responsible for collecting and remitting that states sales taxes.

There are several activities that cause a business to have a Washington state sales tax nexus. The most obvious and well-known is, of course, having an office or place of business within the state. However, other business activities may not be as obvious. These can include, but are not limited to:

- Having an employee or other representative in-state who solicits sales

- Installing or assembling goods within the state

- Warehousing product in the state, such as having a Washington-based warehouse, fulfillment house, or using Fulfillment by Amazon and having stock in one of the FBA warehouses

- Renting or leasing property

- Providing certain services within the state

Retailers who operate an affiliate program previously had nexus in Washington if they paid affiliates a commission and if they made $10,000 or more in gross retail sales into the state of Washington under the agreement during the previous calendar year. This is known as a click-through nexus, and it no longer applies.

Sellers should also be aware of a provision known as trailing nexus. This says that a retailer who had nexus but stops the business activity that created the nexus, is still considered to have nexus for the remainder of that year, as well as one additional calendar year after.

Read Also: How To Pay Oklahoma State Taxes

State Tax Rates And Rules For Income Sales Property Fuel Cigarette And Other Taxes That Impact Washington Residents

Retirees: Mixed Tax Picture

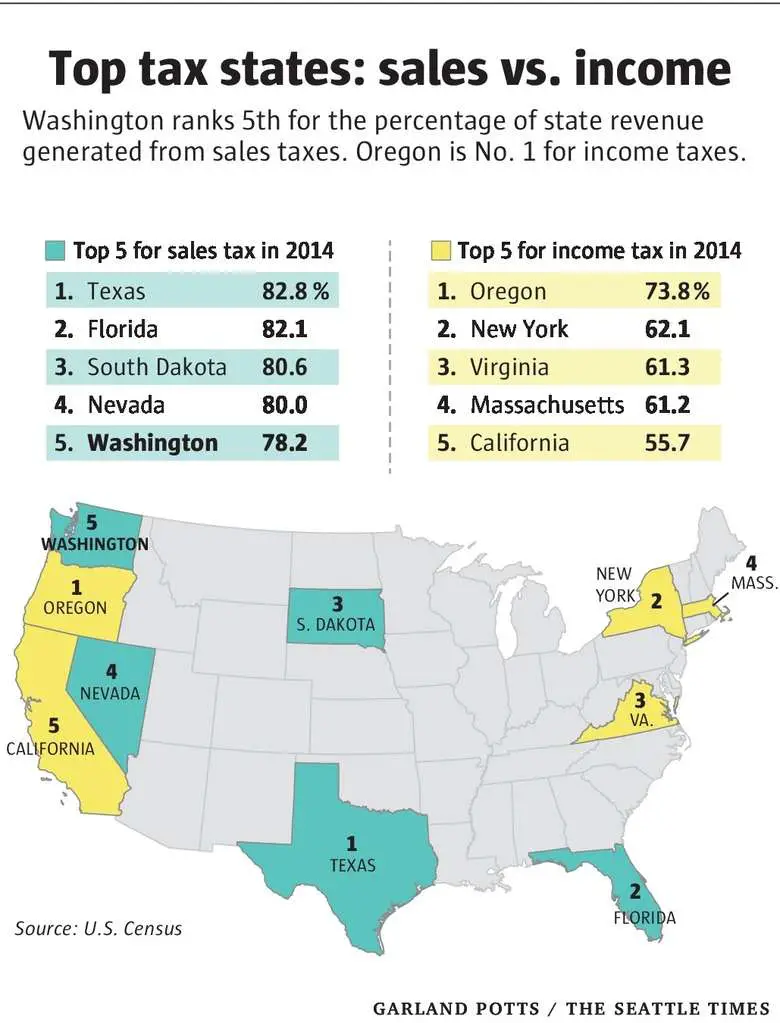

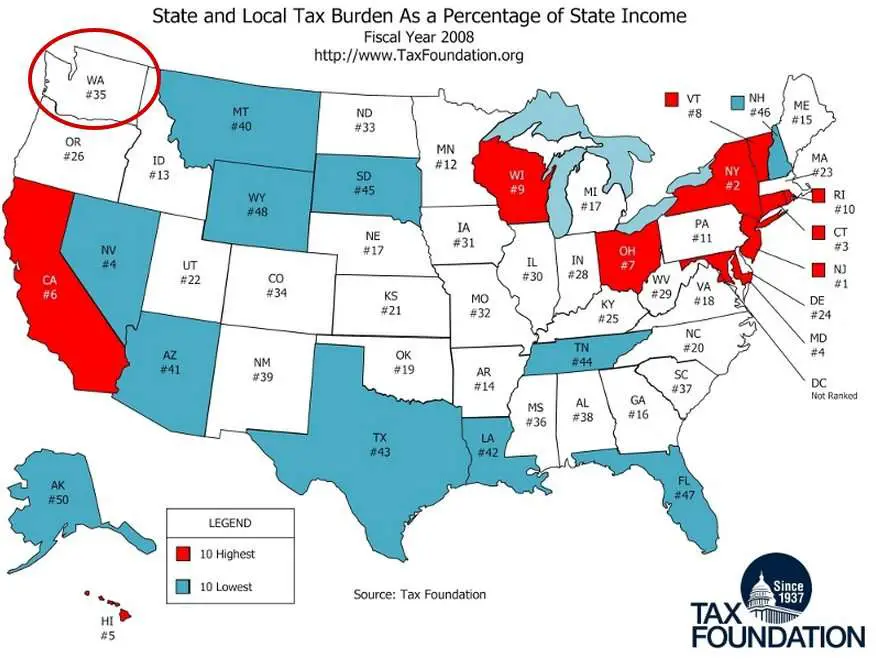

The Evergreen State is one of nine states with no personal income tax. However, sales taxes in Washington are extremely high. At 9.29%, the state’s combined state and local sales tax rate is the 4th-highest in the nation.

Property taxes in Washington are more reasonable, though. In fact, the median property tax rate is close to the national average.

Washington is also one of a handful of states with an estate tax.

Lowest In Sales Tax In The Tacoma Olympia And South Sound Region

You’ll Find One of the Lowest Auto Sales Tax Rates in Washington State at Northwest Chevrolet

- Northwest Chevrolet sales tax: 8.3%

- Tacoma sales tax: 10.4%

BIG SAVINGS

- $25k Vehicle Save $500!

- $50k Vehicle Save $1,000!!

- $75k Vehicle Save $1,500!!

Northwest Chevrolet’s Oil Changes for Life It’s just a short drive to McKenna – and it’s worth every penny!

Recommended Reading: How Much Do You Have To Earn To Pay Tax

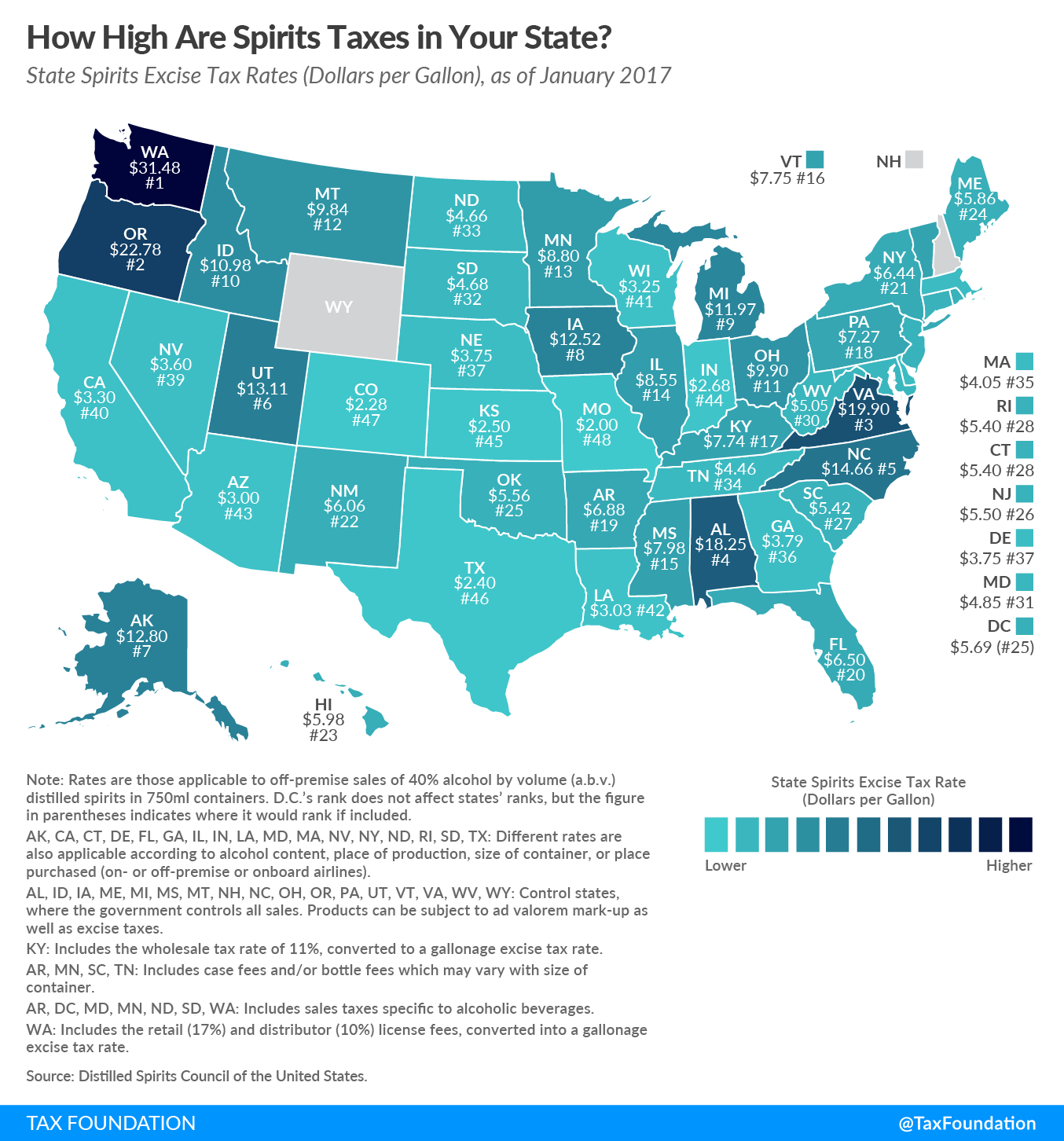

How Much Is Alcohol Tax In Washington

Spirits sales tax is based on the selling price of spirits in the original package. The rate paid by the general public is 20.5%. The rate paid by on-premises retailers such as restaurants and bars on purchases from distributors and distillers is 13.7%.

How To Settle A Washington Sales Tax Liability

Along the way, or even after one the critical notices are issued, there is the possibility tosettle your Washington sales tax case by negotiating with the Washington Department of Revenue. Washington will consider settlements if the issue is nonrecurring, the law is unsettled, a strict application of the law has harsh consequences, there is uncertainty of the outcome of the decision, or the taxpayer is unable to pay.

Often, you can get better results here than with the auditor. If you or your professional seldom does state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements. DO NOT try to negotiate a settlement without an experienced Washington state and local tax lawyer or other professional.

Also Check: How To Claim Mileage On Taxes

Do Washington Vehicle Taxes Apply To Rebates And Trade

With many dealerships, you can trade-in your old car and receive a credit that will be applied to your new chosen vehicle. If you trade-in your old vehicle and receive a $5,000 credit on a $10,000 vehicle, you’ll only end up paying $5,000 for the new car. In Washington State, the taxable price of the new vehicle would only be $5,000 because your trade-in’s original value is not subject to sales tax.

Often, manufacturer rebates or cash incentives are offered on vehicles as a way to encourage sales. However, Washington applies its vehicle taxes before the rebates or incentives, so taxes will be paid on a vehicle as if it costs the full, original price.

Other Taxes And Fees On Washington Car Purchases

Washington vehicle buyers may encounter a number of additional fees and taxes, such as:

- Registration fee: $50

- Plate transfer fee: $10

- Title fee: $26

Some dealerships also charge a documentation fee, which covers the costs of the dealership handling the documents associated with the purchase of the vehicle. The average documentation fee in Washington State is $150, and state law caps the fee at this rate. However, the cost can vary depending on the dealership you go to.

Understanding Washington State vehicle sales tax can often take time, especially since sales tax on vehicles can vary drastically depending on where you live. However, with just a little patience and understanding, it will get easier to familiarize yourself with how vehicle sales tax in Washington State works.

Don’t Miss: Where Is My Federal Income Tax Return

Washington Motor Fuel Taxes

Cigarettes and little cigars: $3.03 per packCigars: 95% of sale price, with a cap of $0.75 per cigarMoist snuff: $2.53 per 1.2-ounce containerOther tobacco products: 95% of sale priceVapor products: Closed products, $0.27 per ml open containers greater than 5 ml, $0.09 per ml

Beer: $0.26 per gallonLiquor: $14.27 per gallon, plus 20.5% “Spirits Sales Tax”

37% excise tax

How Do I Calculate Sales Tax

Multiply the cost of an item or service by the sales tax in order to find out the total cost. The equation looks like this: Item or service cost x sales tax = total sales tax. Add the total sales tax to the Item or service cost to get your total cost.

Recommended Reading: How Did I File Taxes Last Year